Diabetes Care Drugs Market Report

Published Date: 31 January 2026 | Report Code: diabetes-care-drugs

Diabetes Care Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Diabetes Care Drugs market, covering insights on market size, growth trends, regional dynamics, and competitive landscape from 2023 to 2033.

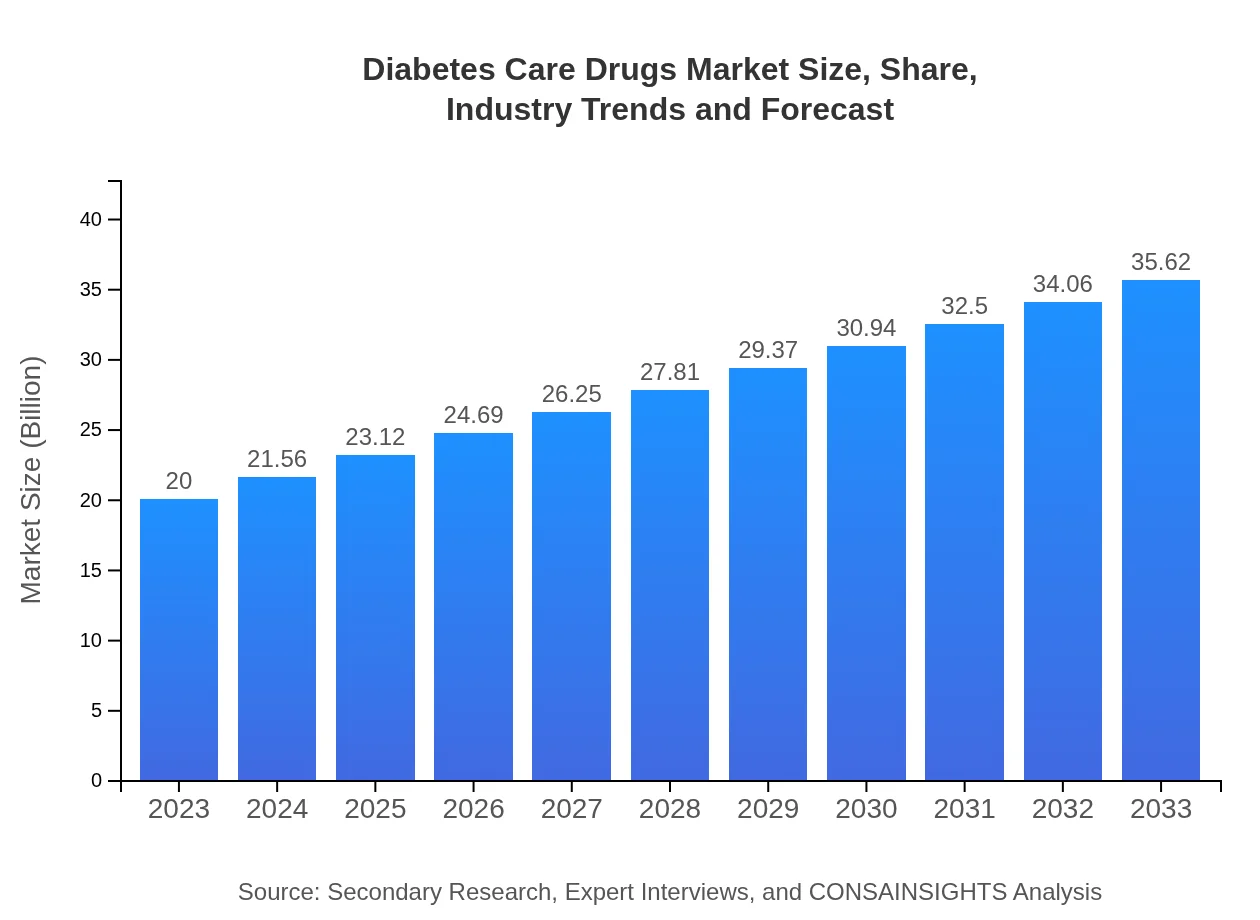

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $35.62 Billion |

| Top Companies | Novo Nordisk, Sanofi, Boehringer Ingelheim, Bristol-Myers Squibb |

| Last Modified Date | 31 January 2026 |

Diabetes Care Drugs Market Overview

Customize Diabetes Care Drugs Market Report market research report

- ✔ Get in-depth analysis of Diabetes Care Drugs market size, growth, and forecasts.

