Digital Payments Market Report

Published Date: 31 January 2026 | Report Code: digital-payments

Digital Payments Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Digital Payments market, highlighting key trends, growth drivers, and forecasts from 2023 to 2033. Insights into market size, technology advancements, and regional performance are also included to provide a clear picture of the industry's future.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

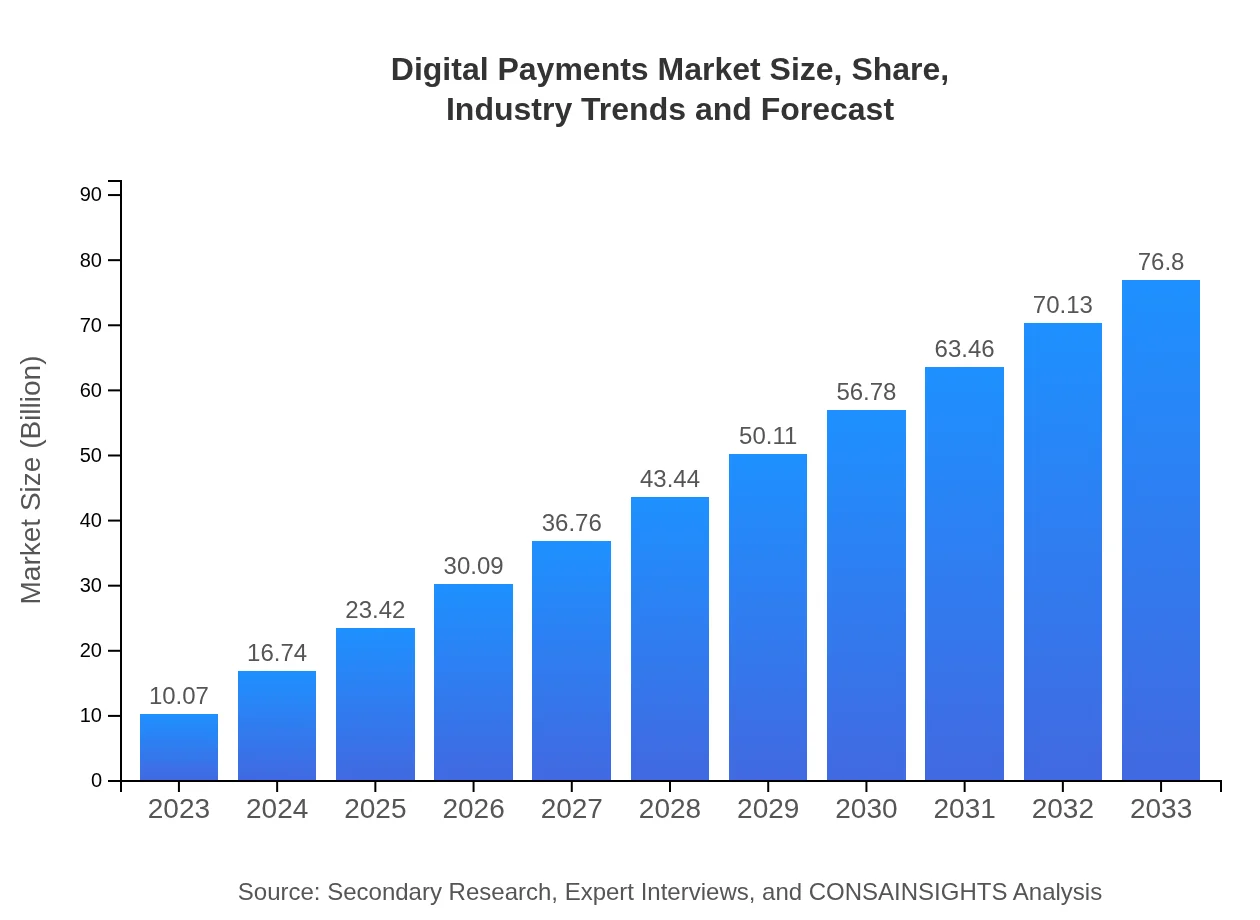

| 2023 Market Size | $10.07 Trillion |

| CAGR (2023-2033) | 21.2% |

| 2033 Market Size | $76.80 Trillion |

| Top Companies | Visa Inc., PayPal Holdings, Inc., Square, Inc., Adyen N.V., Stripe, Inc. |

| Last Modified Date | 31 January 2026 |

Digital Payments Market Overview

Customize Digital Payments Market Report market research report

- ✔ Get in-depth analysis of Digital Payments market size, growth, and forecasts.

