Dental Lasers Market Report

Published Date: 31 January 2026 | Report Code: dental-lasers

Dental Lasers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the dental lasers market, covering market size forecasts, trends, and insights from 2023 to 2033. It also explores segmentation, regional dynamics, key players, and future projections to equip stakeholders with actionable data.

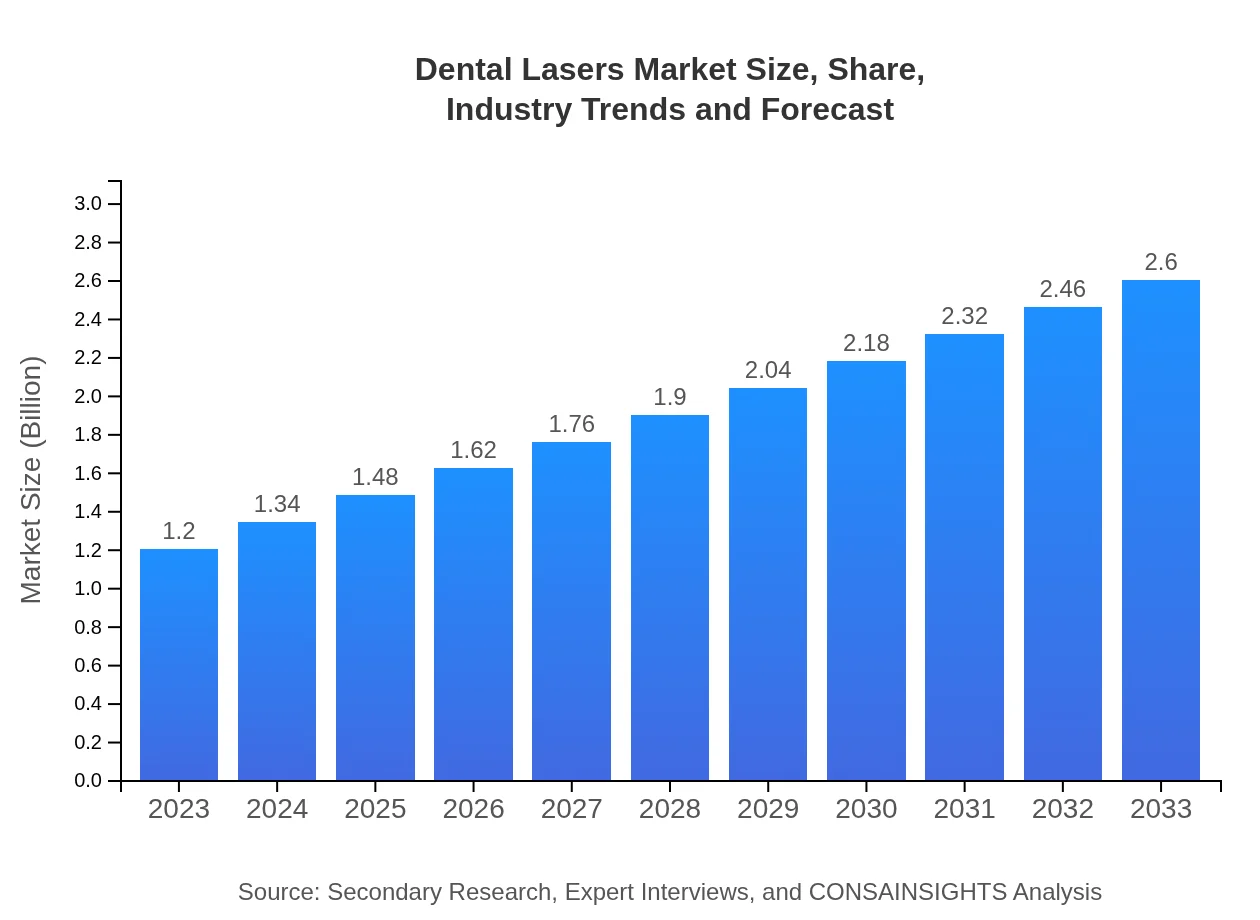

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $2.60 Billion |

| Top Companies | Biolase, Inc., Convergent Dental, Inc., Carbon, Inc., Lumenis |

| Last Modified Date | 31 January 2026 |

Dental Lasers Market Overview

Customize Dental Lasers Market Report market research report

- ✔ Get in-depth analysis of Dental Lasers market size, growth, and forecasts.

