Digital Audio Workstation Market Report

Published Date: 31 January 2026 | Report Code: digital-audio-workstation

Digital Audio Workstation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Digital Audio Workstation (DAW) market, examining trends, sizes, and growth forecasts from 2023 to 2033. Insights into market dynamics, segmentation, leading companies, and future projections are detailed to assist stakeholders in strategic decision-making.

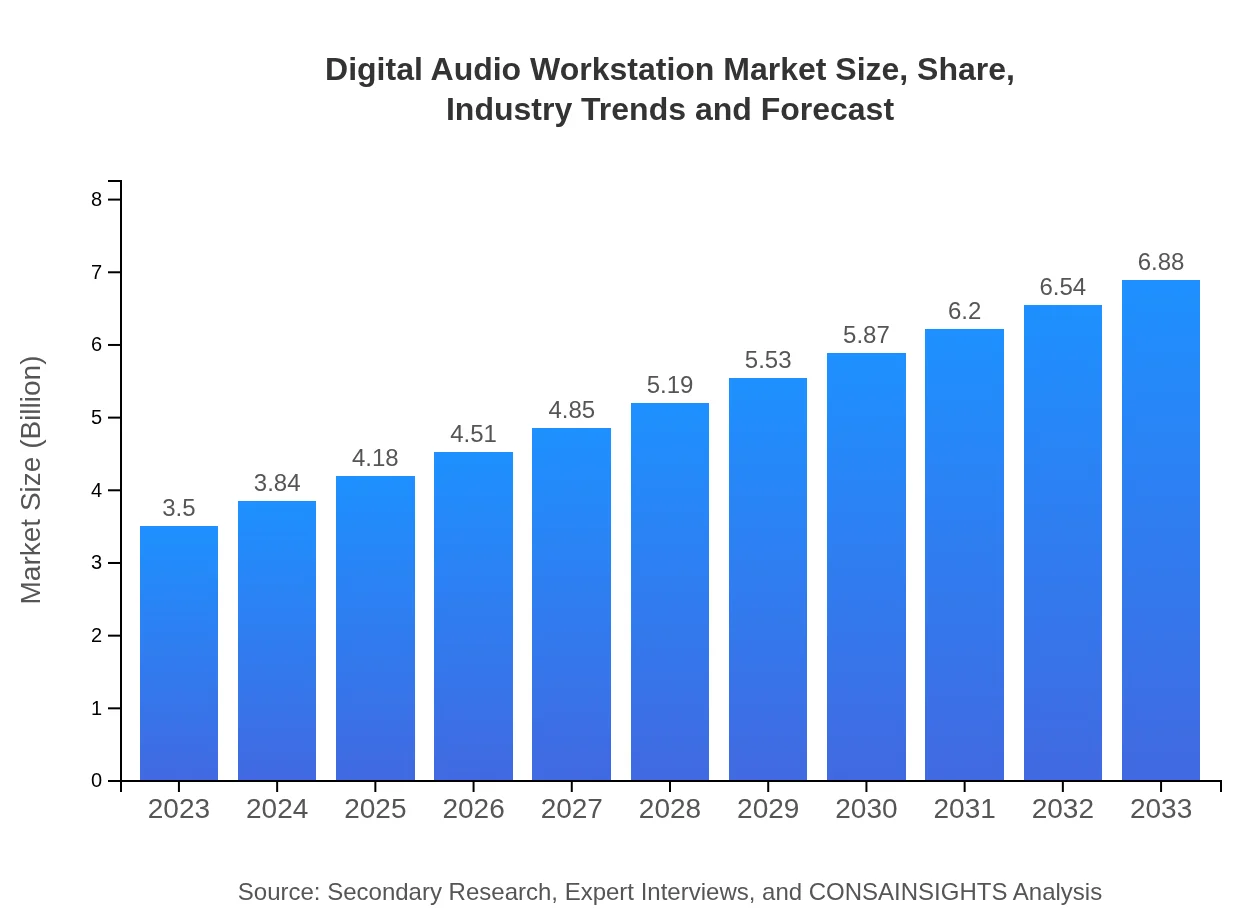

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Avid Technology, Inc., Image-Line Software, Apple Inc., Steinberg Media Technologies GmbH, Ableton AG |

| Last Modified Date | 31 January 2026 |

Digital Audio Workstation Market Overview

Customize Digital Audio Workstation Market Report market research report

- ✔ Get in-depth analysis of Digital Audio Workstation market size, growth, and forecasts.

