Digital Impression Systems Market Report

Published Date: 31 January 2026 | Report Code: digital-impression-systems

Digital Impression Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Digital Impression Systems market, focusing on market size, growth forecasts, key trends, and regional insights from 2023 to 2033.

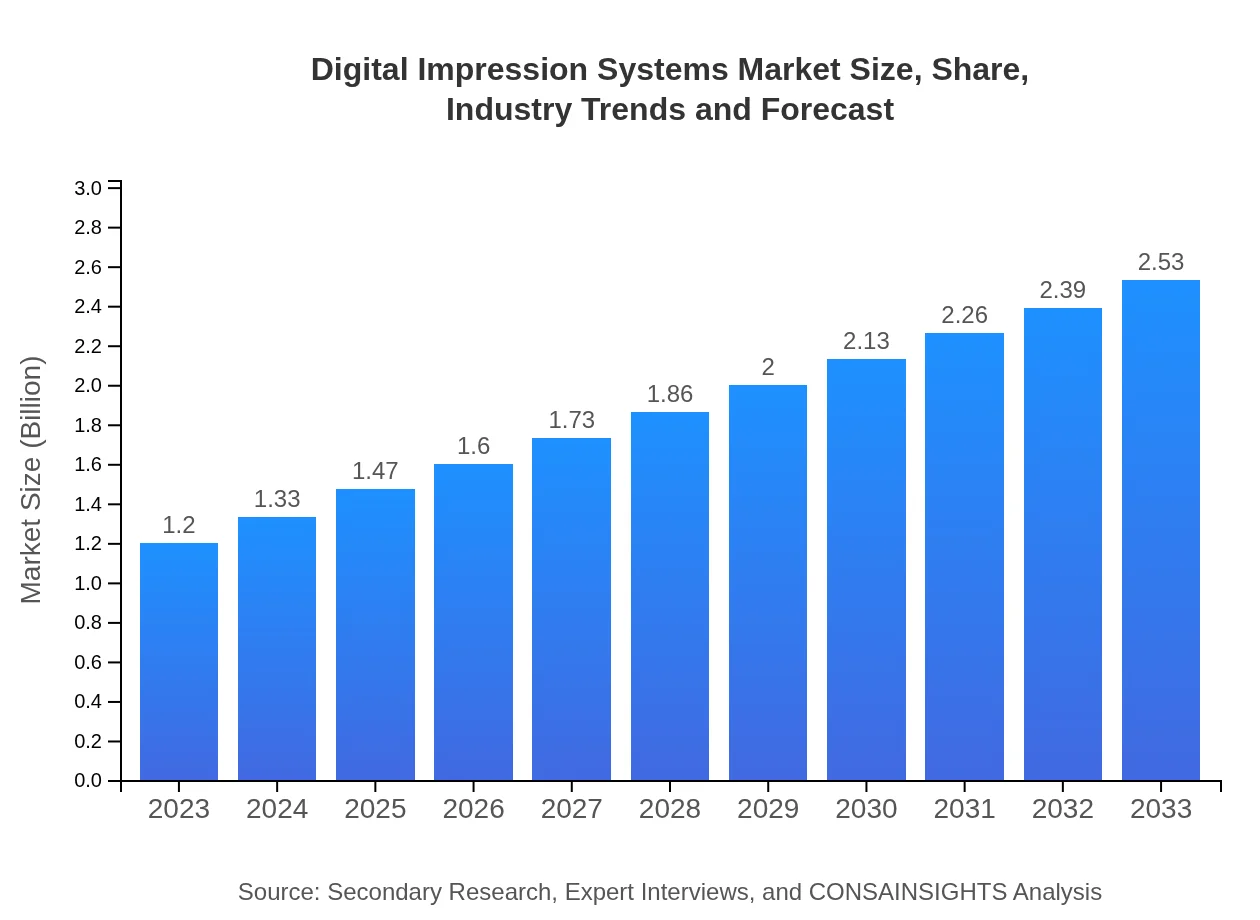

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $2.53 Billion |

| Top Companies | 3D Systems, Stratasys, HP Inc., Canon Inc., Ricoh Company Ltd. |

| Last Modified Date | 31 January 2026 |

Digital Impression Systems Market Overview

Customize Digital Impression Systems Market Report market research report

- ✔ Get in-depth analysis of Digital Impression Systems market size, growth, and forecasts.