- ✔ Understand Dental Lasers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Lasers

What is the Market Size & CAGR of Dental Lasers market in 2023?

Dental Lasers Industry Analysis

Dental Lasers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Lasers Market Analysis Report by Region

Europe Dental Lasers Market Report:

Europe's market is predicted to grow from $340 million in 2023 to $740 million in 2033, reflecting strong demand in countries like Germany and the UK, where advanced dental technologies are rapidly being adopted.Asia Pacific Dental Lasers Market Report:

In the Asia Pacific region, the market is projected to grow from $240 million in 2023 to $520 million in 2033, driven by rising dental healthcare spending and increasing awareness about the benefits of laser treatments.North America Dental Lasers Market Report:

In North America, the dental lasers market is expected to expand from $420 million in 2023 to $910 million by 2033. This growth is propelled by high consumer spending on dental services and a well-established healthcare infrastructure.South America Dental Lasers Market Report:

The South American market is anticipated to escalate from $50 million in 2023 to $110 million by 2033, supported by a growing middle-class population and enhancements in dental technology adoption across various countries.Middle East & Africa Dental Lasers Market Report:

The Middle East and Africa market is projected to grow from $150 million in 2023 to $320 million by 2033, as dental professionals increasingly adopt laser technology to improve treatment outcomes and patient experiences.Tell us your focus area and get a customized research report.

