Dental Lab Market Report

Published Date: 31 January 2026 | Report Code: dental-lab

Dental Lab Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Dental Lab sector, focusing on market size, growth trends, competitive landscape, and regional insights from 2023 to 2033.

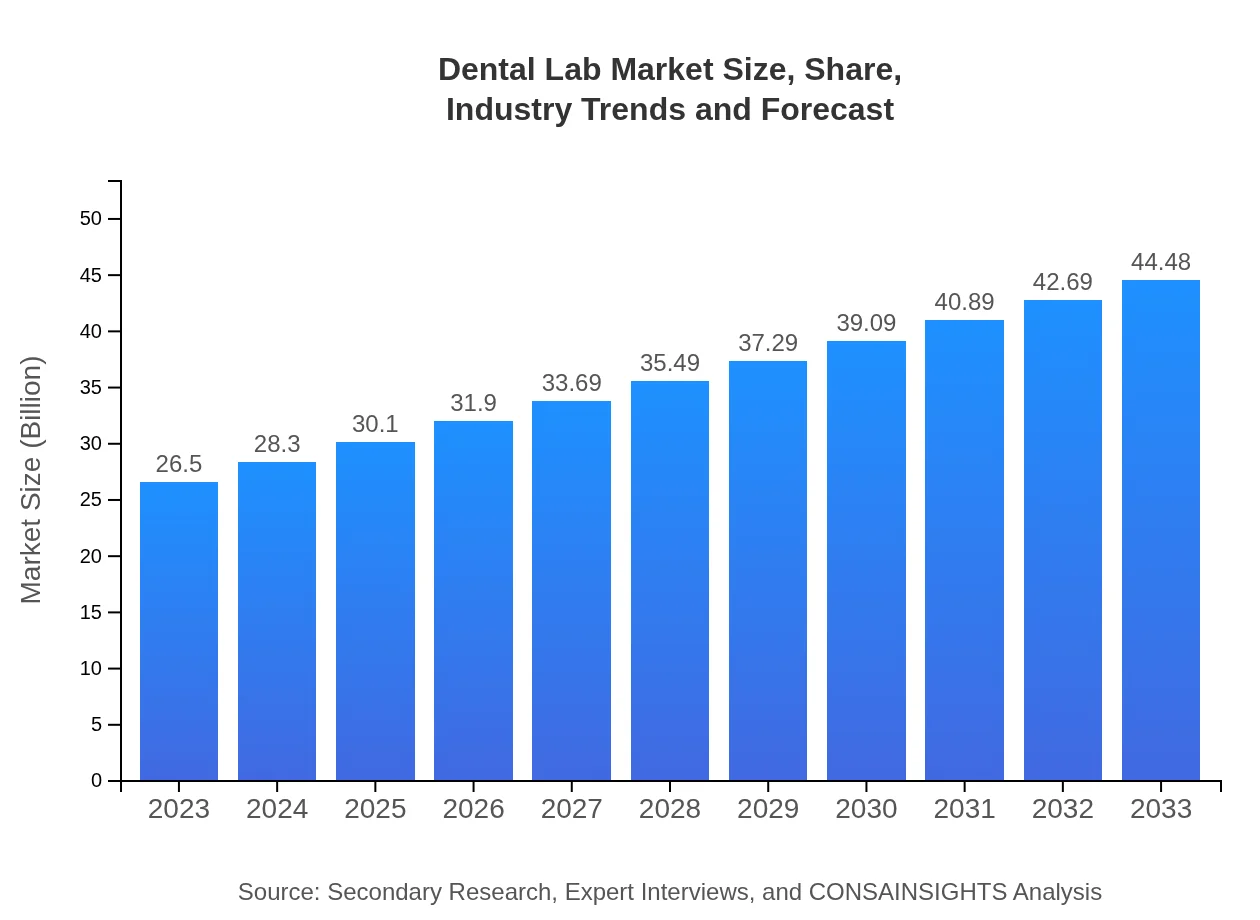

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $26.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $44.48 Billion |

| Top Companies | Straumann Holding AG, Danaher Corporation, Dentsply Sirona Inc., Henry Schein, Inc. |

| Last Modified Date | 31 January 2026 |

Dental Lab Market Overview

Customize Dental Lab Market Report market research report

- ✔ Get in-depth analysis of Dental Lab market size, growth, and forecasts.

