Dental X Ray Systems Market Report

Published Date: 31 January 2026 | Report Code: dental-x-ray-systems

Dental X Ray Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Dental X Ray Systems market, covering key insights, market size, trends, and growth forecasts from 2023 to 2033. It explores various segments, regional dynamics, and the competitive landscape within the industry.

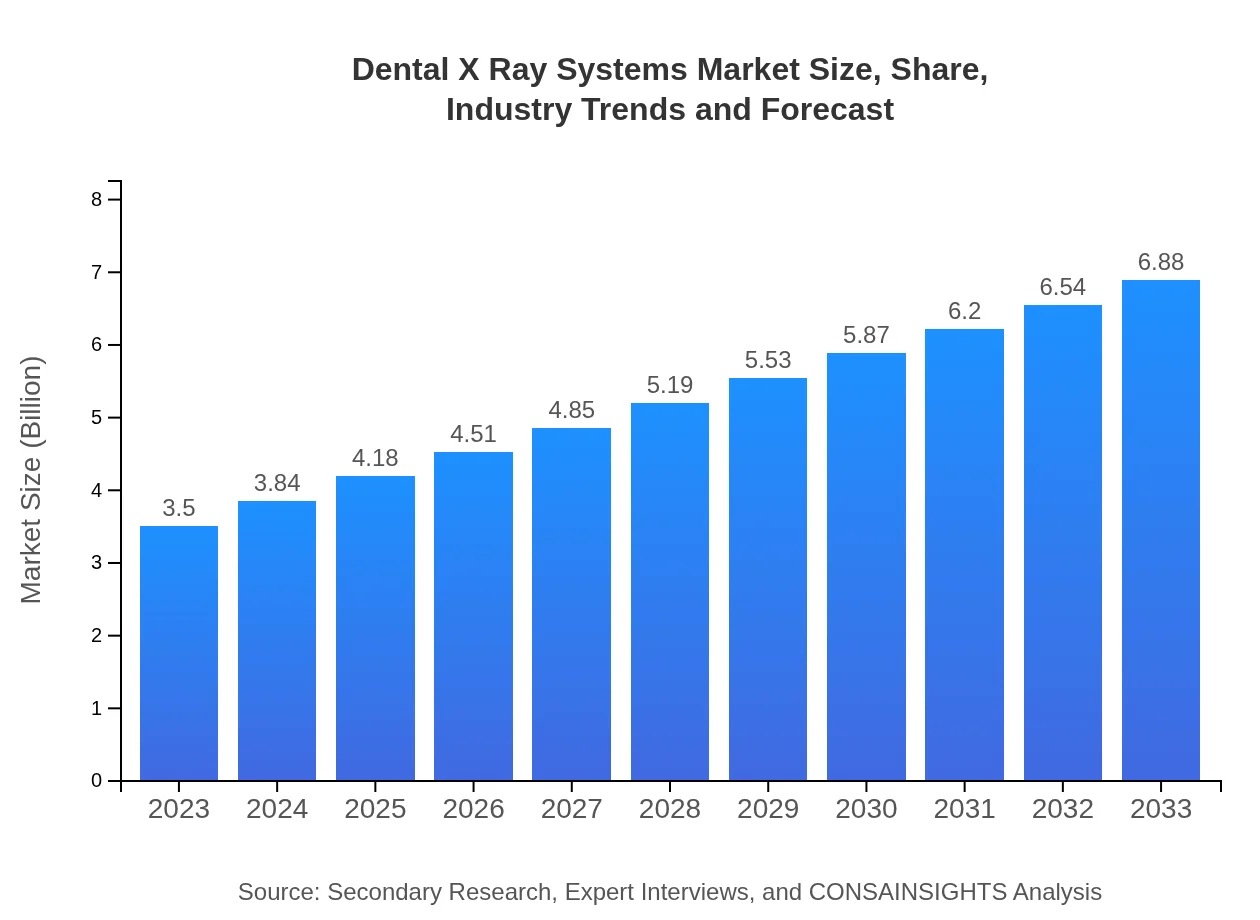

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Planmeca, Carestream Dental, Danaher Corporation, Sirona Dental Systems |

| Last Modified Date | 31 January 2026 |

Dental X Ray Systems Market Overview

Customize Dental X Ray Systems Market Report market research report

- ✔ Get in-depth analysis of Dental X Ray Systems market size, growth, and forecasts.