- ✔ Understand Digital Impression Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Impression Systems

What is the Market Size & CAGR of Digital Impression Systems market in 2023?

Digital Impression Systems Industry Analysis

Digital Impression Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Impression Systems Market Analysis Report by Region

Europe Digital Impression Systems Market Report:

The European market size is approximately $0.41 billion in 2023, anticipated to double to $0.86 billion by 2033 due to strong regulatory support for advanced manufacturing and sustainability. Heightened demand for custom manufacturing also drives growth as industries transition to digital platforms.Asia Pacific Digital Impression Systems Market Report:

In 2023, the Asia Pacific region holds a market size of $0.22 billion with expectations to reach $0.46 billion by 2033. The booming manufacturing sector and increased investment in technological innovations drive the market here, as many countries in the region expand capabilities to meet rising consumer demands.North America Digital Impression Systems Market Report:

North America shares a market size of $0.41 billion in 2023, projected to grow to $0.87 billion by 2033. Significant investments from leading digital impression firms and a focus on innovation keep this region at the forefront, especially within healthcare and manufacturing.South America Digital Impression Systems Market Report:

The South American market is currently valued at $0.01 billion in 2023, growing to $0.02 billion by 2033. The slower growth rate is attributed to economic fluctuations and limited technological adoption; however, initiatives in industrial digitization are expected to spur gradual growth.Middle East & Africa Digital Impression Systems Market Report:

The Middle East and Africa exhibit a 2023 market size of $0.15 billion, expected to increase to $0.32 billion by 2033. The gradual economic development and rising awareness of digital systems contribute to growth, with regional investments in advanced technologies.Tell us your focus area and get a customized research report.

