Digital Remittance Market Report

Published Date: 24 January 2026 | Report Code: digital-remittance

Digital Remittance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the digital remittance market, covering market size, trends, segmentation, and regional insights from 2023 to 2033. Key insights, forecasts, and leading companies are also detailed, offering valuable perspective on the future of digital remittance.

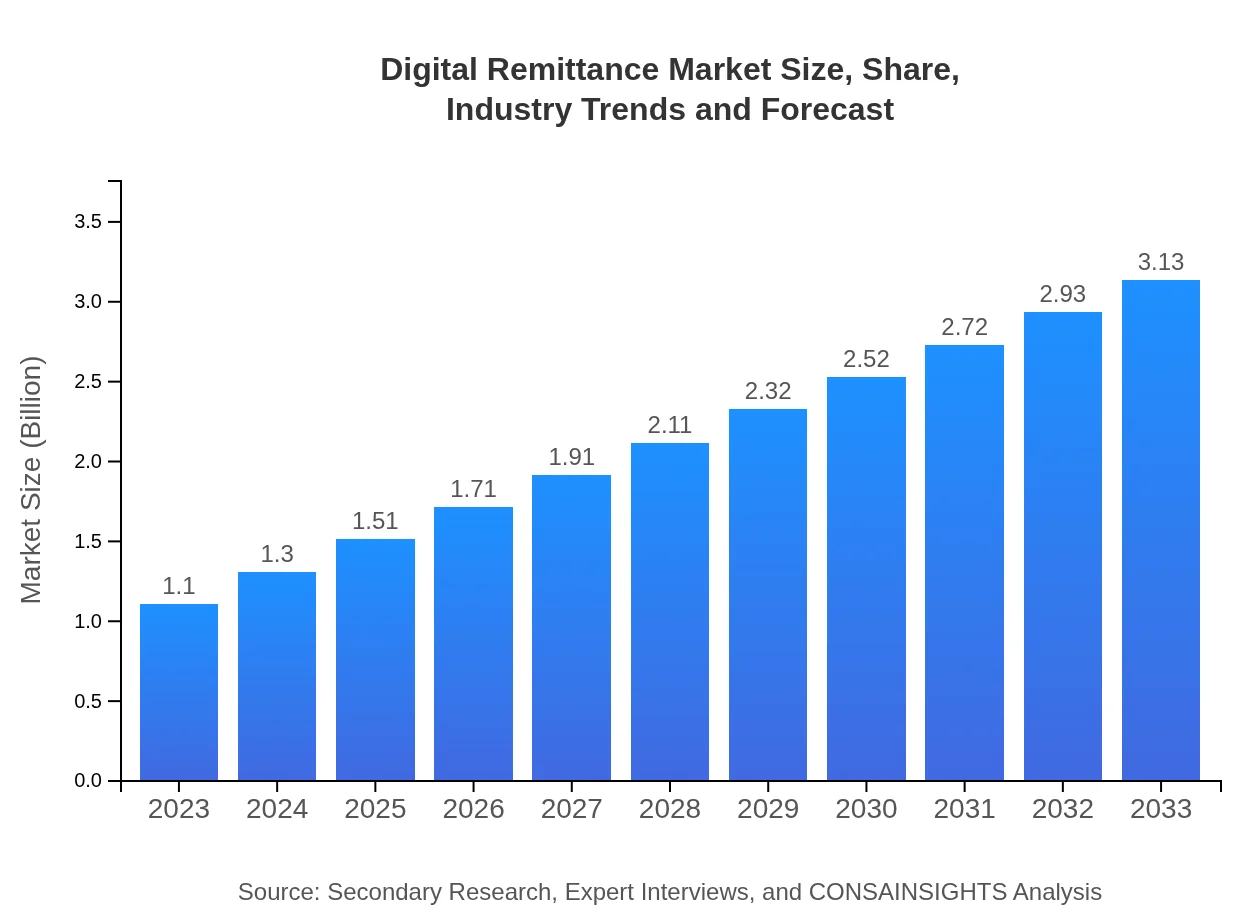

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.10 Trillion |

| CAGR (2023-2033) | 10.6% |

| 2033 Market Size | $3.13 Trillion |

| Top Companies | Western Union, PayPal/Xoom, TransferWise (Wise), Revolut, Remitly |

| Last Modified Date | 24 January 2026 |

Digital Remittance Market Overview

Customize Digital Remittance Market Report market research report

- ✔ Get in-depth analysis of Digital Remittance market size, growth, and forecasts.

