Dental Services Market Report

Published Date: 31 January 2026 | Report Code: dental-services

Dental Services Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Dental Services market, providing insights into market size, growth trends, regional dynamics, and key players for the forecast period from 2023 to 2033.

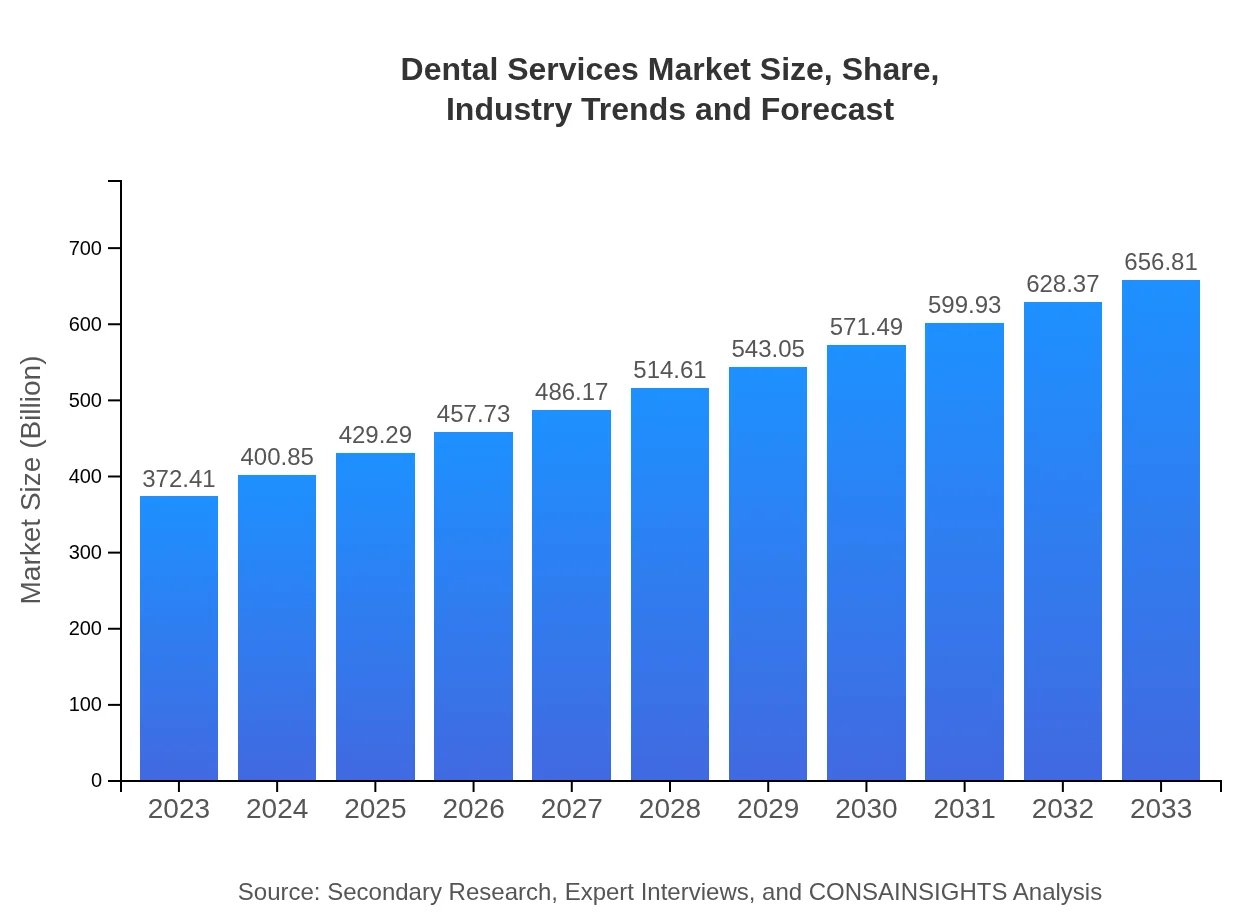

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $372.41 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $656.81 Billion |

| Top Companies | Align Technology, Inc., Henry Schein, Inc., Dentsply Sirona, Colgate-Palmolive Company |

| Last Modified Date | 31 January 2026 |

Dental Services Market Overview

Customize Dental Services Market Report market research report

- ✔ Get in-depth analysis of Dental Services market size, growth, and forecasts.

