Direct Fed Microbials Market Report

Published Date: 02 February 2026 | Report Code: direct-fed-microbials

Direct Fed Microbials Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Direct Fed Microbials market from 2023 to 2033, highlighting key trends, market size, and growth potential across various regions and segments.

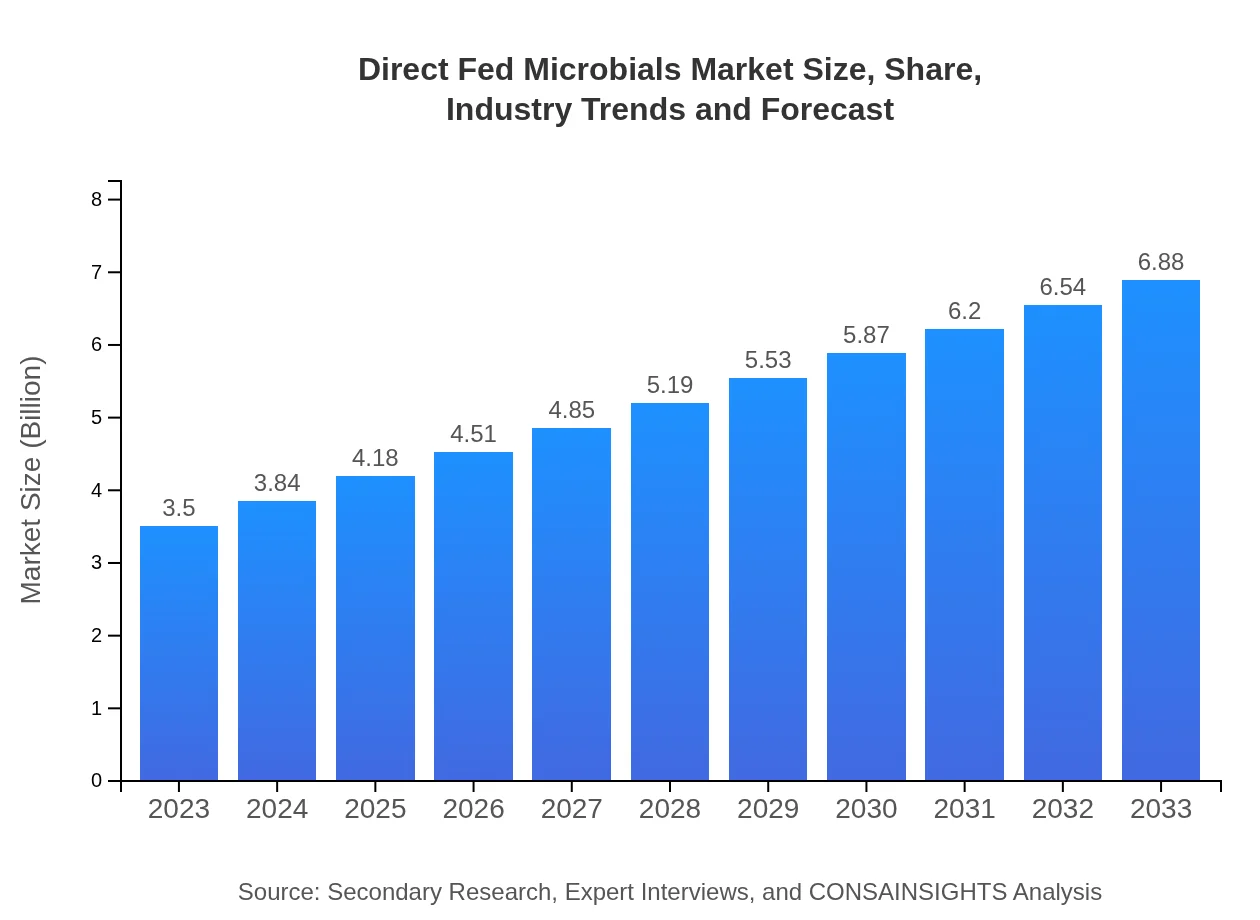

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Alltech, Lallemand Animal Nutrition, BASF SE, DSM Nutritional Products |

| Last Modified Date | 02 February 2026 |

Direct Fed Microbials Market Overview

Customize Direct Fed Microbials Market Report market research report

- ✔ Get in-depth analysis of Direct Fed Microbials market size, growth, and forecasts.

