Dental Syringes Market Report

Published Date: 31 January 2026 | Report Code: dental-syringes

Dental Syringes Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Dental Syringes market, covering market trends, size, and growth forecasts for the period from 2023 to 2033. It presents an in-depth analysis of different market segments and regions, highlighting key players and technological advancements.

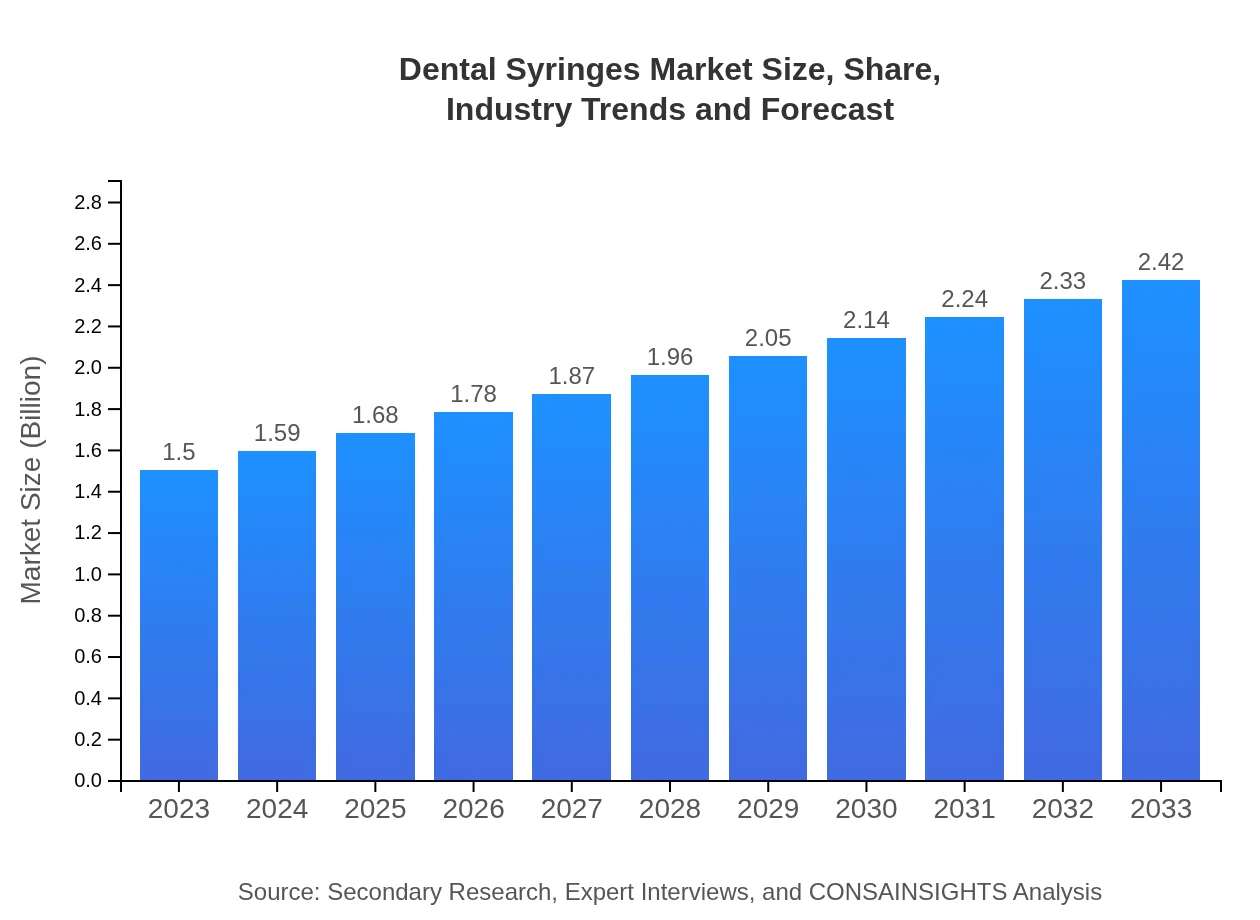

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $2.42 Billion |

| Top Companies | BD (Becton, Dickinson and Company), Henke Sass Wolf GmbH, Dentsply Sirona, Parker Hannifin |

| Last Modified Date | 31 January 2026 |

Dental Syringes Market Overview

Customize Dental Syringes Market Report market research report

- ✔ Get in-depth analysis of Dental Syringes market size, growth, and forecasts.