- ✔ Understand Dental Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Services

What is the Market Size & CAGR of Dental Services market in 2023-2033?

Dental Services Industry Analysis

Dental Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Services Market Analysis Report by Region

Europe Dental Services Market Report:

The European market for dental services is expected to grow from $91.76 billion in 2023 to $161.84 billion by 2033. Factors such as rising disposable income, an aging population, and advanced dental technologies are key drivers. Countries like Germany and the UK are notable markets where the demand for both traditional and cosmetic dental services is increasing.Asia Pacific Dental Services Market Report:

The Asia Pacific region is experiencing robust growth in the Dental Services market, with a market size expected to increase from $81.07 billion in 2023 to $142.99 billion by 2033. Rising dental care awareness and access to advanced services are significant contributors to this growth. Nations like India and China are investing heavily in healthcare infrastructure, thereby boosting demand for dental services.North America Dental Services Market Report:

North America holds the largest share of the Dental Services market, from $134.03 billion in 2023 to $236.38 billion by 2033. The presence of well-established dental infrastructure and high healthcare expenditure contributes to this dominance. Moreover, the growing emphasis on aesthetic treatments and preventive care is further driving market growth.South America Dental Services Market Report:

In South America, the Dental Services market is projected to grow from $26.96 billion in 2023 to $47.55 billion by 2033. Increased health awareness, coupled with improvements in the economy, has spurred investments in dental care services. Brazil and Argentina are leading markets due to large populations and increasing healthcare expenditure.Middle East & Africa Dental Services Market Report:

The Middle East and Africa are anticipated to see market growth from $38.58 billion in 2023 to $68.05 billion by 2033. Despite facing challenges related to healthcare access, the region shows potential due to increasing awareness about oral health and expanding dental service availability in urban areas.Tell us your focus area and get a customized research report.