- ✔ Understand Digital Payments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Payments

What is the Market Size & CAGR of Digital Payments market in 2023?

Digital Payments Industry Analysis

Digital Payments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Payments Market Analysis Report by Region

Europe Digital Payments Market Report:

Europe's Digital Payments market is estimated at $3.54 billion in 2023, poised for expansion to $27.00 billion by 2033. The increasing regulatory support for digital transactions and a strong emphasis on consumer protection and security are significant in this market's growth.Asia Pacific Digital Payments Market Report:

In 2023, the Asia Pacific region's Digital Payments market stands at $1.79 billion, expected to surge to $13.65 billion by 2033. The rapid urbanization, high mobile penetration rates, and government initiatives promoting cashless economies are key growth drivers in countries like China and India.North America Digital Payments Market Report:

North America, valued at $3.23 billion in 2023, is anticipated to grow to $24.65 billion by 2033. The United States leads the charge due to a strong consumer preference for digital transactions, along with significant investments in technology and innovation within the payment ecosystem.South America Digital Payments Market Report:

The South American Digital Payments market is valued at $0.51 billion in 2023 with a projection of reaching $3.92 billion by 2033. The growing adoption of ecommerce and fintech services have stimulated demand in this region, despite previous infrastructural challenges.Middle East & Africa Digital Payments Market Report:

In 2023, the Middle East and Africa market is approximately $0.99 billion, expected to escalate to $7.59 billion by 2033. Factors such as mobile technology integration and the surge in ecommerce are enabling faster adoption of digital payments in this diverse region.Tell us your focus area and get a customized research report.