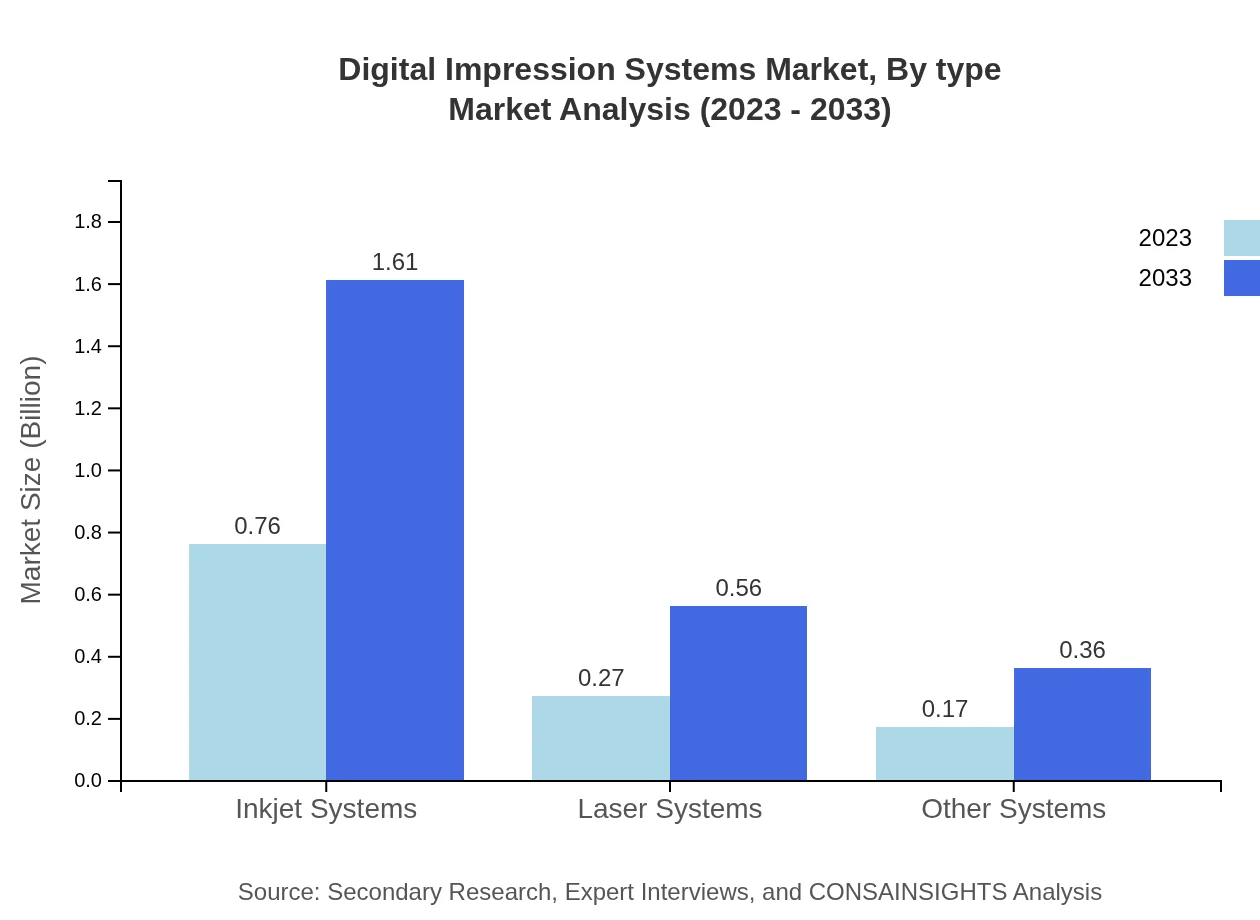

Digital Impression Systems Market Analysis By Type

The Digital Impression Systems market is primarily segmented into three categories: Inkjet Systems, Laser Systems, and Other Systems. By 2033, Inkjet Systems are projected to maintain a dominant market size of $1.61 billion, constituting over 63.58% share in 2023. Laser Systems, with a projected market size of $0.56 billion in 2033, will account for 22.26% market share. Other Systems are anticipated to contribute $0.36 billion by 2033 with a 14.16% market share.

