Digital Banking Multichannel Integration Solutions Market Report

Published Date: 31 January 2026 | Report Code: digital-banking-multichannel-integration-solutions

Digital Banking Multichannel Integration Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Digital Banking Multichannel Integration Solutions market, offering insights on market size, trends, technology advancements, and forecasts for the period of 2023 to 2033.

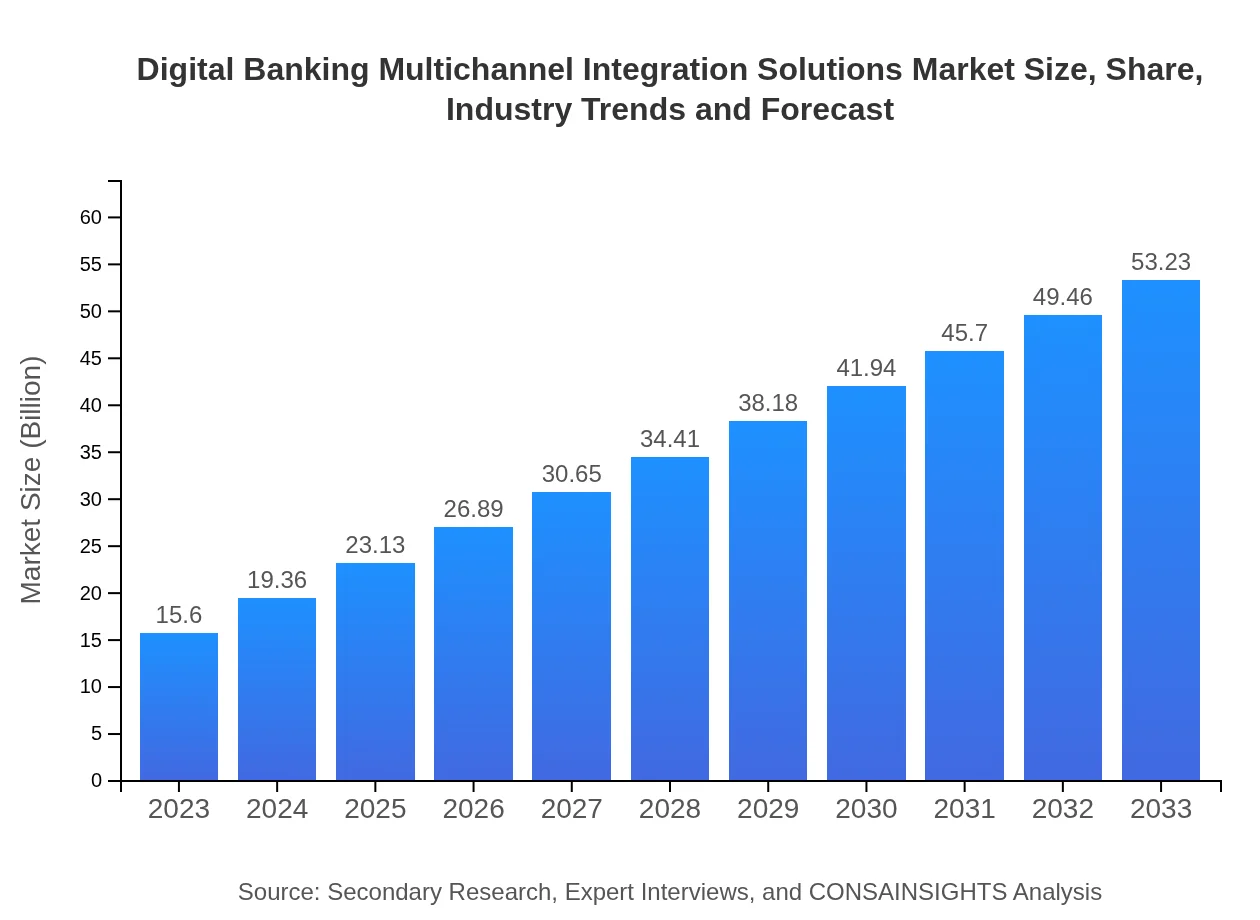

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $53.23 Billion |

| Top Companies | SAP, Oracle, FIS, Salesforce, Temenos |

| Last Modified Date | 31 January 2026 |

Digital Banking Multichannel Integration Solutions Market Overview

Customize Digital Banking Multichannel Integration Solutions Market Report market research report

- ✔ Get in-depth analysis of Digital Banking Multichannel Integration Solutions market size, growth, and forecasts.

