Dental Impression Systems Market Report

Published Date: 31 January 2026 | Report Code: dental-impression-systems

Dental Impression Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dental Impression Systems market, detailing insights on market size, growth trends, technological advancements, and future forecasts from 2023 to 2033.

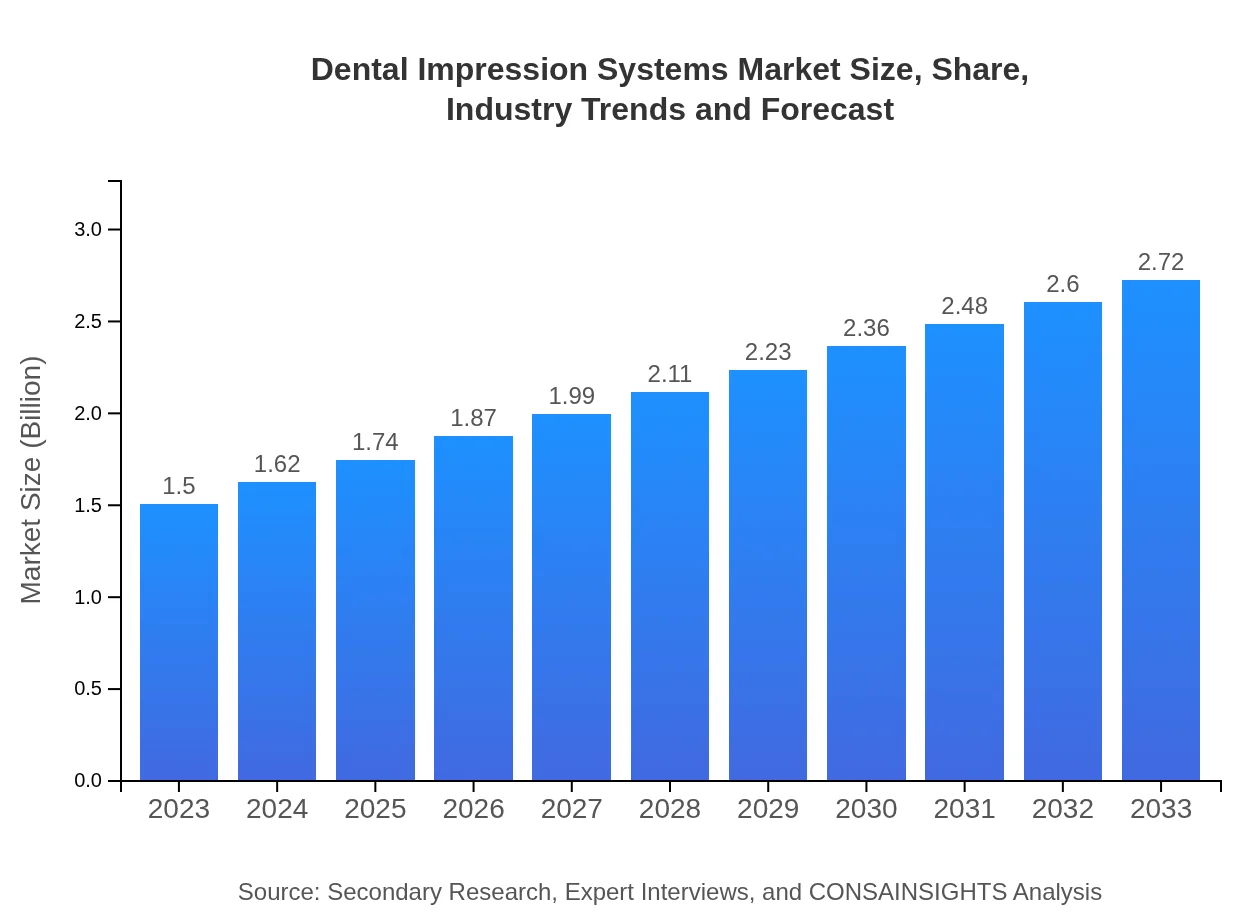

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $2.72 Billion |

| Top Companies | 3M Company, Henry Schein, Inc., Align Technology, Inc., DENTSPLY Sirona |

| Last Modified Date | 31 January 2026 |

Dental Impression Systems Market Overview

Customize Dental Impression Systems Market Report market research report

- ✔ Get in-depth analysis of Dental Impression Systems market size, growth, and forecasts.