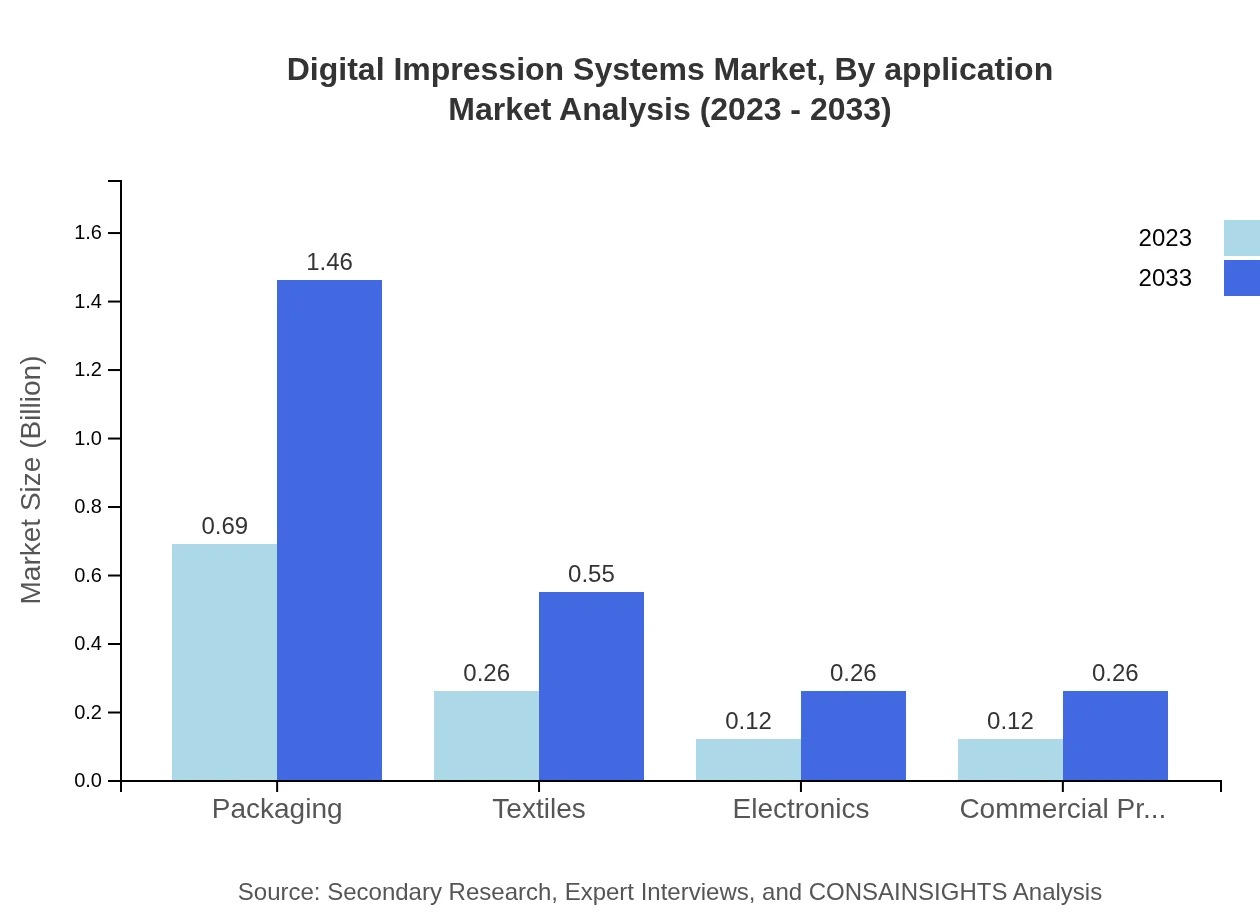

Digital Impression Systems Market Analysis By Application

Major applications of Digital Impression Systems include Media and Entertainment, Automotive, Pharmaceuticals, Food and Beverage, and Packaging. By 2033, Media and Entertainment will dominate with a market size of $1.46 billion, comprising approximately 57.66% of the total. The Automotive sector is projected to grow to $0.55 billion, while Pharmaceuticals and Food and Beverage share smaller segments at $0.26 billion each.

