Digital Inspection Market Report

Published Date: 22 January 2026 | Report Code: digital-inspection

Digital Inspection Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Digital Inspection market from 2023 to 2033, delivering insights on market dynamics, size, growth forecast, regional trends, industry segmentation, and leading players, thereby providing a comprehensive understanding to inform strategic decision-making.

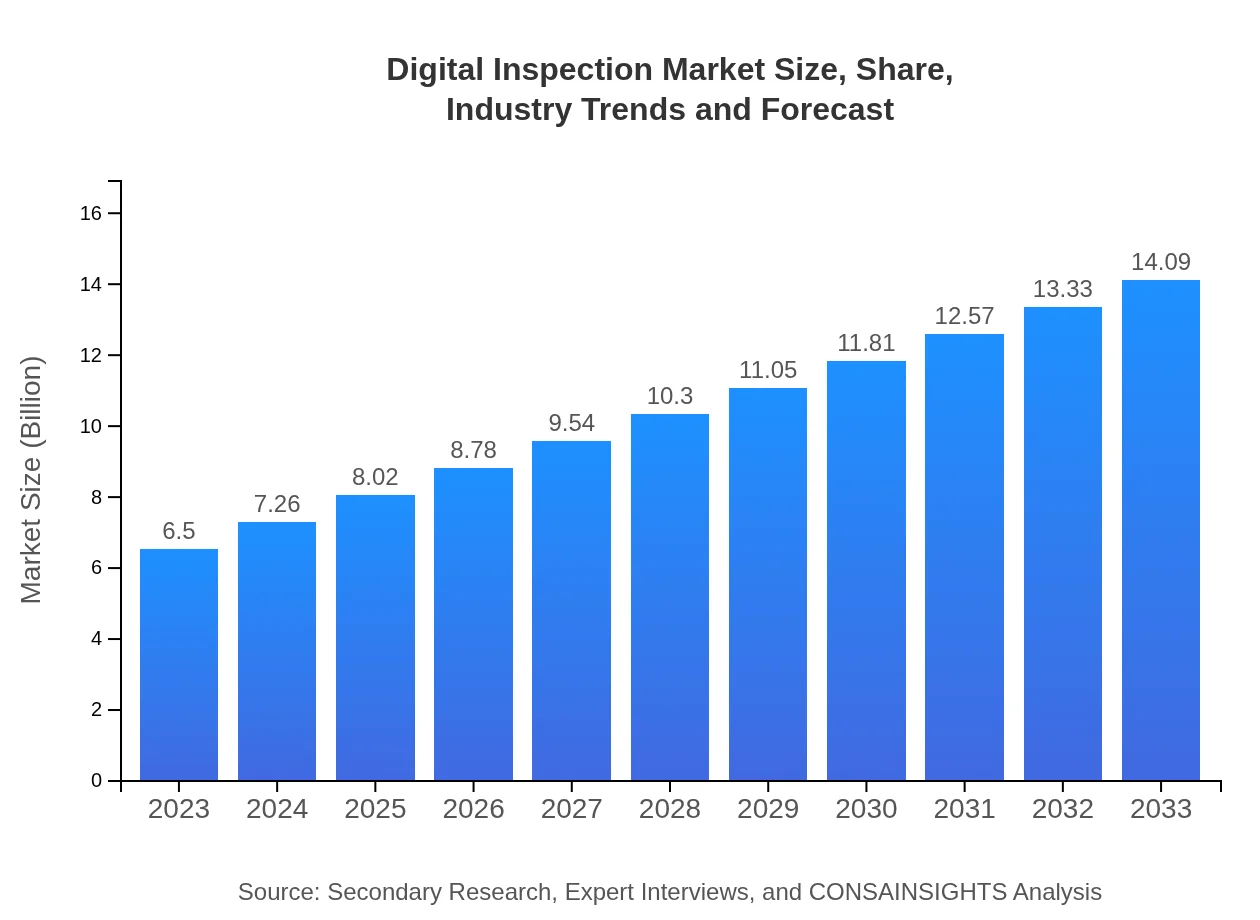

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $14.09 Billion |

| Top Companies | Siemens AG, General Electric, FLIR Systems, Mistras Group |

| Last Modified Date | 22 January 2026 |

Digital Inspection Market Overview

Customize Digital Inspection Market Report market research report

- ✔ Get in-depth analysis of Digital Inspection market size, growth, and forecasts.

