Dental Practice Management Software Market Report

Published Date: 31 January 2026 | Report Code: dental-practice-management-software

Dental Practice Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Dental Practice Management Software market, exploring key trends, market size, growth forecasts, and segmentations for the period 2023 to 2033. Insights into regional performance and technology trends are also covered.

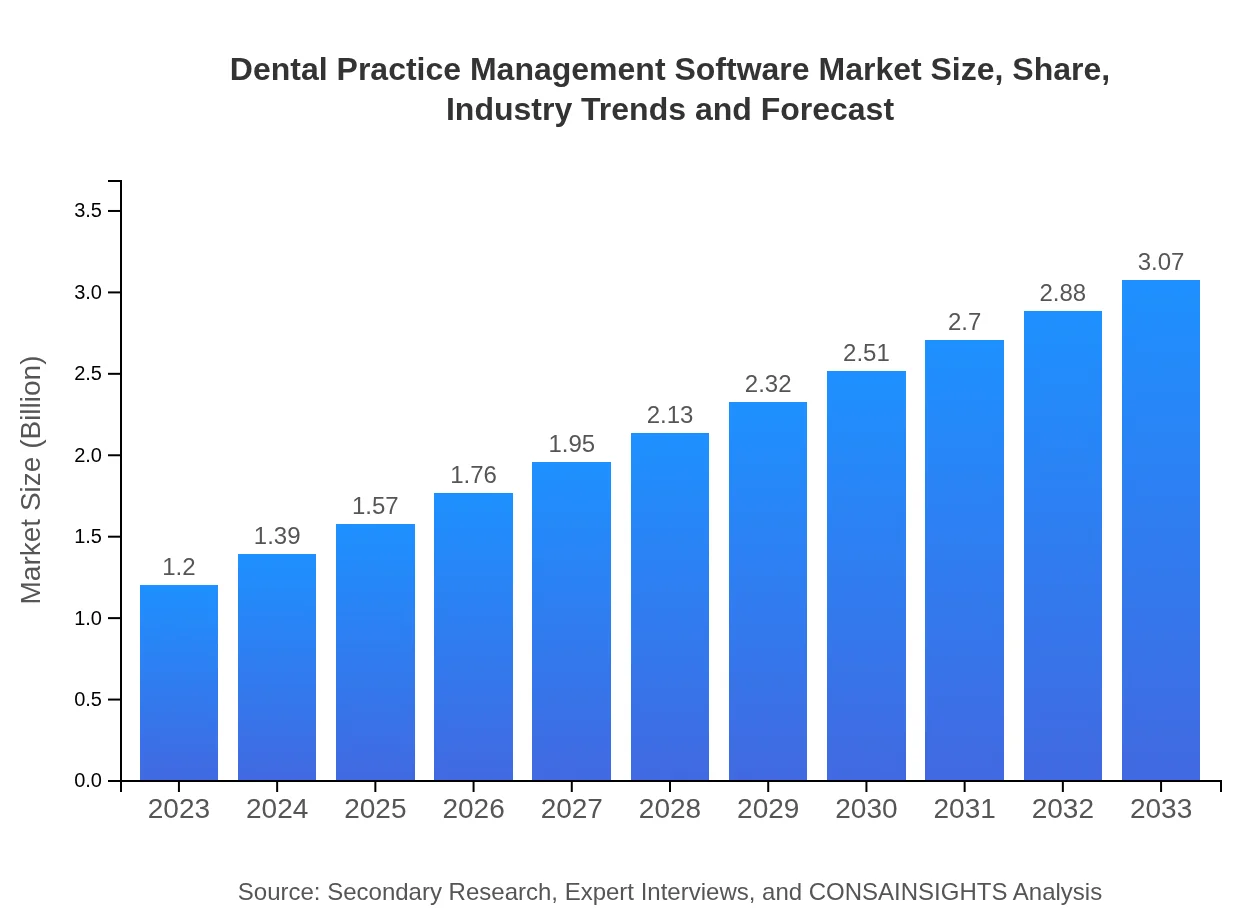

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $3.07 Billion |

| Top Companies | Dentrix, Open Dental, Carestream Dental, eClinicalWorks, Practice-Web |

| Last Modified Date | 31 January 2026 |

Dental Practice Management Software Market Overview

Customize Dental Practice Management Software Market Report market research report

- ✔ Get in-depth analysis of Dental Practice Management Software market size, growth, and forecasts.

