Digital X Ray Devices Market Report

Published Date: 31 January 2026 | Report Code: digital-x-ray-devices

Digital X Ray Devices Market Size, Share, Industry Trends and Forecast to 2033

This report covers an in-depth analysis of the Digital X Ray Devices market, offering insights on market trends, size, segments, regional performance, and forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

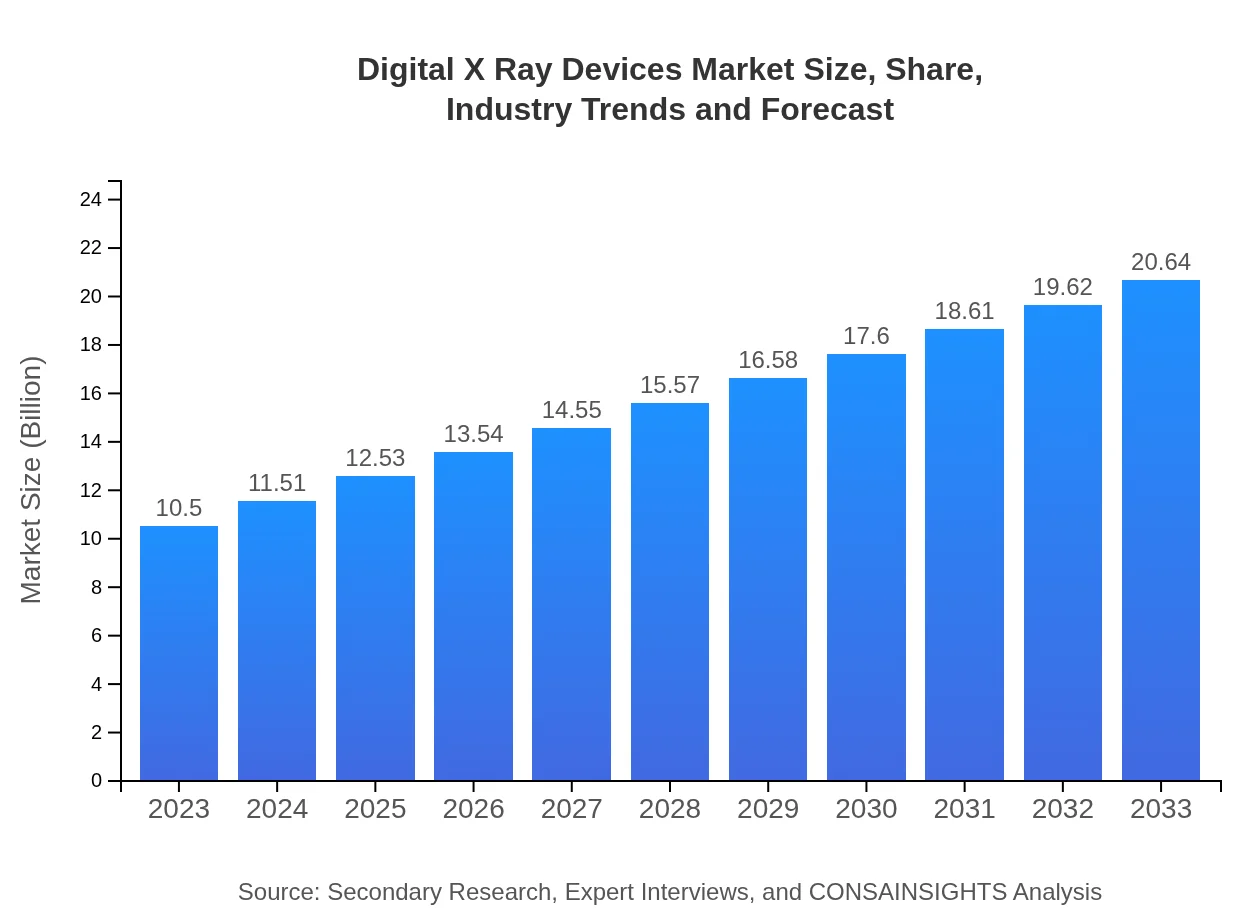

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings Corporation |

| Last Modified Date | 31 January 2026 |

Digital X Ray Devices Market Overview

Customize Digital X Ray Devices Market Report market research report

- ✔ Get in-depth analysis of Digital X Ray Devices market size, growth, and forecasts.

- ✔ Understand Digital X Ray Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital X Ray Devices

What is the Market Size & CAGR of Digital X Ray Devices market in 2023?