- ✔ Understand Dental Lab's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Lab

What is the Market Size & CAGR of the Dental Lab market in 2023?

Dental Lab Industry Analysis

Dental Lab Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Lab Market Analysis Report by Region

Europe Dental Lab Market Report:

Europe has a robust dental lab market, valued at $8.01 billion in 2023 and expected to reach $13.44 billion by 2033. The region benefits from high healthcare standards, a surge in dental labs offering personalized solutions, and technological advancements.Asia Pacific Dental Lab Market Report:

The Asia Pacific region holds significant potential for growth, with a market size of approximately $4.74 billion in 2023, projected to reach $7.96 billion by 2033. Factors include a rising population, increased dental healthcare spending, and growing awareness about oral health.North America Dental Lab Market Report:

In North America, the dental lab market size reached $9.83 billion in 2023 and is forecasted to grow to $16.49 billion by 2033. High disposable incomes and advanced healthcare systems, alongside cosmetic dentistry trends, are significant contributors to this growth.South America Dental Lab Market Report:

South America’s dental lab market is relatively nascent, valued at $0.39 billion in 2023, expected to grow to $0.65 billion by 2033. Increasing investment in healthcare infrastructure and dental tourism are pivotal drivers for the market.Middle East & Africa Dental Lab Market Report:

The Middle East and Africa dental lab market was valued at $3.54 billion in 2023 and is estimated to grow to $5.93 billion by 2033. Growth is stimulated by increasing healthcare investments and a focus on improving dental care accessibility.Tell us your focus area and get a customized research report.

