Directed Energy Weapons Market Report

Published Date: 03 February 2026 | Report Code: directed-energy-weapons

Directed Energy Weapons Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Directed Energy Weapons (DEW) market, covering market dynamics, trends, and insights from 2023 to 2033. It highlights the market size, segmentation, regional analyses, technological advancements, product performance, and forecasts for future growth.

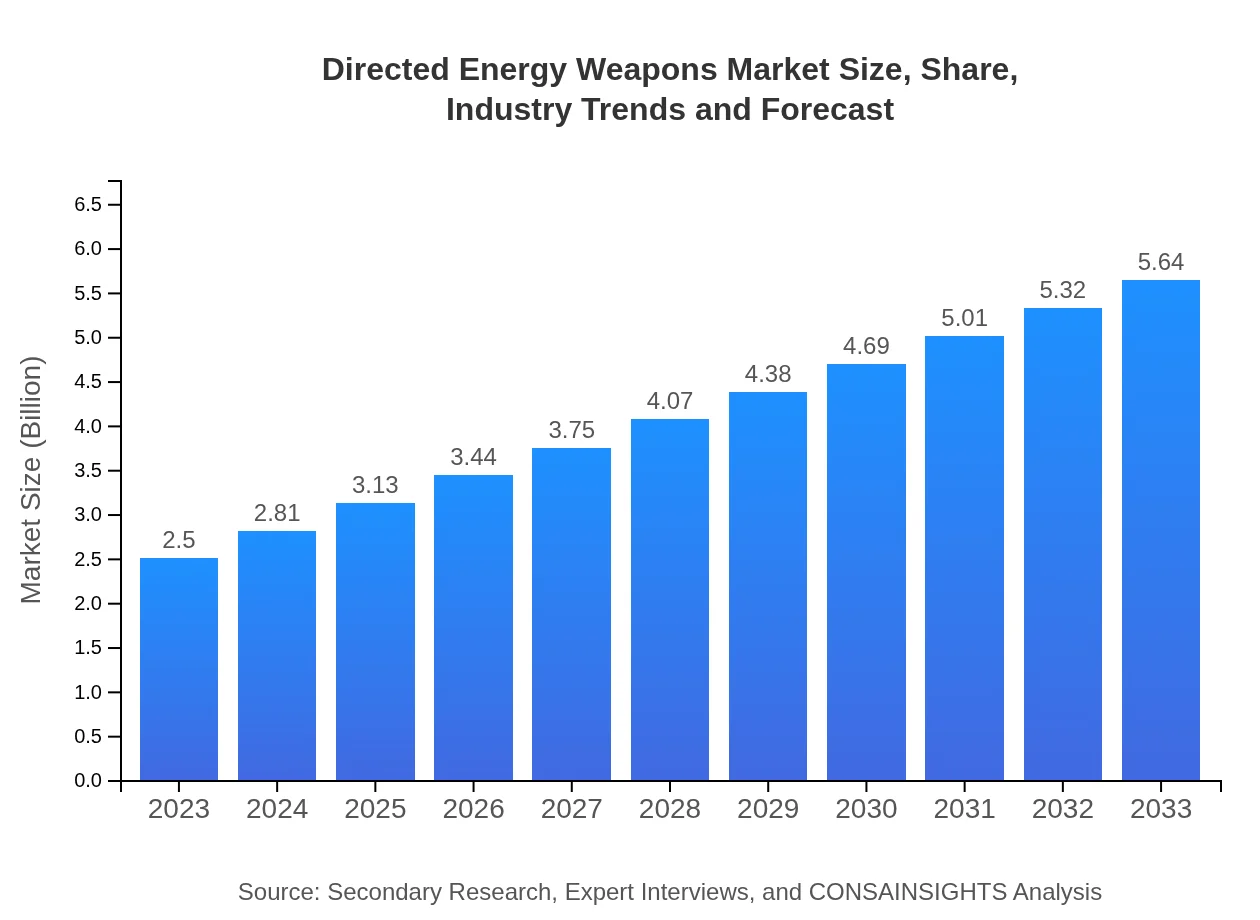

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $5.64 Billion |

| Top Companies | Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, Boeing Defense, Space & Security, General Atomics |

| Last Modified Date | 03 February 2026 |

Directed Energy Weapons Market Overview

Customize Directed Energy Weapons Market Report market research report

- ✔ Get in-depth analysis of Directed Energy Weapons market size, growth, and forecasts.

