Digital Innovation In Insurance Market Report

Published Date: 31 January 2026 | Report Code: digital-innovation-in-insurance

Digital Innovation In Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Digital Innovation in Insurance market, covering trends, growth forecasts, and market dynamics from 2023 to 2033. It aims to equip stakeholders with valuable data and analysis for informed decision-making.

| Metric | Value |

|---|---|

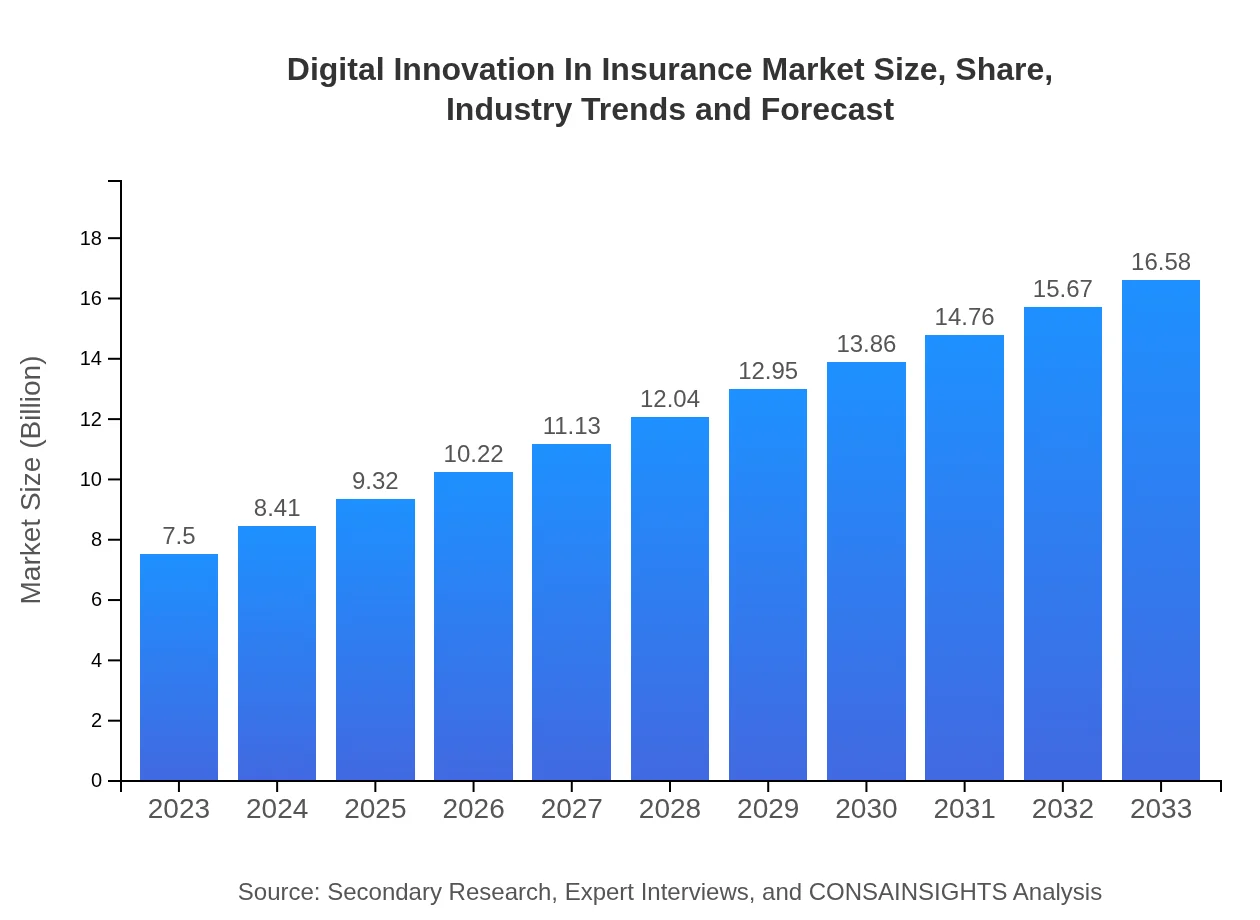

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 8.0% |

| 2033 Market Size | $16.58 Billion |

| Top Companies | IBM, Cognizant, SAP, Accenture |

| Last Modified Date | 31 January 2026 |

Digital Innovation In Insurance Market Overview

Customize Digital Innovation In Insurance Market Report market research report

- ✔ Get in-depth analysis of Digital Innovation In Insurance market size, growth, and forecasts.