- ✔ Understand Diabetes Care Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Diabetes Care Drugs

What is the Market Size & CAGR of Diabetes Care Drugs market in 2023?

Diabetes Care Drugs Industry Analysis

Diabetes Care Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Diabetes Care Drugs Market Analysis Report by Region

Europe Diabetes Care Drugs Market Report:

Europe's market size for diabetes care drugs is anticipated to grow from $6.95 billion in 2023 to $12.38 billion by 2033. The region benefits from robust healthcare systems and a strong focus on diabetes research and treatment.Asia Pacific Diabetes Care Drugs Market Report:

In 2023, the Asia Pacific diabetes care drugs market is valued at $3.56 billion, expected to grow to $6.34 billion by 2033, supported by rising healthcare access and increasing awareness. Countries like China and India are driving growth due to their large diabetic populations.North America Diabetes Care Drugs Market Report:

The North America diabetes care drugs market is projected at $6.99 billion in 2023, surging to $12.44 billion by 2033. The region demonstrates the highest growth rate, driven by advanced healthcare infrastructure and high diabetes prevalence.South America Diabetes Care Drugs Market Report:

The South American market size stands at approximately $0.65 billion in 2023, with expectations to increase to $1.15 billion by 2033. This growth is facilitated by rising healthcare investment and improved access to diabetes medications.Middle East & Africa Diabetes Care Drugs Market Report:

In the Middle East and Africa, the market is valued at $1.86 billion in 2023, with growth expected to reach $3.31 billion by 2033. The increased focus on healthcare accessibility in the region is a key driver for this growth.Tell us your focus area and get a customized research report.

