Digital Pathology Market Report

Published Date: 31 January 2026 | Report Code: digital-pathology

Digital Pathology Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report on Digital Pathology analyzes key insights and data trends from 2023 to 2033, addressing market size, growth potential, technological advancements, and regional dynamics, providing a roadmap for stakeholders in this evolving landscape.

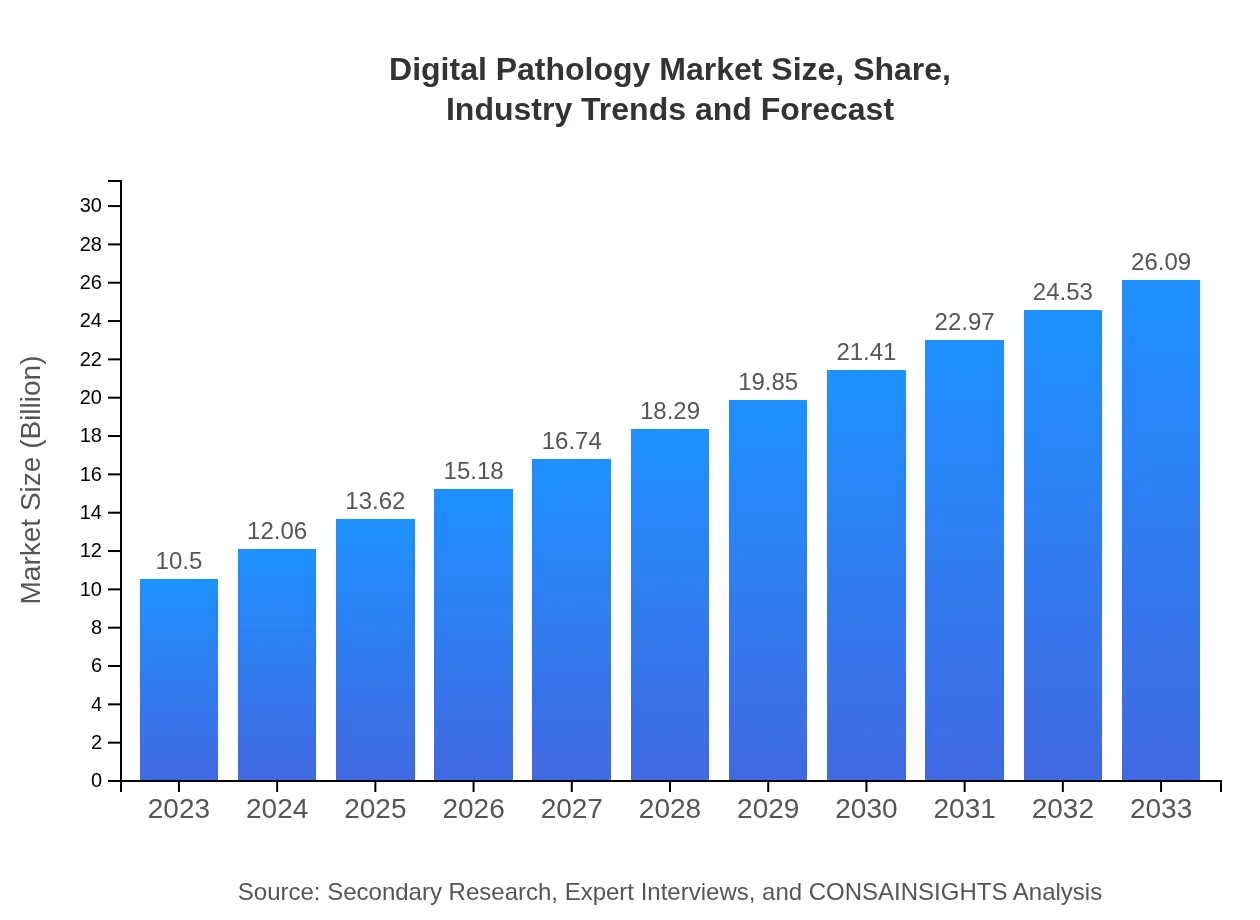

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | Roche Diagnostics, Philips Healthcare, Leica Biosystems, 3DHISTECH |

| Last Modified Date | 31 January 2026 |

Digital Pathology Market Overview

Customize Digital Pathology Market Report market research report

- ✔ Get in-depth analysis of Digital Pathology market size, growth, and forecasts.