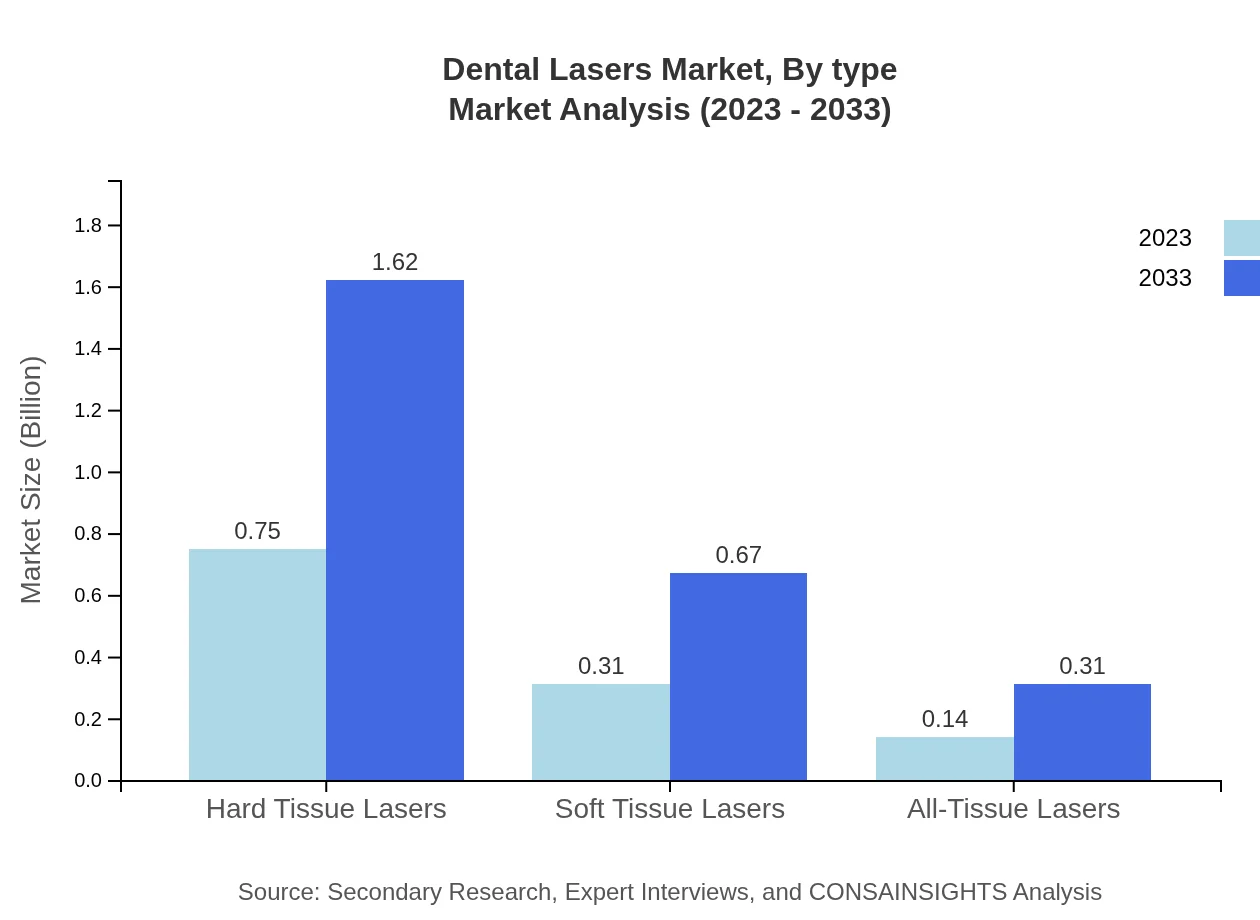

Dental Lasers Market Analysis By Type

The dental lasers market is segmented by type into hard tissue lasers, soft tissue lasers, and all-tissue lasers. Hard tissue lasers, accounting for 62.43% share in 2023, are projected to grow from $0.75 billion to $1.62 billion by 2033. Soft tissue lasers represent 25.66% of the market and will increase from $0.31 billion to $0.67 billion during the same period. All-tissue lasers, although a smaller segment, show promising growth from $0.14 billion to $0.31 billion.

