Disaster Recovery As A Service Draas Market Report

Published Date: 31 January 2026 | Report Code: disaster-recovery-as-a-service-draas

Disaster Recovery As A Service Draas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive examination of the Disaster Recovery as a Service (DRaaS) market from 2023 to 2033, detailing market trends, growth forecasts, segmentation, and regional insights to inform stakeholders in their strategic decision-making.

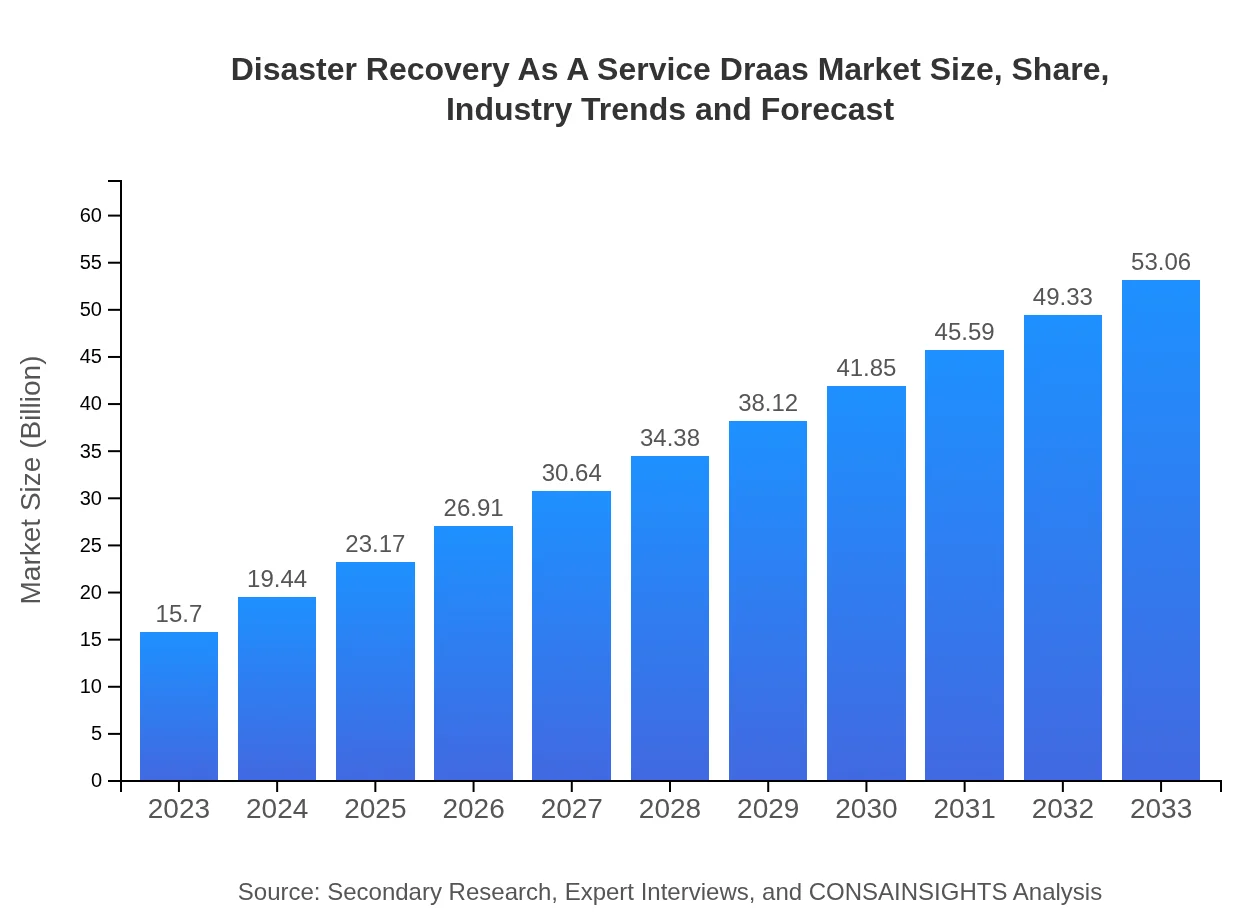

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 12.4% |

| 2033 Market Size | $53.06 Billion |

| Top Companies | IBM, Microsoft, VMware, Acronis, Zerto |

| Last Modified Date | 31 January 2026 |

Disaster Recovery As A Service Draas Market Overview

Customize Disaster Recovery As A Service Draas Market Report market research report

- ✔ Get in-depth analysis of Disaster Recovery As A Service Draas market size, growth, and forecasts.

- ✔ Understand Disaster Recovery As A Service Draas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Disaster Recovery As A Service Draas

What is the Market Size & CAGR of Disaster Recovery As A Service Draas market in 2033?