- ✔ Understand Dental Practice Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Practice Management Software

What is the Market Size & CAGR of Dental Practice Management Software market in 2023?

Dental Practice Management Software Industry Analysis

Dental Practice Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Practice Management Software Market Analysis Report by Region

Europe Dental Practice Management Software Market Report:

The European market for Dental Practice Management Software is projected to grow significantly, from $0.30 billion in 2023 to $0.77 billion by 2033. This increase is fueled by the regulatory support for digital healthcare solutions and a growing emphasis on integrating patient management systems across healthcare facilities.Asia Pacific Dental Practice Management Software Market Report:

In the Asia-Pacific region, the Dental Practice Management Software market is projected to grow from $0.23 billion in 2023 to $0.60 billion by 2033. The rising number of dental clinics, along with increasing awareness of oral health, drives this growth. Countries like India and China are witnessing significant investments in healthcare technologies, which includes the adoption of DPMS solutions.North America Dental Practice Management Software Market Report:

North America remains the largest market for Dental Practice Management Software, projected to grow from $0.47 billion in 2023 to $1.19 billion by 2033. The region's advanced healthcare infrastructure, high adoption of new technologies, and a significant number of dental practices drive this robust growth. Moreover, the presence of key software providers strengthens the market's outlook.South America Dental Practice Management Software Market Report:

The South American market for Dental Practice Management Software is expected to experience growth from $0.08 billion in 2023 to $0.19 billion by 2033. This growth is primarily supported by the improving healthcare infrastructure and the increasing number of dental practices that are digitizing their operations.Middle East & Africa Dental Practice Management Software Market Report:

In the Middle East and Africa, the Dental Practice Management Software market is expected to grow from $0.12 billion in 2023 to $0.31 billion by 2033. Regional investments in healthcare and rising dental tourism are key factors that will boost the adoption of software solutions aimed at enhancing dental practices.Tell us your focus area and get a customized research report.