Digital X Ray Devices Industry Analysis

Digital X Ray Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital X Ray Devices Market Analysis Report by Region

Europe Digital X Ray Devices Market Report:

The European market for Digital X Ray Devices stands at approximately $3.07 billion in 2023, with growth expected to reach $6.03 billion by 2033. Government initiatives to improve healthcare facilities, along with rising demand for cost-effective diagnostic solutions, are fostering market growth. France, Germany, and the UK are emerging as key players, prompting extensive research and commercialization of innovative imaging technologies.Asia Pacific Digital X Ray Devices Market Report:

In 2023, the Asia Pacific region's Digital X Ray Devices market is valued at approximately $2.06 billion, with projections showing considerable growth to $4.04 billion by 2033. The expansion here is driven by increasing investments in healthcare technology, rising awareness regarding early diagnosis, and an improvement in the healthcare infrastructure. Countries like China and India are actively embracing modern imaging technologies, hence enhancing their market footprint in the regional landscape.North America Digital X Ray Devices Market Report:

North America dominates the Digital X Ray Devices market, with an estimated value of $3.68 billion in 2023, projected to grow to $7.23 billion by 2033. The robust healthcare ecosystem and the presence of major industry players are attributing to this region’s growth. Technological advancements in imaging, regulatory support, and a high prevalence of diseases necessitate the use of superior diagnostic imaging products.South America Digital X Ray Devices Market Report:

The South America Digital X Ray Devices market was valued at around $0.80 billion in 2023 and is expected to reach $1.57 billion by 2033. Although this market lags behind others in terms of size, it presents valuable growth potential driven by increasing healthcare expenditure and government initiatives to enhance diagnostic facilities. Key markets in this region include Brazil and Argentina, which are actively investing in modernization.Middle East & Africa Digital X Ray Devices Market Report:

In 2023, the Middle East and Africa market for Digital X Ray Devices is valued at around $0.90 billion and is predicted to reach $1.76 billion by 2033. Market growth in this region is driven by improving healthcare standards and increased funding for healthcare infrastructure. Rapid developments in the Gulf countries are likely to push the adoption of advanced Diagnostic Imaging technologies.Tell us your focus area and get a customized research report.