- ✔ Understand Digital Remittance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Remittance

What is the Market Size & CAGR of Digital Remittance market in 2023?

Digital Remittance Industry Analysis

Digital Remittance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Remittance Market Analysis Report by Region

Europe Digital Remittance Market Report:

In Europe, the digital remittance market is projected at $0.29 trillion in 2023, increasing to $0.82 trillion by 2033. The region exhibits innovative payment solutions and strong regulatory frameworks, which support market growth. Countries like the UK and Germany lead in technology adoption for digital transactions.Asia Pacific Digital Remittance Market Report:

In 2023, the Asia Pacific market size for digital remittance stands at $0.23 trillion, expected to grow to $0.65 trillion by 2033. The region's growth is fueled by a high population of migrants, particularly in countries like India and China, who seek efficient money transfer solutions to support families back home. The increasing adoption of technology and smartphones also plays a critical role.North America Digital Remittance Market Report:

North America, with a market size of $0.38 trillion in 2023, is anticipated to grow to $1.07 trillion by 2033. The United States is home to a large immigrant population, driving demand for digital remittance services. Established players and new entrants are continually enhancing their platforms to cater to this growing demographic.South America Digital Remittance Market Report:

The digital remittance market in South America is valued at $0.08 trillion in 2023 and is projected to reach $0.22 trillion by 2033. The region faces challenges such as economic instability and currency volatility, but there is a strong demand for cross-border remittances, particularly towards countries like Brazil and Argentina. Local fintech solutions are gaining traction in this market.Middle East & Africa Digital Remittance Market Report:

The digital remittance market in the Middle East and Africa stands at $0.13 trillion in 2023 and is expected to reach $0.36 trillion by 2033. This region has a significant number of labor migrants, especially in the Gulf states, which boosts remittance flows. Increased access to digital financial services is expected to transform this market.Tell us your focus area and get a customized research report.