- ✔ Understand Dental X Ray Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dental X Ray Systems

What is the Market Size & CAGR of Dental X Ray Systems market in 2023?

Dental X Ray Systems Industry Analysis

Dental X Ray Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dental X Ray Systems Market Analysis Report by Region

Europe Dental X Ray Systems Market Report:

Europe's market will grow from $1.07 billion in 2023 to $2.11 billion by 2033. The region is characterized by stringent regulatory requirements and a strong emphasis on innovative healthcare solutions, supporting the adoption of advanced Dental X Ray Systems.Asia Pacific Dental X Ray Systems Market Report:

The Asia Pacific market is valued at $0.67 billion in 2023 and is expected to reach $1.31 billion by 2033, demonstrating significant growth due to increasing dental clinics and awareness regarding oral health. Emerging markets in this region are rapidly embracing advanced dental technologies.North America Dental X Ray Systems Market Report:

North America leads the market with a value of $1.24 billion in 2023, projected to grow to $2.43 billion by 2033. High dental expenditure, a well-established dental healthcare system, and the presence of major industry players contribute to this robust growth forecast.South America Dental X Ray Systems Market Report:

In South America, the market is anticipated to grow from $0.35 billion in 2023 to $0.69 billion in 2033. Expanding healthcare access and a focus on improving dental care quality play a crucial role in driving this growth.Middle East & Africa Dental X Ray Systems Market Report:

The market in the Middle East and Africa is valued at $0.18 billion in 2023 and is projected to reach $0.35 billion by 2033. This growth is attributed to increasing investments in healthcare infrastructure and a rising demand for dental imaging technologies.Tell us your focus area and get a customized research report.