- ✔ Understand Dental Syringes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental Syringes

What is the Market Size & CAGR of Dental Syringes market in 2023?

Dental Syringes Industry Analysis

Dental Syringes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental Syringes Market Analysis Report by Region

Europe Dental Syringes Market Report:

Europe's market is anticipated to increase from USD 0.40 billion in 2023 to USD 0.65 billion by 2033, driven by stringent safety regulations and rising investments in dental healthcare infrastructure.Asia Pacific Dental Syringes Market Report:

In the Asia Pacific region, the Dental Syringes market is projected to grow from USD 0.32 billion in 2023 to USD 0.51 billion by 2033, driven by rising healthcare expenditures and an increasing focus on oral health.North America Dental Syringes Market Report:

North America holds the largest market share, with a projected value of USD 0.52 billion in 2023 growing to USD 0.84 billion by 2033, largely influenced by advanced healthcare systems and high demand for dental services.South America Dental Syringes Market Report:

The South American market is expected to rise from USD 0.06 billion in 2023 to USD 0.10 billion by 2033, supported by growing awareness of dental hygiene and access to dental services in urban areas.Middle East & Africa Dental Syringes Market Report:

In the Middle East and Africa, the market is set to grow from USD 0.20 billion in 2023 to USD 0.33 billion by 2033, as the region witnesses improvements in healthcare accessibility and increasing dental care awareness.Tell us your focus area and get a customized research report.