- ✔ Understand Digital Banking Multichannel Integration Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Banking Multichannel Integration Solutions

What is the Market Size & CAGR of Digital Banking Multichannel Integration Solutions market in 2023?

Digital Banking Multichannel Integration Solutions Industry Analysis

Digital Banking Multichannel Integration Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Banking Multichannel Integration Solutions Market Analysis Report by Region

Europe Digital Banking Multichannel Integration Solutions Market Report:

The European market is anticipated to grow from $3.76 billion in 2023 to $12.82 billion by 2033. Regulatory pressures combined with a need for enhanced customer service experience are pushing European banks towards multichannel integration solutions.Asia Pacific Digital Banking Multichannel Integration Solutions Market Report:

In the Asia Pacific region, the market size is expected to grow from $3.01 billion in 2023 to $10.27 billion by 2033. The increasing adoption of mobile banking, coupled with a rising middle class and digital literacy, is fueling demand for multichannel integration solutions.North America Digital Banking Multichannel Integration Solutions Market Report:

North America leads the market with a size of $5.81 billion in 2023, expected to rise to $19.84 billion by 2033. The region's significant investment in digital infrastructures and the presence of large financial institutions contribute to its dominance in the market.South America Digital Banking Multichannel Integration Solutions Market Report:

For South America, the market size stands at approximately $1.04 billion in 2023, projected to reach $3.53 billion by 2033. Enhancements in mobile payment technologies and a shift towards digital banking solutions drives this growth, particularly among younger consumers.Middle East & Africa Digital Banking Multichannel Integration Solutions Market Report:

In the Middle East and Africa, the market size of $1.98 billion in 2023 is forecasted to expand to $6.77 billion by 2033. There is a transition towards digital banking due to increased smartphone penetration, enabling greater access to banking services.Tell us your focus area and get a customized research report.