- ✔ Understand Directed Energy Weapons's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Directed Energy Weapons

What is the Market Size & CAGR of Directed Energy Weapons market in 2023?

Directed Energy Weapons Industry Analysis

Directed Energy Weapons Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Directed Energy Weapons Market Analysis Report by Region

Europe Directed Energy Weapons Market Report:

Europe sees growth in the DEW sector from $0.83 billion in 2023 to $1.86 billion by 2033, supported by NATO initiatives and collaborations in defense projects among member countries to enhance border security.Asia Pacific Directed Energy Weapons Market Report:

The Asia-Pacific region is expected to grow from $0.41 billion in 2023 to $0.93 billion in 2033. Increased military spending by countries like China and India, coupled with technological collaborations in weapon systems, is driving this growth.North America Directed Energy Weapons Market Report:

North America, leading the market, is projected to grow from $0.91 billion in 2023 to $2.06 billion by 2033. The U.S. military's focus on integrating advanced DEWs for national defense and missile interception significantly influences this trajectory.South America Directed Energy Weapons Market Report:

In South America, the DEW market is projected to increase from $0.12 billion in 2023 to $0.28 billion in 2033, primarily due to emerging security threats and collaborations in defense technology with global players.Middle East & Africa Directed Energy Weapons Market Report:

The Middle East and Africa market is anticipated to rise from $0.23 billion in 2023 to $0.51 billion in 2033, attributed to increasing defense budgets and the necessity of advanced technologies in conflict-prone regions.Tell us your focus area and get a customized research report.

