Digital Textile Printing Market Report

Published Date: 22 January 2026 | Report Code: digital-textile-printing

Digital Textile Printing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Digital Textile Printing market, focusing on market trends, size forecasts, segmentation, regional insights, and key industry players for the period 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

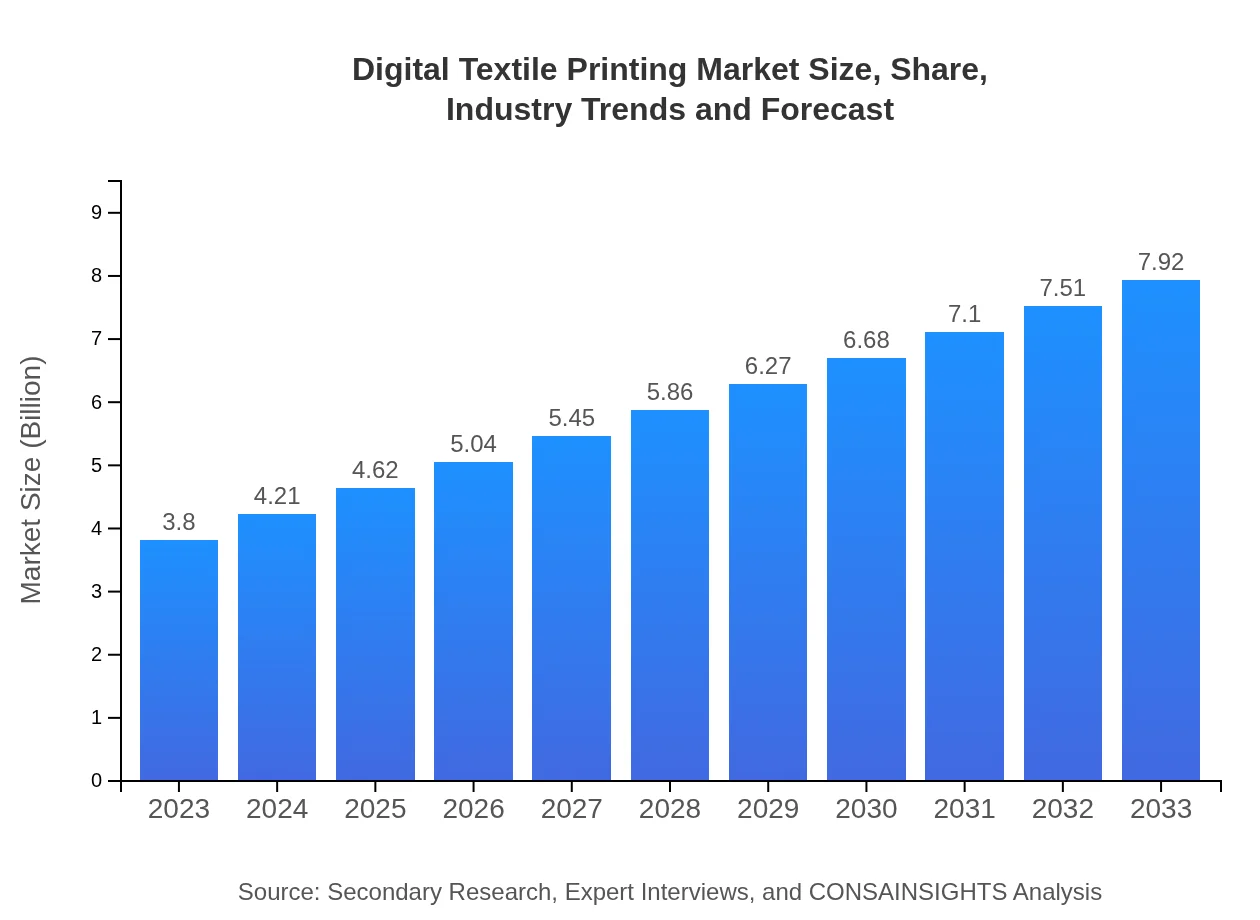

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 7.4% |

| 2033 Market Size | $7.92 Billion |

| Top Companies | Epson, Mimaki, RICOH, Brother Industries, Durst Phototechnik |

| Last Modified Date | 22 January 2026 |

Digital Textile Printing Market Overview

Customize Digital Textile Printing Market Report market research report

- ✔ Get in-depth analysis of Digital Textile Printing market size, growth, and forecasts.