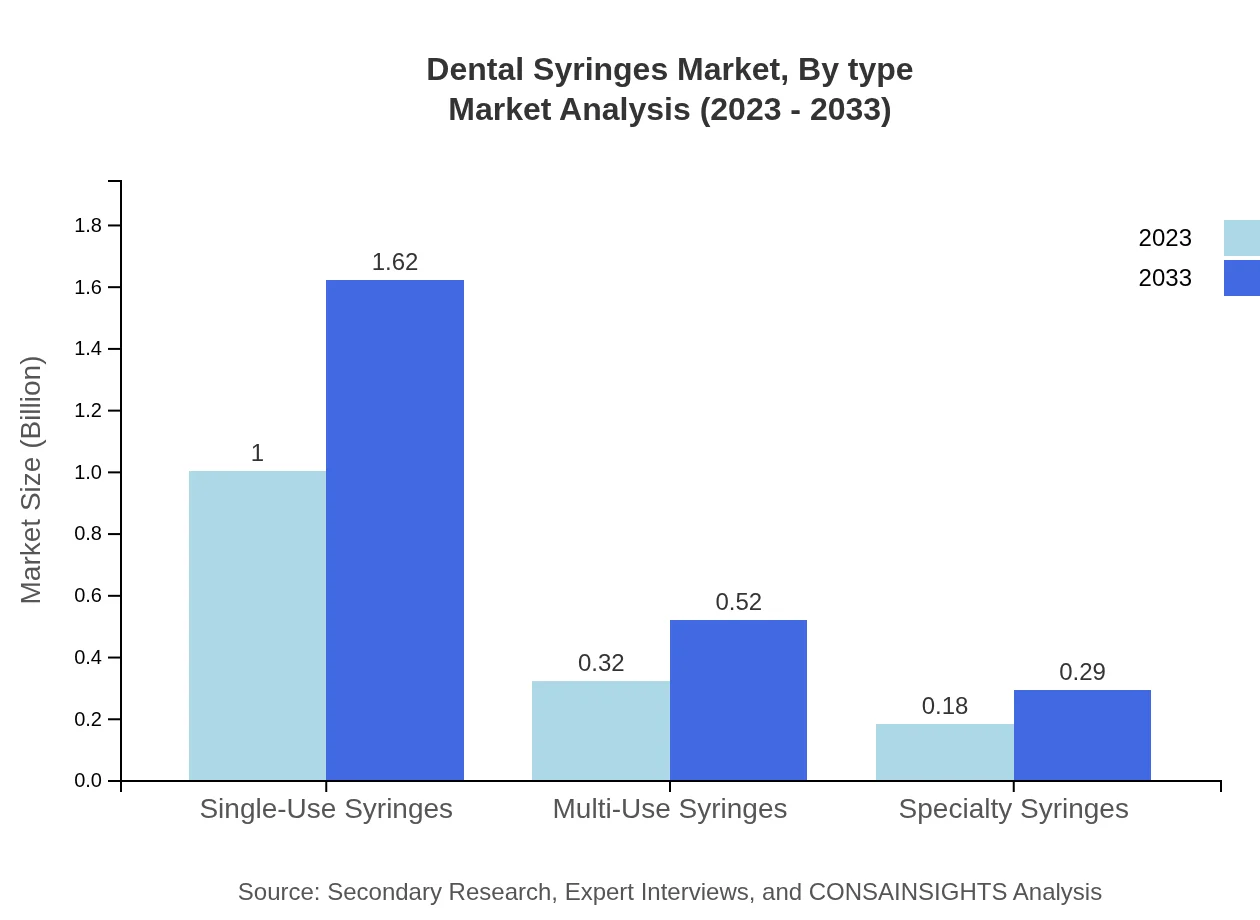

Dental Syringes Market Analysis By Type

Single-use syringes dominate the market, expected to grow from USD 1.00 billion in 2023 to USD 1.62 billion by 2033, holding a market share of 66.73%. Multi-use syringes follow with a market value of USD 0.32 billion in 2023, projected to reach USD 0.52 billion by 2033. Specialty syringes account for smaller market segments, set to grow from USD 0.18 billion in 2023 to USD 0.29 billion by 2033 at a share of 11.9%.

