Direct Carrier Billing Market Report

Published Date: 31 January 2026 | Report Code: direct-carrier-billing

Direct Carrier Billing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Direct Carrier Billing market, covering its current state, segmentation, technological innovations, and regional insights. It also includes market size forecasts from 2023 to 2033.

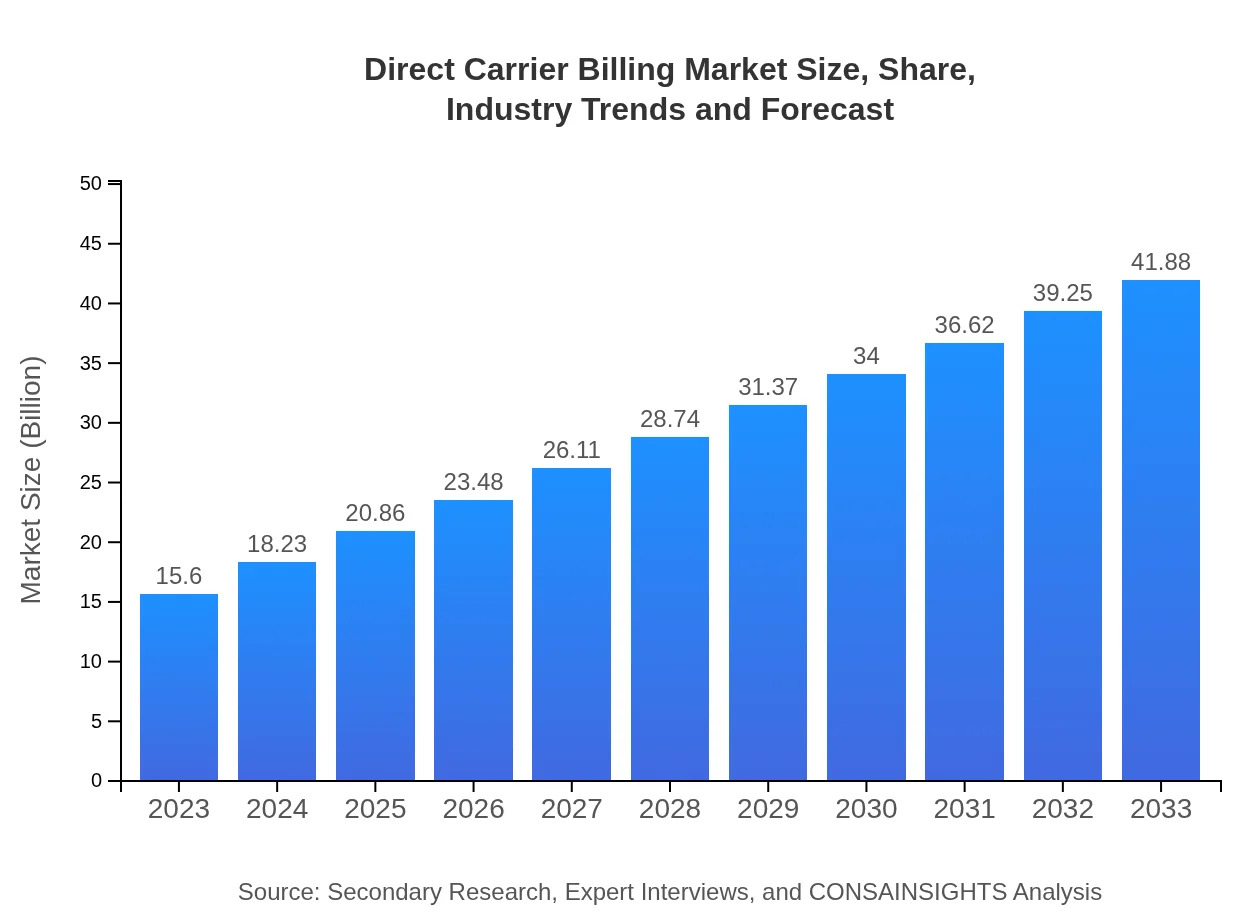

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $41.88 Billion |

| Top Companies | Boku Inc., Fortumo, BilltoMobile |

| Last Modified Date | 31 January 2026 |

Direct Carrier Billing Market Overview

Customize Direct Carrier Billing Market Report market research report

- ✔ Get in-depth analysis of Direct Carrier Billing market size, growth, and forecasts.