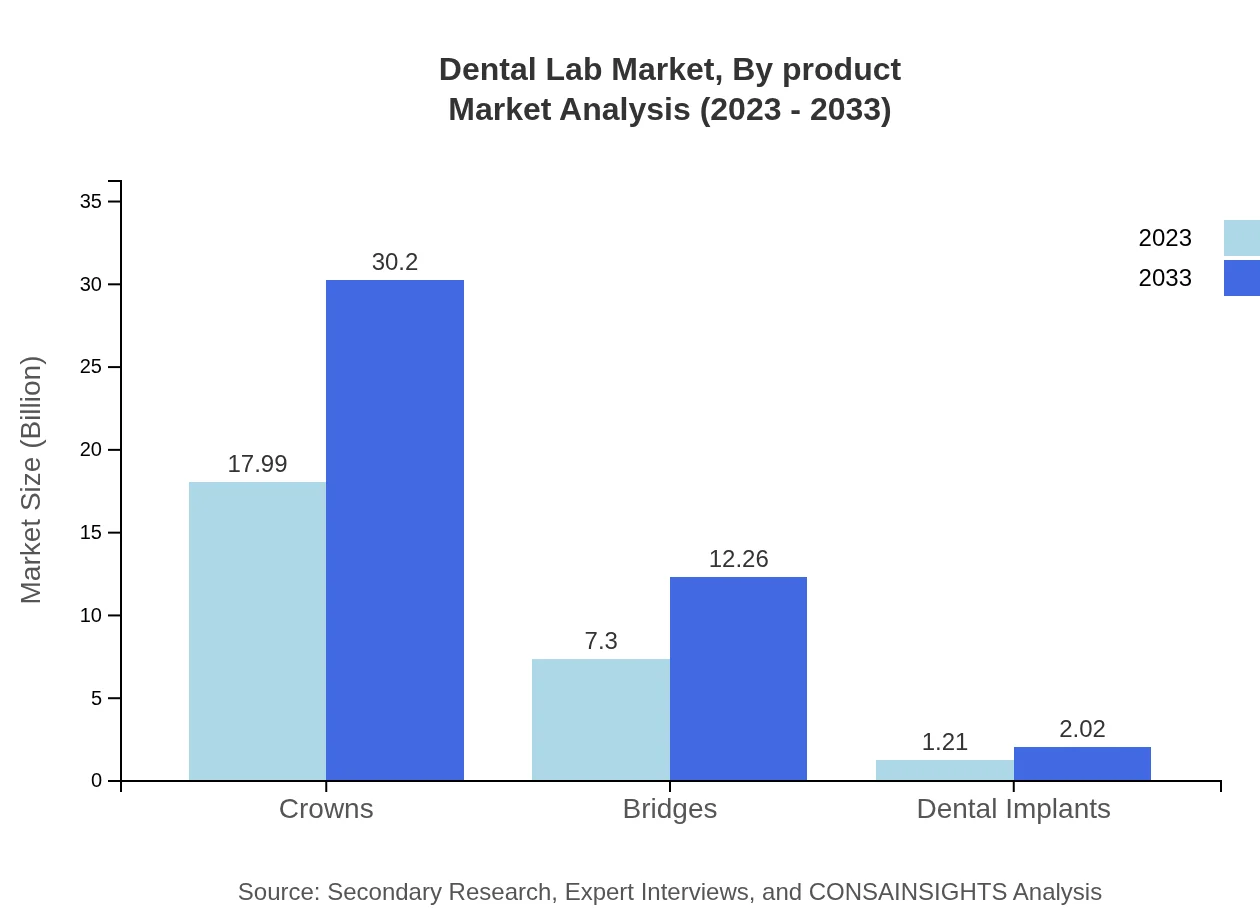

Dental Lab Market Analysis By Product

In the Dental Lab market, crowns remain the leading product segment, with a market size of approximately $17.99 billion in 2023, expected to grow to $30.20 billion by 2033, capturing a significant share of 67.9%. The bridges segment follows closely, showing a steady increase from $7.30 billion to $12.26 billion during the same period, maintaining a share of 27.55%. Other products like dental implants, though smaller in market size at $1.21 billion in 2023, are projected to double by 2033, reflecting an upward trend in restorative dental procedures.

