Digital Assurance Market Report

Published Date: 31 January 2026 | Report Code: digital-assurance

Digital Assurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Digital Assurance market from 2023 to 2033, focusing on market dynamics, growth trends, regional insights, and competitive landscape.

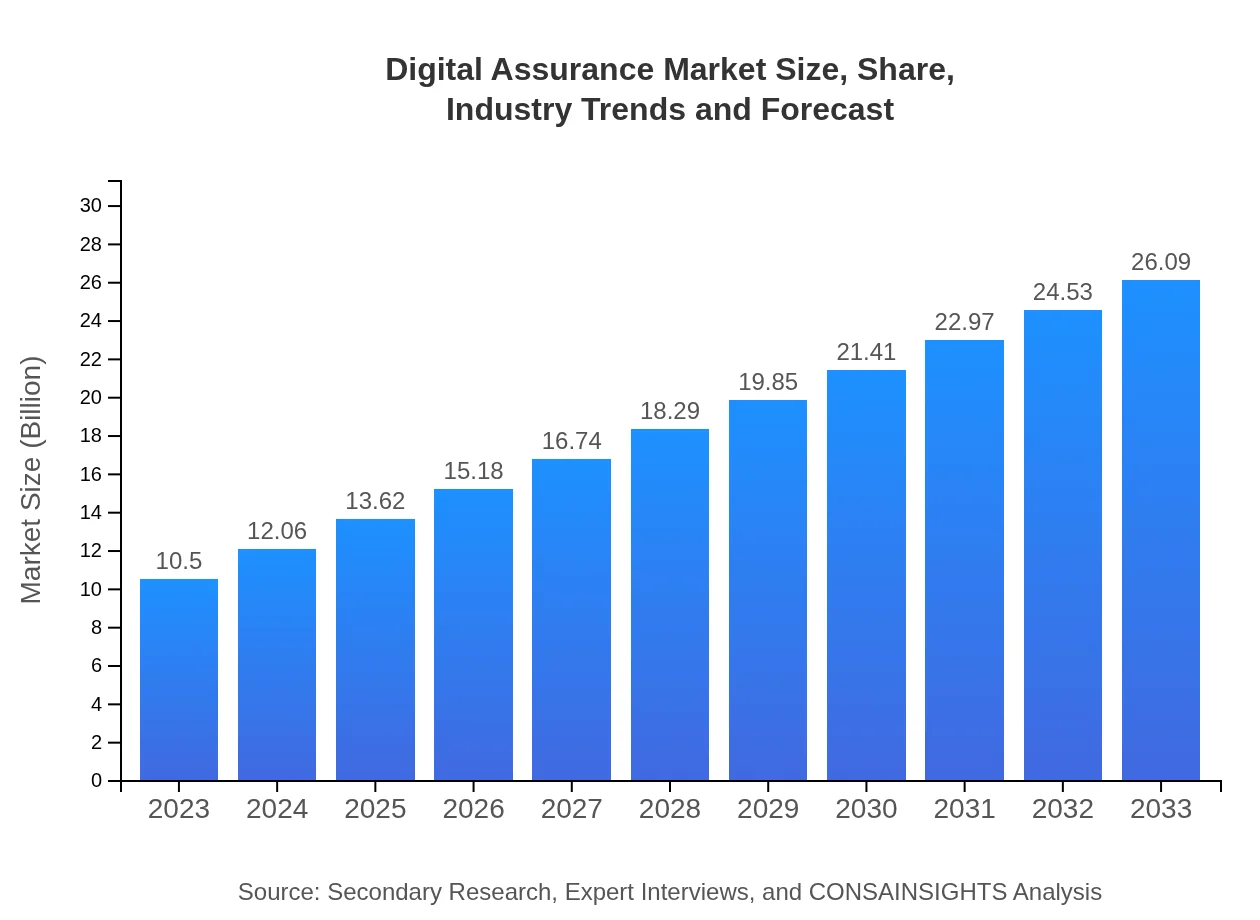

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | Accenture, Capgemini, IBM, Infosys, TCS (Tata Consultancy Services) |

| Last Modified Date | 31 January 2026 |

Digital Assurance Market Overview

Customize Digital Assurance Market Report market research report

- ✔ Get in-depth analysis of Digital Assurance market size, growth, and forecasts.

