Digital Lending Platform Market Report

Published Date: 24 January 2026 | Report Code: digital-lending-platform

Digital Lending Platform Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Digital Lending Platform market from 2023 to 2033. It covers market trends, size, segments, regional insights, and future forecasts, offering valuable insights for stakeholders in the industry.

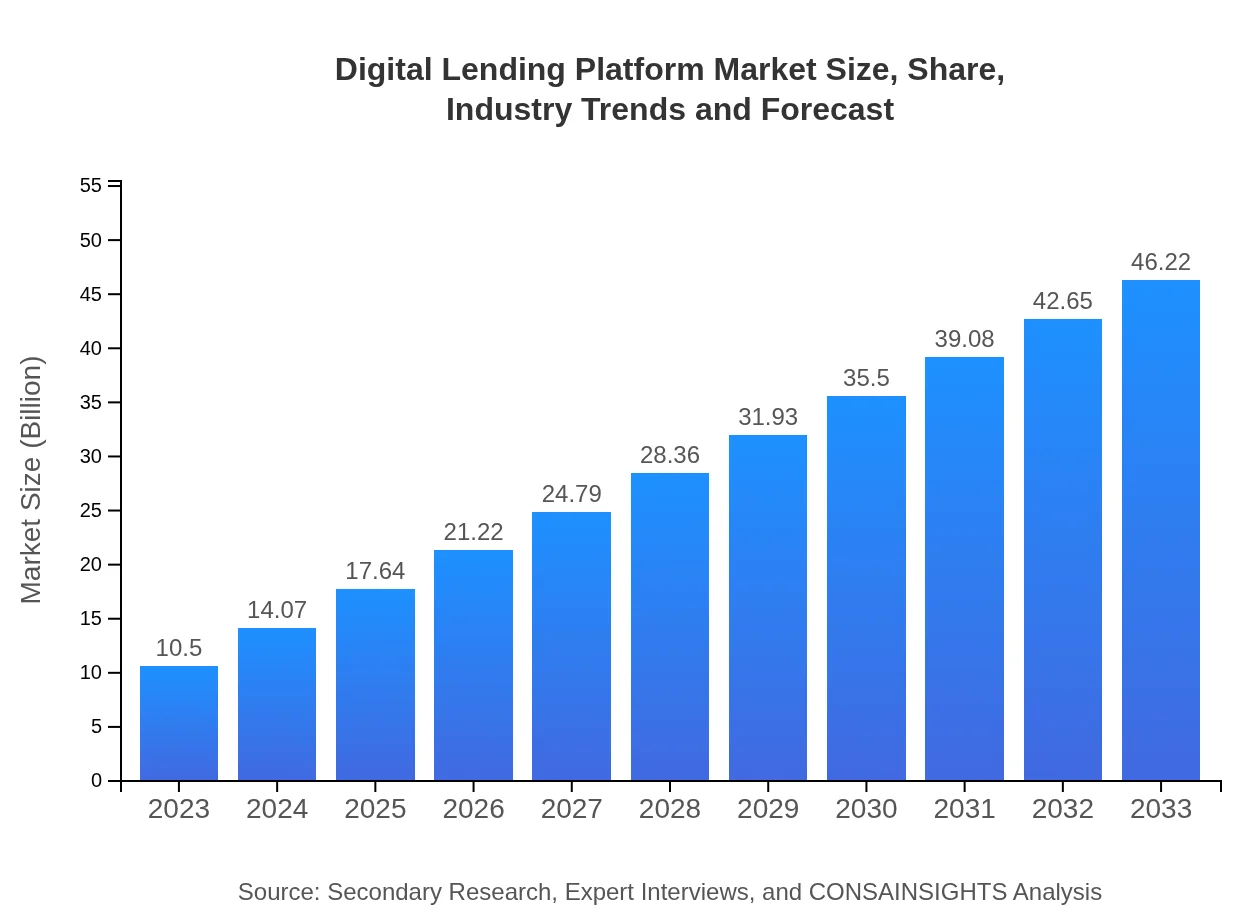

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $46.22 Billion |

| Top Companies | LendingClub, SoFi, Upstart, Kiva, Zopa |

| Last Modified Date | 24 January 2026 |

Digital Lending Platform Market Overview

Customize Digital Lending Platform Market Report market research report

- ✔ Get in-depth analysis of Digital Lending Platform market size, growth, and forecasts.

