Digital Insurance Platform Market Report

Published Date: 31 January 2026 | Report Code: digital-insurance-platform

Digital Insurance Platform Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Digital Insurance Platform market, including market dynamics, segmentation, regional insights, and future forecasts for 2023-2033. Key insights on market leaders and technological advancements are also discussed.

| Metric | Value |

|---|---|

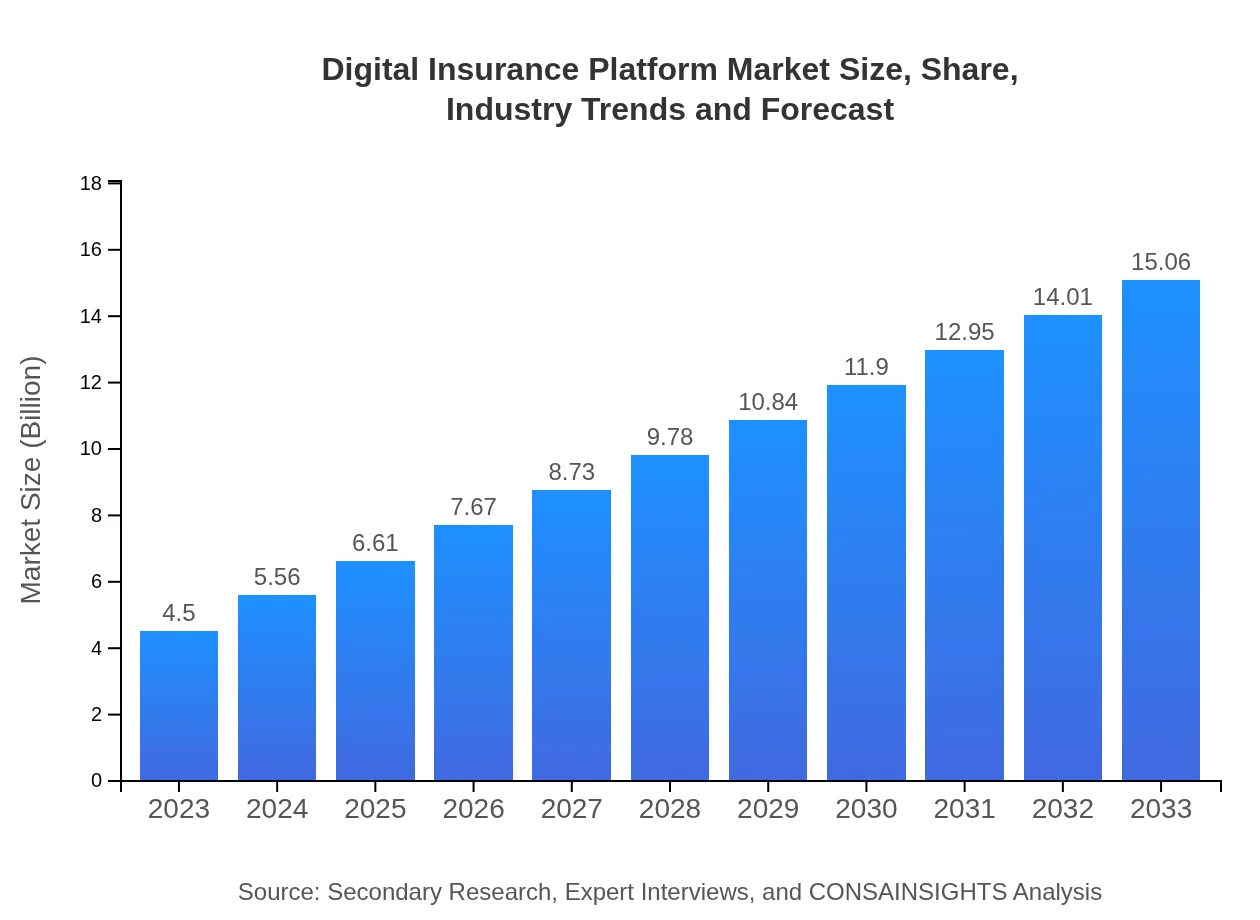

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $15.06 Billion |

| Top Companies | Shift Technology, Zego, Guidewire Software |

| Last Modified Date | 31 January 2026 |

Digital Insurance Platform Market Overview

Customize Digital Insurance Platform Market Report market research report

- ✔ Get in-depth analysis of Digital Insurance Platform market size, growth, and forecasts.