Disaster Recovery As A Service Draas Industry Analysis

Disaster Recovery As A Service Draas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Disaster Recovery As A Service Draas Market Analysis Report by Region

Europe Disaster Recovery As A Service Draas Market Report:

The European market is expected to grow from $3.87 billion in 2023 to $13.07 billion by 2033. Increasing regulatory compliance requirements for data protection and a rise in cyber threats are primary drivers for market growth in this region.Asia Pacific Disaster Recovery As A Service Draas Market Report:

In the Asia Pacific region, the DRaaS market was valued at approximately $3.22 billion in 2023 and is expected to grow to around $10.87 billion by 2033. The growth is attributed to increasing investments in IT infrastructure and rising awareness of disaster recovery solutions among enterprises looking to mitigate risks associated with data loss.North America Disaster Recovery As A Service Draas Market Report:

North America dominates the DRaaS market with a value of $5.46 billion in 2023, projected to reach $18.44 billion by 2033. The presence of major service providers, high adoption rates of cloud technologies, and stringent regulations concerning data protection contribute significantly to this growth.South America Disaster Recovery As A Service Draas Market Report:

The market in South America is relatively smaller, with a size of $1.13 billion in 2023, growing to $3.81 billion by 2033. The region's growth is driven mainly by increasing digitization efforts and the need for robust disaster recovery plans in businesses across various sectors.Middle East & Africa Disaster Recovery As A Service Draas Market Report:

In the Middle East and Africa, the market size is estimated at $2.03 billion in 2023, potentially reaching $6.87 billion by 2033. Growing investments in IT infrastructure and an increased focus on data security contribute to the rising demand for DRaaS solutions.Tell us your focus area and get a customized research report.

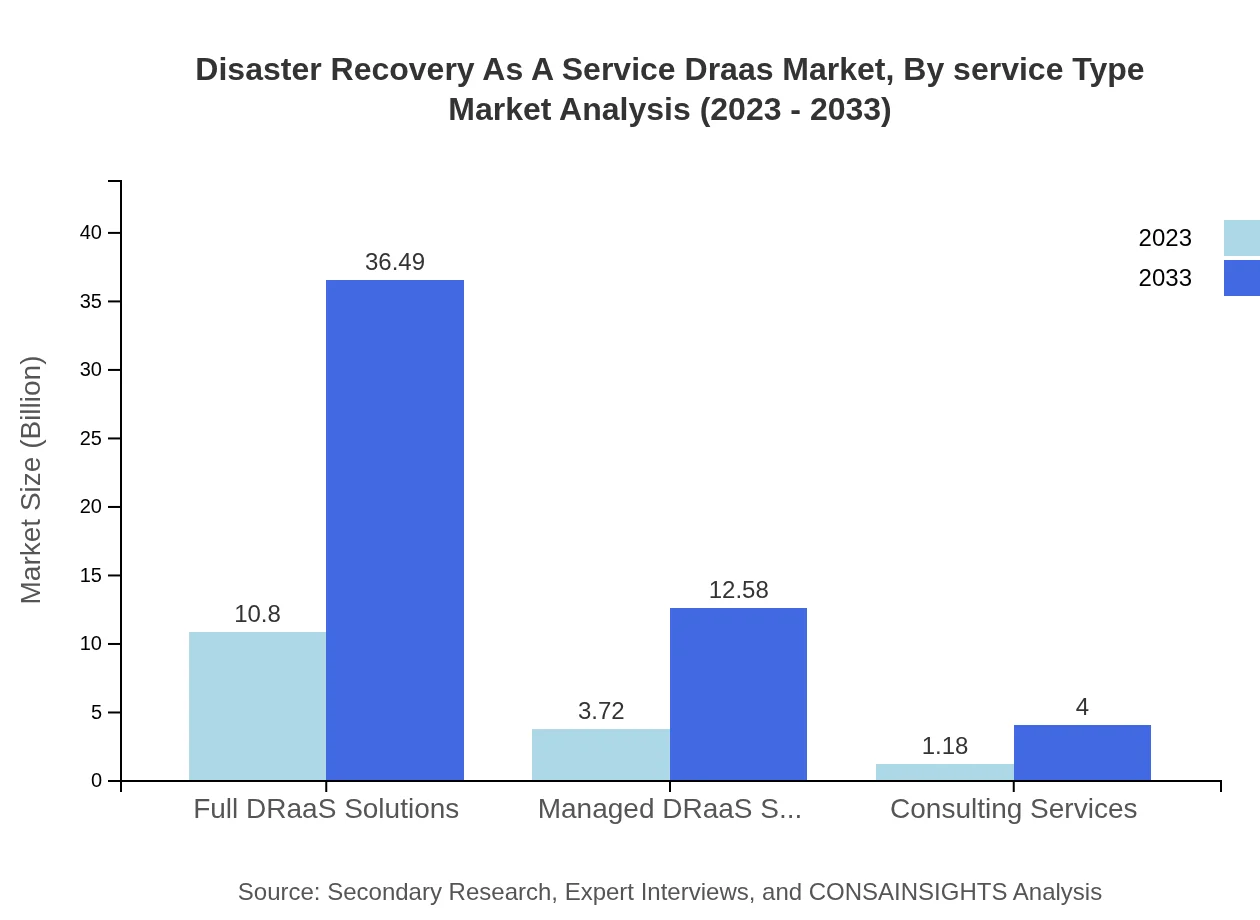

Disaster Recovery As A Service Draas Market Analysis By Service Type

The DRaaS market, segmented by service type, shows that Full DRaaS Solutions commanded a significant market share of 68.77% in 2023, expected to remain stable at 68.77% through 2033, reflecting a consistent demand for comprehensive disaster recovery strategies. Managed DRaaS Services account for 23.7% of the market in 2023, with a projected growth to maintain that share, underpinning enterprises' need for professional service management.