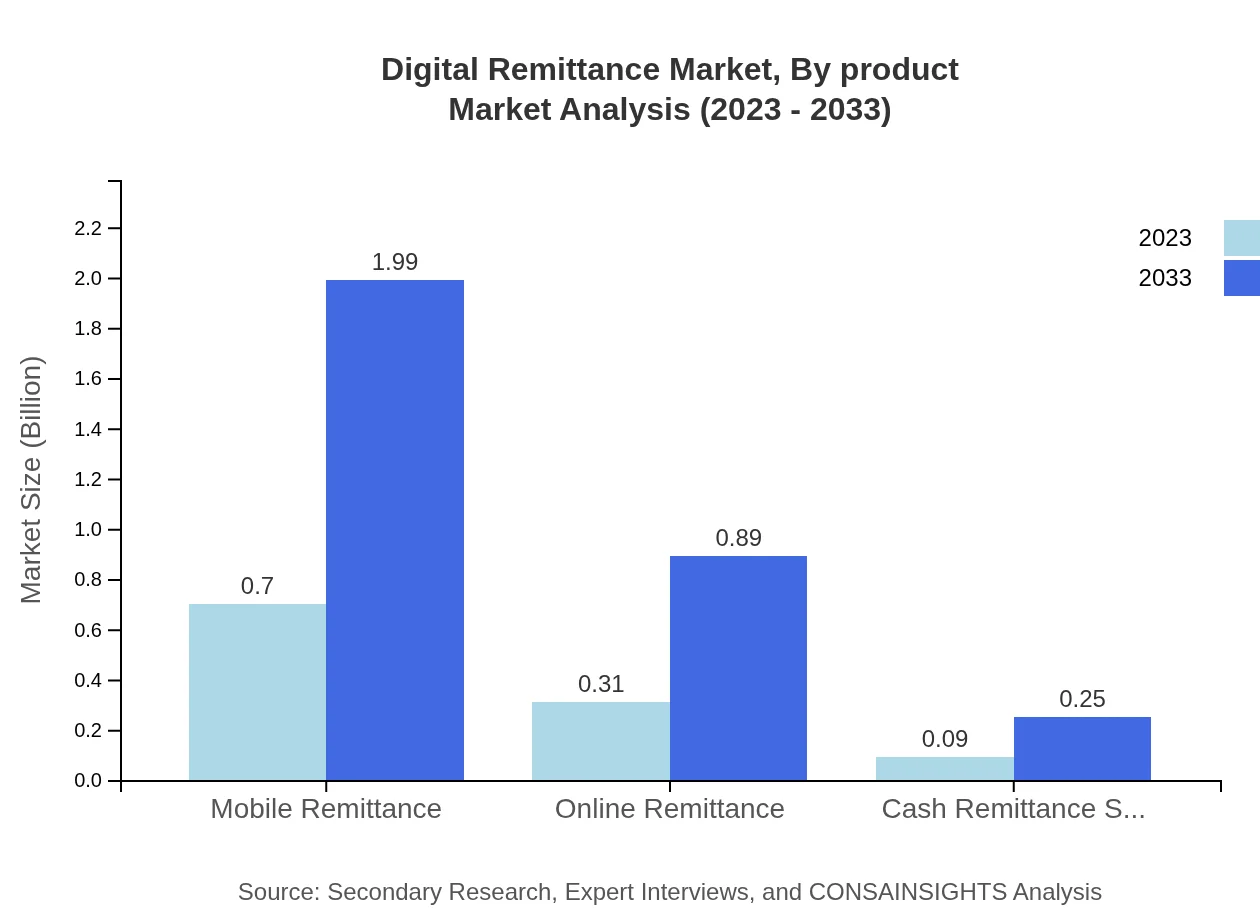

Digital Remittance Market Analysis By Product

The product segment includes Mobile Remittance, Online Remittance, and Cash Remittance Services. Mobile Remittance leads with a market size of $0.70 trillion in 2023, projected to grow to $1.99 trillion by 2033, driven by convenience and accessibility. Online Remittance services hold a market size of $0.31 trillion in 2023, advancing to $0.89 trillion by 2033, appealing to tech-savvy users. Cash Remittance services, while smaller, are growing steadily from $0.09 trillion in 2023 to $0.25 trillion in 2033.