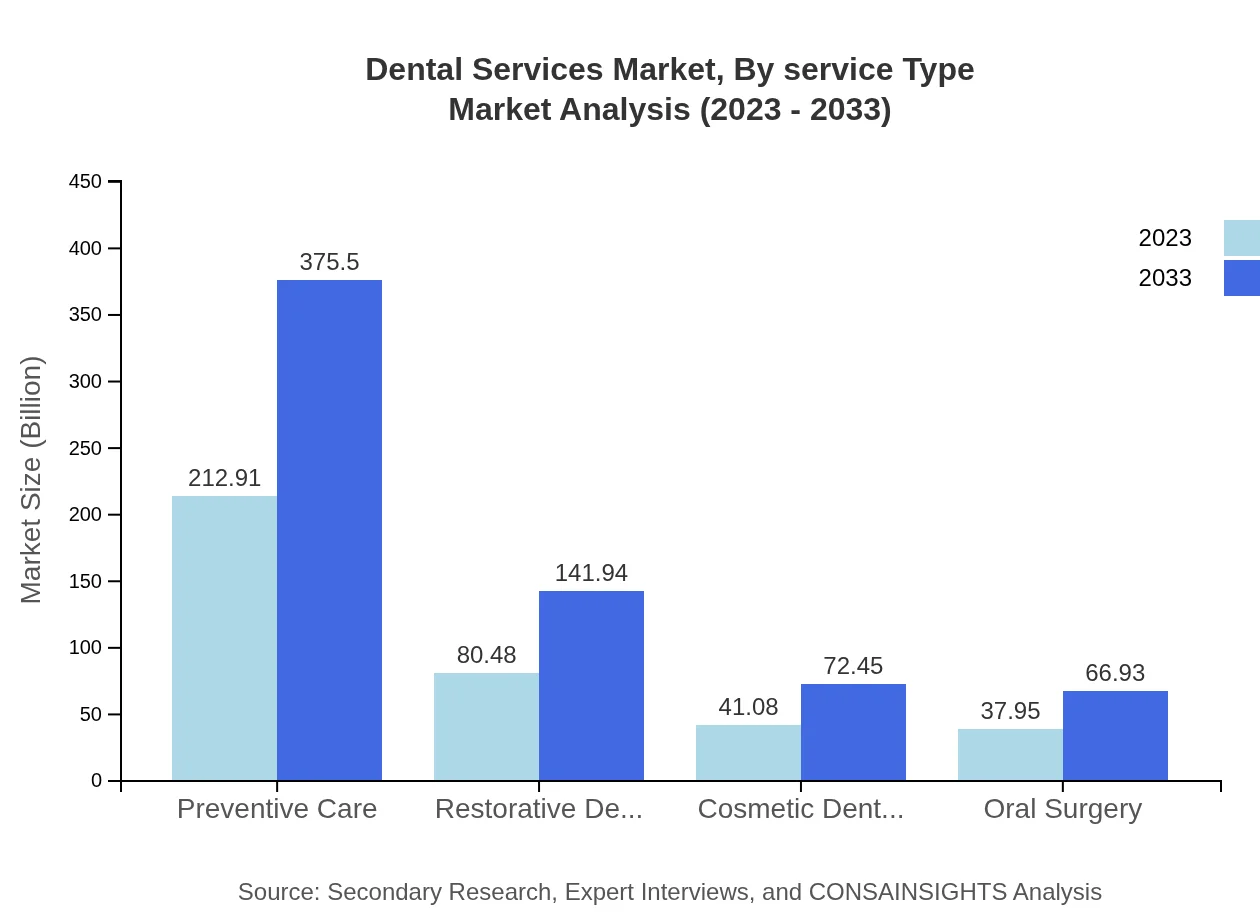

Dental Services Market Analysis By Service Type

The market offers several service types including preventive care, restorative dentistry, cosmetic dentistry, and oral surgery. Preventive care, consisting of regular checkups and cleanings, holds the largest share, while restorative services are seeing increased demand due to higher rates of dental issues. Cosmetic dentistry is rapidly expanding, reflecting the consumer focus on aesthetic enhancement.