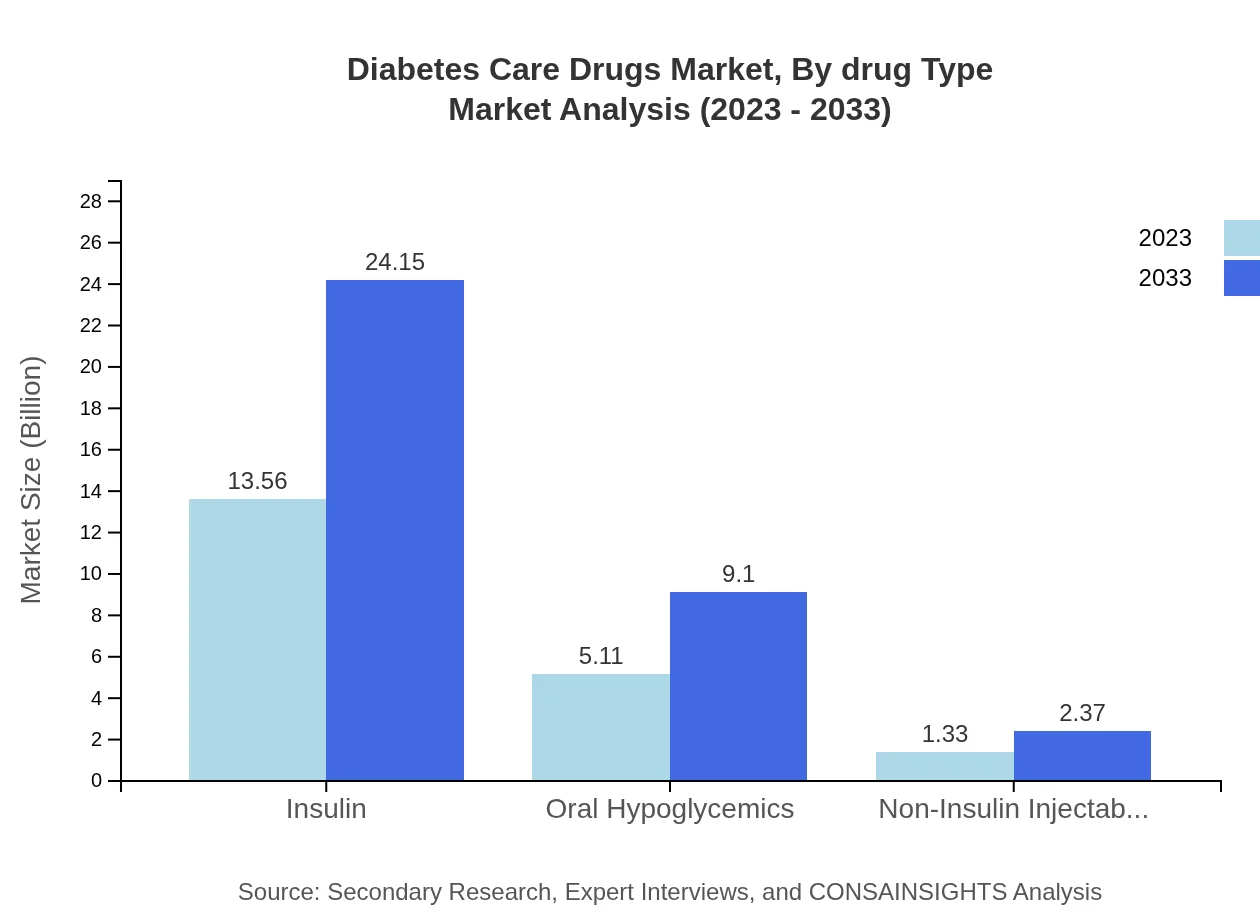

Diabetes Care Drugs Market Analysis By Drug Type

The diabetes care drugs market can be classified into several therapeutic classes. Insulin remains the dominant segment, recording a market value of $13.56 billion in 2023, projected to increase to $24.15 billion by 2033, holding a share of 67.8%. Oral hypoglycemics follow with a 25.54% share, valued at $5.11 billion in 2023 and estimated to reach $9.10 billion by 2033. Non-insulin injectables, although smaller at $1.33 billion in 2023, are anticipated to grow to $2.37 billion, capturing 6.66% of the market.