- ✔ Understand Digital Textile Printing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Textile Printing

What is the Market Size & CAGR of Digital Textile Printing market in 2023?

Digital Textile Printing Industry Analysis

Digital Textile Printing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Textile Printing Market Analysis Report by Region

Europe Digital Textile Printing Market Report:

The European Digital Textile Printing market is set to grow from $1.23 billion in 2023 to $2.57 billion by 2033. A strong focus on eco-friendly printing solutions and fashion-forward designs will significantly contribute to market growth, with leading brands and retailers investing heavily in digital solutions.Asia Pacific Digital Textile Printing Market Report:

The Asia Pacific region is projected to grow from $0.60 billion in 2023 to $1.24 billion by 2033, driven by a booming fashion industry and significant investments in textile technology. China's thriving textile sector and India’s growing expertise in digital printing technology are key growth contributors.North America Digital Textile Printing Market Report:

North America is forecasted to rise from $1.41 billion in 2023 to $2.94 billion by 2033. The region benefits from high consumer expenditure on luxury and personalized textiles, with a strong emphasis on sustainability initiatives driving innovation in the sector.South America Digital Textile Printing Market Report:

In South America, the market is expected to increase from $0.13 billion in 2023 to $0.27 billion by 2033. Growth is primarily fueled by the expanding fashion industry and local manufacturers adopting digital printing technologies to meet emerging consumer trends.Middle East & Africa Digital Textile Printing Market Report:

The Middle East and Africa market is estimated to grow from $0.43 billion in 2023 to $0.89 billion by 2033, driven by the rising demand for personalized textiles in both regions. With a growing retail sector, digital textile printing is set to play a crucial role in meeting consumer preferences.Tell us your focus area and get a customized research report.