- ✔ Understand Digital Insurance Platform's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Insurance Platform

What is the Market Size & CAGR of Digital Insurance Platform market in 2023?

Digital Insurance Platform Industry Analysis

Digital Insurance Platform Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Insurance Platform Market Analysis Report by Region

Europe Digital Insurance Platform Market Report:

The European market for Digital Insurance Platforms is forecasted to rise from $1.23 billion in 2023 to $4.12 billion by 2033. The emphasis on regulation and compliance along with advancements in customer engagement technologies drive market expansion in Europe.Asia Pacific Digital Insurance Platform Market Report:

The Asia Pacific region's Digital Insurance Platform market is projected to grow from $0.88 billion in 2023 to $2.96 billion by 2033. Factors such as digital transformation among insurers and increasing penetration of insurance in emerging economies accelerate growth in this region.North America Digital Insurance Platform Market Report:

North America exhibits the largest market for Digital Insurance Platforms, anticipated to grow from $1.61 billion in 2023 to $5.40 billion by 2033. The established presence of leading technology firms and high consumer demand for digital products underscore the region's growth prospects.South America Digital Insurance Platform Market Report:

In South America, the market is expected to increase from $0.30 billion in 2023 to $0.99 billion by 2033. A surge in mobile device usage and digital payment solutions significantly supports the adoption of digital insurance platforms in this region.Middle East & Africa Digital Insurance Platform Market Report:

The Middle East and Africa region shows robust growth from $0.48 billion in 2023 to $1.60 billion by 2033, driven by increasing internet penetration and evolving financial technologies.Tell us your focus area and get a customized research report.