- ✔ Understand Dental Impression Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Impression Systems

What is the Market Size & CAGR of Dental Impression Systems market in 2033?

Dental Impression Systems Industry Analysis

Dental Impression Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Impression Systems Market Analysis Report by Region

Europe Dental Impression Systems Market Report:

In Europe, the market size is expected to grow from $0.48 billion in 2023 to $0.87 billion by 2033. Regulatory support for dental innovation, combined with a high prevalence of dental diseases, is fuelling this growth.Asia Pacific Dental Impression Systems Market Report:

In the Asia Pacific region, the market is expected to grow significantly, reaching $0.46 billion by 2033 from $0.25 billion in 2023. This growth is attributed to increasing disposable incomes, expanding dental practices, and growing awareness regarding oral health.North America Dental Impression Systems Market Report:

North America will remain the largest market, with an estimated size increase from $0.57 billion in 2023 to approximately $1.03 billion by 2033. Factors driving this growth include high adoption rates of advanced technologies and a strong dental care market.South America Dental Impression Systems Market Report:

For South America, the Dental Impression Systems market is projected to expand from $0.10 billion in 2023 to $0.18 billion by 2033. This growth is supported by improving healthcare infrastructure and rising dental tourism in countries like Brazil and Argentina.Middle East & Africa Dental Impression Systems Market Report:

The Middle East and Africa market is projected to grow from $0.10 billion in 2023 to $0.19 billion by 2033, driven by increasing investment in healthcare infrastructure and awareness of dental treatment options.Tell us your focus area and get a customized research report.