- ✔ Understand Digital Inspection's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Inspection

What is the Market Size & CAGR of Digital Inspection market in 2023?

Digital Inspection Industry Analysis

Digital Inspection Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Inspection Market Analysis Report by Region

Europe Digital Inspection Market Report:

The European market showcases significant growth potential, expanding from $1.72 billion in 2023 to approximately $3.74 billion by 2033. Europe is home to numerous manufacturing hubs and a strong focus on technological innovation, positioning it as a leader in implementing digital inspection technologies across different industries, particularly in the automotive and aerospace sectors.Asia Pacific Digital Inspection Market Report:

In the Asia Pacific region, the Digital Inspection market is projected to grow from $1.27 billion in 2023 to $2.76 billion by 2033. Increased industrial activity, particularly in countries like China and India, is propelling demand for advanced inspection solutions. Adoption of IoT technologies and rising investments in infrastructure and manufacturing are key drivers of growth in this region.North America Digital Inspection Market Report:

North America commands a substantial share of the Digital Inspection market, with its size expected to increase from $2.44 billion in 2023 to $5.29 billion by 2033. The U.S. and Canada lead in adoption due to robust manufacturing sectors and stringent regulations demanding high-quality standards. Moreover, increased investment in technology is spurring market advancements.South America Digital Inspection Market Report:

The market in South America is smaller but shows promise, growing from $0.20 billion in 2023 to $0.43 billion by 2033. Countries like Brazil and Argentina are exploring digital solutions to enhance industrial processes amidst evolving regulatory landscapes which demand stricter compliance and inspection protocols.Middle East & Africa Digital Inspection Market Report:

In the Middle East and Africa, the market is forecasted to grow from $0.86 billion in 2023 to $1.86 billion by 2033. The increasing focus on infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries, and rising demand for high safety standards in oil and gas, are significant growth contributors in this region.Tell us your focus area and get a customized research report.