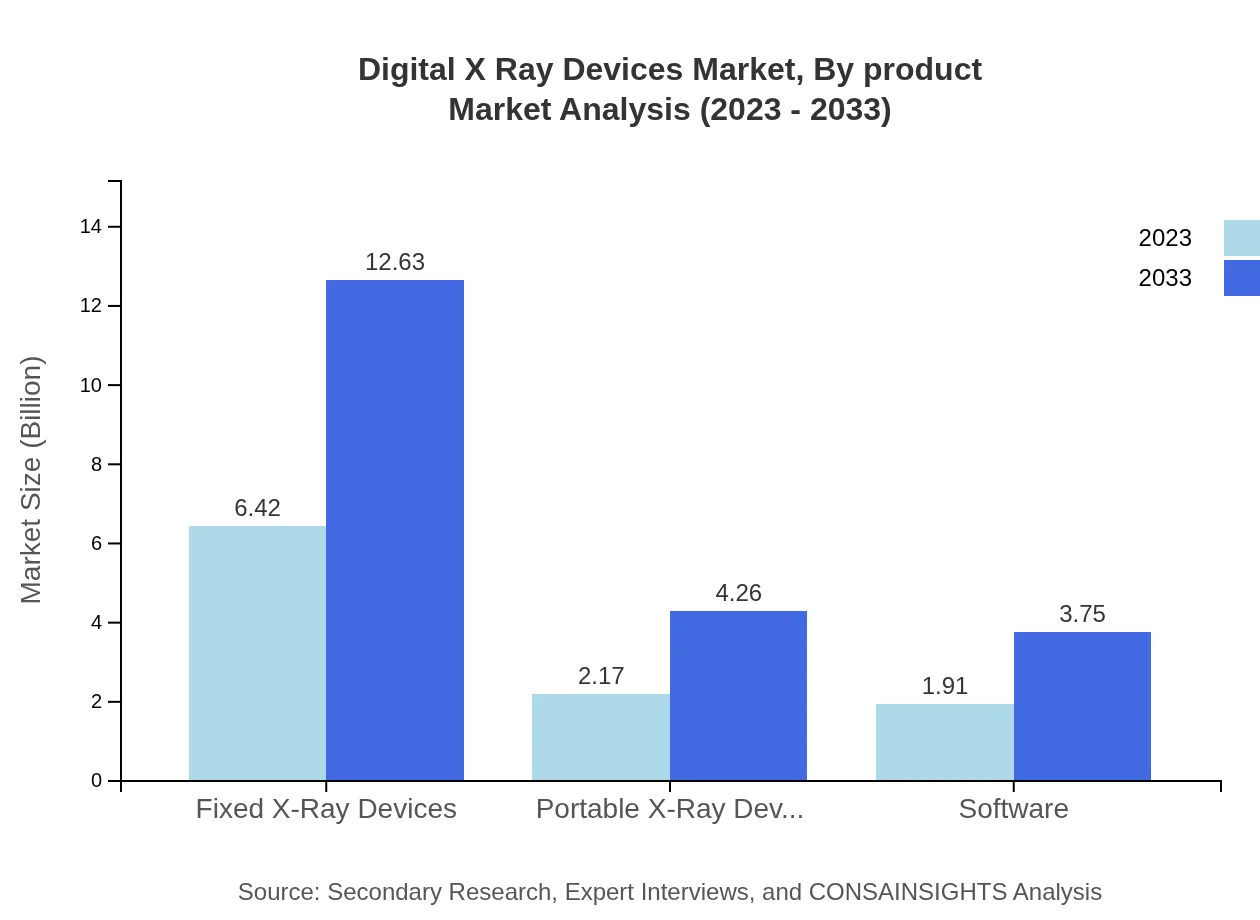

Digital X Ray Devices Market Analysis By Product

Fixed X-Ray Devices dominate the market, expected to grow from $6.42 billion in 2023 to $12.63 billion in 2033, maintaining a 61.19% market share. This segment includes traditional systems that provide consistent performance in clinical settings. Portable X-Ray Devices, on the other hand, show promising growth, forecasted to expand from $2.17 billion to $4.26 billion, capturing 20.63% of the market share. Software developments, essential for image acquisition and processing, are also gaining traction, anticipated to rise from $1.91 billion to $3.75 billion, constituting an 18.18% share by 2033.