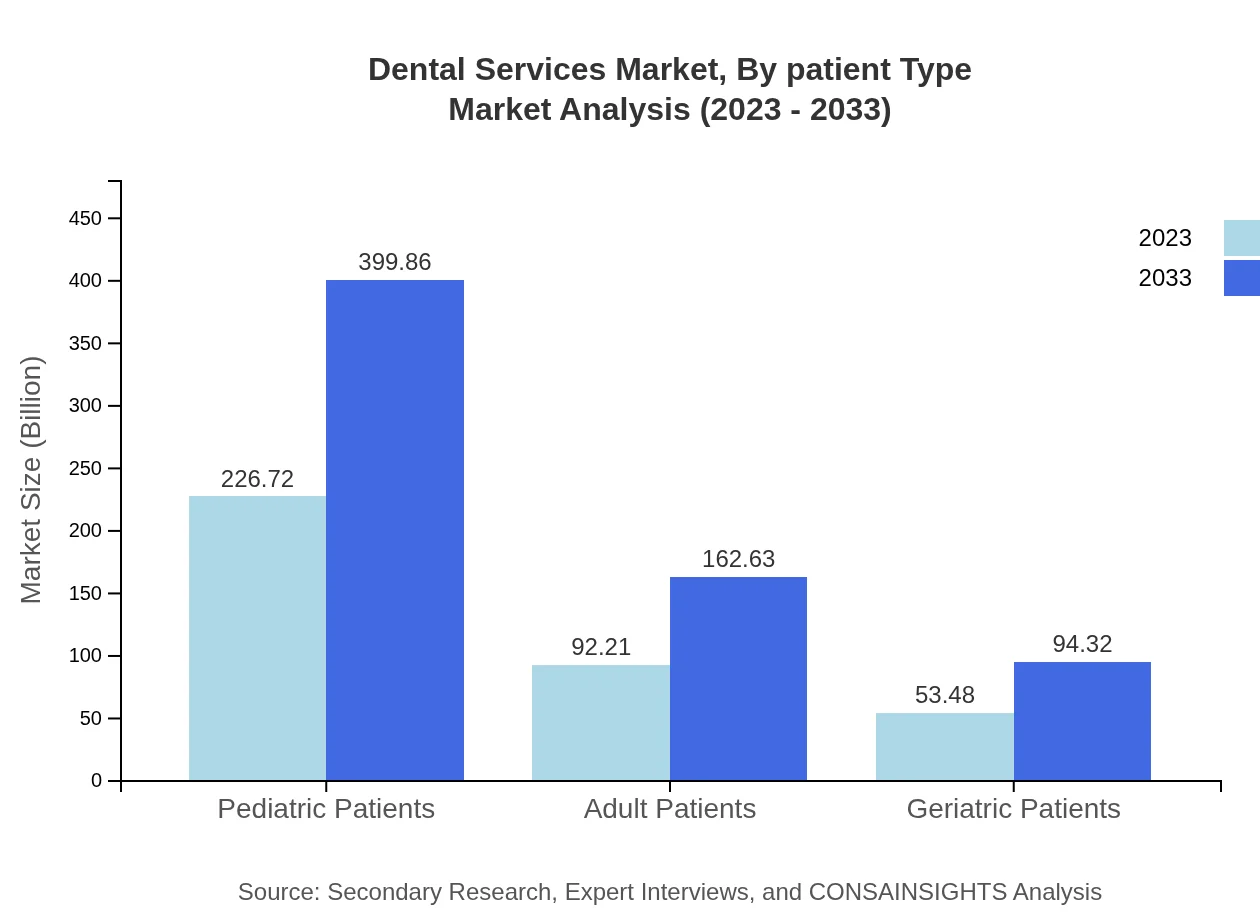

Dental Services Market Analysis By Patient Type

Patient types in the Dental Services industry are classified into pediatric, adult, and geriatric patients. Pediatric patients are expected to drive significant growth due to increasing awareness of early dental care. Adult patients represent a substantial portion of the market focused on both preventive and restorative services. Geriatric patients are increasingly seeking specialized dental care services as they experience age-related oral conditions.