- ✔ Understand Digital Audio Workstation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Audio Workstation

What is the Market Size & CAGR of Digital Audio Workstation market in 2023?

Digital Audio Workstation Industry Analysis

Digital Audio Workstation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Audio Workstation Market Analysis Report by Region

Europe Digital Audio Workstation Market Report:

The European market for Digital Audio Workstations is projected to grow from $1.19 billion in 2023 to $2.34 billion by 2033. Countries like Germany and the UK lead in music production innovation, with a significant demand for DAWs in professional studios, educational institutions, and among hobbyists. The emphasis on high-quality audio content drives ongoing investments in advanced audio production tools.Asia Pacific Digital Audio Workstation Market Report:

The Asia-Pacific region is emerging as a significant market for Digital Audio Workstations, with a 2023 market size of $0.66 billion, projected to grow to $1.30 billion by 2033. This growth is driven by increasing smartphone penetration, a burgeoning music industry, and a rising number of content creators. The region's youthful demographic and affinity towards music consumption further bolsters demand for accessible audio production tools.North America Digital Audio Workstation Market Report:

North America continues to dominate the DAW market, with a market size of $1.18 billion in 2023, foreseen to reach $2.32 billion by 2033. The region is home to major music studios and content production houses, alongside a robust educational framework promoting audio engineering. The increasing number of independent artists and podcasts reflects a growing affinity for DAW technologies.South America Digital Audio Workstation Market Report:

In South America, the Digital Audio Workstation market is expected to reach $0.28 billion in 2023, doubling to $0.56 billion by 2033. Interest in music production and content creation is on the rise, supported by expanding internet access and infrastructure improvements. Latin American artists' global influence is also contributing to increased investments in audio production technologies.Middle East & Africa Digital Audio Workstation Market Report:

The Middle East and Africa are slowly gaining traction in the Digital Audio Workstation market, with a 2023 valuation of $0.18 billion expanding to $0.36 billion by 2033. Growing interest in music creation, coupled with investments in technology infrastructure and education in audio engineering, will likely enhance the region's market growth.Tell us your focus area and get a customized research report.

