Dental Fittings Market Report

Published Date: 31 January 2026 | Report Code: dental-fittings

Dental Fittings Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Dental Fittings market for the forecast period of 2023 to 2033, including market size, segmented insights, and regional trends impacting growth and development.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

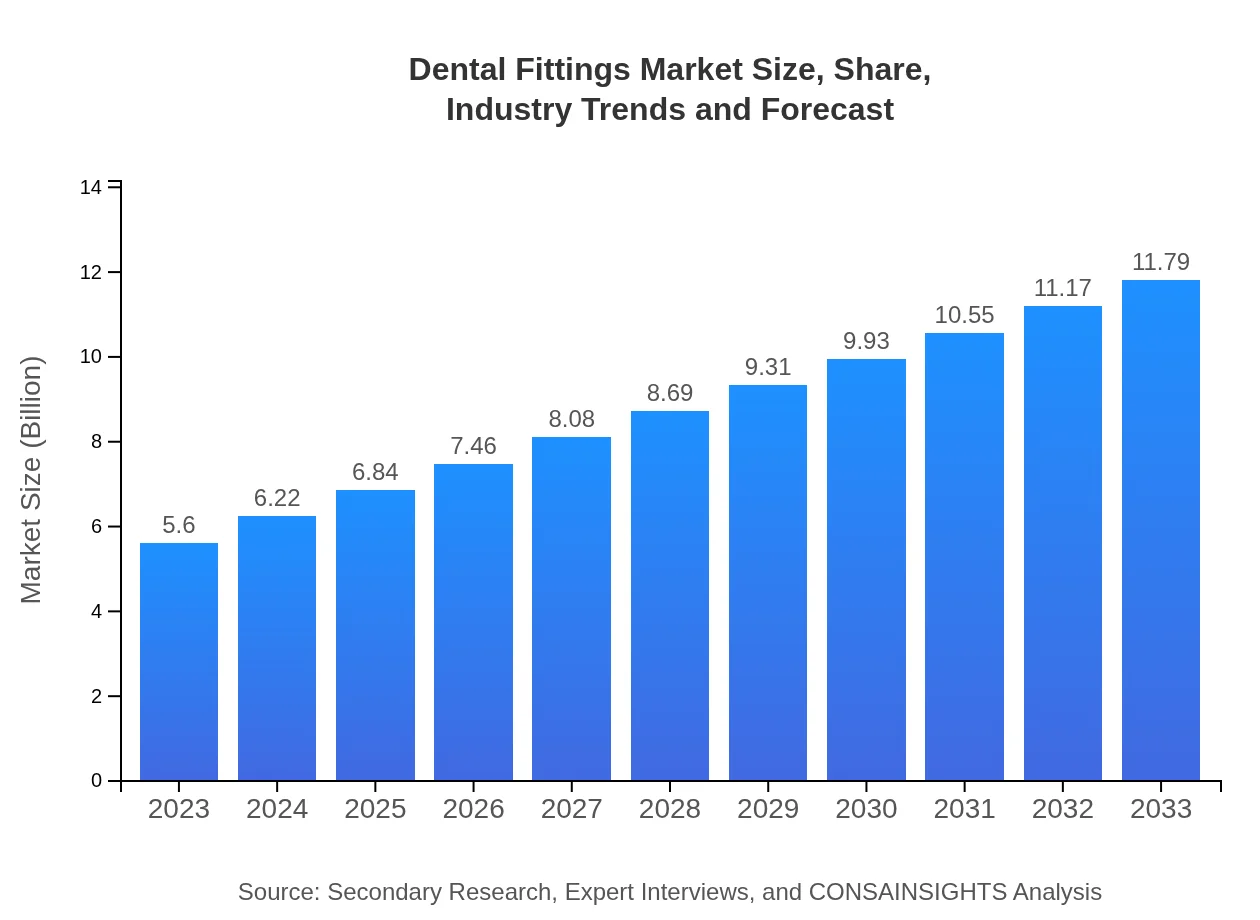

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $11.79 Billion |

| Top Companies | Straumann Holding AG, Dentsply Sirona, Henry Schein Inc., Align Technology Inc., Benco Dental |

| Last Modified Date | 31 January 2026 |

Dental Fittings Market Overview

Customize Dental Fittings Market Report market research report

- ✔ Get in-depth analysis of Dental Fittings market size, growth, and forecasts.