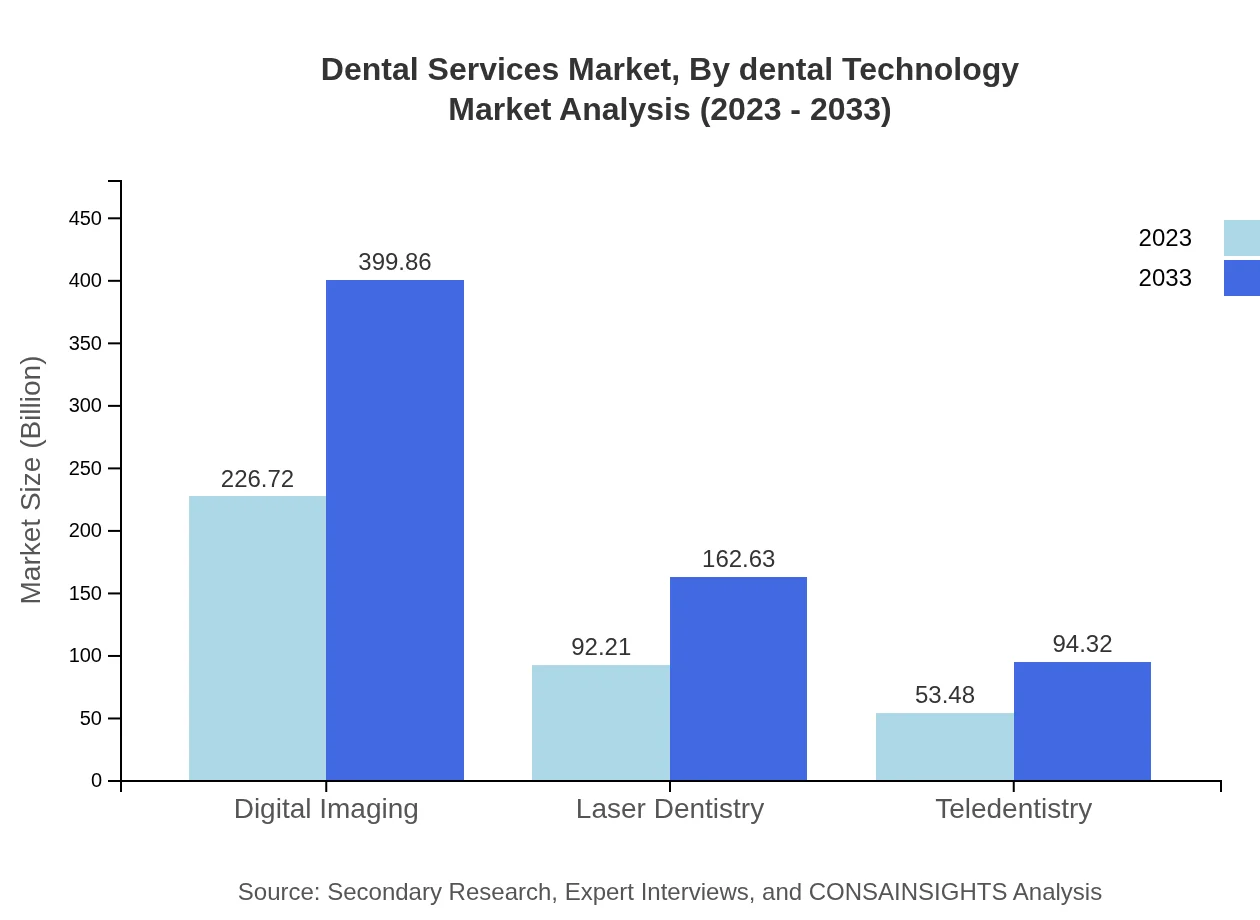

Dental Services Market Analysis By Dental Technology

Advancements in dental technology are shaping the industry significantly, including the implementation of digital imaging, laser dentistry, and teledentistry. Digital imaging, for example, enhances diagnostics and treatment planning, while teledentistry expands access to care and reduces geographical barriers.

