Diagnostic Imaging Market Report

Published Date: 31 January 2026 | Report Code: diagnostic-imaging

Diagnostic Imaging Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Diagnostic Imaging market, covering key insights on market size, trends, and regional performance from 2023 to 2033.

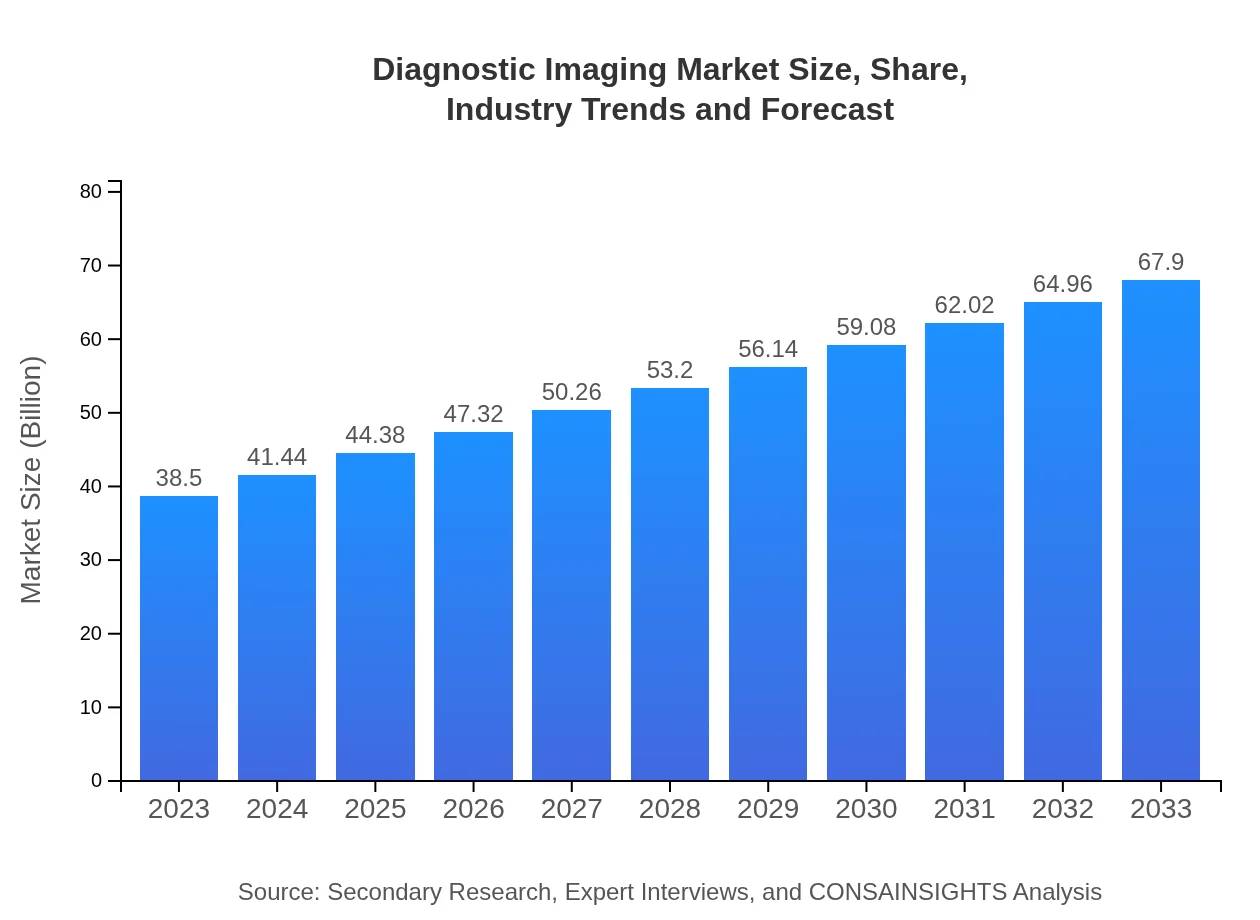

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $38.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $67.90 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Toshiba Medical Systems |

| Last Modified Date | 31 January 2026 |

Diagnostic Imaging Market Overview

Customize Diagnostic Imaging Market Report market research report

- ✔ Get in-depth analysis of Diagnostic Imaging market size, growth, and forecasts.