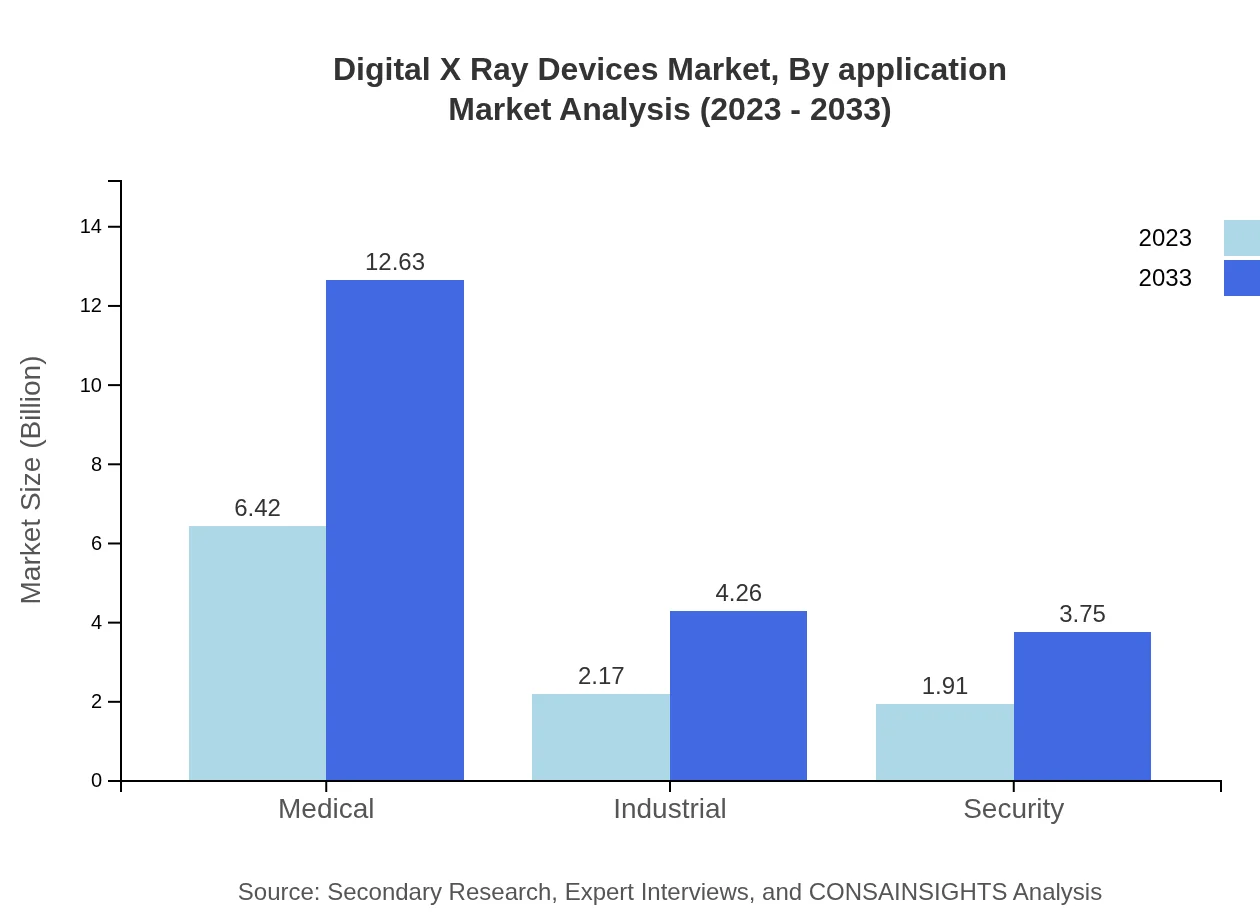

Digital X Ray Devices Market Analysis By Application

Clinical applications dominate the market, projected to grow from $9.24 billion in 2023 to $18.16 billion by 2033, maintaining an 87.99% share. Diagnostic Centers follow with a share of 20.63%, expected to rise from $2.17 billion to $4.26 billion. Non-clinical use, although smaller, is also growing, rising from $1.26 billion to $2.48 billion, accounting for 12.01% of the market.