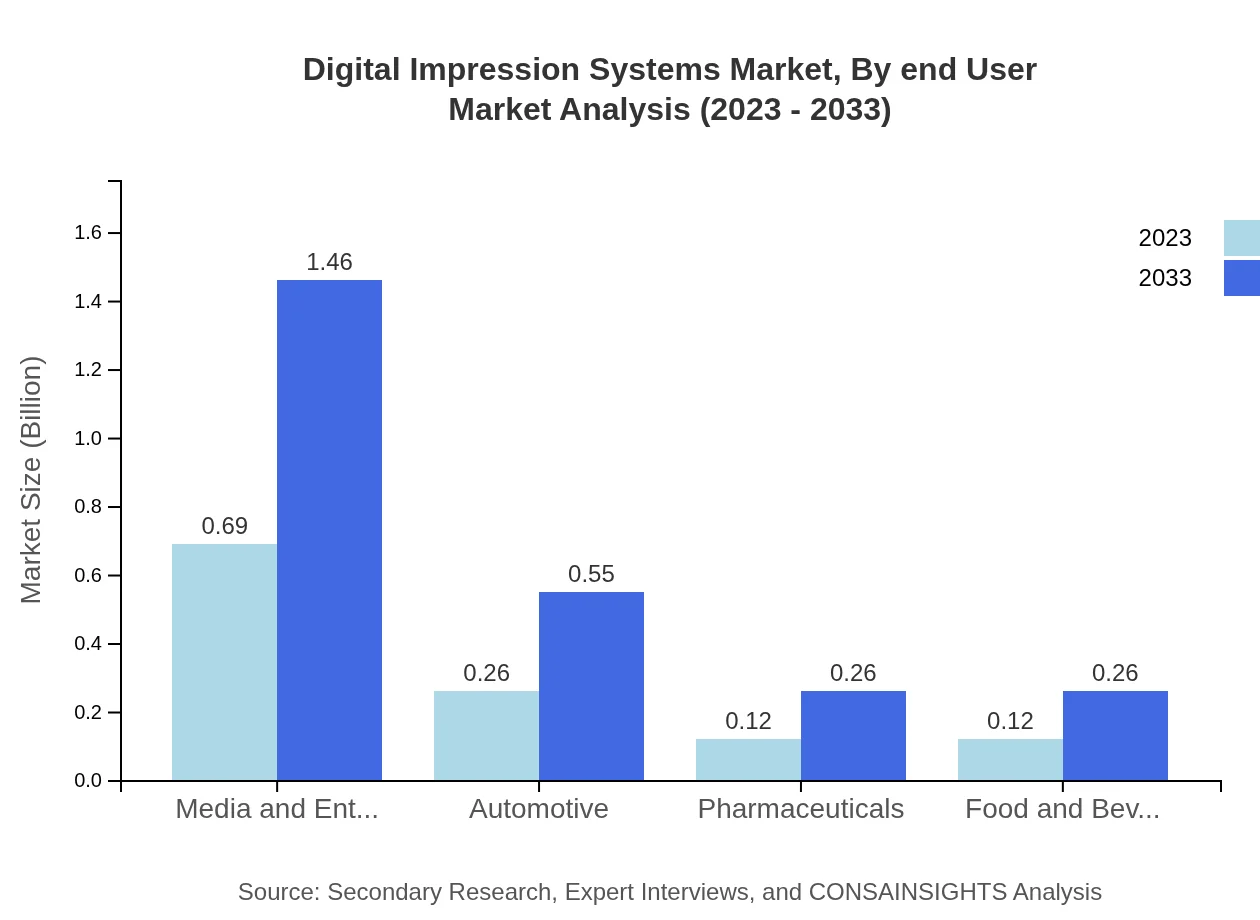

Digital Impression Systems Market Analysis By End User

End-users in the Digital Impression Systems market encompass sectors such as Healthcare, Retail, and Manufacturing. Healthcare and Retail are expected to dominate as they increasingly adopt digital systems for efficiency and accuracy in production and customer engagement. Manufacturing, although traditional, is adapting and digitizing operations, positioning itself as a critical end-user.