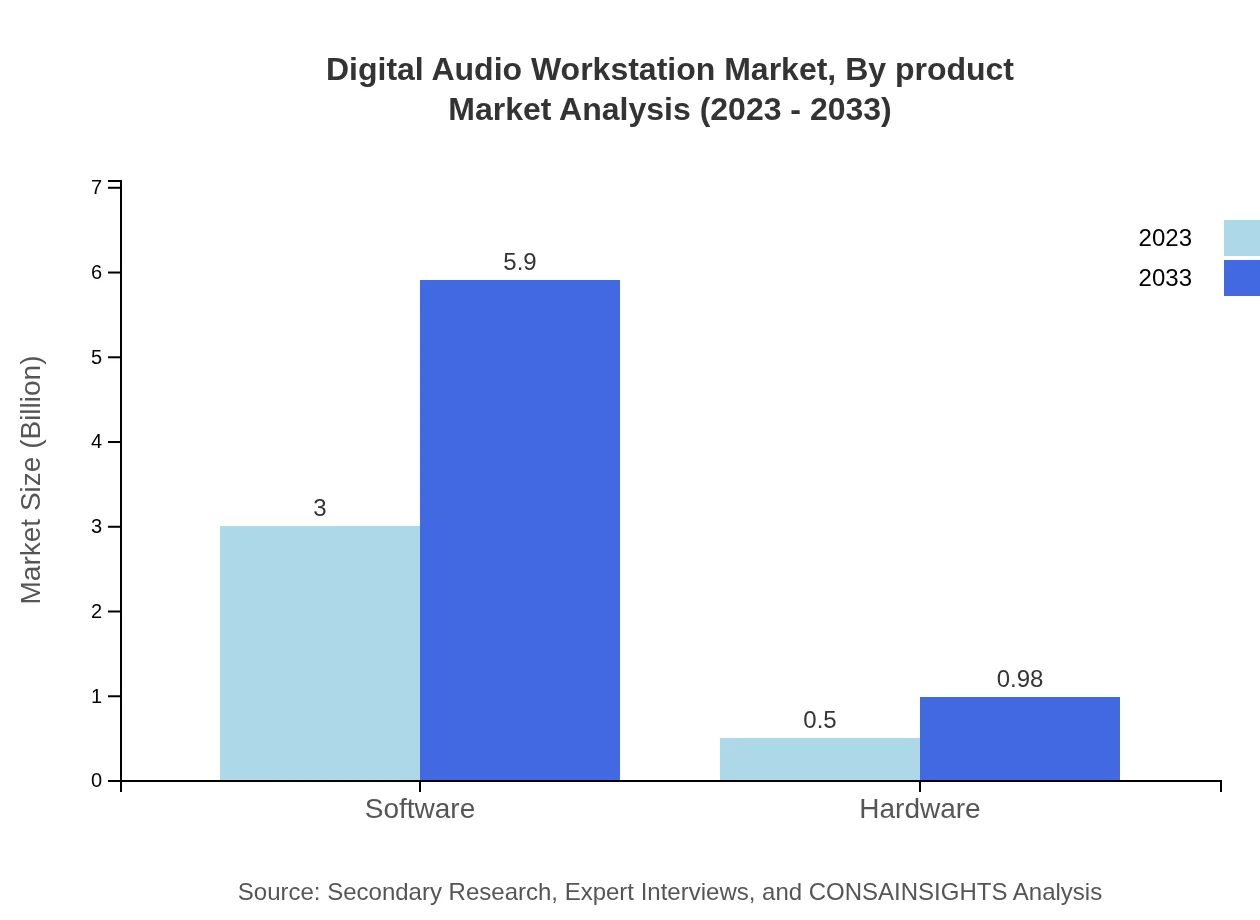

Digital Audio Workstation Market Analysis By Product

The software segment of the Digital Audio Workstation market holds the largest share, accounting for approximately $3 billion in 2023, with expectations to reach $5.90 billion by 2033. Hardware accounts for a smaller portion, starting at $0.50 billion in 2023 and rising to $0.98 billion across the same period. The competition among software providers continues to focus on innovation and user experience.

