Diameter Signaling Market Report

Published Date: 31 January 2026 | Report Code: diameter-signaling

Diameter Signaling Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Diameter Signaling market, encompassing market size, segmentation, regional insights, and forecasts from 2023 to 2033. It caters to industry stakeholders seeking data-driven insights and helps in strategic planning.

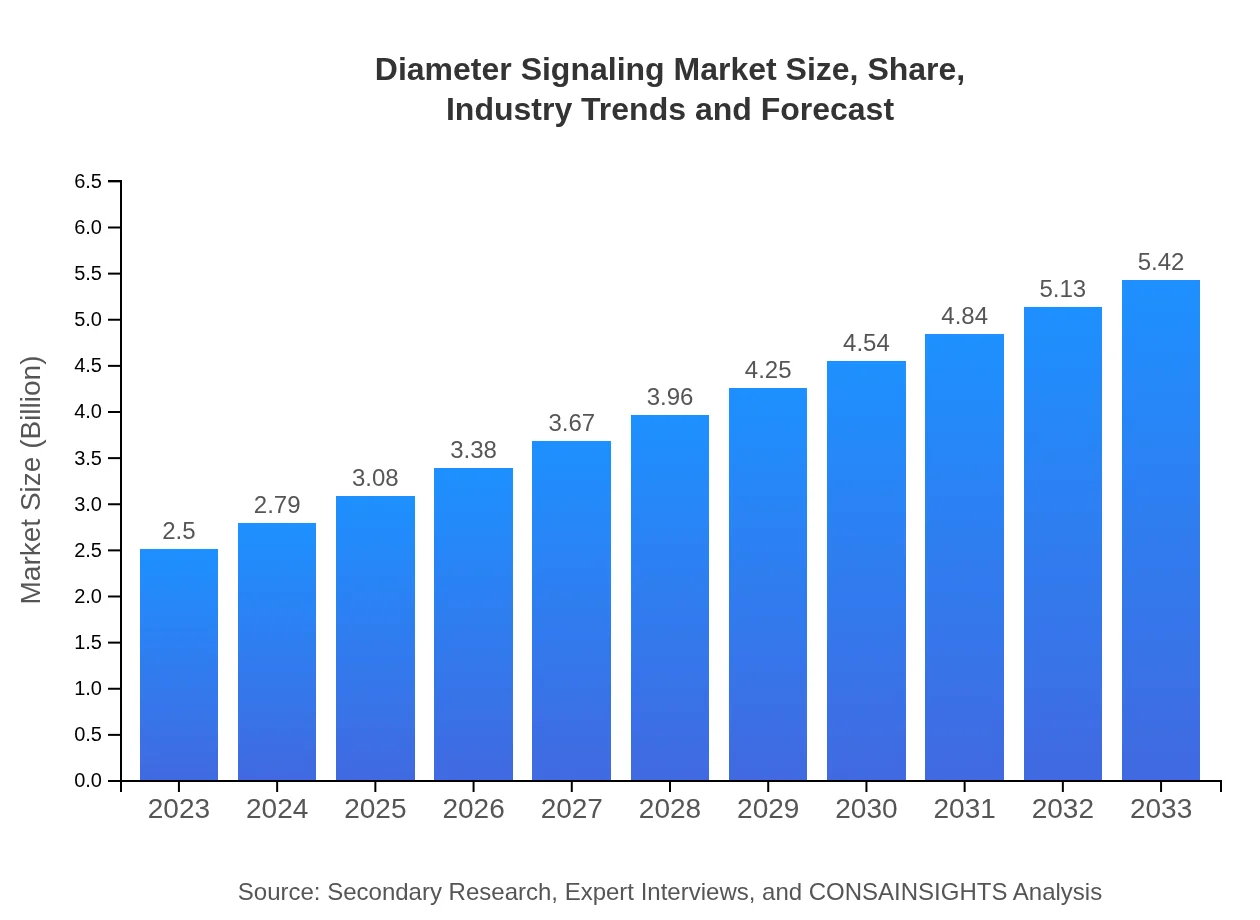

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Ericsson , Huawei Technologies, Amdocs, Oracle Corporation, Nokia |

| Last Modified Date | 31 January 2026 |

Diameter Signaling Market Overview

Customize Diameter Signaling Market Report market research report

- ✔ Get in-depth analysis of Diameter Signaling market size, growth, and forecasts.

