Diagnostic Radiopharmaceuticals And Contrast Media Market Report

Published Date: 31 January 2026 | Report Code: diagnostic-radiopharmaceuticals-and-contrast-media

Diagnostic Radiopharmaceuticals And Contrast Media Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Diagnostic Radiopharmaceuticals and Contrast Media market, focusing on market trends, segmentation, regional insights, and future forecasts from 2023 to 2033.

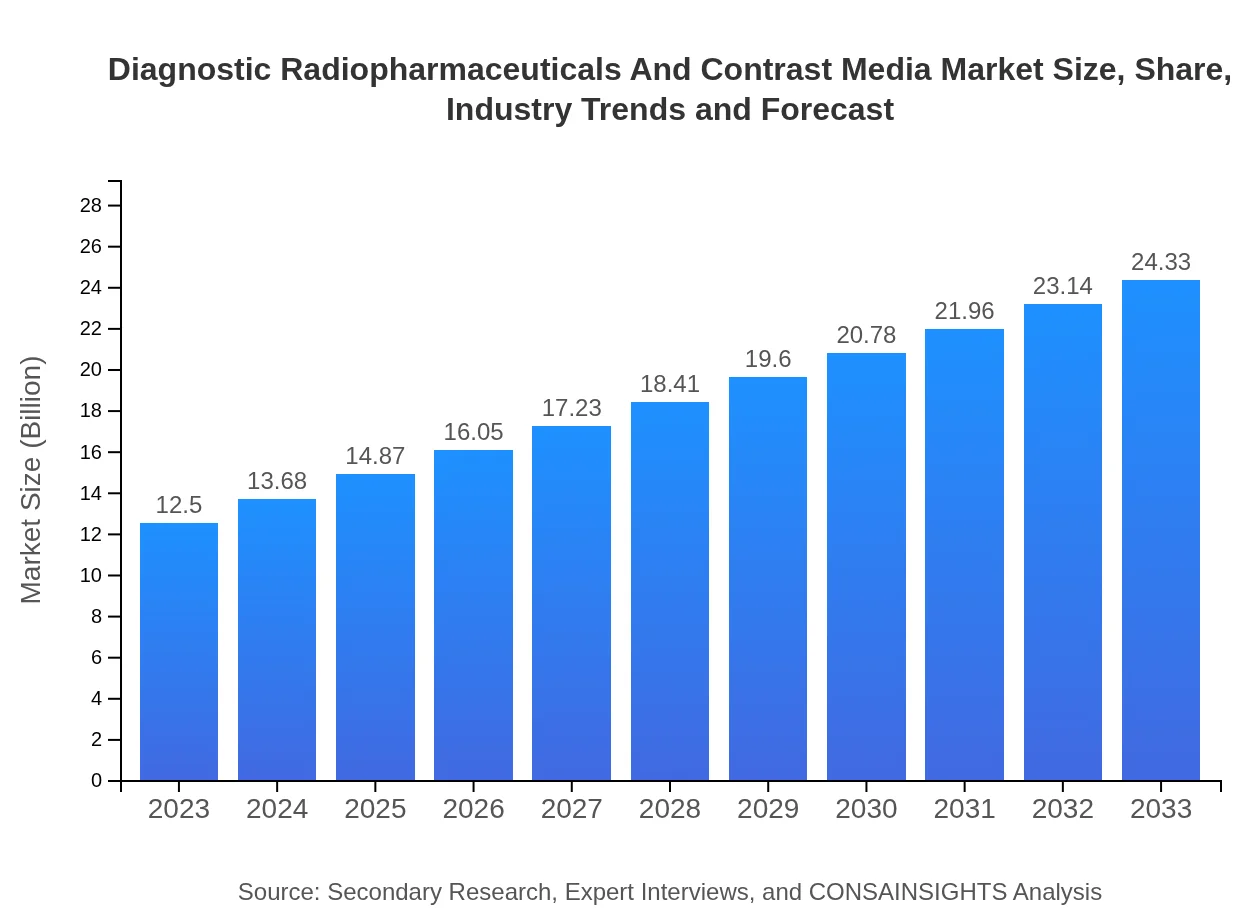

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $24.33 Billion |

| Top Companies | GE Healthcare, Siemens Healthineers, Lantheus Medical Imaging, Bayer AG |

| Last Modified Date | 31 January 2026 |

Diagnostic Radiopharmaceuticals And Contrast Media Market Overview

Customize Diagnostic Radiopharmaceuticals And Contrast Media Market Report market research report

- ✔ Get in-depth analysis of Diagnostic Radiopharmaceuticals And Contrast Media market size, growth, and forecasts.