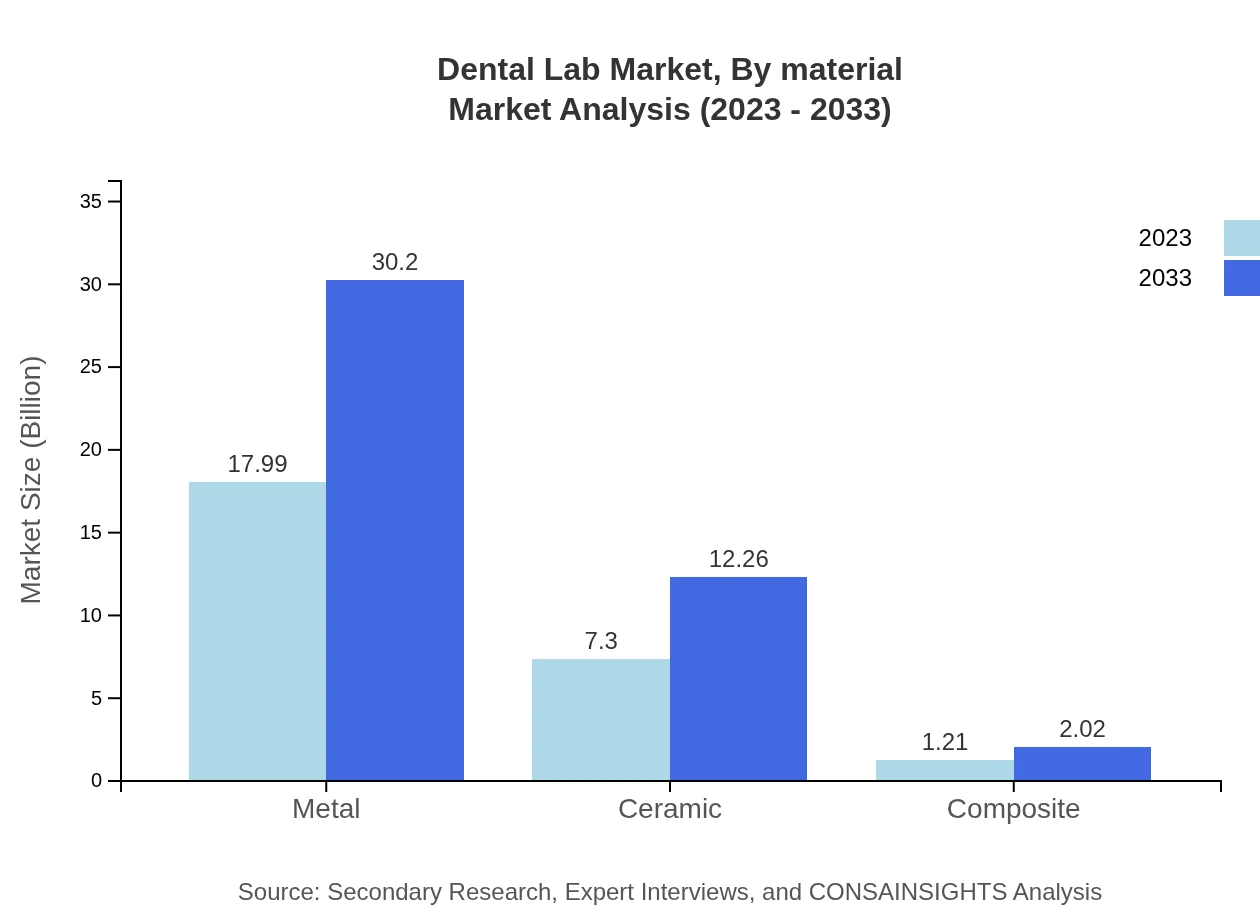

Dental Lab Market Analysis By Material

Materials play a crucial role in determining the effectiveness and durability of dental products. The predominant material, metal, holds a market size of $17.99 billion and is expected to reach $30.20 billion by 2033, maintaining a share of 67.9%. Ceramic, primarily used in aesthetic restorations, commands a market size of $7.30 billion, growing to $12.26 billion with a steady share of 27.55%. Emerging materials like composites also show potential, albeit at a smaller scale, projected to expand from $1.21 billion to $2.02 billion.

