Diabetes Care Devices Market Report

Published Date: 31 January 2026 | Report Code: diabetes-care-devices

Diabetes Care Devices Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Diabetes Care Devices market, presenting insights and forecasts from 2023 to 2033. It covers market size, industry trends, regional dynamics, and key market segments to provide a comprehensive overview for stakeholders in the healthcare sector.

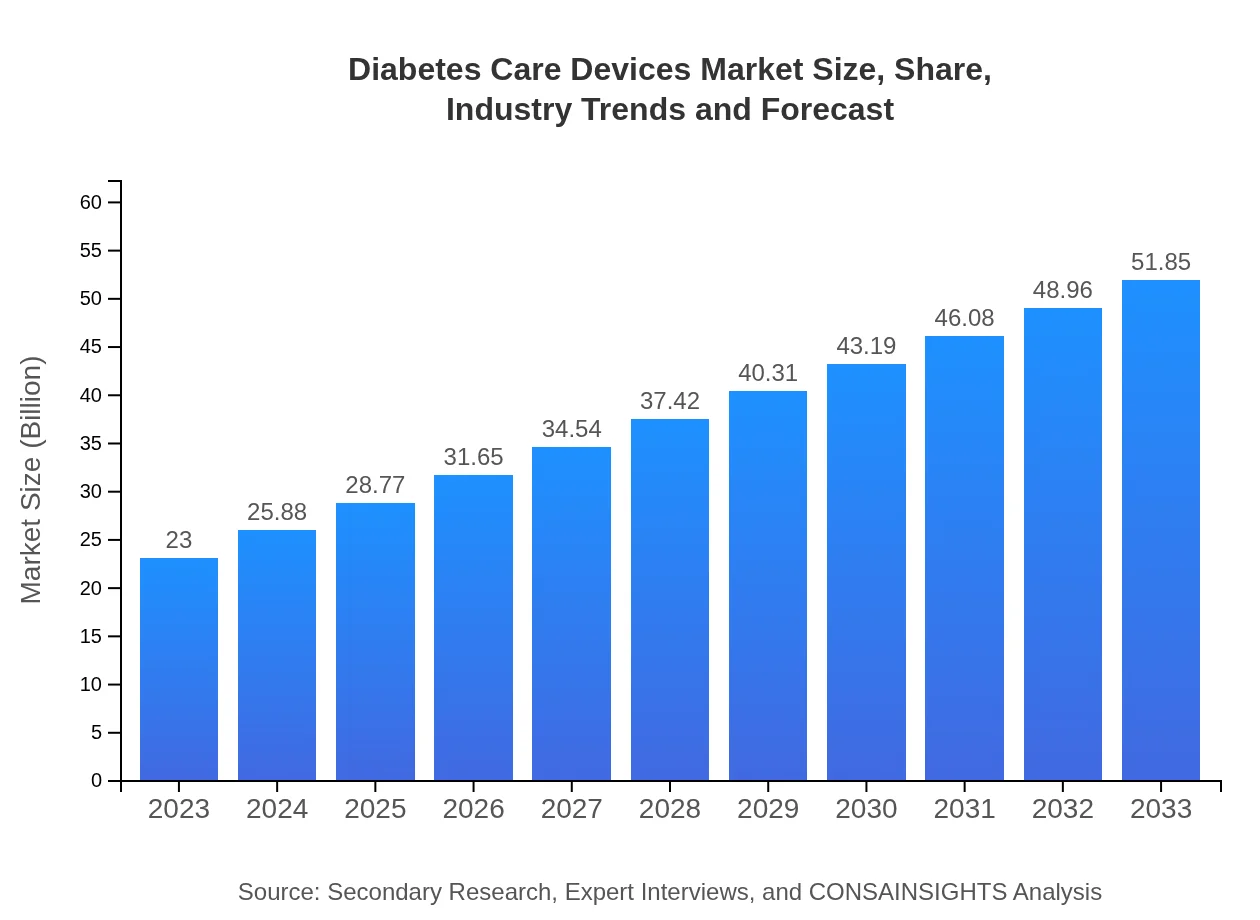

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $51.85 Billion |

| Top Companies | Roche Diabetes Care, Abbott Laboratories, Medtronic , Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Diabetes Care Devices Market Overview

Customize Diabetes Care Devices Market Report market research report

- ✔ Get in-depth analysis of Diabetes Care Devices market size, growth, and forecasts.