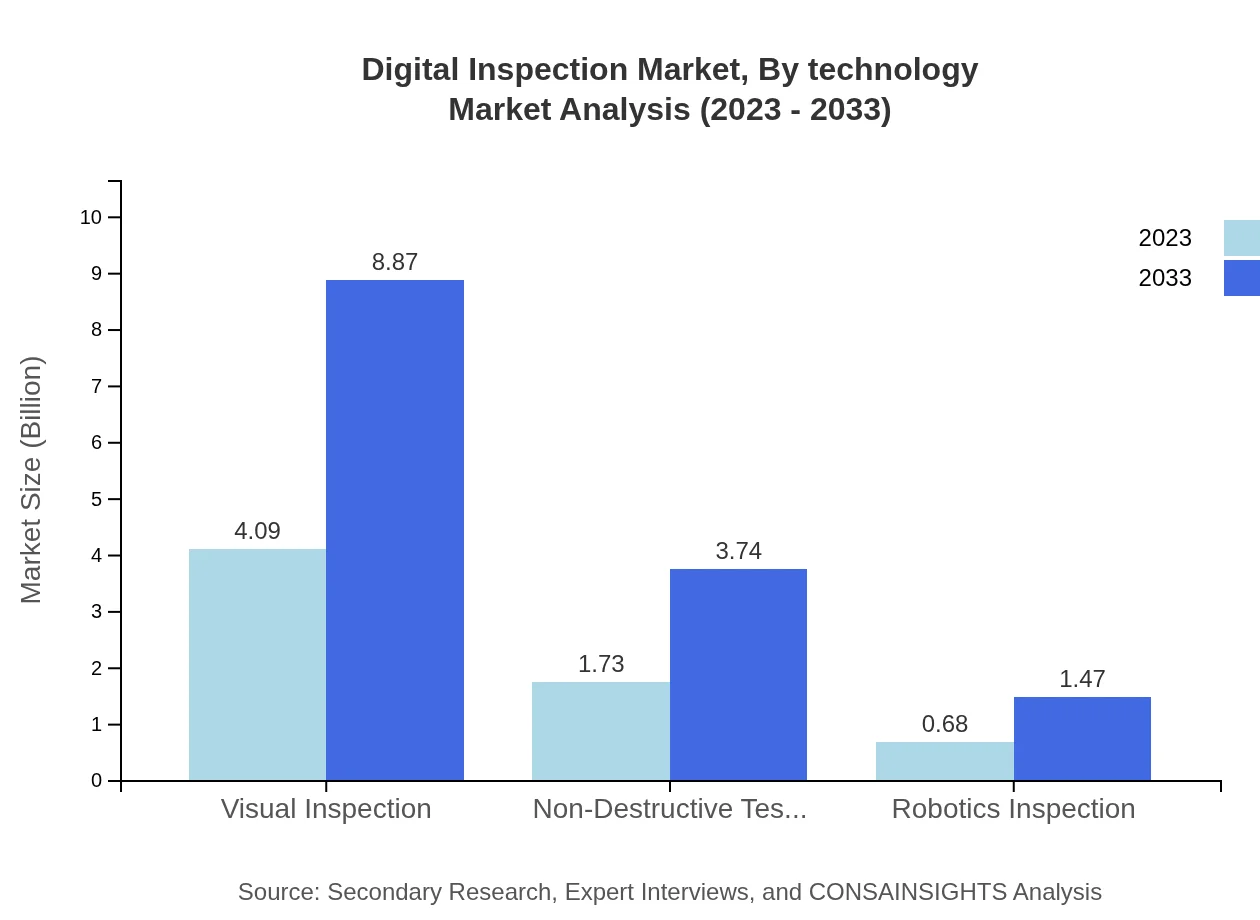

Digital Inspection Market Analysis By Technology

The Digital Inspection market showcases diverse technologies, including Non-Destructive Testing (NDT), visual inspection, and robotics inspection. As of 2023, visual inspection holds the largest share, valued at 4.09 billion with a projected growth to 8.87 billion by 2033. NDT is another critical segment, expanding from 1.73 billion to 3.74 billion in the same timeframe. Robotics inspection, though smaller currently, is set to grow significantly, indicative of trends toward automation and efficiency in inspection processes.