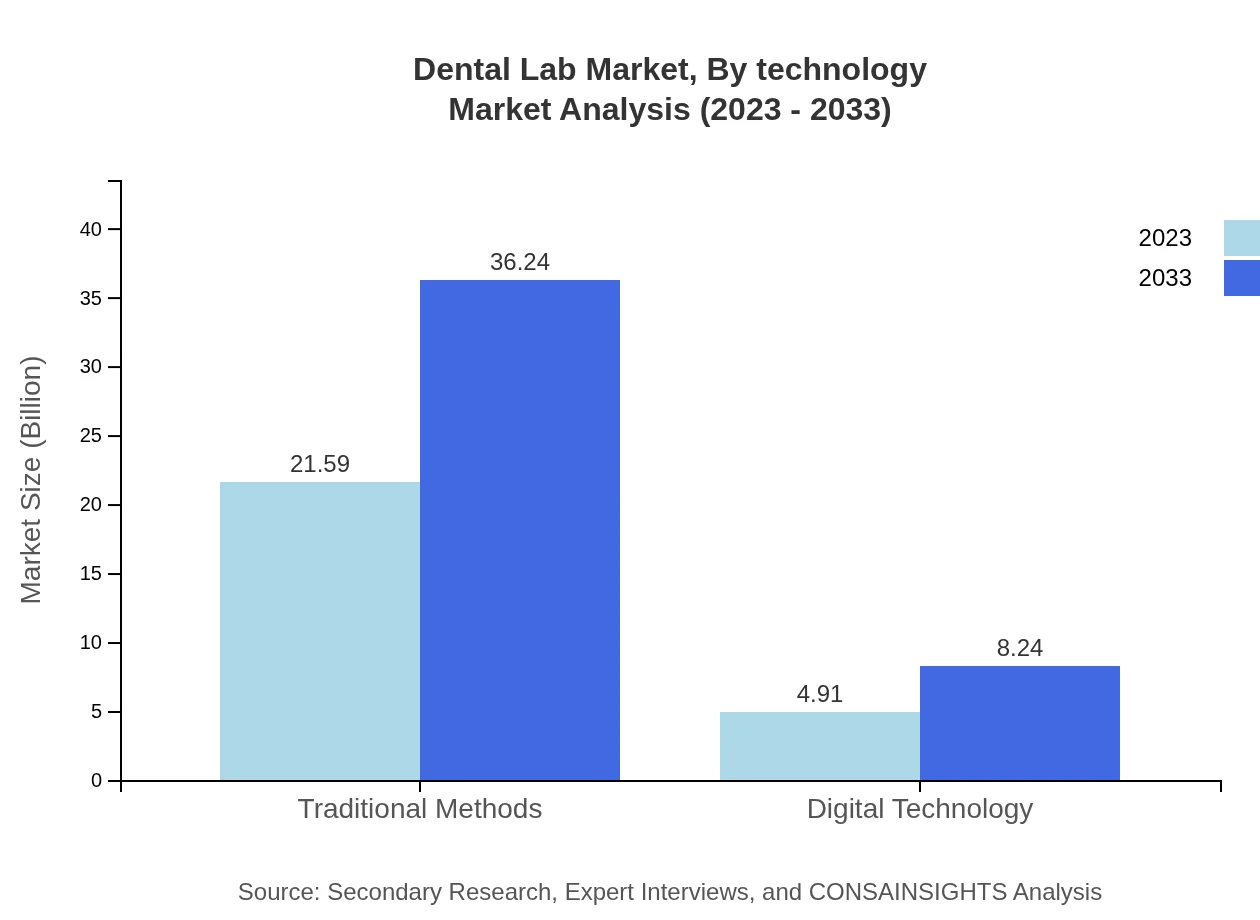

Dental Lab Market Analysis By Technology

The Dental Lab market is evolving with the introduction of digital technology alongside traditional methods. Traditional methodologies accounted for a size of $21.59 billion in 2023, growing to $36.24 billion by 2033, reflecting an extensive reliance on established practices. Conversely, digital technology is gaining traction with sizes projected to double from $4.91 billion to $8.24 billion, capturing an 18.53% market share as innovations like CAD/CAM systems gain popularity.