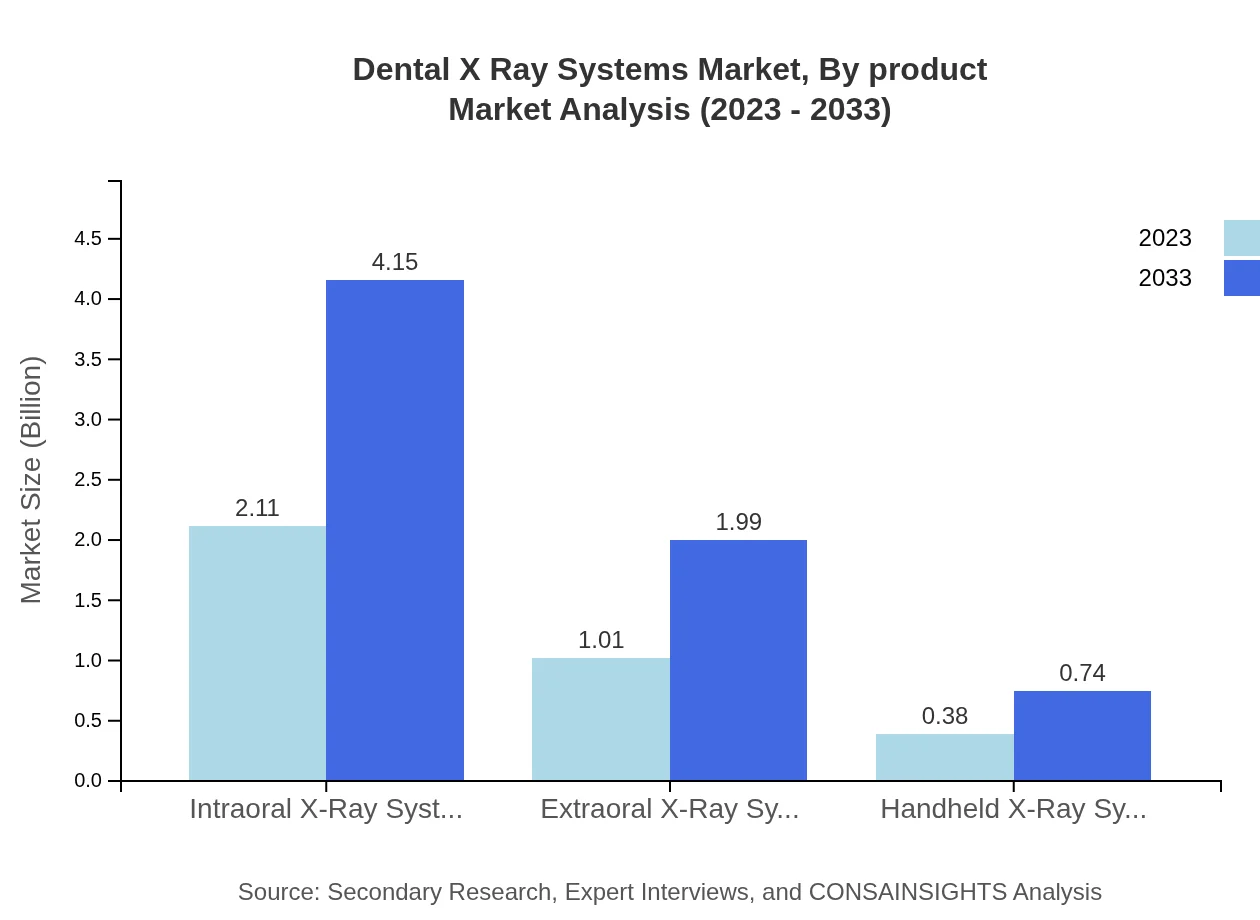

Dental X Ray Systems Market Analysis By Product

The Dental X-Ray Systems market, by product, is primarily segmented into intraoral, extraoral, and handheld X-ray systems. Intraoral systems, estimated at $2.11 billion in 2023 and expected to rise to $4.15 billion by 2033, hold the largest market share. Extraoral and handheld systems are also on the rise due to their unique applications in various dental procedures.