- ✔ Understand Diameter Signaling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Diameter Signaling

What is the Market Size & CAGR of Diameter Signaling market in 2023?

Diameter Signaling Industry Analysis

Diameter Signaling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Diameter Signaling Market Analysis Report by Region

Europe Diameter Signaling Market Report:

In Europe, the market size is projected to rise from $0.70 billion in 2023 to $1.52 billion by 2033. Factors such as strong regulatory frameworks and the pursuit of innovative communication technologies will be pivotal.Asia Pacific Diameter Signaling Market Report:

The Asia Pacific region is anticipated to see significant growth, reaching a market size of $1.03 billion by 2033, up from $0.48 billion in 2023. The burgeoning telecommunications sector backed by government initiatives to digitize economies is a key driver.North America Diameter Signaling Market Report:

North America will lead the market, expected to grow from $0.82 billion in 2023 to $1.78 billion by 2033. High internet penetration and demand for advanced telecommunications services are significant contributors.South America Diameter Signaling Market Report:

South America projects a slower growth trajectory, with market size estimates to increase from $0.21 billion in 2023 to $0.46 billion by 2033. This growth is largely fueled by investments in telecommunications infrastructure.Middle East & Africa Diameter Signaling Market Report:

The Middle East and Africa region is forecasted to expand from $0.29 billion in 2023 to $0.63 billion by 2033, with increasing investments in mobile and broadband services fueling this growth.Tell us your focus area and get a customized research report.