- ✔ Understand Dental Fittings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Fittings

What is the Market Size & CAGR of Dental Fittings market in 2023?

Dental Fittings Industry Analysis

Dental Fittings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Fittings Market Analysis Report by Region

Europe Dental Fittings Market Report:

The European market is also experiencing robust growth, projected to increase from $1.73 billion in 2023 to $3.65 billion by 2033. Factors such as growing elderly demographics and extensive dental insurance coverage enhance market potential.Asia Pacific Dental Fittings Market Report:

In the Asia-Pacific region, the Dental Fittings market is projected to grow from $0.95 billion in 2023 to $2.00 billion by 2033. The growth is driven by rising disposable incomes, increased dental tourism, and an expanding elderly population seeking dental care.North America Dental Fittings Market Report:

North America commands the largest market share, estimated to grow from $2.12 billion in 2023 to $4.45 billion by 2033. The significant driver here is the high prevalence of dental issues and the adoption of advanced dental technologies in healthcare facilities.South America Dental Fittings Market Report:

The South American market is comparatively smaller, expected to rise from $0.09 billion in 2023 to $0.20 billion by 2033. Growth factors include increasing access to dental care and a rise in awareness about oral hygiene.Middle East & Africa Dental Fittings Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.71 billion in 2023 to $1.50 billion by 2033, driven by increasing healthcare investments and expanding dental service accessibility.Tell us your focus area and get a customized research report.