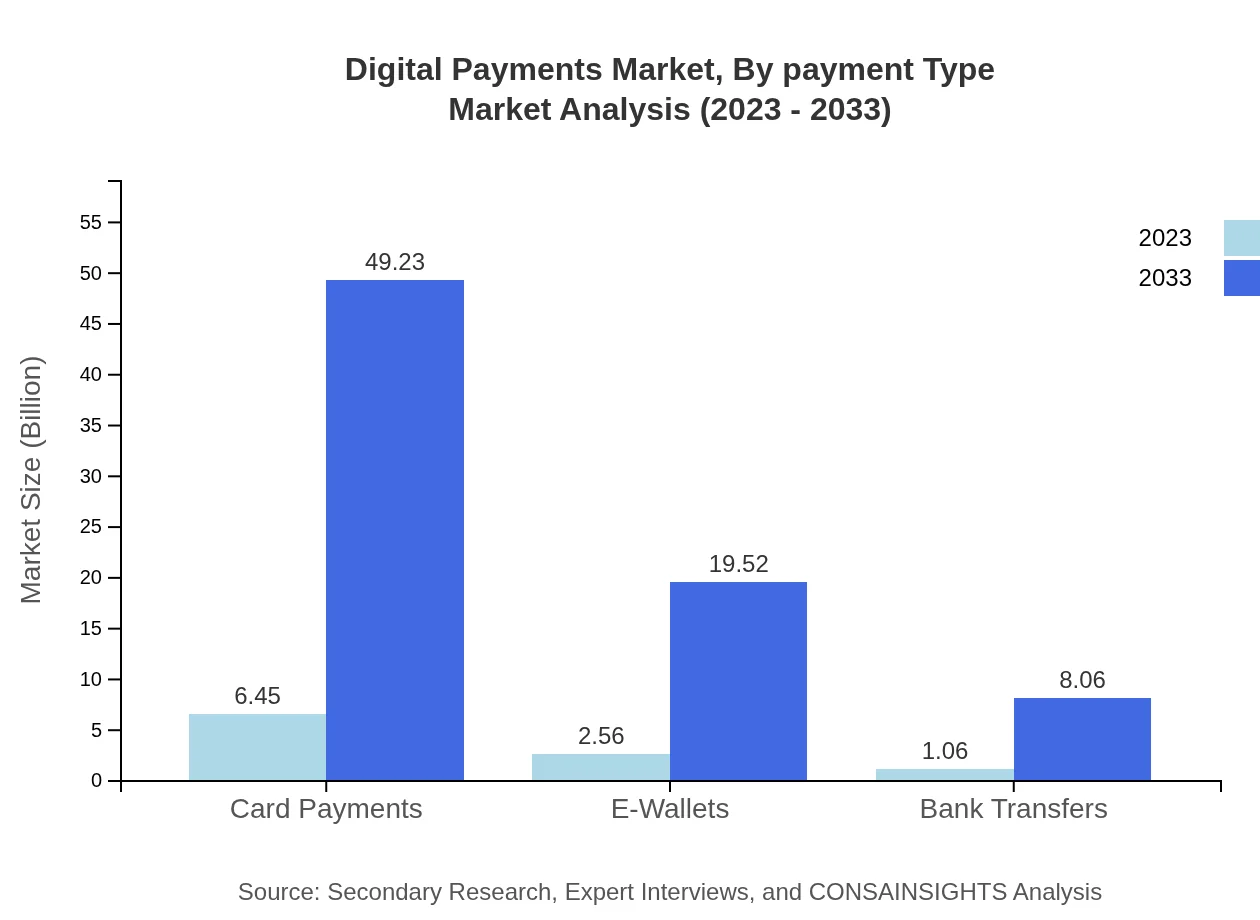

Digital Payments Market Analysis By Payment Type

The market segmentation by payment type highlights various categories such as card payments, e-wallets, bank transfers, mobile payment solutions, and others. Card payments lead the market with a size of $6.45 billion in 2023, expected to grow to $49.23 billion by 2033. E-wallets follow closely with $2.56 billion in size, anticipating significant growth as more users prefer cashless transactions. Bank transfers and mobile solutions also show promising market sizes with $1.06 billion and $2.56 billion respectively in 2023.