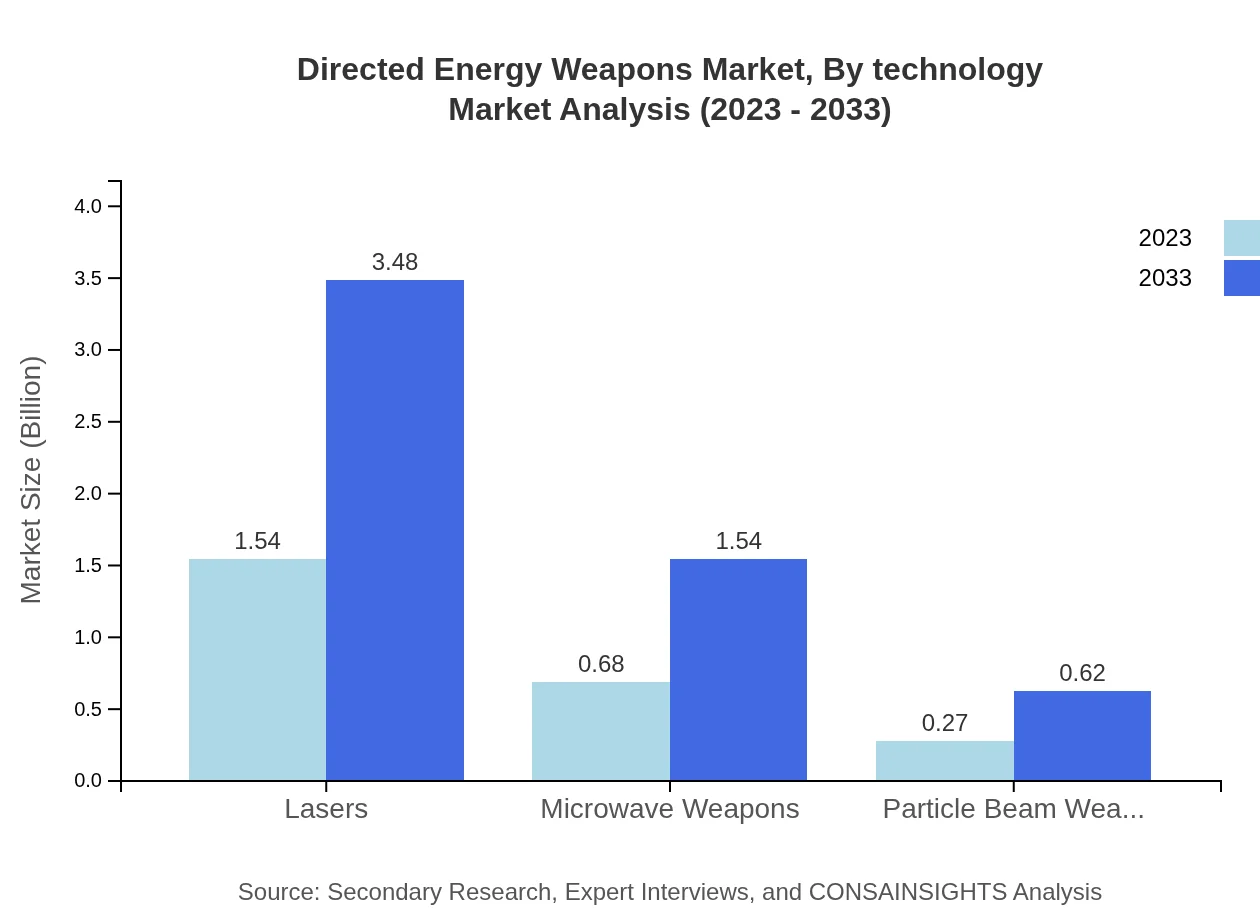

Directed Energy Weapons Market Analysis By Technology

The market is categorized mainly into three technologies: lasers (size: $1.54 billion in 2023; $3.48 billion in 2033), microwave weapons (size: $0.68 billion in 2023; $1.54 billion in 2033), and particle beam weapons (size: $0.27 billion in 2023; $0.62 billion in 2033). Lasers dominate the market segment due to their efficiency and precision in various military operations.

