Digital Transaction Management Dtm Market Report

Published Date: 31 January 2026 | Report Code: digital-transaction-management-dtm

Digital Transaction Management Dtm Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Digital Transaction Management (DTM) market, highlighting insights into market trends, size, growth forecasts, and segmentation from 2023 to 2033.

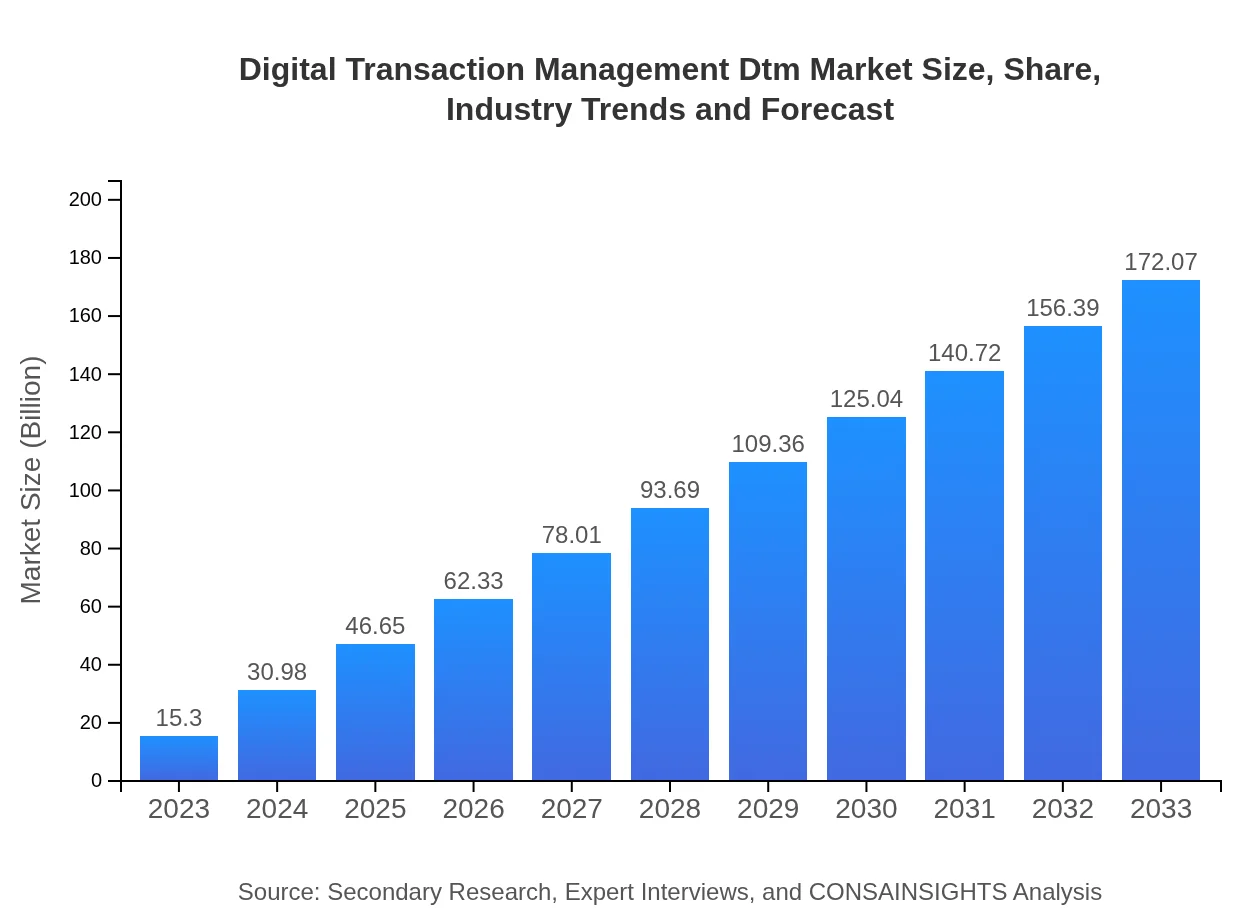

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 25.6% |

| 2033 Market Size | $172.07 Billion |

| Top Companies | DocuSign, Adobe Sign, OneSpan, PandaDoc |

| Last Modified Date | 31 January 2026 |

Digital Transaction Management Dtm Market Overview

Customize Digital Transaction Management Dtm Market Report market research report

- ✔ Get in-depth analysis of Digital Transaction Management Dtm market size, growth, and forecasts.

