Diaphragm Valve Market Report

Published Date: 22 January 2026 | Report Code: diaphragm-valve

Diaphragm Valve Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the diaphragm valve market, including insights into market trends, size, segmentation, and regional dynamics from 2023 to 2033. It aims to assist stakeholders in understanding market growth, competitive landscape, and future opportunities.

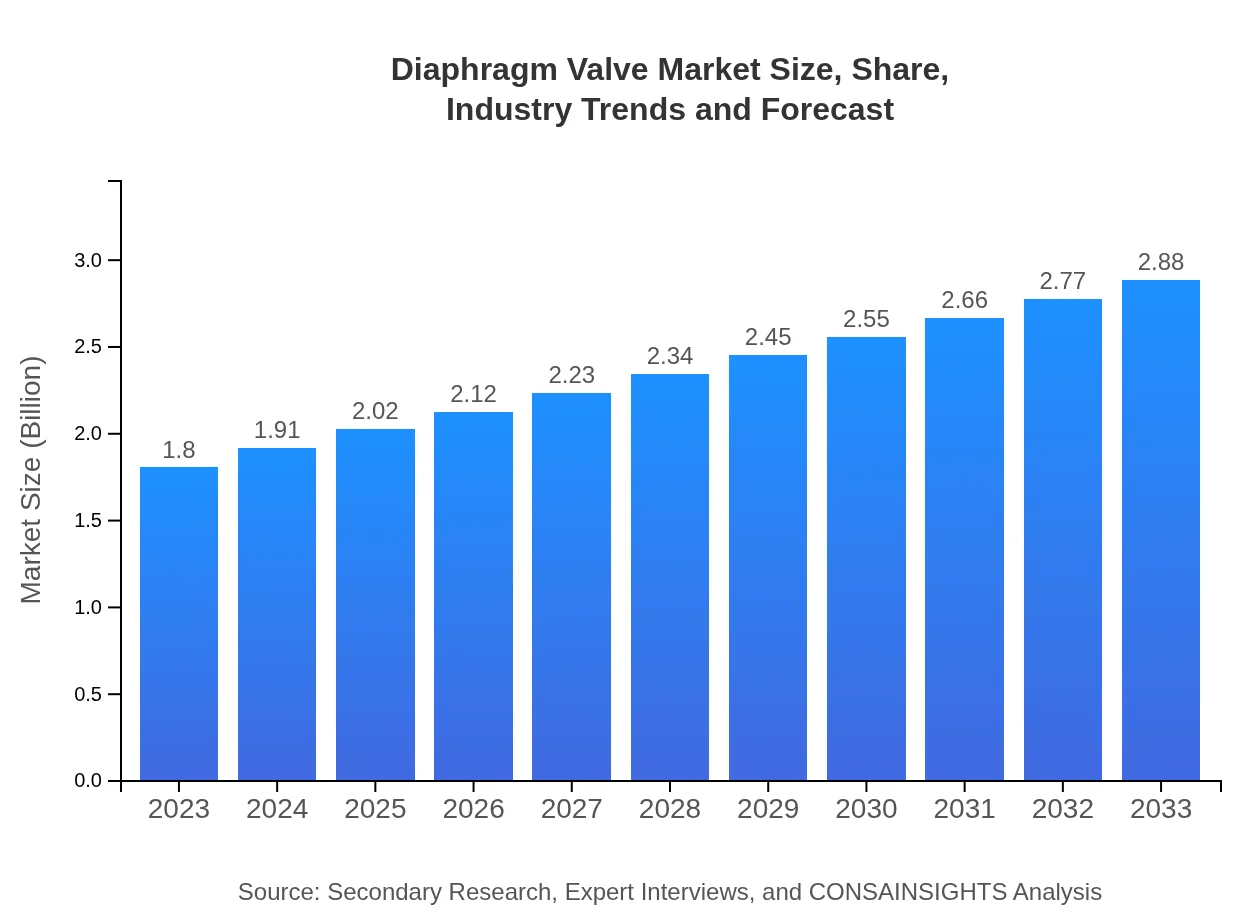

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $2.88 Billion |

| Top Companies | Emerson Electric Co., Flowserve Corporation, Pentair PLC, KSB SE & Co. KGaA, GEMU GmbH |

| Last Modified Date | 22 January 2026 |

Diaphragm Valve Market Overview

Customize Diaphragm Valve Market Report market research report

- ✔ Get in-depth analysis of Diaphragm Valve market size, growth, and forecasts.