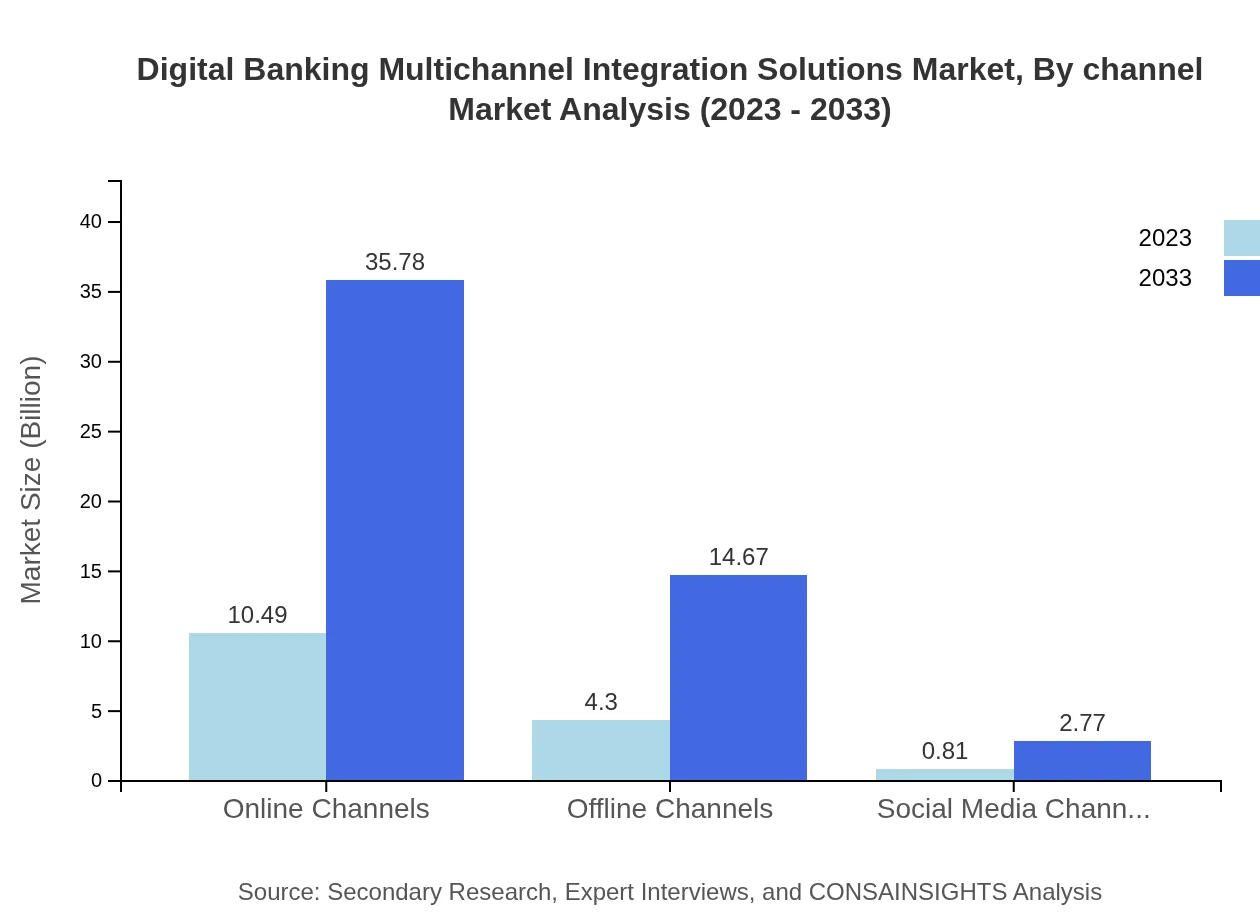

Digital Banking Multichannel Integration Solutions Market Analysis By Channel

The Digital Banking Multichannel Integration Solutions Market is categorized into online channels, offline channels, and social media channels. Online channels dominate the market, projected to increase from $10.49 billion in 2023 to $35.78 billion by 2033, capturing a significant portion of overall market share. Meanwhile, offline channels will also grow, although at a slower pace, reflecting traditional banking's gradual integration with digital offerings.