- ✔ Understand Diagnostic Imaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Diagnostic Imaging

What is the Market Size & CAGR of Diagnostic Imaging market in 2023?

Diagnostic Imaging Industry Analysis

Diagnostic Imaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Diagnostic Imaging Market Analysis Report by Region

Europe Diagnostic Imaging Market Report:

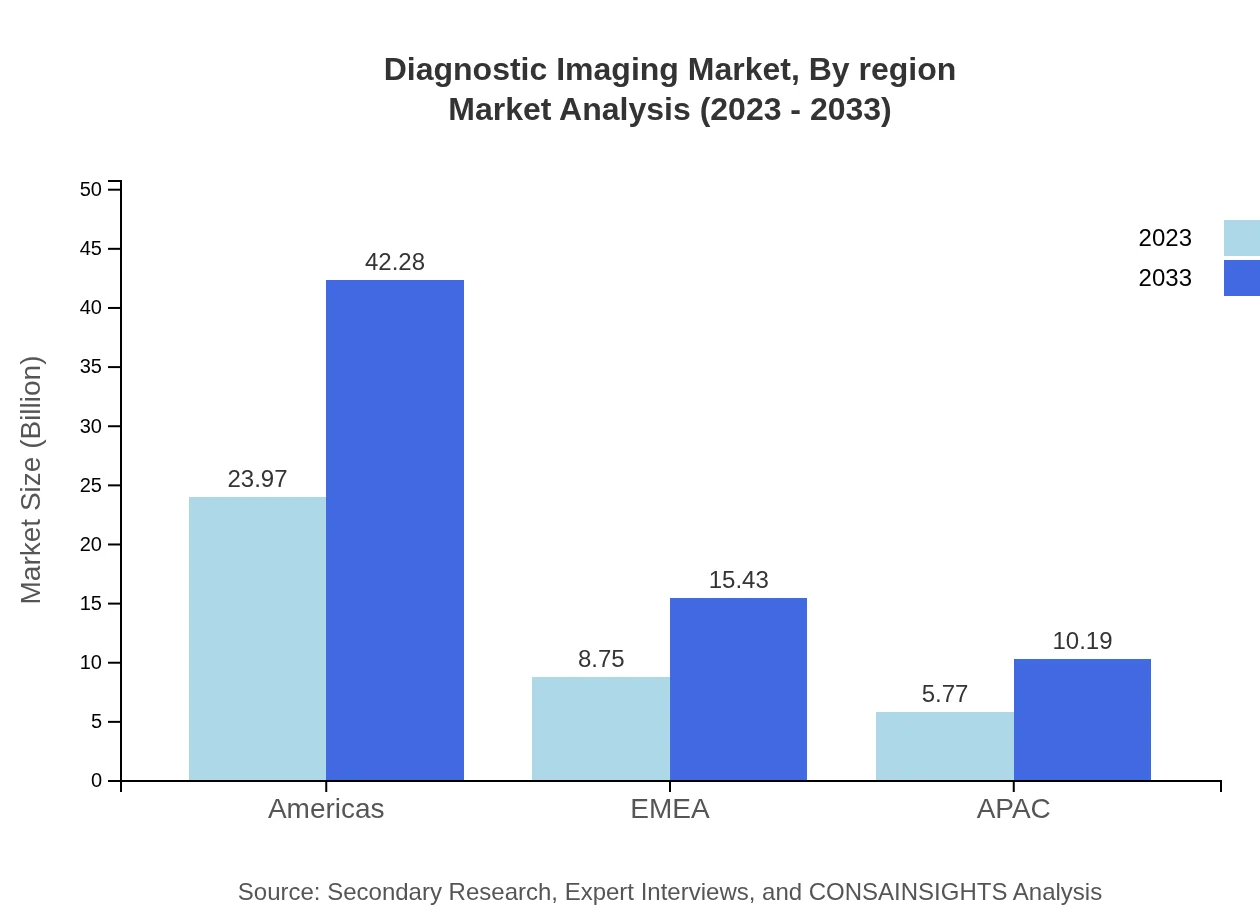

In Europe, the Diagnostic Imaging market is estimated at $10.51 billion in 2023, with projections of $18.54 billion by 2033. The growth is supported by stringent healthcare policies, technological advancements, and growing demand for personalized healthcare solutions.Asia Pacific Diagnostic Imaging Market Report:

In 2023, the Asia Pacific Diagnostic Imaging market is valued at approximately $7.58 billion and is projected to grow to $13.38 billion by 2033. This region is experiencing rapid advancements in healthcare infrastructure and increased healthcare spending, driving the demand for diagnostic imaging technologies.North America Diagnostic Imaging Market Report:

Valued at $14.10 billion in 2023 and projected to reach $24.87 billion by 2033, North America holds the largest share of the Diagnostic Imaging market. The region benefits from advanced healthcare infrastructure, innovative technology adoption, and a high prevalence of chronic illnesses.South America Diagnostic Imaging Market Report:

The South American Diagnostic Imaging market, valued at approximately $1.77 billion in 2023, is expected to expand to $3.12 billion by 2033. Government initiatives to improve healthcare access and growing urbanization contribute to this growth.Middle East & Africa Diagnostic Imaging Market Report:

The Middle East and Africa market, at $4.53 billion in 2023, is anticipated to grow to $7.99 billion by 2033. Investment in healthcare infrastructure and an increasing number of hospitals are key drivers of growth in this region.Tell us your focus area and get a customized research report.

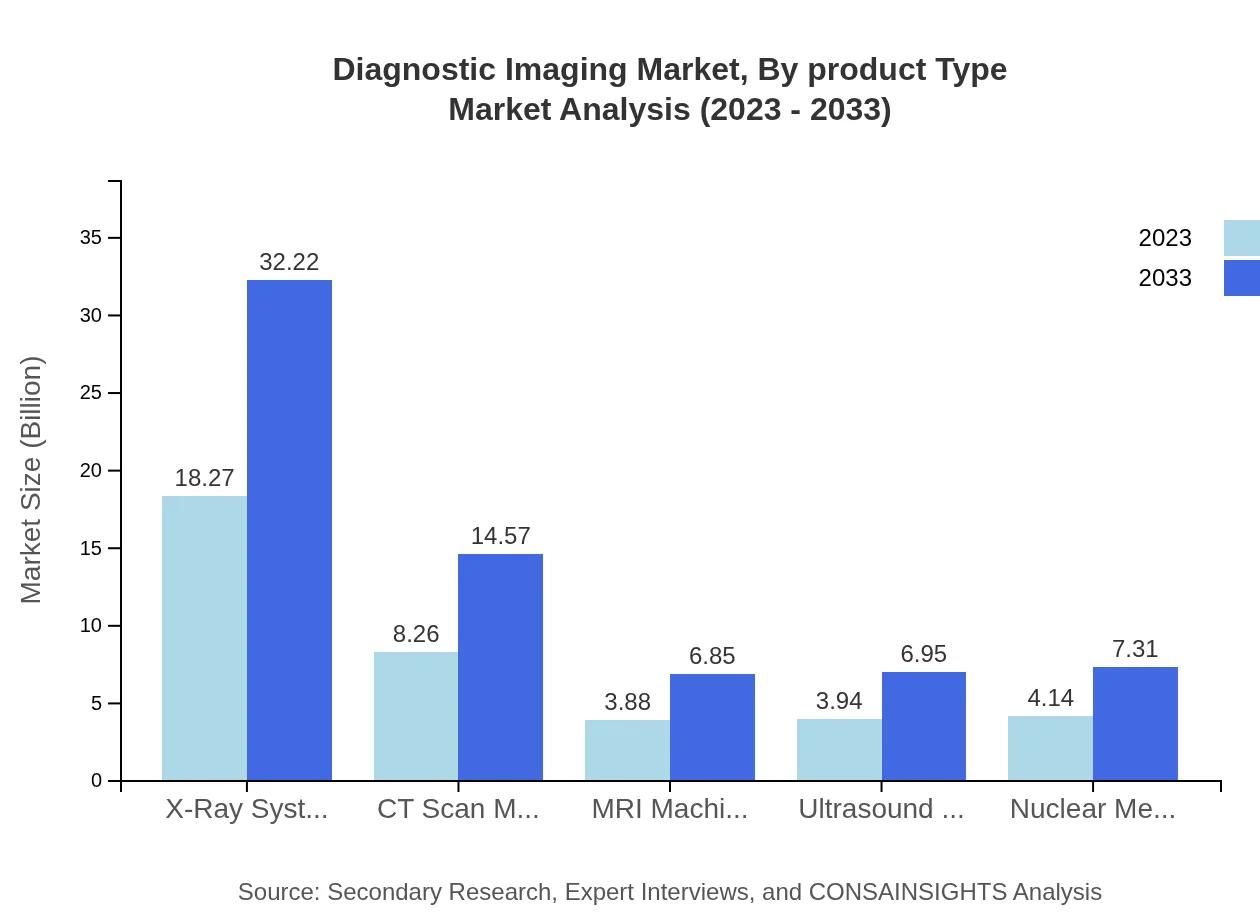

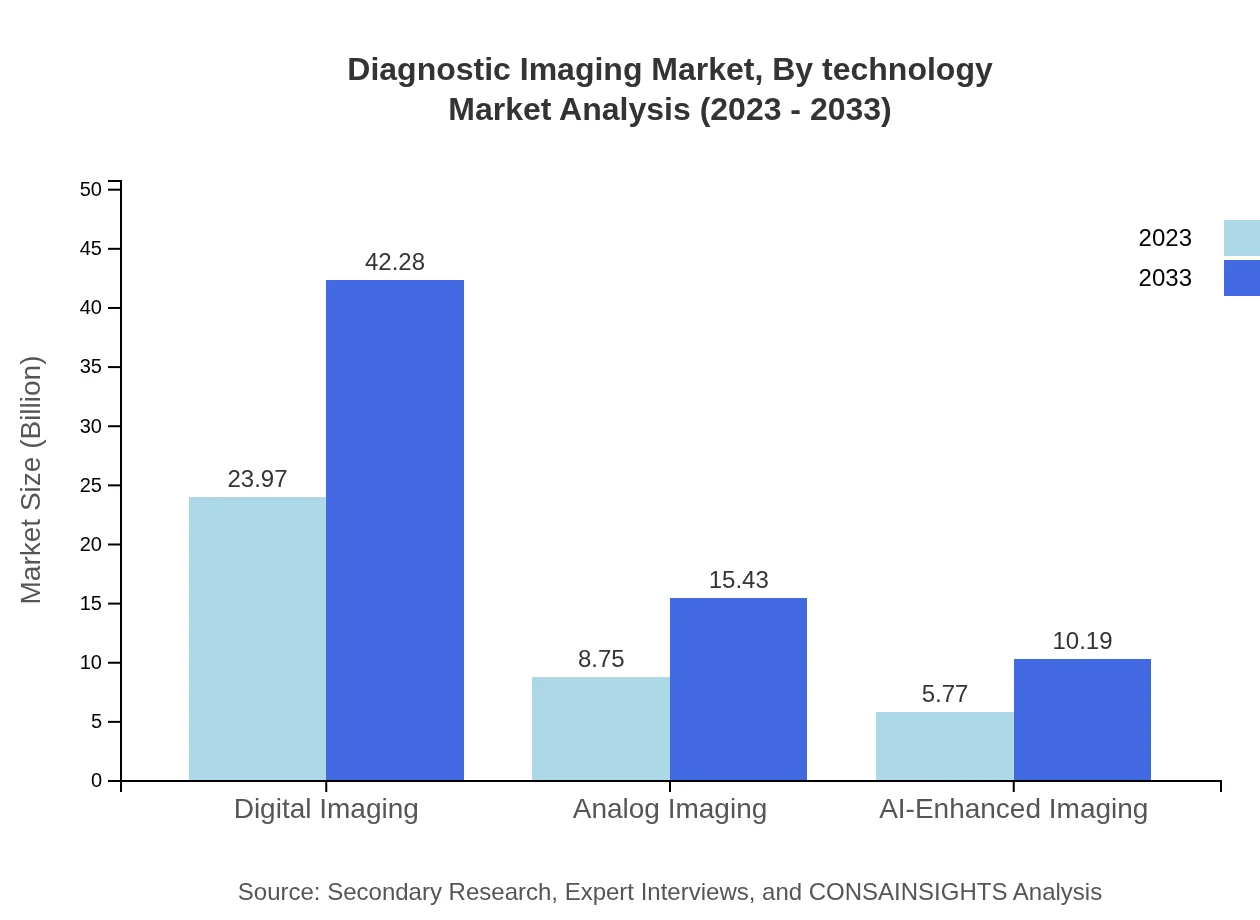

Diagnostic Imaging Market Analysis By Product Type

The product type segmentation showcases diverse imaging modalities such as Digital Imaging, Analog Imaging, and AI-Enhanced Imaging. Digital Imaging, with a market size of $23.97 billion in 2023, dominates due to its efficiency and superior image quality. Analog Imaging is projected to grow steadily, supported by demand in certain demographics. AI-Enhanced Imaging solutions, though currently smaller at $5.77 billion, are expected to capture significant share due to increasing integration of technology in healthcare.