- ✔ Understand Direct Carrier Billing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Direct Carrier Billing

What is the Market Size & CAGR of Direct Carrier Billing market in 2033?

Direct Carrier Billing Industry Analysis

Direct Carrier Billing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Direct Carrier Billing Market Analysis Report by Region

Europe Direct Carrier Billing Market Report:

Europe's market is projected to expand from $4.42 billion in 2023 to $11.87 billion by 2033. Regulatory support for digital payments and high consumer confidence in mobile payment methods will drive this growth.Asia Pacific Direct Carrier Billing Market Report:

In the Asia Pacific region, the Direct Carrier Billing market size is expected to grow from $3.15 billion in 2023 to $8.46 billion by 2033, driven by the region's rapid smartphone penetration and a youthful consumer demographic that is increasingly adopting mobile payment solutions.North America Direct Carrier Billing Market Report:

North America is anticipated to see its DCB market increase from $5.35 billion in 2023 to $14.37 billion in 2033. The region's advanced technological infrastructure and high demand for digital services are significant contributors to this growth.South America Direct Carrier Billing Market Report:

The South American market for Direct Carrier Billing is forecasted to grow from $0.64 billion in 2023 to $1.71 billion in 2033. Economic improvements and burgeoning digital content consumption are propelling market growth in this region.Middle East & Africa Direct Carrier Billing Market Report:

In the Middle East and Africa, the Direct Carrier Billing market is expected to grow from $2.04 billion in 2023 to $5.47 billion by 2033. Increasing internet penetration, smartphone use, and a shift to cashless transactions are key growth factors.Tell us your focus area and get a customized research report.