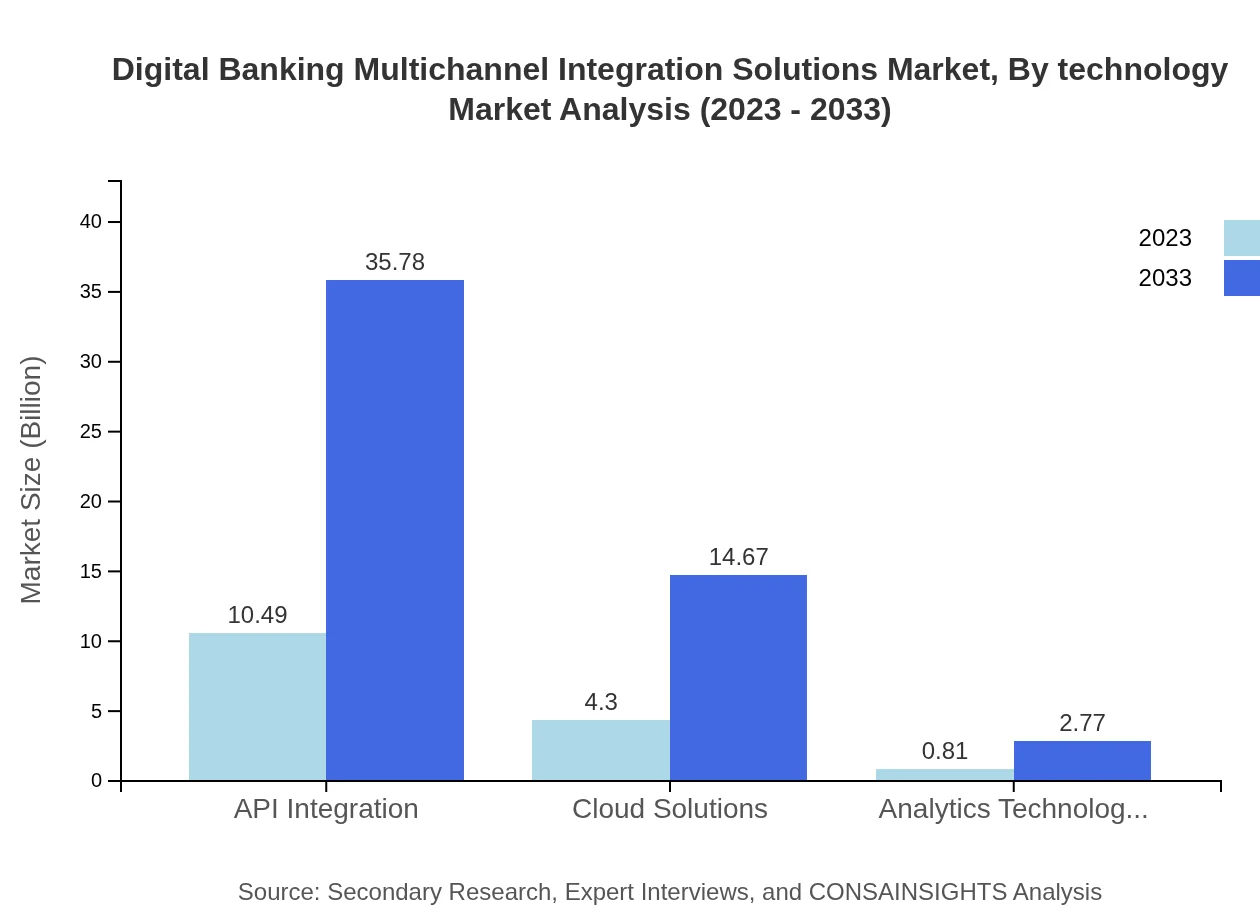

Digital Banking Multichannel Integration Solutions Market Analysis By Technology

Technologies such as API integration, cloud solutions, and analytics technologies are driving innovations in this market. API integration alone is projected to expand from $10.49 billion in 2023 to $35.78 billion by 2033, highlighting its critical role in enabling seamless banking experiences across platforms.