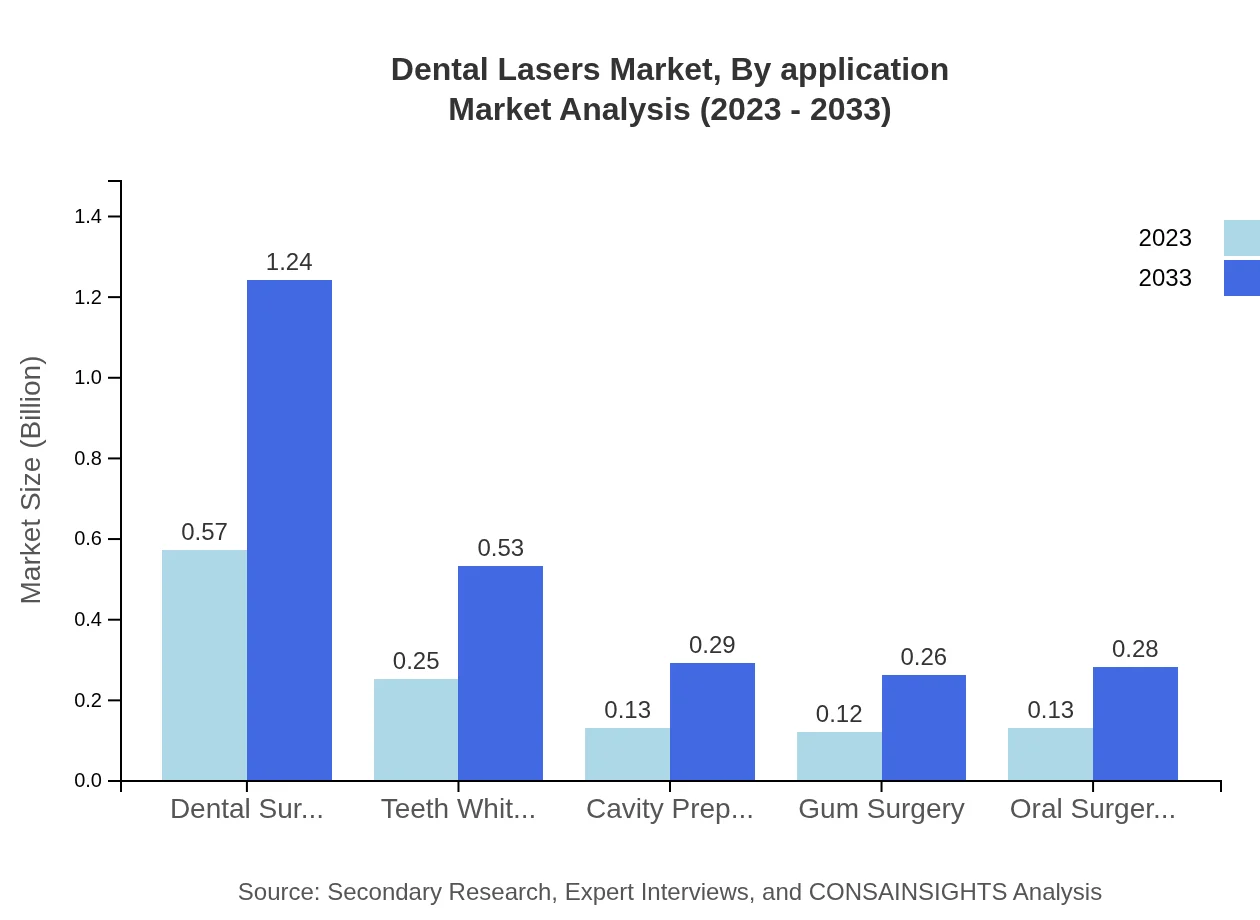

Dental Lasers Market Analysis By Application

In terms of application, dental surgery dominates with a 47.65% market share in 2023, growing from $0.57 billion to $1.24 billion by 2033. Teeth whitening follows at 20.48%, expected to expand from $0.25 billion to $0.53 billion. Other applications, including cavity preparation and gum surgery, also show positive growth trends.