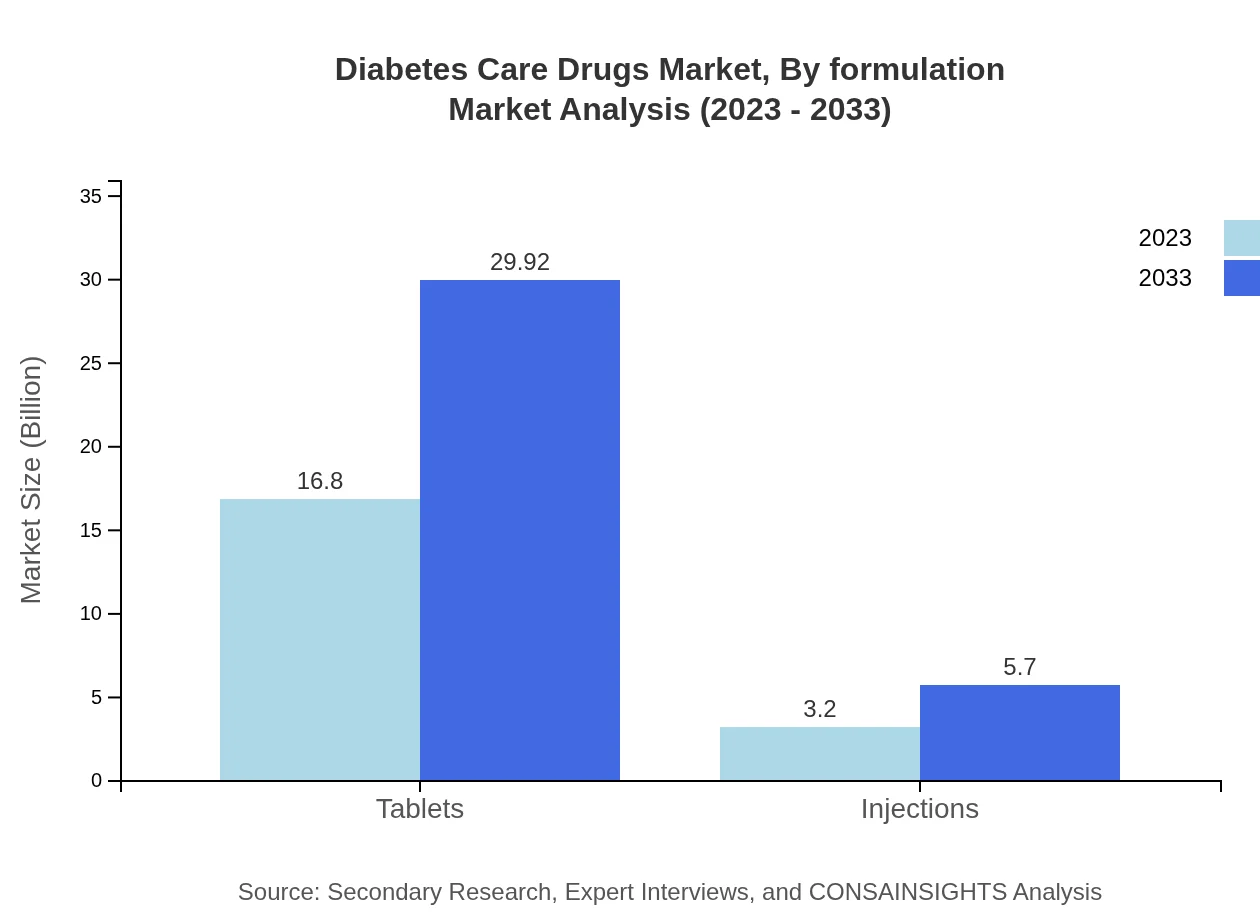

Diabetes Care Drugs Market Analysis By Formulation

Among the various formulations, tablets stand out with a market size of $16.80 billion in 2023, growing to $29.92 billion by 2033, dominating with 83.99% of the market. Injections, while comprising a smaller segment at $3.20 billion in 2023, are projected to expand to $5.70 billion by 2033, representing a 16.01% share. The trend towards patient-centered care and preferences for certain delivery methods significantly influence these numbers.

