Digital Radiology Radiography Market Report

Published Date: 31 January 2026 | Report Code: digital-radiology-radiography

Digital Radiology Radiography Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Digital Radiology Radiography market, covering insights, trends, and forecasts from 2023 to 2033, including market size, growth rates, and an overview of key players and technologies impacting the industry.

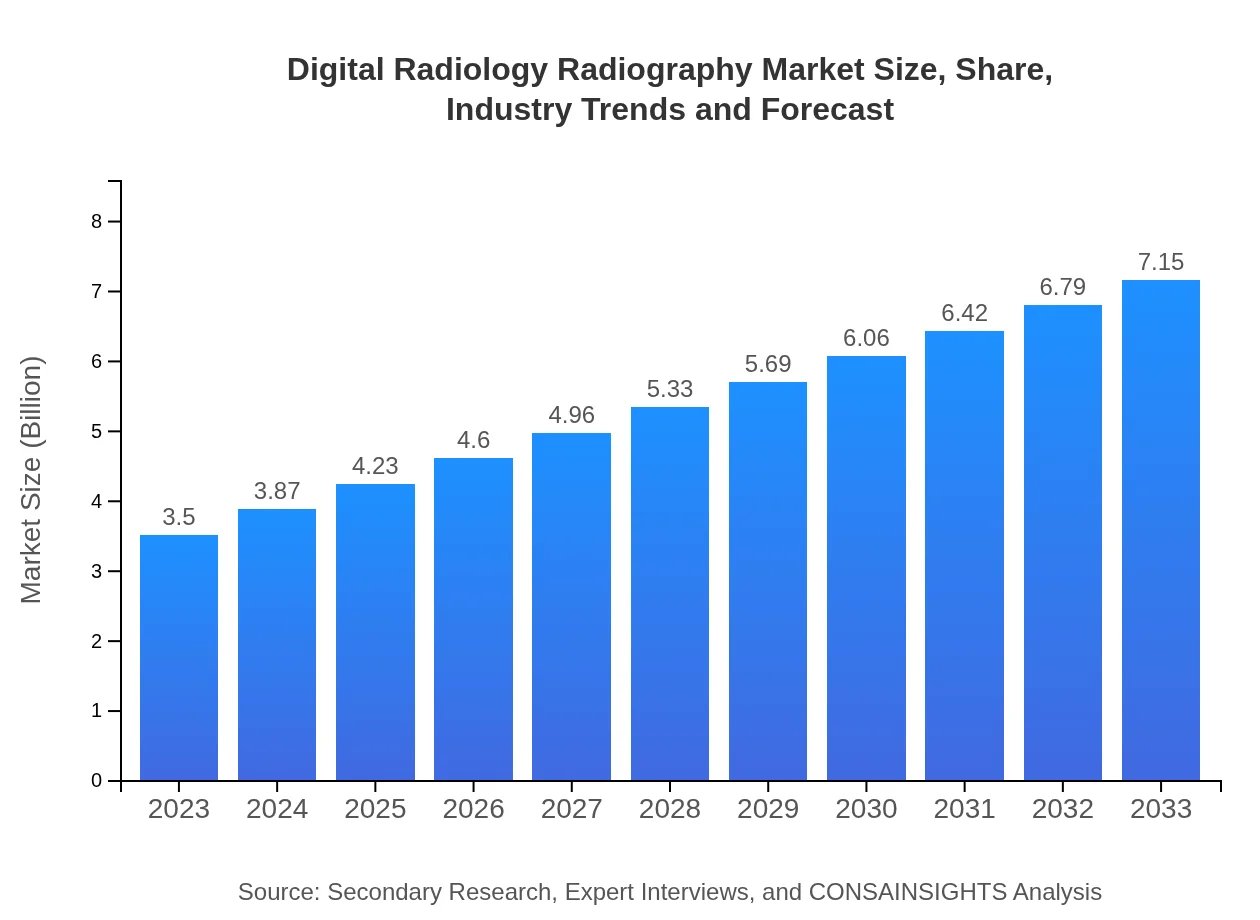

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Medical Systems |

| Last Modified Date | 31 January 2026 |

Digital Radiology Radiography Market Overview

Customize Digital Radiology Radiography Market Report market research report

- ✔ Get in-depth analysis of Digital Radiology Radiography market size, growth, and forecasts.