- ✔ Understand Diabetes Care Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Diabetes Care Devices

What is the Market Size & CAGR of the Diabetes Care Devices market in 2023?

Diabetes Care Devices Industry Analysis

Diabetes Care Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Diabetes Care Devices Market Analysis Report by Region

Europe Diabetes Care Devices Market Report:

The European market for Diabetes Care Devices is projected to expand from 6.57 billion USD in 2023 to 14.81 billion USD by 2033, fueled by technological advancements and strong regulatory support for innovative devices.Asia Pacific Diabetes Care Devices Market Report:

The Asia Pacific region is anticipated to grow significantly, with forecasts indicating a market size of 9.79 billion USD by 2033, up from 4.34 billion USD in 2023. This growth is driven by a rising patient pool and improved healthcare infrastructure.North America Diabetes Care Devices Market Report:

North America is expected to dominate the market, witnessing growth from 8.66 billion USD in 2023 to 19.52 billion USD by 2033, propelled by high healthcare expenditure and the presence of major market players.South America Diabetes Care Devices Market Report:

In South America, the market is expected to grow from 1.19 billion USD in 2023 to 2.69 billion USD by 2033, primarily due to increasing awareness and acceptance of diabetes care technologies.Middle East & Africa Diabetes Care Devices Market Report:

The Middle East and Africa market is projected to grow from 2.23 billion USD to 5.03 billion USD from 2023 to 2033, driven by increasing diabetes awareness and improving healthcare infrastructures.Tell us your focus area and get a customized research report.