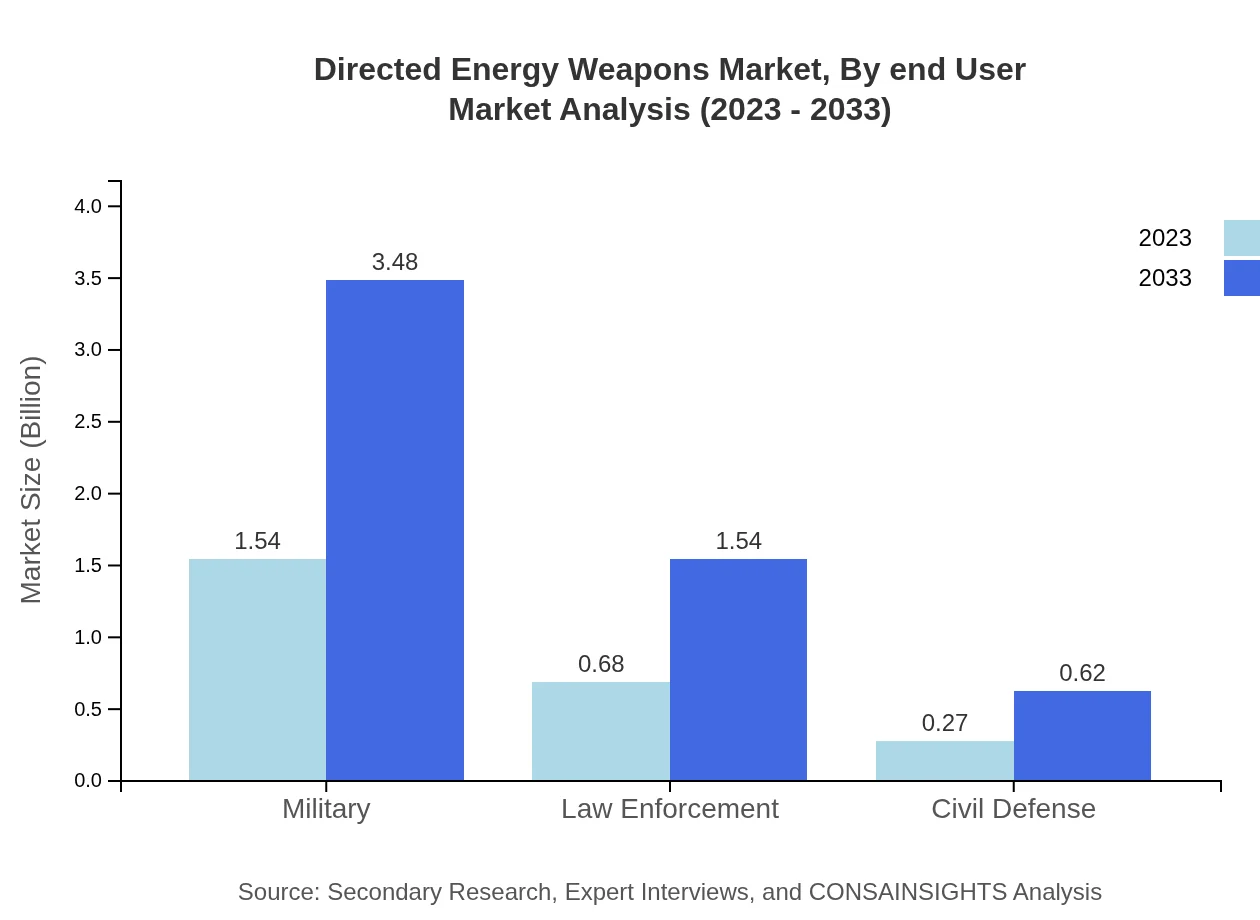

Directed Energy Weapons Market Analysis By End User

The DEW market is segmented based on end-users into military (size: $1.54 billion in 2023; $3.48 billion in 2033), law enforcement (size: $0.68 billion in 2023; $1.54 billion in 2033), and civil defense (size: $0.27 billion in 2023; $0.62 billion in 2033). The military sector will continue to dominate the market due to the demand for state-of-the-art defense systems.