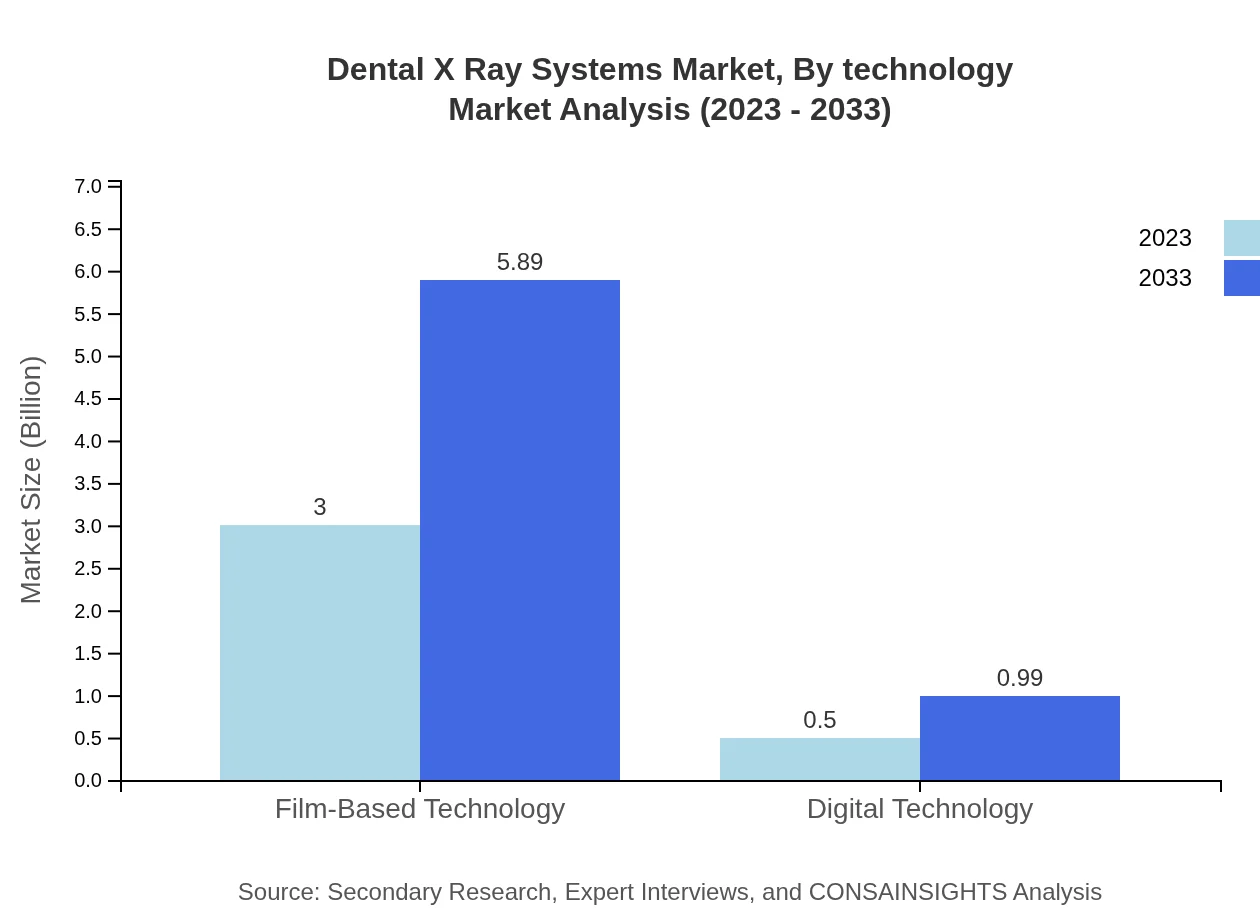

Dental X Ray Systems Market Analysis By Technology

The technology segment of the Dental X-Ray Systems market is divided into film-based and digital technologies. Film-based technology continues to dominate with a market size of $3.00 billion in 2023, projected to grow to $5.89 billion in 2033. Digital technology, while smaller at $0.50 billion currently, is gaining traction and is expected to reach $0.99 billion as practices modernize.