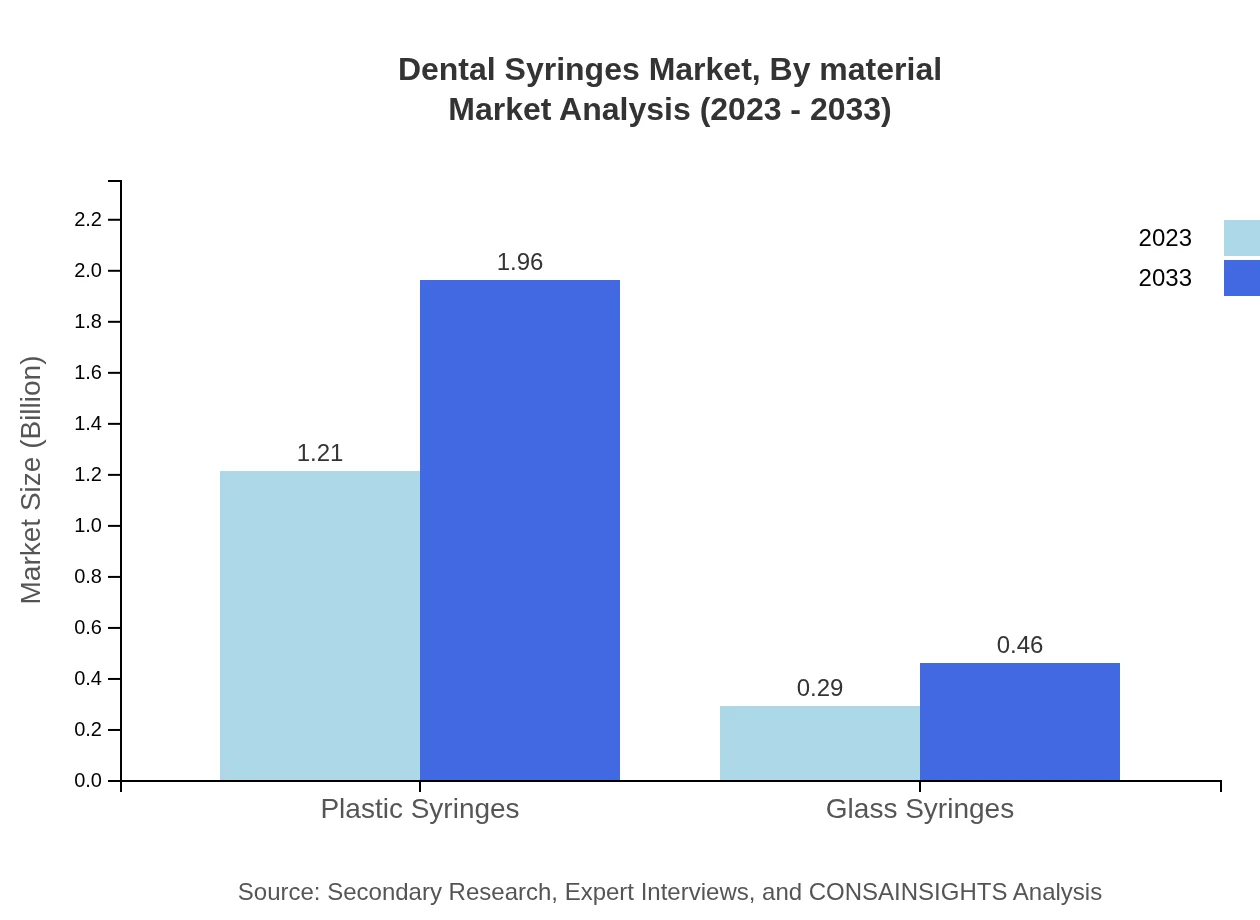

Dental Syringes Market Analysis By Material

Plastic syringes make up the larger portion of the market, valued at USD 1.21 billion in 2023 and expected to reach USD 1.96 billion by 2033, with an 80.91% share. Glass syringes, while less common, are anticipated to grow from USD 0.29 billion in 2023 to USD 0.46 billion by 2033 at a share of 19.09%.