- ✔ Understand Direct Fed Microbials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Direct Fed Microbials

What is the Market Size & CAGR of Direct Fed Microbials market in 2023?

Direct Fed Microbials Industry Analysis

Direct Fed Microbials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Direct Fed Microbials Market Analysis Report by Region

Europe Direct Fed Microbials Market Report:

The European market is anticipated to expand from $0.94 billion in 2023 to $1.85 billion by 2033, characterized by rising consumer demand for organic and antibiotic-free meat products, propelling farmers to adopt DFMs in livestock feeding.Asia Pacific Direct Fed Microbials Market Report:

In the Asia Pacific region, the DFMs market is projected to grow from $0.71 billion in 2023 to $1.40 billion by 2033, fueled by livestock production demands and evolving agricultural practices. China and India are key players, emphasizing improvements in animal nutrition and health.North America Direct Fed Microbials Market Report:

North America holds a significant share in the DFMs market, projected to surge from $1.23 billion in 2023 to $2.41 billion by 2033. Strong regulatory frameworks supporting the use of natural additives and a robust pet food industry foster this growth.South America Direct Fed Microbials Market Report:

The South American market, though smaller, is expected to rise from $0.17 billion in 2023 to $0.33 billion in 2033, driven by increasing meat production and the need for natural feed alternatives in farms, with Brazil leading the regional market.Middle East & Africa Direct Fed Microbials Market Report:

The Middle East and Africa are showing a steady rise in the DFMs market, expected to grow from $0.45 billion in 2023 to $0.89 billion by 2033. Increasing awareness regarding livestock health and veterinary care is driving demand in this region.Tell us your focus area and get a customized research report.