- ✔ Understand Digital Radiology Radiography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Radiology Radiography

What is the Market Size & CAGR of Digital Radiology Radiography market in 2023?

Digital Radiology Radiography Industry Analysis

Digital Radiology Radiography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Radiology Radiography Market Analysis Report by Region

Europe Digital Radiology Radiography Market Report:

Europe's Digital Radiology Radiography market is anticipated to expand from $0.88 billion in 2023 to $1.79 billion by 2033. The growth is fueled by a well-established healthcare system, rising incidences of chronic diseases, and continuous investments in research and development of imaging technologies. The increasing focus on preventive care and patient management will also contribute to market growth in this region.Asia Pacific Digital Radiology Radiography Market Report:

The Asia Pacific region is expected to witness substantial growth in the Digital Radiology Radiography market, with a projected value of $1.53 billion by 2033, up from $0.75 billion in 2023. This growth is driven by increasing healthcare expenditure, advancements in imaging technology, and a rising preference for early diagnosis across developing economies. The expansion of healthcare infrastructure and increasing patient awareness regarding diagnostic imaging will further contribute to market expansion in this region.North America Digital Radiology Radiography Market Report:

North America remains a dominant player in the Digital Radiology Radiography market, projected to reach $2.48 billion by 2033 from $1.21 billion in 2023. This region benefits from advanced healthcare infrastructure, high adoption rates of new technologies, and a significant rise in diagnostic imaging procedures. The presence of major healthcare providers and increased investments in AI and digital technologies further bolster growth.South America Digital Radiology Radiography Market Report:

In South America, the market for Digital Radiology Radiography is estimated to grow from $0.31 billion in 2023 to $0.64 billion by 2033. The growth is driven by an increase in chronic diseases leading to higher demand for imaging services and government initiatives aimed at improving healthcare access. Collaborative efforts to enhance imaging technology are also expected to play a key role in transforming the healthcare landscape.Middle East & Africa Digital Radiology Radiography Market Report:

The Middle East and Africa market for Digital Radiology Radiography is expected to grow from $0.35 billion in 2023 to $0.71 billion by 2033. Factors such as increasing health awareness, government initiatives to improve healthcare facilities, and the rising burden of diseases are driving this growth. Additionally, the integration of advanced technologies, including telemedicine and remote diagnostics, is expected to reshape the regional landscape positively.Tell us your focus area and get a customized research report.

