Dicing Equipment Market Report

Published Date: 31 January 2026 | Report Code: dicing-equipment

Dicing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an exhaustive analysis of the Dicing Equipment market, offering insights on growth trends, market dynamics, and a regional breakdown from 2023 to 2033.

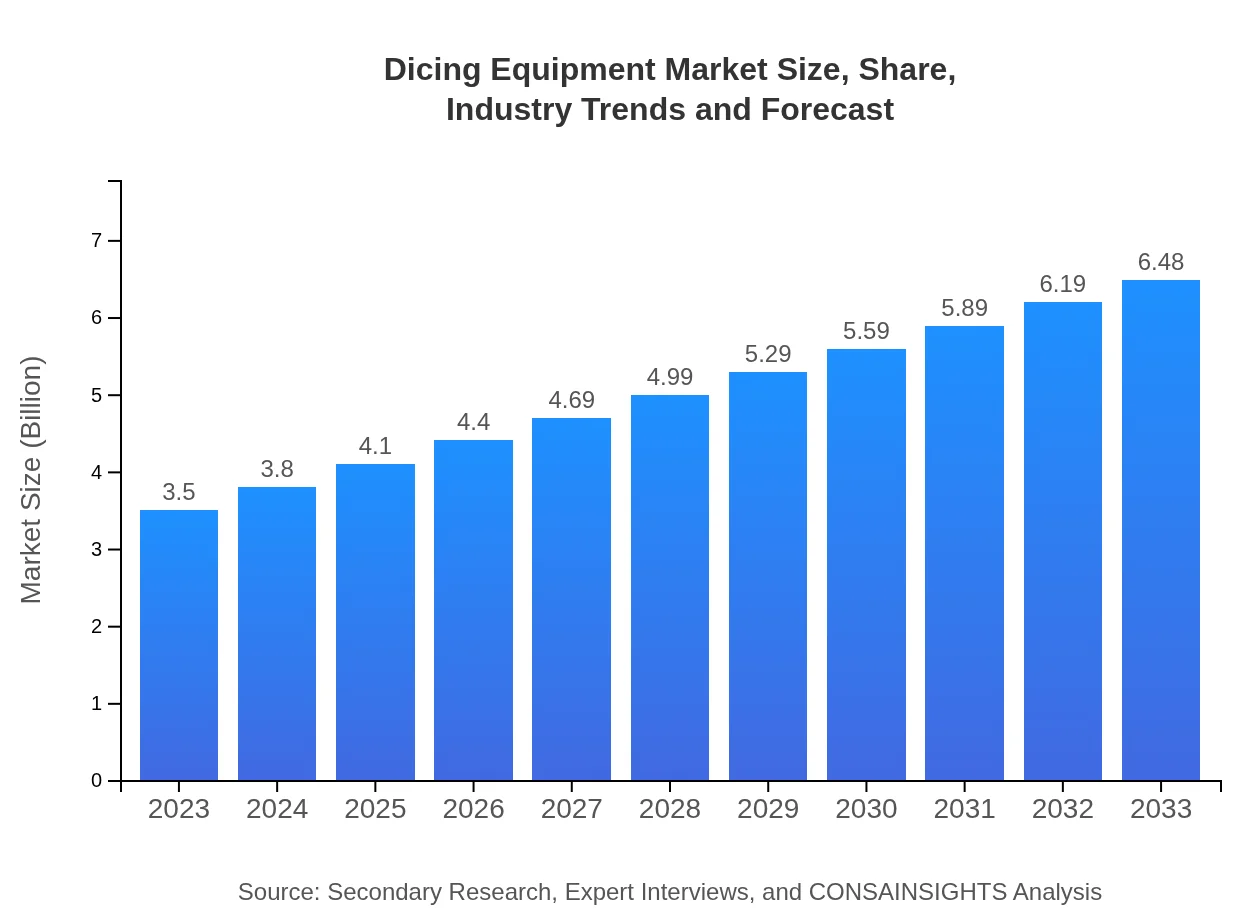

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | DISCO Corporation, Tokyo Seimitsu Co. Ltd., K&S Engineering, Fujimi Incorporated, Headway Technology, Inc. |

| Last Modified Date | 31 January 2026 |

Dicing Equipment Market Overview

Customize Dicing Equipment Market Report market research report

- ✔ Get in-depth analysis of Dicing Equipment market size, growth, and forecasts.