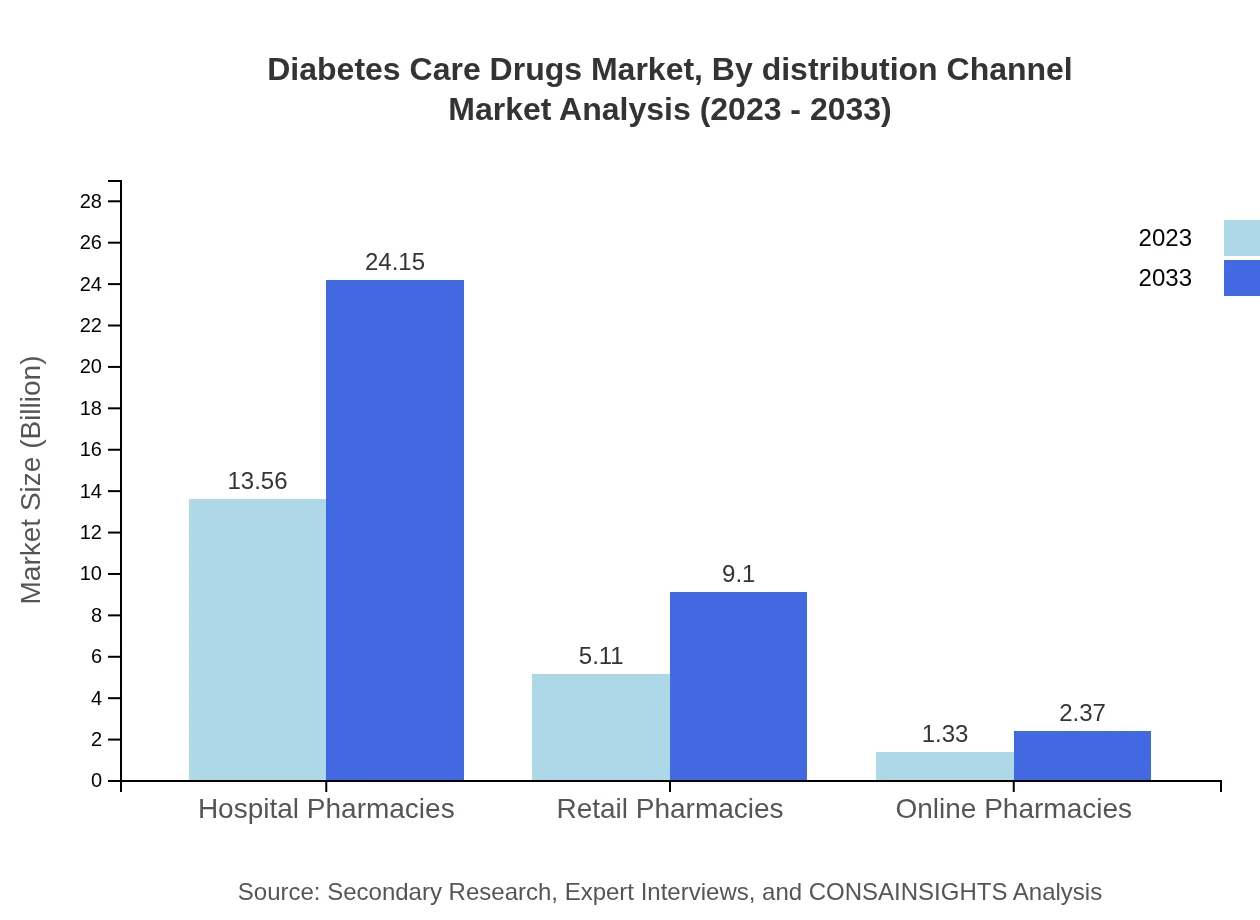

Diabetes Care Drugs Market Analysis By Distribution Channel

The distribution channels for diabetes care drugs include hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies dominate with a significant market size of $13.56 billion in 2023, expected to reach $24.15 billion by 2033, maintaining a 67.8% market share. Retail pharmacies and online pharmacies also contribute considerably, with respective market values of $5.11 billion and $1.33 billion in 2023, expected to grow to $9.10 billion and $2.37 billion respectively.