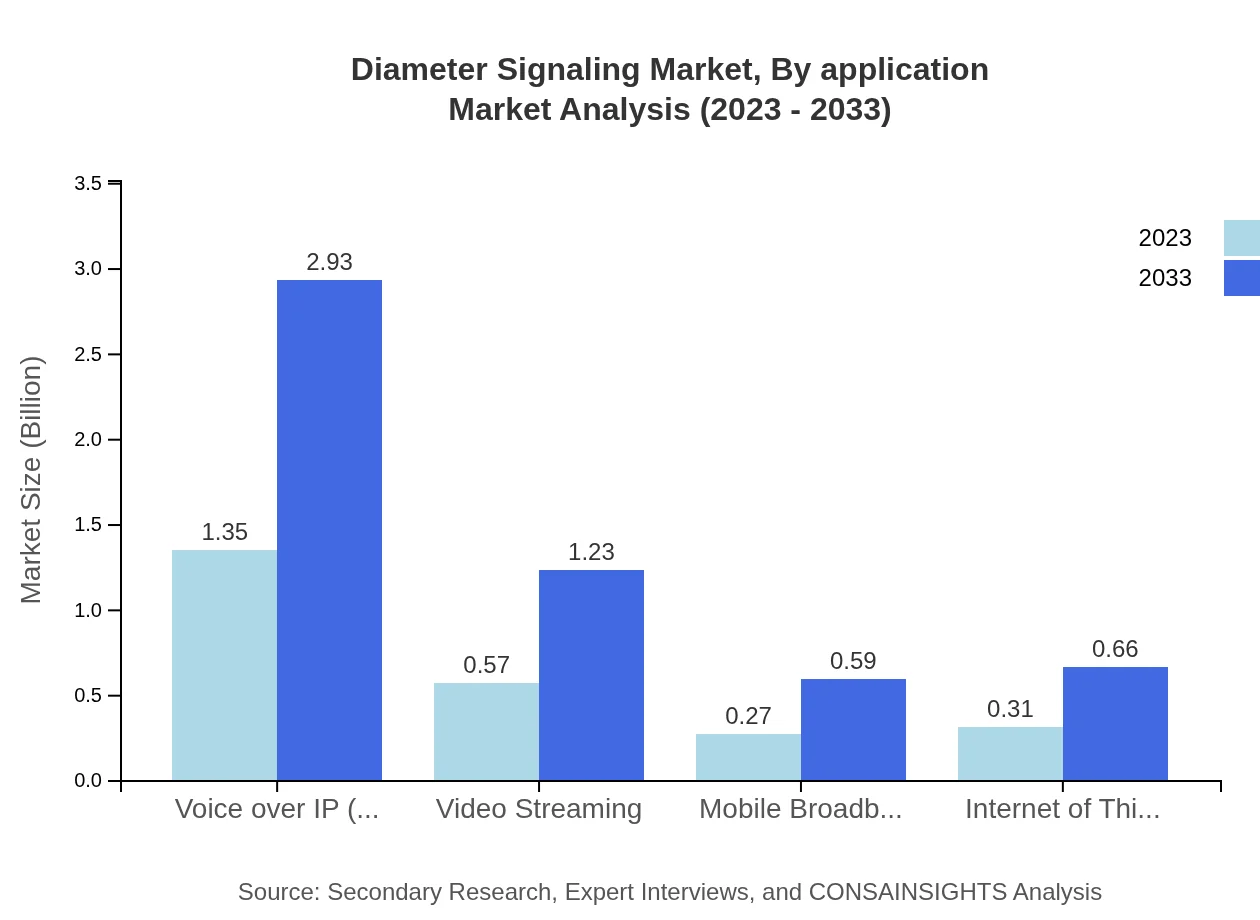

Diameter Signaling Market Analysis By Application

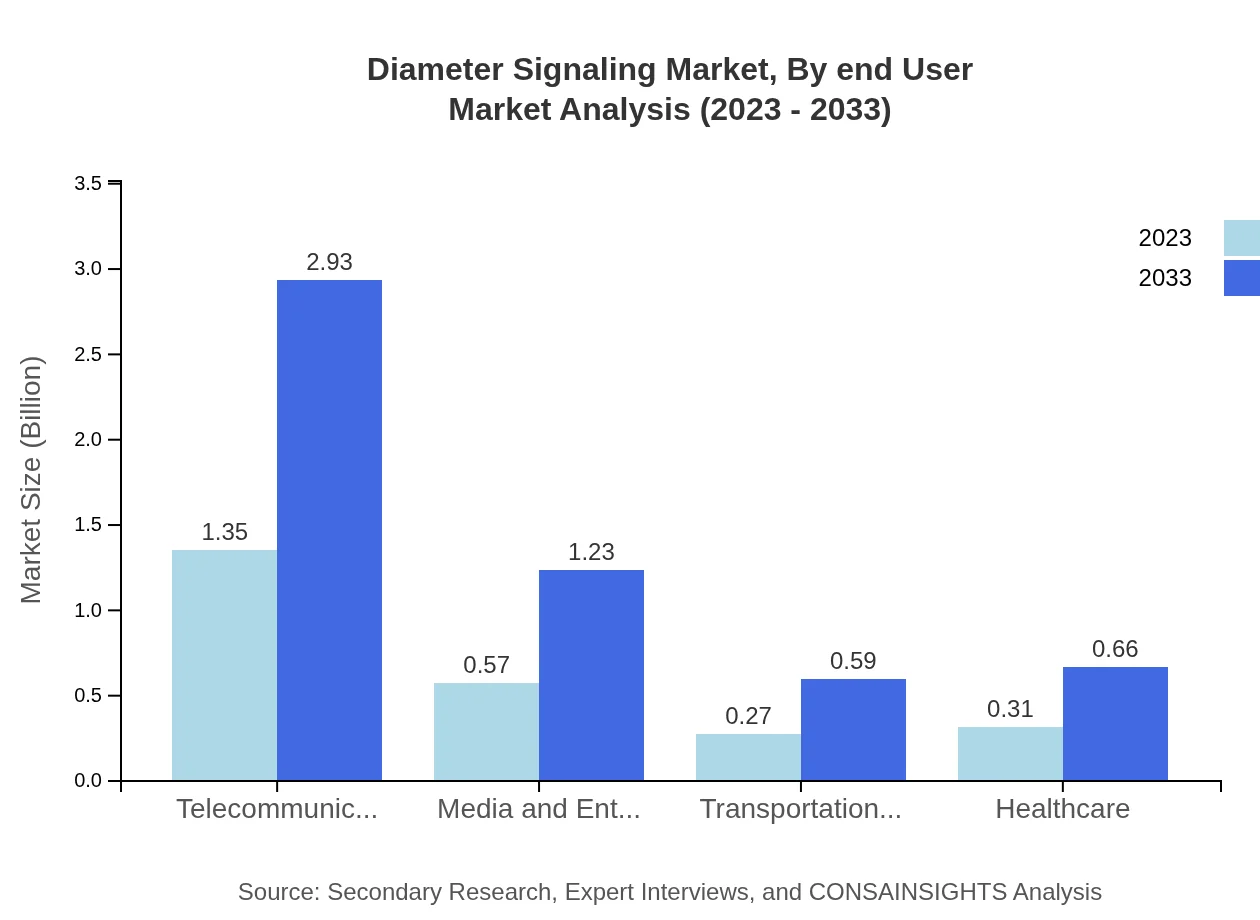

In 2023, the Diameter Signaling Market was dominated by telecommunications, valued at $1.35 billion, forecasted to reach $2.93 billion by 2033. The media and entertainment sector is also significant, projected from $0.57 billion to $1.23 billion in the same period.