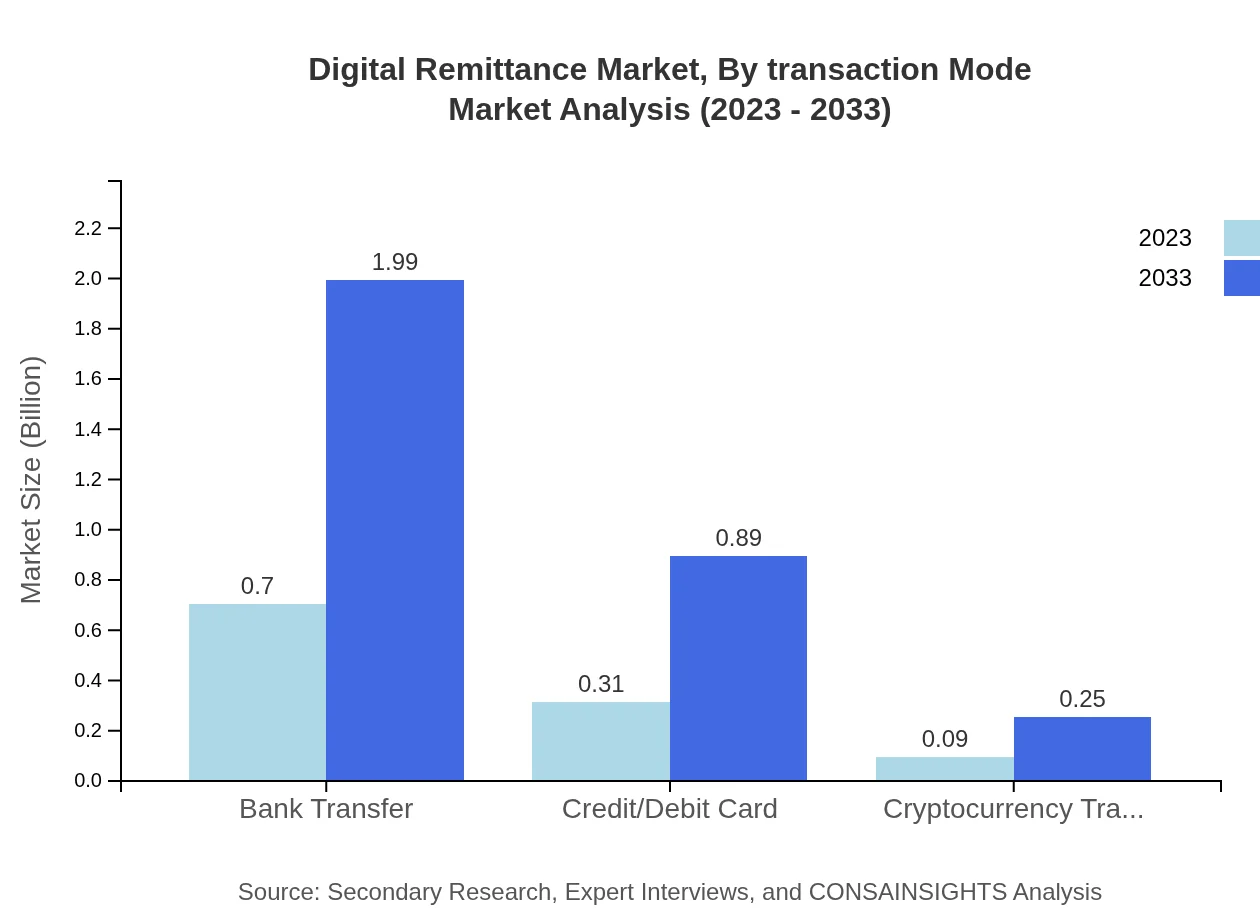

Digital Remittance Market Analysis By Transaction Mode

Transaction modes consist of Individuals and Businesses. Individuals account for a market share of $0.70 trillion in 2023, increasing to $1.99 trillion in 2033, owing to personal remittances. Business transaction remittance is expected to grow from $0.31 trillion in 2023 to $0.89 trillion by 2033, as companies expand globally and require efficient payment solutions.