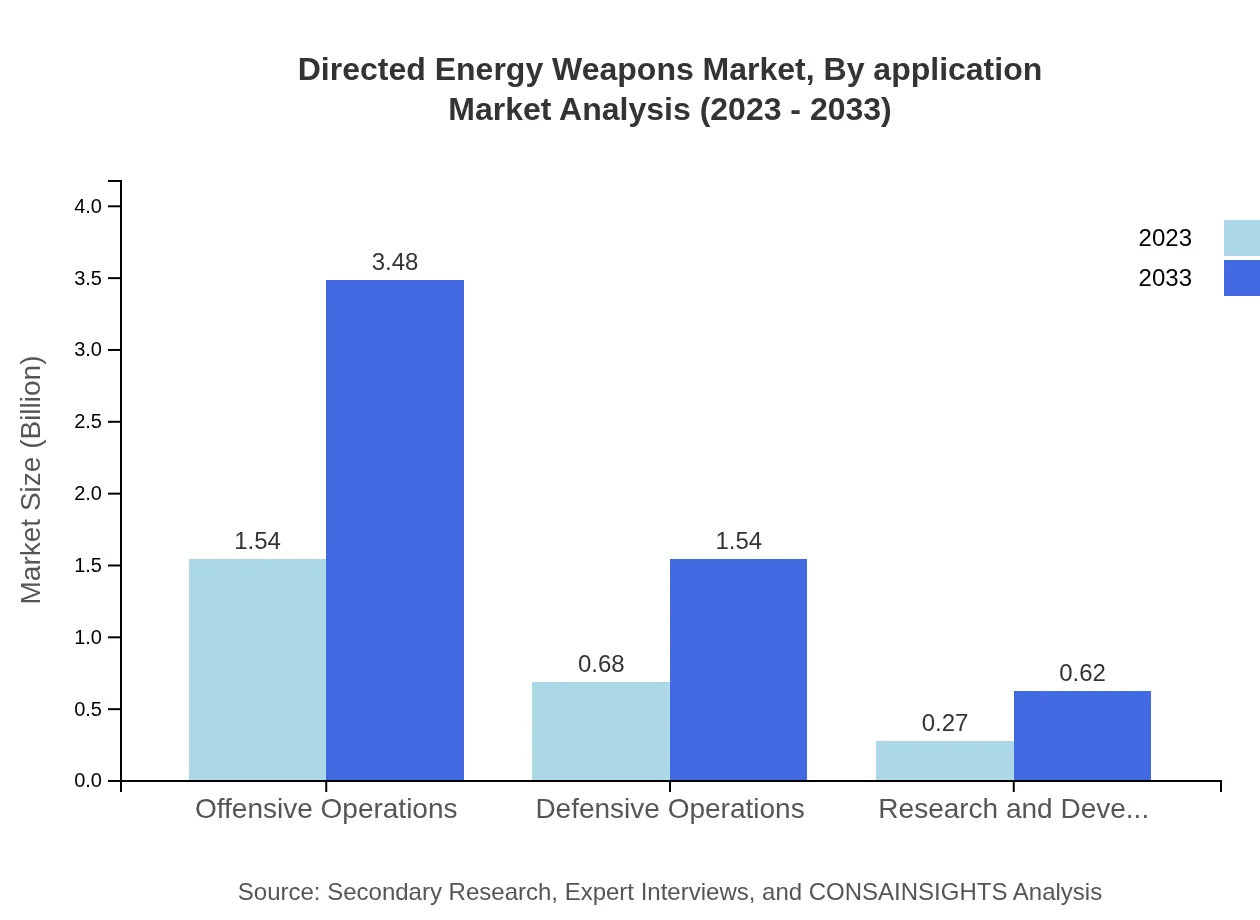

Directed Energy Weapons Market Analysis By Application

The DEW market can also be analyzed by application, which includes offensive operations (size: $1.54 billion in 2023; $3.48 billion in 2033), and defensive operations (size: $0.68 billion in 2023; $1.54 billion in 2033). The increasing threat of aerial attacks necessitates advanced defensive systems.