- ✔ Understand Digital Transaction Management Dtm's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Transaction Management Dtm

What is the Market Size & CAGR of Digital Transaction Management Dtm market in 2023?

Digital Transaction Management Dtm Industry Analysis

Digital Transaction Management Dtm Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Transaction Management Dtm Market Analysis Report by Region

Europe Digital Transaction Management Dtm Market Report:

In Europe, the DTM market is expected to grow from $4.66 billion in 2023 to $52.41 billion by 2033. The region’s growth is influenced by stringent regulations on data protection and the increasing trend of digital transformation among businesses, particularly in the UK, Germany, and France. The demand for secure and efficient transaction processes is driving the innovation of DTM functions across various industries.Asia Pacific Digital Transaction Management Dtm Market Report:

In 2023, the Asia Pacific DTM market is valued at $2.80 billion and is expected to grow to $31.47 billion by 2033. The region is experiencing rapid digital transformation, catalyzed by robust internet penetration and mobile adoption rates. Countries like India, China, and Japan are leading the growth, driven by the need for digital solutions to enhance business efficiency and customer engagement.North America Digital Transaction Management Dtm Market Report:

North America holds a significant share of the DTM market, valued at $5.78 billion in 2023, which is anticipated to soar to $64.96 billion by 2033. The U.S. and Canada are leading markets due to their developed IT infrastructure, proactive approach to regulatory compliance, and a strong emphasis on customer experience. Major businesses in this region are rapidly adopting DTM solutions to streamline operations and engage customers effectively.South America Digital Transaction Management Dtm Market Report:

The South American DTM market is valued at $0.85 billion in 2023, projected to reach $9.53 billion by 2033. This growth is propelled by an increasing emphasis on eCommerce and digital solutions to improve transaction processes across sectors. The market is gradually adopting DTM technologies, albeit at a slower pace compared to other regions.Middle East & Africa Digital Transaction Management Dtm Market Report:

The Middle East and Africa DTM market, valued at $1.22 billion in 2023, is projected to reach $13.70 billion by 2033. Increased digitalization efforts and investments in technological infrastructure have enhanced the adoption of DTM solutions. Notably, countries like UAE and South Africa are leading the way in integrating digital transaction services into their economic frameworks.Tell us your focus area and get a customized research report.