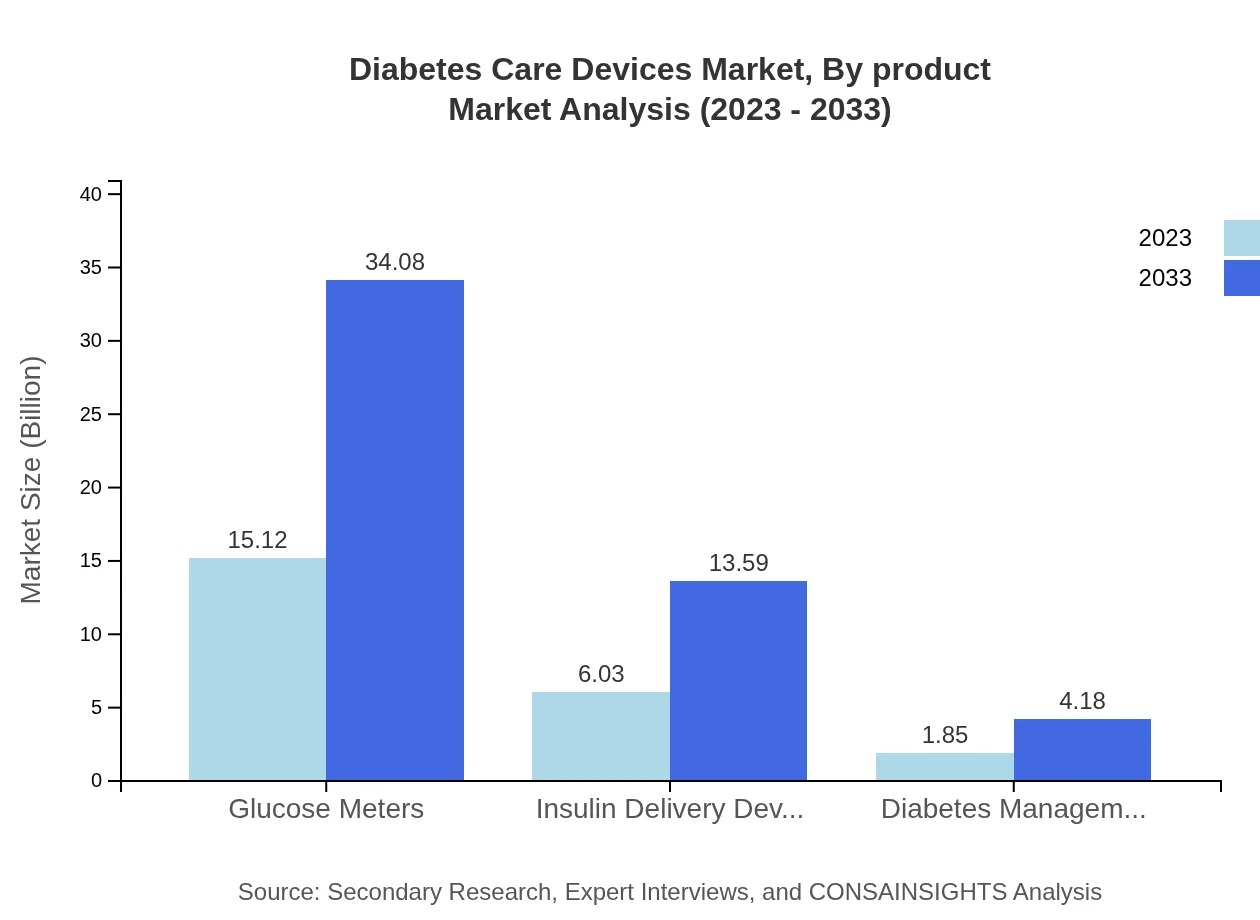

Diabetes Care Devices Market Analysis By Product

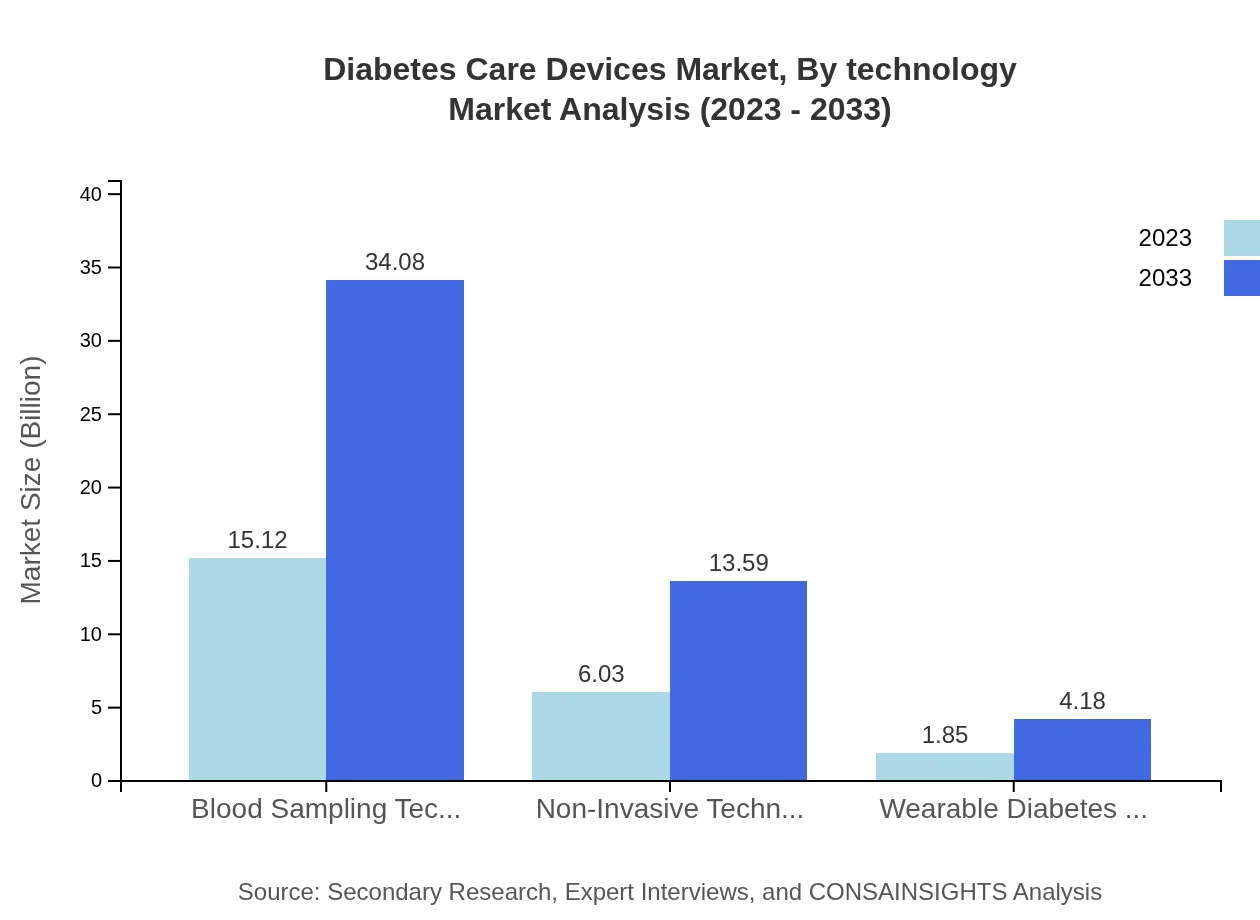

The largest segment in the Diabetes Care Devices market is glucose meters, expected to grow from 15.12 billion USD in 2023 to 34.08 billion USD by 2033. Insulin delivery devices follow, with projections of growth from 6.03 billion to 13.59 billion USD in the same period. The increasing need for effective management of diabetes propels the demand for these devices.