- ✔ Understand Digital Lending Platform's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Lending Platform

What is the Market Size & CAGR of Digital Lending Platform market in 2023?

Digital Lending Platform Industry Analysis

Digital Lending Platform Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Lending Platform Market Analysis Report by Region

Europe Digital Lending Platform Market Report:

In Europe, the market is valued at $2.66 billion in 2023 with expected growth to $11.69 billion by 2033. Strong regulatory frameworks and increasing investment in fintech innovations support the region's expansion in digital lending.Asia Pacific Digital Lending Platform Market Report:

In 2023, the Asia Pacific Digital Lending Platform market is valued at approximately $2.12 billion, expected to grow to $9.35 billion by 2033. This region is driven by the increasing smartphone penetration, digital payment adoption, and a growing middle class seeking accessible financing options.North America Digital Lending Platform Market Report:

North America leads the market with an estimated size of $3.83 billion in 2023, projected to reach $16.86 billion by 2033. The presence of established financial institutions and innovative fintech startups drives the adoption of digital lending platforms.South America Digital Lending Platform Market Report:

The South American market is projected to grow from $0.93 billion in 2023 to $4.07 billion by 2033. Factors such as a rising fintech ecosystem and the need for financial inclusion contribute to this growth as more consumers seek digital loan solutions.Middle East & Africa Digital Lending Platform Market Report:

The Middle East and Africa market is valued at $0.96 billion in 2023 and is projected to reach $4.25 billion by 2033, driven by increased smartphone usage and the push for financial services accessibility in emerging markets.Tell us your focus area and get a customized research report.