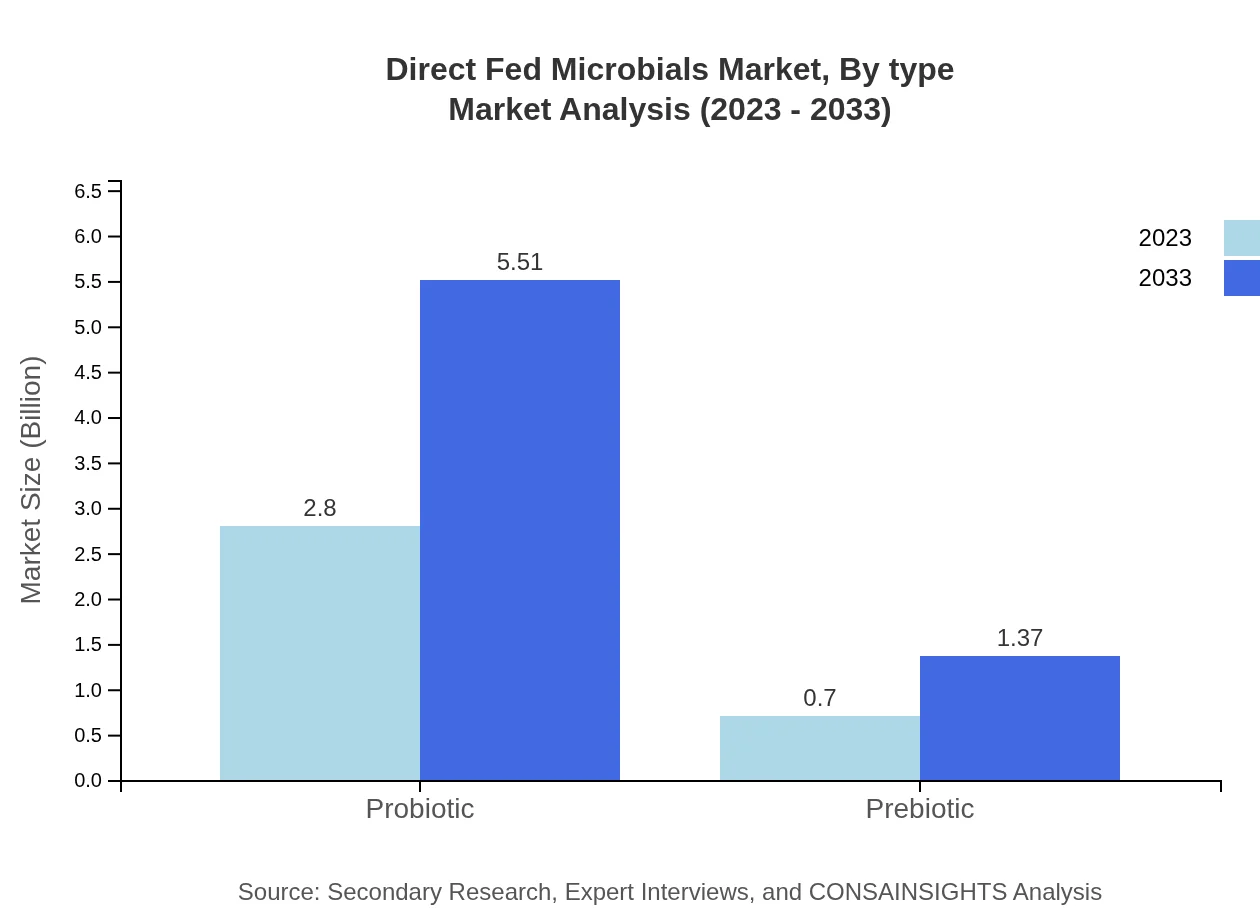

Direct Fed Microbials Market Analysis By Type

Probiotics dominate the DFM market, expected to grow from $2.80 billion in 2023 to $5.51 billion by 2033, holding an 80.11% market share. Prebiotics also show promising growth from $0.70 billion to $1.37 billion, with a 19.89% share.