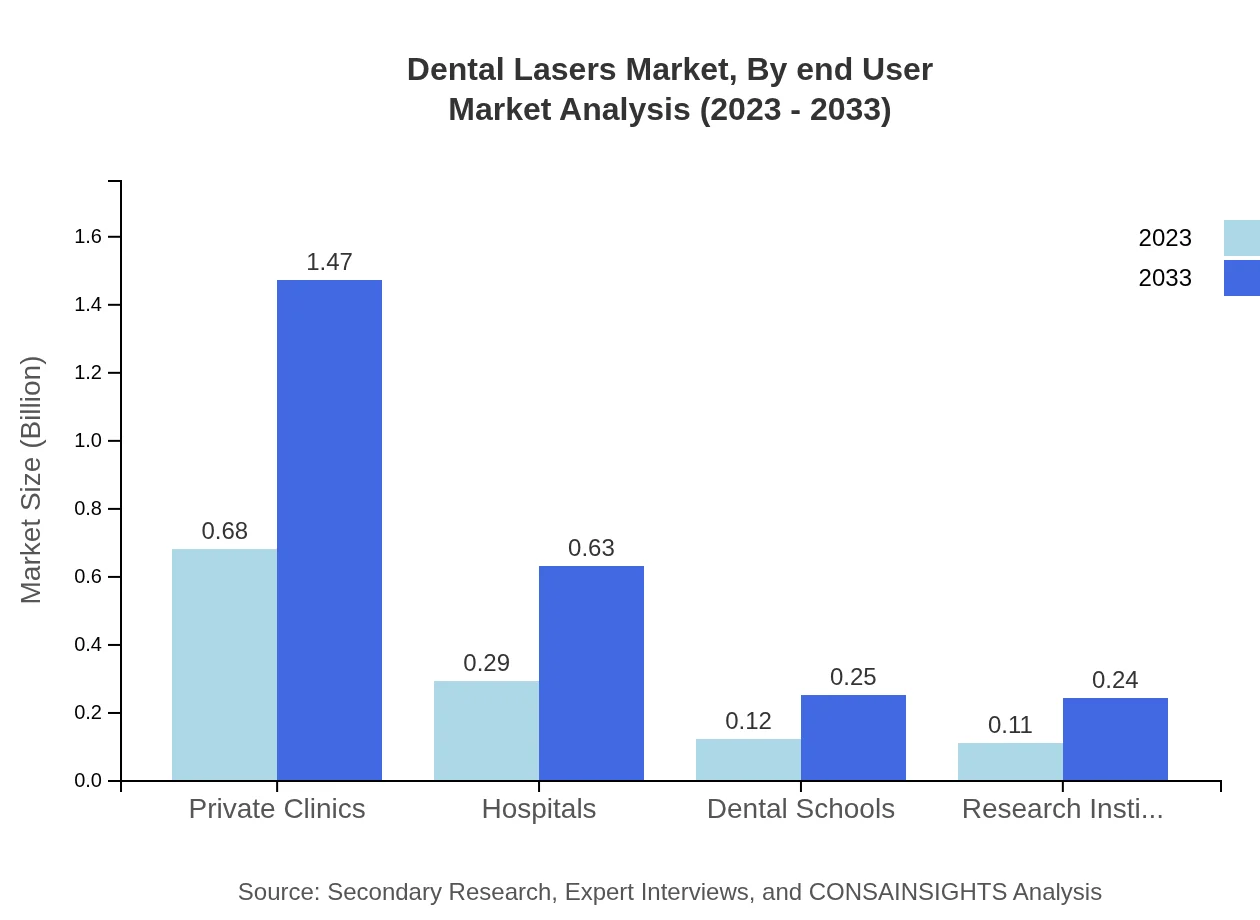

Dental Lasers Market Analysis By End User

The market is categorized by end users including private clinics, hospitals, dental schools, and research institutes. Private clinics lead this segment with 56.64% market share, growing from $0.68 billion to $1.47 billion by 2033. Hospitals hold a significant share of 24.37%, expected to increase from $0.29 billion to $0.63 billion.