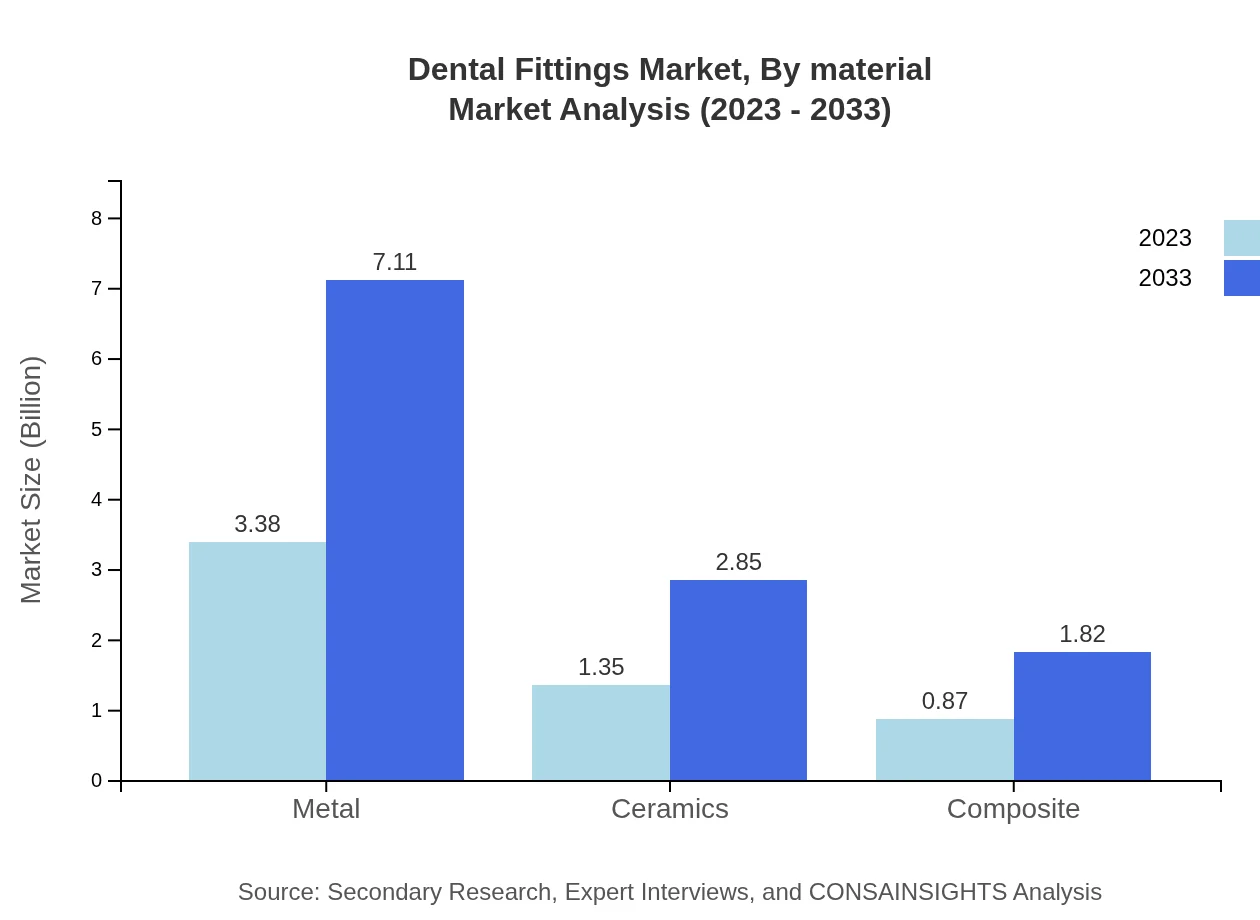

Dental Fittings Market Analysis By Material

By material, the market is dominated by metals, accounting for a significant size of $3.38 billion in 2023 and projected to grow to $7.11 billion by 2033, representing 60.35% market share. Following metal, ceramics are valued at $1.35 billion, projected to reach $2.85 billion, capturing 24.17%. Composite materials serve niche applications, showing growth capability from $0.87 billion to $1.82 billion.