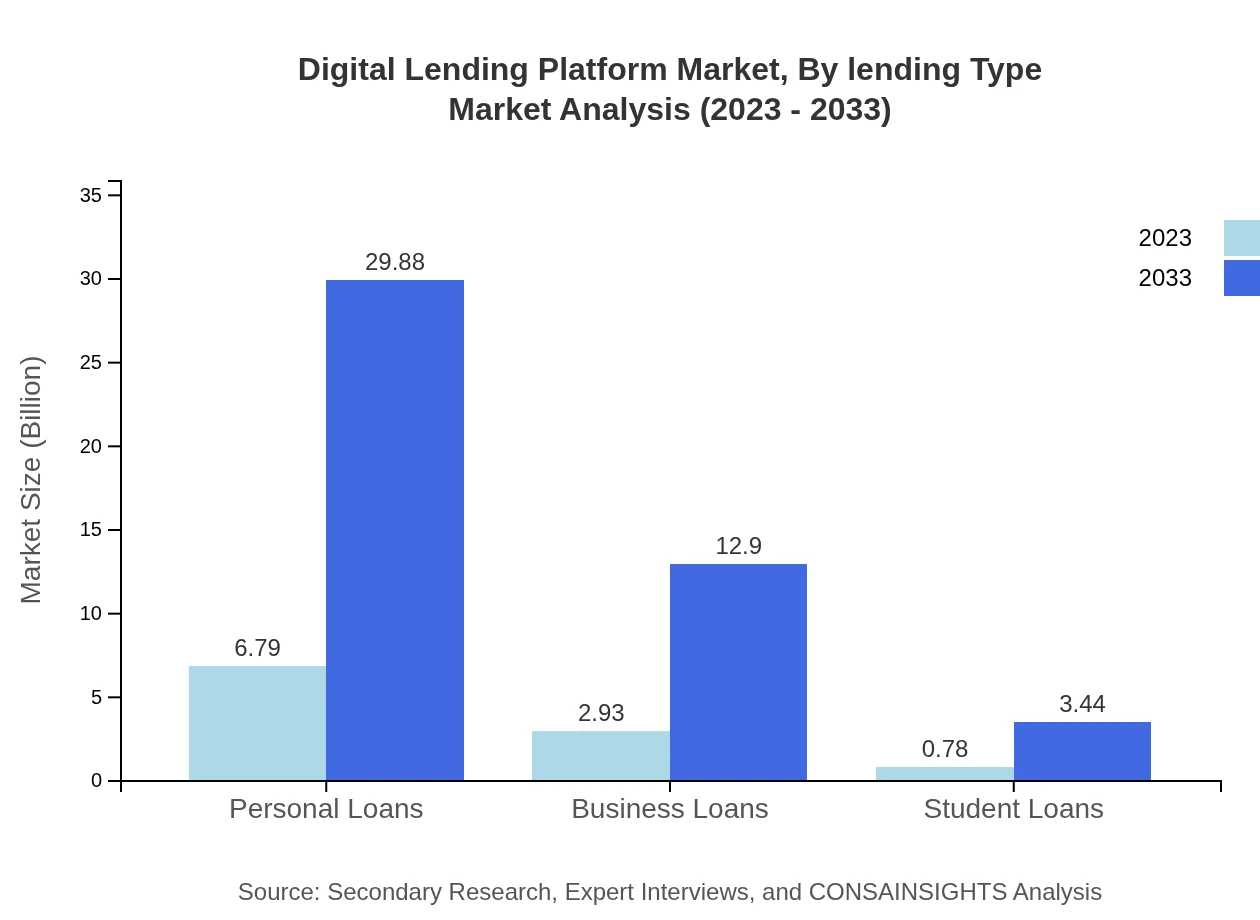

Digital Lending Platform Market Analysis By Lending Type

The analysis indicates a robust lending market across segments. Individual borrowers represent the largest share, with a market size of $6.79 billion in 2023, expected to grow to $29.88 billion by 2033. This segment accounts for 64.65% of the market share. Business borrowers follow, with a size of $2.93 billion in 2023 and a forecast of $12.90 billion in 2033, holding 27.91% market share. Lenders represent a small but growing segment, expected to reach $3.44 billion by 2033 from $0.78 billion in 2023, making up 7.44% of the market.