- ✔ Understand Digital Assurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Assurance

What is the Market Size & CAGR of Digital Assurance market in 2023?

Digital Assurance Industry Analysis

Digital Assurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Assurance Market Analysis Report by Region

Europe Digital Assurance Market Report:

Europe's Digital Assurance market is expected to grow from $2.93 billion in 2023 to $7.27 billion by 2033. Regulatory compliance and risk management are critical drivers of demand in this region, as organizations strive to align with stringent digital regulations while integrating new technologies.Asia Pacific Digital Assurance Market Report:

The Asia Pacific region is expected to demonstrate healthy growth, with market size projected to increase from $2.14 billion in 2023 to $5.33 billion by 2033. The region is rapidly embracing digital technologies, which drives demand for Digital Assurance services as businesses seek to enhance their digital capabilities and support large-scale transformations.North America Digital Assurance Market Report:

North America leads the market with a projected growth from $3.57 billion in 2023 to $8.86 billion by 2033. This region's advanced IT infrastructure and high adoption rates of digital solutions across enterprises ensure continued demand for Digital Assurance services.South America Digital Assurance Market Report:

In South America, the Digital Assurance market is estimated to grow from $1.04 billion in 2023 to $2.57 billion by 2033. This growth is spurred by increasing investment in technology infrastructure and the growing importance of cybersecurity measures across industries.Middle East & Africa Digital Assurance Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.83 billion in 2023 to $2.06 billion by 2033. Increasing digitalization among businesses and governments, along with a growing emphasis on operational excellence, is fueling the demand for Digital Assurance solutions.Tell us your focus area and get a customized research report.