- ✔ Understand Diaphragm Valve's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Diaphragm Valve

What is the Market Size & CAGR of Diaphragm Valve market in 2023?

Diaphragm Valve Industry Analysis

Diaphragm Valve Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Diaphragm Valve Market Analysis Report by Region

Europe Diaphragm Valve Market Report:

Starting at $0.57 billion in 2023, the European market is expected to grow to $0.91 billion by 2033. The growth is largely driven by stringent regulatory standards and a shift towards sustainable practices in various industries.Asia Pacific Diaphragm Valve Market Report:

In 2023, the diaphragm valve market size for Asia Pacific stands at approximately $0.32 billion, projected to reach $0.51 billion by 2033. Driven by rapid industrialization and increasing water treatment needs, this region foresees substantial growth in demand for diaphragm valves across various sectors.North America Diaphragm Valve Market Report:

North America is a robust market approximately valued at $0.68 billion in 2023, with projections of growing to $1.09 billion by 2033. The region's emphasis on safety and efficiency in industrial processes is propelling demand for advanced diaphragm valves.South America Diaphragm Valve Market Report:

The South American market presents a slower growth scenario with a market size of -$0.02 billion in 2023, forecasted to slightly decrease to -$0.03 billion by 2033. Economic constraints and reduced industrial activities pose challenges in this region.Middle East & Africa Diaphragm Valve Market Report:

The Middle East and Africa's diaphragm valve market is growing steadily, starting at $0.25 billion in 2023 and anticipated to reach $0.40 billion by 2033. The oil and gas sector's stability in the region fuels demand for reliable valve solutions.Tell us your focus area and get a customized research report.