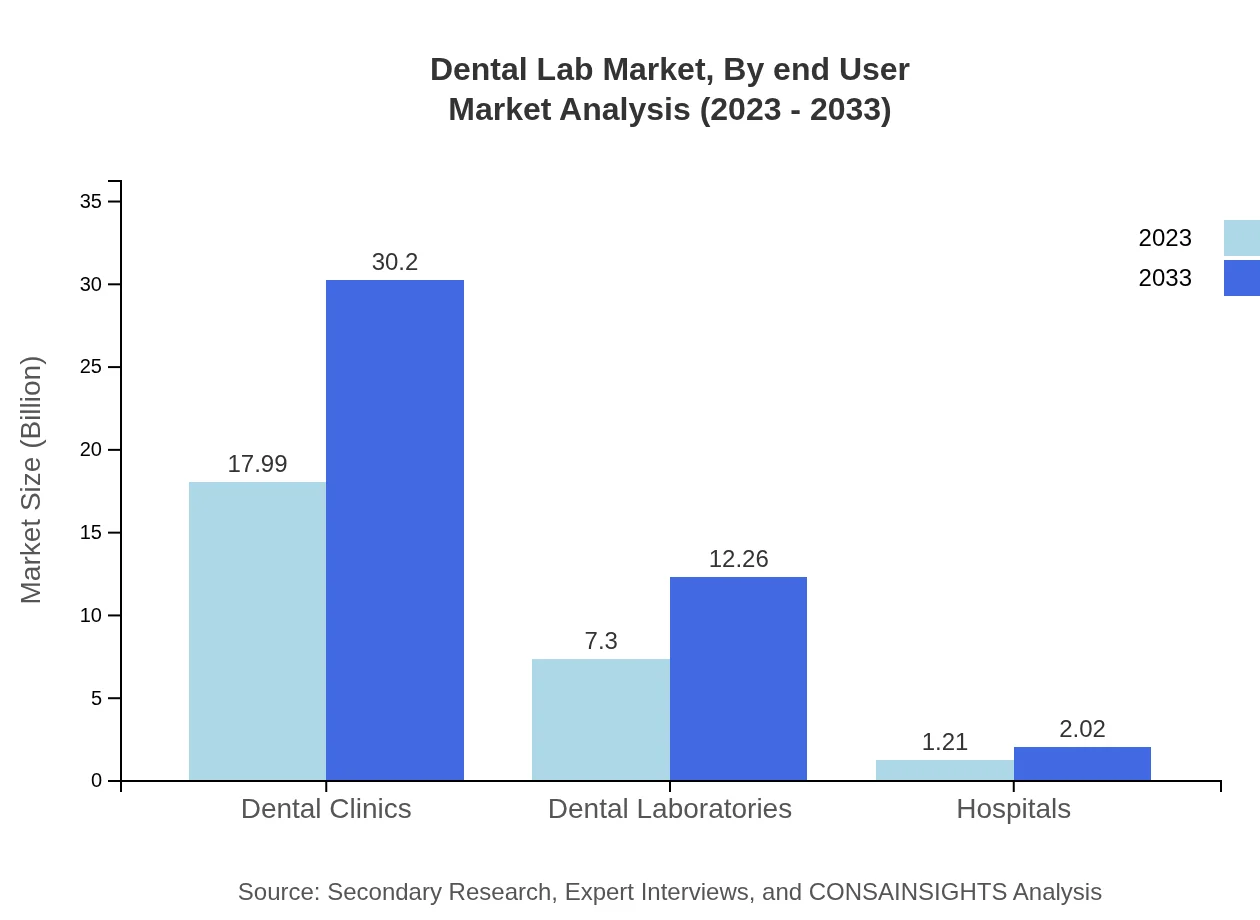

Dental Lab Market Analysis By End User

The end-user landscape features dental clinics as the most significant players, commanding a market size of $17.99 billion in 2023 and expected to reach $30.20 billion by 2033, achieving a share of 67.9%. Dental laboratories and hospitals also contribute a notable size of $7.30 billion and $1.21 billion respectively, with steady growth anticipated.