- ✔ Understand Diagnostic Radiopharmaceuticals And Contrast Media's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Diagnostic Radiopharmaceuticals And Contrast Media

What is the Market Size & CAGR of Diagnostic Radiopharmaceuticals And Contrast Media market in 2023?

Diagnostic Radiopharmaceuticals And Contrast Media Industry Analysis

Diagnostic Radiopharmaceuticals And Contrast Media Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Diagnostic Radiopharmaceuticals And Contrast Media Market Analysis Report by Region

Europe Diagnostic Radiopharmaceuticals And Contrast Media Market Report:

The European market, with a projected size of $3.28 billion in 2023, is anticipated to grow to $6.38 billion by 2033. This growth is supported by combined efforts in R&D by public and private sectors to develop novel imaging agents.Asia Pacific Diagnostic Radiopharmaceuticals And Contrast Media Market Report:

In the Asia Pacific region, the market size was approximately $2.49 billion in 2023 and is projected to grow to $4.84 billion by 2033, driven by rising healthcare expenditure and improving access to advanced imaging facilities. Increased prevalence of lifestyle-related diseases is further boosting demand in this region.North America Diagnostic Radiopharmaceuticals And Contrast Media Market Report:

North America is the largest market for Diagnostic Radiopharmaceuticals and Contrast Media, with an estimated size of $4.64 billion in 2023 and anticipated growth to $9.02 billion by 2033. The ongoing technological innovations and a significant presence of major market players propel this growth.South America Diagnostic Radiopharmaceuticals And Contrast Media Market Report:

The South American market, worth $0.76 billion in 2023, is expected to reach $1.47 billion by 2033. Factors contributing to growth include expanding healthcare infrastructure and increasing public awareness about advanced diagnostic procedures.Middle East & Africa Diagnostic Radiopharmaceuticals And Contrast Media Market Report:

In the Middle East and Africa, the market is expected to grow from $1.34 billion in 2023 to $2.61 billion by 2033, driven by advancements in healthcare technology and increasing partnerships between regional firms and established healthcare entities.Tell us your focus area and get a customized research report.