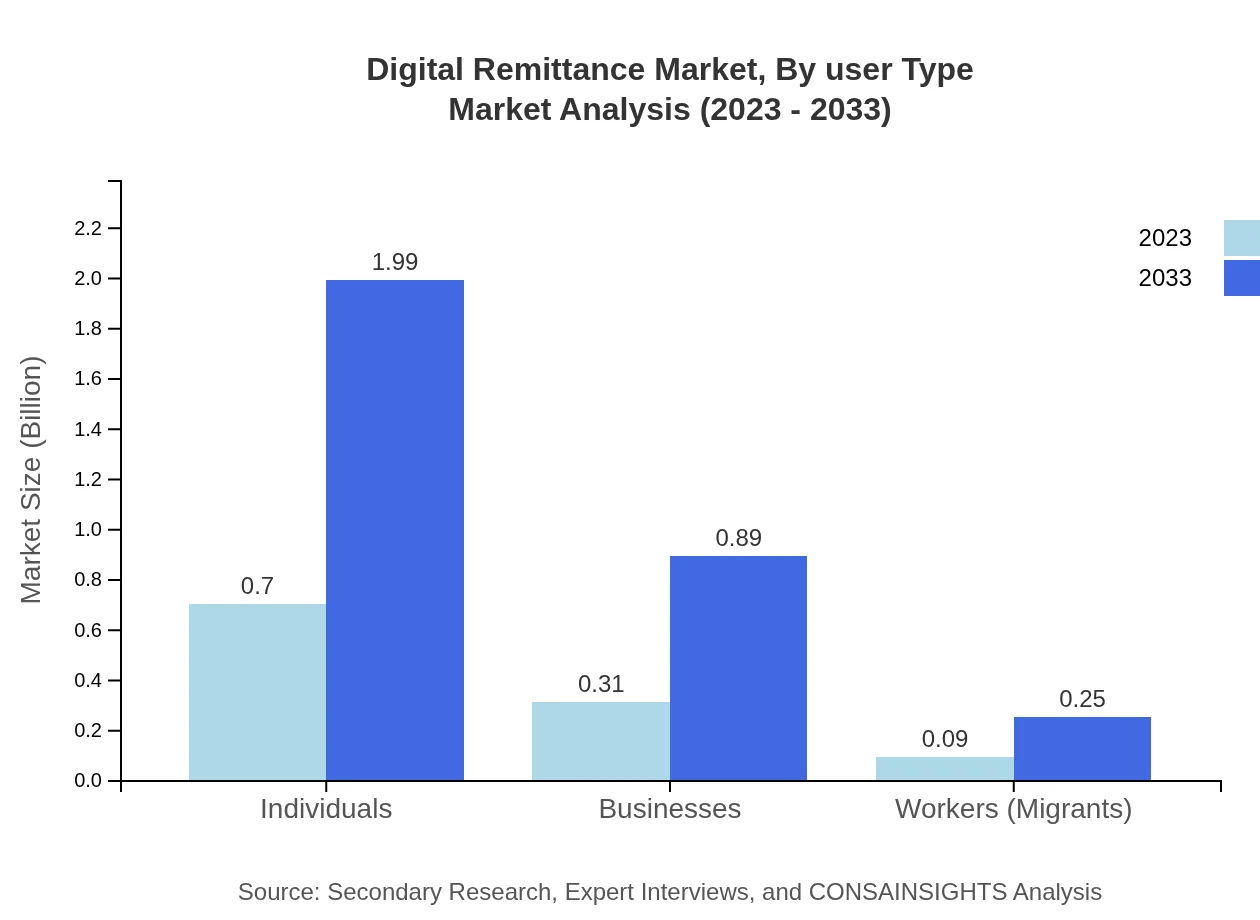

Digital Remittance Market Analysis By User Type

By user type, individuals dominate the market, accounting for $0.70 trillion in 2023, with projections of $1.99 trillion by 2033. Businesses are also gaining ground, with a market size rising from $0.31 trillion in 2023 to $0.89 trillion in 2033, as firms seek efficient ways to manage payroll and supplier payments across borders.