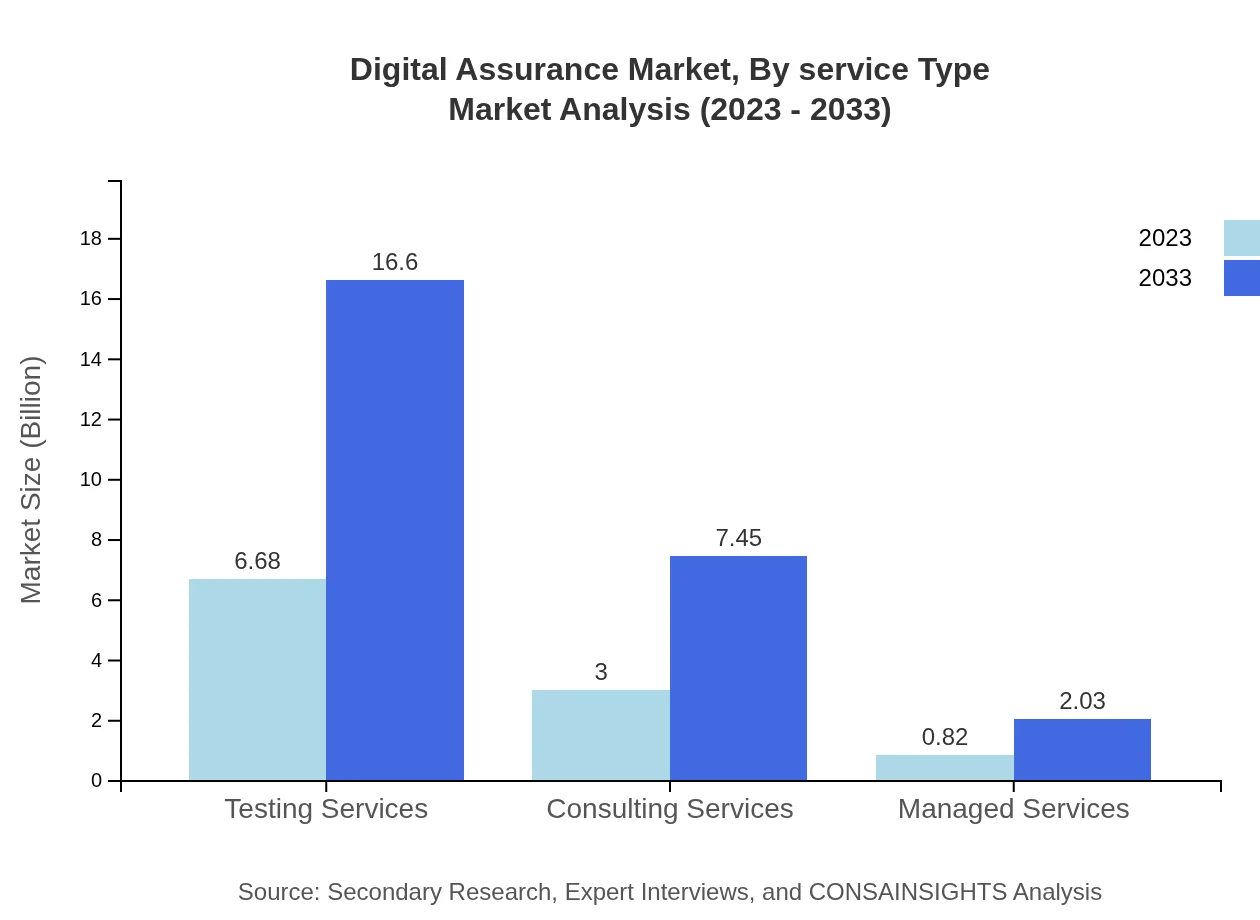

Digital Assurance Market Analysis By Service Type

Major service types include Testing Services, with a market size of $6.68 billion in 2023, expected to grow to $16.60 billion by 2033, representing a 63.64% market share. Consulting and Automation Tools follow suit, indicating a strong inclination towards quality assurance and automation in software development processes.