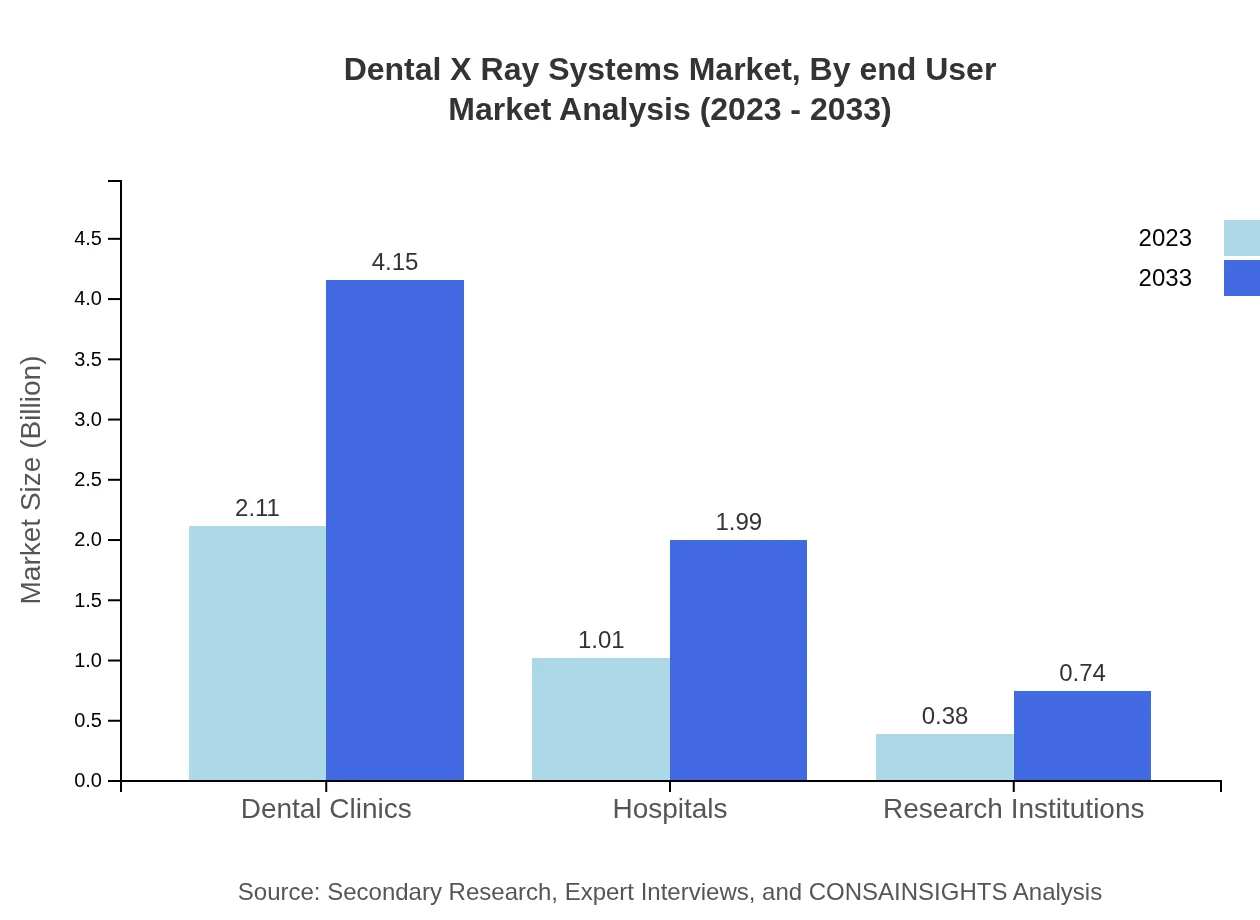

Dental X Ray Systems Market Analysis By End User

By end-user, the Dental X-Ray Systems are primarily used in dental clinics, hospitals, and research institutions. Dental clinics account for the largest share, around 60.28%, in 2023, growing from $2.11 billion to $4.15 billion by 2033. Hospitals also play a significant role, with expected growth from $1.01 billion to $1.99 billion within the same period.