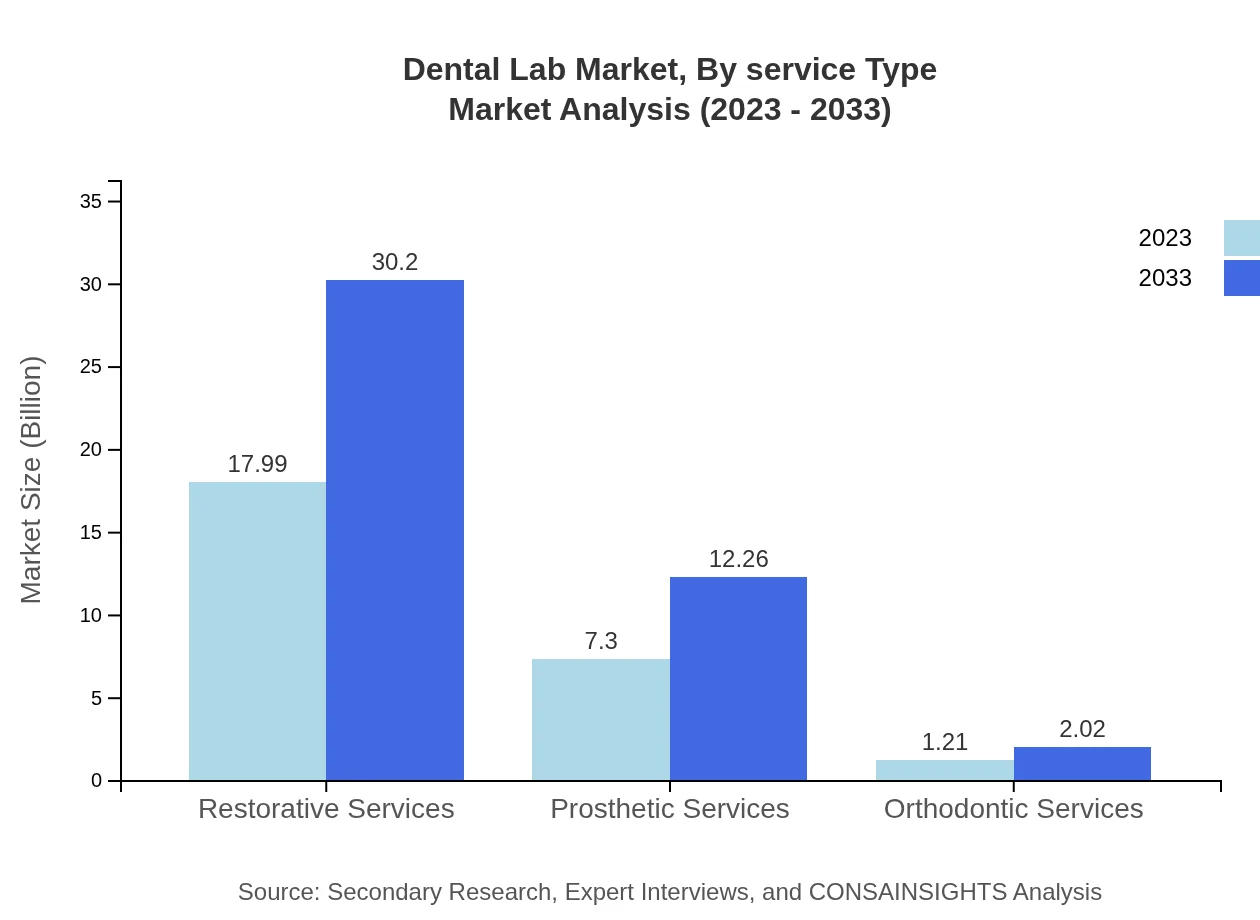

Dental Lab Market Analysis By Service Type

Service types focus predominantly on restorative services, generating a size of $17.99 billion in 2023 and projected to grow to $30.20 billion by 2033, holding a share of 67.9%. Other services, including prosthetic and orthodontic offerings, also show growth, with distinct upward trajectories reflecting evolving patient needs.

Dental Lab Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Lab Industry

Straumann Holding AG:

A global leader in implant, restorative, and regenerative dentistry, Straumann provides innovative solutions and products aimed at improving patient experiences and outcomes.Danaher Corporation:

Danaher is a diversified conglomerate with a significant presence in the dental segment through its dental platform, encompassing multiple brands providing products related to restorative and preventive dentistry.Dentsply Sirona Inc.:

A prominent player specializing in dental products and technologies, Dentsply Sirona focuses on improving dental practice workflows, helping dentists deliver better dental care.Henry Schein, Inc.:

This company serves the dental community globally, providing various technologies and services, including laboratory products, aiding in improving clinical and operational efficiencies.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Lab?

The global dental lab market is valued at approximately $26.5 billion in 2023, with a projected CAGR of 5.2% leading to a market size of nearly $43.5 billion by 2033. This growth reflects increasing demand for dental services and innovations.

What are the key market players or companies in the dental Lab industry?

Key players in the dental lab industry include renowned companies such as Dentsply Sirona, Straumann, and Henry Schein, which are known for their advanced dental technologies, extensive product portfolios, and strong global distribution networks.

What are the primary factors driving growth in the dental lab industry?

The growth of the dental lab industry is primarily driven by increasing oral health awareness, a growing aging population, advancements in dental technology, and rising demand for cosmetic dentistry options, which collectively enhance service offerings and market size.

Which region is the fastest Growing in the dental lab market?

North America emerges as the fastest-growing region in the dental lab market, with the market projected to grow from $9.83 billion in 2023 to $16.49 billion by 2033. This growth is fueled by technological advancements and an increasing number of dental clinics.

Does ConsaInsights provide customized market report data for the dental lab industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the dental lab industry, allowing clients to obtain focused insights based on geographical market dynamics, segments, and trends pertinent to their business strategies.

What deliverables can I expect from the dental lab market research project?

Deliverables from the dental lab market research project include comprehensive market analysis reports, segmentation insights, competitive landscape evaluations, growth forecasts, and actionable recommendations tailored to enhance decision-making and strategic planning.

What are the market trends of dental lab?

Current market trends in the dental lab industry include a shift towards digital technology and 3D printing, increasing interest in cosmetic procedures, a rise in implantology, and a growing emphasis on patient-centric care, driving innovation and market growth.