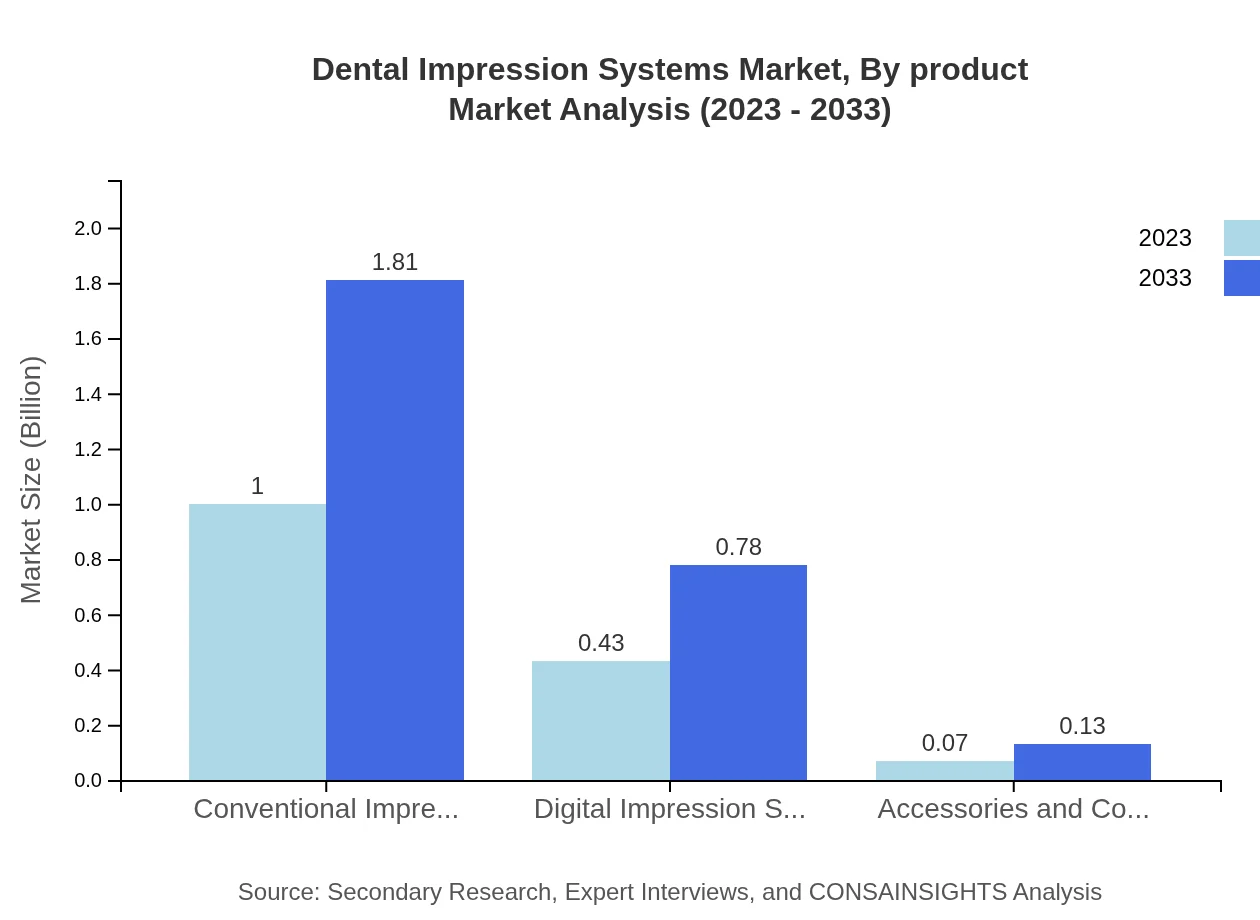

Dental Impression Systems Market Analysis By Product

In 2023, the Conventional Impression Systems segment dominates the market, with a size of $1.00 billion, projected to grow to $1.81 billion by 2033. Digital Impression Systems, while smaller, are rapidly gaining prominence, expected to increase from $0.43 billion to $0.78 billion in the same period. Accessories and consumables also hold a market size of $0.07 billion, increasing to $0.13 billion by 2033.