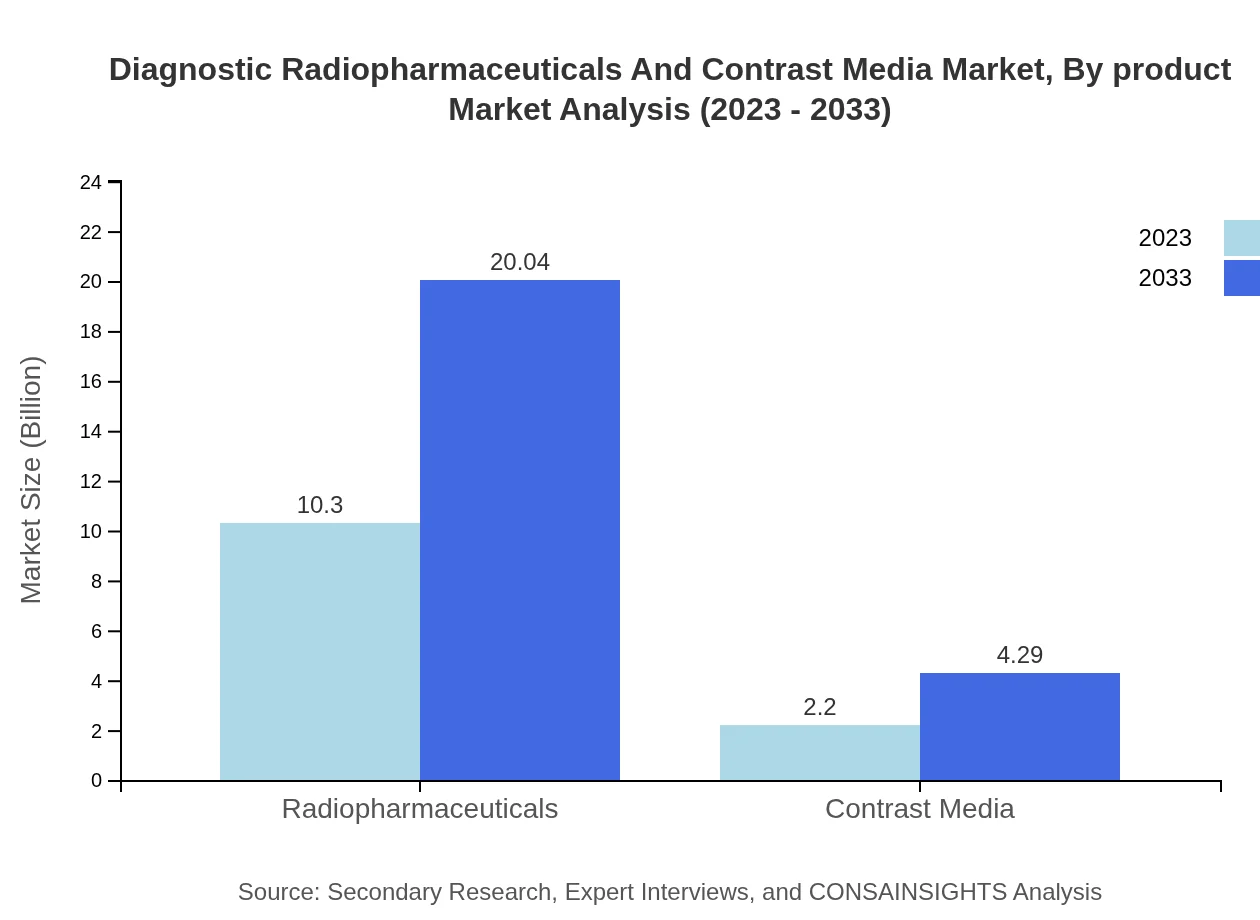

Diagnostic Radiopharmaceuticals And Contrast Media Market Analysis By Product

The Diagnostic Radiopharmaceuticals and Contrast Media market is significantly driven by Radiopharmaceuticals, which will reach $20.04 billion by 2033, accounting for 82.38% of the market share. Contrast Media, although smaller, is also growing and projected to reach $4.29 billion by 2033, holding 17.62% of the market share. The emphasis on organic compounds in developing improved products is essential for market players.