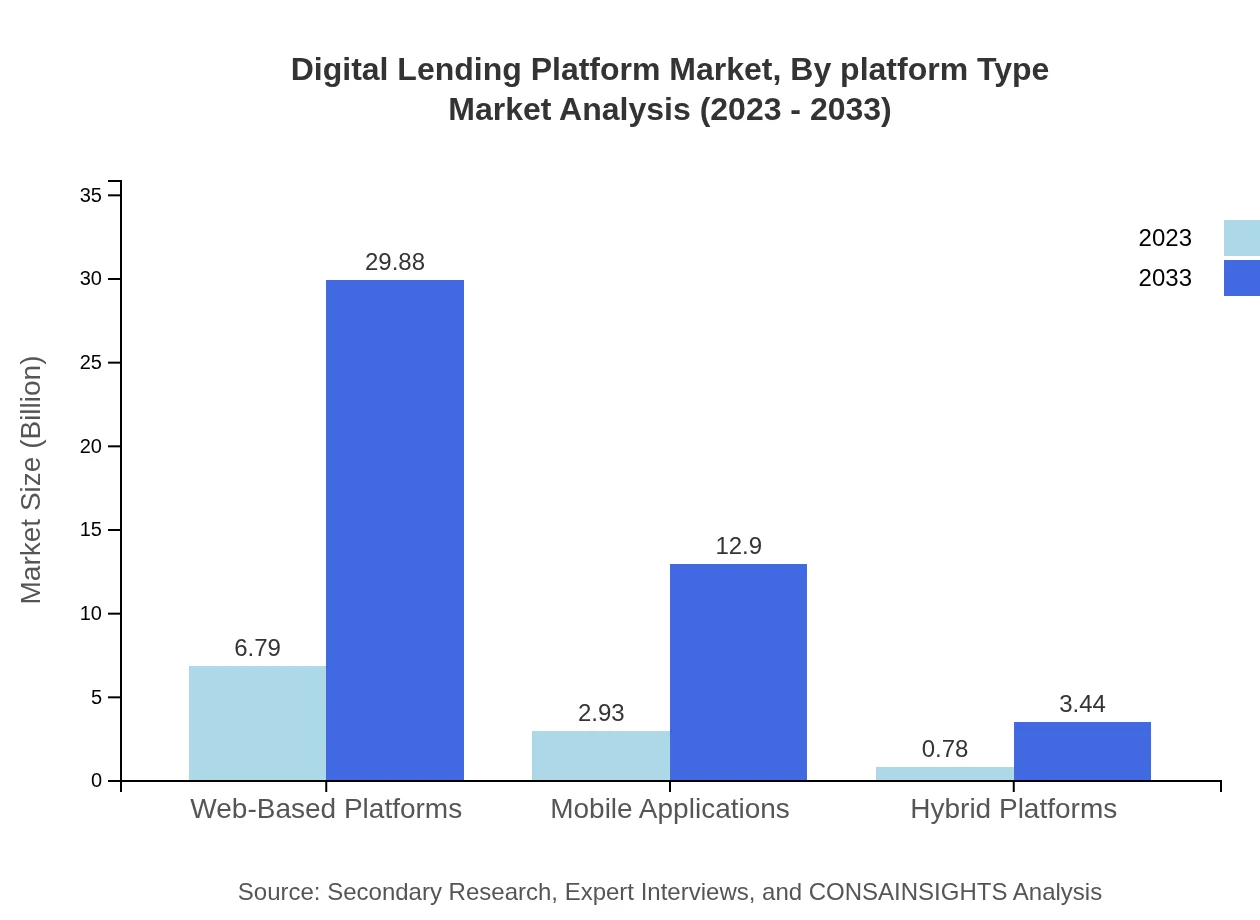

Digital Lending Platform Market Analysis By Platform Type

Web-based platforms dominate the Digital Lending Platform market, accounting for $6.79 billion in 2023 and projected to reach $29.88 billion by 2033, holding 64.65% of the market share. Mobile applications gain traction, expected to grow from $2.93 billion in 2023 to $12.90 billion by 2033, making up 27.91% of the market. Hybrid platforms, still an emerging segment, are anticipated to grow to $3.44 billion by 2033 from $0.78 billion in 2023, holding 7.44% market share.