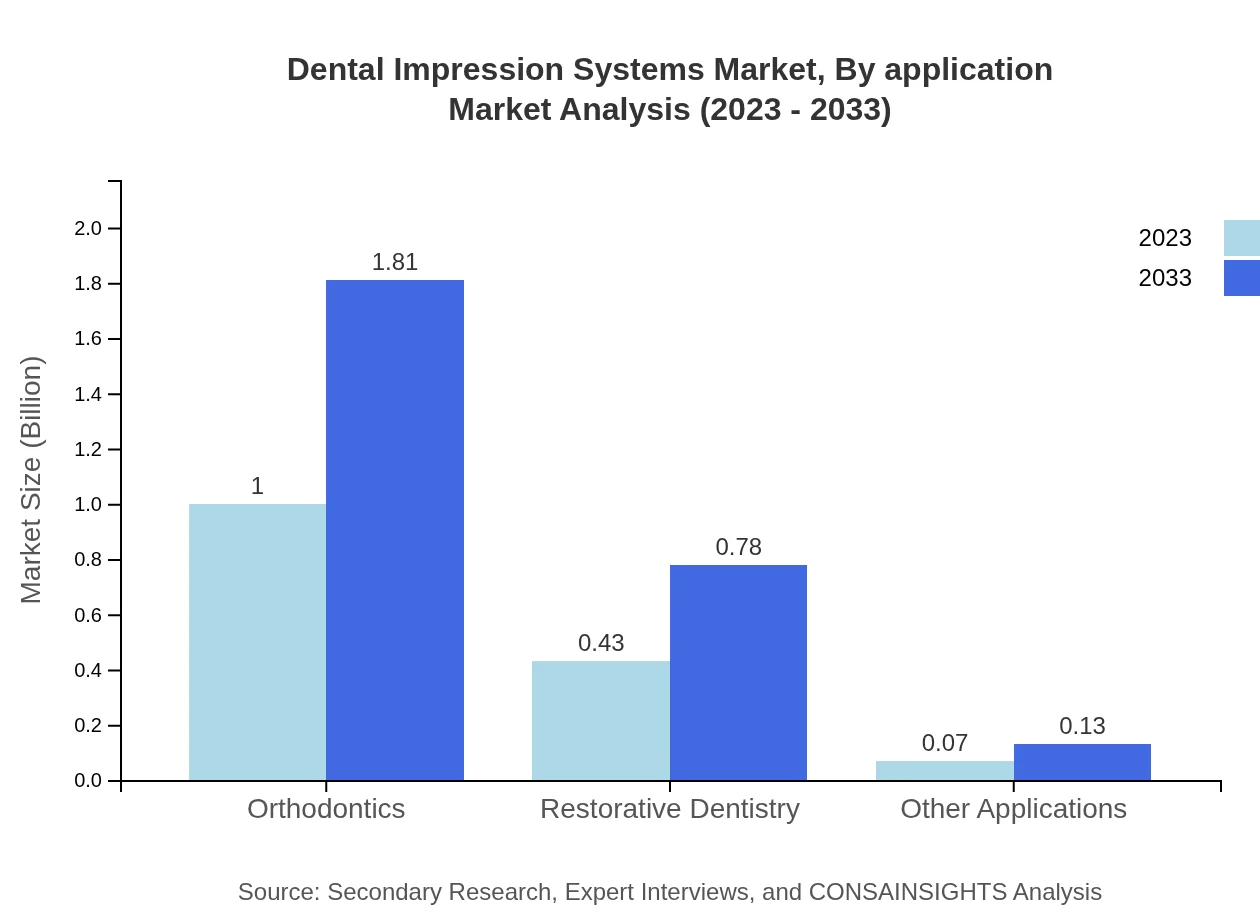

Dental Impression Systems Market Analysis By Application

Applications of dental impression systems include Orthodontics, Restorative Dentistry, and Other Applications. Orthodontics occupies a significant share, projected to grow from $1.00 billion in 2023 to $1.81 billion by 2033. Restorative Dentistry will expand from $0.43 billion to $0.78 billion, while Other Applications represent a smaller yet crucial segment.