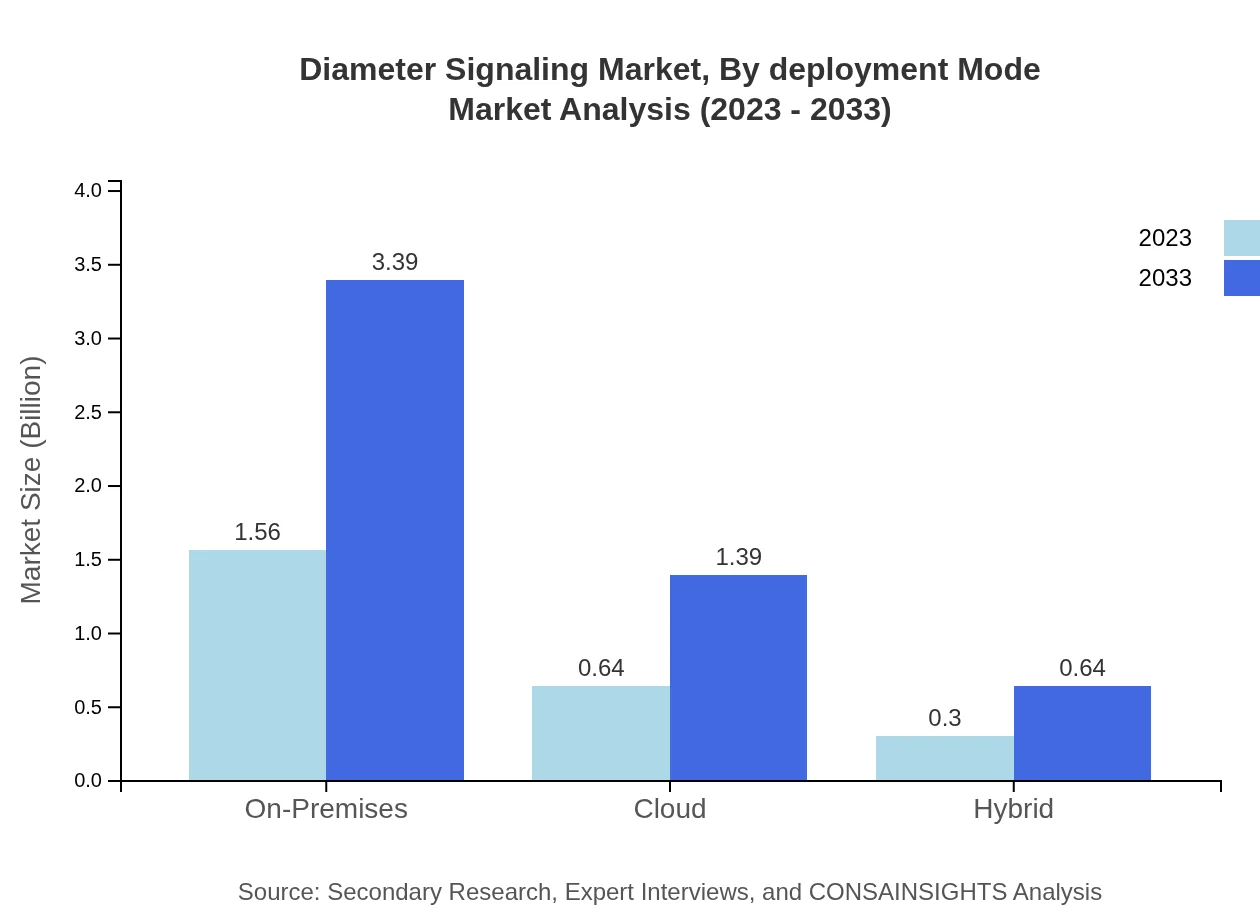

Diameter Signaling Market Analysis By Deployment Mode

Deployment modes such as on-premises and cloud-based solutions are critical, with on-premises holding a market size of $1.56 billion, set to grow to $3.39 billion by 2033.