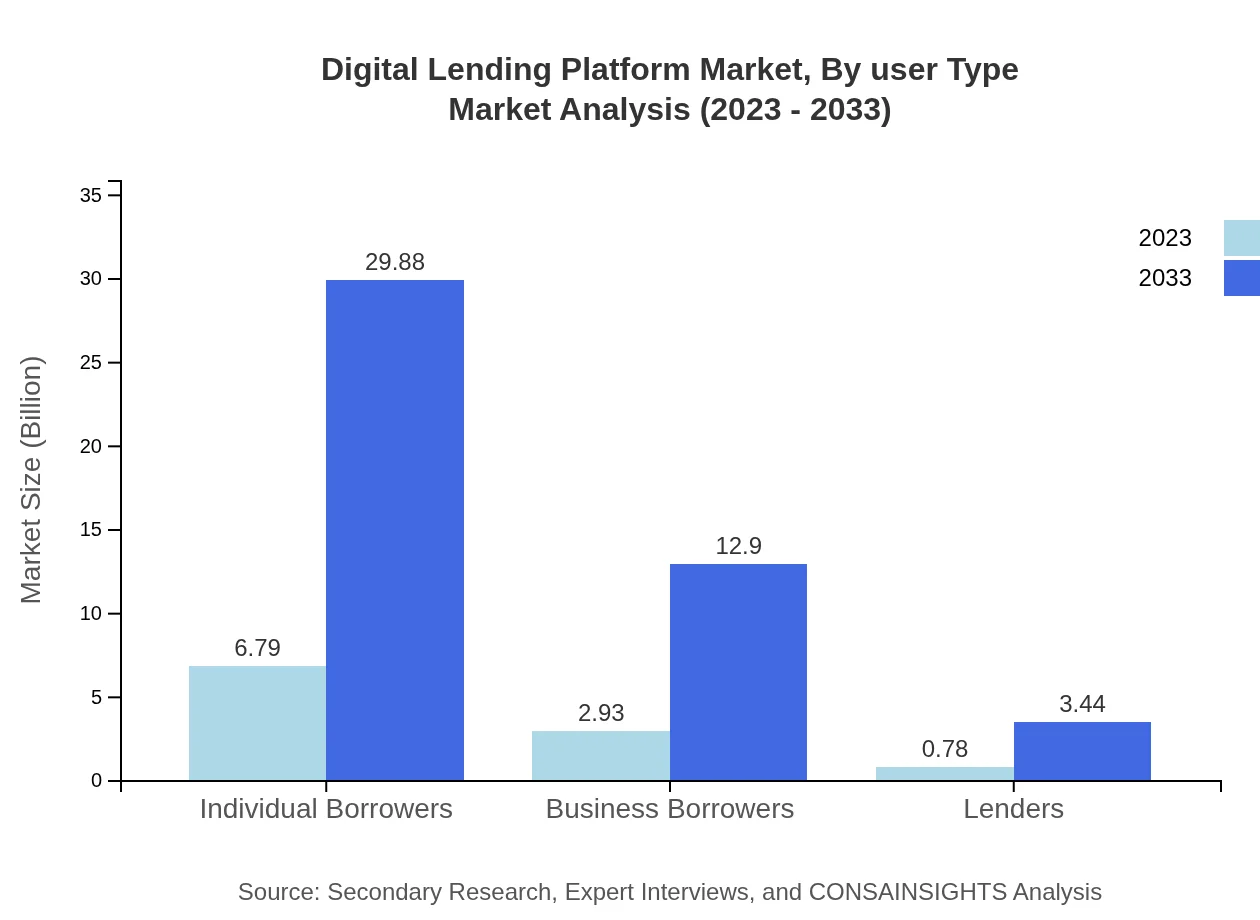

Digital Lending Platform Market Analysis By User Type

The market is primarily driven by individual users, who have a significant stake in the market size at $6.79 billion in 2023, growing to $29.88 billion by 2033. This reflects a constant 64.65% share. Business users account for $2.93 billion in 2023, growing to $12.90 billion by 2033, maintaining a 27.91% share. Lenders account for $0.78 billion in 2023 with a growth outlook to $3.44 billion by 2033, making up 7.44% of the market share.