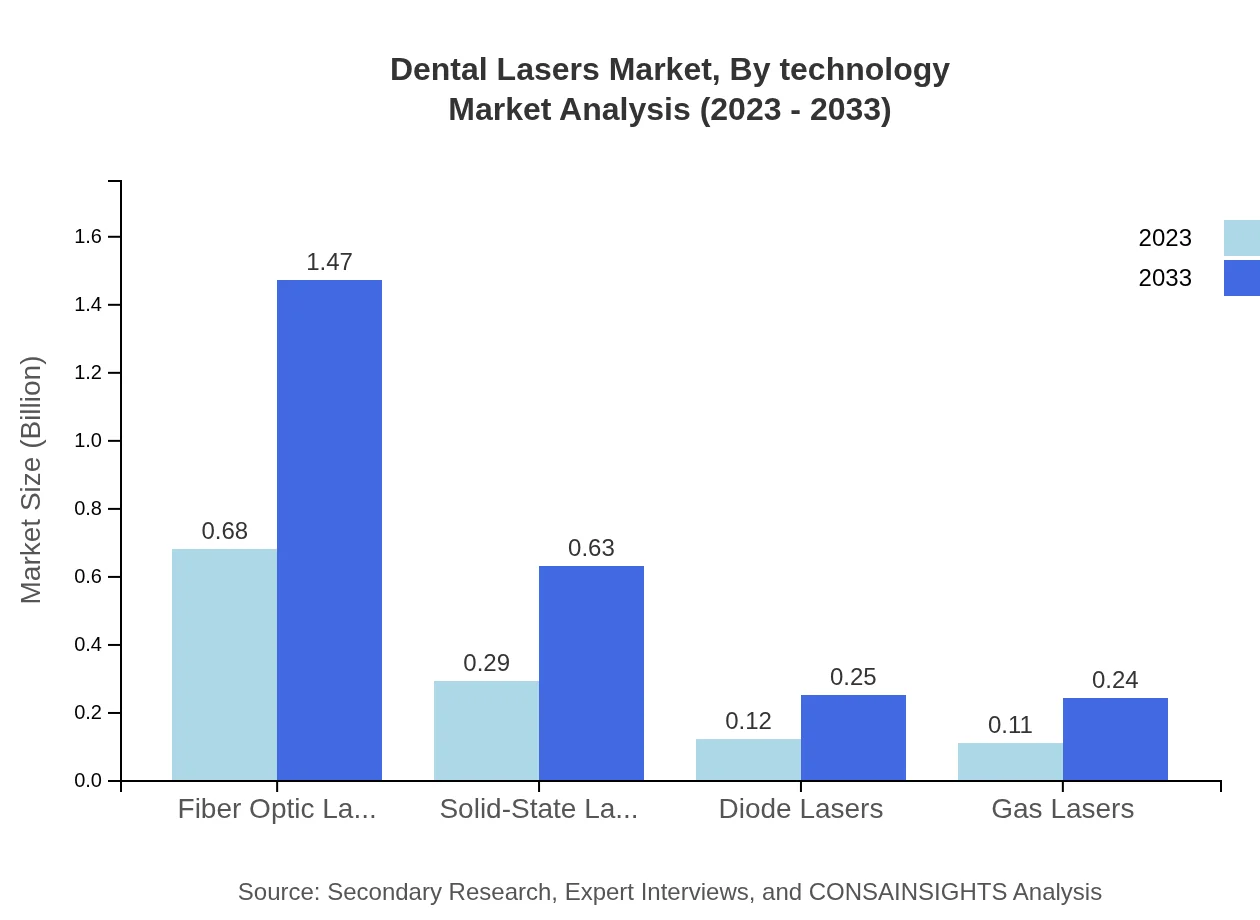

Dental Lasers Market Analysis By Technology

Key technologies in the dental lasers market include fiber optic lasers, solid-state lasers, diode lasers, and gas lasers. Fiber optic lasers are dominant, constituting 56.64% of the market and growing from $0.68 billion to $1.47 billion, followed by solid-state lasers and diode lasers with substantial shares.