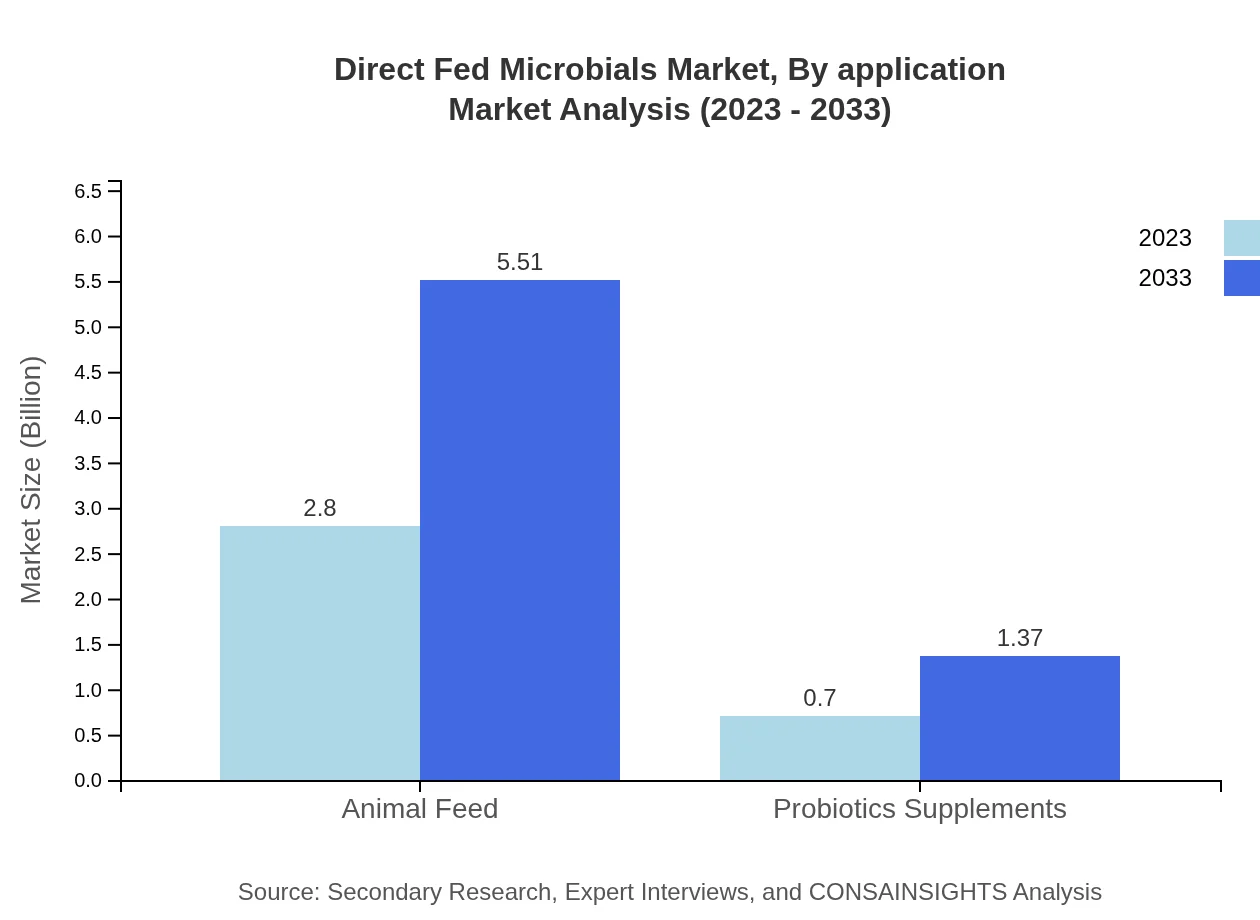

Direct Fed Microbials Market Analysis By Application

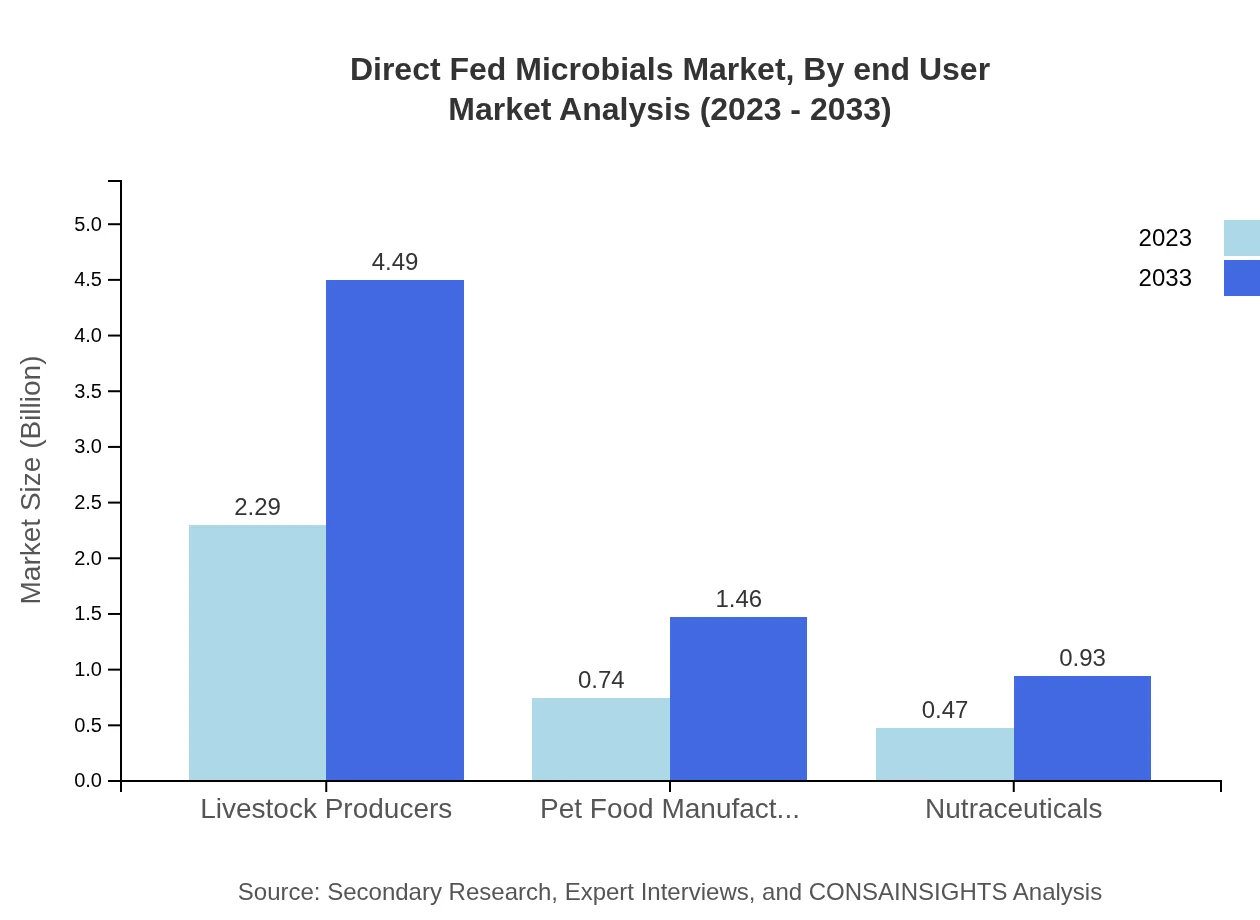

The market for livestock producers is significant, projected to increase from $2.29 billion to $4.49 billion (65.31% share), while pet food manufacturers are also critical players, growing from $0.74 billion to $1.46 billion (21.21%).