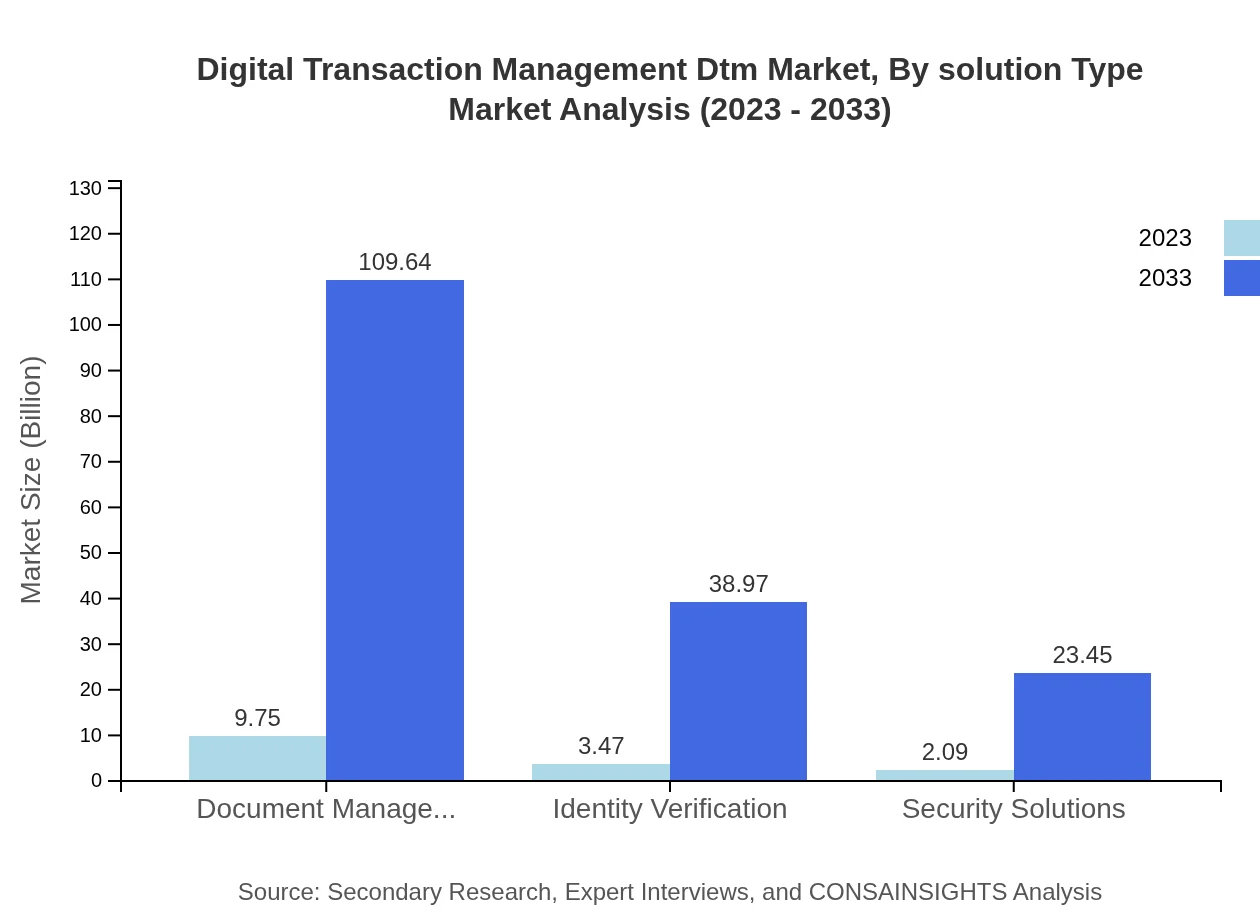

Digital Transaction Management Dtm Market Analysis By Solution Type

The DTM market is significantly influenced by solution types, including Document Management, Identity Verification, and Security Solutions. Document Management is projected to grow from $9.75 billion in 2023 to $109.64 billion by 2033, representing a significant segment of the market with a share of 63.72%. Other segments, such as Identity Verification and Security Solutions, are anticipated to experience robust growth due to the increasing emphasis on security and compliance in digital transactions.