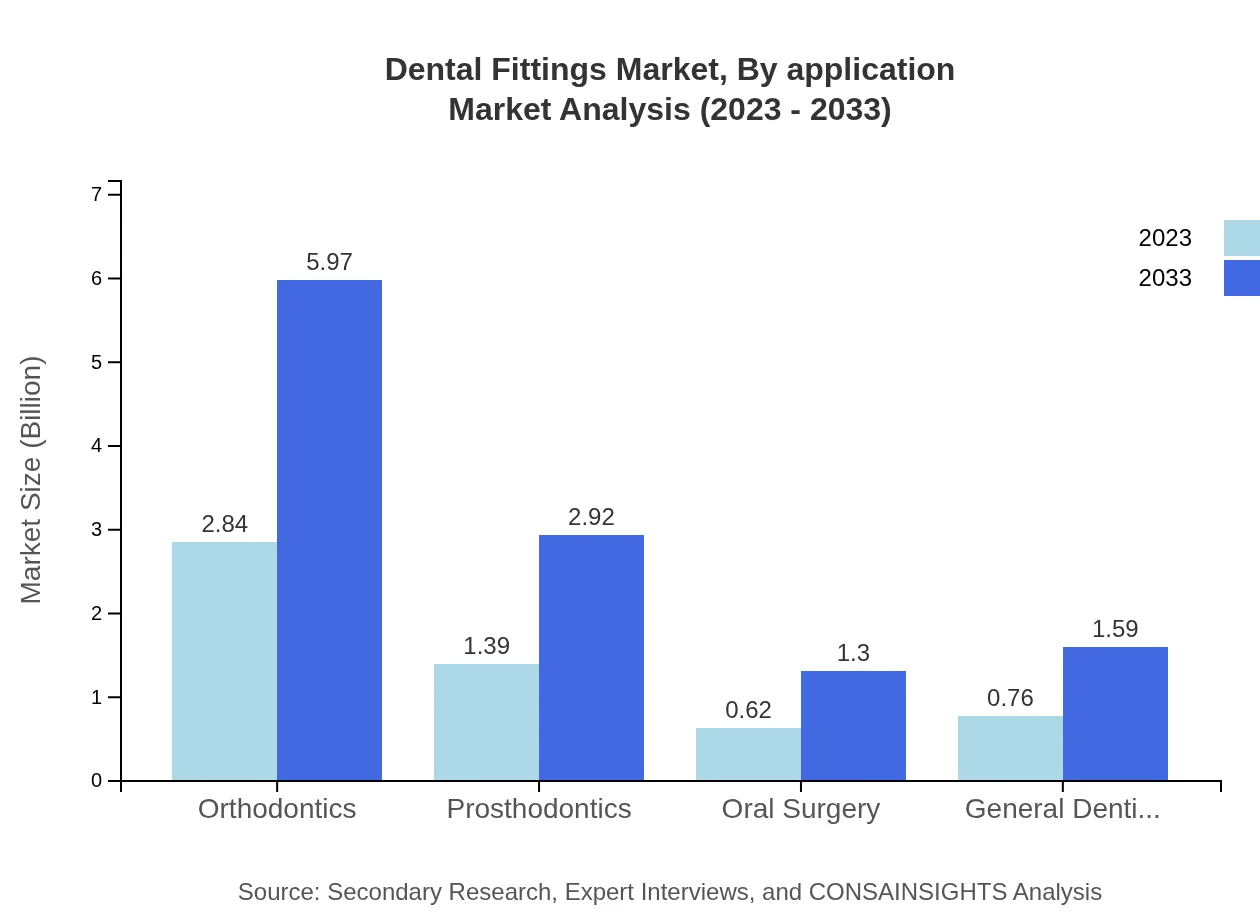

Dental Fittings Market Analysis By Application

The application segmentation highlights a prevalence in the orthodontics segment, which stands at $2.84 billion in 2023, expected to rise to $5.97 billion by 2033, holding a 50.66% share. Dental crowns follow with a similar trend. Conversely, oral surgery segments show steady growth, indicating the broad applicability of dental fittings across medical specialties.