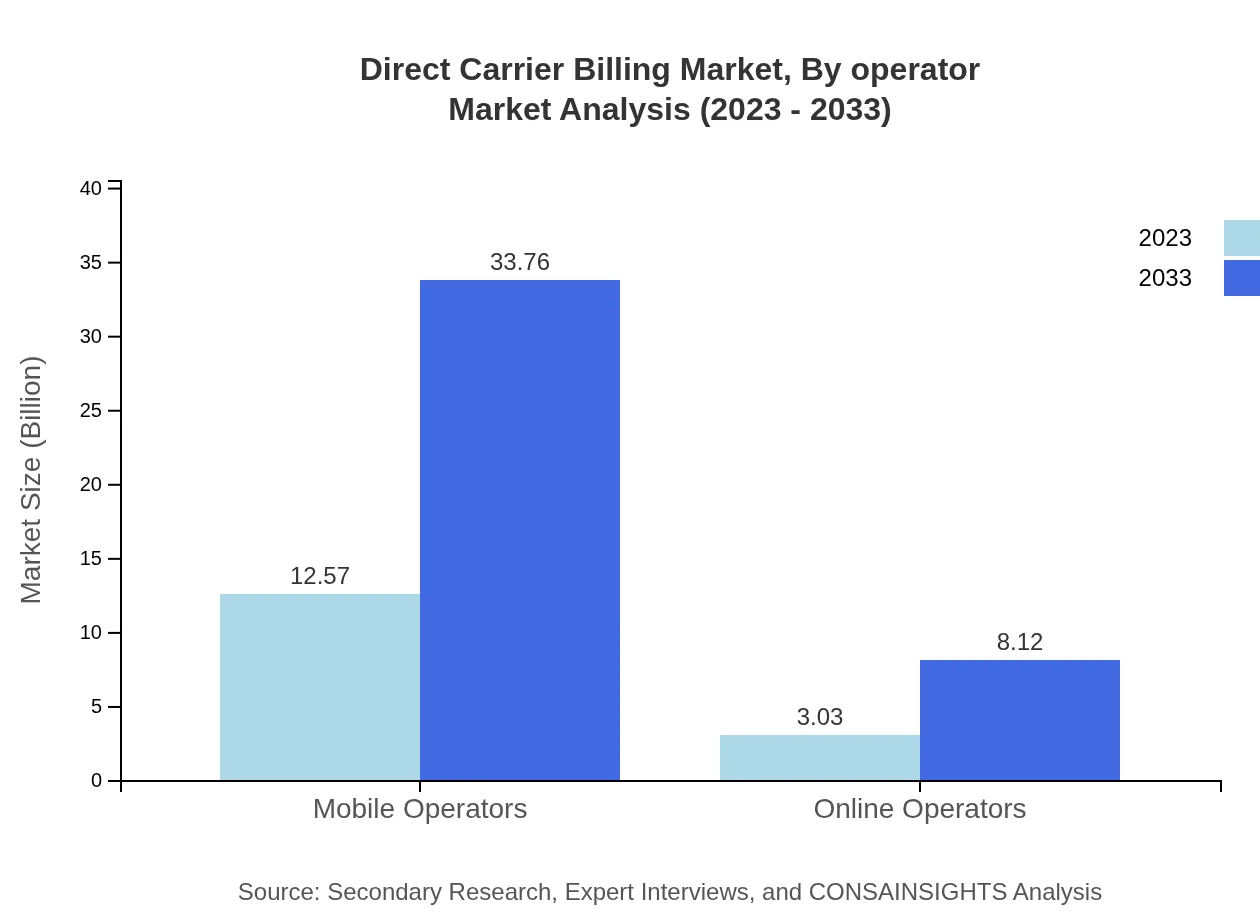

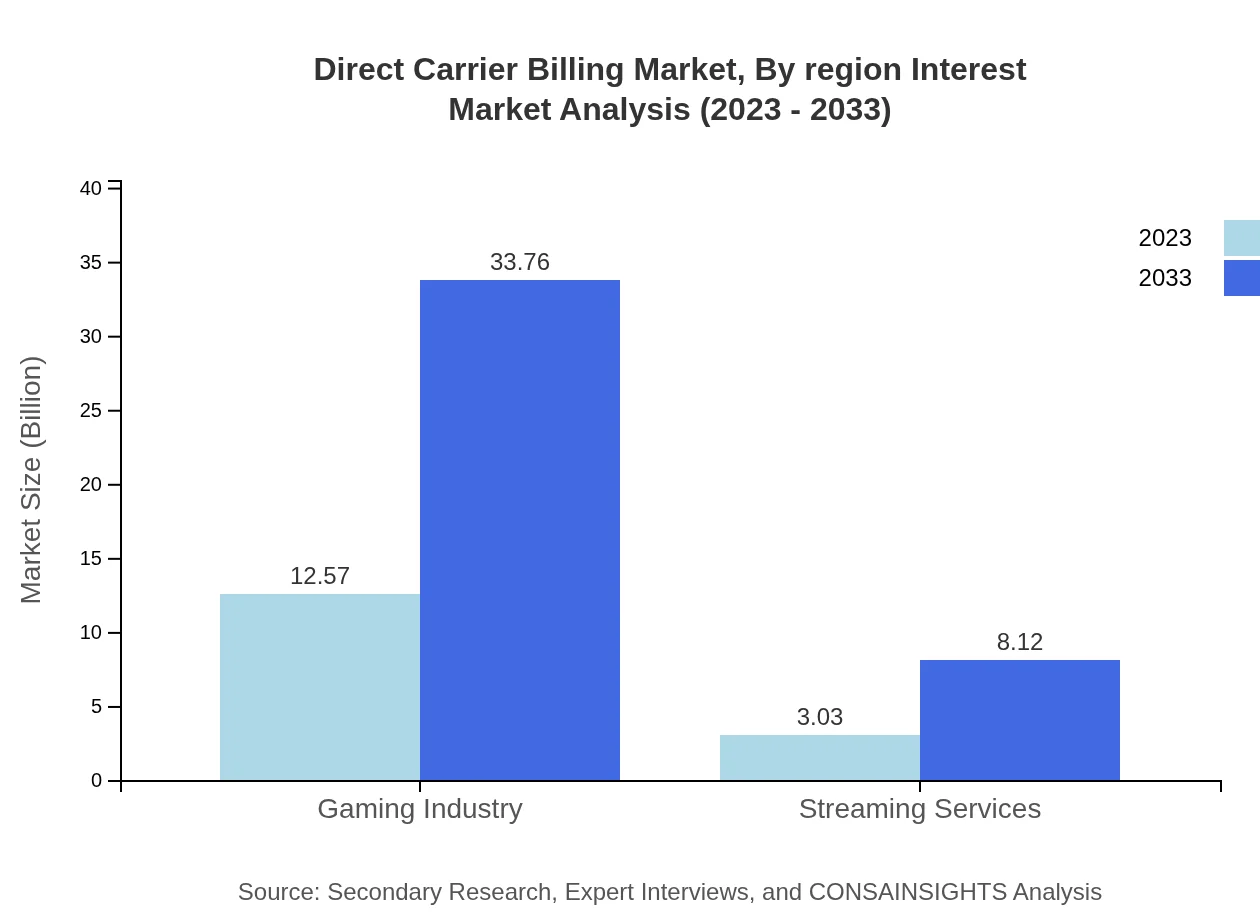

Direct Carrier Billing Market Analysis By Operator

The Direct Carrier Billing market segmented by operator reveals Mobile Operators dominating the landscape. In 2023, Mobile Operators account for a market size of $12.57 billion, projected to grow to $33.76 billion by 2033, maintaining a market share of 80.6%. Online Operators, while smaller, are also growing, with a market size increase from $3.03 billion in 2023 to $8.12 billion by 2033, representing a 19.4% market share.