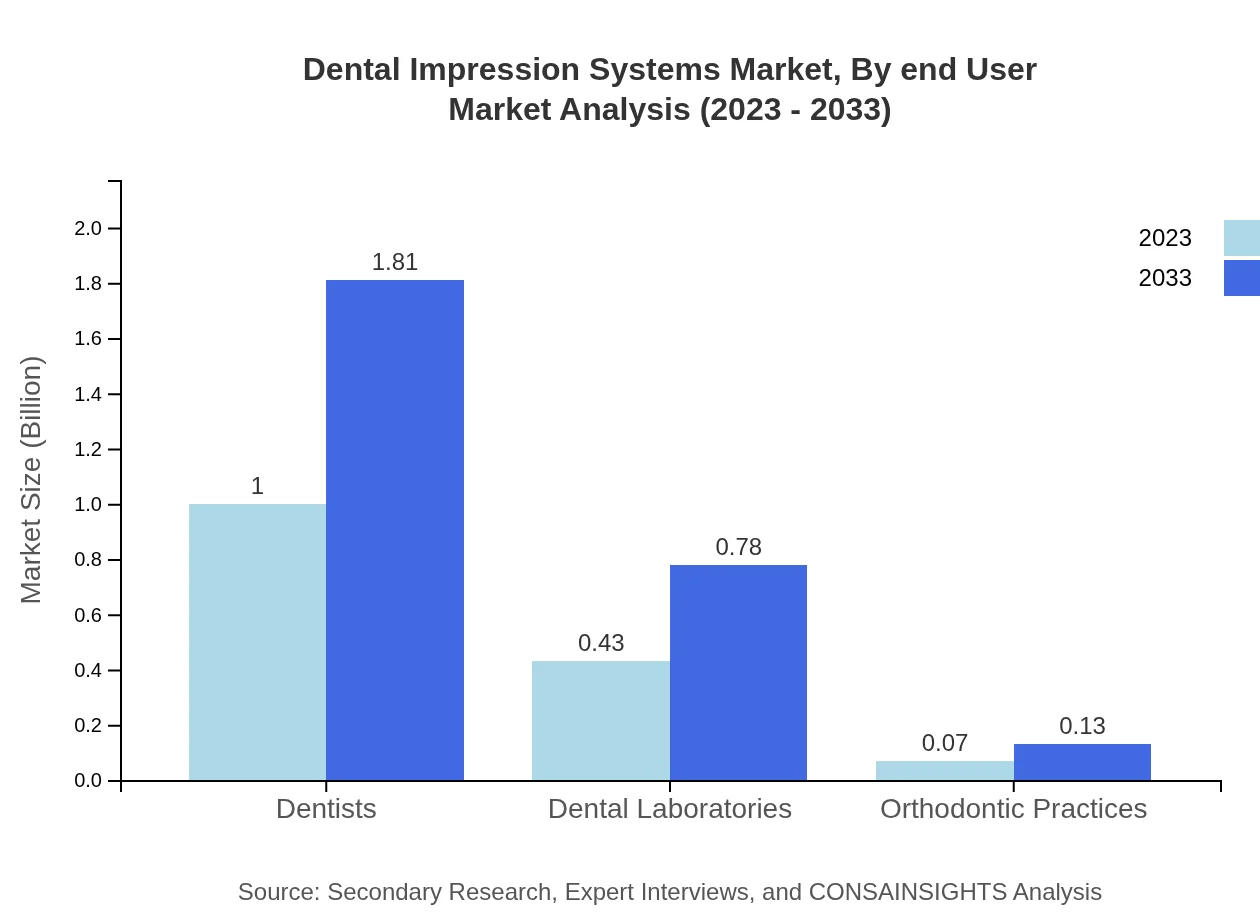

Dental Impression Systems Market Analysis By End User

The market is divided into segments based on end-users, including Dentists, Dental Laboratories, and Orthodontic Practices. Dentists make up a significant portion, expected to maintain a market size of $1.00 billion, growing to $1.81 billion. Dental Laboratories will see growth from $0.43 billion to $0.78 billion, indicating the importance of collaboration between practices and labs.