- ✔ Understand Dicing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dicing Equipment

What is the Market Size & CAGR of Dicing Equipment market in 2033?

Dicing Equipment Industry Analysis

Dicing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dicing Equipment Market Analysis Report by Region

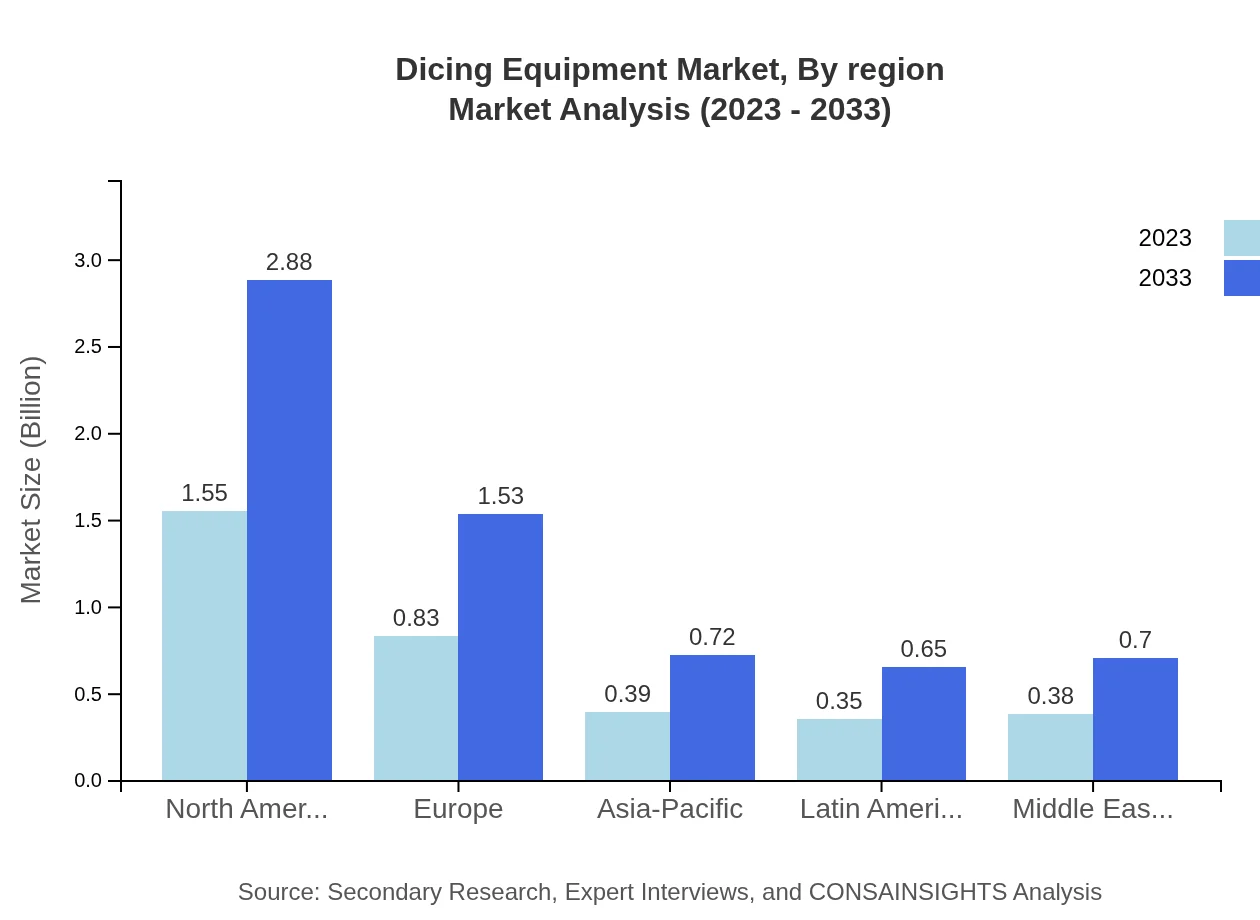

Europe Dicing Equipment Market Report:

The European Dicing Equipment market, valued at $1.09 billion in 2023, is forecasted to grow to $2.03 billion by 2033. The increase is fueled by innovation in medical devices and renewable energy applications, along with a strong focus on sustainability and energy efficiency in production processes.Asia Pacific Dicing Equipment Market Report:

In 2023, the Dicing Equipment market in the Asia-Pacific region was valued at around $0.55 billion, expected to rise to approximately $1.02 billion by 2033. The growth is stimulated by the region's manufacturing dominance in electronics and semiconductors, notably countries like China, Japan, and South Korea. Moreover, governmental initiatives promoting technological advancements further bolster opportunities.North America Dicing Equipment Market Report:

North America leads the Dicing Equipment market with a valuation of approximately $1.35 billion in 2023, projected to escalate to $2.50 billion by 2033. The region is benefitting from high technological adoption rates and substantial investments in electronics, automotive, and telecommunications, driving the demand for advanced dicing solutions.South America Dicing Equipment Market Report:

The South American market for Dicing Equipment was valued at $0.10 billion in 2023 and is expected to reach $0.18 billion by 2033. While growth is modest, increased investments in silicon-based technologies and electronics manufacturing are expected to gradually increase the demand for dicing equipment in this region.Middle East & Africa Dicing Equipment Market Report:

The Middle East and Africa market stood at about $0.41 billion in 2023, with projections reaching approximately $0.77 billion by 2033. Growth is primarily driven by expanding electronics sectors in the UAE and South Africa, along with burgeoning renewable energy projects requiring advanced dicing applications.Tell us your focus area and get a customized research report.