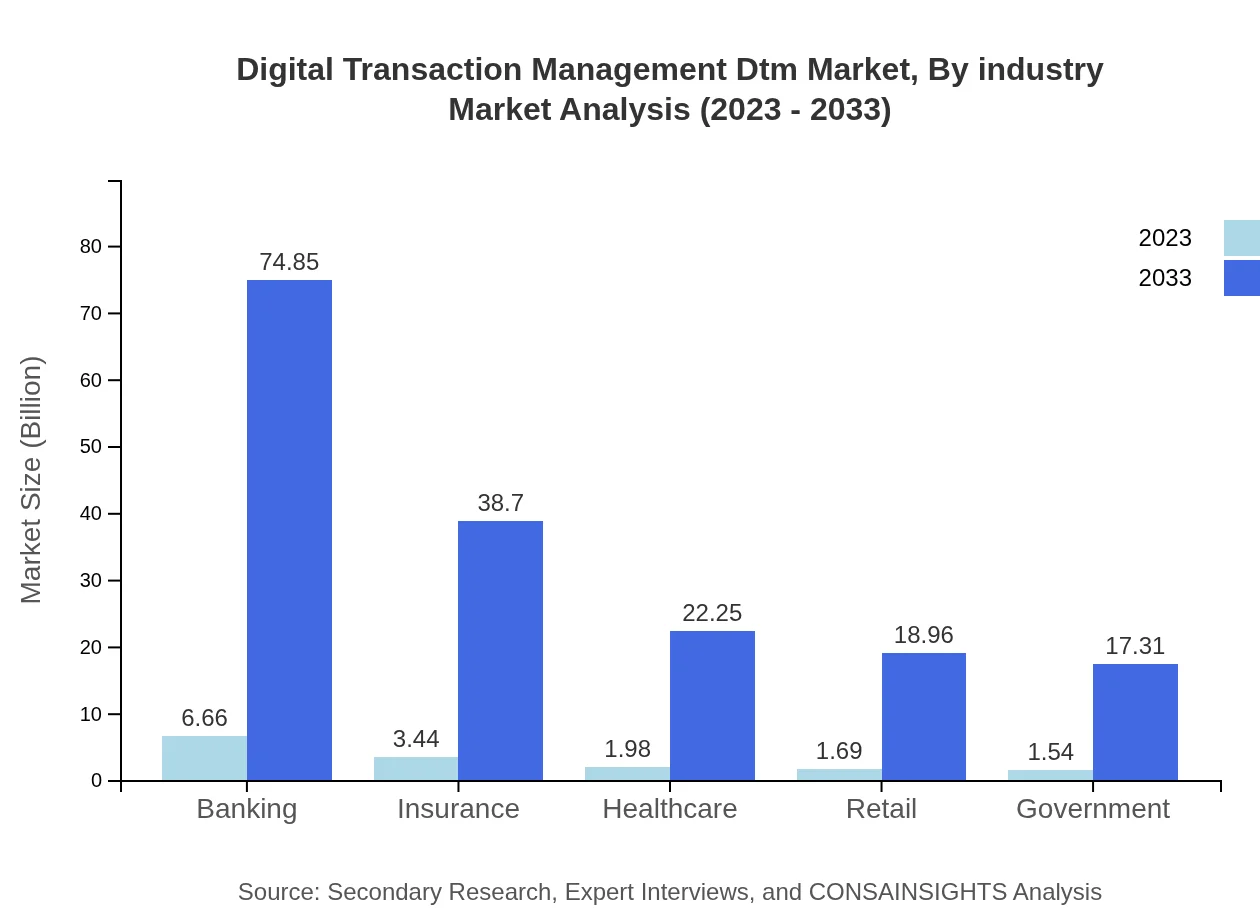

Digital Transaction Management Dtm Market Analysis By Industry

The banking sector holds a substantial share in the DTM market, valued at $6.66 billion in 2023, and projected to reach $74.85 billion by 2033. The insurance industry and healthcare show promising growth trajectories, with the insurance market growing from $3.44 billion to $38.70 billion, and healthcare from $1.98 billion to $22.25 billion over the same period. This demonstrates the diverse applicability of DTM across industries.