- ✔ Understand Digital Innovation In Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Innovation In Insurance

What is the Market Size & CAGR of Digital Innovation In Insurance market in 2023?

Digital Innovation In Insurance Industry Analysis

Digital Innovation In Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Innovation In Insurance Market Analysis Report by Region

Europe Digital Innovation In Insurance Market Report:

The European market is projected to grow from $1.91 billion in 2023 to $4.22 billion by 2033. This growth reflects a strong regulatory push toward innovation and modernization in financial services, coupled with the adoption of cutting-edge technologies to improve efficiency and customer engagement.Asia Pacific Digital Innovation In Insurance Market Report:

In 2023, the Asia Pacific market for Digital Innovation in Insurance stands at $1.48 billion, projected to grow to $3.28 billion by 2033. This growth is fueled by rapid digitalization, increasing smartphone penetration, and a burgeoning middle-class population demanding improved insurance services.North America Digital Innovation In Insurance Market Report:

North America, with a market size of $2.57 billion in 2023, is set to grow to $5.68 billion by 2033. This region leads innovations in insurance technology, driven by significant investment from established insurers and a keen focus on regulatory compliance and customer experience enhancement.South America Digital Innovation In Insurance Market Report:

The South American region shows a market size of $0.59 billion in 2023, expected to reach $1.31 billion by 2033. Growth is driven primarily by enhancing digital platforms and the expansion of broadband access, which aims to meet customer demands for more accessible insurance services.Middle East & Africa Digital Innovation In Insurance Market Report:

In the Middle East and Africa, the market for Digital Innovation in Insurance is expected to expand from $0.95 billion in 2023 to $2.09 billion by 2033. Factors driving this growth include the rise of digital banking, increasing investments in technology, and a growing demand for personalized insurance products.Tell us your focus area and get a customized research report.