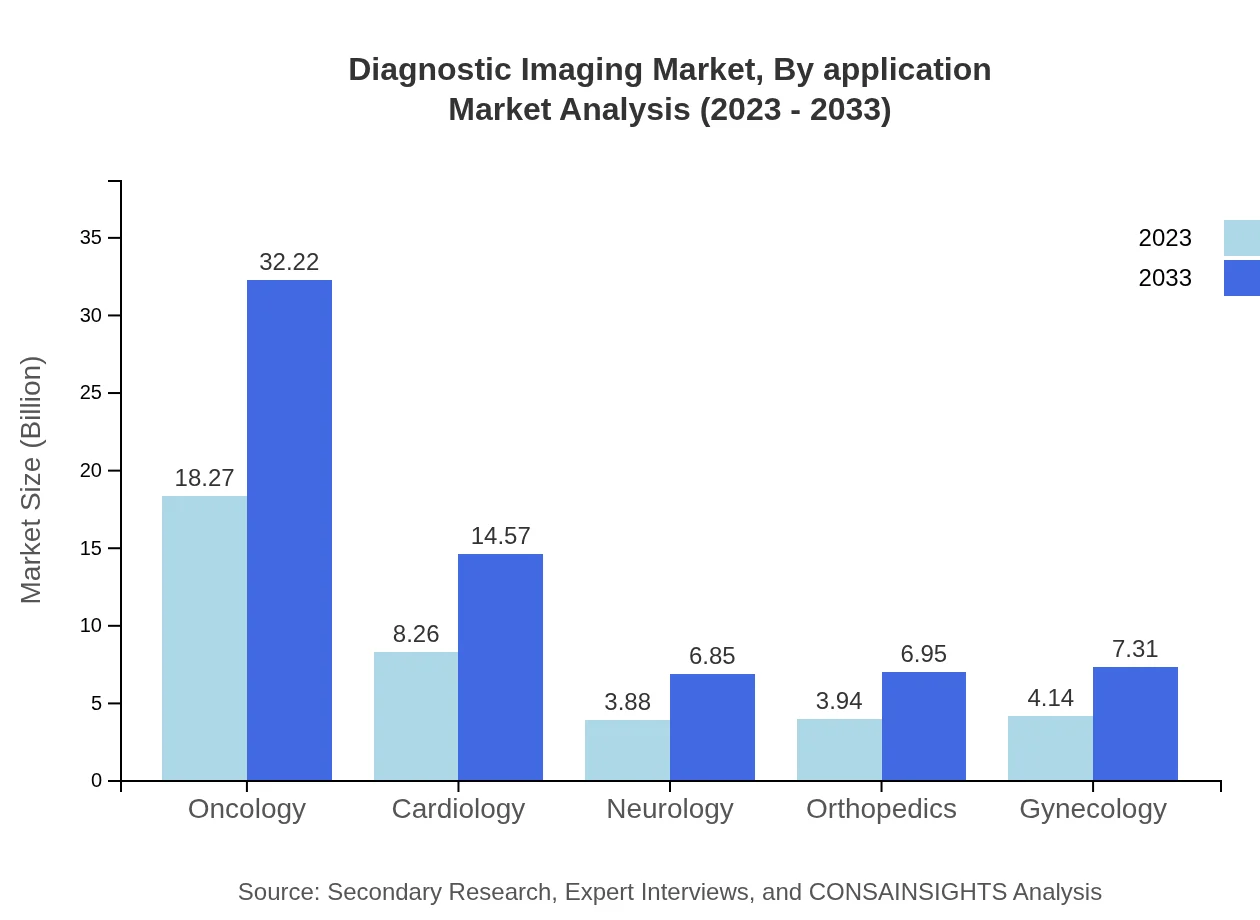

Diagnostic Imaging Market Analysis By Application

The primary applications of Diagnostic Imaging include Oncology, Cardiology, Neurology, Orthopedics, and Gynecology. Oncology leads with a market share of 47.45%, highlighting the essential role of imaging in cancer diagnosis and treatment. Other applications, such as Cardiology and Orthopedics, are also witnessing increased investment and technological advancements, emphasizing the need for accurate imaging solutions.