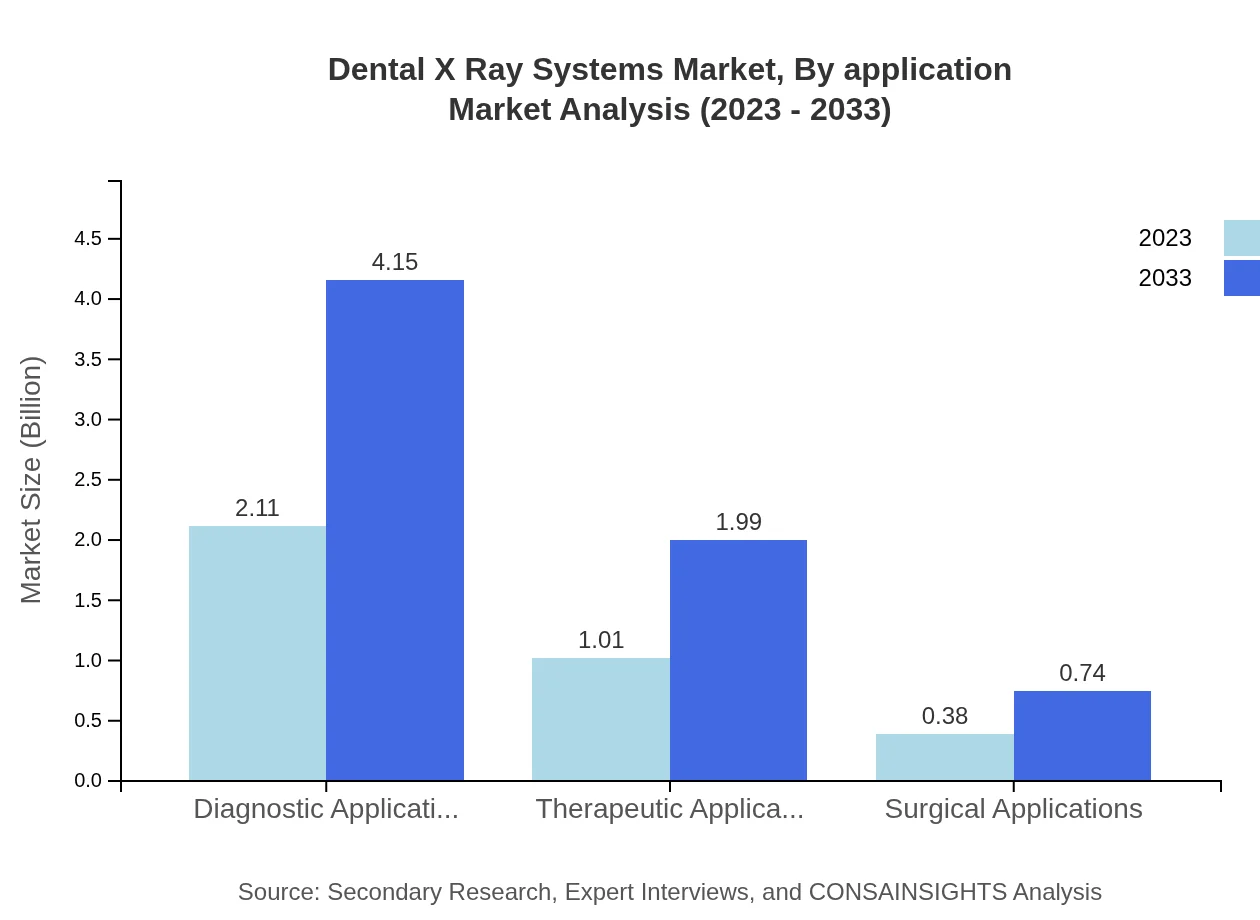

Dental X Ray Systems Market Analysis By Application

The market is categorized by applications including diagnostic, therapeutic, and surgical. Diagnostic applications are the most prevalent segment, amounting to $2.11 billion in 2023 and anticipated to reach $4.15 billion by 2033. Therapeutic and surgical applications also exhibit notable growth, indicating the broadening scope of these systems.