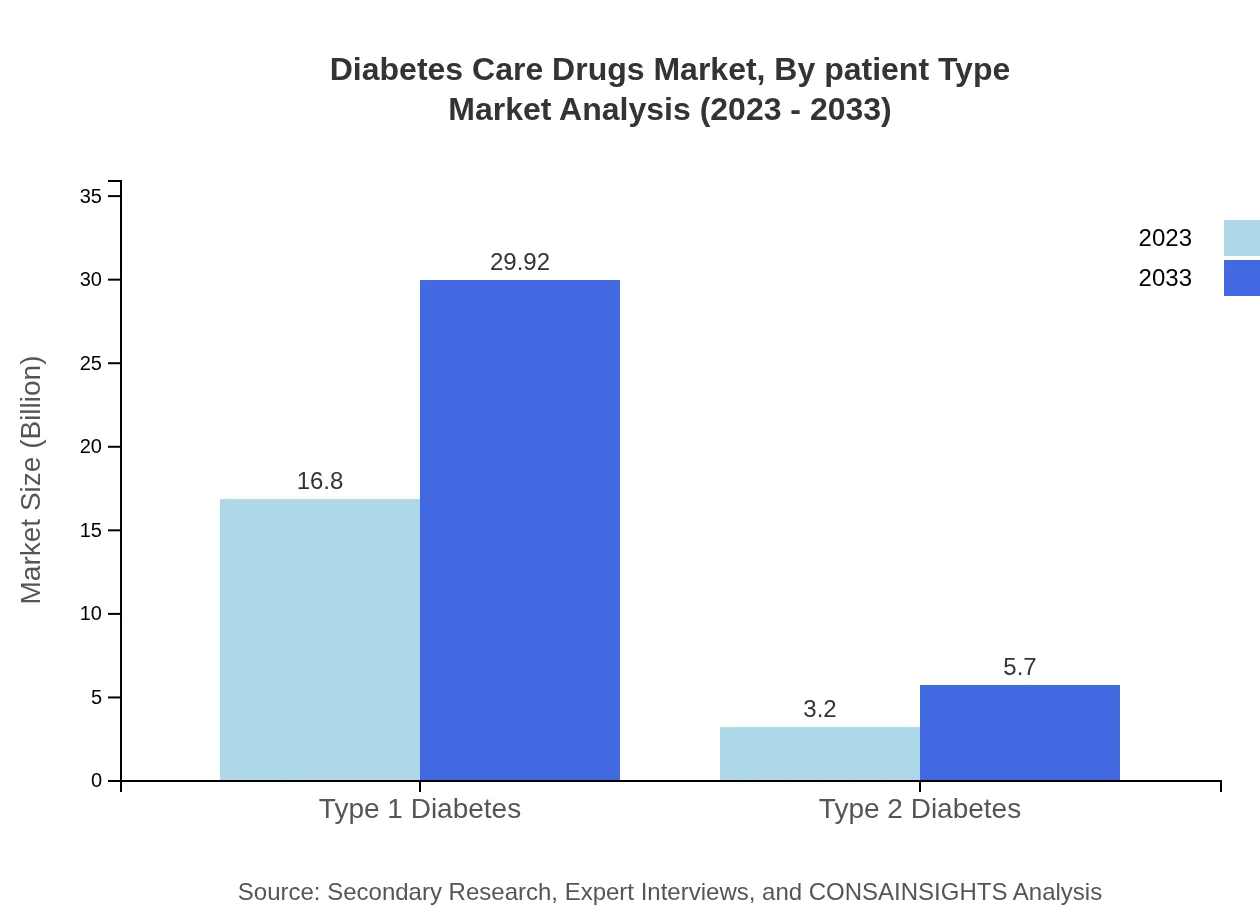

Diabetes Care Drugs Market Analysis By Patient Type

The patient type segmentation shows that Type 1 diabetes medications dominate with a market size of $16.80 billion in 2023, projected to grow to $29.92 billion by 2033, holding an 83.99% share. Conversely, Type 2 diabetes has a smaller market size of $3.20 billion in 2023, predicted to expand to $5.70 billion by 2033, representing 16.01% of the market. This reflects the ongoing trend toward more effective and tailored treatments in practice.

Diabetes Care Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Diabetes Care Drugs Industry

Novo Nordisk:

A leader in diabetes care, Novo Nordisk has a strong portfolio of insulin and GLP-1 receptor agonists, playing a key role in treatment paradigms globally.Sanofi:

Sanofi is a major player in the diabetes market, providing a range of insulin products and innovative therapies addressing diabetes management needs.Boehringer Ingelheim:

Known for its contributions to diabetes care, Boehringer Ingelheim focuses on innovation in diabetes treatments and brings a comprehensive approach to managing the disease.Bristol-Myers Squibb:

With a strong presence in the diabetes segment, Bristol-Myers Squibb has a wide variety of diabetes drugs that cater to diverse patient needs.We're grateful to work with incredible clients.

FAQs

What is the market size of diabetes Care Drugs?

The global diabetes care drugs market is currently valued at approximately $20 billion, with an expected CAGR of 5.8% from 2023 to 2033. By the end of this period, the market is anticipated to significantly expand, reflecting the rising prevalence of diabetes.

What are the key market players or companies in the diabetes Care Drugs industry?

Key players in the diabetes care drugs market include major pharmaceutical companies such as Novo Nordisk, Sanofi, and Eli Lilly. These organizations have a significant market share and are actively involved in the research and development of innovative diabetes treatments.

What are the primary factors driving the growth in the diabetes Care Drugs industry?

The growth of the diabetes-care-drugs market is primarily driven by factors such as the increasing prevalence of diabetes globally, advancements in medication technologies, and rising awareness about diabetes management. Furthermore, an aging population and lifestyle changes contribute to the demand.

Which region is the fastest Growing in the diabetes Care Drugs market?

The fastest-growing region in the diabetes care drugs market is North America, with a projected market size growth from $6.99 billion in 2023 to $12.44 billion by 2033. Other significant regions include Europe and Asia Pacific, which also show considerable market expansion.

Does ConsaInsights provide customized market report data for the diabetes Care Drugs industry?

Yes, ConsaInsights offers customized market report data tailored to meet specific client needs in the diabetes-care-drugs industry. Our tailored reports focus on detailed market dynamics, trends, and forecasts based on individual business objectives.

What deliverables can I expect from this diabetes Care Drugs market research project?

From the diabetes-care-drugs market research project, you can expect comprehensive deliverables including detailed market analyses, forecasts, competitive landscapes, and insights on trends and growth opportunities. We also provide data segmentation by region and drug type.

What are the market trends of diabetes Care Drugs?

Current market trends in diabetes care drugs include a shift towards more personalized medicine, innovative drug delivery systems, and an increase in the use of digital health technologies. Moreover, there is a growing emphasis on preventative care and lifestyle modifications.