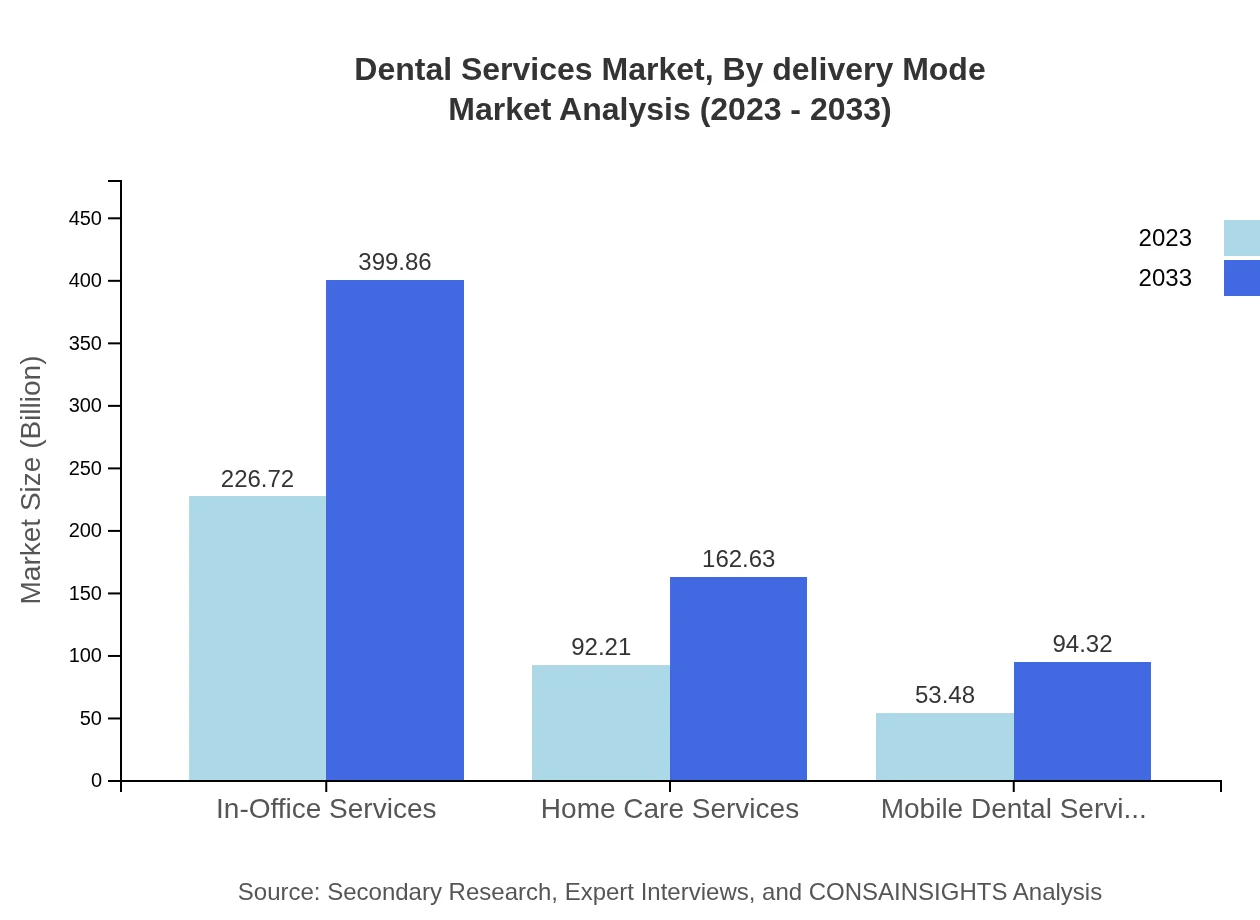

Dental Services Market Analysis By Delivery Mode

The delivery modes in dental services include in-office services, home care services, and mobile dental services. In-office services remain predominant due to the traditional nature of dental practices, but there is growing demand for home care and mobile services driven by convenience and increasing focus on patient-centric care.

Dental Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Services Industry

Align Technology, Inc.:

Align Technology is a global leader in clear aligner therapy through its Invisalign product line. The company has revolutionized orthodontics with advanced digital treatment planning.Henry Schein, Inc.:

Henry Schein is a leading provider of healthcare products and services to dental and medical professionals, delivering innovative solutions and high-quality products.Dentsply Sirona:

Dentsply Sirona is one of the largest manufacturers of dental products and technologies, offering a wide range of tools and solutions to improve dental care efficiency.Colgate-Palmolive Company:

Colgate is renowned for its oral care products, contributing significantly to dental health education through its outreach and preventive care programs.We're grateful to work with incredible clients.

FAQs

What is the market size of dental services?

The global dental services market size is estimated at $372.41 billion in 2023, with a forecasted CAGR of 5.7% through 2033, indicating significant growth in the industry over the next decade.

What are the key market players or companies in the dental services industry?

Key players in the dental services industry include large dental chains, individual clinics, and companies specializing in dental equipment and technology. These entities dominate the market landscape through strategic partnerships and technological advancements.

What are the primary factors driving the growth in the dental services industry?

Growth in the dental services industry is driven by increasing dental awareness, a growing aging population, technological advancements, and an increase in disposable income which allows for more spent on dental health.

Which region is the fastest Growing in the dental services market?

The fastest-growing region in the dental services market is North America, with a market growth from $134.03 billion in 2023 to $236.38 billion by 2033, showcasing a robust demand for dental care services.

Does ConsaInsights provide customized market report data for the dental services industry?

Yes, ConsaInsights offers customized market reports tailored to the dental services industry, facilitating businesses with specific focus areas, regions, or market segments to better meet their unique needs.

What deliverables can I expect from this dental services market research project?

Deliverables from the dental services market research project typically include comprehensive market analysis, segmentation data, competitive landscape, trends analysis, and forecasts covering various geographical regions.

What are the market trends of dental services?

Current market trends in dental services include an increase in preventive care, growing adoption of teledentistry and digital tools, a rise in cosmetic procedures, and expansion of mobile dental services to reach underserved populations.