- ✔ Understand Digital Pathology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Pathology

What is the Market Size & CAGR of Digital Pathology market in 2023?

Digital Pathology Industry Analysis

Digital Pathology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

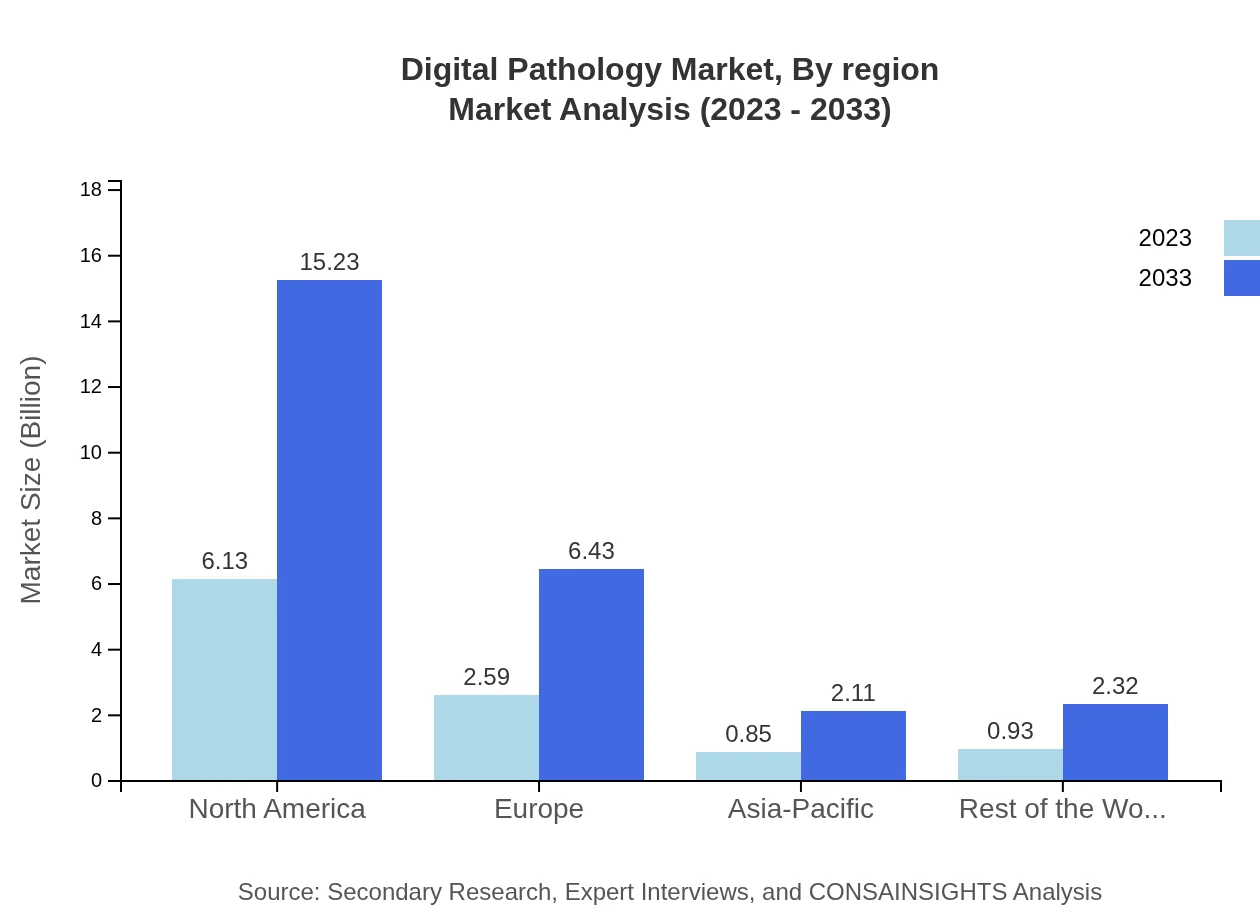

Digital Pathology Market Analysis Report by Region

Europe Digital Pathology Market Report:

In Europe, the Digital Pathology market is projected to grow from $2.64 billion in 2023 to $6.57 billion by 2033. The European market is witnessing strong growth due to the increasing prevalence of chronic diseases, advancements in pathology automation, and supportive government initiatives for digital transformation in healthcare.Asia Pacific Digital Pathology Market Report:

In the Asia Pacific region, the Digital Pathology market size is expected to grow from $2.08 billion in 2023 to $5.17 billion by 2033. The growth is fueled by increasing investments in healthcare infrastructure, rising awareness of digital solutions, and expanding research initiatives. Countries like Japan and China are leading the adoption of digital pathology technologies for improved diagnostic capabilities.North America Digital Pathology Market Report:

North America holds a significant share of the Digital Pathology market, with a value of $3.42 billion in 2023, projected to reach $8.49 billion by 2033. The region benefits from advanced healthcare systems, high adoption rates of innovative technologies, and significant investments in R&D, primarily driven by the United States.South America Digital Pathology Market Report:

The South American Digital Pathology market is anticipated to increase from $1.04 billion in 2023 to $2.60 billion by 2033. Factors such as enhancing healthcare services, growing awareness about advanced diagnostic tools, and governmental initiatives are driving the market in this region. Brazil and Argentina are key contributors to this growth.Middle East & Africa Digital Pathology Market Report:

The Middle East and Africa region is expected to expand its Digital Pathology market from $1.31 billion in 2023 to $3.27 billion by 2033. The growth is driven by improving healthcare infrastructure, increasing investment in digital technologies, and rising demand for effective diagnostic solutions, with countries like UAE and South Africa leading the way.Tell us your focus area and get a customized research report.