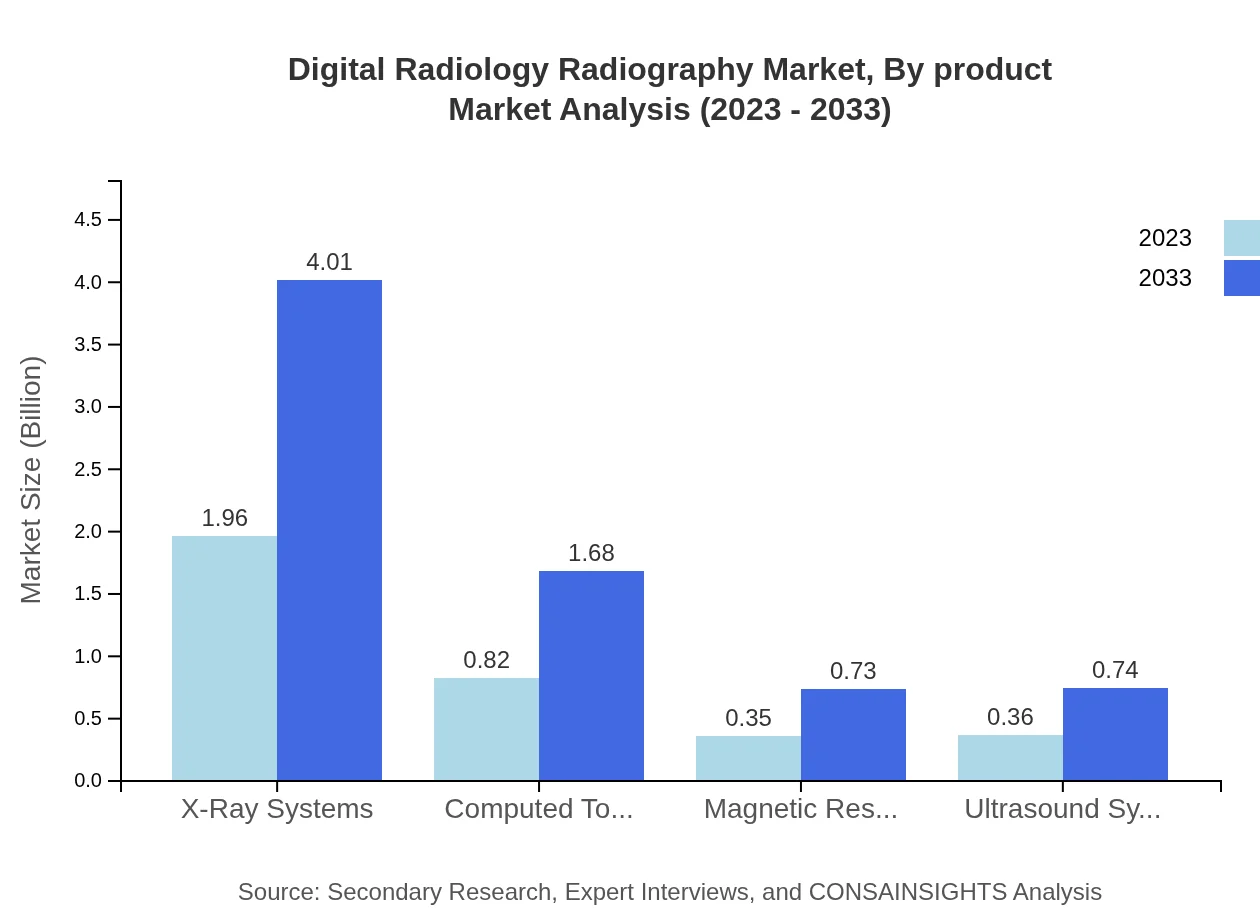

Digital Radiology Radiography Market Analysis By Product

In the by-product segment, X-ray systems dominate the market with a size of $1.96 billion in 2023, expected to reach $4.01 billion by 2033. Computed Tomography systems also play a significant role with a size of $0.82 billion and are projected to grow to $1.68 billion. The continuous advancements in imaging technologies drive the demand for these products to support various clinical needs.