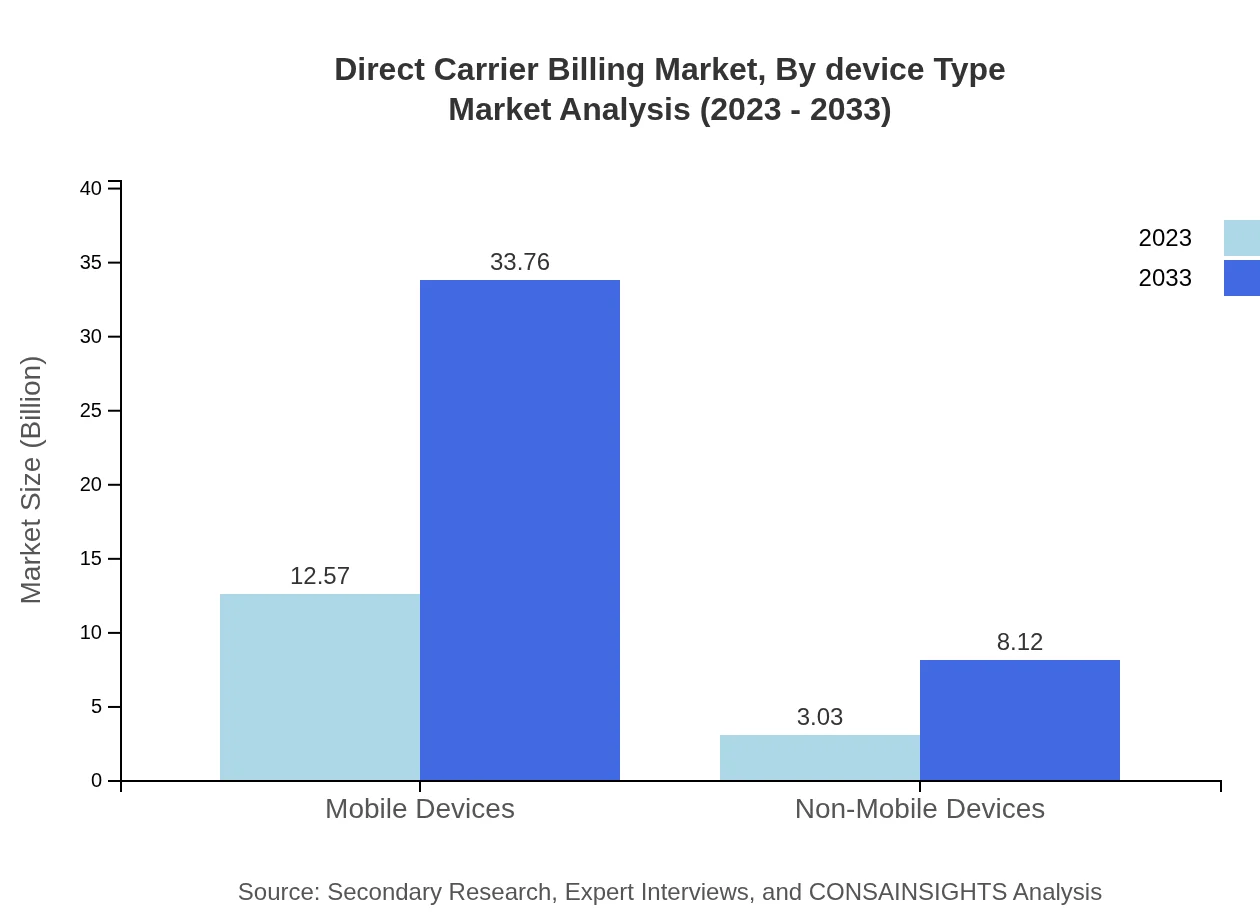

Direct Carrier Billing Market Analysis By Device Type

The analysis by device type shows Mobile Devices holding a significant market size of $12.57 billion in 2023, expected to rise to $33.76 billion by 2033, maintaining an 80.6% share of the market. Non-Mobile Devices are projected to grow from $3.03 billion in 2023 to $8.12 billion by 2033, capturing a 19.4% market share.