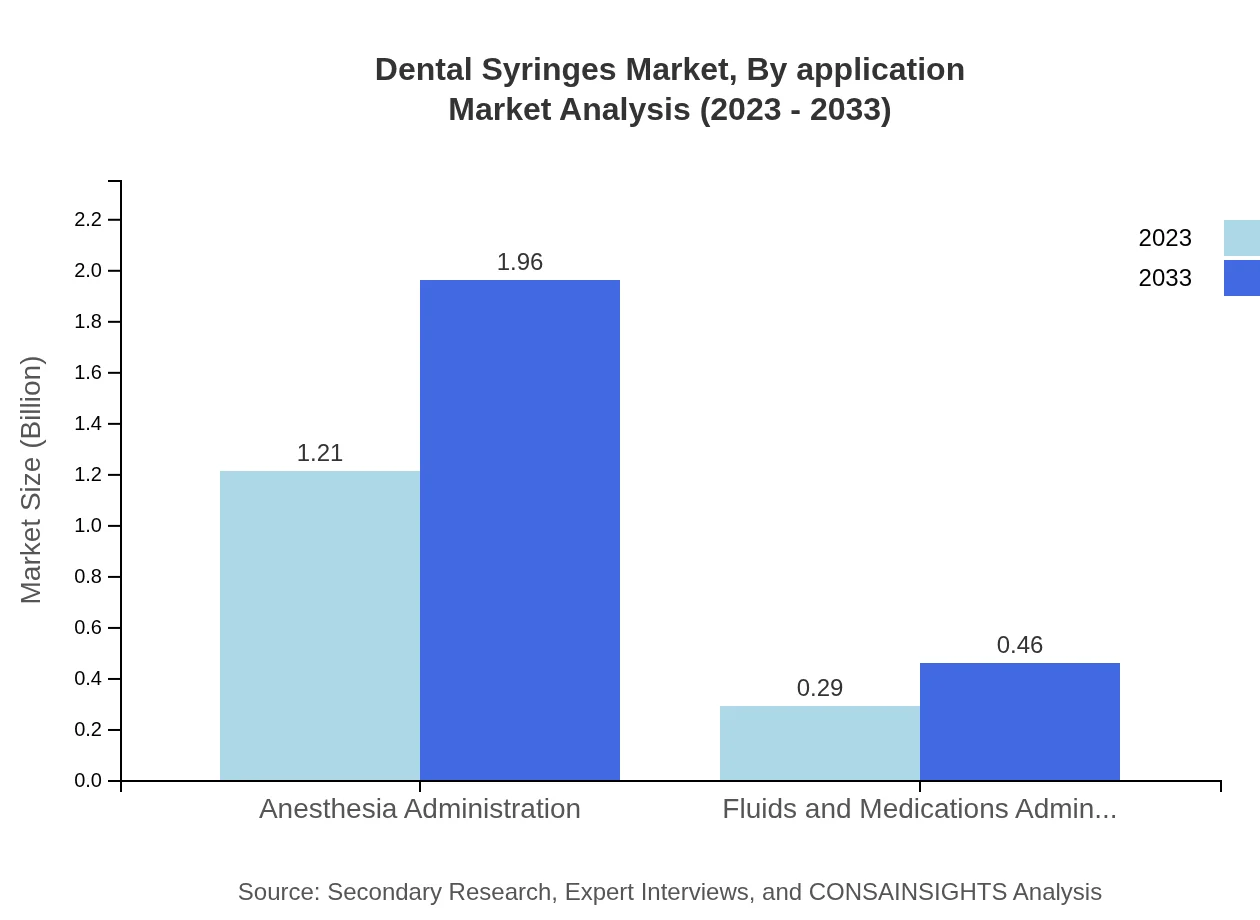

Dental Syringes Market Analysis By Application

The application of dental syringes is primarily for anesthesia administration, valued at USD 1.21 billion in 2023 and projected to rise to USD 1.96 billion by 2033. Fluids and medications administration follow, expanding from USD 0.29 billion in 2023 to USD 0.46 billion by 2033.