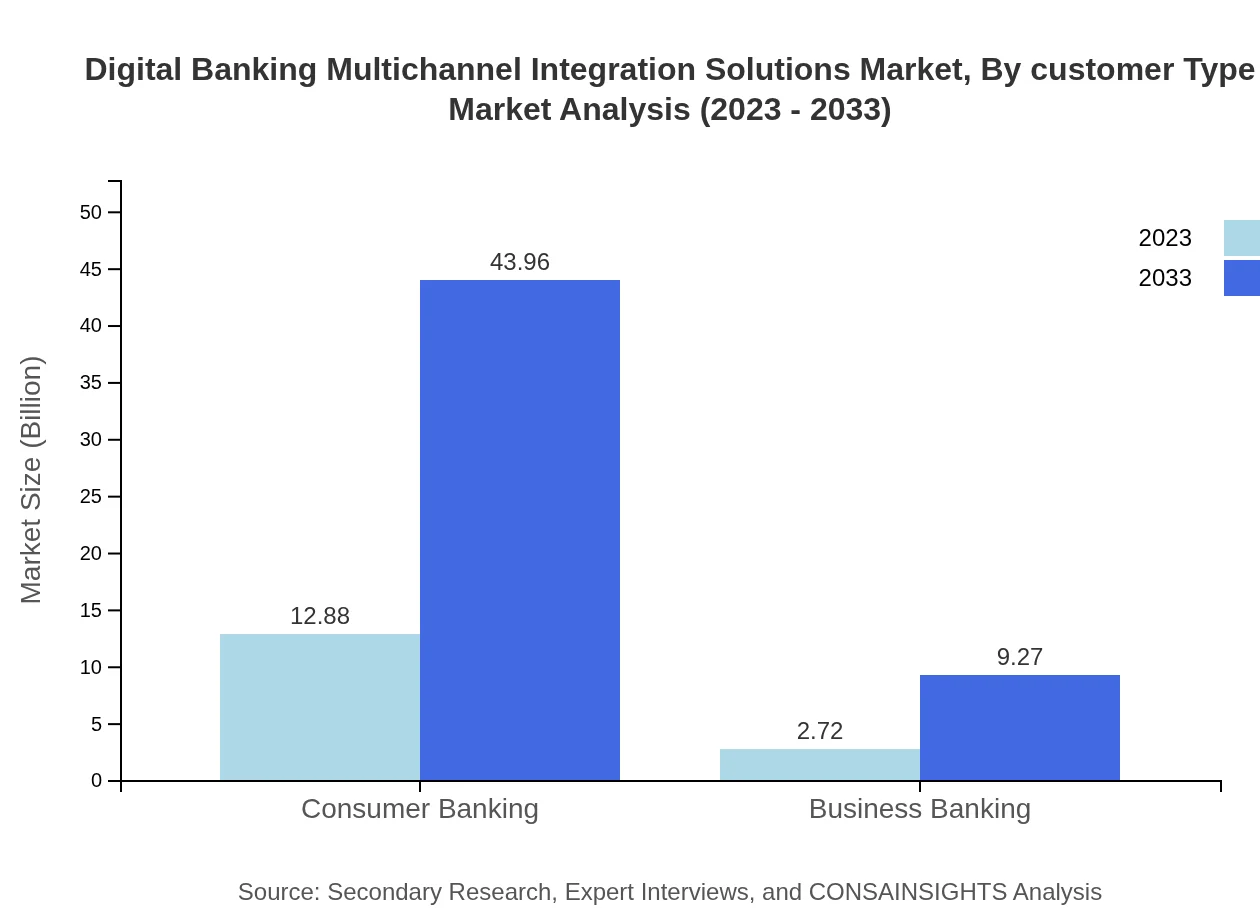

Digital Banking Multichannel Integration Solutions Market Analysis By Customer Type

The market analysis by customer type reveals strong demand from both consumer and business banking segments. Consumer banking is expected to grow from $12.88 billion in 2023 to $43.96 billion by 2033, indicating a robust shift towards personalized customer experiences.