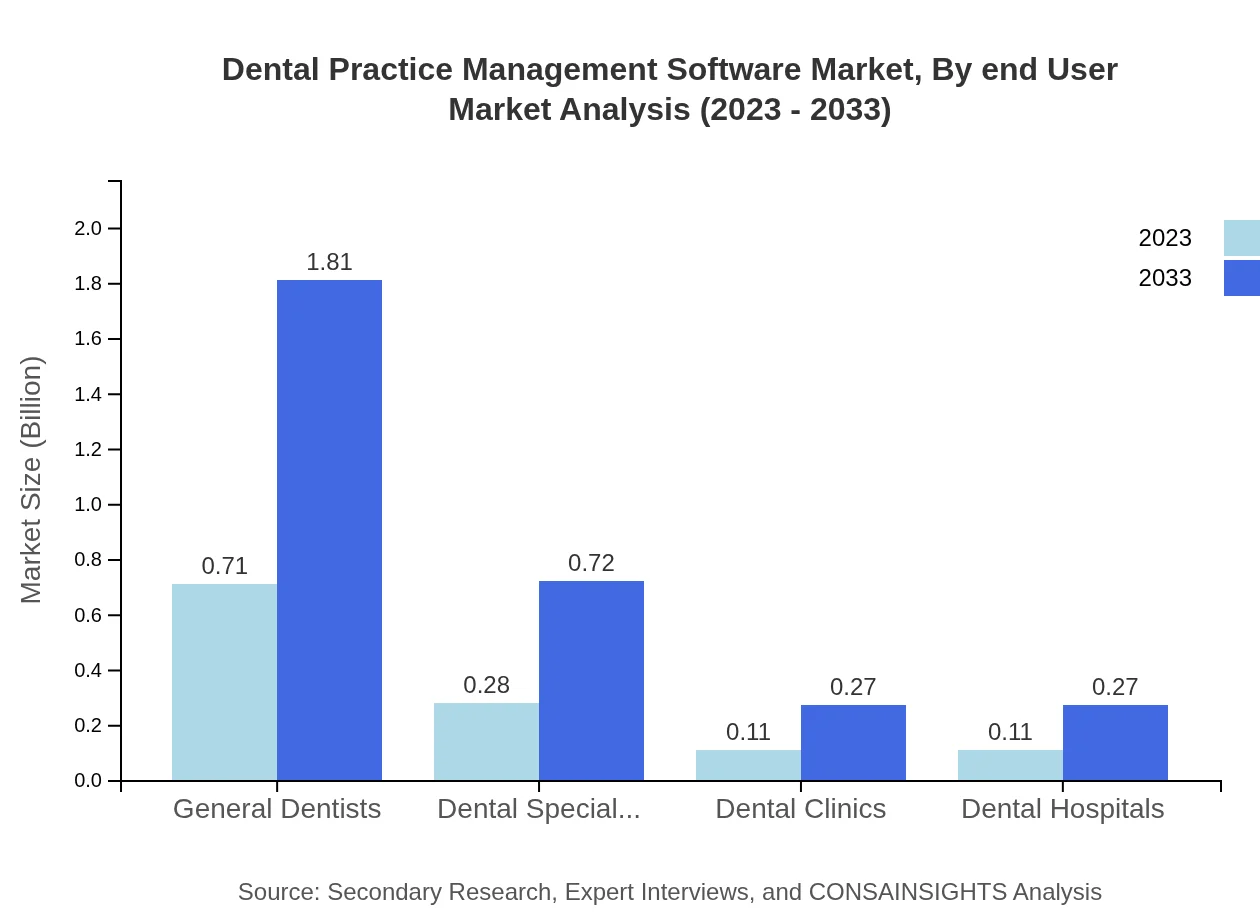

Dental Practice Management Software Market Analysis By End User

The market segmentation by end user highlights: - **General Dentists**: From $0.71 billion in 2023 to $1.81 billion by 2033, representing 58.81% market share throughout the period. - **Dental Specialists**: Expected to grow from $0.28 billion in 2023 to $0.72 billion by 2033, constituting 23.52% of the market share. - **Dental Clinics**: Anticipated to increase from $0.11 billion to $0.27 billion, maintaining an 8.84% market share. - **Dental Hospitals**: Projected market size of $0.11 billion in 2023 growing to $0.27 billion by 2033, also serving 8.83% of the market.