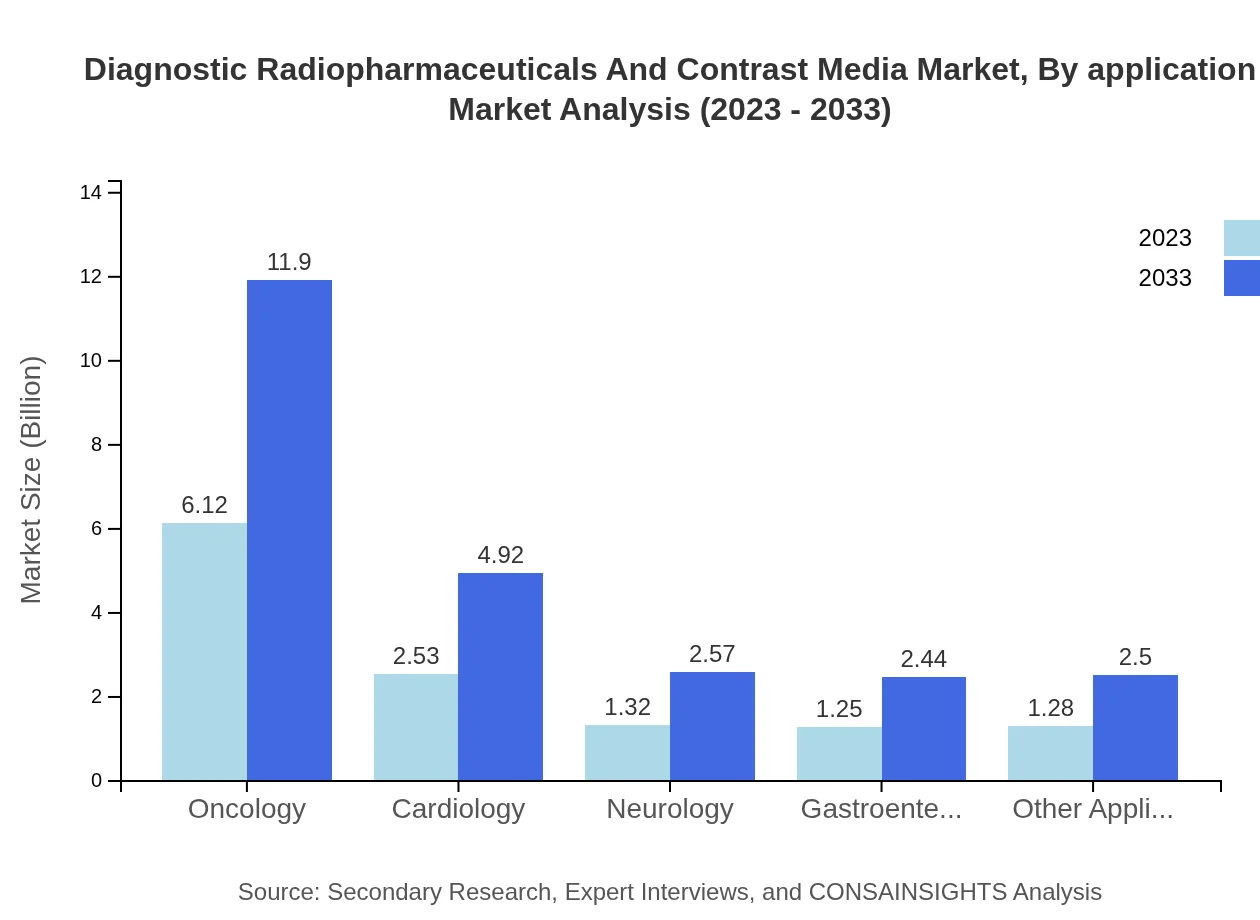

Diagnostic Radiopharmaceuticals And Contrast Media Market Analysis By Application

Applications in oncology dominate the market, expected to grow from $6.12 billion in 2023 to $11.90 billion in 2033, holding a significant 48.92% market share. Cardiology and neurology are also critical applications, showing growth due to rising cases of these health conditions.