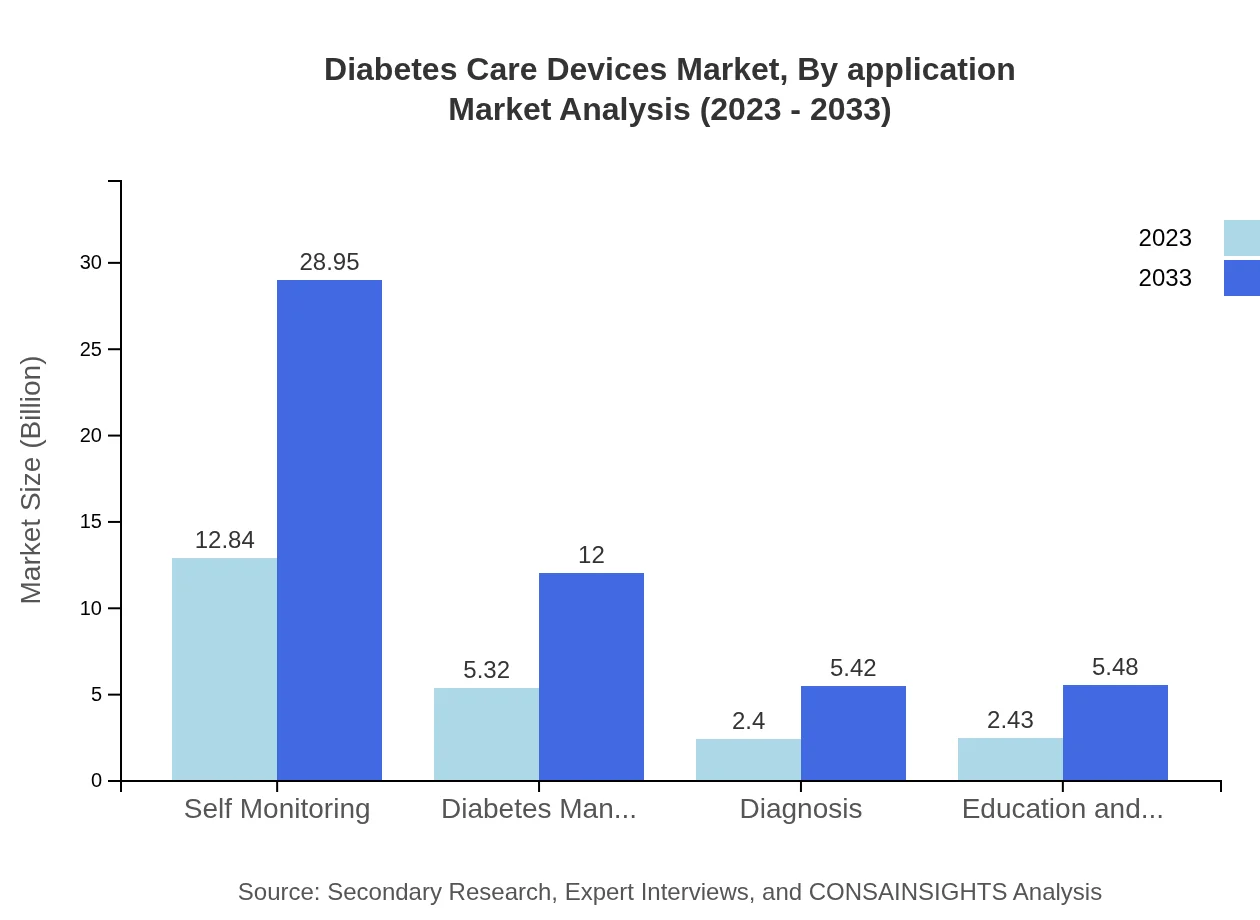

Diabetes Care Devices Market Analysis By Application

The self-monitoring segment dominates the application market, with a share of 55.84% in 2023, projected to remain the same by 2033. Other notable applications include diabetes management and education, which reflect growing opportunities as patient needs evolve.