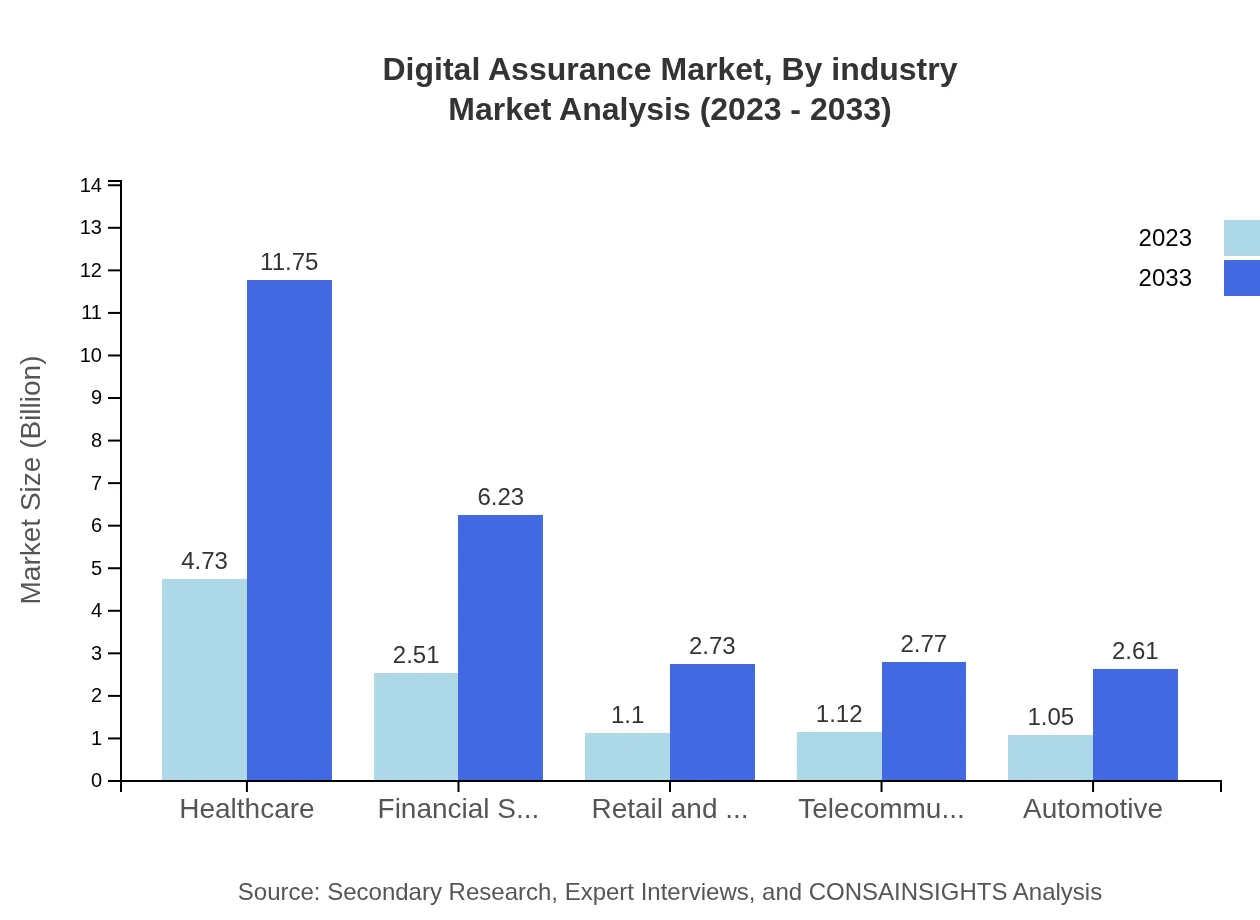

Digital Assurance Market Analysis By Industry

The Healthcare industry holds a dominant market share of 45.03% in 2023 with a valuation of $4.73 billion, projected to grow significantly to $11.75 billion by 2033. The Financial Services sector also showcases robust growth, demonstrating the critical role of Digital Assurance in risk management and compliance.