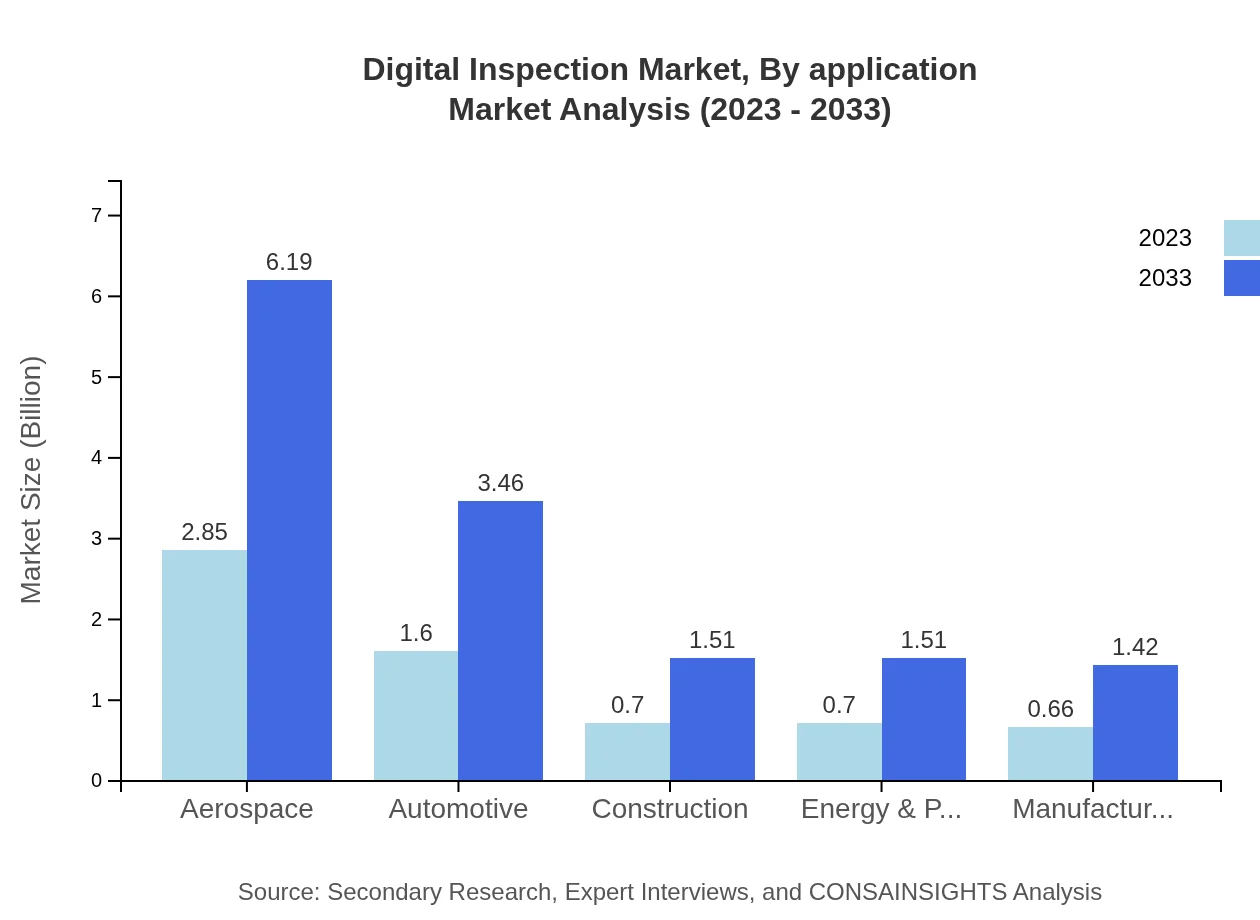

Digital Inspection Market Analysis By Application

Applications of Digital Inspection span quality control, preventive maintenance, and compliance verification. Each application offers unique benefits and addresses specific industry challenges. For example, quality control is critical in manufacturing, while preventive maintenance is increasingly essential in sectors like oil and gas. Each application segment is expected to expand, driven by growing awareness of the benefits of adopting digital inspection solutions.