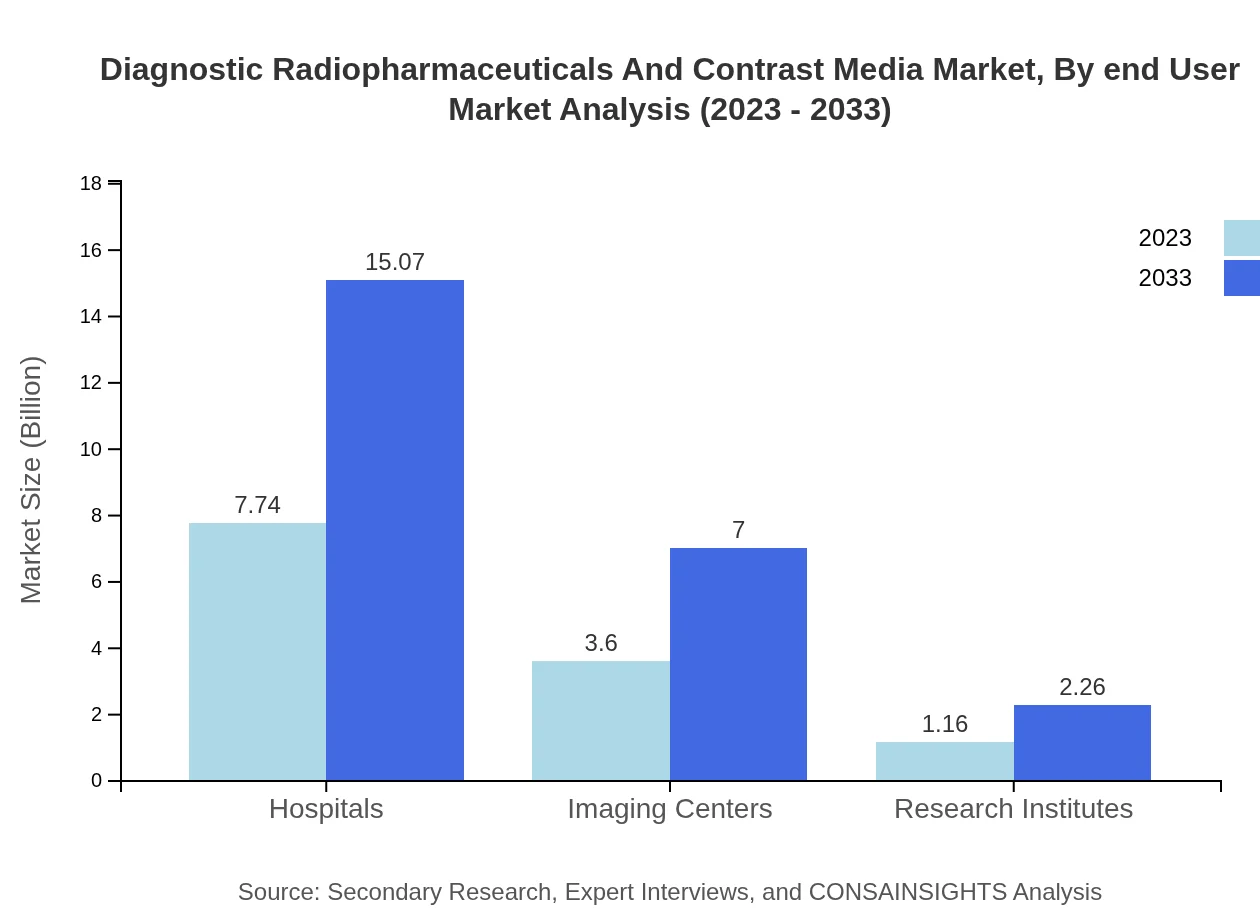

Diagnostic Radiopharmaceuticals And Contrast Media Market Analysis By End User

Hospitals constitute the largest share of end-users, with a market size projected to grow from $7.74 billion in 2023 to $15.07 billion by 2033, holding a 61.94% market share. Imaging centers follow closely, expected to rise from $3.60 billion to $7.00 billion in the same period.