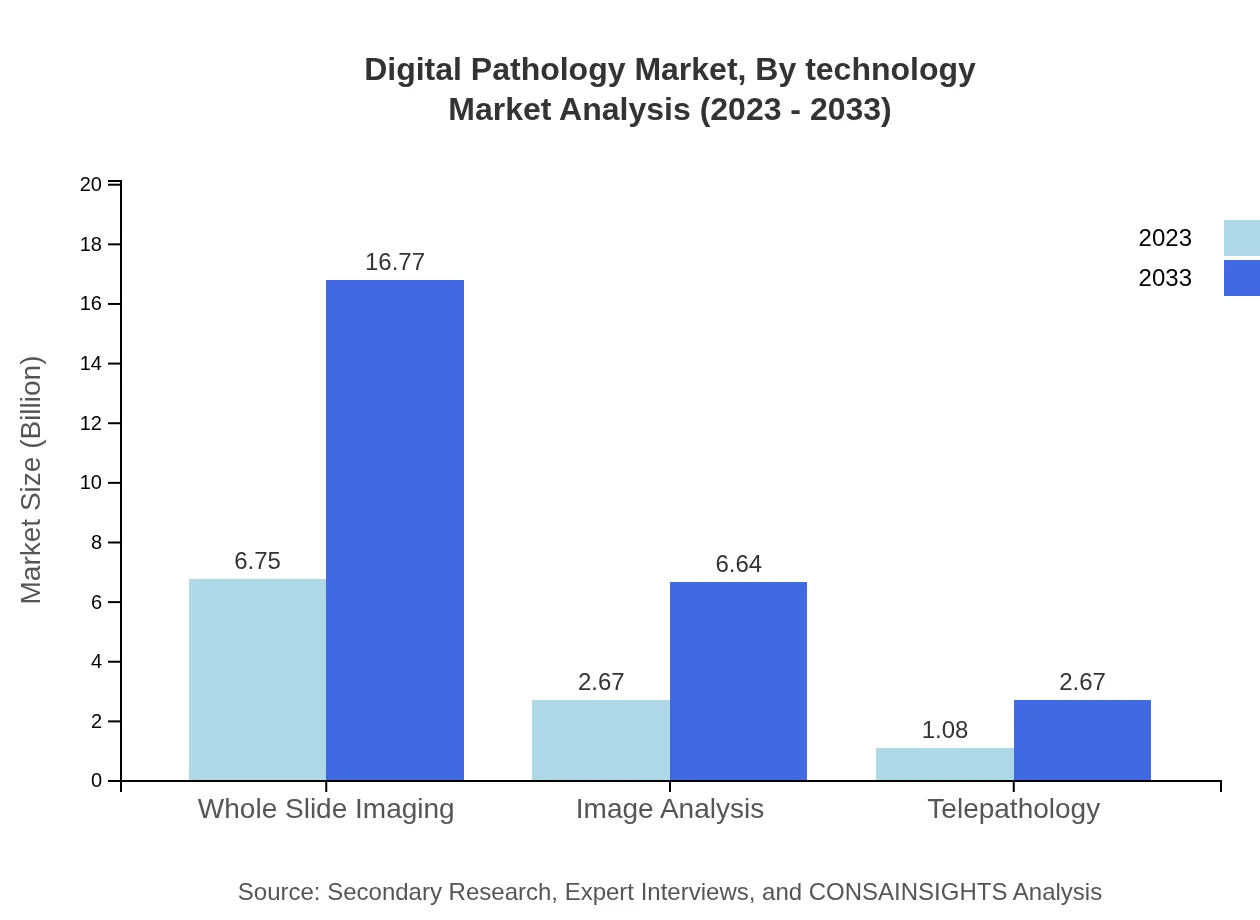

Digital Pathology Market Analysis By Technology

The Digital Pathology market can be categorized based on technology into segments such as Whole Slide Imaging, Image Analysis, and Telepathology. Whole Slide Imaging is the leading technology, expected to grow from $6.75 billion in 2023 to $16.77 billion by 2033. Image Analysis is also gaining traction, anticipated to reach $6.64 billion by 2033. Telepathology is emerging, with projections to expand to $2.67 billion by the same year.