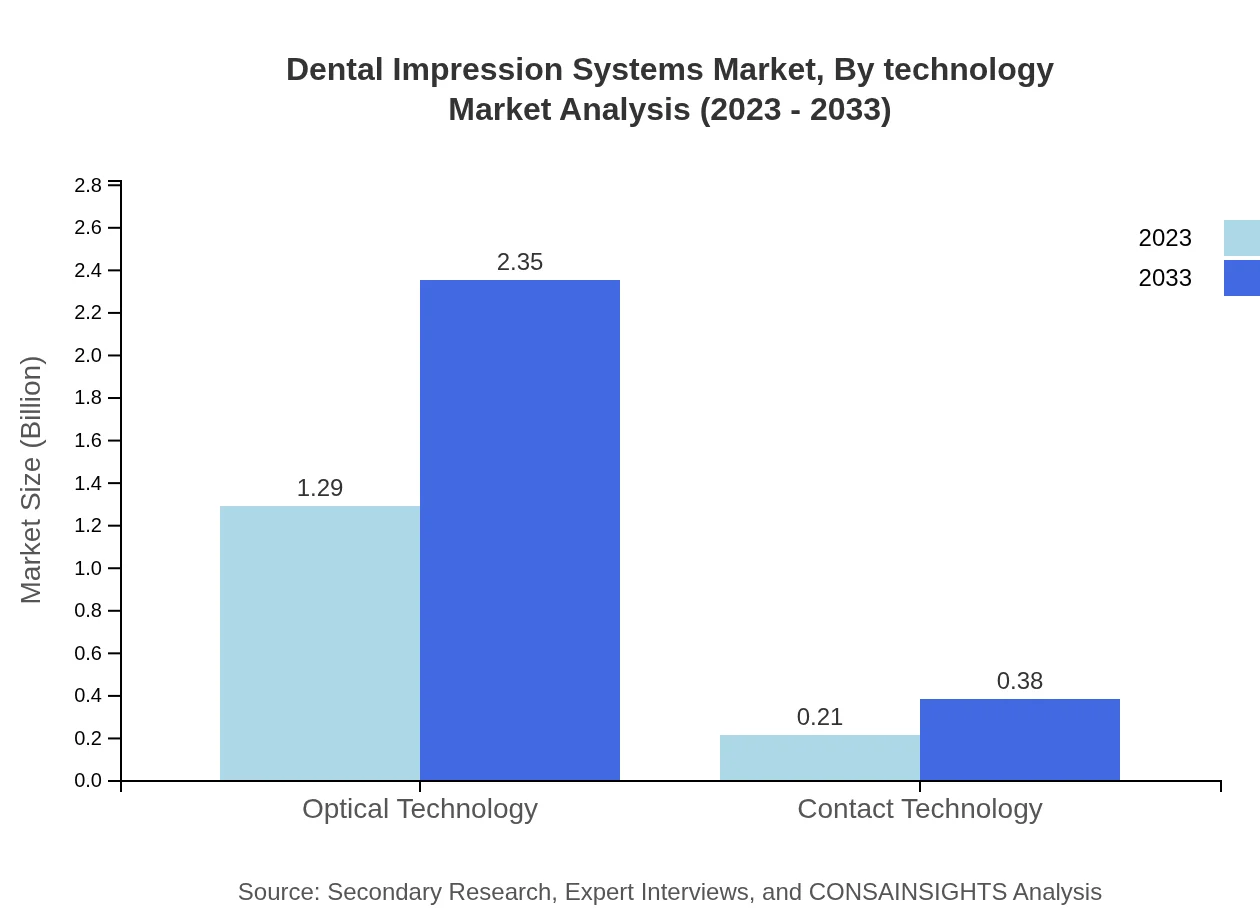

Dental Impression Systems Market Analysis By Technology

The technology segment highlights the dominance of Optical Technology in the market, which accounts for a size of $1.29 billion in 2023, projected to double to $2.35 billion by 2033. Contact Technology, while smaller, has a stable segment size projected to grow from $0.21 billion to $0.38 billion over the same period.