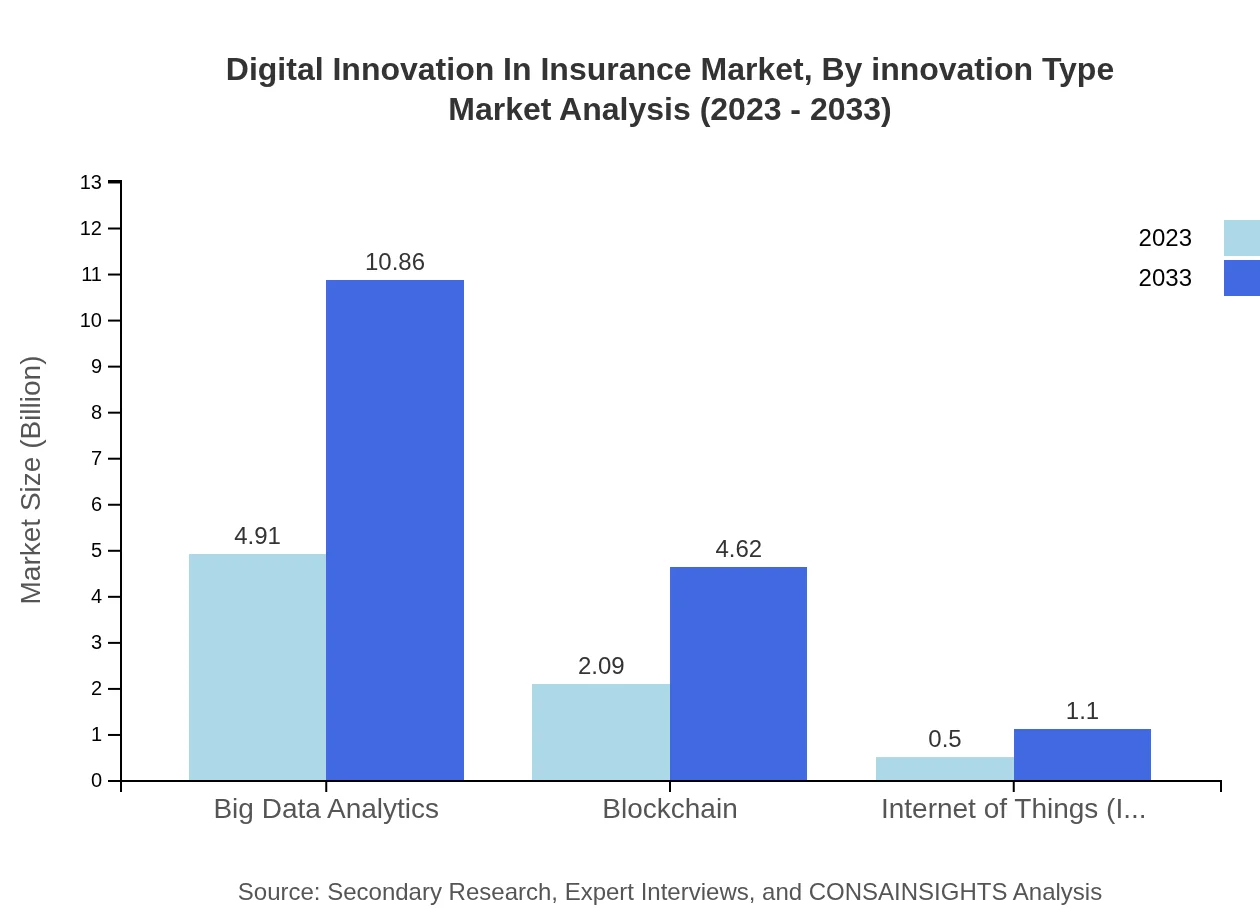

Digital Innovation In Insurance Market Analysis By Innovation Type

The Digital Innovation in Insurance market showcases a variety of innovation types, including Big Data Analytics, Blockchain, and AI. For instance, Big Data Analytics is projected to grow from $4.91 billion in 2023 to $10.86 billion in 2033, signifying its importance in risk assessment and customer insights. Similarly, Blockchain technology is expected to rise from $2.09 billion to $4.62 billion, enhancing transaction security and transparency.