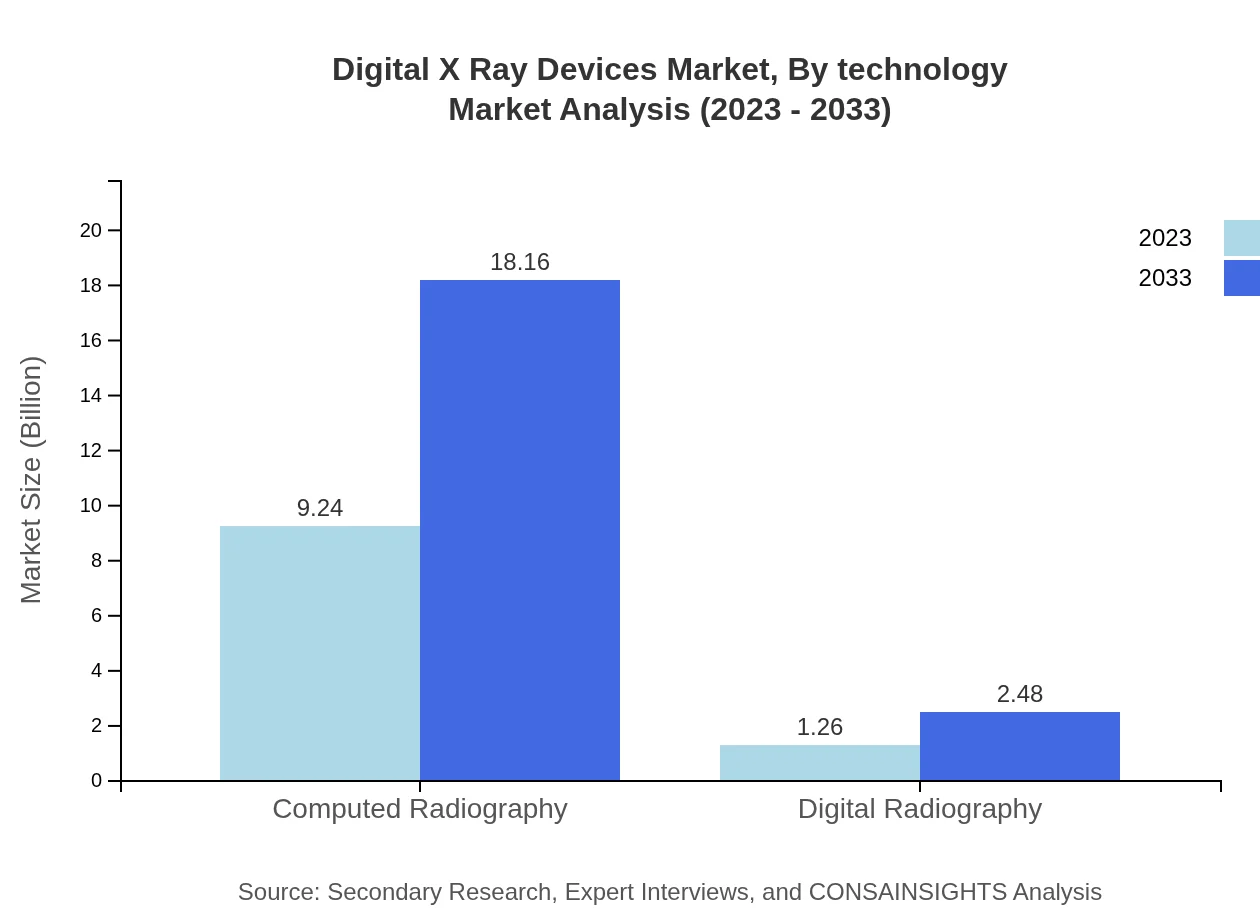

Digital X Ray Devices Market Analysis By Technology

The Digital X Ray Devices market is segmented into Computed Radiography and Digital Radiography. Computed Radiography dominates with a substantial share due to its efficiency, expected to grow from $9.24 billion to $18.16 billion, sustaining an 87.99% market share. Meanwhile, Digital Radiography is forecasted to increase from $1.26 billion to $2.48 billion, accounting for 12.01% of the market.