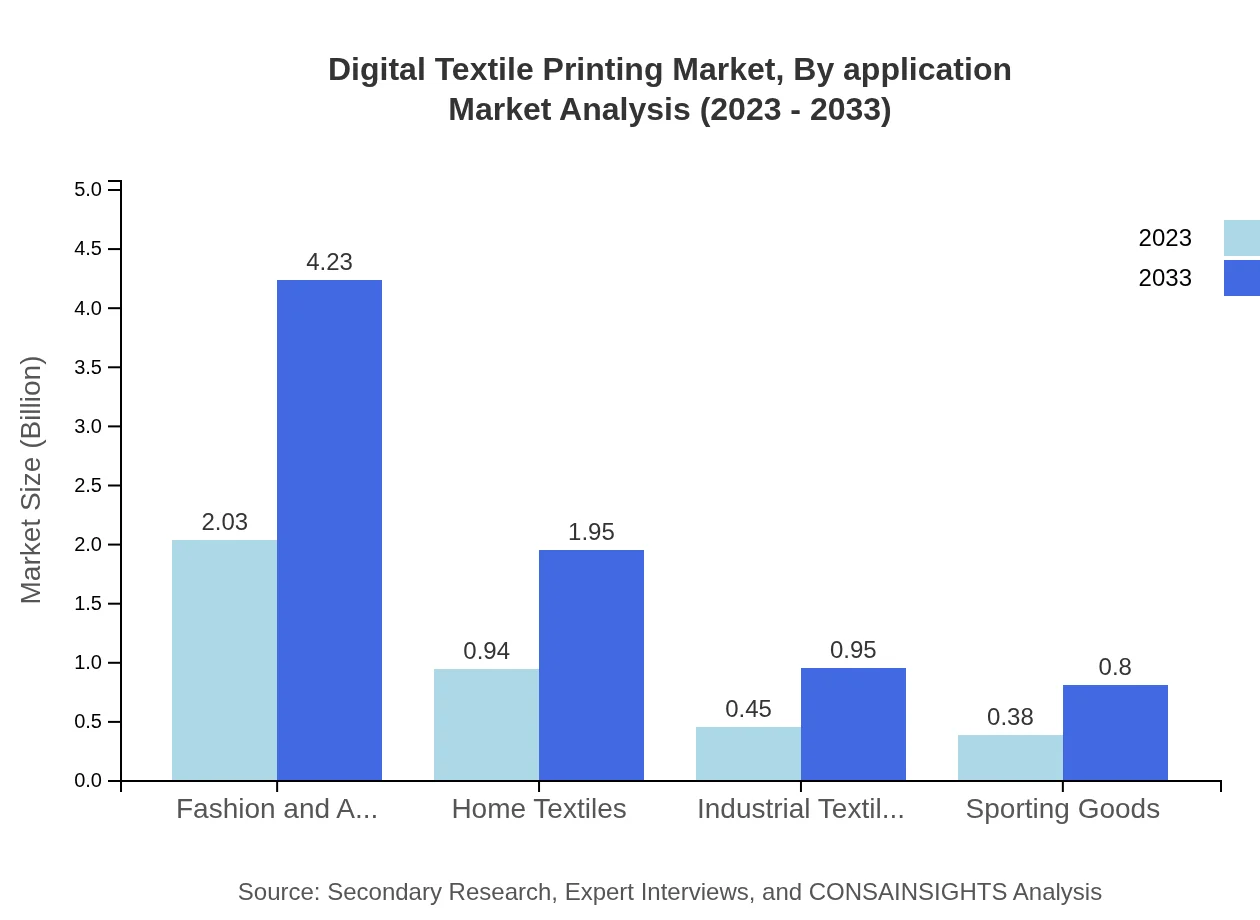

Digital Textile Printing Market Analysis By Application

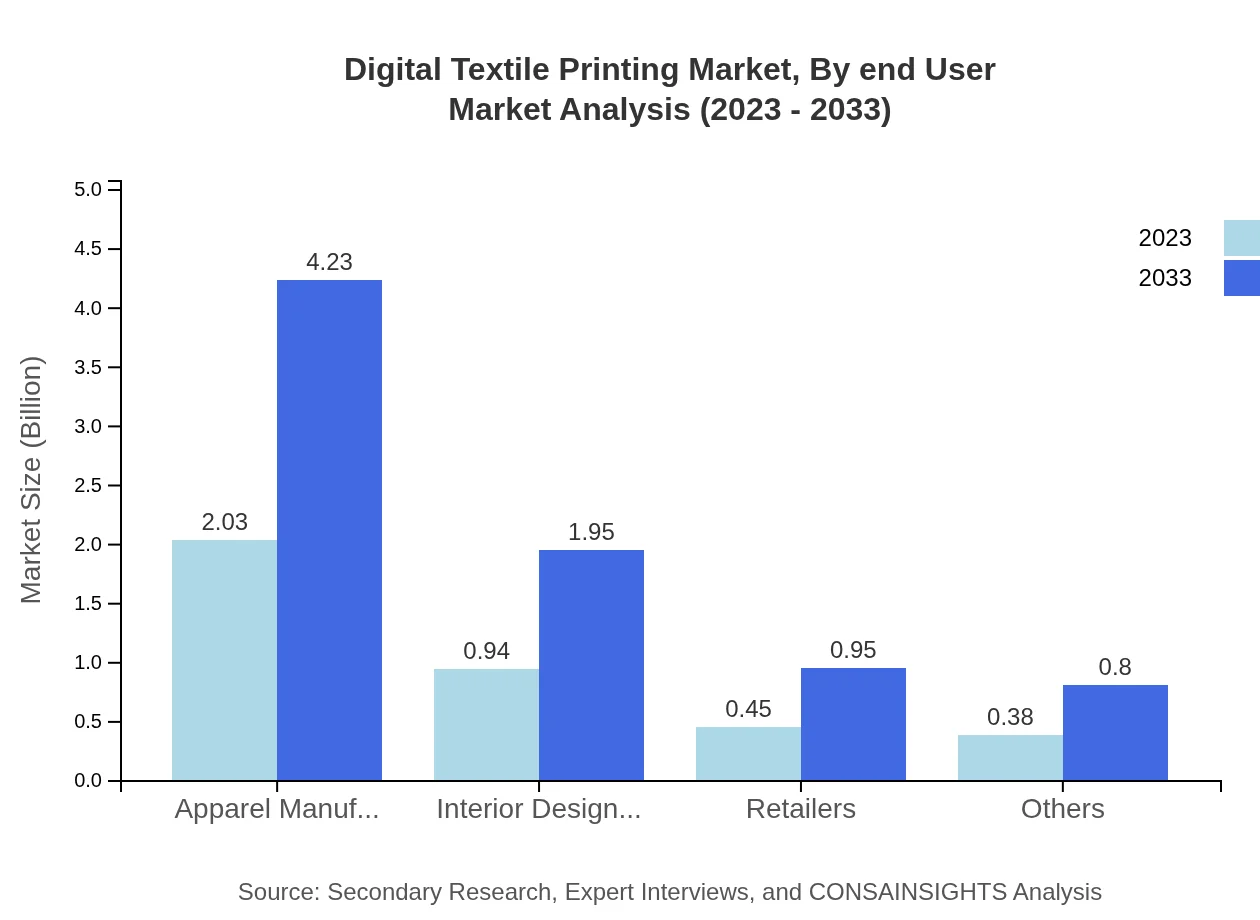

In 2023, the Apparel Manufacturers segment accounted for a market size of $2.03 billion, projected to rise to $4.23 billion by 2033, representing a share of 53.35%. Other segments include: 1) Interior Designers: Size - $0.94 billion (2023) to $1.95 billion (2033), with a share of 24.62%. 2) Retailers: Size - $0.45 billion (2023) to $0.95 billion (2033), holding a share of 11.97%. 3) Others: Size - $0.38 billion (2023) to $0.80 billion (2033), with a share of 10.06%.