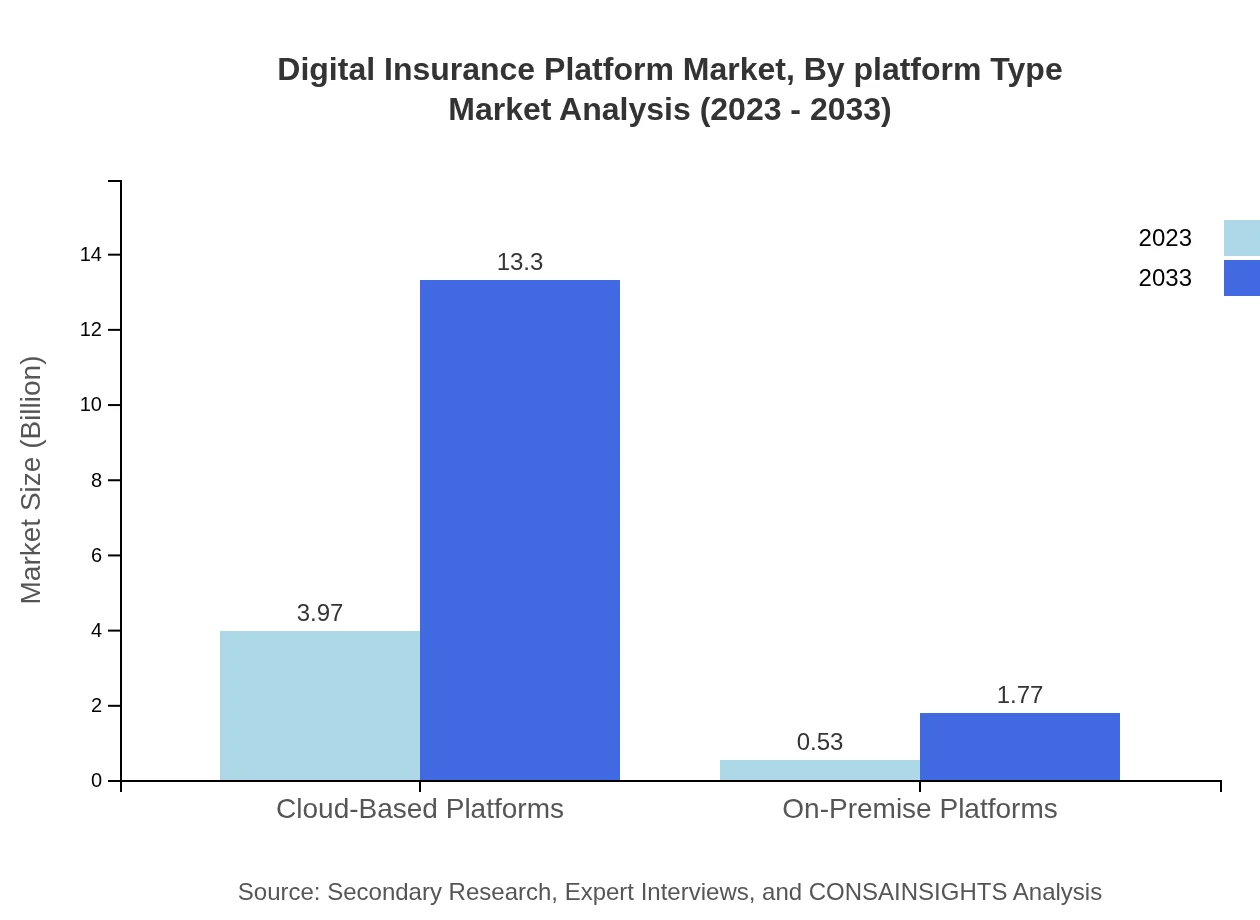

Digital Insurance Platform Market Analysis By Platform Type

The platform type segmentation shows a significant inclination towards cloud-based platforms, accounting for $3.97 billion in 2023 and projected to grow to $13.30 billion by 2033. In contrast, on-premise platforms are expected to move from $0.53 billion to $1.77 billion in the same timeframe.