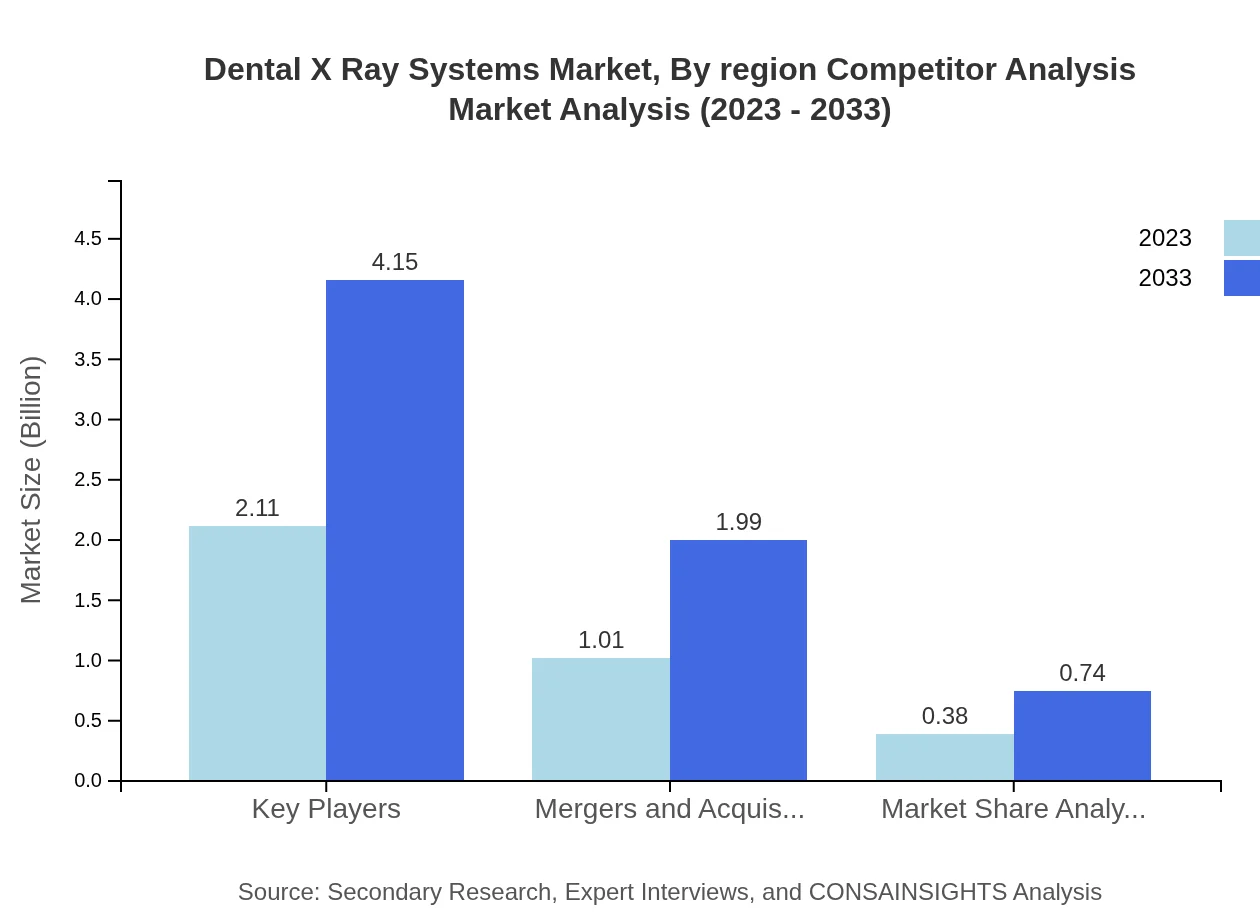

Dental X Ray Systems Market Analysis By Region Competitor Analysis

Competitor analysis in the Dental X-Ray Systems market showcases major players continuing to innovate. Firms like Planmeca, Carestream Dental, and Danaher Corporation are key players, focusing on mergers and acquisitions to bolster their market share and enhance technology offerings.

Dental X Ray Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dental X Ray Systems Industry

Planmeca:

Planmeca is a Finnish company that specializes in manufacturing advanced dental imaging equipment, including a full range of x-ray systems known for their precision and quality.Carestream Dental:

Carestream Dental provides a wide array of imaging solutions for dental practices, focusing on digital innovations that improve diagnostic capabilities and practice efficiency.Danaher Corporation:

Danaher Corporation is a leading science and technology innovator that operates in various industries, including dental. They focus on advanced imaging technologies to enhance dental care quality.Sirona Dental Systems:

Sirona Dental Systems specializes in developing comprehensive solutions for the dental industry, including digital imaging systems that streamline workflow and enhance patient care.We're grateful to work with incredible clients.

FAQs

What is the market size of dental X Ray Systems?

The global dental X-ray systems market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 6.8%, reaching significant growth by 2033. This growth is driven by technological advancements and increasing demand for dental imaging.

What are the key market players or companies in this dental X Ray Systems industry?

Key players in the dental X-ray systems market include leading companies that dominate the sector with innovative products. These firms engage in research, development, and manufacturing of devices that enhance diagnostic capabilities in dentistry.

What are the primary factors driving the growth in the dental X Ray Systems industry?

Growth in the dental X-ray systems industry is primarily driven by increases in dental diseases, advancements in imaging technology, and rising awareness of preventive dental care. Additionally, the growing geriatric population contributes to an increased demand for dental imaging.

Which region is the fastest Growing in the dental X Ray Systems?

The fastest-growing region in the dental X-ray systems market is North America, expected to grow from $1.24 billion in 2023 to $2.43 billion by 2033. Europe follows closely, growing from $1.07 billion to $2.11 billion.

Does ConsaInsights provide customized market report data for the dental X Ray Systems industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the dental X-ray systems industry. This ensures stakeholders receive relevant insights that meet their specific research needs.

What deliverables can I expect from this dental X Ray Systems market research project?

Deliverables from the dental X-ray systems market research project include comprehensive market analysis, segmented data insights, competitive landscape assessments, and forecasts covering the next decade, ensuring informed strategic decision-making.

What are the market trends of dental X Ray Systems?

Current market trends in dental X-ray systems highlight a shift towards digital technologies, increased adoption of intraoral systems, and enhanced focus on diagnostic applications, driven by innovations aimed at improving patient care and diagnostic accuracy.