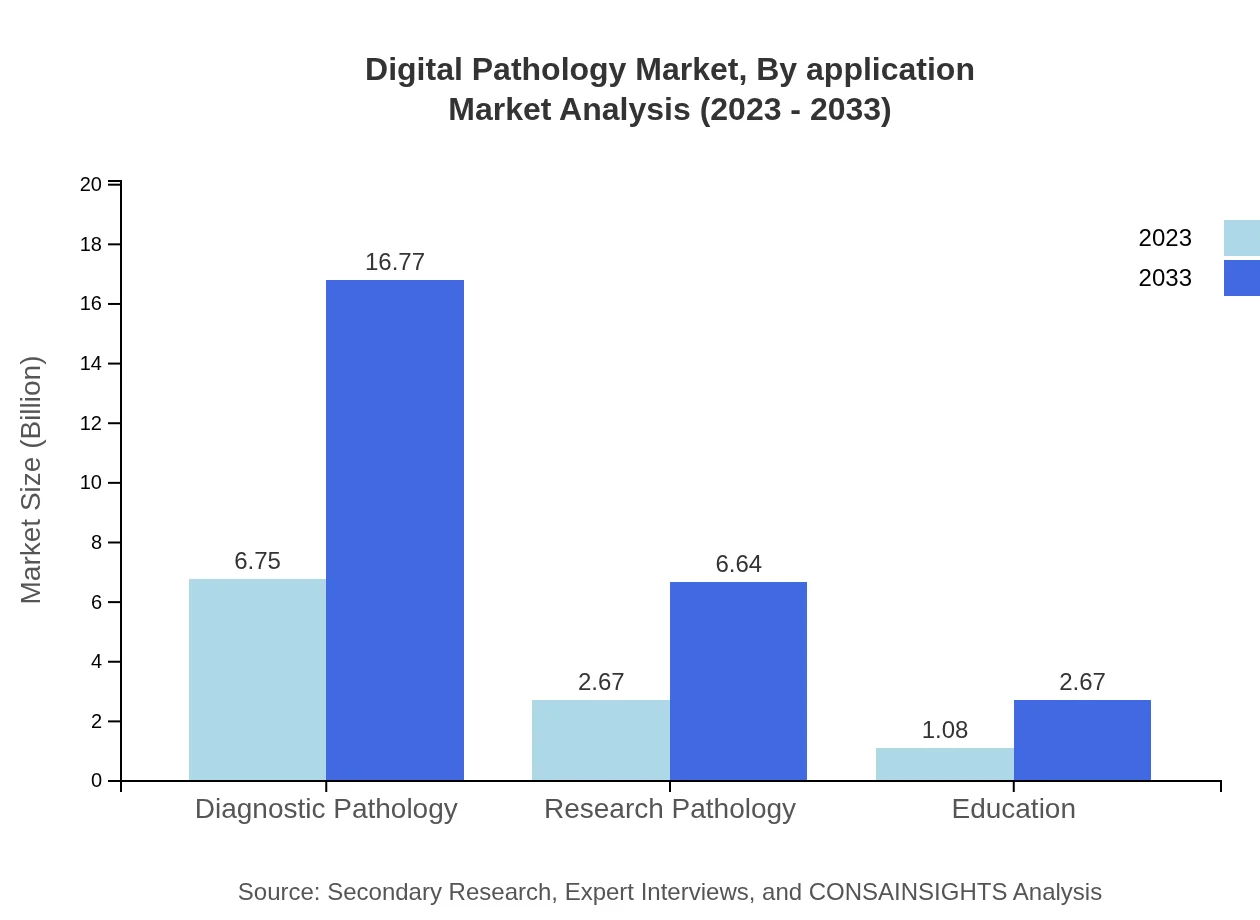

Digital Pathology Market Analysis By Application

When analyzed by application, the Digital Pathology market encompasses Diagnostic Pathology, Research Pathology, and Education. Diagnostic Pathology is the predominant application segment with a market value of $6.75 billion in 2023, projected to rise to $16.77 billion by 2033. Research Pathology is also witnessing growth, expected to reach $2.67 billion by 2033.