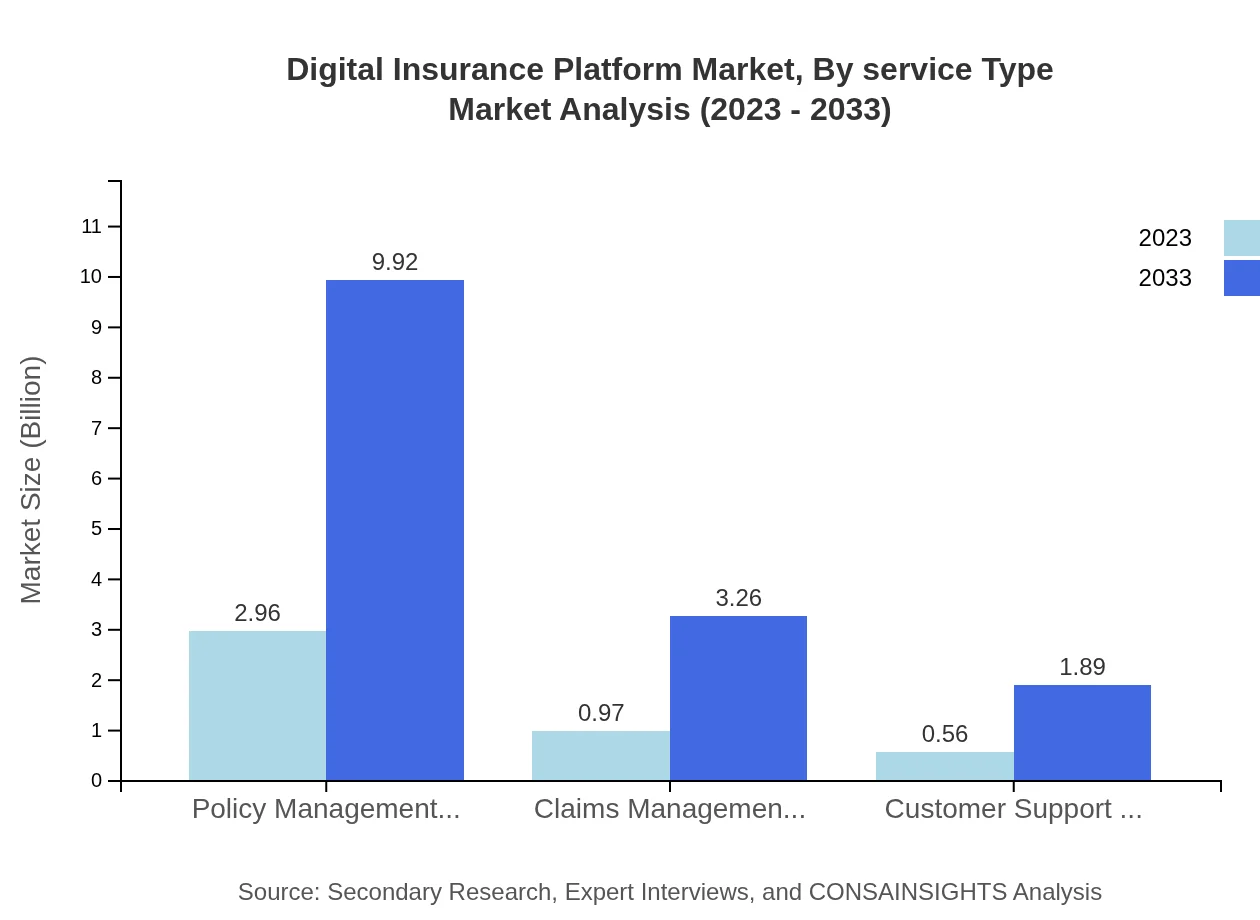

Digital Insurance Platform Market Analysis By Service Type

Service type analysis reflects that policy management services lead with a market size of $2.96 billion in 2023, expected to double to $9.92 billion by 2033. Claims management follows closely, with an increase from $0.97 billion to $3.26 billion in the same decade.