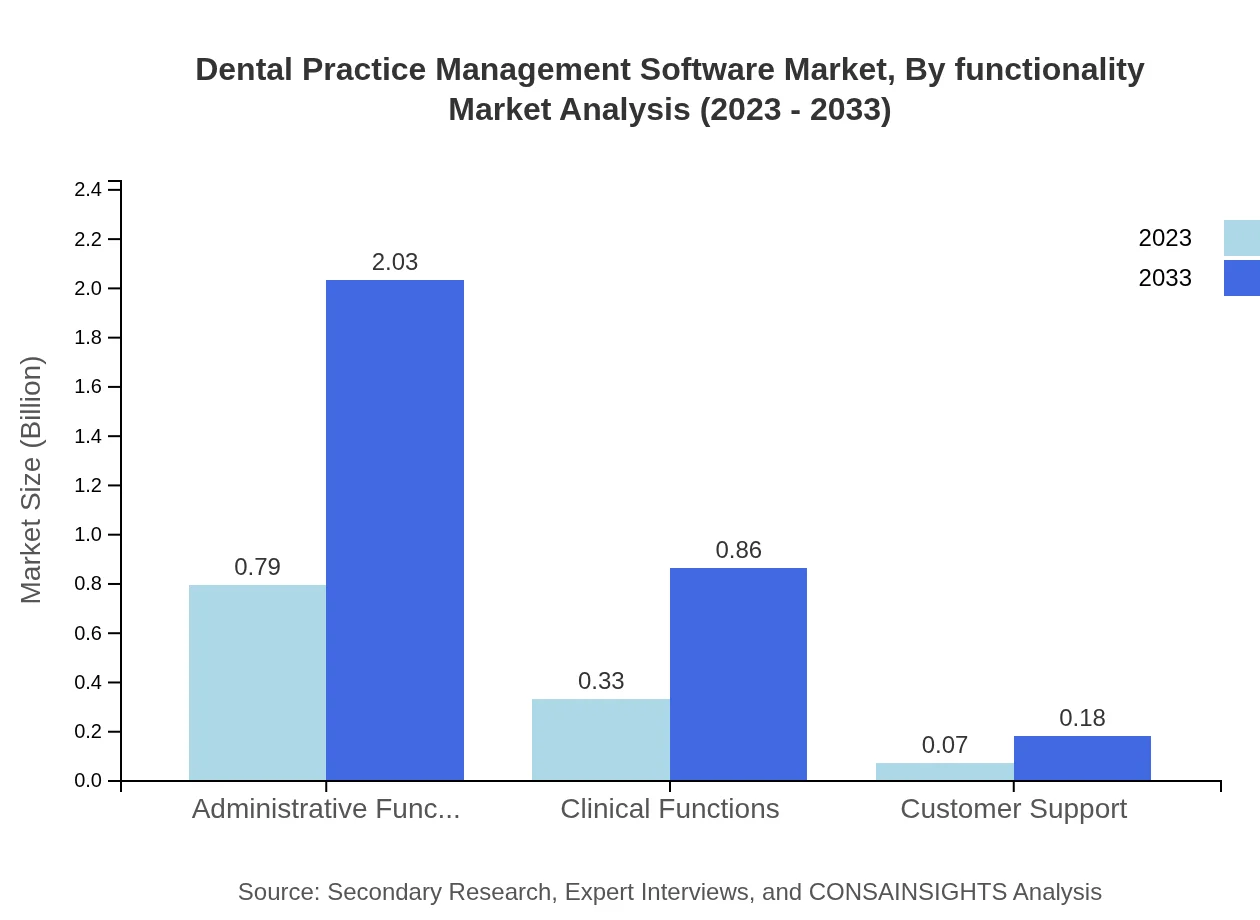

Dental Practice Management Software Market Analysis By Functionality

Analyzing by functionality, the market exhibits: - **Administrative Functions**: Size expansion from $0.79 billion to $2.03 billion (66.15% share). - **Clinical Functions**: Growth from $0.33 billion to $0.86 billion (27.91% share). - **Customer Support**: Projected to grow from $0.07 billion to $0.18 billion (5.94% share). These functionalities are integral to the software's efficiency in managing dental practices.