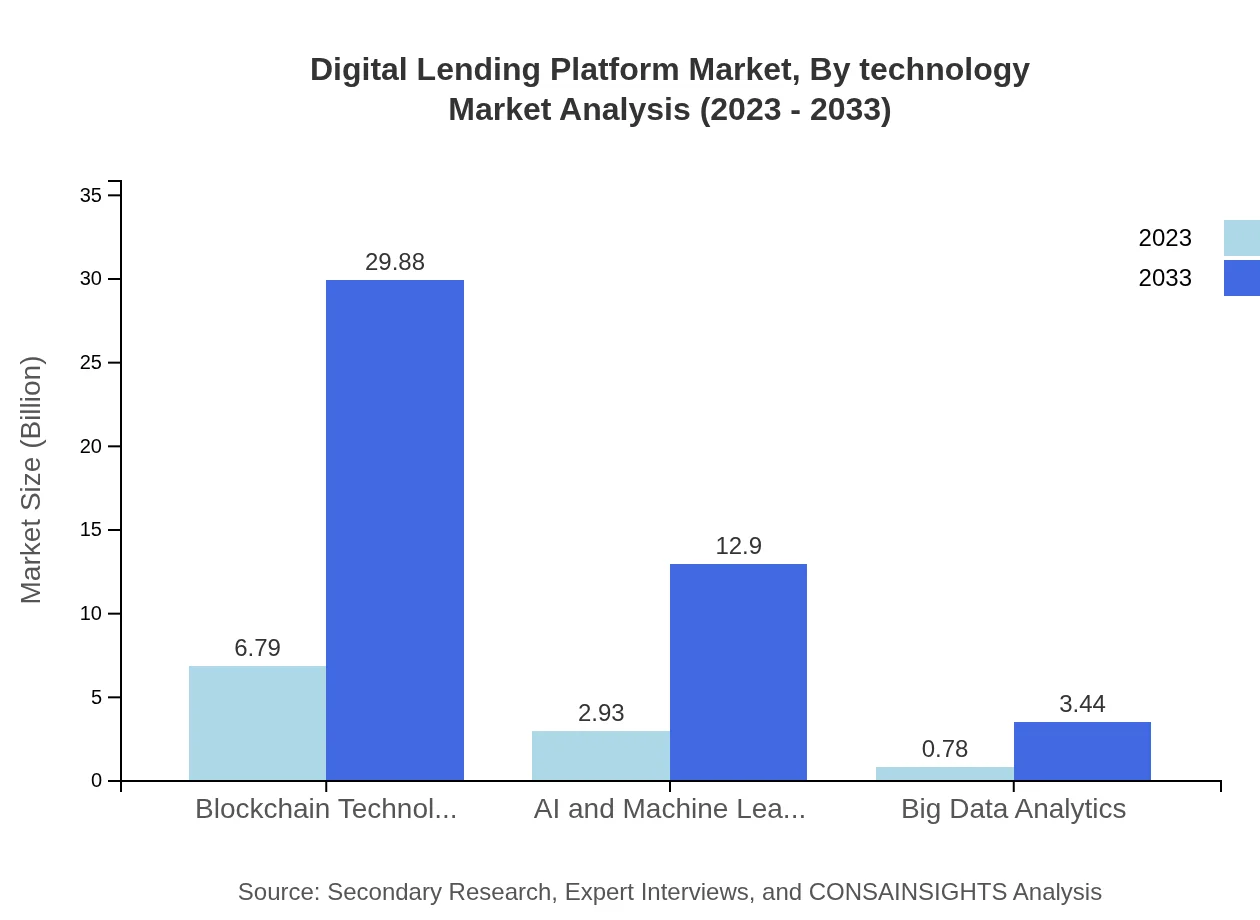

Digital Lending Platform Market Analysis By Technology

Key technologies in the Digital Lending Platform market include blockchain technology, artificial intelligence, and big data analytics. Blockchain is expected to grow from $6.79 billion in 2023 to $29.88 billion by 2033, holding 64.65% of the market share. AI and machine learning will grow from $2.93 billion to $12.90 billion, representing 27.91% of the share. Big data analytics, while smaller, is projected to increase to $3.44 billion from $0.78 billion, holding 7.44% of the market share.