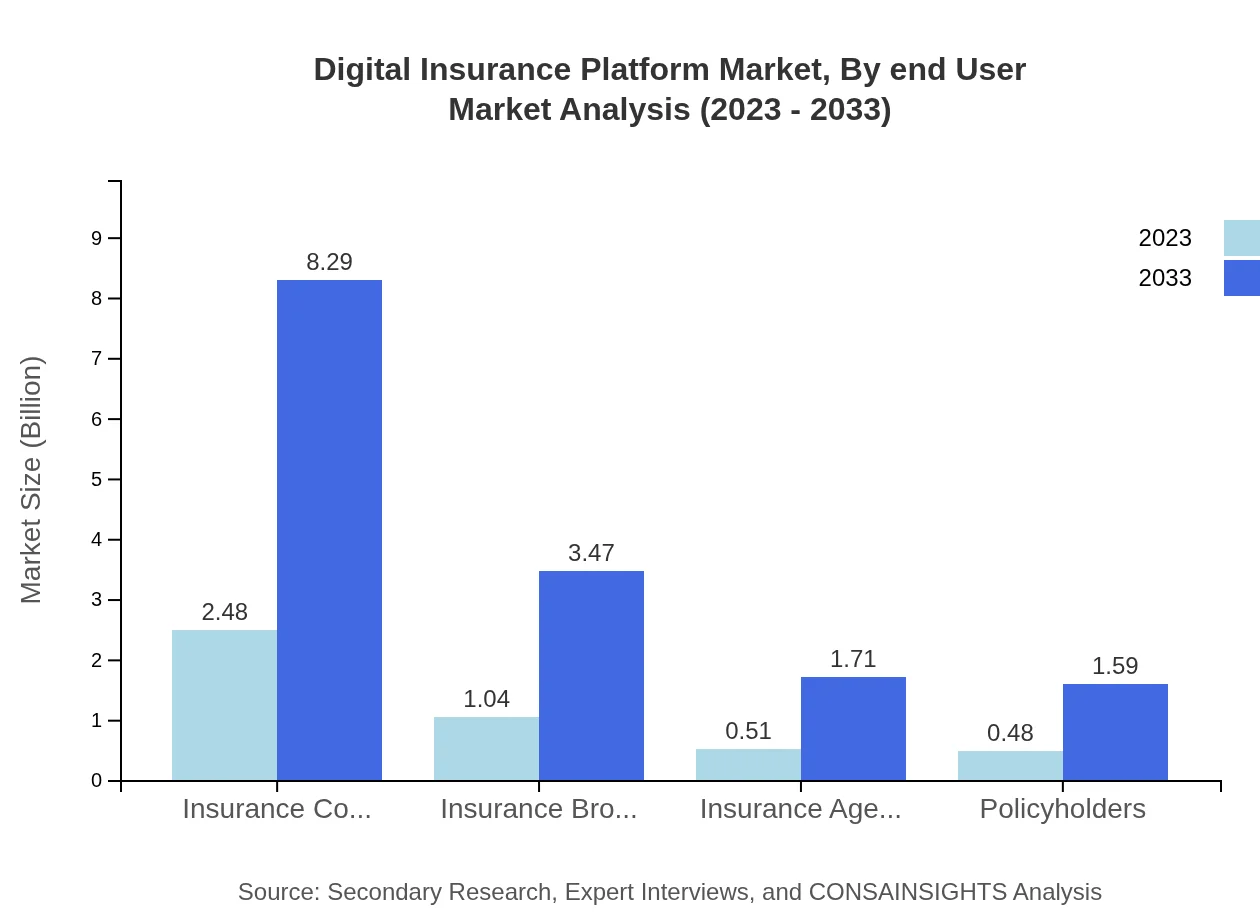

Digital Insurance Platform Market Analysis By End User

Insurance companies are the largest end-users, with a market size of $2.48 billion in 2023 and anticipated growth to $8.29 billion by 2033. Brokers and agents also represent significant segments, with respective sizes moving from $1.04 billion to $3.47 billion, and $0.51 billion to $1.71 billion over the same period.