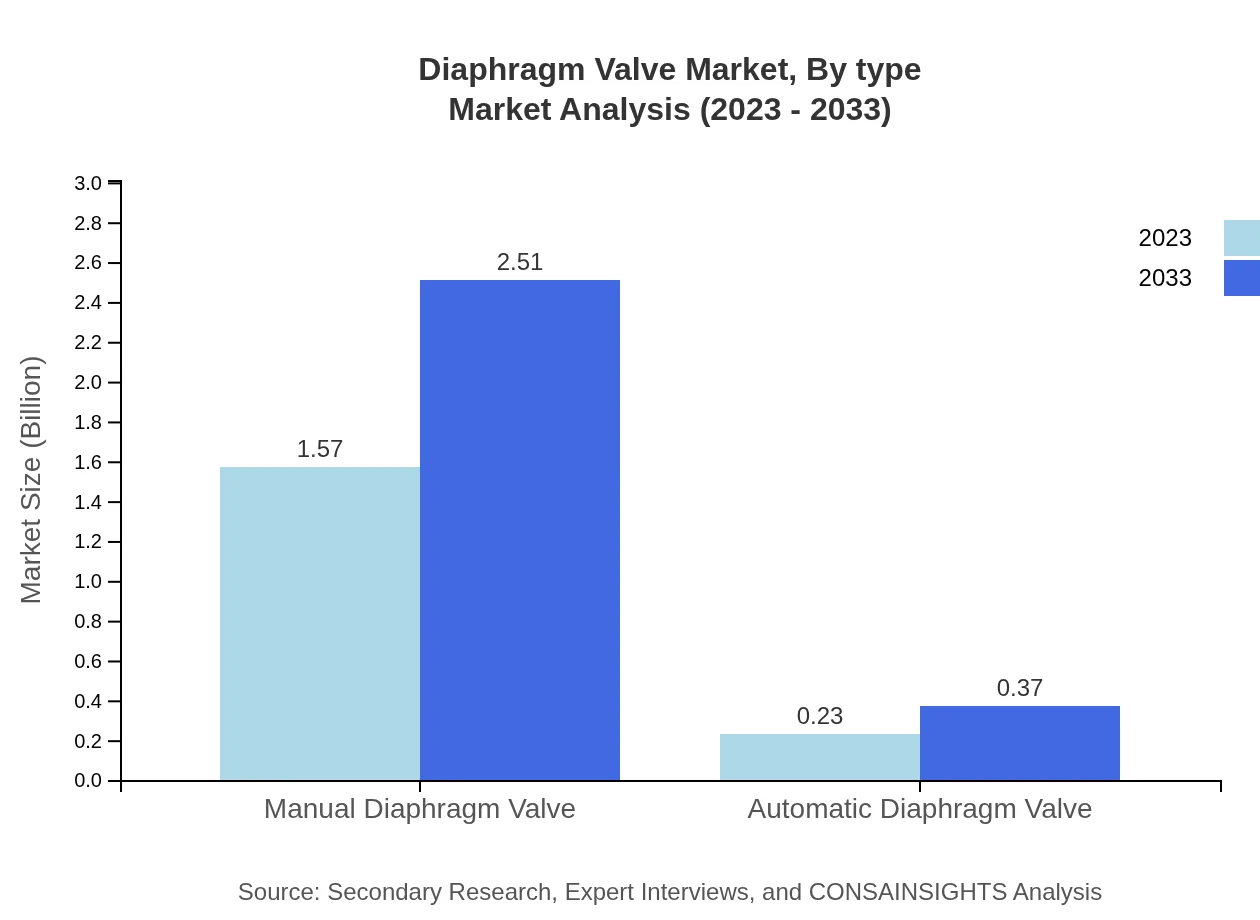

Diaphragm Valve Market Analysis By Type

The market for diaphragm valves is split between Manual and Automatic types. Manual Diaphragm Valves are forecasted to dominate with a market size of $1.57 billion in 2023, expected to increase to $2.51 billion by 2033, capturing 87.27% market share. In contrast, Automatic Diaphragm Valves, while growing from $0.23 billion in 2023 to $0.37 billion in 2033, hold a smaller share of 12.73%.