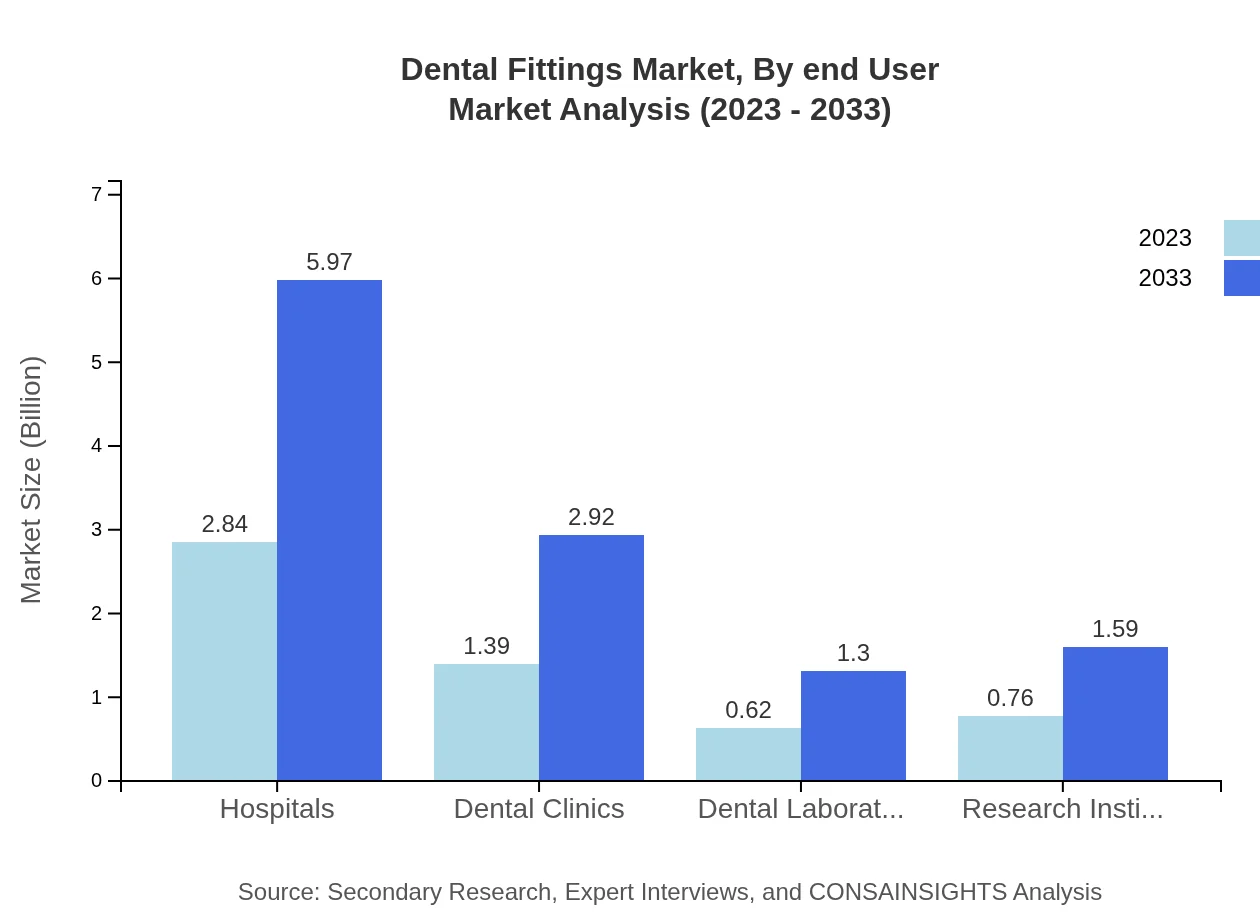

Dental Fittings Market Analysis By End User

End-users in the dental fittings industry primarily include hospitals, dental clinics, and research institutions. Hospitals represent the most substantial share of the market firmly holding 50.66% in 2023, and this is anticipated to remain stable over the forecast period. Dental clinics contribute significantly as well, projected to grow steadily as the demand for local dental services increases.