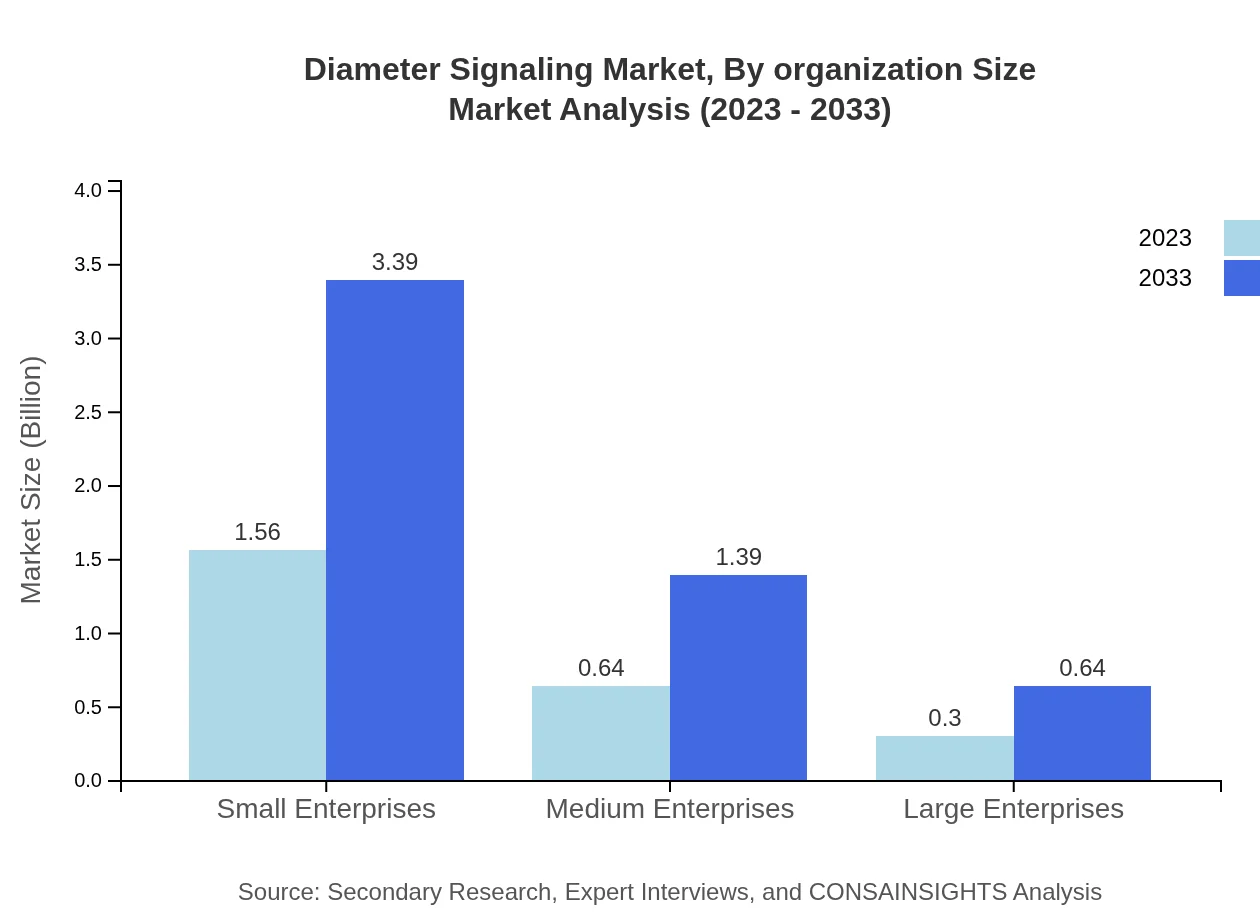

Diameter Signaling Market Analysis By Organization Size

The market segment for small enterprises saw a substantial size of $1.56 billion in 2023, projected to grow to $3.39 billion by 2033, highlighting the demand from smaller firms for robust signaling solutions.