Digital Lending Platform Market Analysis By Regulatory Framework

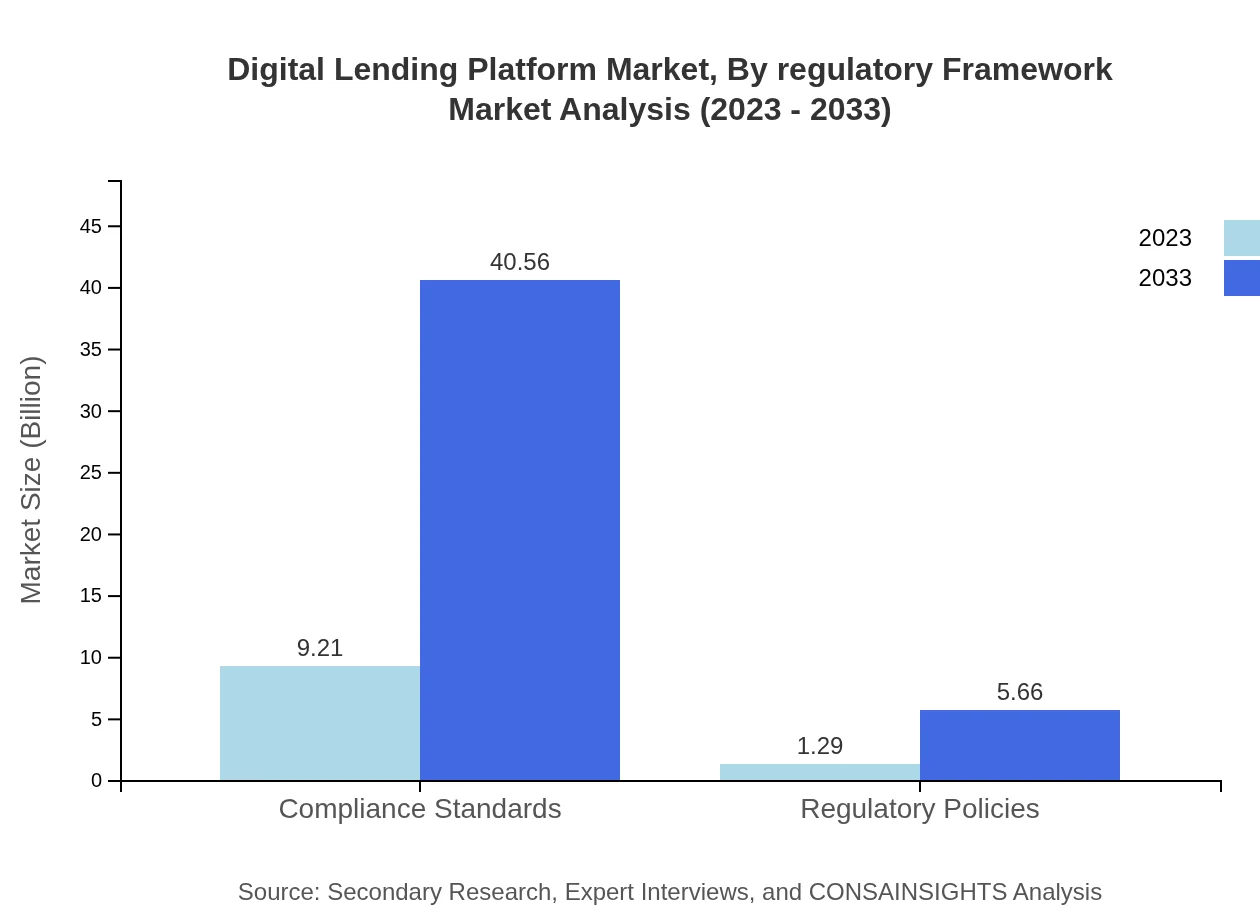

Compliance standards will shape the Digital Lending Platform market significantly, with a size projected to grow from $9.21 billion in 2023 to $40.56 billion by 2033, holding 87.76% market share. Regulatory policies will increase from $1.29 billion to $5.66 billion during the same period, maintaining a 12.24% market share. These frameworks are crucial for establishing reliable lending practices.

Digital Lending Platform Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Lending Platform Industry

LendingClub:

A prominent US-based online lending platform offering personal loans and business loans, renowned for its innovative peer-to-peer lending model.SoFi:

A financial technology company that provides student and personal loans, known for its streamlined application process and competitive rates.Upstart:

Leveraging AI to enhance credit assessment, Upstart is known for personal loans catering to a wide range of customers including those with limited credit histories.Kiva:

An international non-profit organization that allows individuals to lend money directly to low-income entrepreneurs and students worldwide, focusing on micro-lending.Zopa:

One of the UK’s original peer-to-peer lending platforms, offering personal loans and savings accounts, emphasizing customer-centric innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Lending Platform?

The global market size of the digital lending platform is valued at $10.5 billion in 2023, projected to grow at a compound annual growth rate (CAGR) of 15.2% over the next decade, equating to substantial growth and opportunity.

What are the key market players or companies in this digital Lending Platform industry?

Key players in the digital lending platform industry include innovative fintech companies, traditional banks expanding their digital services, and alternative lenders. Their competitive strategies are shaping the future landscape of digital lending.

What are the primary factors driving the growth in the digital Lending Platform industry?

Growth factors include increased digital adoption, a rising demand for quick and accessible lending solutions, technological advancements in AI and big data, and favorable regulatory frameworks enabling fintech innovation.

Which region is the fastest Growing in the digital Lending Platform?

The fastest-growing region in the digital lending platform market is North America, expected to grow from $3.83 billion in 2023 to $16.86 billion by 2033. This growth is driven by technology adoption and consumer demand.

Does ConsaInsights provide customized market report data for the digital Lending Platform industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the digital lending platform industry. Clients benefit from bespoke insights that align with their unique market strategies.

What deliverables can I expect from this digital Lending Platform market research project?

Deliverables from the market research project include comprehensive reports, market analysis, segment insights, and growth forecasts. These will be tailored to guide strategic decisions in the digital lending space.

What are the market trends of digital Lending Platform?

Current market trends include a shift towards online and mobile lending solutions, growing use of blockchain for securing transactions, and increased adoption of AI in risk assessment and customer service within digital lending.