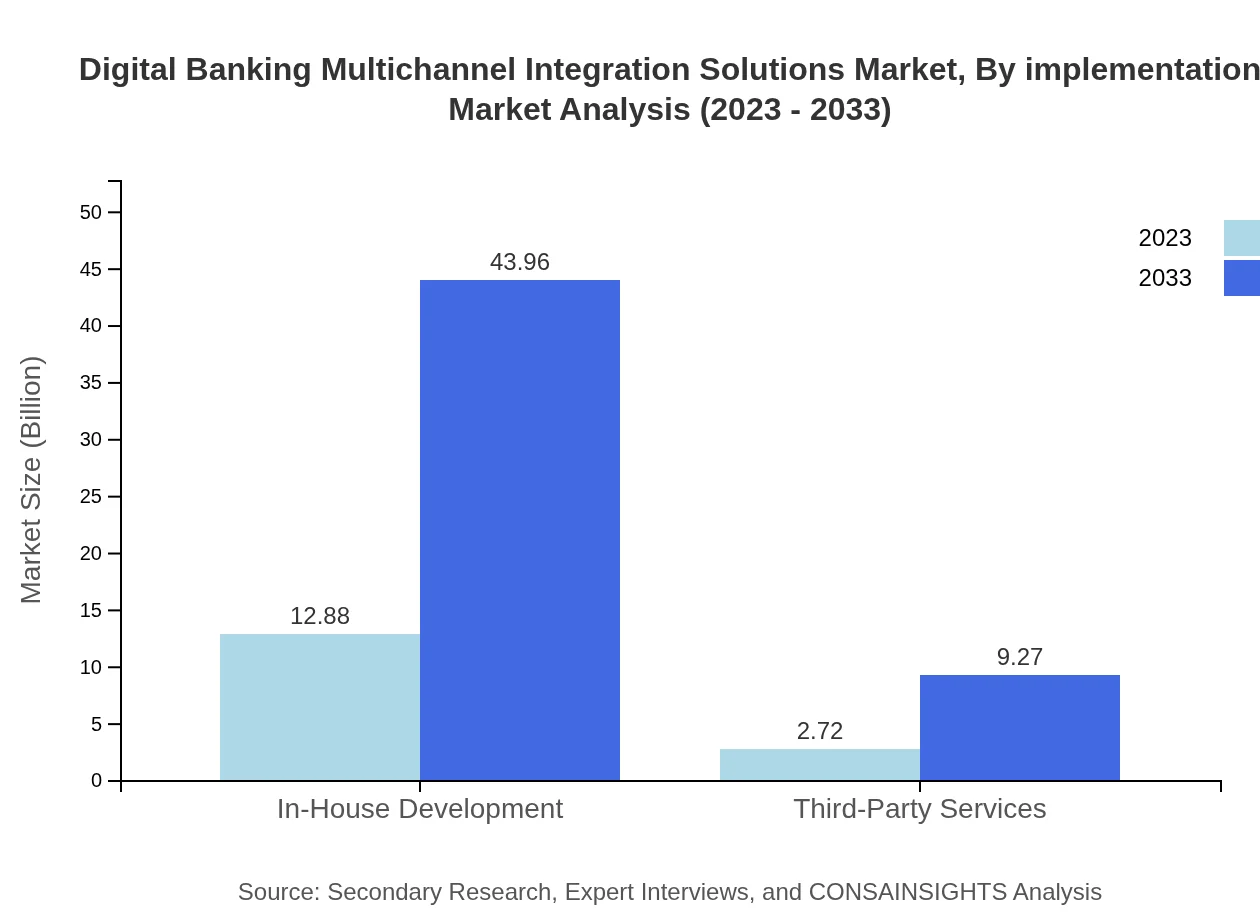

Digital Banking Multichannel Integration Solutions Market Analysis By Implementation

Implementation methods are classified into in-house development and third-party services. In-house development, valued at $12.88 billion in 2023, is expected to remain prominent, capturing 82.59% market share due to the customization it provides to banks.