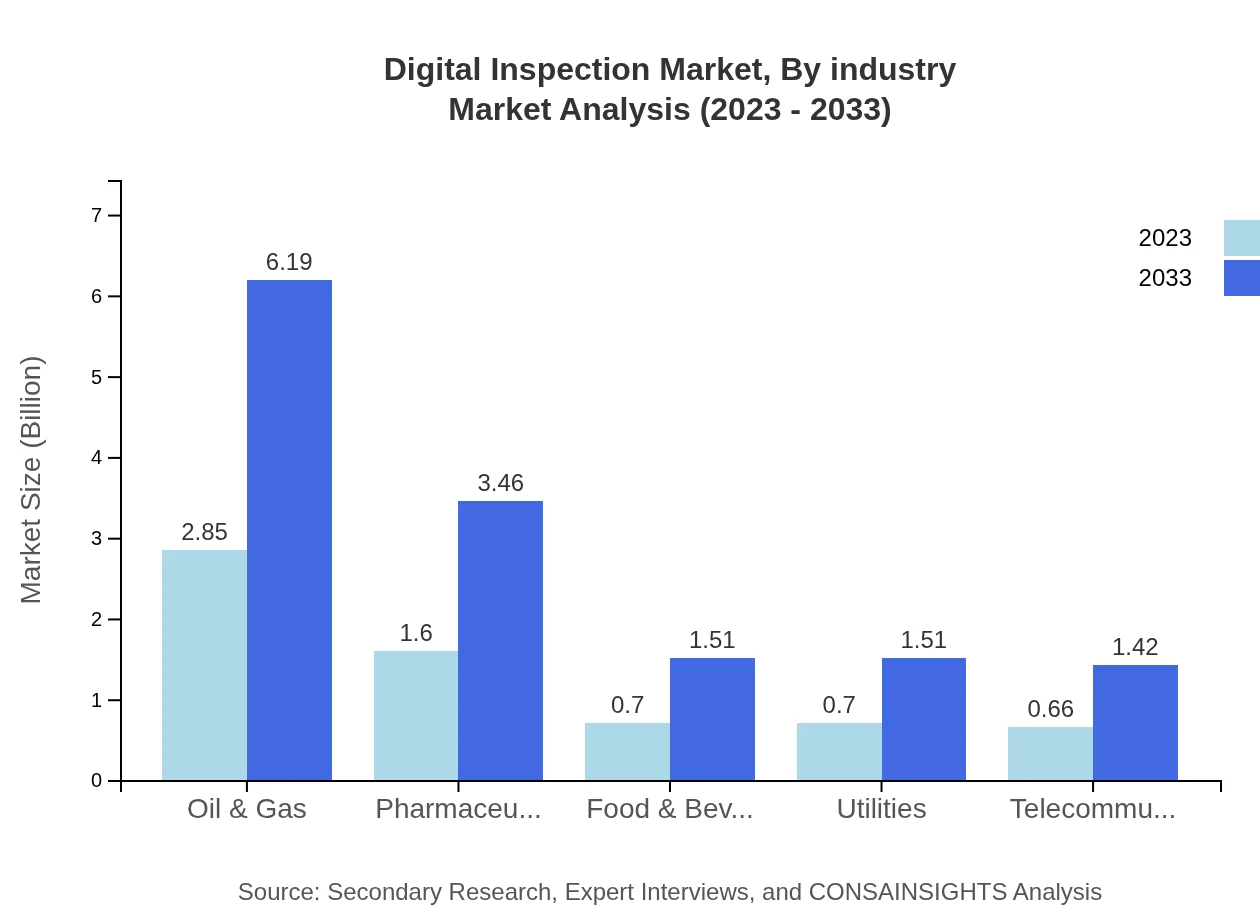

Digital Inspection Market Analysis By Industry

Key industries utilizing digital inspection technologies include oil & gas, pharmaceuticals, food & beverage, aerospace, and automotive. The oil & gas industry leads with a market size of 2.85 billion in 2023, forecasted to grow to 6.19 billion by 2033. The pharmaceutical sector is also significant, alongside the food and beverage industry, each contributing vital market share and showcasing the overall industry’s diversification.