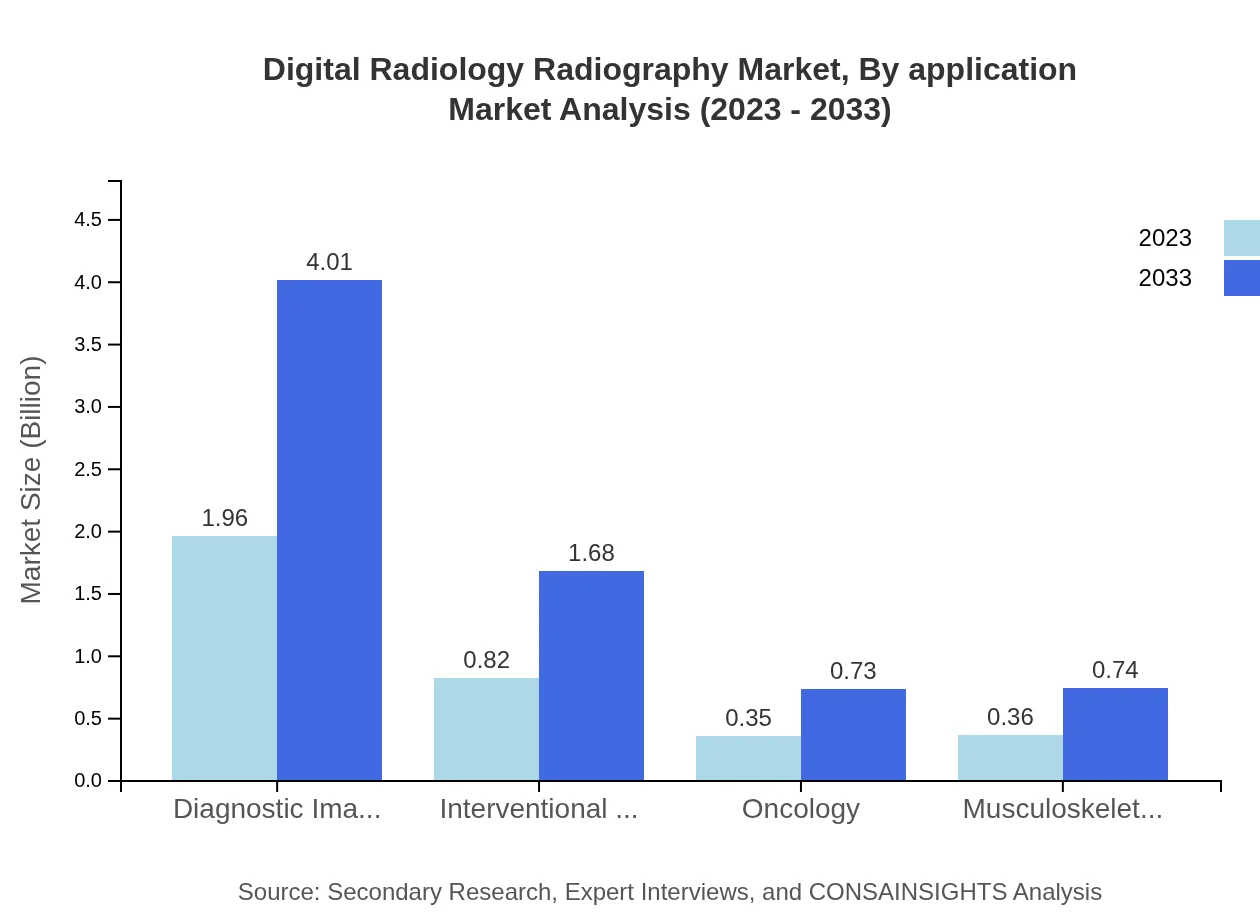

Digital Radiology Radiography Market Analysis By Application

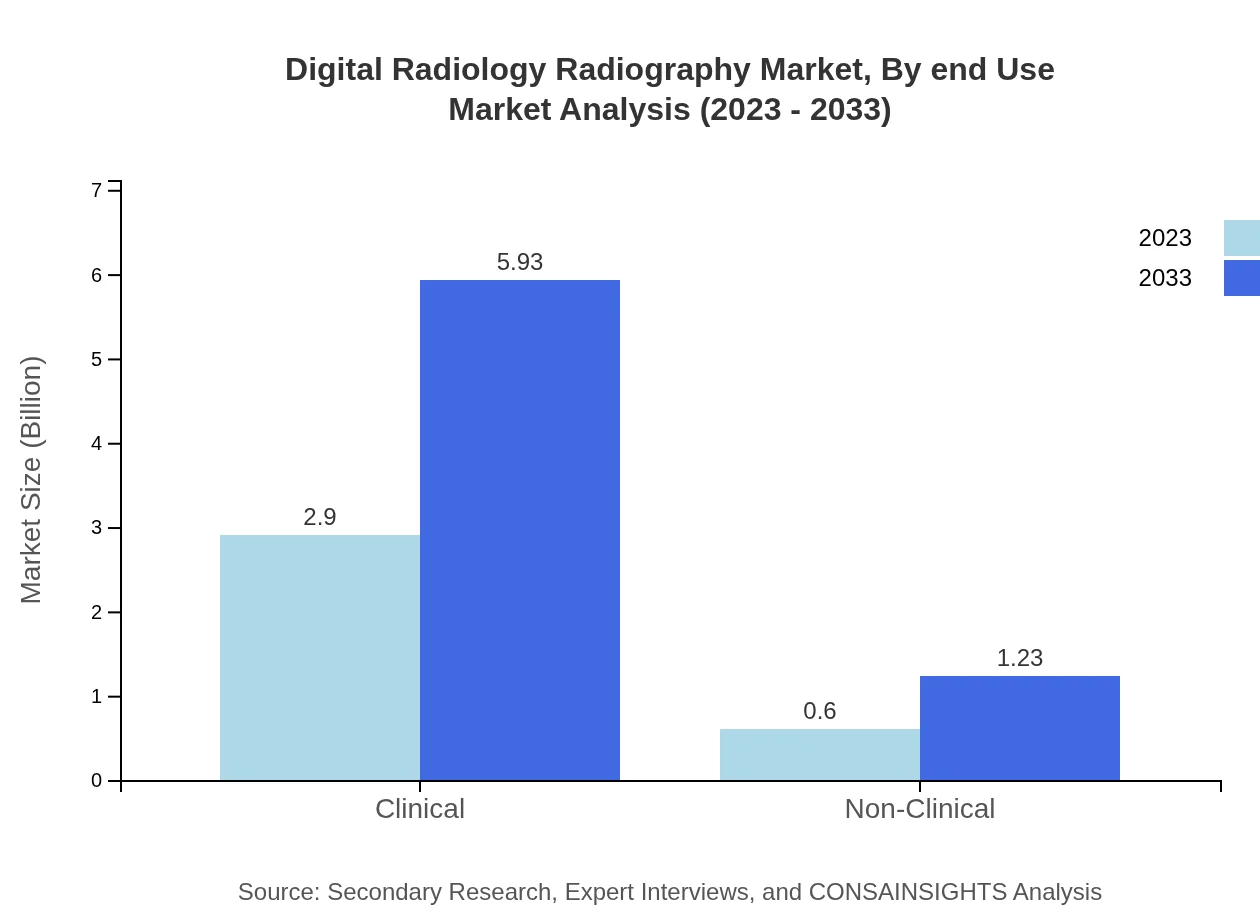

The clinical application segment leads the market size, valued at $2.90 billion in 2023, with projections of reaching $5.93 billion by 2033. Diagnostic imaging, interventional radiology, and oncology are key areas driving demand, emphasizing the importance of accuracy and efficiency in patient care.