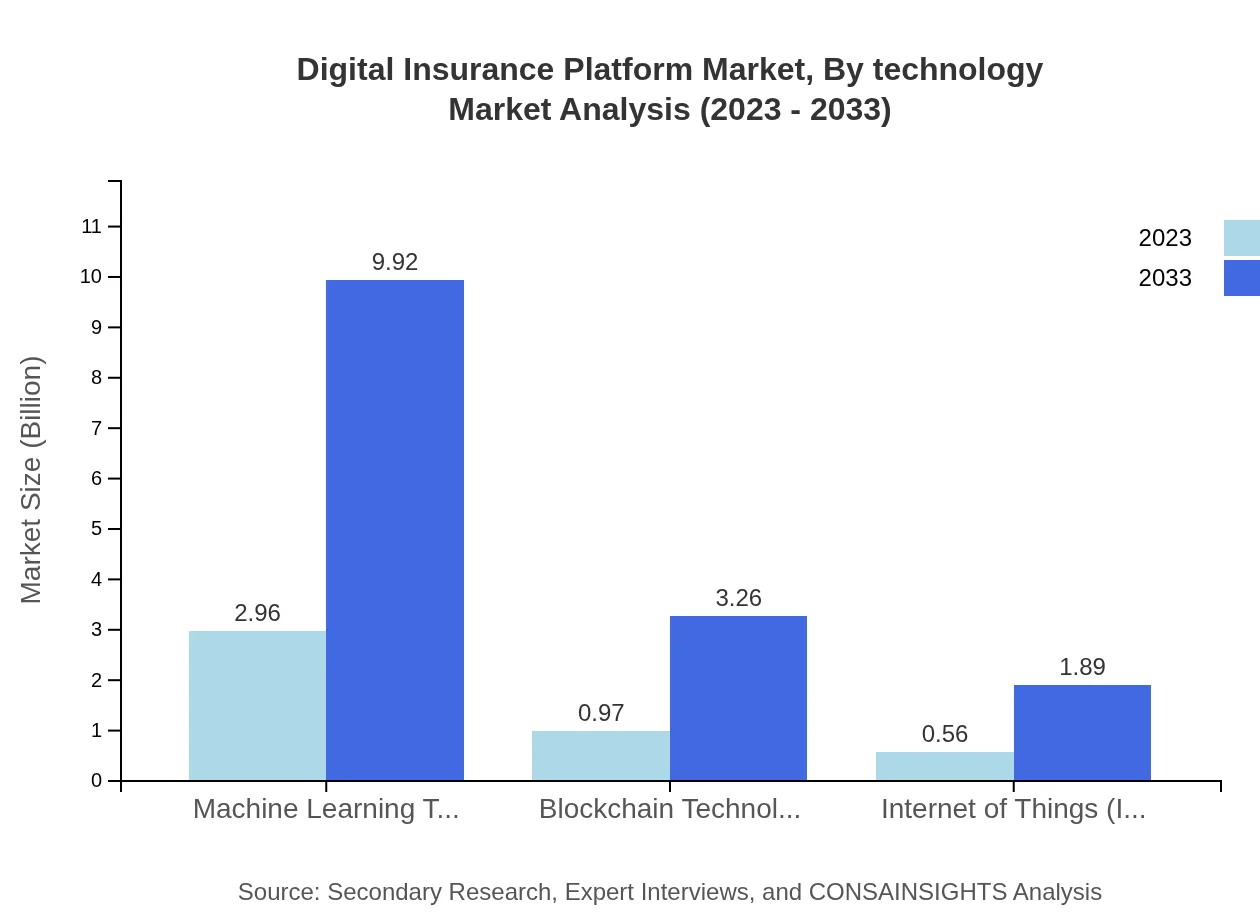

Digital Insurance Platform Market Analysis By Technology

The technology segment sees machine learning technologies taking a staggering share with a market size of $2.96 billion in 2023, forecasted to grow to $9.92 billion by 2033. Additionally, blockchain technology and IoT are notable contenders, with blockchain rising from $0.97 billion to $3.26 billion, and IoT expanding from $0.56 billion to $1.89 billion.

Digital Insurance Platform Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Insurance Platform Industry

Shift Technology:

Shift Technology utilizes AI to enhance fraud detection and streamline claims processing for insurers, making it a leader in digital insurance innovation.Zego:

Zego offers flexible insurance solutions, and its platform serves the needs of businesses transitioning to digital operations while providing personalized services.Guidewire Software:

Guidewire provides a comprehensive suite of software solutions for property and casualty insurers, facilitating enhanced operational efficiency and seamless user experiences.We're grateful to work with incredible clients.

FAQs

What is the market size of Digital Insurance Platform?

The global Digital Insurance Platform market is currently valued at $4.5 billion with a substantial CAGR of 12.3%. By 2033, the market is projected to grow significantly, reflecting robust advancements in technology and service offerings.

What are the key market players or companies in this Digital Insurance Platform industry?

Key players in the Digital Insurance Platform market include major insurance companies, technology firms such as those specializing in automation, artificial intelligence, and data analytics, as well as service providers focusing on cloud-based and on-premise solutions.

What are the primary factors driving the growth in the Digital Insurance Platform industry?

Significant driving factors include the increasing adoption of technology in insurance, demand for automation, enhancements in customer experience through digital channels, and a shift towards data-driven decision-making processes within the industry.

Which region is the fastest Growing in the Digital Insurance Platform?

The fastest-growing region in the Digital Insurance Platform market is North America, projected to rise from $1.61 billion in 2023 to $5.40 billion by 2033. Other regions also show potential, notably Europe and Asia Pacific, indicating widespread growth.

Does ConsInsights provide customized market report data for the Digital Insurance Platform industry?

Yes, ConsInsights specializes in tailoring market report data, offering clients customizable insights into specific segments, trends, and forecasts relevant to the Digital Insurance Platform industry, ensuring alignment with individual business needs.

What deliverables can I expect from this Digital Insurance Platform market research project?

Deliverables include comprehensive market analysis reports, detailed forecasts, segmentation insights, competitive landscape assessments, and actionable recommendations tailored to enhance strategic decision-making for stakeholders in the Digital Insurance Platform sector.

What are the market trends of Digital Insurance Platform?

Current market trends include an increasing focus on leveraging machine learning and blockchain technology, a shift towards cloud-based platforms, and enhanced integration of IoT in insurance offerings, marking a transformative phase for the Digital Insurance Platform industry.