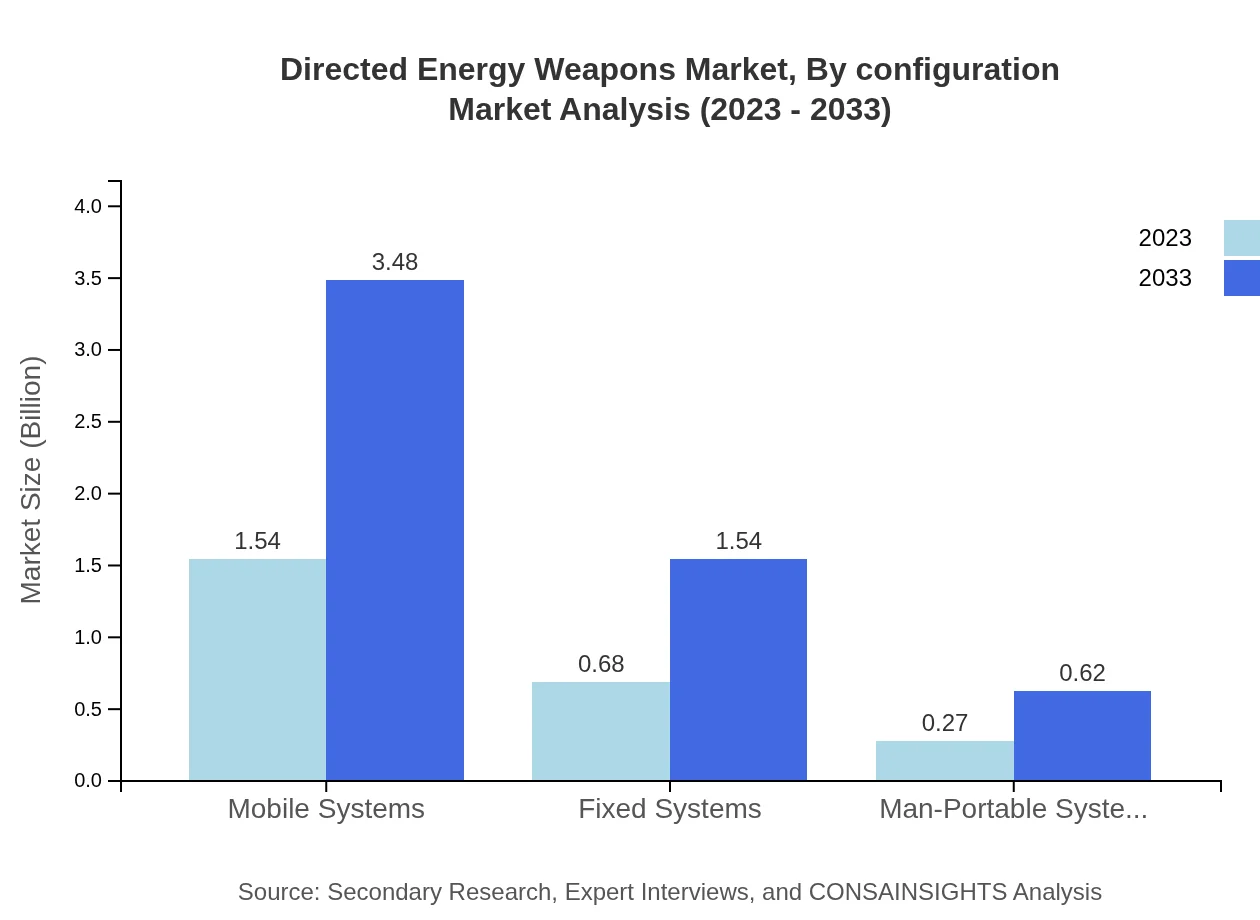

Directed Energy Weapons Market Analysis By Configuration

The market is segmented into mobile systems (size: $1.54 billion in 2023; $3.48 billion in 2033) and fixed systems (size: $0.68 billion in 2023; $1.54 billion in 2033). Mobile systems are preferred for their flexibility and rapid deployment capabilities.