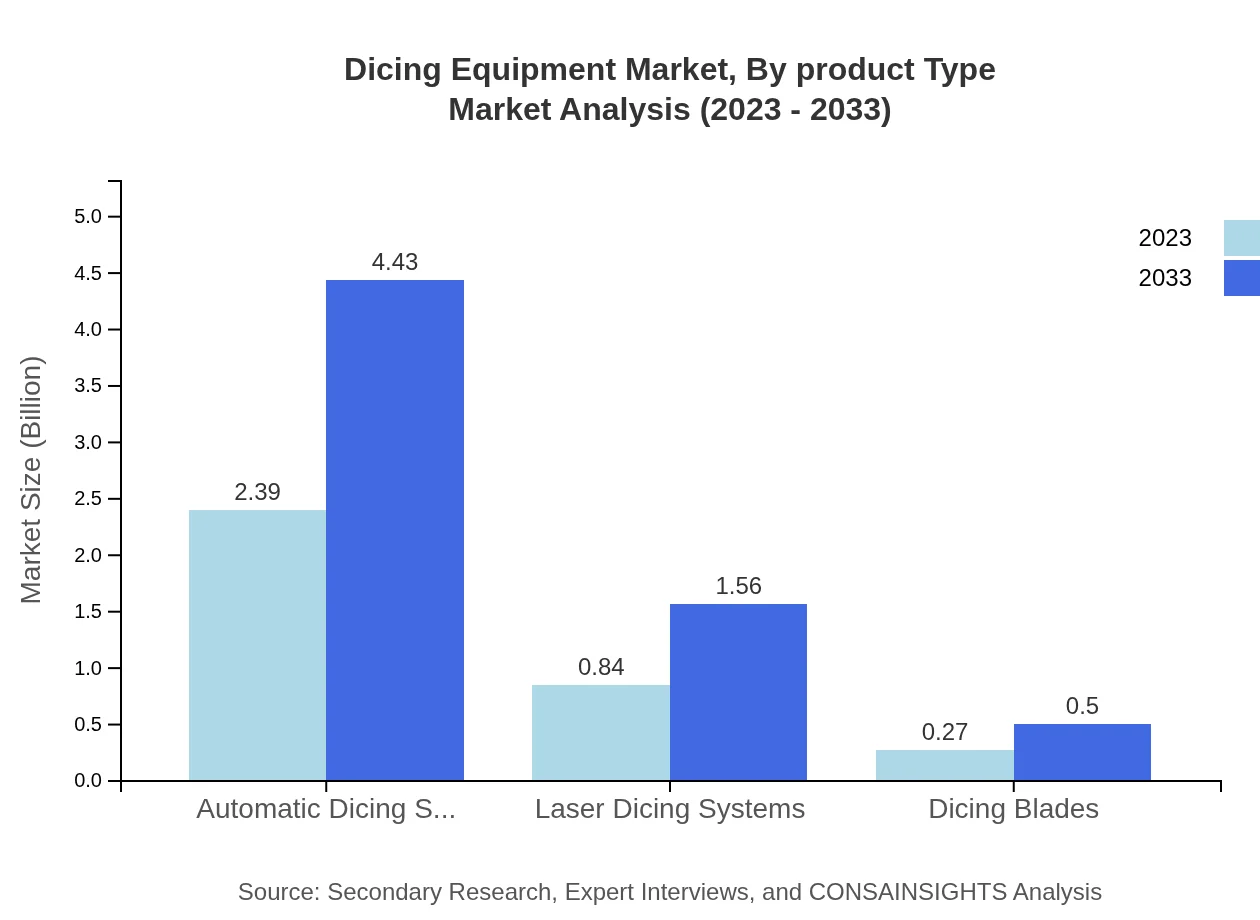

Dicing Equipment Market Analysis By Product Type

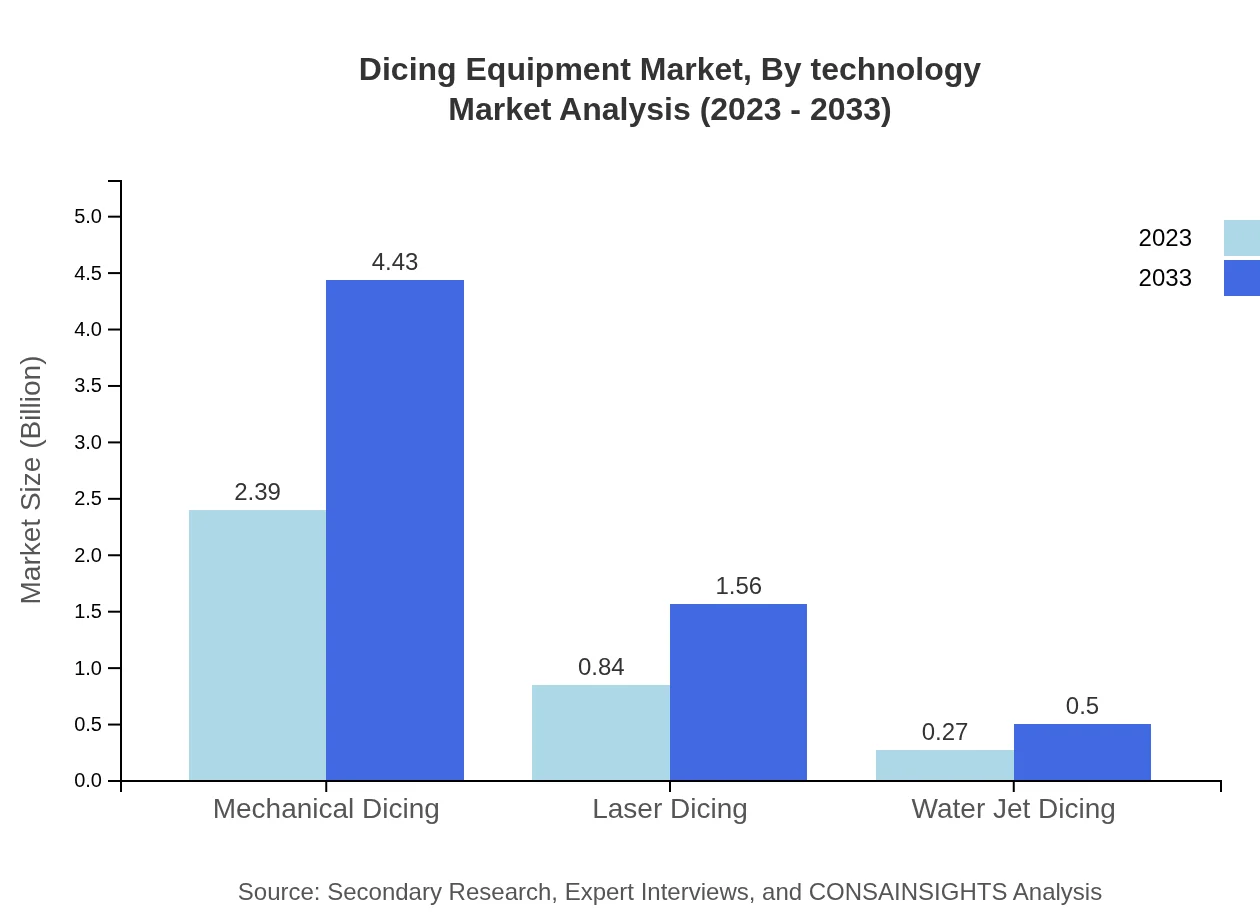

The Dicing Equipment market by product type highlights significant segments: Mechanical Dicing, Laser Dicing, and Water Jet Dicing. Mechanical dicing dominates the market, contributing 68.33% in 2023, with projected growth continuing at a CAGR reflective of the ongoing need for high precision in semiconductor applications. Laser dicing holds a notable share, around 24.02%, and is increasingly used due to its efficiency in cutting different materials. Water Jet Dicing, although smaller, serves niche applications requiring less heat generation.