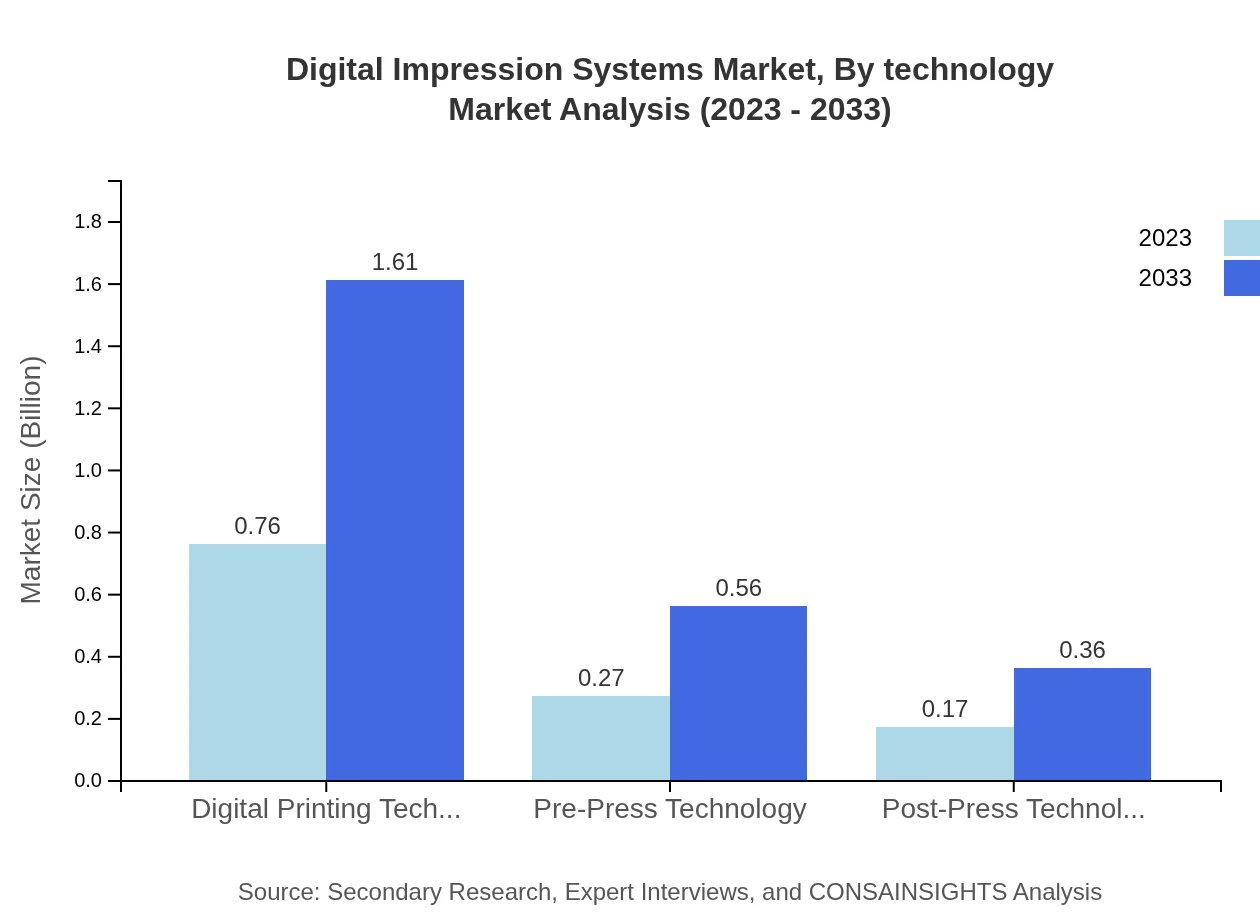

Digital Impression Systems Market Analysis By Technology

Technological advancements in Digital Impression Systems involve innovations in key areas like 3D printing and traditional printing methodologies. Both Inkjet and Laser technologies are critical in driving efficiency, particularly with advancements in eco-friendly materials and faster processing times.