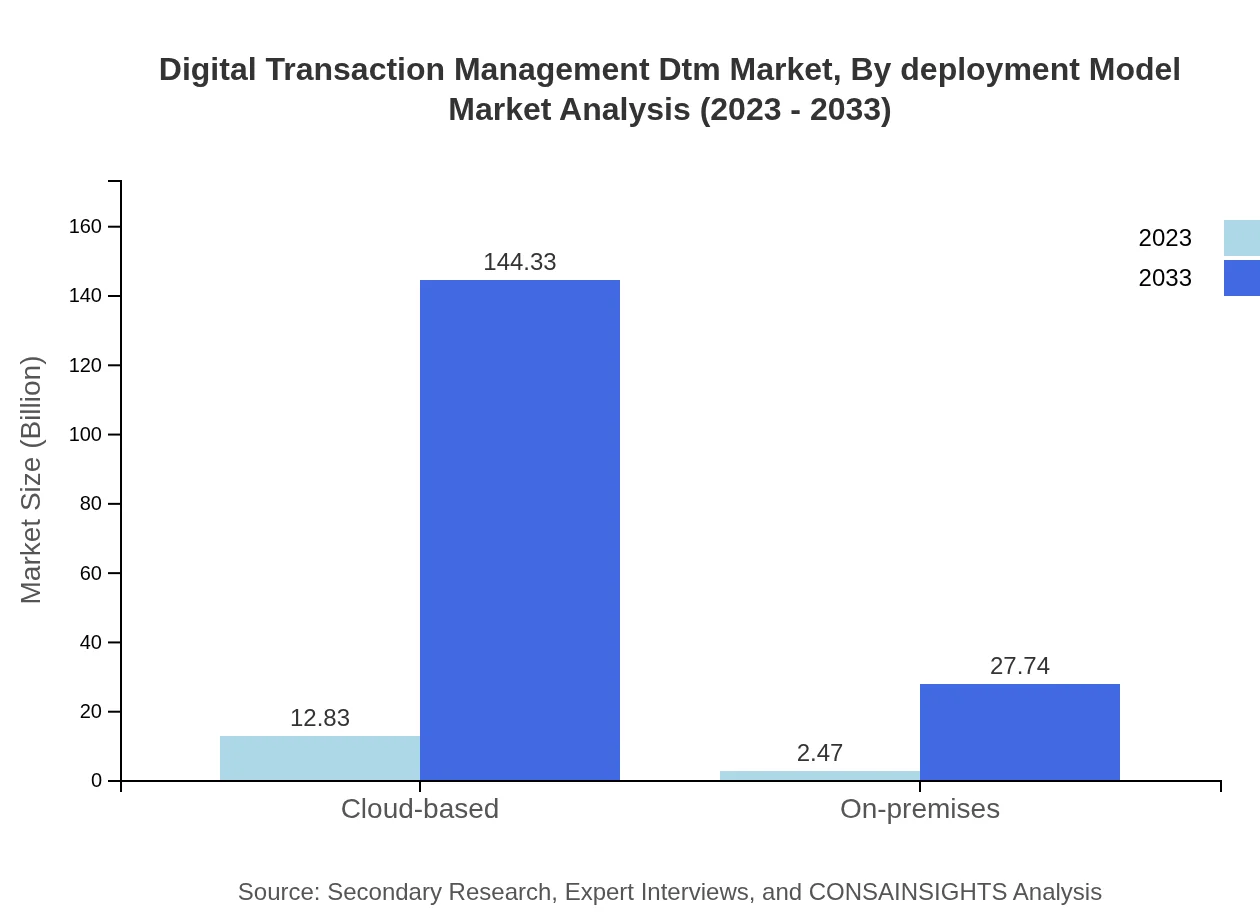

Digital Transaction Management Dtm Market Analysis By Deployment Model

The DTM market is predominantly driven by cloud-based deployment models which account for a significant share (83.88%) of the market size, growing from $12.83 billion in 2023 to $144.33 billion by 2033. On-premises models serve a niche market and are expected to expand from $2.47 billion to $27.74 billion during the same timeframe, driven by businesses wishing to maintain control over data security.