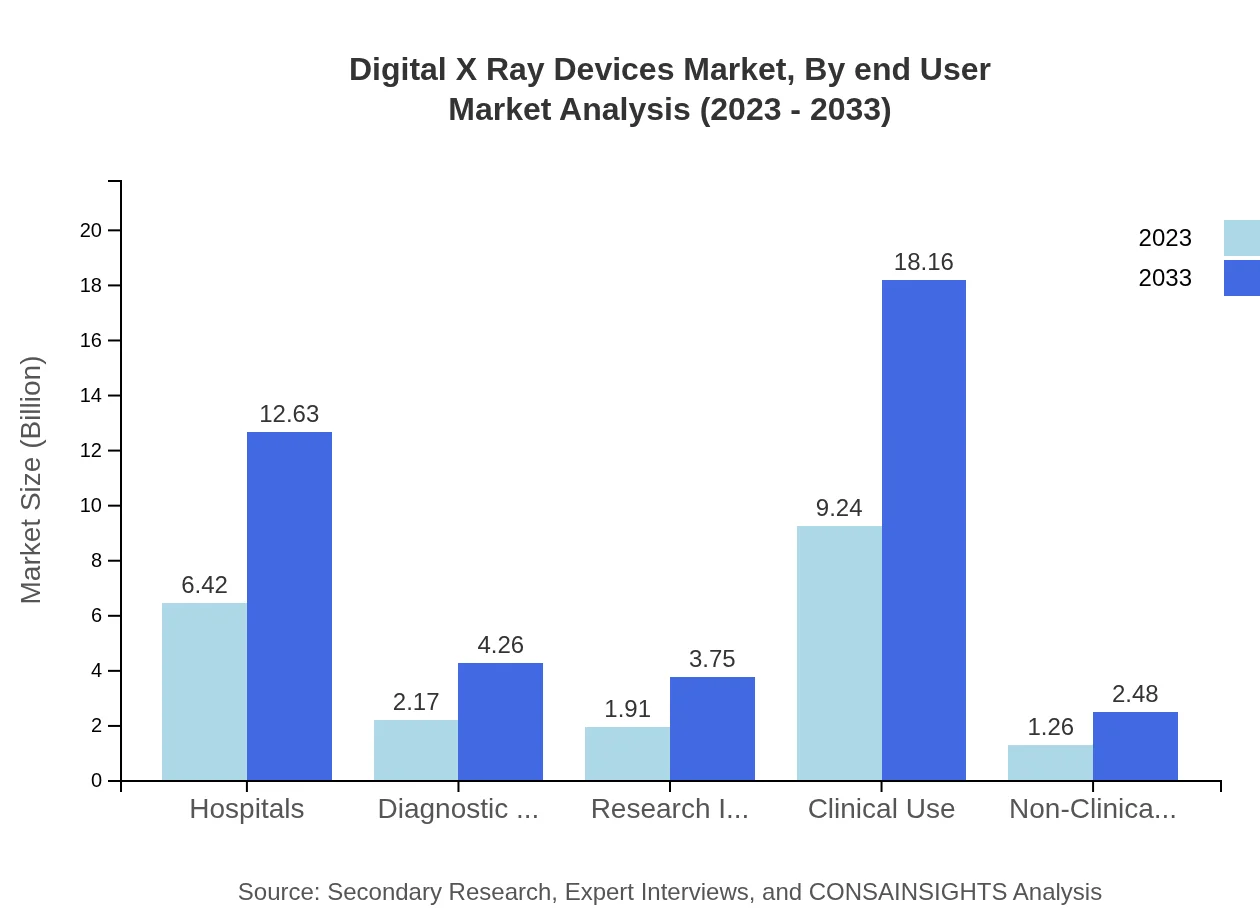

Digital X Ray Devices Market Analysis By End User

The primary end-user segment for Digital X Ray Devices includes Hospitals, comprising a significant market share of 61.19% from $6.42 billion in 2023 to $12.63 billion by 2033. The demand from Diagnostic Centers and Research Institutes grows steadily, forecasted to reach $4.26 billion and $3.75 billion respectively by 2033, showcasing the market's broad appeal across various medical fields.

Digital X Ray Devices Market Analysis By End Use

Global Digital X-Ray Devices Market, By End-Use Market Analysis (2023 - 2033)

The medical segment leads the market, with a significant share of 61.19%, anticipated to grow from $6.42 billion to $12.63 billion. The industrial segment and security applications are on the rise, with projections indicating growth from $2.17 billion to $4.26 billion and steady advancements in security applications showing promise.

Digital X Ray Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital X Ray Devices Industry

Siemens Healthineers:

Siemens Healthineers is a leading provider of diagnostic imaging and laboratory diagnostics equipment, continually innovating digital X-Ray technology to enhance diagnostic capabilities while ensuring patient safety.GE Healthcare:

GE Healthcare offers advanced medical imaging solutions, with a strong focus on digital X-ray devices, committed to improving image quality and operational efficiency in healthcare settings.Philips Healthcare:

Philips Healthcare integrates advanced technology and medical imaging, providing comprehensive solutions in digital X-ray systems that emphasize patient-centered care and diagnostic accuracy.Canon Medical Systems:

Canon Medical Systems offers a wide range of digital imaging solutions, focusing on innovative technology that improves clinical workflows and enhances diagnostic performance.Fujifilm Holdings Corporation:

Fujifilm is dedicated to improving diagnostic imaging services through innovative digital X-ray systems that enhance imaging quality and reduce radiation doses for patients.We're grateful to work with incredible clients.

FAQs

What is the market size of digital X Ray devices?

The global digital X-ray devices market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 6.8%. By 2033, the market is expected to expand significantly, driven by advancements in technology and increasing demand for diagnostic imaging.

What are the key market players or companies in the digital X Ray devices industry?

The digital X-ray devices industry is dominated by key players such as GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Fujifilm Imaging. These companies lead through innovations, comprehensive product portfolios, and strategic partnerships.

What are the primary factors driving the growth in the digital X Ray devices industry?

Key factors driving growth include rising demand for diagnostic imaging procedures, advancements in X-ray technology, increasing prevalence of chronic diseases, and a growing focus on early detection and preventative healthcare measures.

Which region is the fastest Growing in the digital X Ray devices market?

The fastest-growing region is North America, where the market is expected to rise from $3.68 billion in 2023 to $7.23 billion by 2033. This growth is fueled by advanced healthcare infrastructure and increased investment in medical technologies.

Does ConsaInsights provide customized market report data for the digital X Ray devices industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the digital X-ray devices industry, ensuring comprehensive insights that meet unique business requirements and objectives.

What deliverables can I expect from this digital X Ray devices market research project?

Deliverables include detailed market analysis reports, growth forecasts, competitive landscape assessments, segmentation analysis, and comprehensive insights into regional and global trends relevant to the digital X-ray devices market.

What are the market trends of digital X Ray devices?

Current trends include the increasing adoption of portable X-ray devices, advancements in digital imaging software, and a focus on enhancing patient safety and comfort. Additionally, there is a growth in applications across medical, industrial, and security sectors.