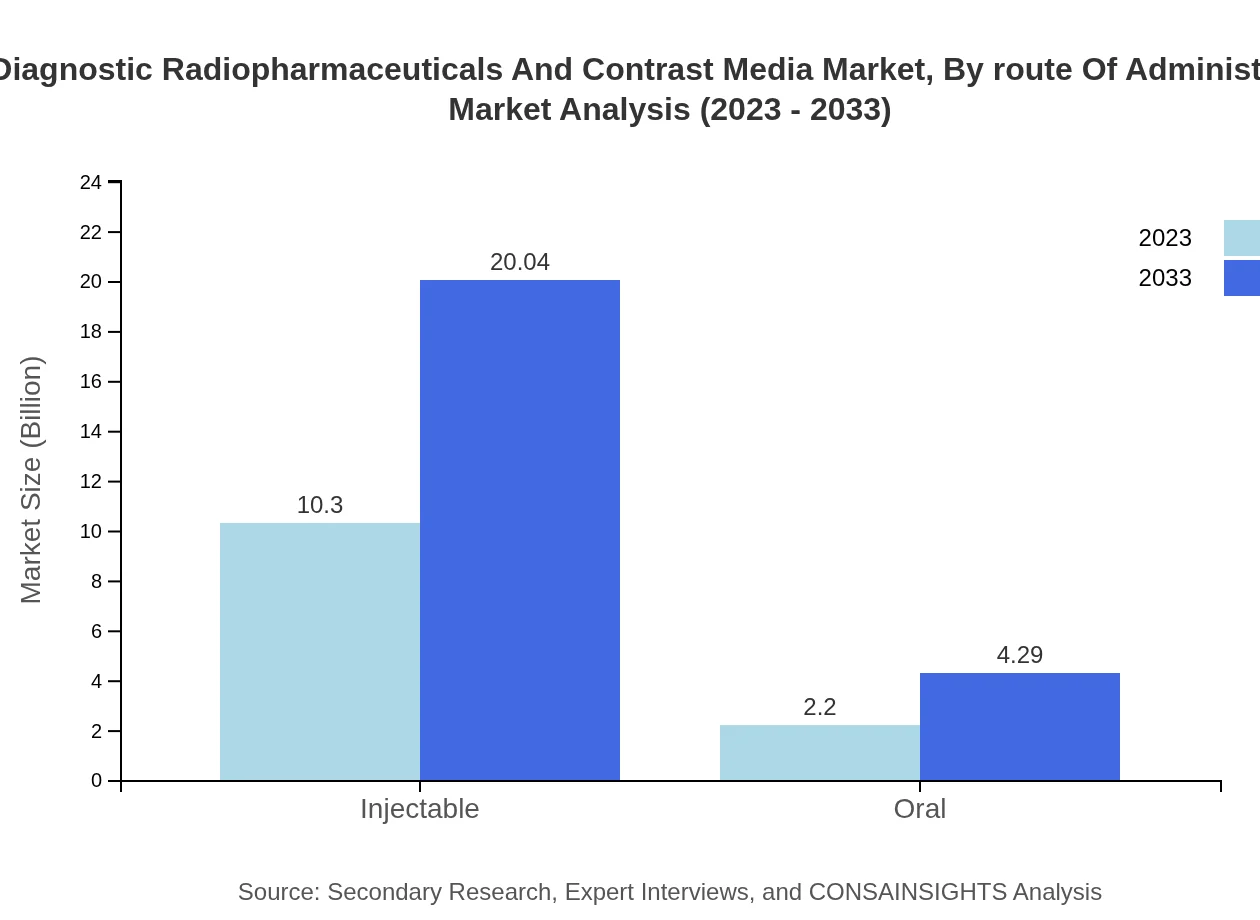

Diagnostic Radiopharmaceuticals And Contrast Media Market Analysis By Route Of Administration

Injectable forms of radiopharmaceuticals represent the majority of the market, growing from $10.30 billion to $20.04 billion, maintaining an 82.38% share. Oral routes, though less predominant, are increasing in popularity, projected to grow to $4.29 billion by 2033.