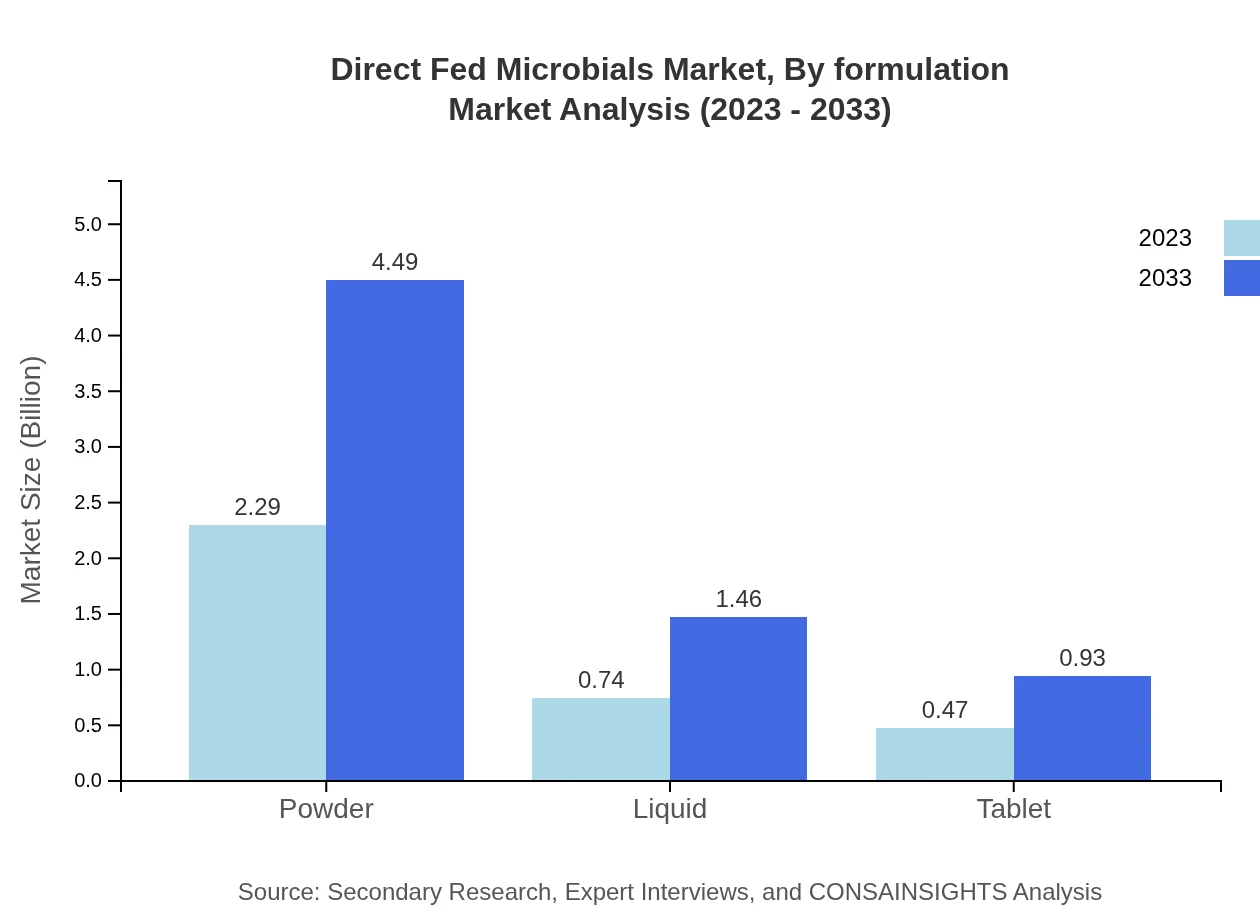

Direct Fed Microbials Market Analysis By Formulation

Powder formulations lead the market with an expected rise from $2.29 billion to $4.49 billion (65.31% share), while liquids and tablets are set to grow moderately from $0.74 billion to $1.46 billion and $0.47 billion to $0.93 billion respectively.

Direct Fed Microbials Market Analysis By End User

Animal feed represents the largest segment of the DFM market, with sizes of $2.80 billion in 2023, projected to grow to $5.51 billion by 2033 (80.11%). In contrast, nutraceuticals are forecasted to grow from $0.47 billion to $0.93 billion (13.48%).