Diaphragm Valve Market Analysis By Material

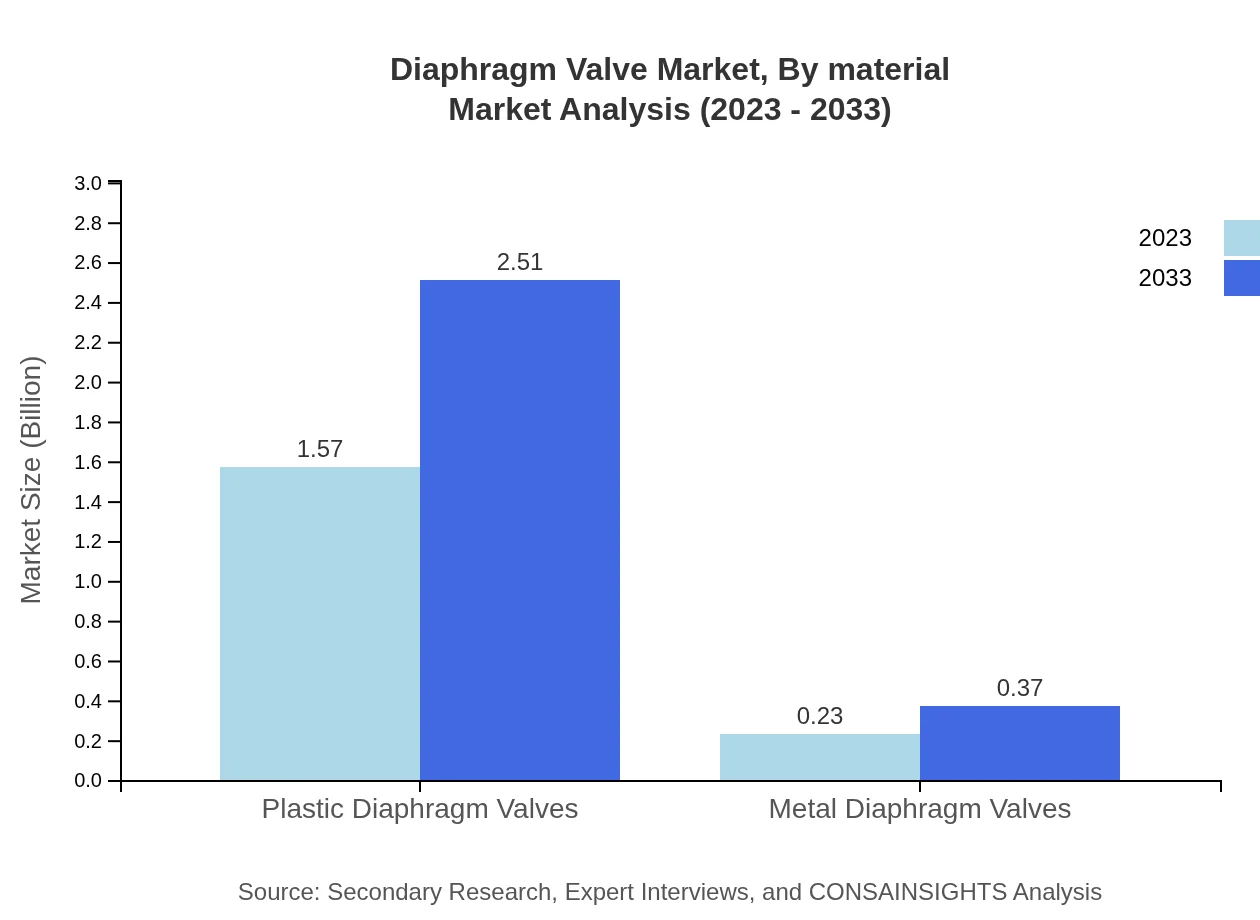

In terms of materials, Plastic Diaphragm Valves lead the market, estimated to be $1.57 billion in 2023 and projected to grow to $2.51 billion by 2033, holding 87.27% share. Metal Diaphragm Valves follow with a modest growth from $0.23 billion to $0.37 billion during the same period, reflecting 12.73% market share.