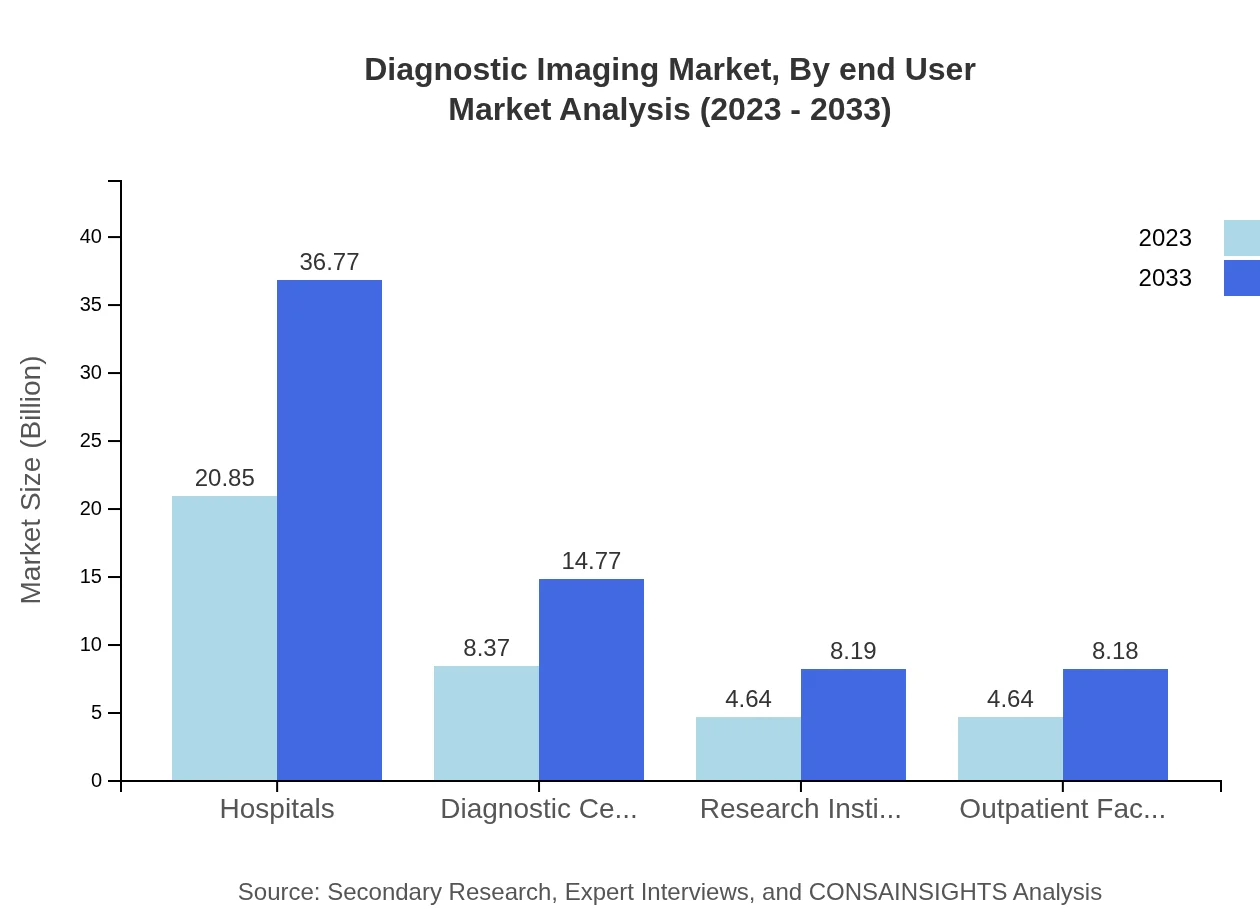

Diagnostic Imaging Market Analysis By End User

Hospitals form the largest segment of the end-user market, capturing 54.15% share due to high patient volumes and advanced imaging requirements. Diagnostic centers represent a substantial segment as they specialize in imaging services. This is expected to grow alongside outpatient facilities and research institutions as healthcare demand shifts towards outpatient care and enhanced diagnostic capabilities.

Diagnostic Imaging Market Analysis By Technology

Technological advancements play a significant role in market dynamics. Digital Imaging technology continues to dominate due to its efficiency, while AI-Enhanced Imaging is poised for rapid growth. This technological shift is supported by the implementation of advanced algorithms improving diagnostic accuracy and reducing time.

Diagnostic Imaging Market Analysis By Region

Regional segments show diverse trends influenced by healthcare infrastructure and investments. The Americas dominate the market with a size of $23.97 billion, while EMEA and APAC regions show promising growth trajectories due to increasing healthcare investments and technological advancements.

Diagnostic Imaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Diagnostic Imaging Industry

Siemens Healthineers:

Siemens Healthineers is a leading provider of innovative imaging solutions, dedicated to enhancing healthcare delivery through advanced medical technology. Their portfolio includes MRI, CT, and X-ray systems that are widely used in clinical settings.GE Healthcare:

GE Healthcare is renowned for its pioneering imaging technologies and solutions that enhance patient care and accelerate insights. They produce a wide range of diagnostic imaging systems, particularly known for their advanced ultrasound and MRI technology.Philips Healthcare:

Philips Healthcare specializes in diagnostic imaging technologies that improve health outcomes through innovation in mobile and AI-powered solutions. Their focus on patient-centered healthcare drives their competitive advantage.Canon Medical Systems:

Canon Medical Systems provides a comprehensive portfolio of advanced imaging solutions, focusing on patient comfort and diagnosis accuracy. Their systems are well-regarded for advanced CT and MRI imaging capabilities.Toshiba Medical Systems:

Toshiba Medical Systems is a vital player in the diagnostic imaging market, known for their imaging equipment's reliability and performance. Their solutions cater to diverse medical imaging applications, enhancing diagnostic efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Diagnostic Imaging?

The global Diagnostic Imaging market is valued at approximately $38.5 billion in 2023 and is projected to grow significantly at a CAGR of 5.7%, reaching around $67.5 billion by 2033.

What are the key market players or companies in the Diagnostic Imaging industry?

Key players in the Diagnostic Imaging market include Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, and Agfa-Gevaert Group, which dominate the market through technological advancements and strategic partnerships.

What are the primary factors driving the growth in the Diagnostic Imaging industry?

Factors driving growth include rising prevalence of chronic diseases, advancements in imaging technology such as AI integration, increasing demand for early diagnosis, and the expansion of healthcare infrastructure worldwide.

Which region is the fastest Growing in the Diagnostic Imaging market?

The North American region is the fastest-growing segment in the Diagnostic Imaging market, with a market size of $14.10 billion in 2023, expected to reach $24.87 billion by 2033.

Does ConsaInsights provide customized market report data for the Diagnostic Imaging industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the Diagnostic Imaging industry, ensuring you receive relevant insights for strategic decision-making.

What deliverables can I expect from this Diagnostic Imaging market research project?

Deliverables include comprehensive market analysis reports, segmentation data, competitor analysis, growth forecasts, and strategic recommendations tailored to your specific needs within the Diagnostic Imaging sector.

What are the market trends of Diagnostic Imaging?

Current trends in the Diagnostic Imaging market include the adoption of telemedicine, increased use of AI for image analysis, shifting towards digital imaging solutions, and a rise in patient-centric care approaches.