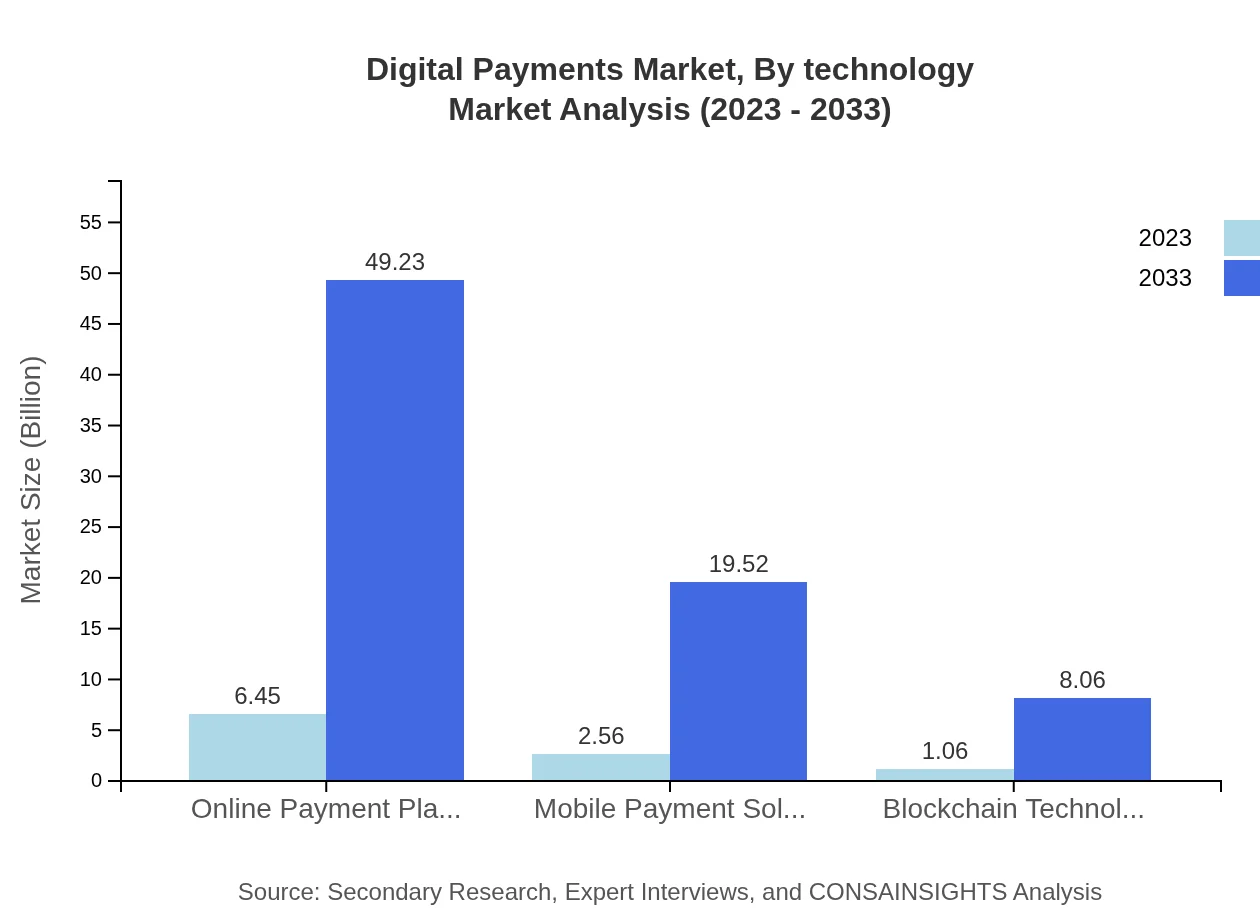

Digital Payments Market Analysis By Technology

The technology-related segment includes advancements like blockchain technology, encryption techniques, and fraud detection systems among others. Blockchain technology is expected to grow from $1.06 billion in 2023 to $8.06 billion by 2033. E-wallet and card payment technologies also increasingly employ advanced encryption techniques to enhance security, with market sizes of $2.56 billion in 2023 and a growth trajectory that reflects greater reliance on secure transaction technologies.