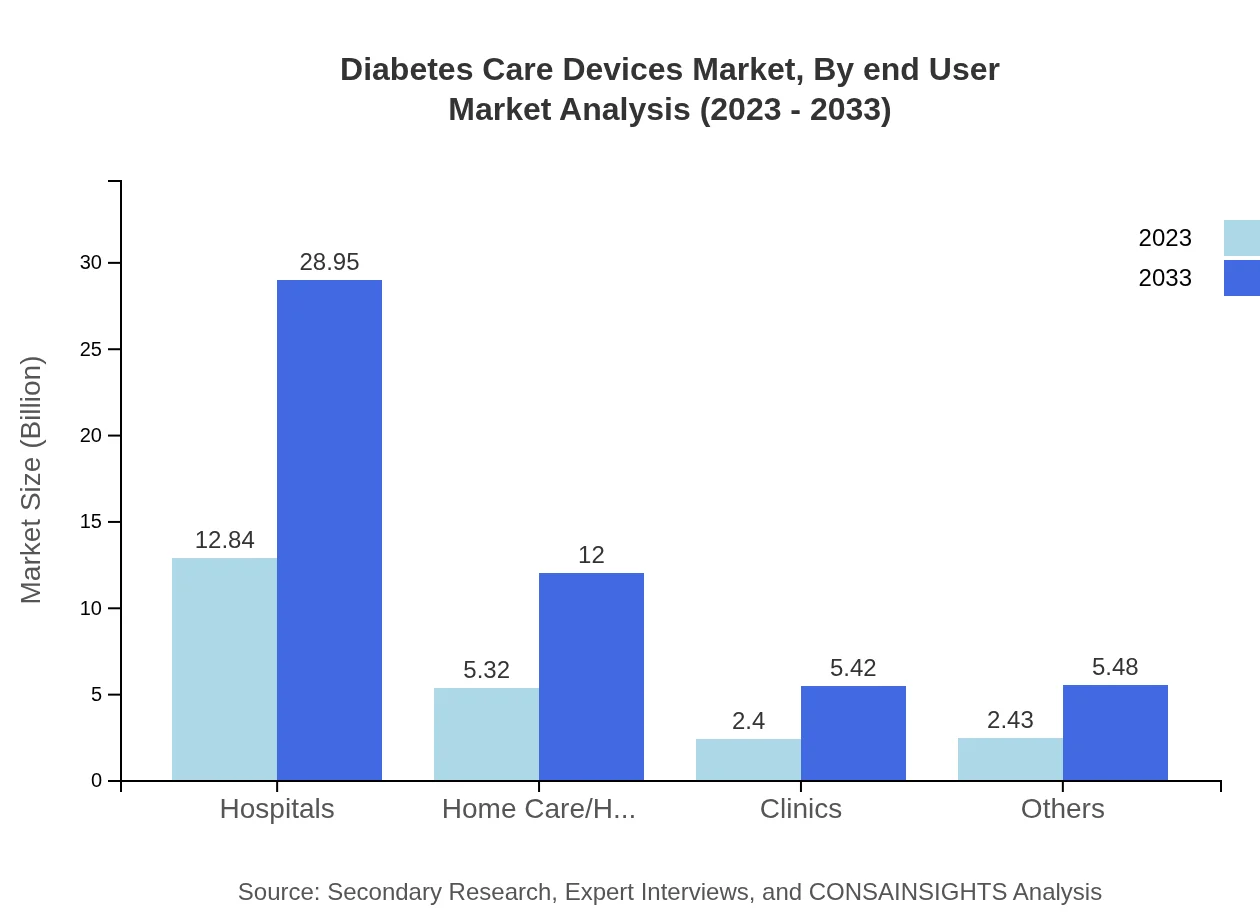

Diabetes Care Devices Market Analysis By End User

Hospitals constitute the primary end-user segment, forecasted to grow from 12.84 billion USD in 2023 to 28.95 billion USD by 2033. Home care and hospice services are also experiencing increased demand due to a shift towards at-home care models.