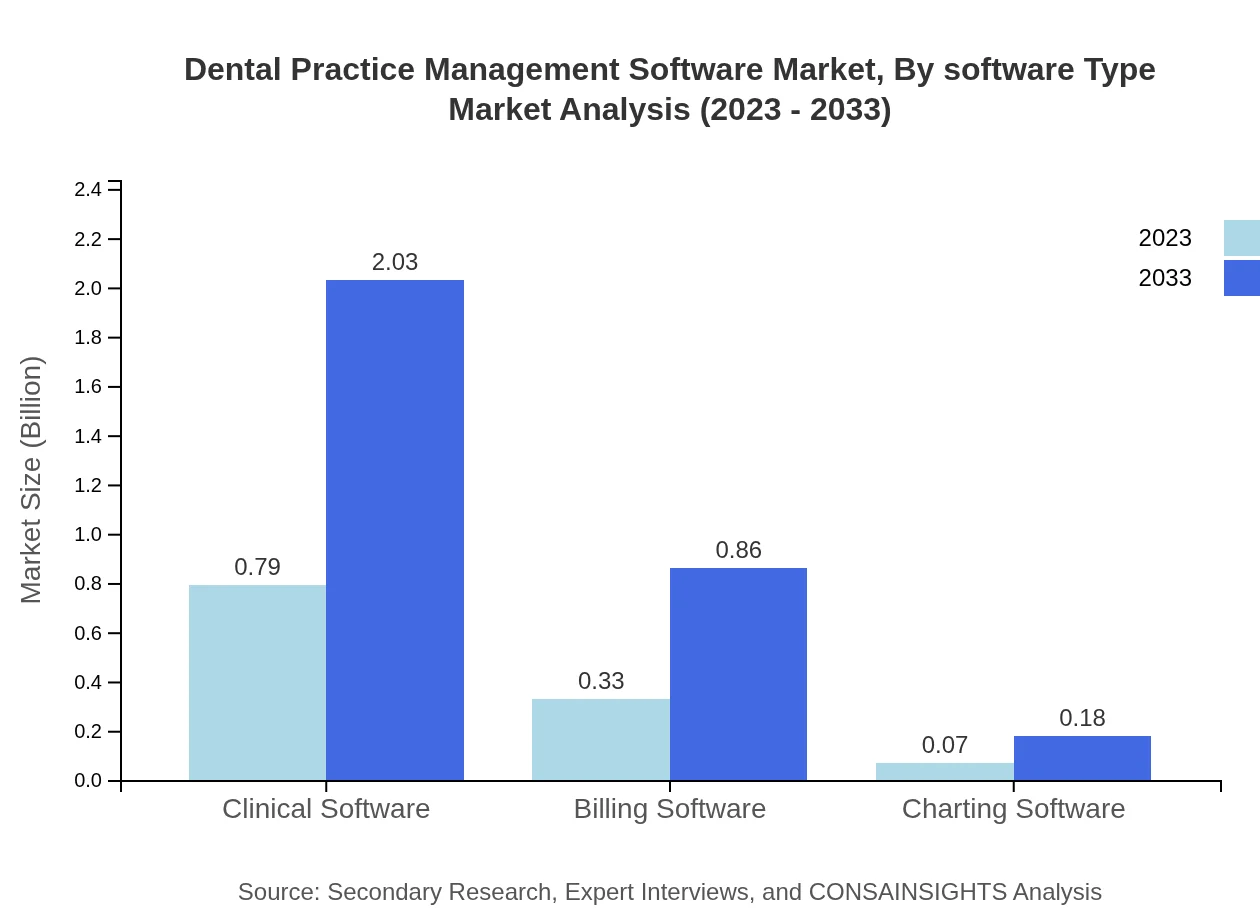

Dental Practice Management Software Market Analysis By Software Type

The performance of software types is as follows: - **Clinical Software**: From $0.79 billion in 2023 to $2.03 billion in 2033 (66.15% market share). - **Billing Software**: Expected growth from $0.33 billion to $0.86 billion (27.91% market share). - **Charting Software**: From $0.07 billion to $0.18 billion (5.94% market share). The clinical software segment holds the largest share due to its critical role in operational efficiency and patient management.