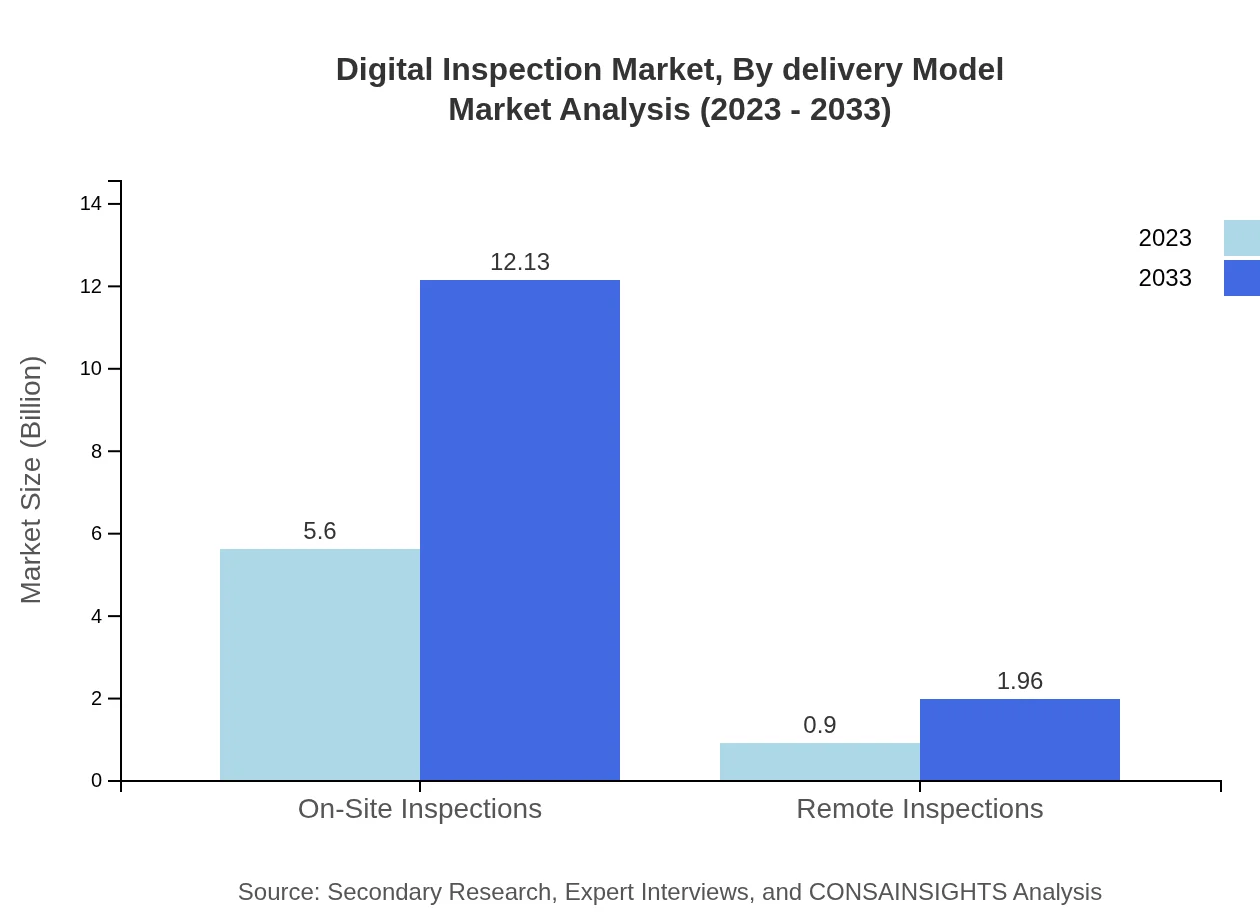

Digital Inspection Market Analysis By Delivery Model

The market is divided into on-site and remote inspections, with on-site inspections dominating the segment with a market size of 5.60 billion in 2023. Remote inspections are gaining traction, growing from 0.90 billion to 1.96 billion by 2033, owing to advancements in technology enabling more effective remote monitoring solutions, proving critical especially during global disruptions like pandemics.

Digital Inspection Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Inspection Industry

Siemens AG:

Siemens AG is a global technology company that specializes in automation and digitization in the industrial sector. The organization offers advanced digital inspection solutions that enhance manufacturing processes while ensuring compliance and safety.General Electric:

General Electric (GE) is renowned for its focus on innovation in technologies including industrial inspection and NDT solutions, catering to critical sectors such as aviation, power generation, and renewable energy.FLIR Systems:

FLIR Systems is a leader in thermal imaging, offering a range of digital inspection products tailored for industrial applications across sectors like manufacturing and utilities.Mistras Group:

Mistras Group provides asset protection solutions and has developed extensive expertise in digital inspection, non-destructive testing, and advanced inspection technologies across various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Inspection?

The digital inspection market is valued at approximately $6.5 billion in 2023, with an anticipated CAGR of 7.8%, indicating robust growth in the sector. By 2033, the market is expected to expand significantly, reflecting increased demand across various industries.

What are the key market players or companies in this digital Inspection industry?

The digital inspection industry features major players including leaders in technology development, inspection services, and automation. Companies actively contributing to market growth typically invest in innovative solutions tailored for optimal quality assurance.

What are the primary factors driving the growth in the digital Inspection industry?

Key factors driving growth in the digital-inspection industry include rising regulatory compliance demands, increased focus on quality assurance, and advancements in technology that enable efficient inspection processes, appealing to diverse sectors.

Which region is the fastest Growing in the digital Inspection?

North America is the fastest-growing region in the digital inspection market, expected to expand from $2.44 billion in 2023 to $5.29 billion by 2033. This growth is driven by technological advancements and rising adoption rates across various industries.

Does ConsaInsights provide customized market report data for the digital Inspection industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the digital-inspection industry, empowering clients to access insights that are most relevant to their strategic decisions and operational planning.

What deliverables can I expect from this digital Inspection market research project?

From this digital inspection market research project, clients can expect comprehensive reports including market size analysis, growth forecasts, regional breakdowns, and insights into key market segments, trends, and competitive landscape.

What are the market trends of digital Inspection?

Current market trends in digital inspection highlight a shift towards automation, increased usage of AI technologies, and a growing emphasis on sustainability and efficiency in inspection practices across sectors.