Dental Impression Systems Market Analysis By Materials

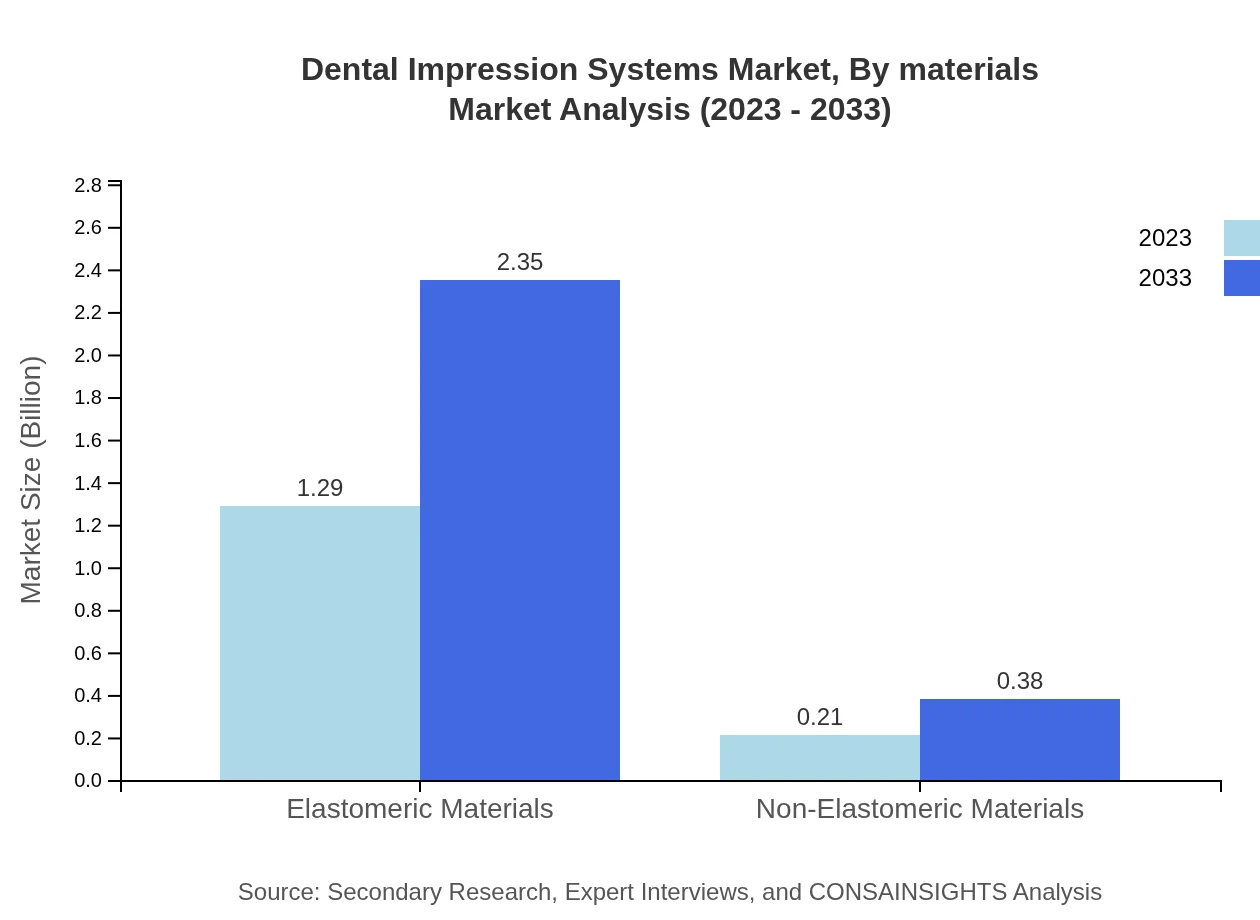

The market is segmented by materials into Elastomeric and Non-Elastomeric categories. Elastomeric materials were valued at $1.29 billion in 2023 and are expected to reach $2.35 billion by 2033. Non-Elastomeric materials, while a smaller segment, will grow from $0.21 billion to $0.38 billion.

Dental Impression Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Impression Systems Industry

3M Company:

Leading provider of dental and orthodontic products, known for innovative solutions in dental impression materials and systems.Henry Schein, Inc.:

Global distributor of healthcare products and services, offering a wide range of dental supplies, including impression systems.Align Technology, Inc.:

Known for its Invisalign system, Align Technology is a pioneer in digital orthodontics and impression technologies.DENTSPLY Sirona:

A major player in dental technology, offering a comprehensive array of products to improve dental care, including digital impression systems.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Impression Systems?

The dental impression systems market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6% over the next decade. By 2033, the market is expected to experience significant growth, driven by advancements in dental technology and increasing demand.

What are the key market players or companies in this dental Impression Systems industry?

Key players in the dental impression systems market include leading manufacturers and technology providers that specialize in both conventional and digital impression solutions, focusing on innovation and product development to meet increasing demand.

What are the primary factors driving the growth in the dental impression systems industry?

Growth in the dental impression systems market is driven by technological advancements, increasing adoption of digital solutions, rising dental health awareness, and the expansion of dental services, which collectively enhance patient experiences and operational efficiencies.

Which region is the fastest Growing in the dental impression systems?

North America is the fastest-growing region in the dental impression systems market, projected to grow from $0.57 billion in 2023 to $1.03 billion by 2033, driven by increasing demand for advanced dental technologies and growing dental health awareness.

Does ConsInsights provide customized market report data for the dental impression systems industry?

Yes, ConsInsights offers customized market report data tailored to the specific needs of clients in the dental impression systems industry, providing insights on trends, growth forecasts, and competitive analysis for informed decision-making.

What deliverables can I expect from this dental impression systems market research project?

Deliverables from the dental impression systems market research project include comprehensive market analysis reports, growth forecasts, competitive landscape assessments, and detailed segmentation data, providing a clear understanding of the market dynamics.

What are the market trends of dental impression systems?

Key market trends include the shift towards digital impression technologies, increased integration of AI and automation in dental practices, and a growing focus on patient-centric solutions that enhance engagement and experiences in dental care.