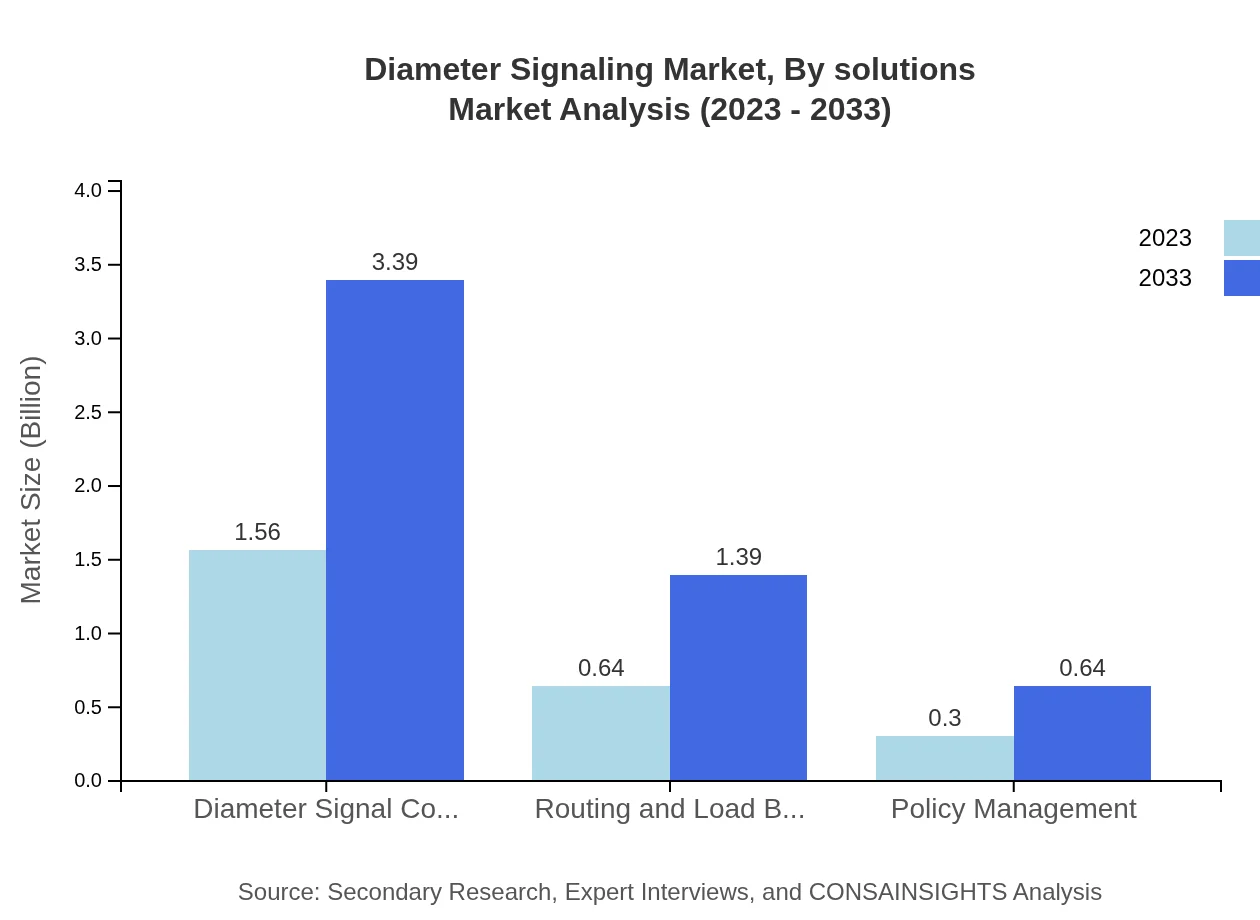

Diameter Signaling Market Analysis By Solutions

Solutions such as Diameter Signal Controllers dominate the market with a size of $1.56 billion in 2023, growing to $3.39 billion by 2033, demonstrating strong market reliance on these fundamental controllers.

Diameter Signaling Market Analysis By End User

End-user analysis reveals a robust demand from telecommunications providers, comprising a significant portion of market activity, with overall growth reflected in increasing investments within the sector.

Diameter Signaling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Diameter Signaling Industry

Ericsson :

A leader in telecommunications, Ericsson provides advanced network signaling solutions essential for driving efficiency in modern 5G networks.Huawei Technologies:

Huawei is a key player in the Diameter Signaling market, focusing on innovative solutions to enhance telecommunications systems globally.Amdocs:

Amdocs specializes in telecommunications software and services, providing comprehensive Diameter Signaling solutions aimed at improving service efficiency.Oracle Corporation:

With robust communication platforms, Oracle enhances Diameter Signaling capabilities, supporting enterprises with agile infrastructure.Nokia :

Nokia delivers a broad range of signaling solutions, contributing to effective network management and service delivery in the telecommunications sector.We're grateful to work with incredible clients.

FAQs

What is the market size of diameter Signaling?

The Diameter Signaling Market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 7.8% through 2033. This growth trajectory reflects increasing adoption in various sectors, enhancing its significance in telecommunications and beyond.

What are the key market players or companies in this diameter Signaling industry?

Key players in the Diameter Signaling industry include major telecommunication companies and technology providers that develop solutions for traffic management, security, and network optimization, leveraging advancements in cloud technology, analytics, and IoT applications for competitive advantage.

What are the primary factors driving the growth in the diameter Signaling industry?

Growth in the Diameter Signaling industry is propelled by the increasing demand for high-speed data, expansion of mobile broadband services, evolution of IoT technology, and the need for enhanced network security, leading to significant investments and advancements in signaling technologies.

Which region is the fastest Growing in the diameter Signaling?

The Asia Pacific region is the fastest-growing market for Diameter Signaling, with a market size projected to reach $1.03 billion by 2033 from $0.48 billion in 2023, driven by technological advancements and rising mobile connectivity in emerging markets.

Does ConsaInsights provide customized market report data for the diameter Signaling industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the Diameter Signaling industry, providing clients with in-depth insights, data analysis, and forecasts based on their unique business requirements and market conditions.

What deliverables can I expect from this diameter Signaling market research project?

Deliverables from the Diameter Signaling market research project include detailed reports, market size projections, growth trends, competitive analysis, and tailored insights that equip businesses with essential information for strategic decision-making and market positioning.

What are the market trends of diameter Signaling?

Key trends in the Diameter Signaling market include the shift towards cloud-based solutions, growing emphasis on network security, increased integration of AI, the rise of VoIP services, and the expansion of mobile broadband that shapes the future landscape of telecommunications.