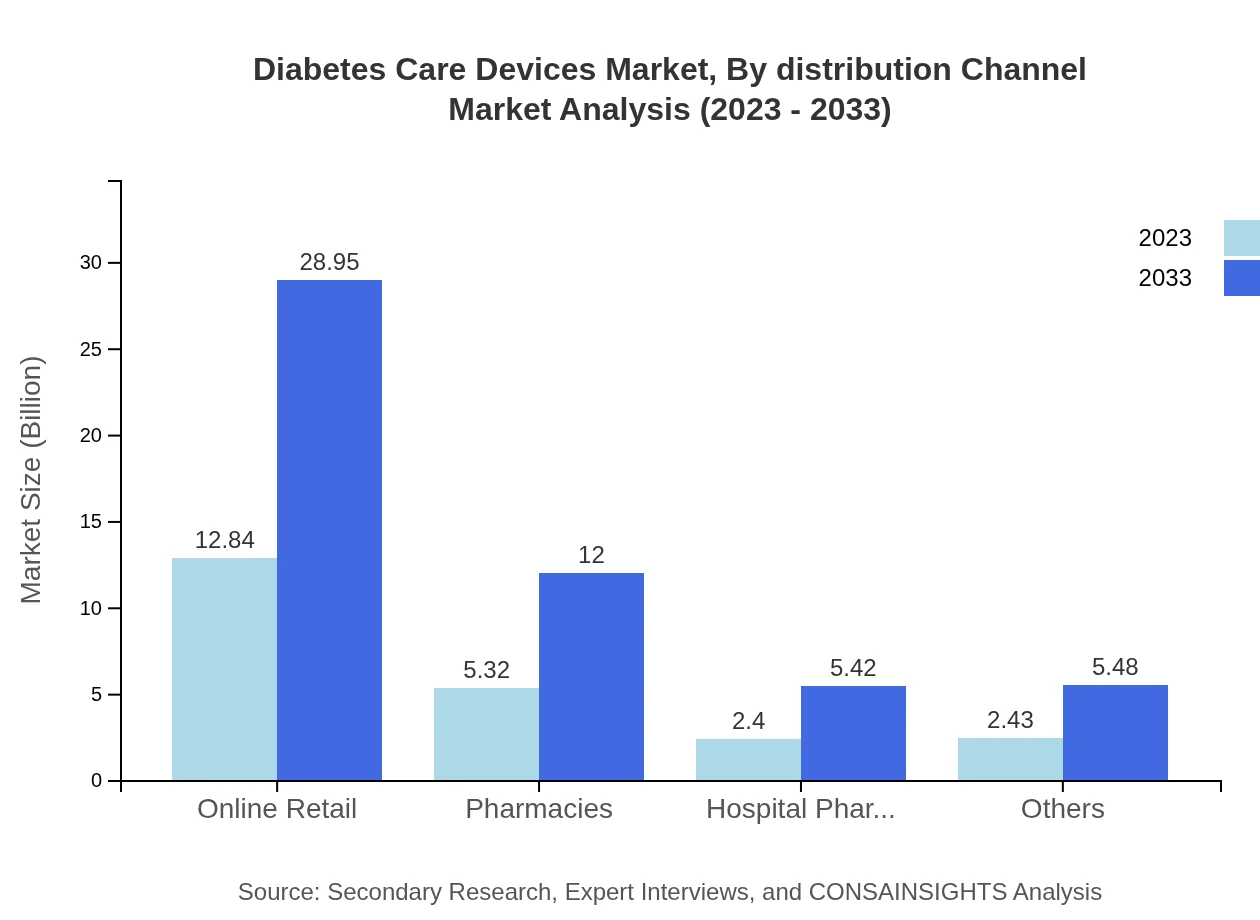

Diabetes Care Devices Market Analysis By Distribution Channel

The online retail channel is leading the distribution landscape with a market share of 55.84% in 2023, expected to maintain its position through 2033. This growth is attributed to the convenience of product availability and increasing online shopping trends.

Diabetes Care Devices Market Analysis By Technology

Recent trends show a rise in the adoption of non-invasive technologies, with projections indicating growth from 6.03 billion USD in 2023 to 13.59 billion USD by 2033. This reflects a significant shift towards user-friendly and less painful methods of glucose monitoring.

Diabetes Care Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Diabetes Care Devices Industry

Roche Diabetes Care:

A leader in diabetes care, Roche offers a wide range of innovative diabetes management solutions including Accu-Chek glucose meters.Abbott Laboratories:

Abbott specializes in glucose monitoring devices and has pioneered continuous glucose monitoring technology with its FreeStyle Libre system.Medtronic :

Medtronic is renowned for its insulin delivery devices and advanced diabetes management solutions.Johnson & Johnson:

Through its LifeScan division, Johnson & Johnson has been a significant player in the diabetes monitoring market, implementing real-time data management solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of diabetes Care Devices?

The global diabetes care devices market is projected to reach approximately $23 billion in 2023, with a remarkable CAGR of 8.2%. This growth reflects the increasing demand for innovative diabetes management solutions and overall health management efforts.

What are the key market players or companies in the diabetes Care Devices industry?

Key players in the diabetes care devices market include major companies like Medtronic, Abbott Laboratories, Roche Diabetes Care, Insulet Corporation, and Dexcom. These companies significantly contribute to market growth through innovation and extensive product offerings.

What are the primary factors driving the growth in the diabetes Care Devices industry?

Factors driving growth in the diabetes care devices market include rising diabetes prevalence, increased healthcare expenditure, technological advancements, and improved patient awareness. Furthermore, government initiatives promoting diabetes management also play a crucial role.

Which region is the fastest Growing in the diabetes Care Devices market?

North America is identified as the fastest-growing region in the diabetes care devices market, projected to expand from $8.66 billion in 2023 to $19.52 billion by 2033, indicating strong demand for advanced diabetes management technologies.

Does ConsaInsights provide customized market report data for the diabetes Care Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the diabetes care devices industry. Clients can request bespoke analysis and insights based on their unique requirements and business objectives.

What deliverables can I expect from this diabetes Care Devices market research project?

The project deliverables include comprehensive market analysis, trend assessment, regional insights, competitive landscape overview, and forecasts. Additionally, clients receive tailored recommendations for strategic decision-making.

What are the market trends of diabetes Care Devices?

Current trends in the diabetes care devices market include the integration of digital health solutions, increased focus on insulin delivery devices, advancements in glucose monitoring technologies, and the rising adoption of diabetes management apps among patients.