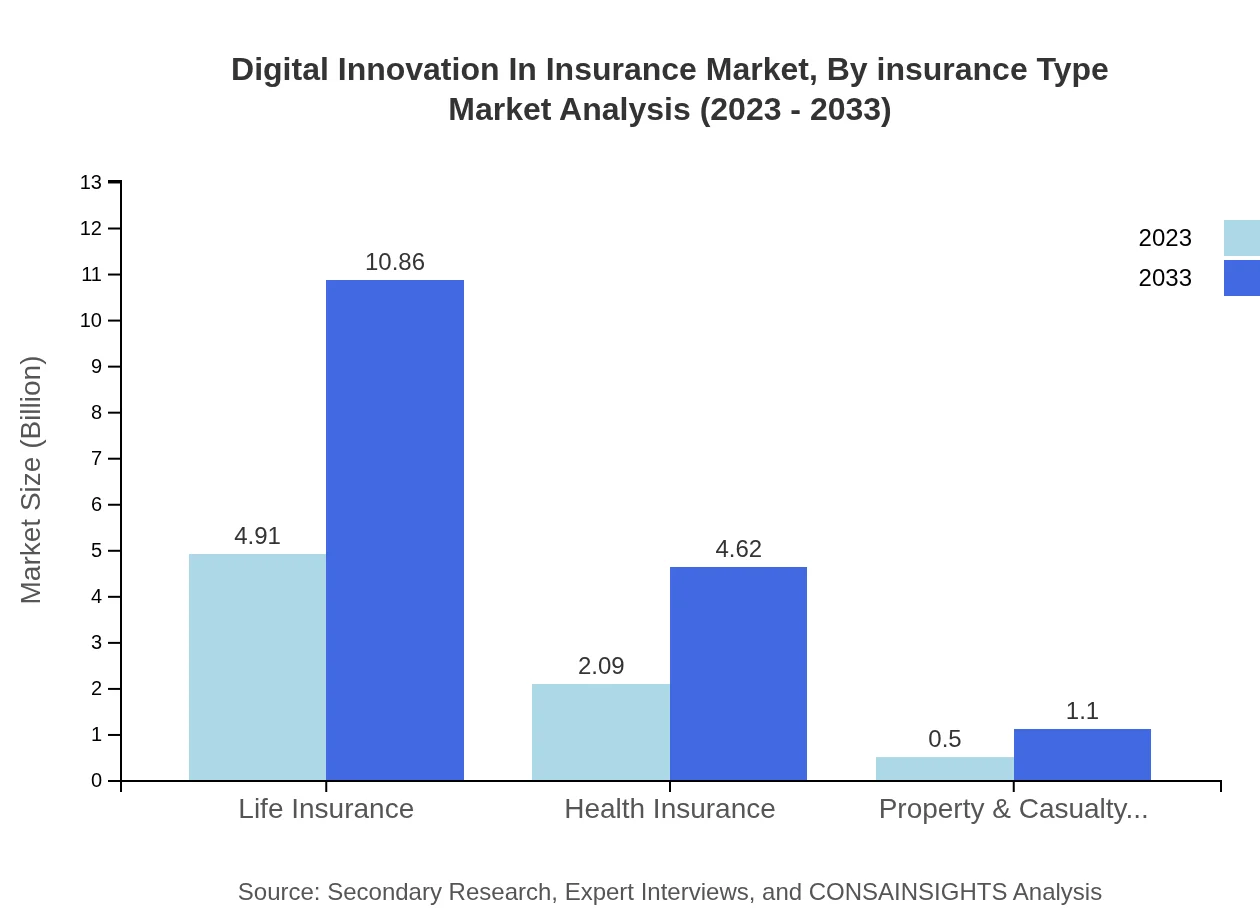

Digital Innovation In Insurance Market Analysis By Insurance Type

Segmentation by insurance type shows significant insights into consumer preferences. Life Insurance dominates the segment, with a market value growing from $4.91 billion in 2023 to $10.86 billion by 2033. Health Insurance follows with substantial potential, projected to grow from $2.09 billion to $4.62 billion due to rising healthcare costs and demand for insurance products tailored to health services.