Diaphragm Valve Market Analysis By Application

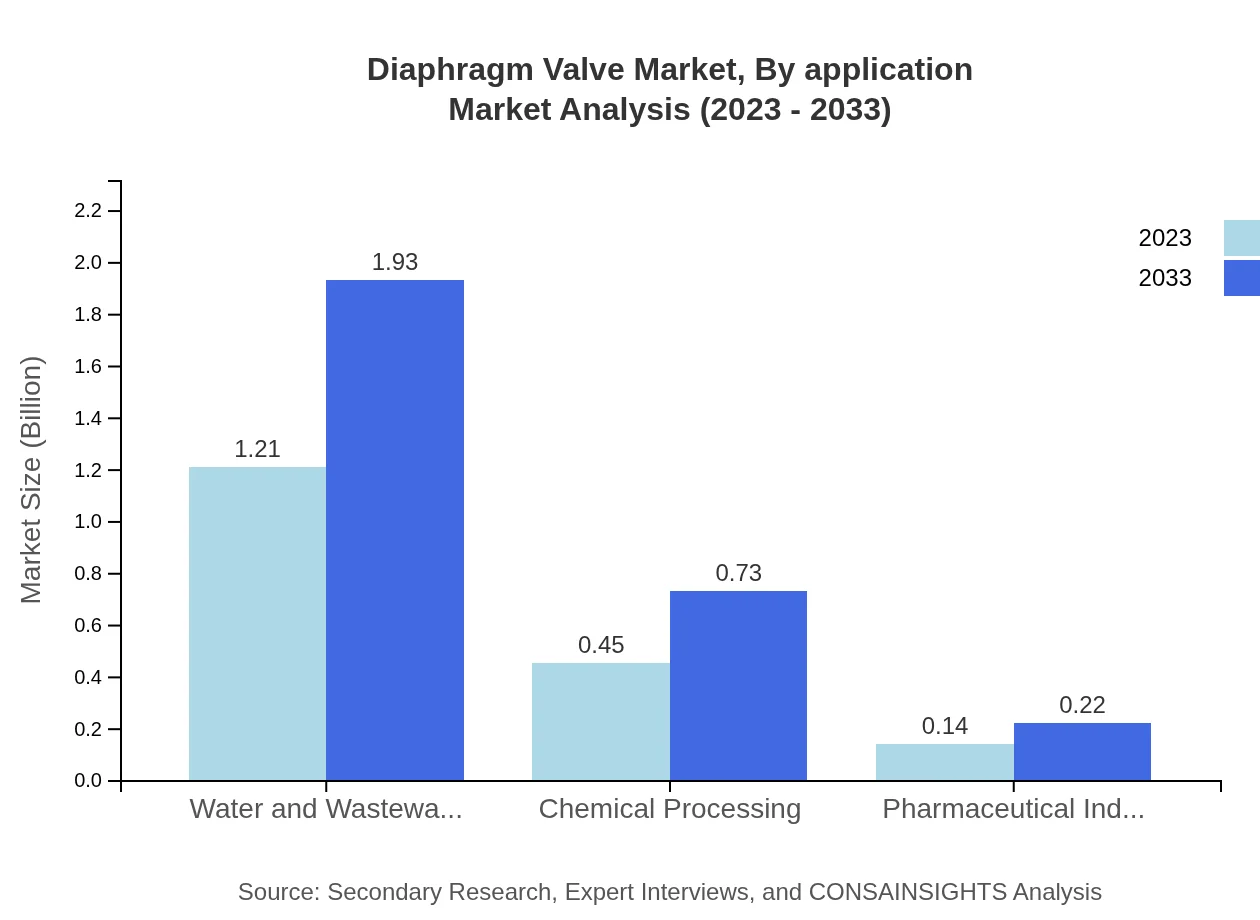

Applications of diaphragm valves are diverse across industries. The Water and Wastewater Treatment sector leads with a market size of $1.21 billion in 2023, expected to grow to $1.93 billion by 2033 (67.21% share). The Food and Beverage sector accounts for $0.45 billion, projected to reach $0.73 billion, meanwhile Chemical Processing and Pharmaceutical industries remain vital contributors to market dynamics.