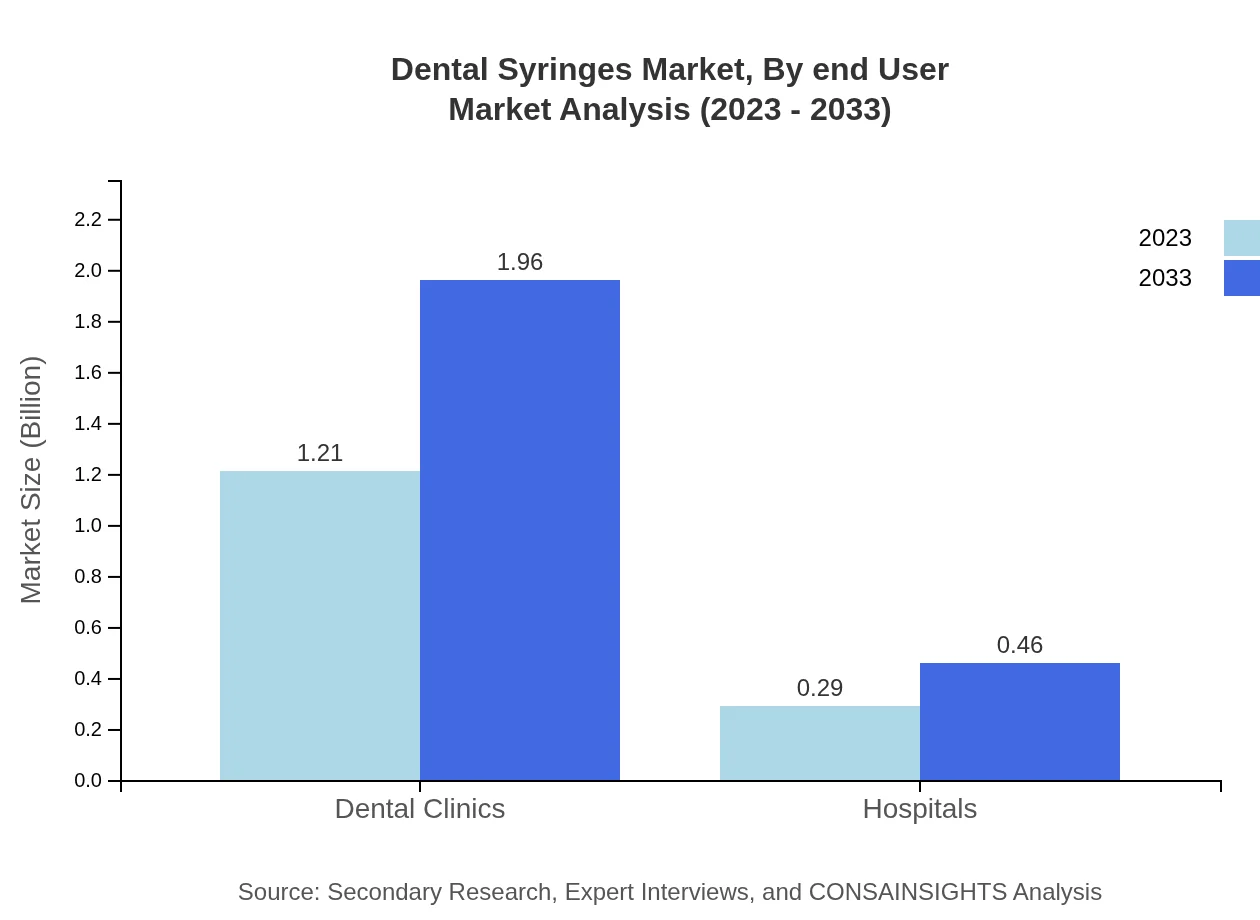

Dental Syringes Market Analysis By End User

Dental clinics represent the predominant end-user segment, with a market size of USD 1.21 billion in 2023, expected to reach USD 1.96 billion by 2033. Hospitals follow, growing from USD 0.29 billion to USD 0.46 billion over the same period.