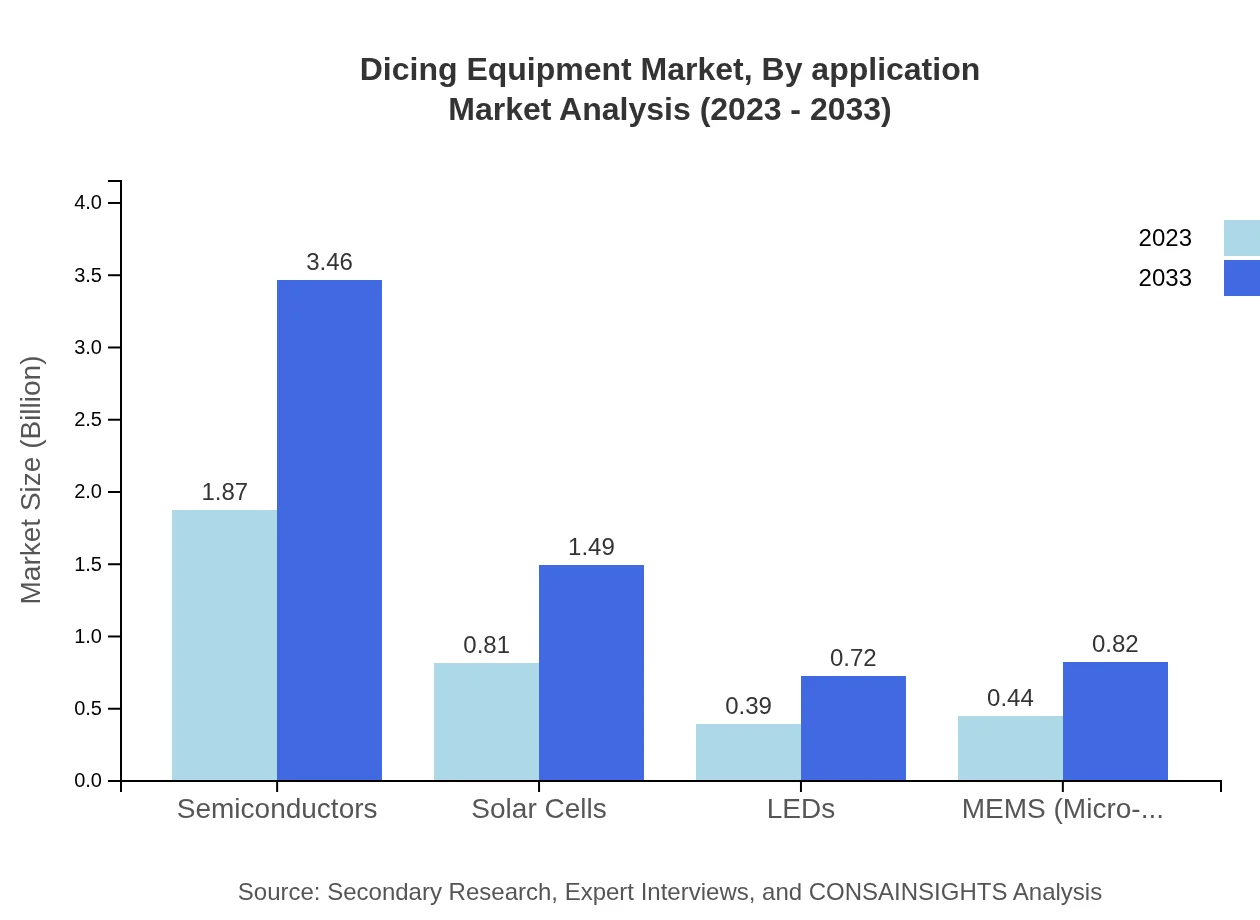

Dicing Equipment Market Analysis By Application

Applications for dicing equipment span various industries but are predominantly concentrated in semiconductors, medical devices, and renewable energy. Semiconductors account for 53.29% of the market in 2023 owing to rising electronic device production. Medical devices and renewable energy sectors are also significant, indicating a diversification in dicing applications.