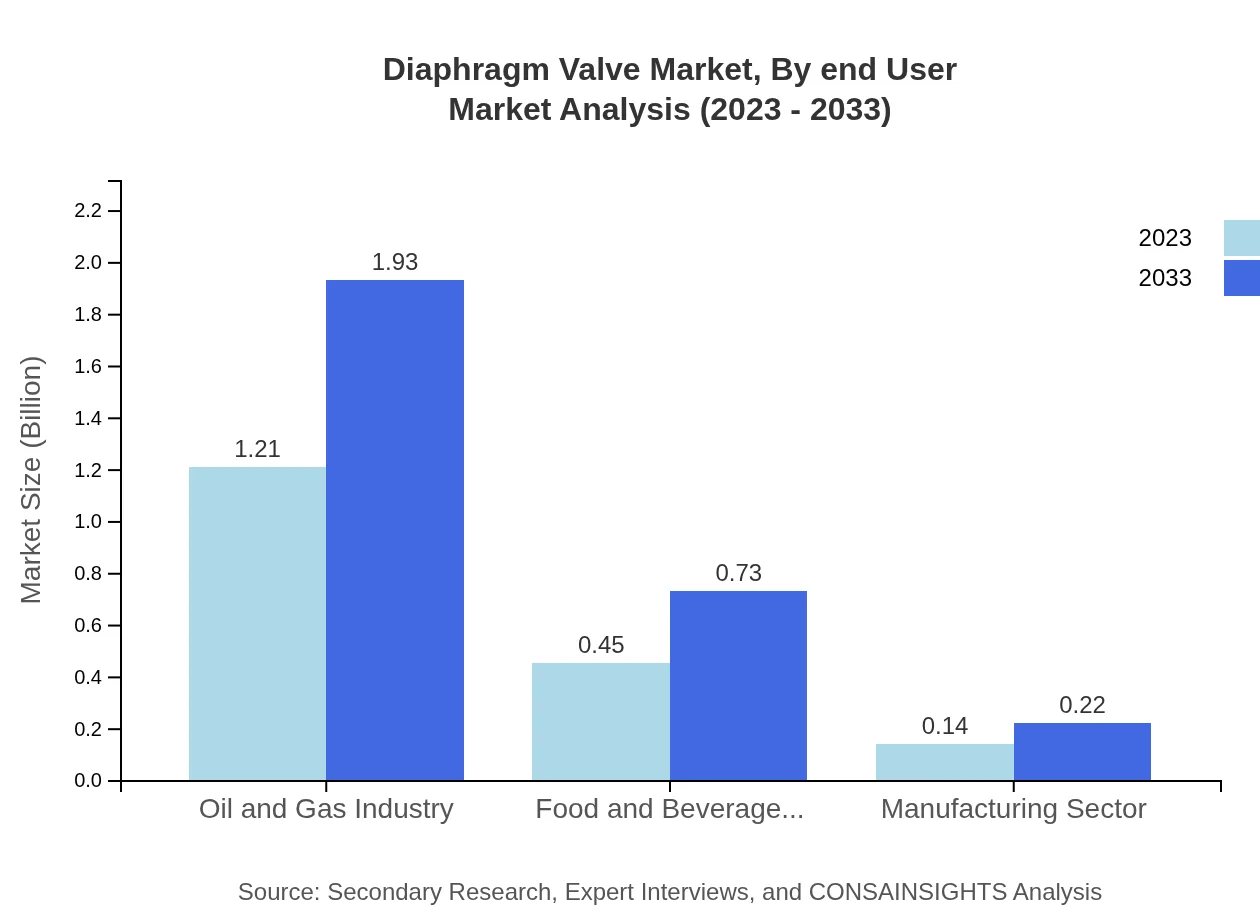

Diaphragm Valve Market Analysis By End User

In the end-user analysis, the Oil and Gas Industry continues to dominate, representing $1.21 billion in 2023 and expected to increase to $1.93 billion by 2033 (contributing 67.21% market share). The Food and Beverage industry shows steady growth from $0.45 billion to $0.73 billion, indicating its significant role in the diaphragm valve market.