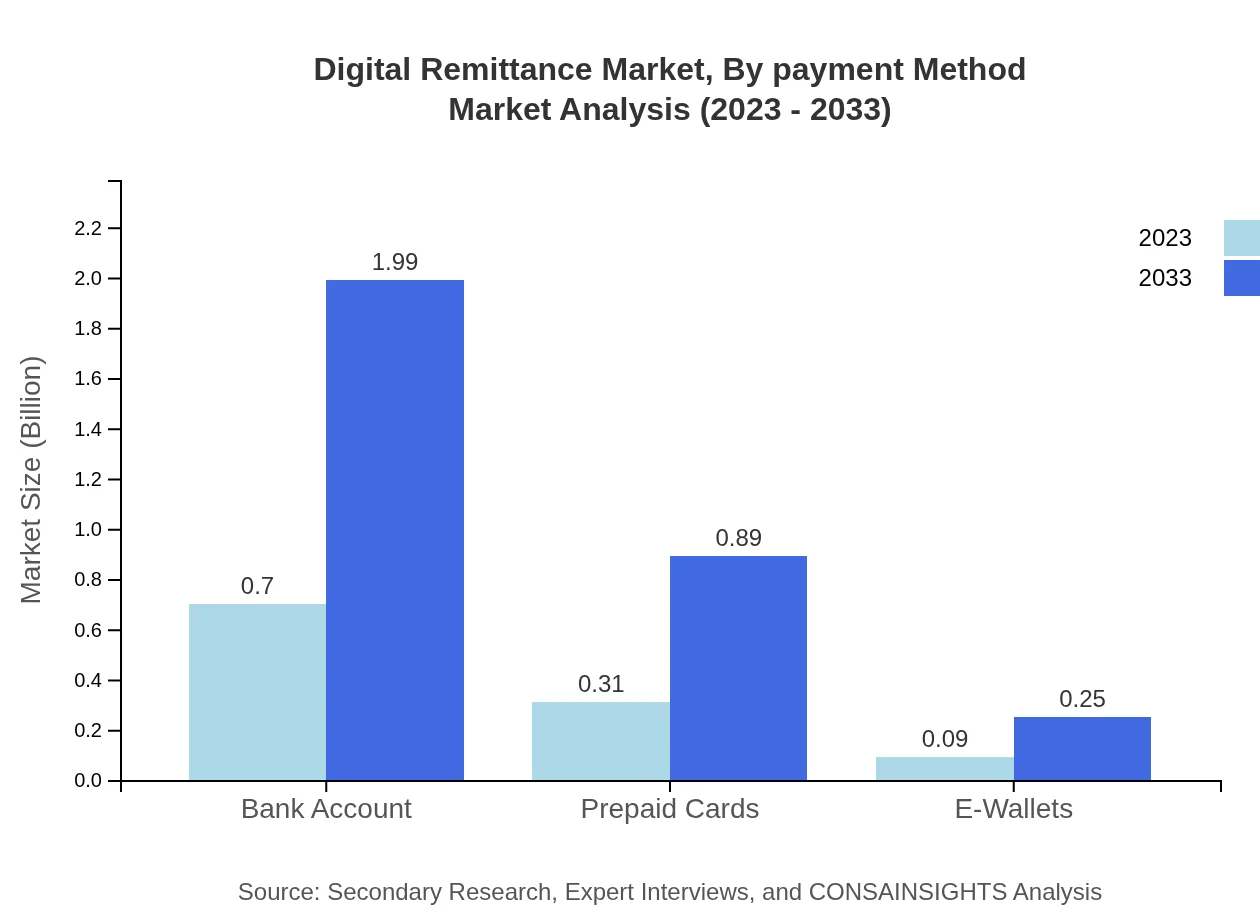

Digital Remittance Market Analysis By Payment Method

Payment methods include Bank Account, Prepaid Cards, E-Wallets, Credit/Debit Cards, and Cryptocurrency Transfers. Bank Account transfers will remain prominent, growing from $0.70 trillion in 2023 to $1.99 trillion by 2033. Prepaid Cards and E-Wallets are also recognized for their significance in providing options for users, demonstrating growth from $0.31 trillion to $0.89 trillion, and from $0.09 trillion to $0.25 trillion, respectively.