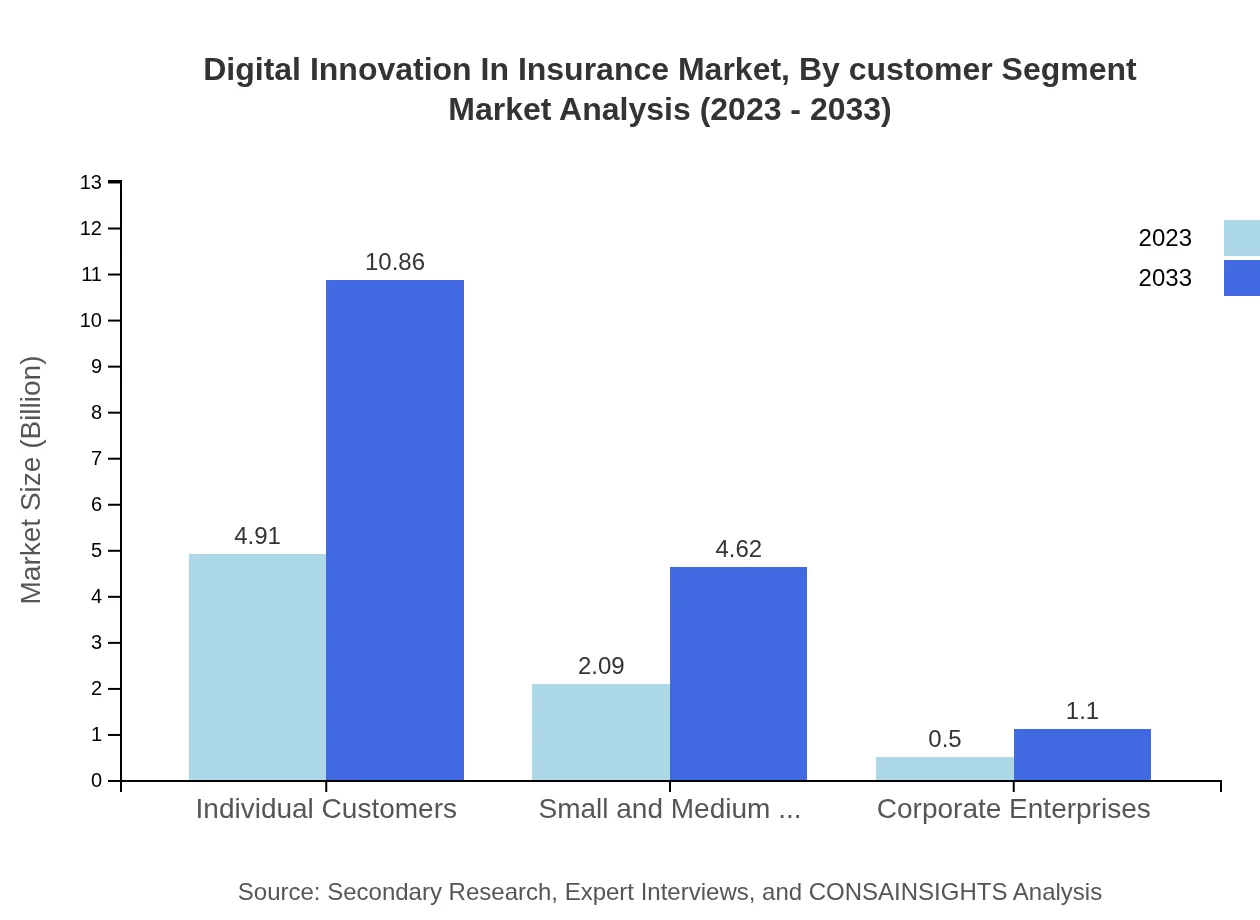

Digital Innovation In Insurance Market Analysis By Customer Segment

The market segments by customer type include Individual Customers and Corporate Enterprises. Individual Customers represent a significant portion, expanding from $4.91 billion in 2023 to $10.86 billion in 2033, driven by the growth of direct sales channels. In comparison, Corporate Enterprises will see lesser growth, from $0.50 billion to $1.10 billion, reflecting their specific needs in tailored insurance solutions.