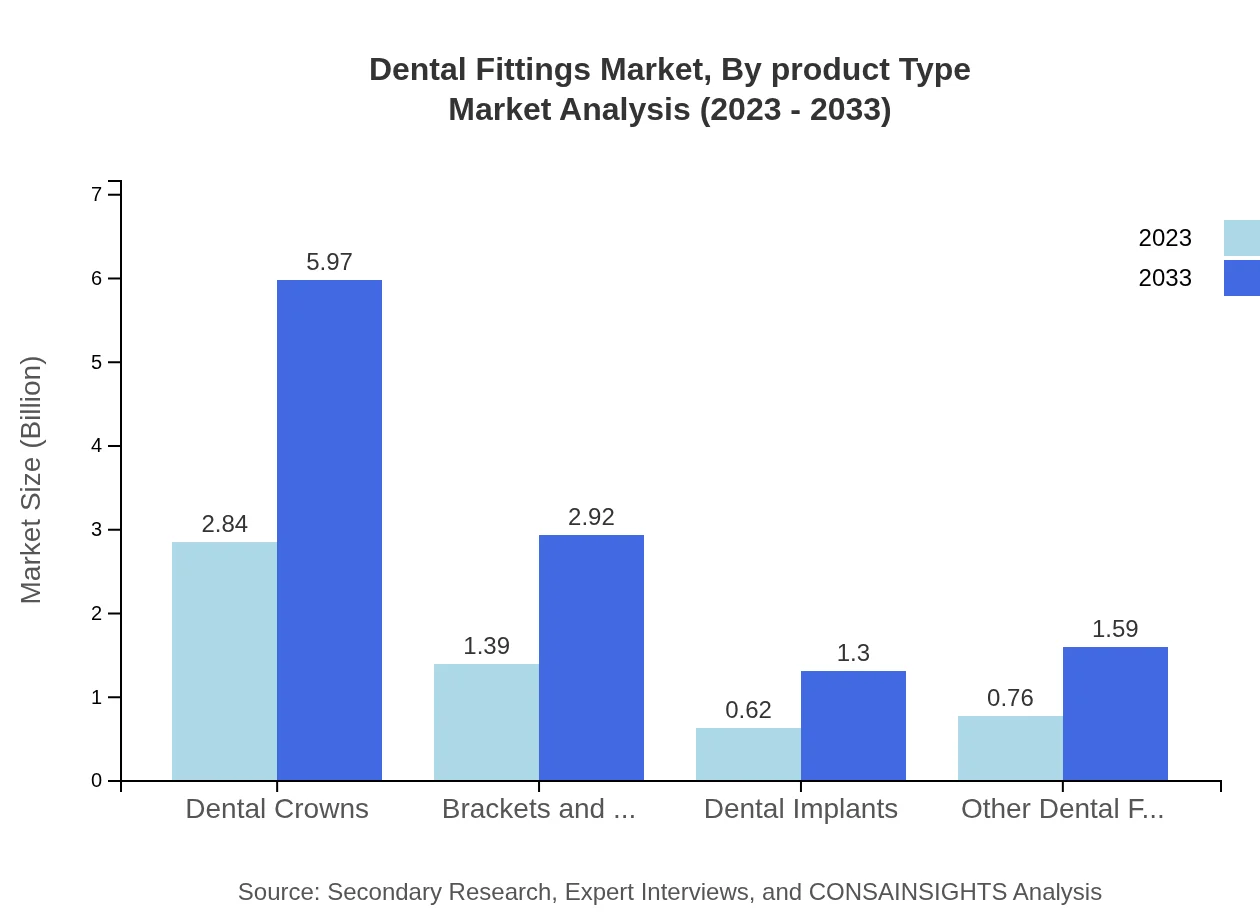

Dental Fittings Market Analysis By Product Type

Product types widely vary, with dental crowns and fittings for orthodontics leading the charge. The forecast suggests robust growth across these categories, with crowns demonstrating high market penetration, and orthodontics solutions showcasing exponential growth due to rising demand among younger demographics.