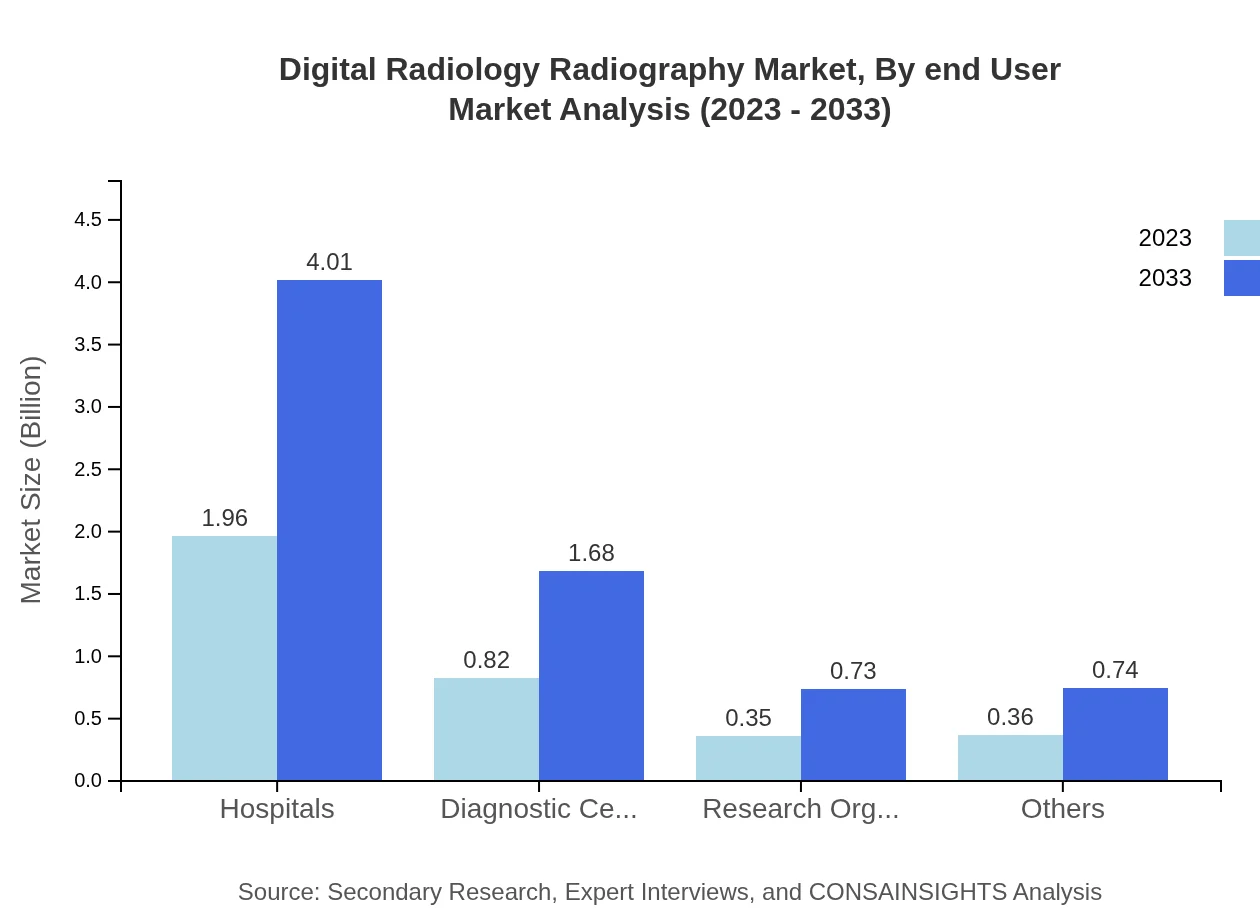

Digital Radiology Radiography Market Analysis By End User

Hospitals constitute the largest end-user segment, accounting for $1.96 billion in 2023, expected to grow to $4.01 billion by 2033. Diagnostic centers and research organizations follow, highlighting the importance of comprehensive diagnostic services for enhancing patient outcomes.