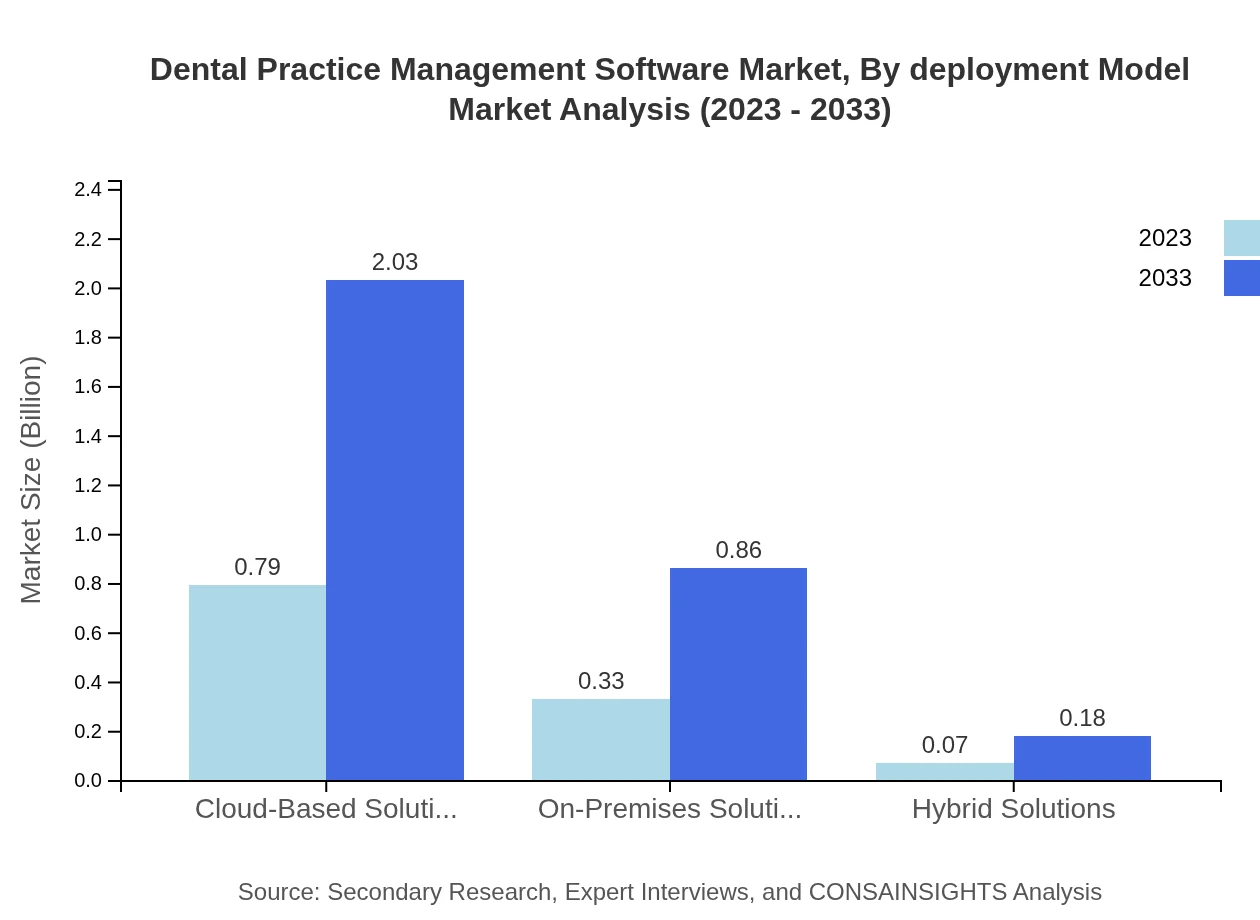

Dental Practice Management Software Market Analysis By Deployment Model

Deployment models reveal: - **Cloud-Based Solutions**: Growing from $0.79 billion to $2.03 billion (66.15% share), with increasing adoption due to flexibility and scalability. - **On-Premises Solutions**: Expected market size progression from $0.33 billion to $0.86 billion (27.91% share). - **Hybrid Solutions**: A minor segment, projected to grow from $0.07 billion to $0.18 billion (5.94% share), catering to practices seeking a combination of both deployment models.

Dental Practice Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Practice Management Software Industry

Dentrix:

A leading provider of practice management software tailored specifically for the dental industry, offering comprehensive solutions for scheduling, billing, and patient engagement.Open Dental:

An open-source software solution that provides flexible, customizable practice management features, focusing on transparency in pricing and accessibility for dental practices.Carestream Dental:

Provides an array of software solutions that integrate with imaging and diagnostic tools, enhancing overall practice operations and patient care.eClinicalWorks:

Offers advanced software solutions for managing dental practices with a focus on interoperability and patient-centered care through integrated systems.Practice-Web:

Known for its powerful and versatile dental practice management software, it focuses on enhancing productivity and overall efficiency for dental professionals.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Practice Management Software?

The dental practice management software market is valued at approximately $1.2 billion in 2023, with a projected CAGR of 9.5%, suggesting robust growth potential through 2033 as dental practices increasingly adopt digital solutions.

What are the key market players or companies in this dental Practice Management Software industry?

Key players in the dental practice management software market include companies like Henry Schein, Dentrix, and Open Dental. These firms lead with innovative solutions, contributing significantly to market growth and setting trends in dental administration.

What are the primary factors driving the growth in the dental Practice Management Software industry?

Growth in the dental practice management software industry is driven by increasing demand for efficient patient management solutions, technological advancements, the need for compliance with regulations, and a rising emphasis on enhancing patient experience and operational efficiency.

Which region is the fastest Growing in the dental Practice Management Software?

North America is the fastest-growing region in the dental practice management software market, expected to increase from $0.47 billion in 2023 to $1.19 billion by 2033, driven by higher adoption rates and advancements in technology.

Does ConsaInsights provide customized market report data for the dental Practice Management Software industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of the dental practice management software industry, allowing stakeholders to gain deeper insights relevant to their business strategies.

What deliverables can I expect from this dental Practice Management Software market research project?

From this market research project, you can expect comprehensive reports including market size, segment analysis, growth forecasts, competitive landscape, and trends that will equip you with actionable insights to make informed decisions.

What are the market trends of dental Practice Management Software?

Current market trends in dental practice management software include a shift towards cloud-based solutions, integration of AI for patient management, growth in mobile accessibility, and an increasing focus on user-friendly interfaces to enhance practice efficiency.