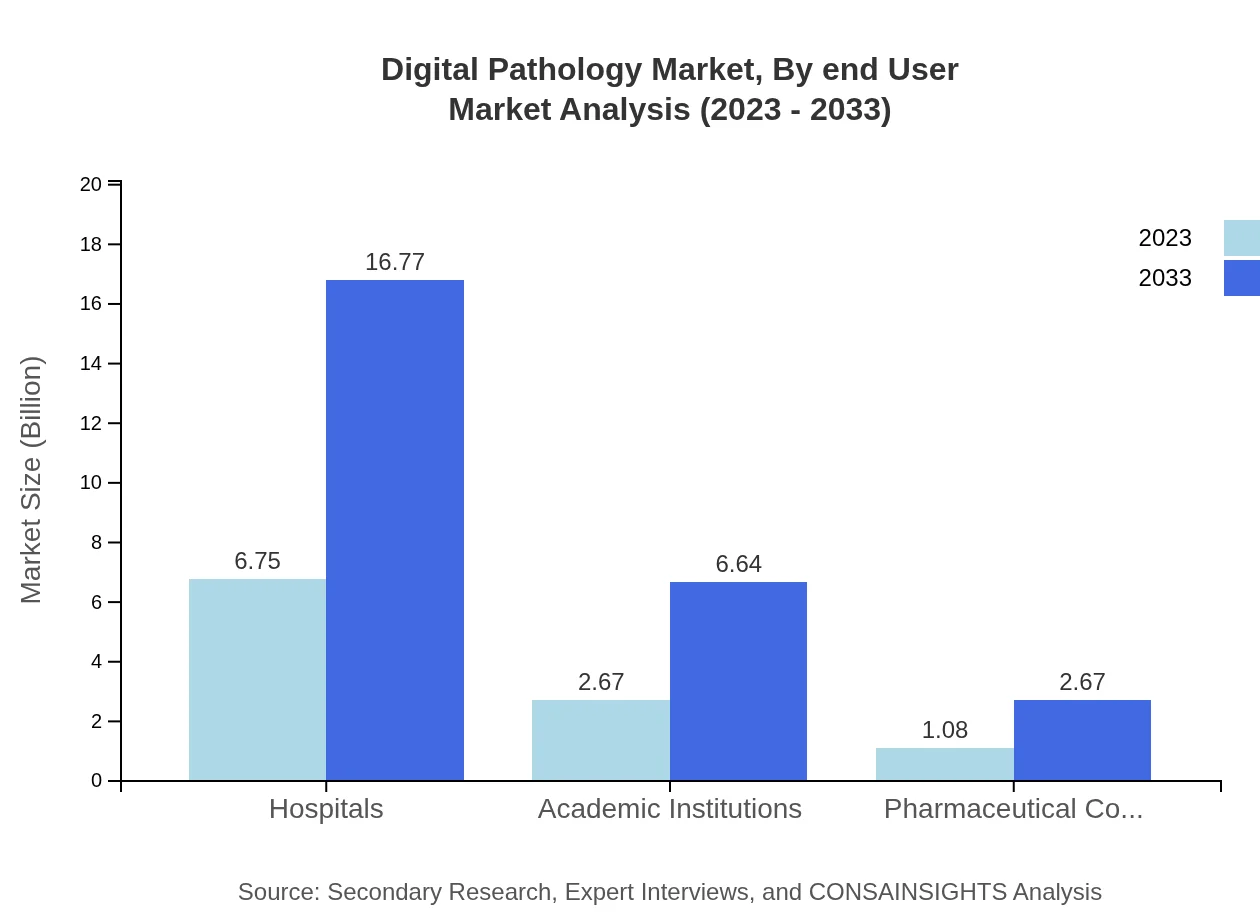

Digital Pathology Market Analysis By End User

The market is segmented by end-user into Hospitals, Academic Institutions, and Pharmaceutical Companies. Hospitals are the major end-users, commanding a market share of $6.75 billion in 2023 and expected to grow to $16.77 billion by 2033. Academic institutions are also significant, forecasted to reach $6.64 billion by the end of the forecast period.

Digital Pathology Market Analysis By Region

Regional analysis highlights North America, Europe, Asia-Pacific, South America, and the Middle East & Africa as critical markets. North America leads with substantial market growth, followed by Europe and Asia-Pacific, indicating a diverse landscape of uptake influenced by local healthcare policies and technological readiness.

Digital Pathology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Pathology Industry

Roche Diagnostics:

A leader in the digital pathology market, Roche focuses on innovation and research to enhance diagnostic precision and improve healthcare outcomes with their advanced diagnostic solutions.Philips Healthcare:

Philips is a key player providing innovative digital pathology solutions aimed at improving diagnostic workflows and enhancing the efficiency of pathology labs through cutting-edge imaging technologies.Leica Biosystems:

Known for its advanced imaging solutions, Leica Biosystems specializes in digital pathology systems that support pathologists in accurate diagnoses and efficient workflows.3DHISTECH:

3DHISTECH develops high-quality digital pathology and imaging systems, catering to a vast range of laboratory requirements and bolstering the transition to digital pathology.We're grateful to work with incredible clients.

FAQs

What is the market size of digital pathology?

The global digital pathology market is expected to reach USD 10.5 billion by 2033, growing at a CAGR of 9.2% from its current size. This indicates significant investment and expansion in the sector over the upcoming decade.

What are the key market players or companies in the digital pathology industry?

Key players in the digital pathology market include major companies like Leica Biosystems, Philips Healthcare, and PathAI, which are at the forefront of technological advancements and competitive strategies in developing digital pathology solutions.

What are the primary factors driving the growth in the digital pathology industry?

Growth in the digital pathology industry is propelled by technological advancements, rising demand for remote diagnostics, increased efficiency in pathology workflows, and the necessity for enhanced diagnostic accuracy and patient care.

Which region is the fastest Growing in the digital pathology market?

North America is projected to be the fastest-growing region in the digital pathology market, with its market size reaching USD 8.49 billion by 2033, driven by extensive adoption and investment in healthcare technologies.

Does ConsaInsights provide customized market report data for the digital pathology industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and insights in the digital pathology industry, helping clients obtain relevant data for their strategic decision-making.

What deliverables can I expect from the digital pathology market research project?

From the digital pathology market research project, expect detailed reports including market forecasts, competitor analysis, trends, and insight on key segments across regions, along with comprehensive data visualizations.

What are the market trends of digital pathology?

Current market trends include increasing adoption of whole slide imaging and AI-driven analysis, the expansion of telepathology services, and growing integration of digital solutions for pathology education and diagnostics.