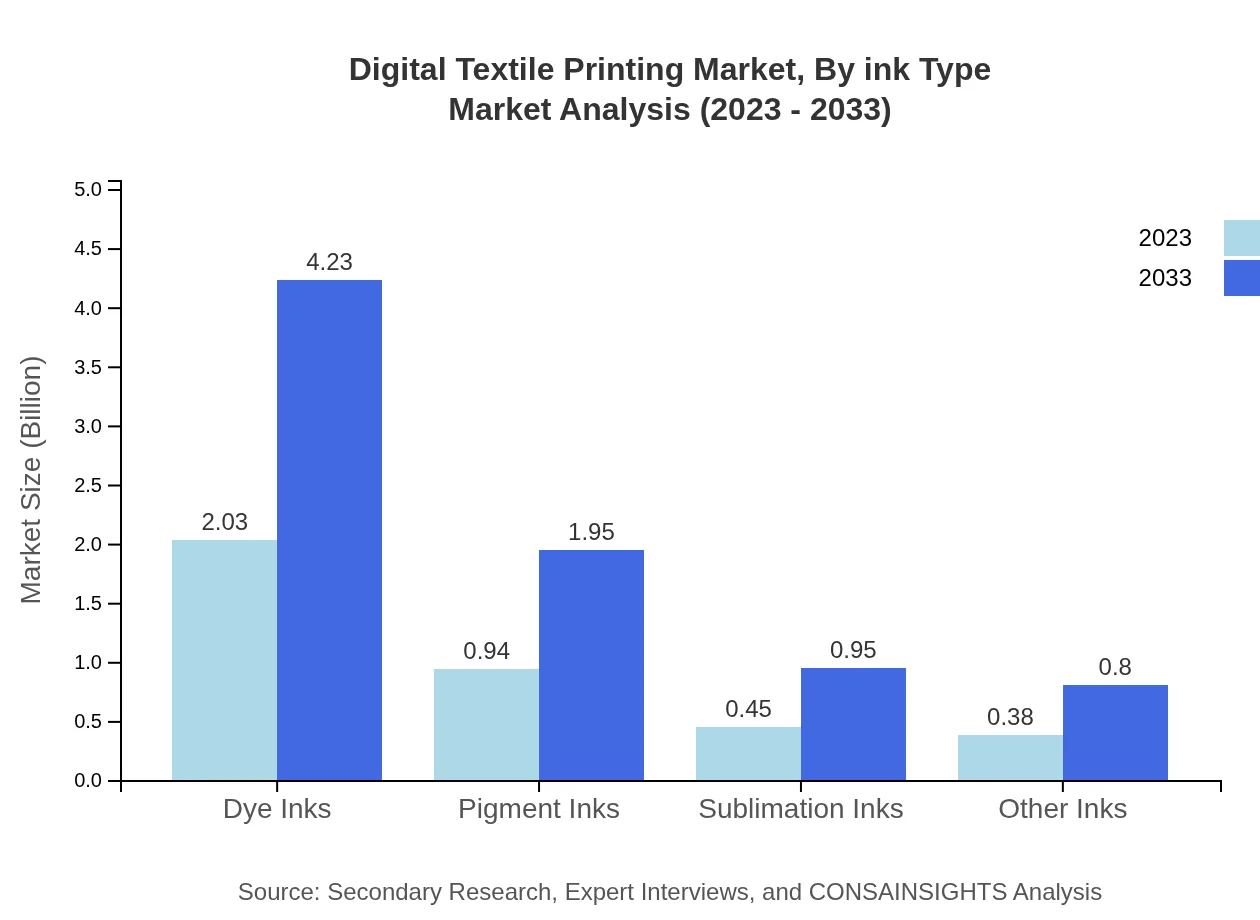

Digital Textile Printing Market Analysis By Ink Type

The Dye Inks segment dominates the market with a size of $2.03 billion in 2023, projected to reach $4.23 billion by 2033, representing a substantial share of 53.35%. Other ink types include Pigment Inks: Size - $0.94 billion (2023) to $1.95 billion (2033), with a share of 24.62%. Sublimation Inks and Other Inks also contribute with sizes of $0.45 and $0.38 billion respectively in 2023.