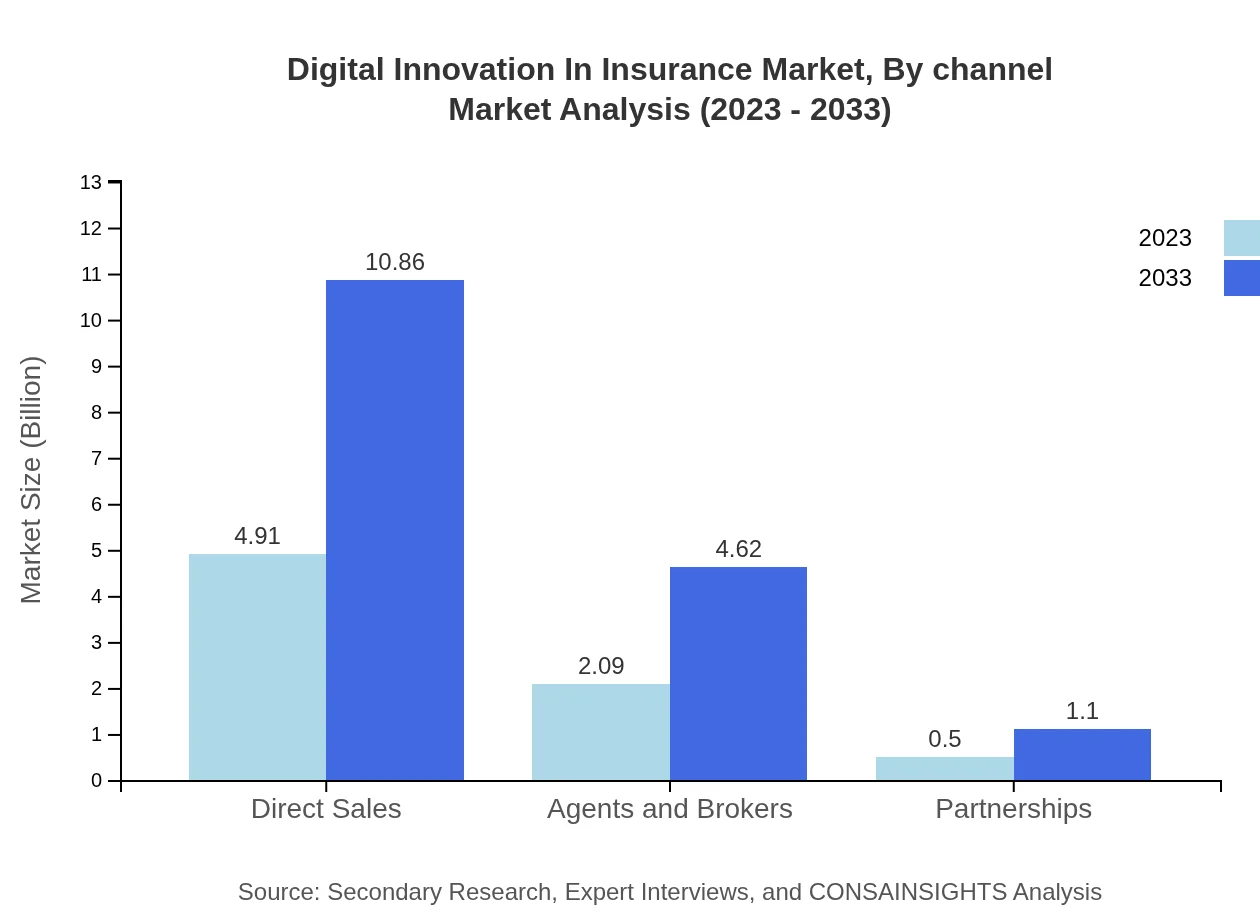

Digital Innovation In Insurance Market Analysis By Channel

Distribution channels include Direct Sales, Agents and Brokers. Direct Sales are leading the channel segment with an anticipated rise from $4.91 billion to $10.86 billion by 2033, showcasing the effective shift towards online sales models. Agents and Brokers hold a smaller segment, projected to increase from $2.09 billion to $4.62 billion, yet remain significant for personalized customer service.

Digital Innovation In Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Innovation In Insurance Industry

IBM:

IBM is at the forefront of digital strategies in insurance, offering AI-driven solutions that enhance data analysis and customer engagement.Cognizant:

Cognizant provides innovative consulting services and technology-driven insurance solutions, helping firms transition to digital models effectively.SAP:

SAP specializes in data management and integration solutions that provide insurers with tools for operational efficiency and customer insights.Accenture:

Accenture leads in providing technology and consulting services tailored for insurance companies, focusing on digital transformation and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Digital Innovation in Insurance?

The Digital Innovation in Insurance market is valued at $7.5 billion in 2023, with a projected growth at a CAGR of 8.0%, indicating substantial expansion and increasing demand for digital solutions in the insurance sector.

What are the key market players or companies in the Digital Innovation in Insurance industry?

Key players in the Digital Innovation in Insurance industry include major insurers, tech startups, and companies specializing in InsurTech services that are pioneering digital solutions such as AI, big data analytics, and blockchain-based insurance platforms.

What are the primary factors driving the growth in the Digital Innovation in Insurance industry?

Key growth drivers in the Digital Innovation in Insurance industry include the increasing adoption of advanced technologies, consumer demand for personalized services, regulatory changes promoting digitalization, and the need for improved operational efficiencies in insurance processes.

Which region is the fastest Growing in the Digital Innovation in Insurance?

The fastest-growing region in the Digital Innovation in Insurance market is North America, projected to grow from $2.57 billion in 2023 to $5.68 billion by 2033, fueled by strong technological advancements and a robust insurance infrastructure.

Does ConsaInsights provide customized market report data for the Digital Innovation in Insurance industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Digital Innovation in Insurance industry, allowing clients to gain targeted insights and actionable intelligence.

What deliverables can I expect from this Digital Innovation in Insurance market research project?

From the market research project on Digital Innovation in Insurance, you can expect comprehensive reports, data analysis, trend evaluations, competitive assessments, and region-specific insights that inform strategic decisions.

What are the market trends of Digital Innovation in Insurance?

Current trends in Digital Innovation in Insurance include increasing reliance on big data analytics for risk assessment, the growth of fully digital insurance models, integration of AI and machine learning, and emerging solutions like blockchain and IoT technologies.