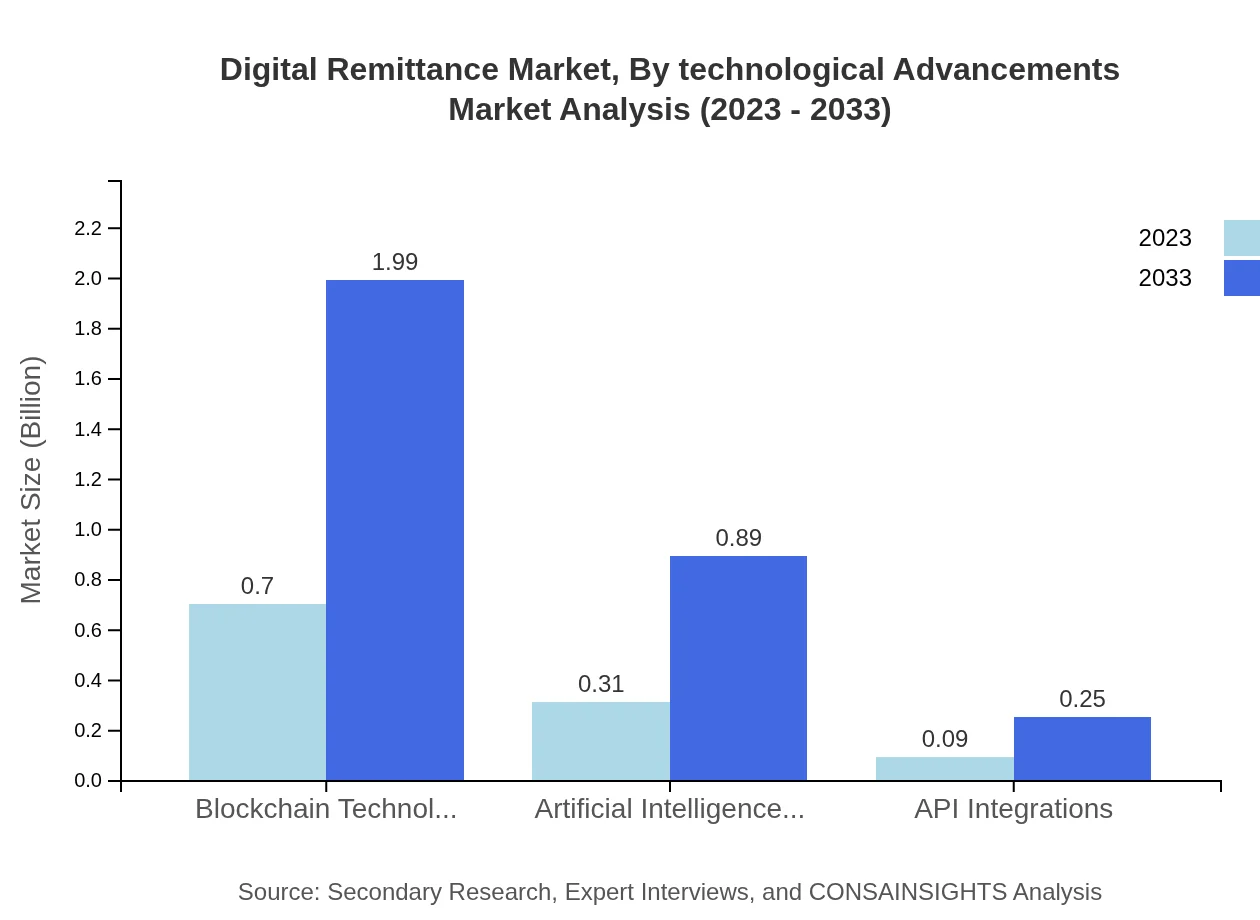

Digital Remittance Market Analysis By Technological Advancements

Technological advancements such as Blockchain Technology, Artificial Intelligence in Remittances, and API Integrations are pivotal. Blockchain is projected to grow from $0.70 trillion in 2023 to $1.99 trillion by 2033. AI is also expanding from $0.31 trillion to $0.89 trillion, enhancing transaction efficiency. API Integrations are essential for seamless connectivity between platforms, with expected growth from $0.09 trillion to $0.25 trillion by 2033.

Digital Remittance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Remittance Industry

Western Union:

A pioneer in money transfers, Western Union offers extensive global coverage and a wide range of services, from traditional cash transfers to digital remittance solutions.PayPal/Xoom:

PayPal's Xoom service provides fast, secure international transfers, leveraging its substantial user base and technological infrastructure.TransferWise (Wise):

Known for its transparent fees and real exchange rates, Wise has transformed how people think about cross-border money transfers.Revolut:

An innovative fintech company, Revolut offers a multi-currency account and low-cost international transfers, appealing to travelers and expatriates.Remitly:

Focusing on low-cost remittances, Remitly provides a digital-first approach, catering mainly to immigrants sending money home.We're grateful to work with incredible clients.

FAQs

What is the market size of digital Remittance?

The global digital remittance market is valued at $1.1 trillion in 2023, and it is projected to grow at a CAGR of 10.6% over the next decade.

What are the key market players or companies in this digital Remittance industry?

Key players in the digital remittance industry include TransferWise, Western Union, PayPal, MoneyGram, Remitly, and Ria Money Transfer. These companies lead in offering diverse digital remittance services and innovative technology solutions.

What are the primary factors driving the growth in the digital Remittance industry?

Driving factors include increased globalization, the rise of migrant labor, technological advancements in payment solutions, and the increasing need for faster and cheaper remittance services in emerging economies.

Which region is the fastest Growing in the digital Remittance?

The Asia-Pacific region is projected to be the fastest-growing market for digital remittances, expanding from $0.23 trillion in 2023 to $0.65 trillion by 2033, driven by a large expatriate population and growing digital adoption.

Does ConsaInsights provide customized market report data for the digital Remittance industry?

Yes, ConsaInsights offers customized market report data tailored to the digital remittance industry, ensuring that specific client needs and insights are addressed through comprehensive research.

What deliverables can I expect from this digital Remittance market research project?

Deliverables include detailed market analysis reports, segmentation data, regional insights, forecasts through 2033, and strategic recommendations based on current market trends.

What are the market trends of digital Remittance?

Market trends include the increasing penetration of mobile remittance solutions, the adoption of artificial intelligence for enhanced user experience, and the growth of cryptocurrency-based transfers in global markets.