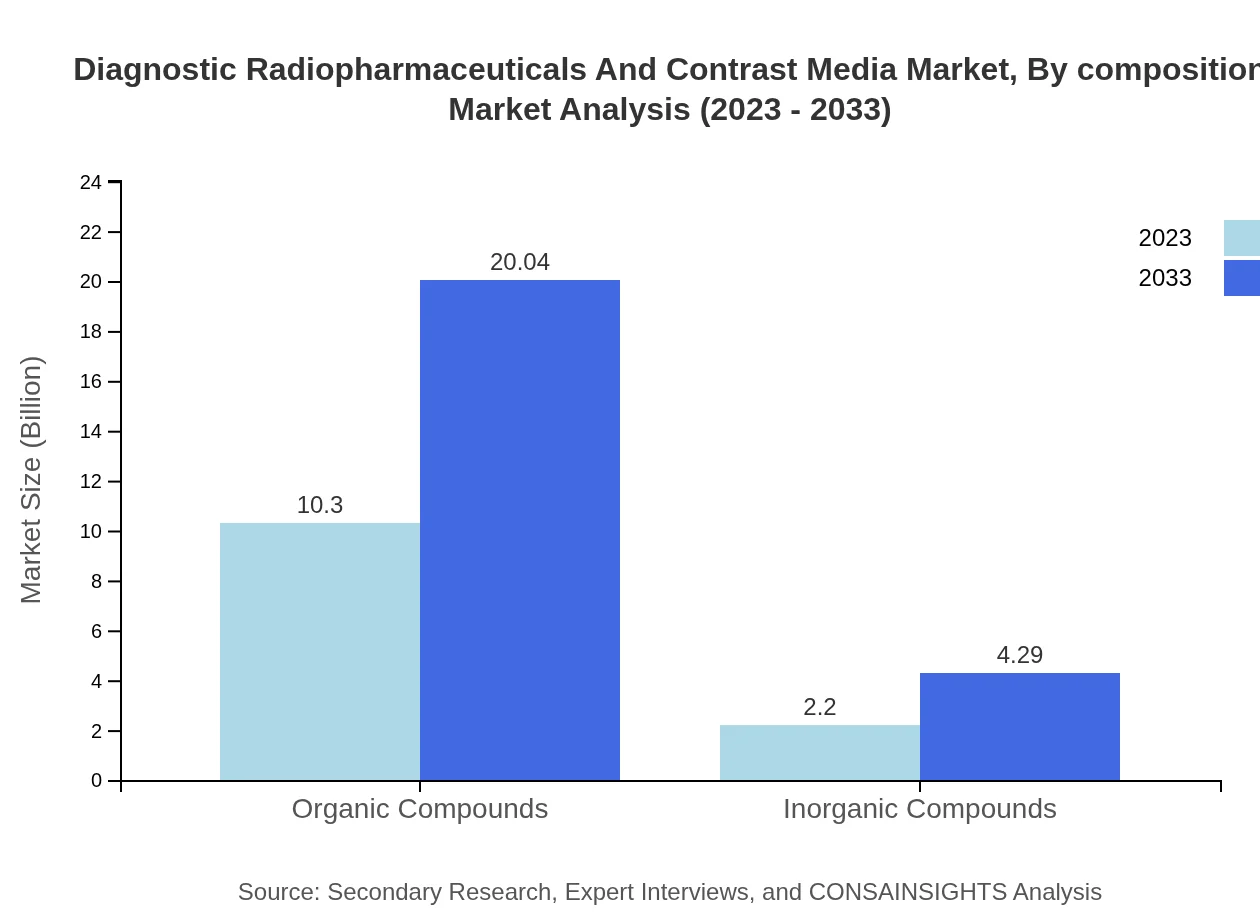

Diagnostic Radiopharmaceuticals And Contrast Media Market Analysis By Composition

The market is heavily dominated by organic compounds, including radiopharmaceuticals, expected to grow from $10.30 billion to $20.04 billion, accounting for 82.38% of the share. Inorganic compounds, while having a smaller share, are anticipated to grow steadily, reaching $4.29 billion by 2033.

Diagnostic Radiopharmaceuticals And Contrast Media Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Diagnostic Radiopharmaceuticals And Contrast Media Industry

GE Healthcare:

A leading provider of medical imaging equipment and diagnostic imaging agents, GE Healthcare innovates in radiopharmaceutical development to improve diagnostic processes.Siemens Healthineers:

Siemens Healthineers excels in combining medical technologies with artificial intelligence, expanding the capabilities of imaging systems using advanced contrast media.Lantheus Medical Imaging:

Lantheus specializes in the development and commercialization of innovative diagnostic and therapeutic radiopharmaceuticals to enhance patient care.Bayer AG:

Bayer AG is known for its strong portfolio in contrast media and established presence in the diagnostic imaging market, focusing on sustainability and innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of diagnostic Radiopharmaceuticals And Contrast Media?

The global market size for diagnostic radiopharmaceuticals and contrast media is estimated at $12.5 billion in 2023, with a compound annual growth rate (CAGR) of 6.7%, expected to see significant expansion by 2033.

What are the key market players or companies in this diagnostic Radiopharmaceuticals And Contrast Media industry?

Key players in the diagnostic radiopharmaceuticals and contrast media market include major pharmaceutical companies specializing in radiopharmaceuticals and imaging agents, ensuring continuous innovation and competition in the sector.

What are the primary factors driving the growth in the diagnostic Radiopharmaceuticals And Contrast Media industry?

Growth in the diagnostic radiopharmaceuticals and contrast media industry is primarily driven by increasing demand for diagnostic imaging, advancements in radiopharmaceutical technology, and a rising prevalence of chronic diseases necessitating effective imaging solutions.

Which region is the fastest Growing in the diagnostic Radiopharmaceuticals And Contrast Media?

The fastest-growing region in the diagnostic radiopharmaceuticals and contrast media market is North America, with its market projected to increase from $4.64 billion in 2023 to $9.02 billion by 2033, reflecting robust healthcare investments.

Does ConsaInsights provide customized market report data for the diagnostic Radiopharmaceuticals And Contrast Media industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the diagnostic radiopharmaceuticals and contrast media industry, enabling clients to gain insights aligned with their strategic objectives.

What deliverables can I expect from this diagnostic Radiopharmaceuticals And Contrast Media market research project?

Deliverables from the diagnostic radiopharmaceuticals and contrast media market research project include comprehensive reports, market trends analysis, competitor benchmarking, and actionable insights designed to support decision-making.

What are the market trends of diagnostic Radiopharmaceuticals And Contrast Media?

Current market trends in diagnostic radiopharmaceuticals and contrast media include increased adoption of advanced imaging technologies, rising personalized medicine approaches, and growing demand for effective imaging in oncology and cardiology applications.