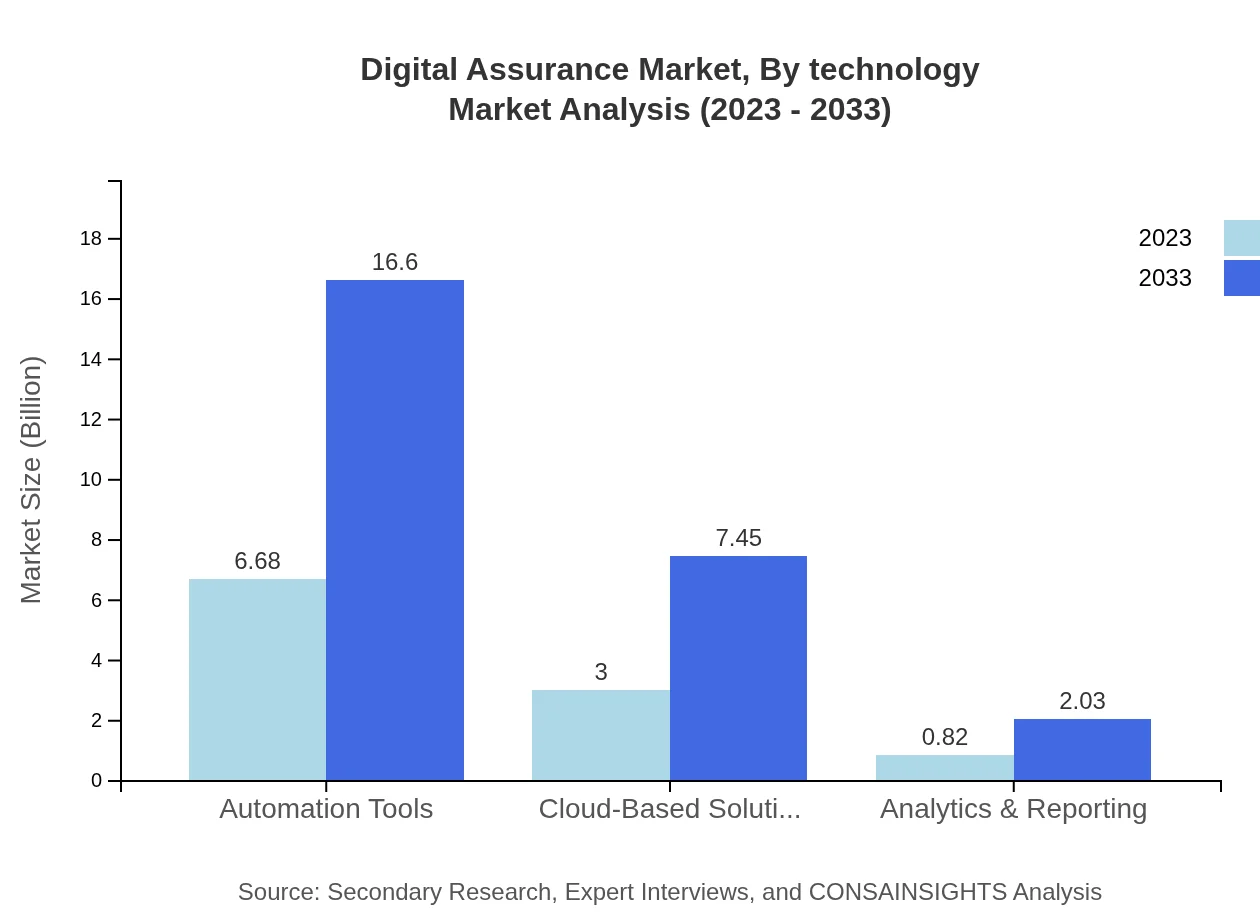

Digital Assurance Market Analysis By Technology

Emerging technologies such as AI, machine learning, and cloud computing drive significant transformations in the Digital Assurance market. Cloud-Based Solutions, expected to grow from $3.00 billion in 2023 to $7.45 billion by 2033, indicate a shift towards more scalable and flexible assurance models.