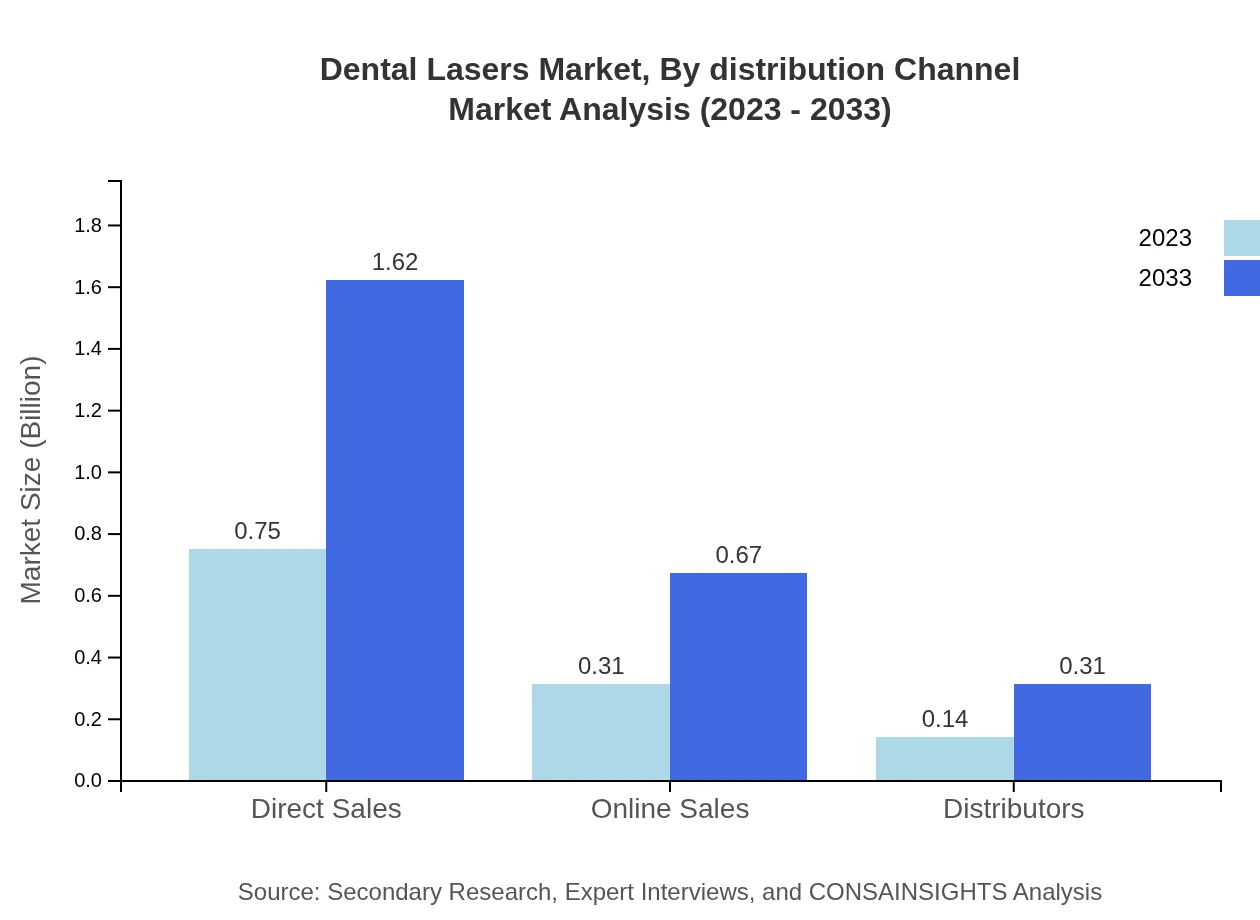

Dental Lasers Market Analysis By Distribution Channel

The distribution of dental lasers occurs through direct sales, online sales, and distribution through third parties. Direct sales capture the lion's share of the market at 62.43%, with an expected increase from $0.75 billion to $1.62 billion. Online sales represent 25.66%, reflecting the shift towards e-commerce in dental equipment.

Dental Lasers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Lasers Industry

Biolase, Inc.:

Biolase is a global leader in dental lasers, providing innovative laser systems that enhance dental procedures.Convergent Dental, Inc.:

Convergent Dental has pioneered technologies that improve patient experiences in dental procedures using laser systems.Carbon, Inc.:

Carbon is known for its advanced dental laser technologies that integrate with other digital dentistry solutions.Lumenis:

Lumenis develops leading-edge laser technologies suitable for a variety of applications within the dental sector.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Lasers?

The dental lasers market is projected to reach approximately $1.2 billion by 2033, growing at a CAGR of 7.8% from its current size. This expansion reflects the increasing adoption of laser technology in dental procedures.

What are the key market players or companies in this dental Lasers industry?

Key players in the dental lasers market include leading companies such as Biolase, Inc., Sirona Dental Systems, and AMD Lasers. These companies dominate the market with their innovative products and strong distribution networks.

What are the primary factors driving the growth in the dental Lasers industry?

Growth in the dental lasers market is driven by factors such as technological advancements, increased demand for minimally invasive procedures, and rising patient preference for pain-free dental treatments. These factors collectively enhance the market's appeal.

Which region is the fastest Growing in the dental Lasers?

The fastest-growing region in the dental lasers market is Asia Pacific, with market size forecasted to grow from $0.24 billion in 2023 to $0.52 billion by 2033, driven by expanding healthcare infrastructure and rising dental care awareness.

Does ConsaInsights provide customized market report data for the dental Lasers industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the dental-lasers industry. This ensures clients receive insights that match their strategic objectives and market interests.

What deliverables can I expect from this dental Lasers market research project?

Deliverables from the dental-lasers market research project include comprehensive market analysis, segmentation data, competitive landscape insights, and regional forecasts, presented in detailed reports to support informed decision-making.

What are the market trends of dental Lasers?

Current trends in the dental lasers market include an increase in the use of hard tissue lasers, advancements in soft tissue technology, and a growing preference for laser-based cosmetic procedures among patients.