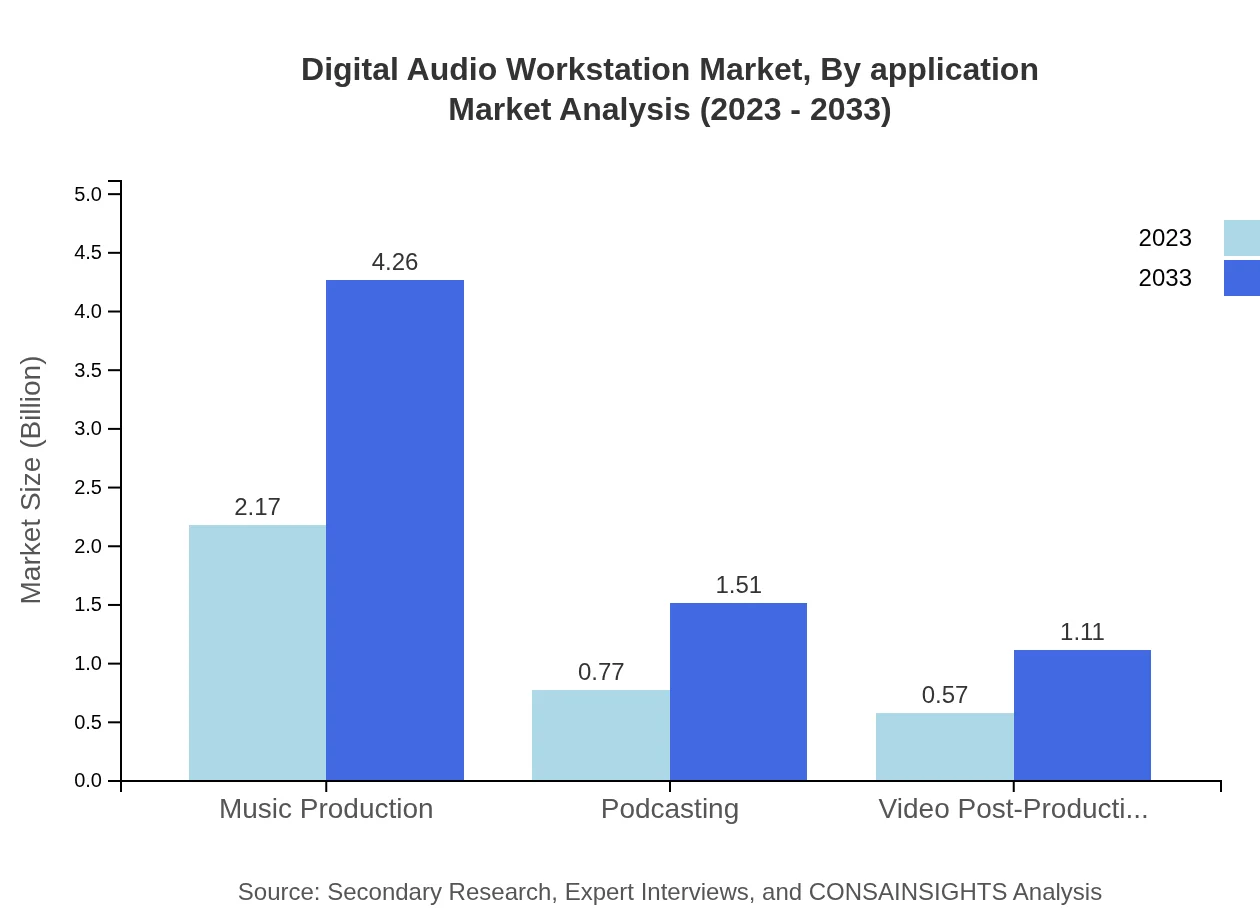

Digital Audio Workstation Market Analysis By Application

Music production remains the dominant application, comprising 61.89% of the market share. Podcasting and video post-production are other significant applications, collectively growing from $0.77 billion in 2023 to $1.51 billion by 2033. As the demand for diverse content increases, so does the relevance of DAWs across different creative industries.