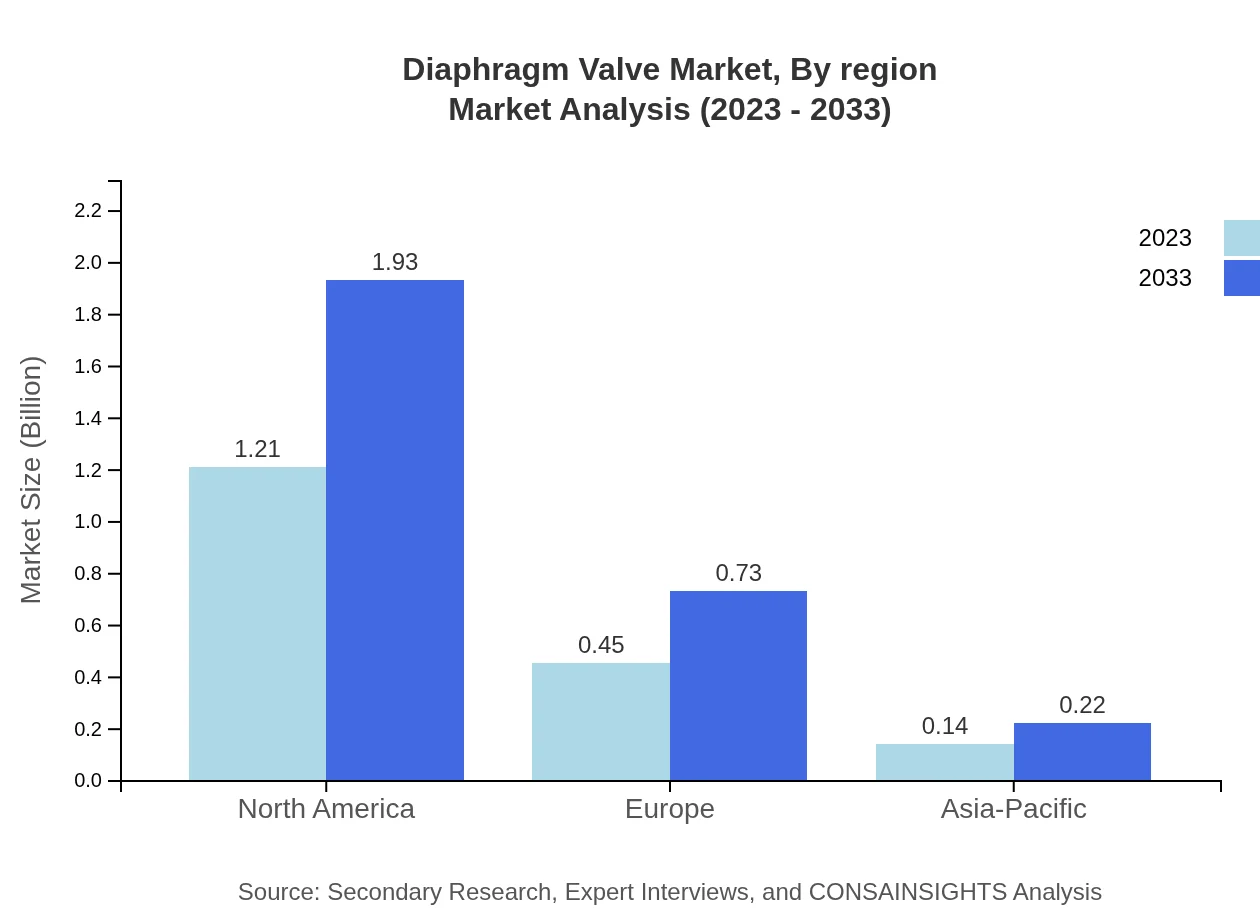

Diaphragm Valve Market Analysis By Region

Regional analysis indicates that North America controls a significant portion of the market, expected to grow from $1.21 billion in 2023 to $1.93 billion in 2033. Europe and Asia Pacific also exhibit strong growth potential, contributing to overall market expansion despite the challenges seen in South America.

Diaphragm Valve Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Diaphragm Valve Industry

Emerson Electric Co.:

A global leader in automation solutions, Emerson designs and manufactures a range of diaphragm valves catering to various industrial needs.Flowserve Corporation:

Specializes in flow control solutions, Flowserve is recognized for its durable and efficient diaphragm valves used in high-risk applications.Pentair PLC:

Pentair offers innovative valve solutions including diaphragm valves, focusing on resource efficiency in the water and wastewater sector.KSB SE & Co. KGaA:

With a robust portfolio of valve solutions, KSB is instrumental in providing reliable diaphragm valves for numerous industrial applications.GEMU GmbH:

GEMU is known for its advanced diaphragm valve technologies that enhance process efficiency and product safety.We're grateful to work with incredible clients.

FAQs

What is the market size of diaphragm Valve?

The global diaphragm valve market is valued at approximately $1.8 Billion in 2023, with a projected CAGR of 4.7% leading up to 2033. This indicates a steady growth trajectory, reflecting an increasing demand across various sectors.

What are the key market players or companies in this diaphragm Valve industry?

Key players in the diaphragm valve industry include companies such as Emerson Electric Co., Flowserve Corporation, and Crane Co. These companies are recognized for their innovations and contributions to operational efficiency in flow-control solutions.

What are the primary factors driving the growth in the diaphragm valve industry?

The growth in the diaphragm valve market is primarily driven by increased demand from industries like water treatment, pharmaceuticals, and oil & gas. Additionally, the trend towards automation and stricter regulatory compliance further fuels market expansion.

Which region is the fastest Growing in the diaphragm valve market?

North America is currently the fastest-growing region for the diaphragm valve market, expected to grow from $0.68 billion in 2023 to $1.09 billion by 2033. This growth is attributed to the booming manufacturing and energy sectors.

Does ConsaInsights provide customized market report data for the diaphragm valve industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the diaphragm valve industry, enabling businesses to understand trends and market dynamics that affect their operations.

What deliverables can I expect from this diaphragm valve market research project?

From the diaphragm valve market research project, clients can expect detailed reports including market analysis, size forecasts, trend assessments, and competitive landscape evaluations, along with actionable insights tailored to strategic planning.

What are the market trends of diaphragm valve?

Current market trends for diaphragm valves indicate a shift towards automated systems, increased utilization in the food & beverage and chemical processing sectors, and a growing preference for plastic valves due to their advantages in weight and resilience.