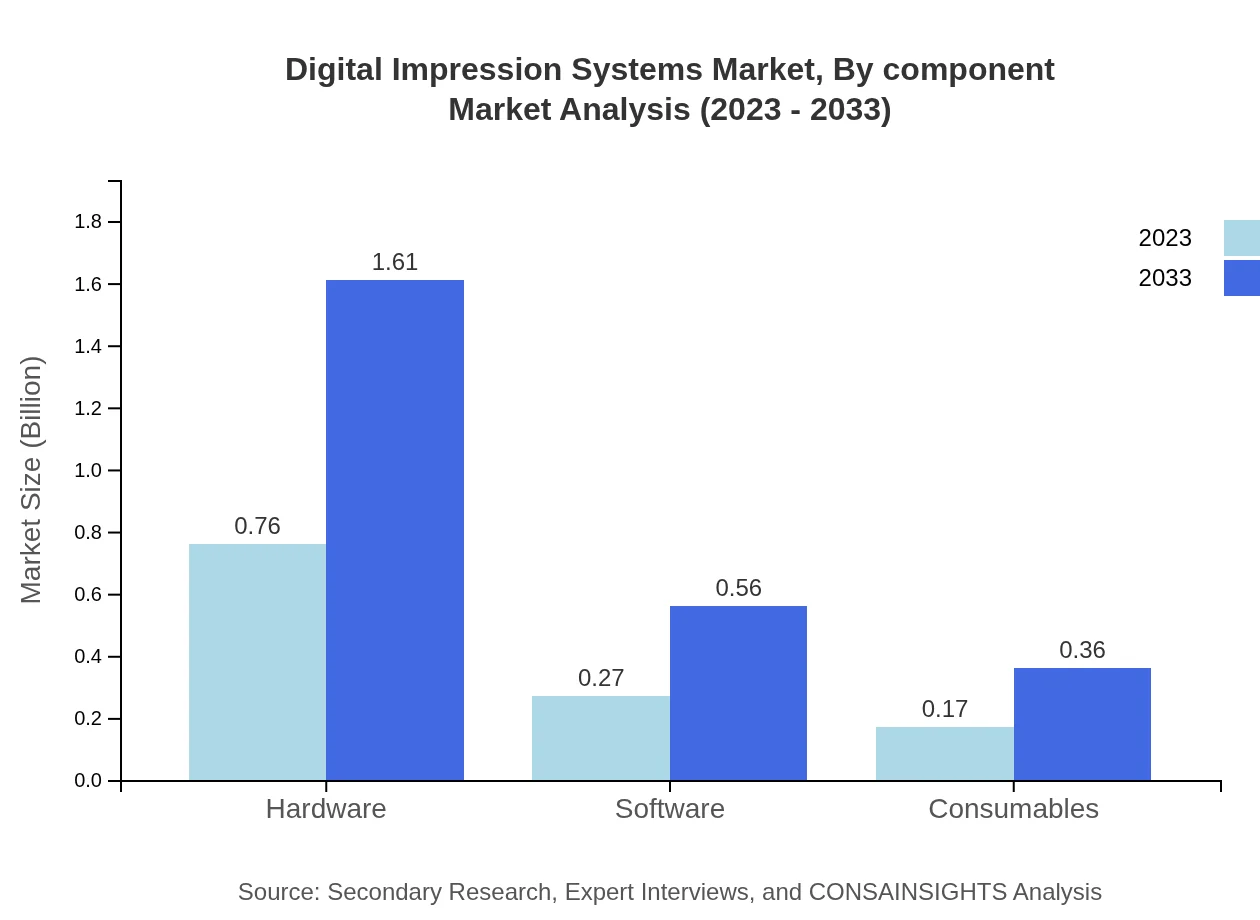

Digital Impression Systems Market Analysis By Component

Components of Digital Impression Systems include Hardware, Software, and Consumables, with Hardware expected to maintain significant market share in the coming years. By 2033, Hardware is likely to reach $1.61 billion, supported by evolving customer demands for high-quality output and system integration.

Digital Impression Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Impression Systems Industry

3D Systems:

3D Systems is a pioneer in 3D printing technology, offering comprehensive digital impression solutions across multiple sectors including healthcare and automotive.Stratasys:

Stratasys specializes in additive manufacturing and is recognized for its advanced digital printing systems used in various industries such as consumer goods and aerospace.HP Inc.:

HP is a global leader in digital printing solutions, providing innovative technologies that enhance printing accuracy and efficiency in commercial and industrial applications.Canon Inc.:

Canon delivers a range of digital impression systems known for their high quality and reliability, predominantly in the media, entertainment, and educational sectors.Ricoh Company Ltd.:

Ricoh is known for its solutions in the digital printing market, focusing on eco-friendly technologies and customer-centric services to augment digital impressions.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Impression Systems?

The digital impression systems market is valued at approximately $1.2 billion in 2023, with an expected CAGR of 7.5% through 2033, signaling robust growth and expanding demand across various industries.

What are the key market players or companies in this digital Impression Systems industry?

Key players in the digital impression systems industry include major technology firms and specialized manufacturers known for their innovative solutions, which drive competition and advancements within the market.

What are the primary factors driving the growth in the digital Impression Systems industry?

Growth in the digital impression systems industry is primarily driven by technological advancements, increasing demand in sectors such as packaging, and a rise in custom printing solutions, enhancing operational efficiency.

Which region is the fastest Growing in the digital Impression Systems?

The fastest-growing region in the digital impression systems market is North America, projected to increase from $0.41 billion in 2023 to $0.87 billion by 2033, demonstrating significant market expansion and opportunities.

Does ConsaInsights provide customized market report data for the digital Impression Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the specific insights and analyses required by businesses in the digital impression systems industry, ensuring relevant and actionable information.

What deliverables can I expect from this digital Impression Systems market research project?

From the digital impression systems market research project, clients can expect comprehensive reports, detailed segment analyses, competitive landscape evaluations, and forecasts to aid strategic decision-making.

What are the market trends of digital Impression Systems?

Key trends in the digital impression systems market include a shift towards eco-friendly materials, enhanced digital printing technologies, and growing applications across various sectors such as automotive and textiles.