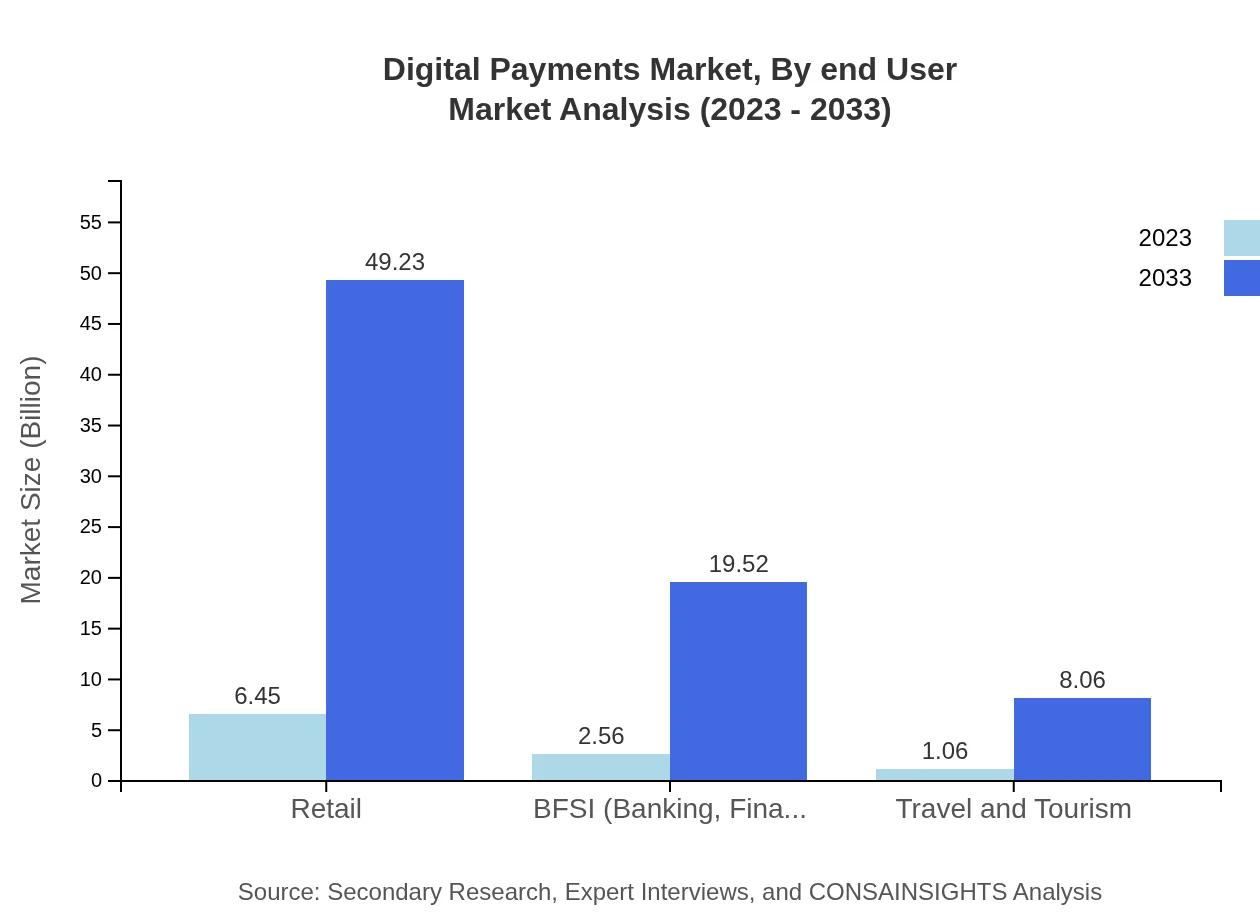

Digital Payments Market Analysis By End User

The Digital Payments market by end-user includes sectors such as retail, banking, travel, and hospitality. The retail segment commands a significant market share with $6.45 billion in 2023, growing significantly as ecommerce continues to thrive. The BFSI sector is another vital segment at $2.56 billion currently, which is projected to rise as more financial institutions adopt digital payment systems.