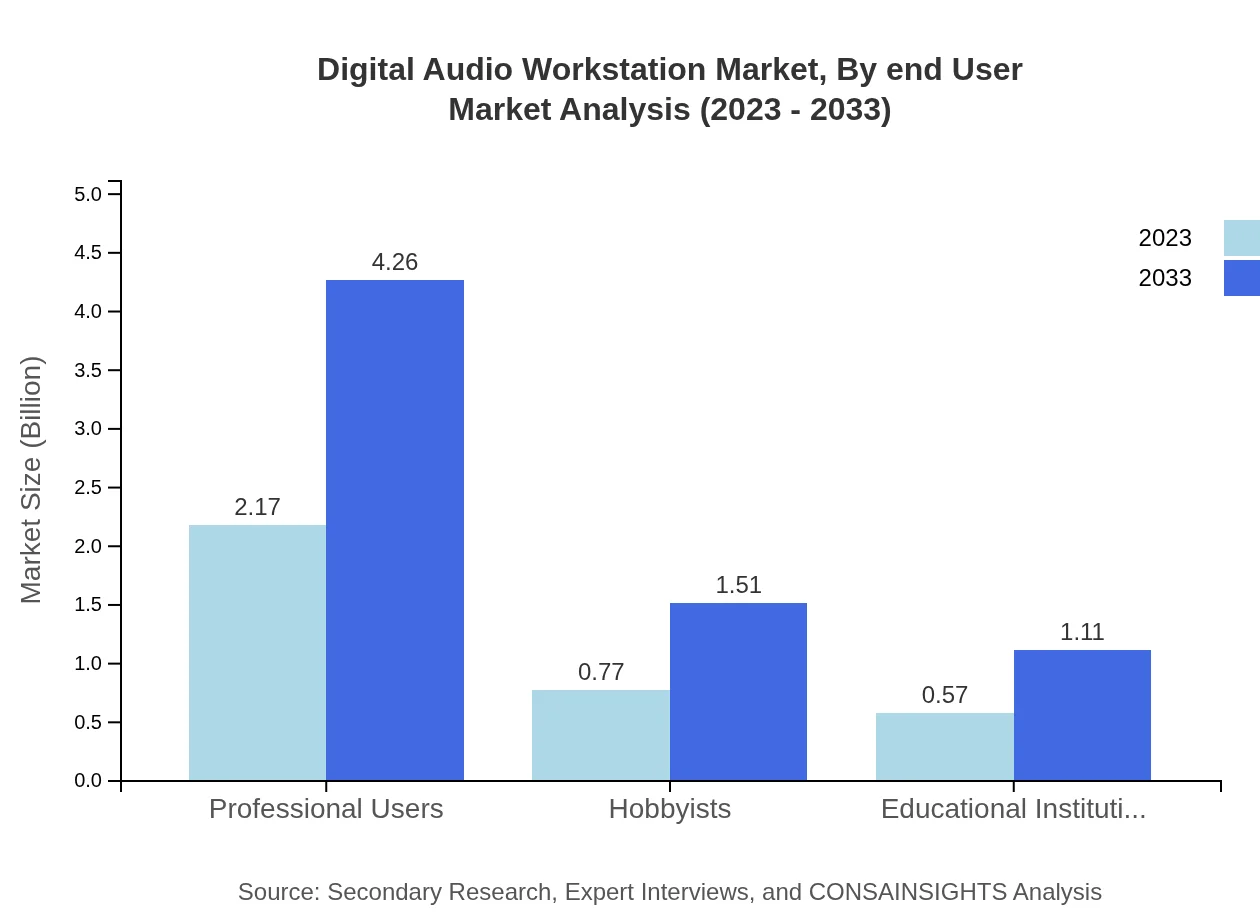

Digital Audio Workstation Market Analysis By End User

The end-user segment highlights professional users as the largest group, accounting for approximately 61.89% of the market. Hobbyists hold 21.96%, while educational institutions constitute about 16.15%. This distribution underscores the popularity of DAWs among professional audio engineers and creators, alongside their growing appeal among casual users.