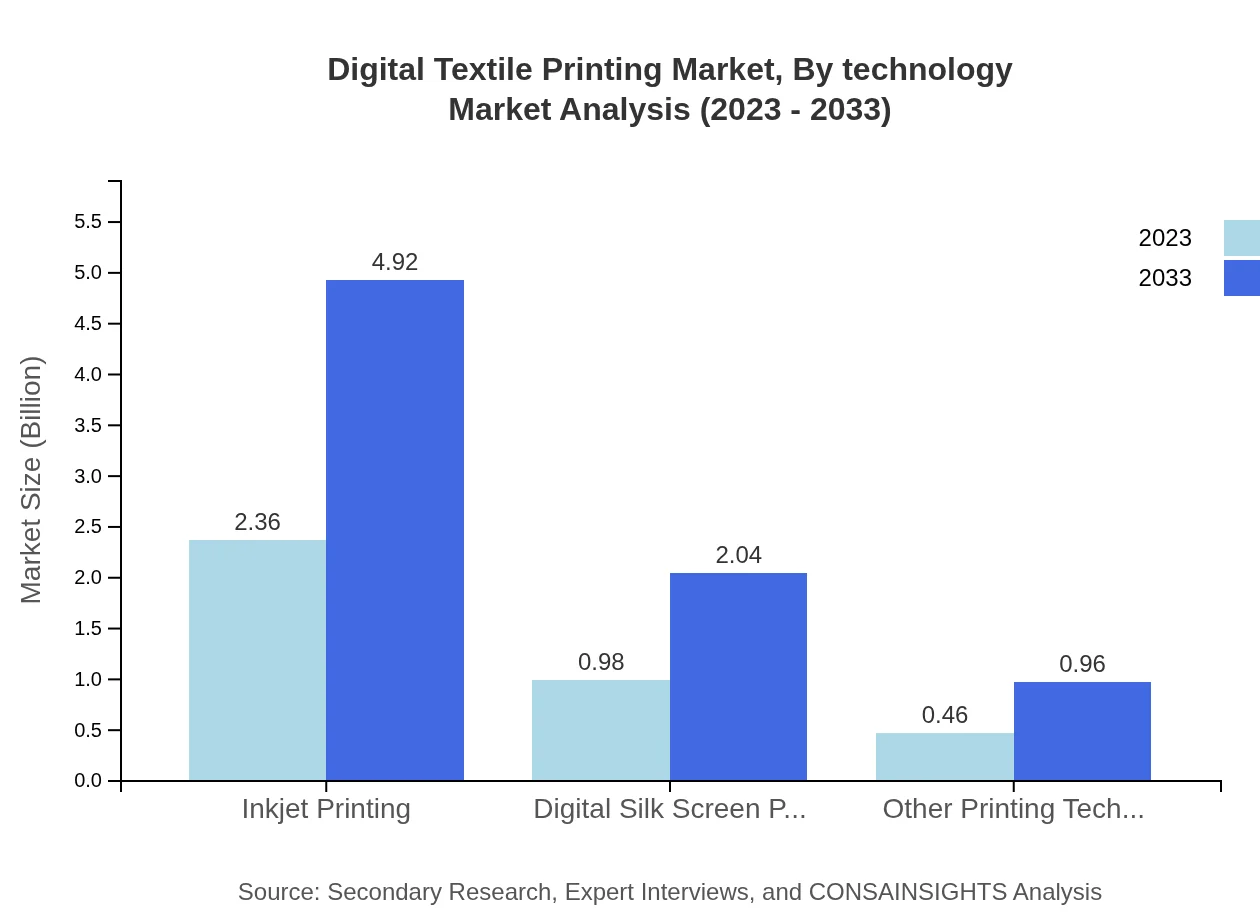

Digital Textile Printing Market Analysis By Technology

Inkjet Printing is leading with a size of $2.36 billion in 2023, expected to grow to $4.92 billion by 2033, maintaining a market share of 62.09%. Digital Silk Screen Printing follows with a size of $0.98 billion in 2023 and is projected to reach $2.04 billion by 2033, with a share of 25.79%.

Digital Textile Printing Market Analysis By End User

The Fashion and Apparel sector plays a pivotal role with a market size of $2.03 billion in 2023, anticipated to reach $4.23 billion by 2033, ensuring a share of 53.35%. Home Textiles and Industrial Textiles segments also exhibit significant potential, contributing $0.94 billion and $0.45 billion respectively in 2023.

Digital Textile Printing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Textile Printing Industry

Epson:

Epson is renowned for its innovative inkjet printing technology, providing reliable and high-quality digital printing solutions for various applications in textiles.Mimaki:

Mimaki specializes in developing cutting-edge digital printer technology and inks for textiles, known for its versatility and high-performance capabilities.RICOH:

RICOH offers advanced digital printing solutions and inks targeted at improving productivity and sustainability in the textile printing industry.Brother Industries:

Brother Industries provides innovative digital textile printing solutions that enhance operational efficiency while focusing on eco-friendly products.Durst Phototechnik:

Durst is recognized for its comprehensive digital printing solutions, contributing significantly to advancements in quality and performance in textile printing.We're grateful to work with incredible clients.

FAQs

What is the market size of digital textile printing?

The digital textile printing market is currently valued at approximately $3.8 billion, with an impressive CAGR of 7.4% expected over the next decade. This growth trajectory indicates robust demand for innovative printing technologies in textiles.

What are the key market players or companies in this digital textile printing industry?

Key players in the digital textile printing industry include established brands and manufacturers like Epson, Mimaki, HP, and Roland. These companies dominate the market with their innovative technologies and comprehensive product portfolios.

What are the primary factors driving the growth in the digital textile printing industry?

Driving factors for the digital textile printing industry include increased demand for customized textiles, advancements in printing technologies, eco-friendly inks, and the growing popularity of on-demand printing solutions.

Which region is the fastest Growing in the digital textile printing?

The Asia Pacific region is expected to be the fastest-growing market for digital textile printing, with a projected increase from $0.60 billion in 2023 to $1.24 billion by 2033, reflecting a significant growth momentum.

Does ConsaInsights provide customized market report data for the digital textile printing industry?

Yes, ConsaInsights offers tailored market report data for the digital textile printing industry, enabling clients to acquire insights uniquely suited to their business needs and market strategies.

What deliverables can I expect from this digital textile printing market research project?

From this market research project, clients can expect comprehensive reports including market size, growth forecasts, competitive analysis, regional insights, and in-depth segmented data for decision-making.

What are the market trends of digital textile printing?

Current trends in digital textile printing include the rise of sustainable printing methods, integration of AI in design processes, customization options, and the expansion of online textile printing platforms.