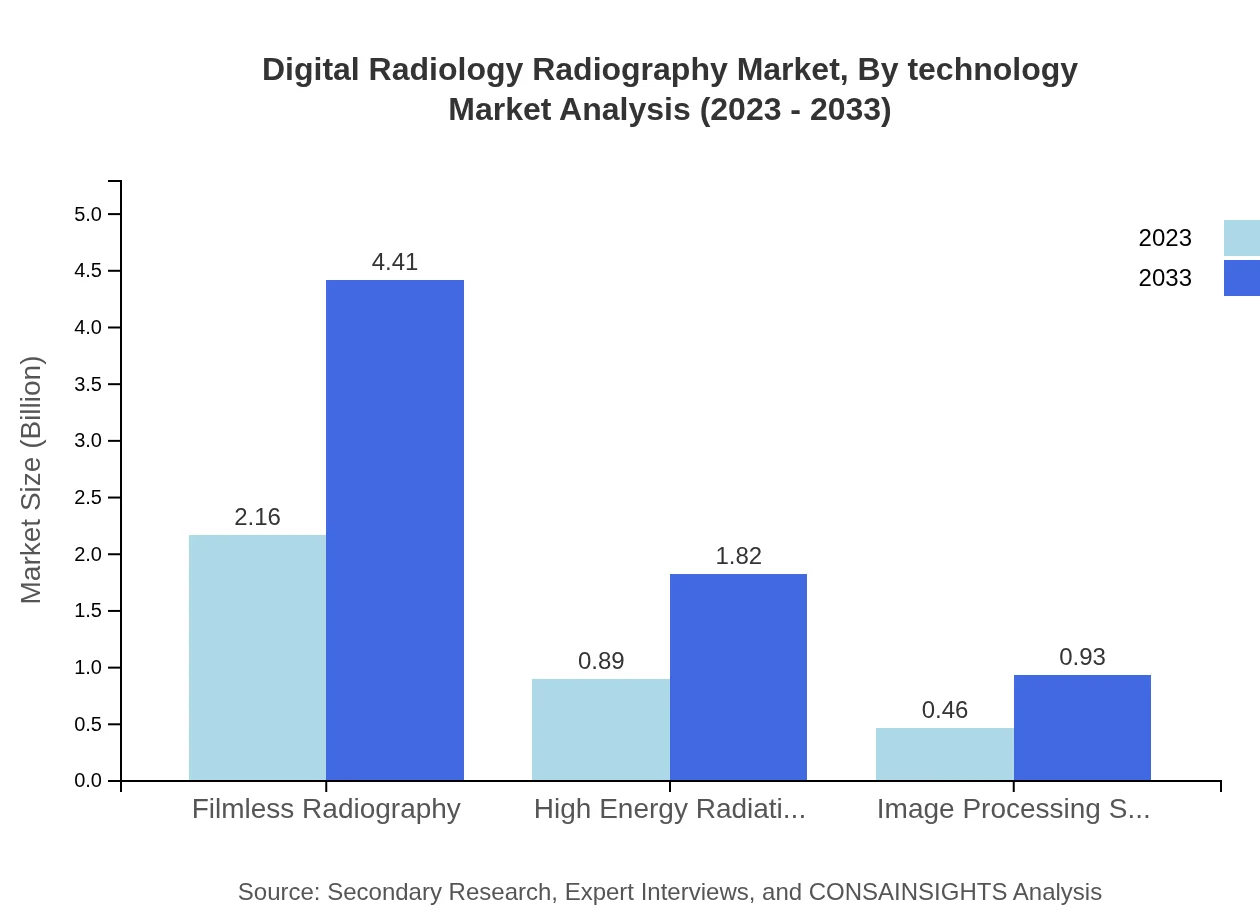

Digital Radiology Radiography Market Analysis By Technology

The technology segment encapsulates innovations such as artificial intelligence and image processing software. With a demand size of $0.46 billion in 2023, anticipated to approximately double by 2033, technological advancements are key in optimizing imaging processes and enhancing diagnostic accuracy.

Digital Radiology Radiography Market Analysis By End Use

The market's scope covers essential uses in clinical diagnostics, interventional radiology, and comprehensive patient monitoring. As healthcare providers shift increasingly toward advanced imaging technologies, these segments are expected to drive significant growth in the coming decade.

Digital Radiology Radiography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Radiology Radiography Industry

Siemens Healthineers:

A leading global company that provides innovative digital imaging solutions, driving advancements in radiology and imaging technologies.GE Healthcare:

Renowned for pioneering sensitive imaging systems, GE Healthcare's technologies are widely applied in clinical and diagnostic practices across the globe.Philips Healthcare:

Philips offers a comprehensive range of diagnostic imaging equipment and solutions, focusing on improving patient care through innovative technologies.Canon Medical Systems:

Canon Medical Systems specializes in medical imaging products, providing advanced solutions that enhance diagnostic capabilities and patient workflows.Fujifilm Medical Systems:

As a leading image quality innovator, Fujifilm develops digital radiography systems that deliver high image resolution and improved diagnostic performance.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Radiology Radiography?

The digital radiology radiography market is projected to reach $3.5 billion by 2033, growing at a CAGR of 7.2%. This growth reflects an increasing demand for advanced imaging solutions, driving significant investments in this sector.

What are the key market players or companies in this digital Radiology Radiography industry?

Key players in the digital radiology radiography industry include major imaging technology companies that innovate in radiography and diagnostic imaging solutions, driving advances in equipment, software, and collaborative healthcare practices.

What are the primary factors driving the growth in the digital radiology Radiography industry?

Growth in the digital radiology radiography industry is driven by technological advancements, increasing healthcare expenditure, and rising awareness about the benefits of early diagnosis and treatment, contributing to higher adoption rates of radiographic technologies.

Which region is the fastest Growing in the digital radiology Radiography market?

The fastest-growing region in the digital radiology radiography market is Europe, with projected market growth from $0.88 billion in 2023 to $1.79 billion by 2033, indicating strong demand and investment in healthcare technologies.

Does ConsaInsights provide customized market report data for the digital radiology Radiography industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs in the digital radiology radiography industry, ensuring clients receive relevant insights and forecasts that align with their market strategies.

What deliverables can I expect from this digital radiology Radiography market research project?

Deliverables from the digital radiology radiography market research project typically include comprehensive reports, executive summaries, data visualizations, and actionable insights based on the latest industry trends and forecasts.

What are the market trends of digital radiology Radiography?

Current market trends in digital radiology radiography include the increasing adoption of AI and machine learning in diagnostics, a shift towards filmless systems, and a growing focus on patient-centric imaging solutions to enhance diagnostic accuracy.