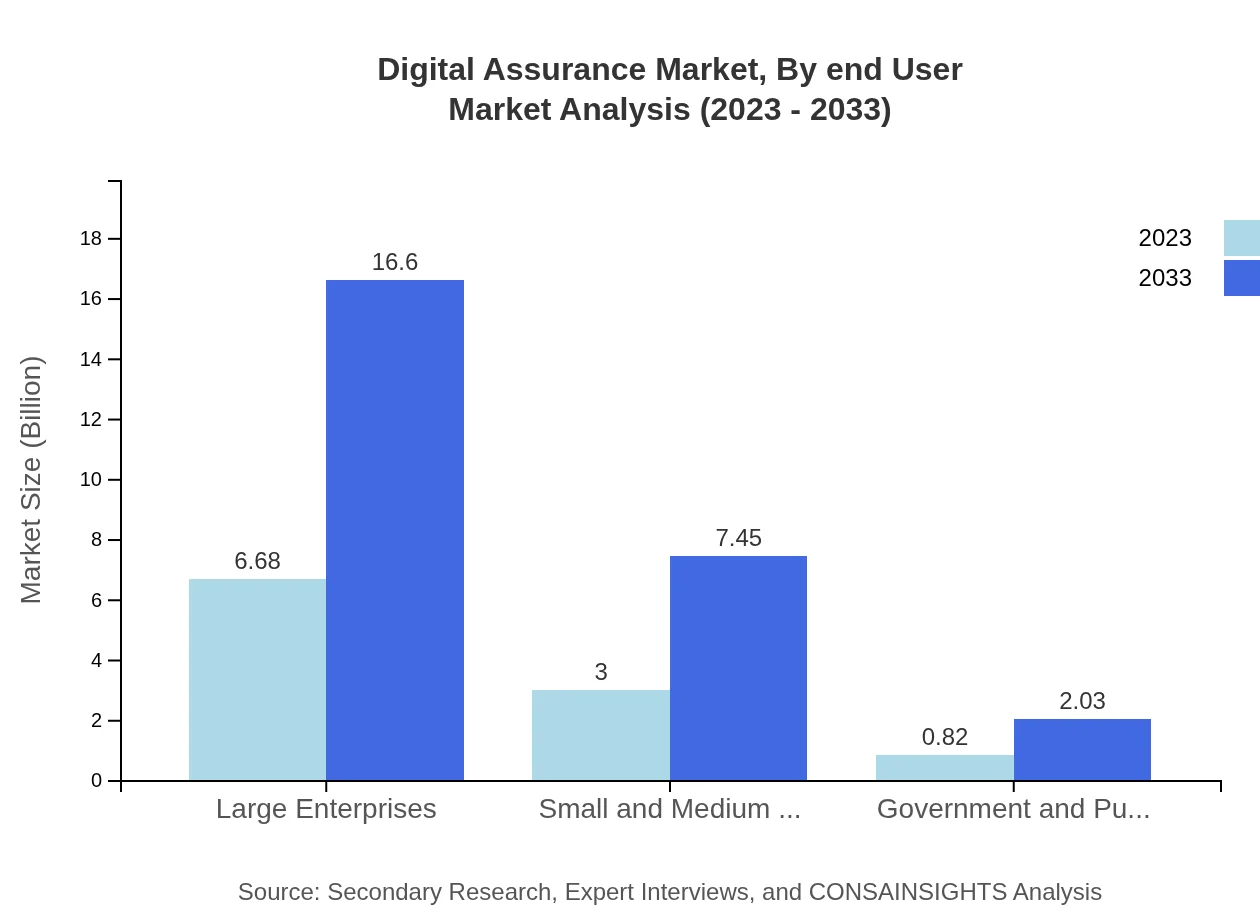

Digital Assurance Market Analysis By End User

End-users in sectors such as IT & Telecom, Healthcare, and Financial Services are increasing their investments in Digital Assurance. This diversification in end-user adoption highlights the adaptability of Digital Assurance solutions in addressing unique industry-specific challenges.