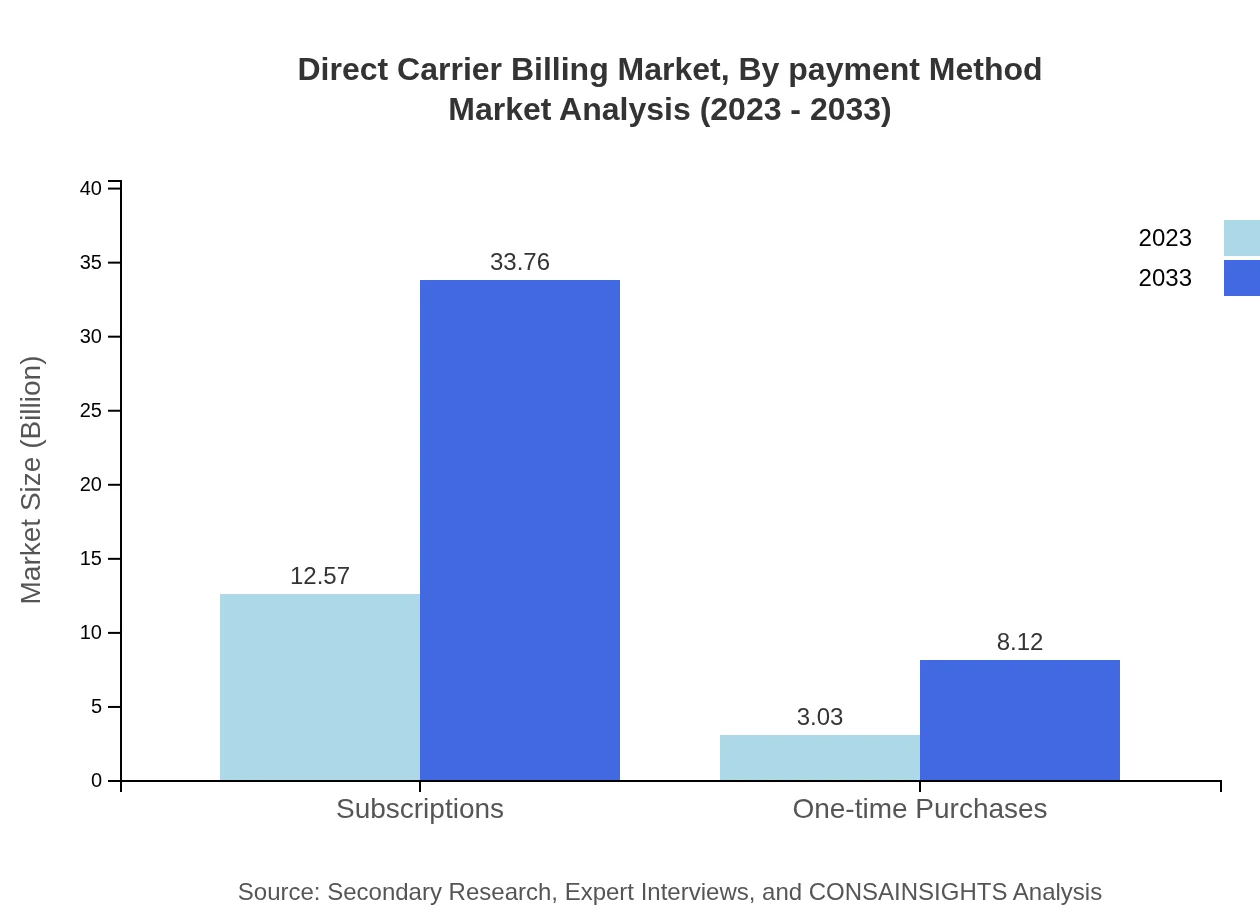

Direct Carrier Billing Market Analysis By Payment Method

In terms of payment methods, Subscriptions are leading the market with a size of $12.57 billion in 2023, increasing to $33.76 billion by 2033, holding firm at an 80.6% market share. One-time Purchases will also see growth, moving from $3.03 billion in 2023 to $8.12 billion by 2033, representing a 19.4% share.

Direct Carrier Billing Market Analysis By Region Interest

Direct Carrier Billing's market by regional interest shows strong growth across all areas, with the Asia Pacific and North America demonstrating particularly high potential due to their large consumer bases and technological advancements.

Direct Carrier Billing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Direct Carrier Billing Industry

Boku Inc.:

Boku Inc. is a leading player in the DCB market, providing global payment solutions for mobile content and digital purchases.Fortumo:

Fortumo specializes in enabling mobile operators to offer direct carrier billing services to content providers, making them a key player in the industry.BilltoMobile:

BilltoMobile offers a simplified payment process for consumers through DCB, primarily focusing on enhancing user experiences.We're grateful to work with incredible clients.

FAQs

What is the market size of Direct Carrier Billing?

The global Direct Carrier Billing market is projected to reach a size of $15.6 billion by 2033, growing at a CAGR of 10% from its current assessment in 2023. This growth reflects an increasing adoption of mobile payment solutions globally.

What are the key market players or companies in the Direct Carrier Billing industry?

Key players in the Direct Carrier Billing industry include companies such as Boku, Fortumo, and Digital Turbine. These companies are influential in shaping the payment landscape, enhancing user experiences, and expanding their global reach by partnering with telecom operators.

What are the primary factors driving the growth in the Direct Carrier Billing industry?

Growth in the Direct Carrier Billing industry is driven by increased smartphone penetration, rising trends in digital subscriptions, and the convenience of mobile billing. Additionally, the expansion of mobile payment ecosystems enhances consumer adoption, propelling market growth.

Which region is the fastest Growing in the Direct Carrier Billing?

The fastest-growing region in the Direct Carrier Billing market is North America, projected to grow from $5.35 billion in 2023 to $14.37 billion by 2033. Strong demand for digital services and innovations in mobile payment solutions contribute to this rapid growth.

Does ConsaInsights provide customized market report data for the Direct Carrier Billing industry?

Yes, ConsaInsights offers customized market report data tailored to the Direct Carrier Billing industry. Clients can benefit from personalized insights that address specific market dynamics, trends, and competitive landscapes according to their unique requirements.

What deliverables can I expect from this Direct Carrier Billing market research project?

From the Direct Carrier Billing market research project, you can expect comprehensive reports including market size data, growth forecasts, regional analysis, competitive landscapes, and key trends influencing the market, delivering valuable insights for strategic decision-making.

What are the market trends of Direct Carrier Billing?

Current trends in the Direct Carrier Billing market include an uptick in the use of mobile devices for transactions, with mobile operators holding an 80.6% market share. Subscriptions are increasing, with projections showing growth from $12.57 billion in 2023 to $33.76 billion by 2033.