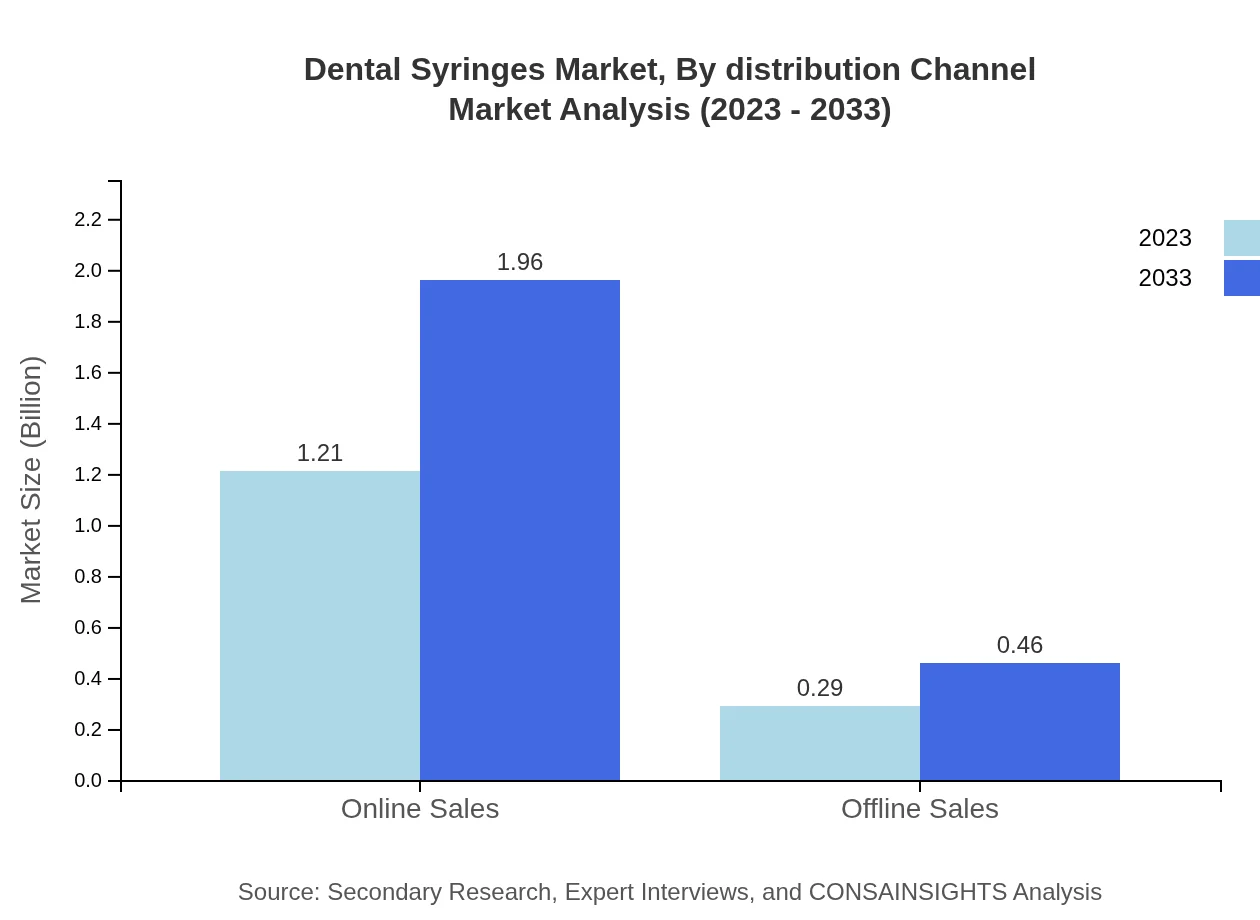

Dental Syringes Market Analysis By Distribution Channel

Online sales channels are leading the distribution of dental syringes, projected to increase from USD 1.21 billion in 2023 to USD 1.96 billion by 2033, while offline sales are anticipated to rise from USD 0.29 billion to USD 0.46 billion.

Dental Syringes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental Syringes Industry

BD (Becton, Dickinson and Company):

A global leader in medical technology, BD offers innovative solutions for drug delivery and diabetes care, including a wide range of dental syringes designed for safety and precision.Henke Sass Wolf GmbH:

This German company specializes in a variety of dental products, including disposable syringes that emphasize user comfort and safety in dental procedures.Dentsply Sirona:

As a prominent player in dental products, Dentsply Sirona manufactures a variety of dental syringes focusing on enhancing patient care with innovative designs.Parker Hannifin:

Parker provides advanced components and systems for a range of healthcare applications, including precision syringes for dentistry.We're grateful to work with incredible clients.

FAQs

What is the market size of dental Syringes?

The global dental syringes market is projected to be valued at $1.5 billion in 2023, with a compound annual growth rate (CAGR) of 4.8% expected through 2033, indicating robust growth driven by expanding dental practices.

What are the key market players or companies in the dental Syringes industry?

Key players in the dental syringes market include major medical and dental supplies manufacturers. Industry leaders focus on innovation and market expansion strategies, contributing to competitive pricing and quality enhancement.

What are the primary factors driving the growth in the dental syringes industry?

Factors fueling growth include increasing demand for dental procedures, advancements in syringe technology, and rising health awareness. Moreover, government initiatives supporting dental health drive market expansion.

Which region is the fastest Growing in the dental Syringes?

The North America region exhibits the fastest growth in the dental syringes market, with a forecasted increase from $0.52 billion in 2023 to $0.84 billion by 2033, driven by advanced healthcare infrastructure.

Does ConsaInsights provide customized market report data for the dental Syringes industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to client needs in the dental syringes industry, offering insights into trends, competitive analysis, and market forecasts.

What deliverables can I expect from this dental Syringes market research project?

Deliverables include comprehensive reports featuring market analysis, forecasts, regional insights, competitive landscape, and segment breakdowns, empowering stakeholders with actionable insights for decision-making.

What are the market trends of dental Syringes?

Trends include a shift towards single-use syringes, increasing adoption of digital sales channels, and heightened focus on patient safety. There’s an observed growth in specialty syringes tailored for specific dental procedures.