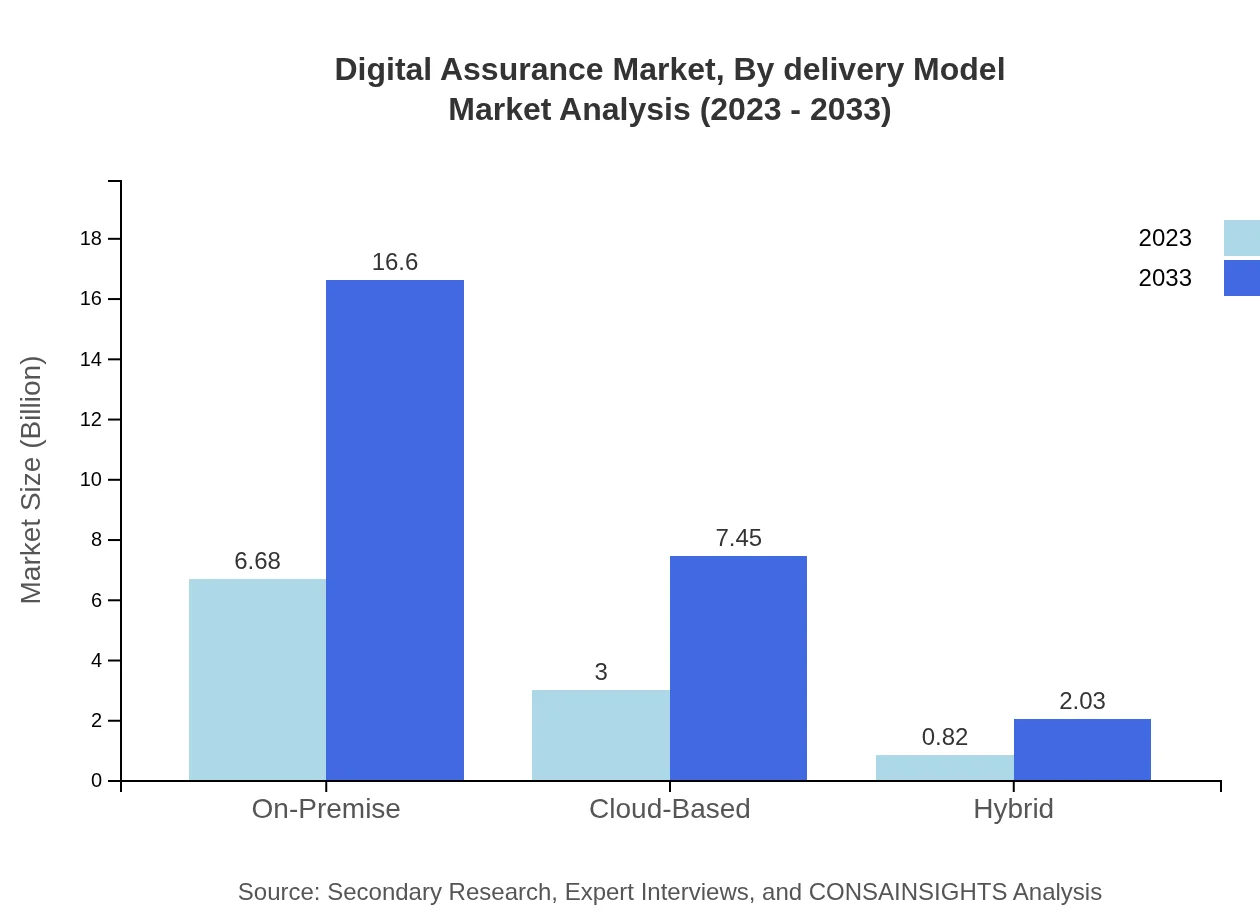

Digital Assurance Market Analysis By Delivery Model

The delivery models are categorized into On-Premise, Cloud-Based, and Hybrid. The shift towards Cloud-Based models is evident, with a projected market size increase from $3.00 billion in 2023 to $7.45 billion by 2033, reflecting broader trends toward digital transformation and remote operations.

Digital Assurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Assurance Industry

Accenture:

A global professional services company that provides Digital Assurance solutions, specializing in testing, security, and quality engineering.Capgemini:

A multinational corporation that provides consulting and technology services, including comprehensive Digital Assurance services tailored for various industries.IBM:

A leader in technology and consulting services, aiding organizations in implementing Digital Assurance practices to enhance quality and performance.Infosys:

A global leader in technology services, focusing on automated testing, quality assurance, and digital transformation initiatives.TCS (Tata Consultancy Services):

TCS offers a wide range of Digital Assurance solutions, emphasizing automation and performance in the digital space.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Assurance?

The global digital assurance market is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 9.2% from 2023. This growth reflects the increasing demand for digital transformation across various sectors.

What are the key market players or companies in this digital Assurance industry?

Key players in the digital assurance market include major tech firms that provide software solutions and consulting services. They contribute significantly to market growth through innovations in automation, cloud-based services, and testing tools.

What are the primary factors driving the growth in the digital assurance industry?

Growth in digital assurance is driven by digital transformation initiatives, rise in cyber threats, regulatory compliance demands, and the need for enhanced customer experiences. Organizations are investing more in assurance solutions to maintain competitive advantage.

Which region is the fastest Growing in the digital assurance market?

Asia Pacific is the fastest-growing region in the digital assurance market, expected to expand from approximately $2.14 billion in 2023 to $5.33 billion by 2033. This growth is accelerated by rapid digitalization across multiple industries.

Does ConsaInsights provide customized market report data for the digital assurance industry?

Yes, ConsaInsights offers customized market report data tailored to meet specific client needs within the digital assurance industry. This includes insights on market size, trends, and competitive analysis for targeted sectors.

What deliverables can I expect from this digital assurance market research project?

Deliverables from the digital assurance market research project include a comprehensive market analysis report, data on market trends, competitive landscape, segmentation analysis, and strategic recommendations for market entry or expansion.

What are the market trends of digital assurance?

Current trends in digital assurance include the rise of automation tools, increased use of cloud solutions, and a focus on analytics and reporting. There's a shift towards integrated assurance models that support agile deployment in businesses.