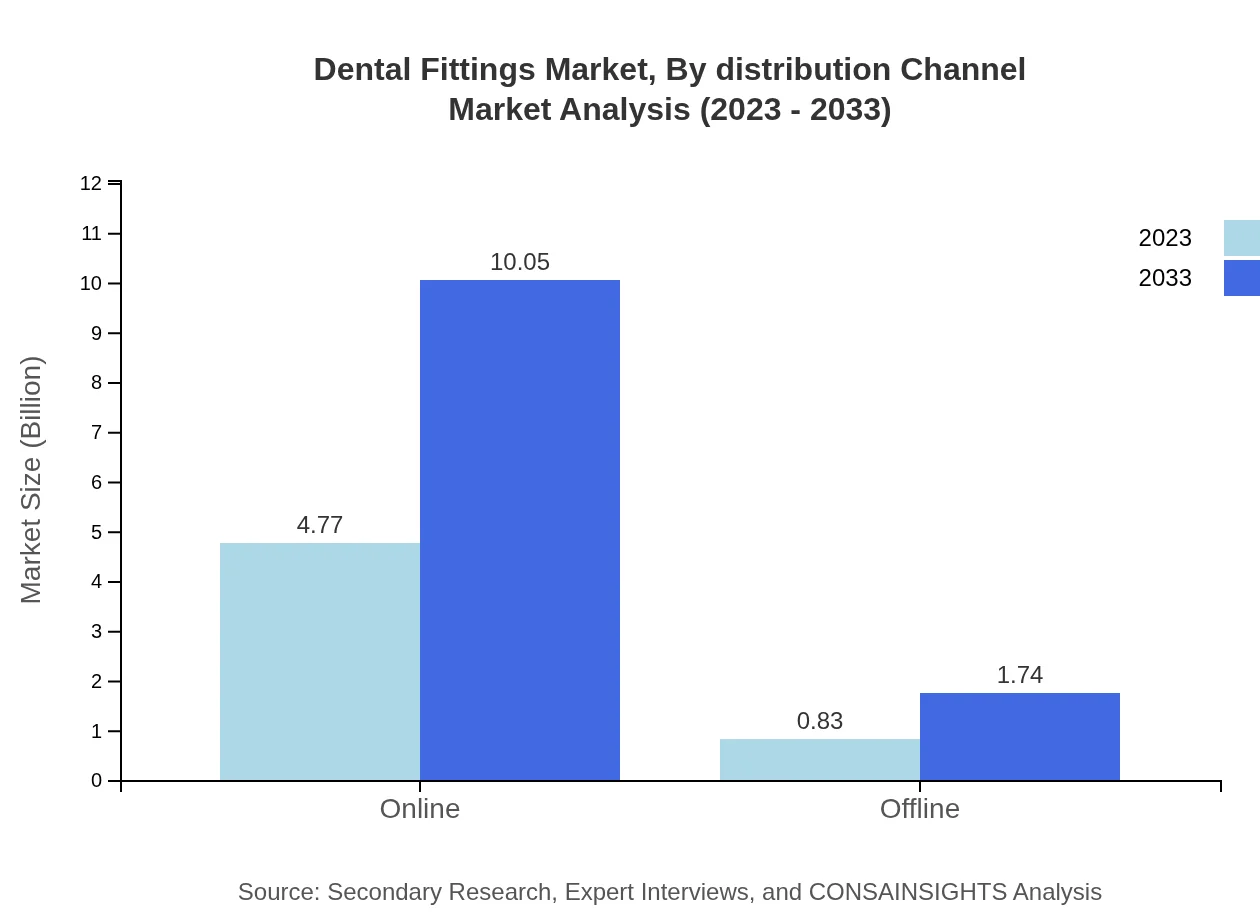

Dental Fittings Market Analysis By Distribution Channel

The distribution channels are classified into online and offline markets, with online sales dominating at $4.77 billion in 2023 and growing to $10.05 billion, occupying 85.25% market share. Increasing digitalization is contributing significantly to this growth, making dental fittings more accessible to customers globally.

Dental Fittings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Fittings Industry

Straumann Holding AG:

A leading provider of dental implants and prosthetics, Straumann is known for innovative solutions and high-quality materials enhancing treatment outcomes.Dentsply Sirona:

A significant player in the dental industry, Dentsply Sirona manufactures a wide range of dental products including restorative solutions and equipment.Henry Schein Inc.:

An important distributor of dental products, Henry Schein's comprehensive range of offerings supports dental practitioners and enhances patient care.Align Technology Inc.:

Famed for its revolutionary Invisalign system, Align Technology focuses on innovative orthodontic solutions facilitating a modern approach to dental fittings.Benco Dental:

Benco is a major dental supply company, dedicated to delivering a full spectrum of products and services for the dental industry.We're grateful to work with incredible clients.

FAQs

What is the market size of dental fittings?

The dental fittings market is expected to grow from 5.6 billion in 2023 to an estimated value reflecting a CAGR of 7.5% by 2033. This growth is driven by increasing dental care demands globally.

What are the key market players or companies in the dental fittings industry?

The dental fittings industry comprises several key players including major manufacturers and distributors. These include companies specializing in dental crowns, implants, and other dental technologies, which collaborate with healthcare institutions to enhance market reach.

What are the primary factors driving the growth in the dental fittings industry?

Key factors driving growth include an increasing emphasis on dental aesthetics, advancements in dental technology, and higher oral health awareness. Additionally, the rising number of dental procedures contributes significantly to market expansion.

Which region is the fastest Growing in the dental fittings market?

Asia Pacific is emerging as the fastest-growing region in the dental fittings market, expanding from a market size of 0.95 billion in 2023 to 2.00 billion by 2033, driven by increased disposable incomes and healthcare investments.

Does ConsaInsights provide customized market report data for the dental fittings industry?

Yes, ConsaInsights offers tailored market report data for the dental fittings industry, enabling clients to access specific insights and trends aligned with their business needs and segments.

What deliverables can I expect from this dental fittings market research project?

Deliverables for the dental fittings market research project include comprehensive market analysis, segmentation reports, regional insights, competitive landscape assessments, and future growth forecasts tailored to your requirements.

What are the market trends of dental fittings?

Current trends in the dental fittings market include the rising popularity of metal and ceramic fittings, a shift towards online purchasing, and increasing adoption of innovative dental technologies designed to enhance patient outcomes.