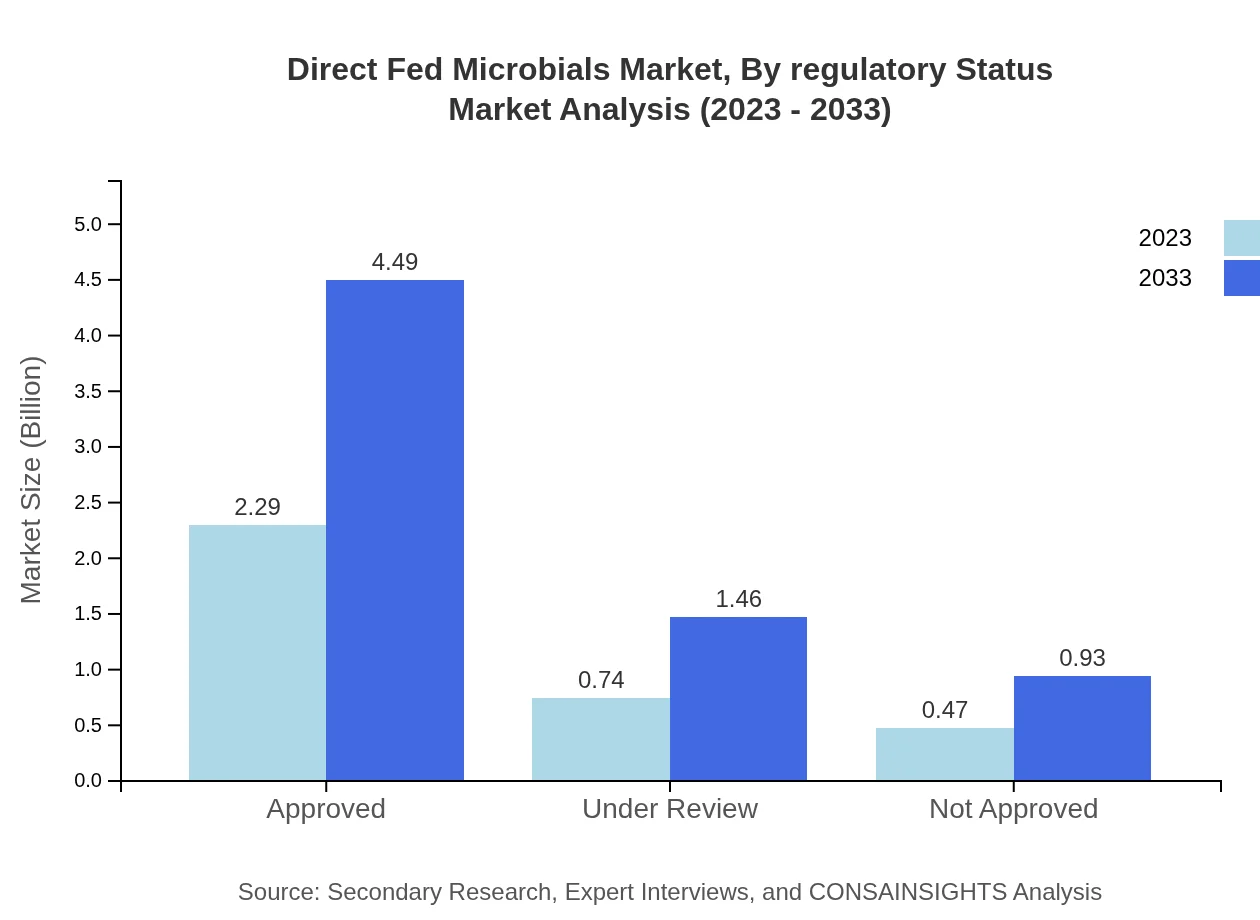

Direct Fed Microbials Market Analysis By Regulatory Status

Approved products dominate with a market size of $2.29 billion in 2023, expanding to $4.49 billion in 2033 (65.31% share), while products under review are seeing growth from $0.74 billion to $1.46 billion (21.21%).

Direct Fed Microbials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Direct Fed Microbials Industry

Alltech:

Alltech is a leading global animal health company, specializing in the development and production of DFMs and innovative nutritional solutions, promoting sustainability in livestock management.Lallemand Animal Nutrition:

Lallemand is a key player in the DFMs market, providing diverse microbial products aimed at improving animal performance and health, with a strong emphasis on research and development.BASF SE:

BASF is a renowned chemicals company actively involved in the DFM sector through its broad portfolio of nutritional solutions, contributing significantly to livestock health and productivity.DSM Nutritional Products:

DSM is a prominent leader in the nutrition industry, offering advanced DFMs designed to enhance feed efficiency and animal health while adhering to high-quality standards.We're grateful to work with incredible clients.

FAQs

What is the market size of direct Fed Microbials?

The direct-fed microbials market is currently valued at approximately $3.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.8% projected over the next decade, indicating a robust growth trajectory.

What are the key market players or companies in this direct Fed Microbials industry?

Key players in the direct-fed microbials market include major companies specializing in probiotics and feed additives. These firms continuously innovate and expand their product lines to meet the increasing demand for animal health solutions.

What are the primary factors driving the growth in the direct Fed Microbials industry?

The growth of the direct-fed microbials industry is primarily driven by the rising demand for animal protein, increased awareness of animal health, and the need for sustainable farming practices. These factors contribute to a stronger emphasis on feed efficiency and animal welfare.

Which region is the fastest Growing in the direct Fed Microbials?

The Asia Pacific region is the fastest-growing market for direct-fed microbials, projected to increase from $0.71 billion in 2023 to $1.40 billion by 2033, following North America which is growing from $1.23 to $2.41 billion in the same period.

Does ConsaInsights provide customized market report data for the direct Fed Microbials industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the direct-fed microbials industry, ensuring comprehensive insights into market dynamics, trends, and forecasts that can aid strategic planning.

What deliverables can I expect from this direct Fed Microbials market research project?

Deliverables from the direct-fed microbials market research project typically include detailed reports, data analysis, market forecasts, and segmentation insights, providing actionable information to support your decision-making process in this dynamic industry.

What are the market trends of direct Fed Microbials?

Current trends in the direct-fed microbials market include increased adoption of probiotics, expansion in organic livestock farming, and growing interest in precision nutrition, all contributing to a more health-conscious approach in animal production.