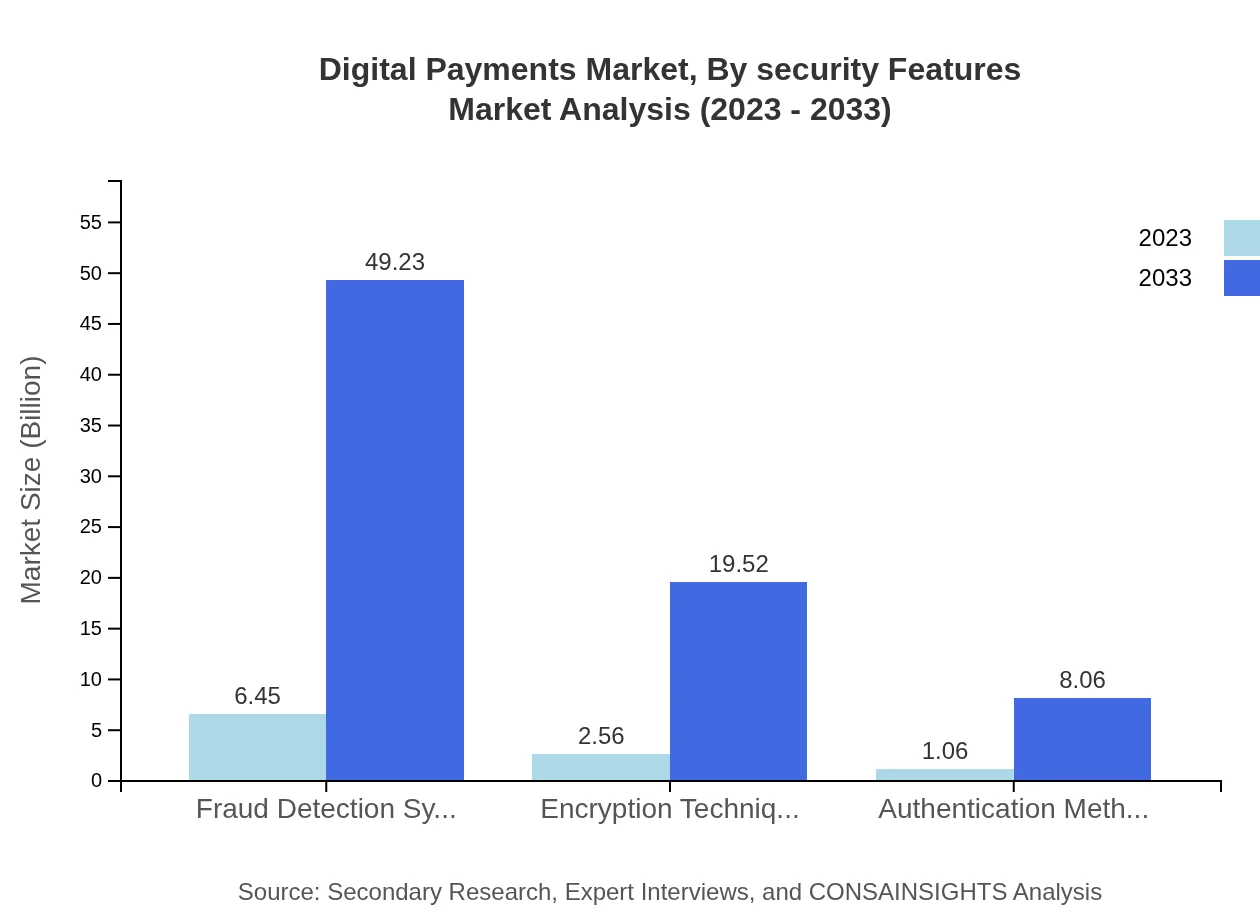

Digital Payments Market Analysis By Security Features

Security remains paramount in digital payments, with fraud detection systems and authentication methods being critical components. Fraud detection solutions, at $6.45 billion in 2023, anticipate robust growth due to increasing risks of cybercrime. Authentication methods are increasingly being integrated with payments systems to boost user confidence and secure transactions.