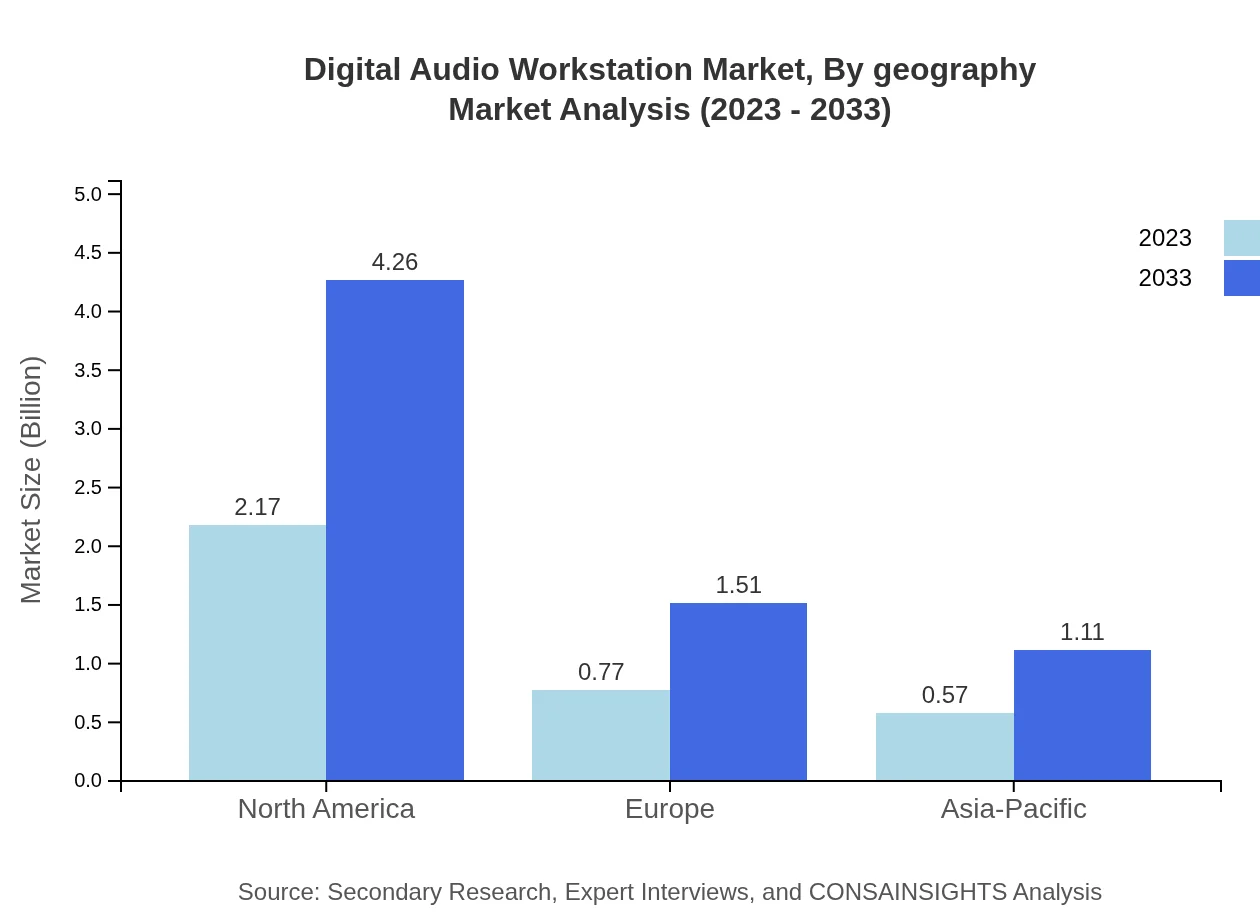

Digital Audio Workstation Market Analysis By Geography

Geographically, North America leads the market with significant contributions from both professional and educational institutions. Europe follows closely, with strong involvement from independent artists and studios. Asia-Pacific is witnessing rapid growth, largely due to increasing smartphone usage and the rise of content creators.

Digital Audio Workstation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Audio Workstation Industry

Avid Technology, Inc.:

A leading provider of digital audio and video production tools, Avid's Pro Tools software is widely adopted in studios and for music production globally.Image-Line Software:

Known for FL Studio, Image-Line Software offers powerful DAW solutions for both beginners and professionals, empowering creative expression through intuitive design.Apple Inc.:

Apple's Logic Pro is a leading DAW software known for rich features and seamless integration with other Apple products, catering to music professionals and enthusiasts.Steinberg Media Technologies GmbH:

Steinberg is recognized for its Cubase DAW, offering comprehensive solutions for music production and audio editing, trusted by musicians worldwide.Ableton AG:

Famous for the Live software, Ableton provides innovative tools for music production and live performances, appealing to diverse user demographics.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Audio Workstation?

The global Digital Audio Workstation market is currently valued at approximately $3.5 billion, with a projected Compound Annual Growth Rate (CAGR) of 6.8% through 2033. This growth reflects the rising demand for audio production software and hardware.

What are the key market players or companies in this digital Audio Workstation industry?

Key players in the Digital Audio Workstation market include major software companies and audio technology firms. These organizations contribute to the development, innovation, and distribution of DAWs, although specific companies were not listed in the provided data.

What are the primary factors driving the growth in the digital Audio Workstation industry?

Growth in the Digital Audio Workstation industry is primarily driven by the increasing prevalence of music production, podcasting, and content creation demands. Additionally, technological advancements in audio editing software enhance user experience, stimulating market adoption.

Which region is the fastest Growing in the digital Audio Workstation?

The fastest-growing region for Digital Audio Workstations is expected to be North America, growing from $2.17 billion in 2023 to $4.26 billion by 2033. Other significant growth is forecasted in Europe and Asia-Pacific as well.

Does ConsaInsights provide customized market report data for the digital Audio Workstation industry?

Yes, ConsaInsights offers customized market report data tailored to specific inquiries regarding the Digital Audio Workstation industry. This includes segmented data, trends analysis, and forecasts based on unique client needs.

What deliverables can I expect from this digital Audio Workstation market research project?

From this market research project, you can expect comprehensive reports detailing market size, growth forecasts, segment analysis, and insights on trends. Additional customized insights specific to client needs will also be included.

What are the market trends of digital Audio Workstation?

Current market trends in Digital Audio Workstations include a shift towards cloud-based solutions, increased integration with mobile platforms, and a growing focus on user-friendly interfaces to attract hobbyists and professionals alike.