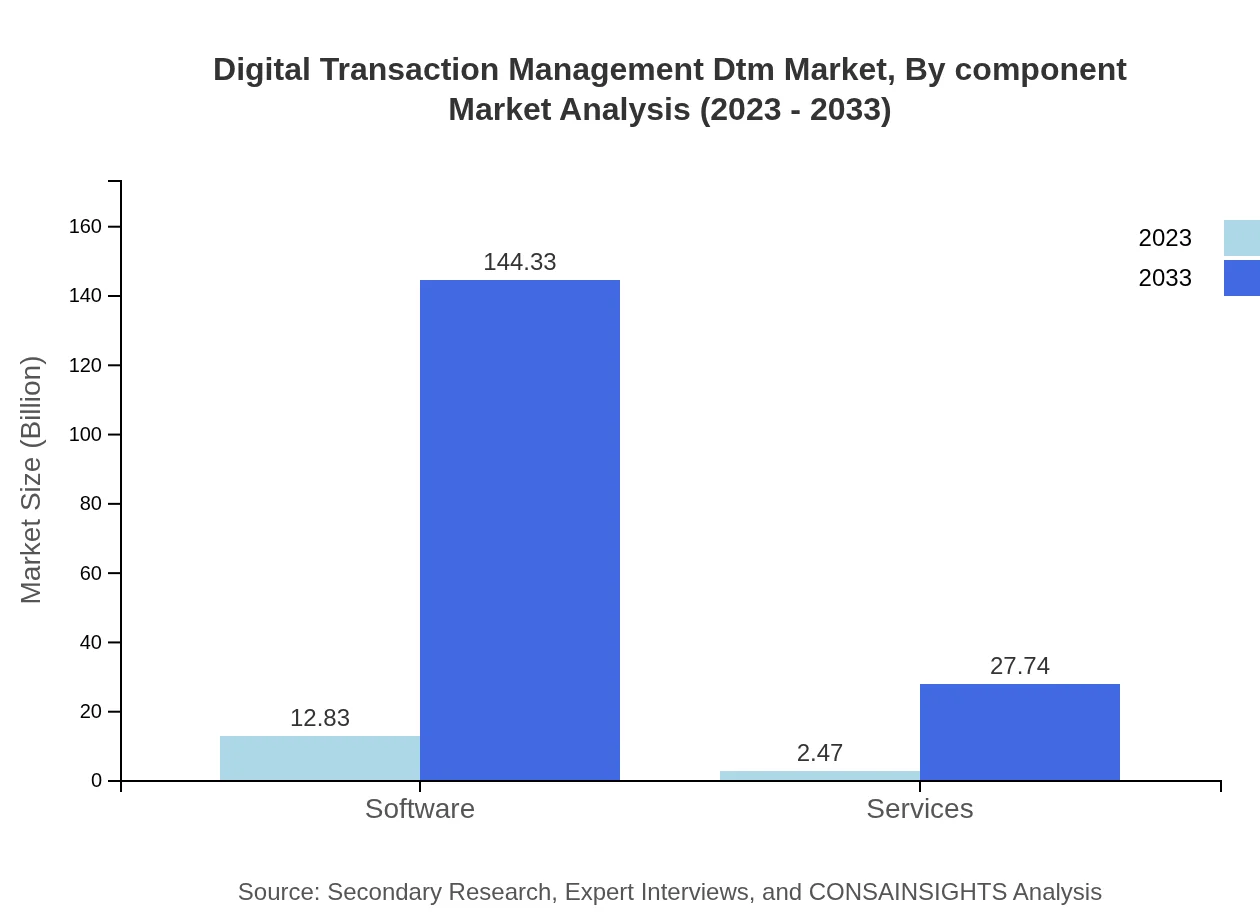

Digital Transaction Management Dtm Market Analysis By Component

Software components dominate the DTM market with a projected growth from $12.83 billion in 2023 to $144.33 billion by 2033, representing an 83.88% share. Services also play an essential role in driving the DTM ecosystem with significant growth anticipated from $2.47 billion to $27.74 billion, as businesses increasingly prioritize customized solutions.