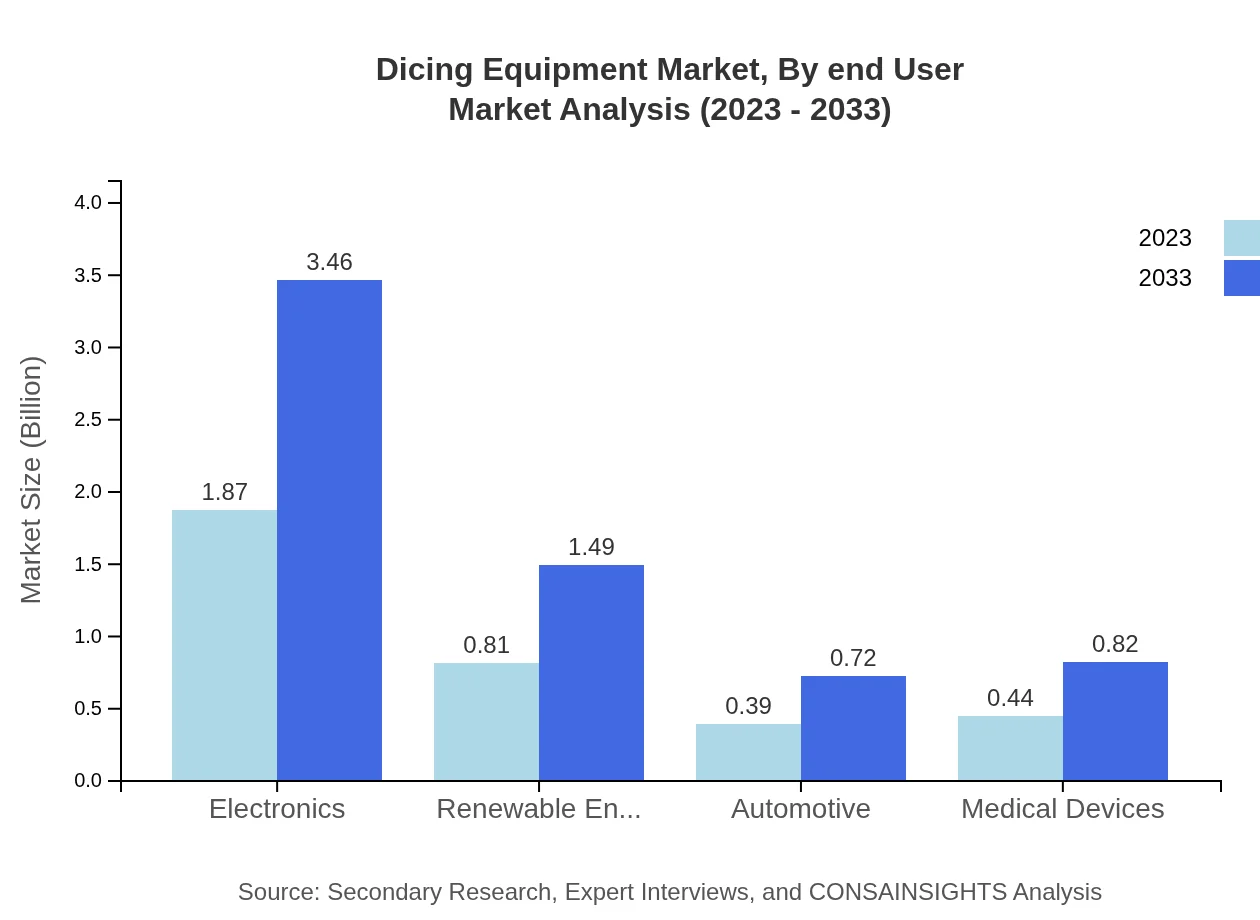

Dicing Equipment Market Analysis By End User

The end-user segmentation showcases crucial areas within electronics, automotive, and medical devices. Electronics stands as the primary user, with approximately 53.29% market share in 2023, driven by demand for compact and high-performance devices. The automotive sector is witnessing growth due to EV technologies requiring advanced electronic systems.

Dicing Equipment Market Analysis By Technology

The technology segment reveals a shift towards automation and precision, with increasing investments in advanced systems like automated dicing saws and laser dicing equipment. The growth trajectory highlights a demand for greater efficiency and lower operational costs across various applications.

Dicing Equipment Market Analysis By Region

Regional analyses underscore distinct growth trajectories influenced by technological adoption and manufacturing capabilities. North America and Europe show significant growth driven by robust electronics sectors, while Asia-Pacific demonstrates rapid expansion fueled by manufacturing capabilities and innovations.

Dicing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dicing Equipment Industry

DISCO Corporation:

Leading provider of dicing saws and related components, renowned for their technological innovations.Tokyo Seimitsu Co. Ltd.:

Specializes in precision dicing saws and automated manufacturing solutions.K&S Engineering:

Known for dicing and packaging solutions, they lead in the automation of the manufacturing process.Fujimi Incorporated:

Provides semiconductor dicing solutions, focusing on advanced materials and substrates.Headway Technology, Inc.:

Offers precision cutting tools and solutions for various applications across the semiconductor industry.We're grateful to work with incredible clients.

FAQs

What is the market size of dicing equipment?

The dicing equipment market is projected to reach a size of approximately $3.5 billion by 2033, growing at a CAGR of 6.2% from its current valuation in 2023. This indicates robust demand driven by technological advancements.

What are the key market players or companies in this dicing equipment industry?

Key players in the dicing equipment industry include names like Disco Corporation, Tokyo Seimitsu Co., and others, which are influential in shaping market dynamics through innovative technologies and solutions, catering to diverse applications across sectors.

What are the primary factors driving the growth in the dicing equipment industry?

Growth in the dicing equipment market is primarily driven by the increasing demand for miniaturized electronic components, advancements in semiconductor technology, and the expansion of industries such as automotive and renewable energy that utilize dicing systems.

Which region is the fastest Growing in the dicing equipment market?

The fastest-growing region in the dicing equipment market is Asia Pacific, projected to grow from $0.55 billion in 2023 to $1.02 billion by 2033. This rapid growth is attributed to expanding electronics manufacturing and rising investments in technology.

Does ConsaInsights provide customized market report data for the dicing equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the dicing equipment industry. This enables clients to gain insights that are relevant to their unique business contexts and requirements.

What deliverables can I expect from this dicing equipment market research project?

Clients can expect comprehensive deliverables including detailed market analysis, trend evaluations, segment breakdowns, competitive landscapes, and actionable insights specifically focused on dicing equipment to inform business strategy.

What are the market trends of dicing equipment?

Current trends in the dicing equipment market include a shift towards automation, increasing adoption of laser dicing technologies, growth in the MEMS segment, and heightened focus on sustainable production practices within the semiconductor industry.