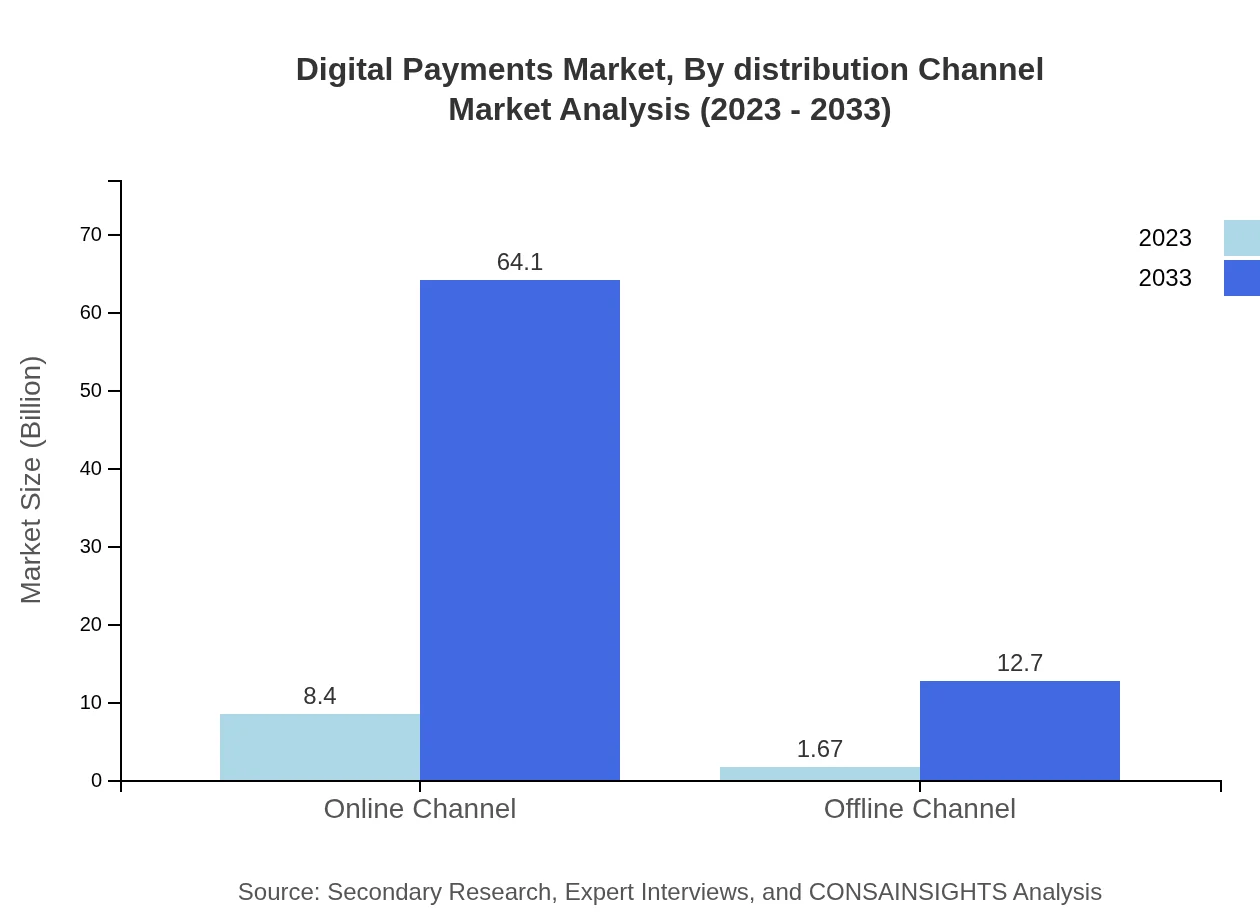

Digital Payments Market Analysis By Distribution Channel

The distribution channels for digital payments are classified into online and offline channels. The online channel is expected to dominate the market with considerable growth from $8.40 billion in 2023 to $64.10 billion by 2033, driven by the rise of digital commerce. Offline channels remain relevant but are projected to grow at a slower pace compared to online platforms.

Digital Payments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Payments Industry

Visa Inc.:

Visa is a global leader in digital payments, providing technologies for secure electronic payments and facilitating transactions across various channels.PayPal Holdings, Inc.:

PayPal is a prominent online payment platform known for its user-friendly services, enabling secure online purchases and money transfers worldwide.Square, Inc.:

Square offers robust payment solutions for businesses, focusing on digital wallets and point-of-sale services that improve transaction efficiency.Adyen N.V.:

Adyen is a global payment company that provides businesses with a modern end-to-end payment solution, processing payments in multiple currencies.Stripe, Inc.:

Stripe provides payment processing solutions tailored for developers and businesses, streamlining online transactions through technology.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Payments?

The digital payments market size is projected to reach approximately $10.07 trillion by 2033, growing at a compound annual growth rate (CAGR) of 21.2% from its current valuation.

What are the key market players or companies in this digital Payments industry?

Key players in the digital payments industry include major financial services and technology firms such as PayPal, Square, Visa, Mastercard, and fintech startups focusing on innovative payment solutions.

What are the primary factors driving the growth in the digital payments industry?

The growth of digital payments is driven by increasing smartphone penetration, the rise of e-commerce, improved internet connectivity, and the growing demand for convenience in financial transactions.

Which region is the fastest Growing in the digital payments?

The fastest-growing region in digital payments is projected to be Asia Pacific, expanding from a market size of $1.79 trillion in 2023 to $13.65 trillion by 2033 due to rising adoption of digital transaction methods.

Does ConsaInsights provide customized market report data for the digital payments industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the digital payments industry, providing insights on market trends, forecasts, and competitive analysis.

What deliverables can I expect from this digital Payments market research project?

Deliverables from the digital payments market research project typically include comprehensive reports, data analytics, SWOT analysis, market forecasts, and segmented insights relevant to the industry.

What are the market trends of digital payments?

Current market trends in digital payments include the rise of mobile payment solutions, increased use of e-wallets, blockchain technology adoption, and heightened focus on security and fraud detection systems.