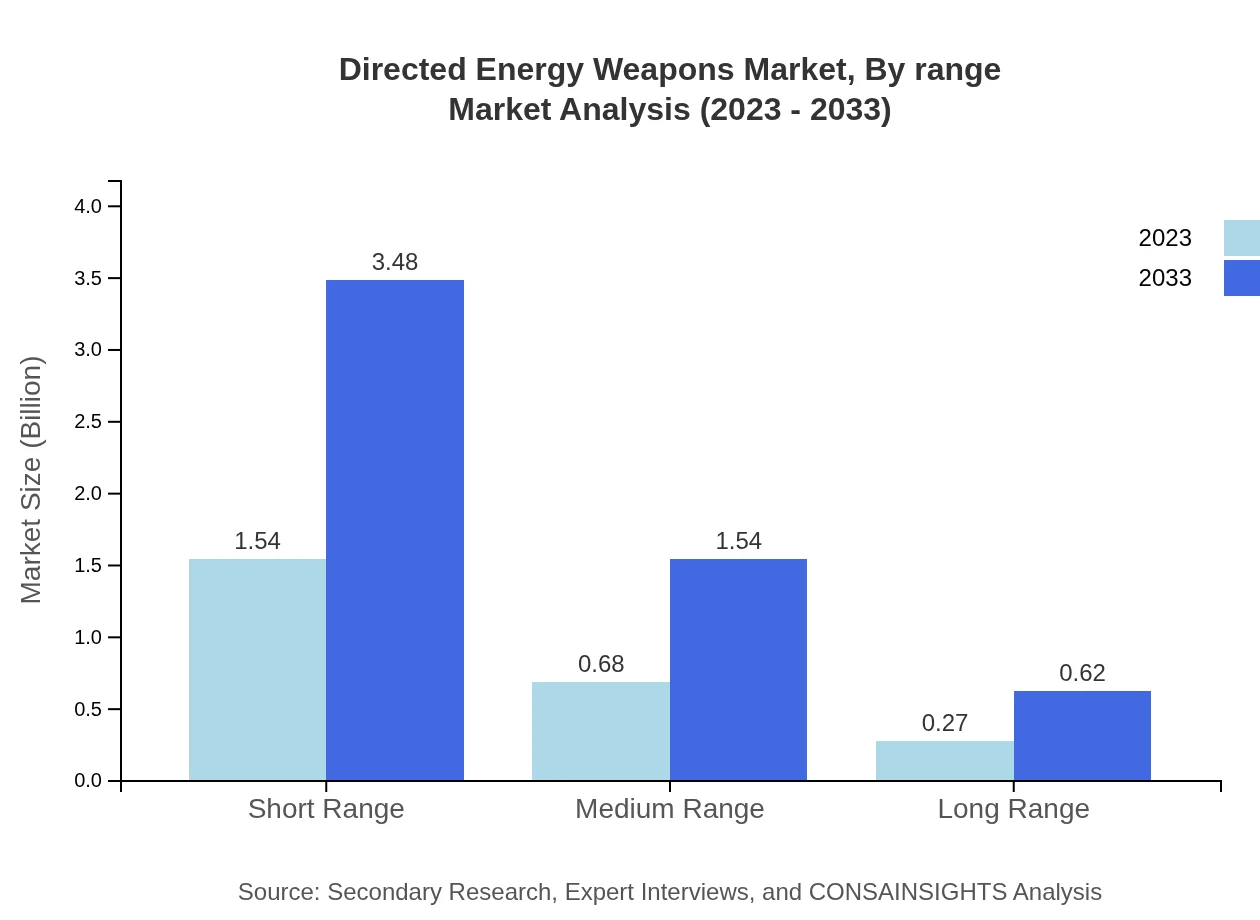

Directed Energy Weapons Market Analysis By Range

A range-based analysis shows the short range (size: $1.54 billion in 2023; $3.48 billion in 2033), medium range (size: $0.68 billion in 2023; $1.54 billion in 2033), and long range (size: $0.27 billion in 2023; $0.62 billion in 2033). Short-range DEWs dominate due to their immediate application in defense scenarios.

Directed Energy Weapons Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Directed Energy Weapons Industry

Lockheed Martin Corporation:

A leading global aerospace and defense contractor, Lockheed Martin is at the forefront of DEW technology, developing high-energy lasers and advanced systems for national defense.Raytheon Technologies Corporation:

Raytheon Technologies is a prominent defense contractor known for its development of microwave and laser-based DEW systems for military applications.Northrop Grumman Corporation:

Providing advanced solutions in defense, Northrop Grumman is involved in the research and development of innovative directed energy systems.Boeing Defense, Space & Security:

Boeing's dedicated defense sector actively engages in direct energy weapons technology, focusing on high-energy laser systems.General Atomics:

General Atomics specializes in high-energy laser technology solutions for military operations, enhancing global defense capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of directed Energy Weapons?

The global directed-energy weapons market is projected to reach $2.5 billion by 2033 with a CAGR of 8.2%, driven by increased defense spending and technological advancements.

What are the key market players or companies in the directed Energy Weapons industry?

Key players include Lockheed Martin, Raytheon Technologies, Northrop Grumman, Boeing, and BAE Systems, all prominent in the development and deployment of directed-energy systems.

What are the primary factors driving the growth in the directed Energy Weapons industry?

Growth is driven by rising defense budgets, advancements in laser technology, increased military applications, and enhanced effectiveness of non-lethal options for crowd control.

Which region is the fastest Growing in the directed Energy Weapons?

North America is the fastest-growing region, with projections increasing from $0.91 billion in 2023 to $2.06 billion by 2033, indicating strong military investment.

Does ConsaInsights provide customized market report data for the directed Energy Weapons industry?

Yes, ConsaInsights offers tailored market reports to meet specific client needs within the directed-energy weapons industry, ensuring relevant and detailed insights.

What deliverables can I expect from this directed Energy Weapons market research project?

Deliverables include comprehensive market analysis, segmented data insights, trend forecasts, regional growth potential, and competitive landscape reports.

What are the market trends of directed Energy Weapons?

Key trends include a shift towards mobile systems, increasing investment in R&D, and the growing adoption of non-lethal weapons in law enforcement.