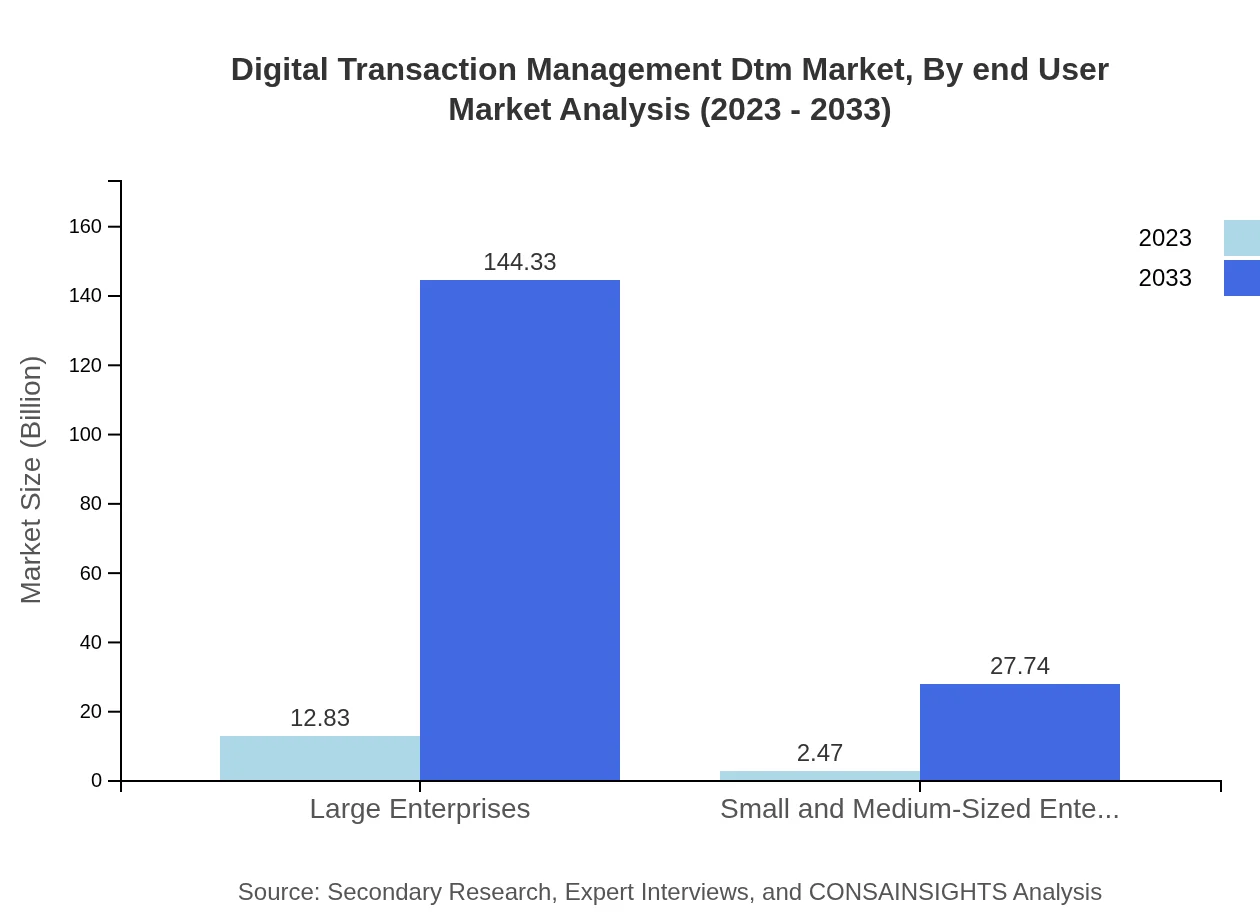

Digital Transaction Management Dtm Market Analysis By End User

Large enterprises command a significant market share with a size of $12.83 billion in 2023, expected to grow to $144.33 billion by 2033, maintaining an 83.88% share. SMEs, though smaller, are also seeing growth from $2.47 billion to $27.74 billion as they adopt DTM solutions to enhance operational efficiency and customer engagement.

Digital Transaction Management Dtm Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Transaction Management Dtm Industry

DocuSign:

DocuSign is a leading provider of electronic signature technology and digital transaction management solutions, helping businesses manage agreements digitally. Their cloud-based services provide streamlined workflows and enhance transaction security.Adobe Sign:

Adobe Sign, part of Adobe Document Cloud, offers comprehensive digital transaction management solutions leveraging advanced technologies. Their platform allows users to send, sign, track, and manage documents securely and efficiently.OneSpan:

OneSpan specializes in identity verification and transaction security solutions. Their offerings help organizations secure transactions and comply with regulations, making them a critical player in the DTM market.PandaDoc:

PandaDoc provides a document management solution that integrates into sales workflows. Their intuitive platform simplifies document creation, approval, and management, catering primarily to SMEs.We're grateful to work with incredible clients.

FAQs

What is the market size of Digital Transaction Management (DTM)?

The Digital Transaction Management (DTM) market is projected to reach approximately $15.3 billion by 2033, growing at a remarkable CAGR of 25.6%. This rapid growth indicates a significant increase in technology adoption and digital workflows.

What are the key market players or companies in the DTM industry?

Key players in the Digital Transaction Management (DTM) market include major technology firms specializing in electronic signatures, cloud solutions, and document management systems, contributing significantly to innovation and market growth.

What are the primary factors driving the growth in the DTM industry?

The growth in the DTM industry is primarily driven by increasing demand for efficiency in business processes, enhanced focus on digital transformation, and rising regulatory compliance requirements, propelling organizations to adopt digital solutions.

Which region is the fastest Growing in the DTM market?

North America is the fastest-growing region in the DTM market, expanding from approximately $5.78 billion in 2023 to an estimated $64.96 billion by 2033, reflecting significant technological advancements and higher adoption rates.

Does ConsaInsights provide customized market report data for the DTM industry?

Yes, ConsaInsights offers tailored market reports for the Digital Transaction Management (DTM) sector, allowing stakeholders to receive insights and data specific to their business needs and market requirements.

What deliverables can I expect from this DTM market research project?

The market research project will deliver comprehensive reports that include market size analysis, trend forecasting, competitive landscape assessments, and custom insights based on the specific requirements of stakeholders.

What are the market trends of DTM?

Key trends in the DTM market include increased adoption of cloud-based solutions, advancements in security features, and rising integration of AI technologies to streamline document processes and improve accuracy.