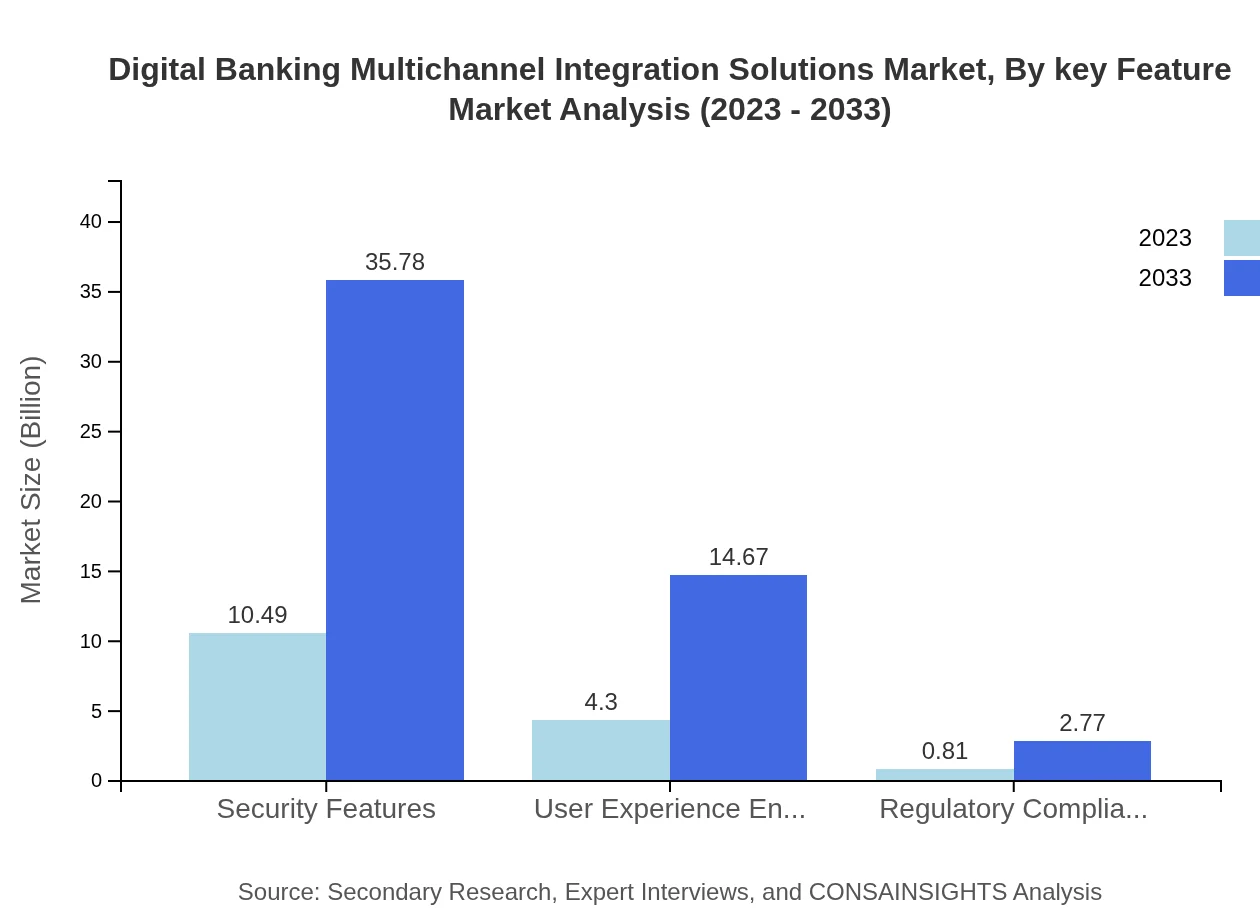

Digital Banking Multichannel Integration Solutions Market Analysis By Key Feature

Key features such as security features and user experience enhancements are critical in this market. Security features will grow from $10.49 billion in 2023 to $35.78 billion by 2033, emphasizing the industry's focus on safeguarding customer information.

Digital Banking Multichannel Integration Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Banking Multichannel Integration Solutions Industry

SAP:

SAP offers integrated solutions that provide banks with the ability to manage customer data and interactions across multiple channels efficiently.Oracle:

Oracle's cloud solutions allow banks to leverage data analytics and machine learning to enhance customer experience and operational efficiency.FIS:

FIS provides comprehensive banking software and services focused on enhancing customer interactions through every banking channel.Salesforce:

Salesforce delivers customer relationship management software with robust mobile capabilities into the banking sector, supporting multichannel strategies.Temenos:

Temenos offers a banking platform that facilitates multichannel integration, driving digital transformation in financial institutions globally.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Banking Multichannel Integration Solutions?

The digital banking multichannel integration solutions market is projected to reach $15.6 billion by 2033, growing at a CAGR of 12.5%. This reflects a robust demand for integrated banking solutions that enhance customer experience across multiple channels.

What are the key market players or companies in this digital Banking Multichannel Integration Solutions industry?

Key players in the digital banking multichannel integration solutions market include major technology firms specializing in financial services. Companies are continually evolving to provide comprehensive solutions, integrating both online and offline channels to enhance user experiences.

What are the primary factors driving the growth in the digital Banking Multichannel Integration Solutions industry?

Growth drivers include increasing consumer demand for seamless banking experiences, the proliferation of mobile banking, and advancements in technology offering enhanced integration solutions. The shift towards digital solutions post-pandemic has also significantly contributed to market momentum.

Which region is the fastest Growing in the digital Banking Multichannel Integration Solutions?

North America is currently the fastest-growing region in this sector, projected to rise from $5.81 billion in 2023 to $19.84 billion by 2033. Europe and Asia-Pacific also exhibit strong growth potential, driven by technological advancements and heightened banking digitization.

Does ConsaInsights provide customized market report data for the digital Banking Multichannel Integration Solutions industry?

Yes, ConsaInsights offers tailored market report data to suit specific client needs in the digital banking multichannel integration solutions industry, allowing stakeholders to make informed decisions based on granular insights and trends relevant to their requirements.

What deliverables can I expect from this digital Banking Multichannel Integration Solutions market research project?

Deliverables include comprehensive market analysis reports, data on segment sizes and shares, competitive landscape assessments, and forecasts. Additional insights into regional trends and consumer behavior will also be provided to aid strategic planning.

What are the market trends of digital Banking Multichannel Integration Solutions?

Current market trends include a shift towards API integration, increased use of cloud solutions, and enhanced security features to protect user data. There is also a growing focus on improving the user experience through innovative technologies and regulatory compliance.