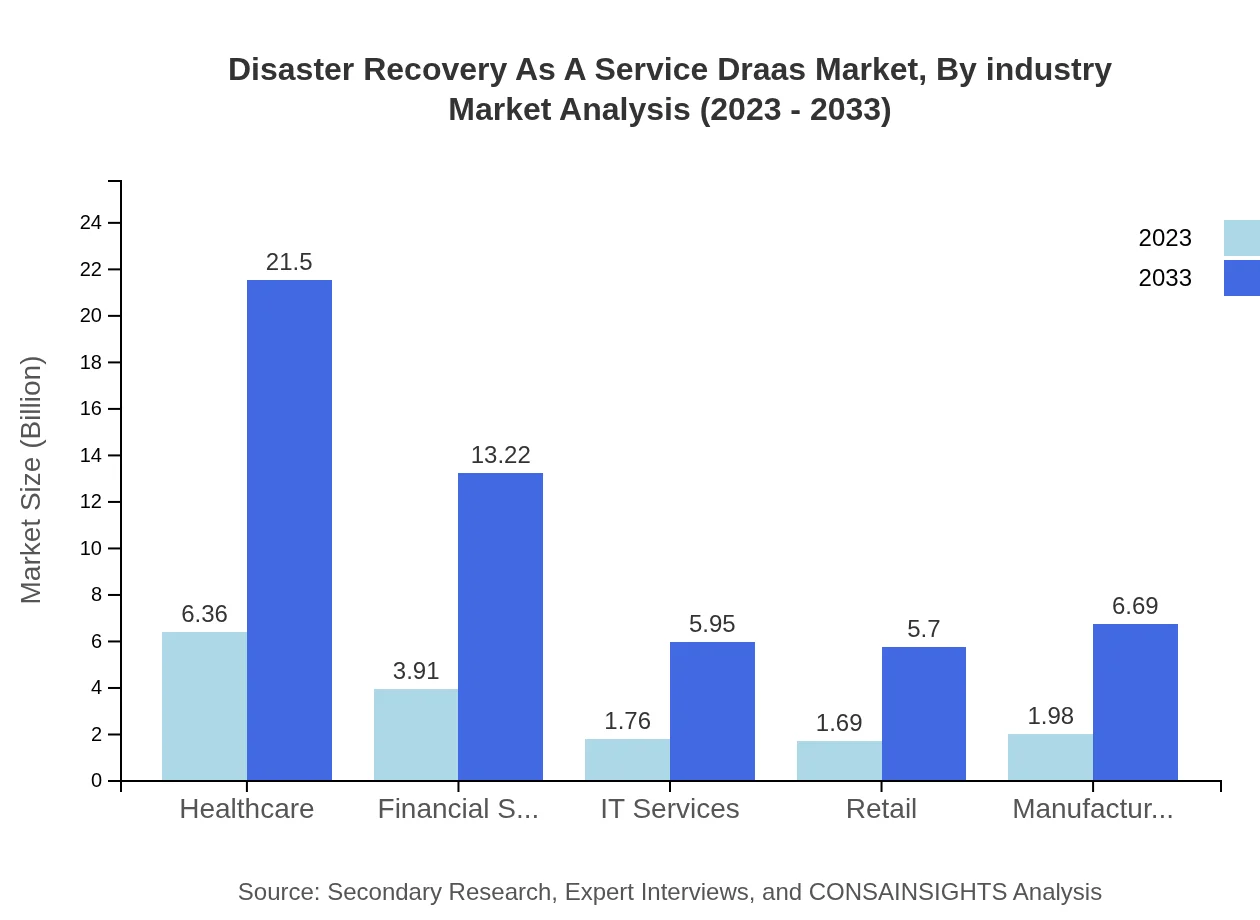

Disaster Recovery As A Service Draas Market Analysis By Industry

The Healthcare industry is the front-runner in the DRaaS market, with a projected increase from $6.36 billion in 2023 to $21.50 billion by 2033, representing 40.52% market share throughout this period. Financial Services follow with a market size increase from $3.91 billion to $13.22 billion, maintaining a 24.91% share. Other sectors such as Retail, IT Services, and Manufacturing display significant growth, showcasing the universal applicability of DRaaS.

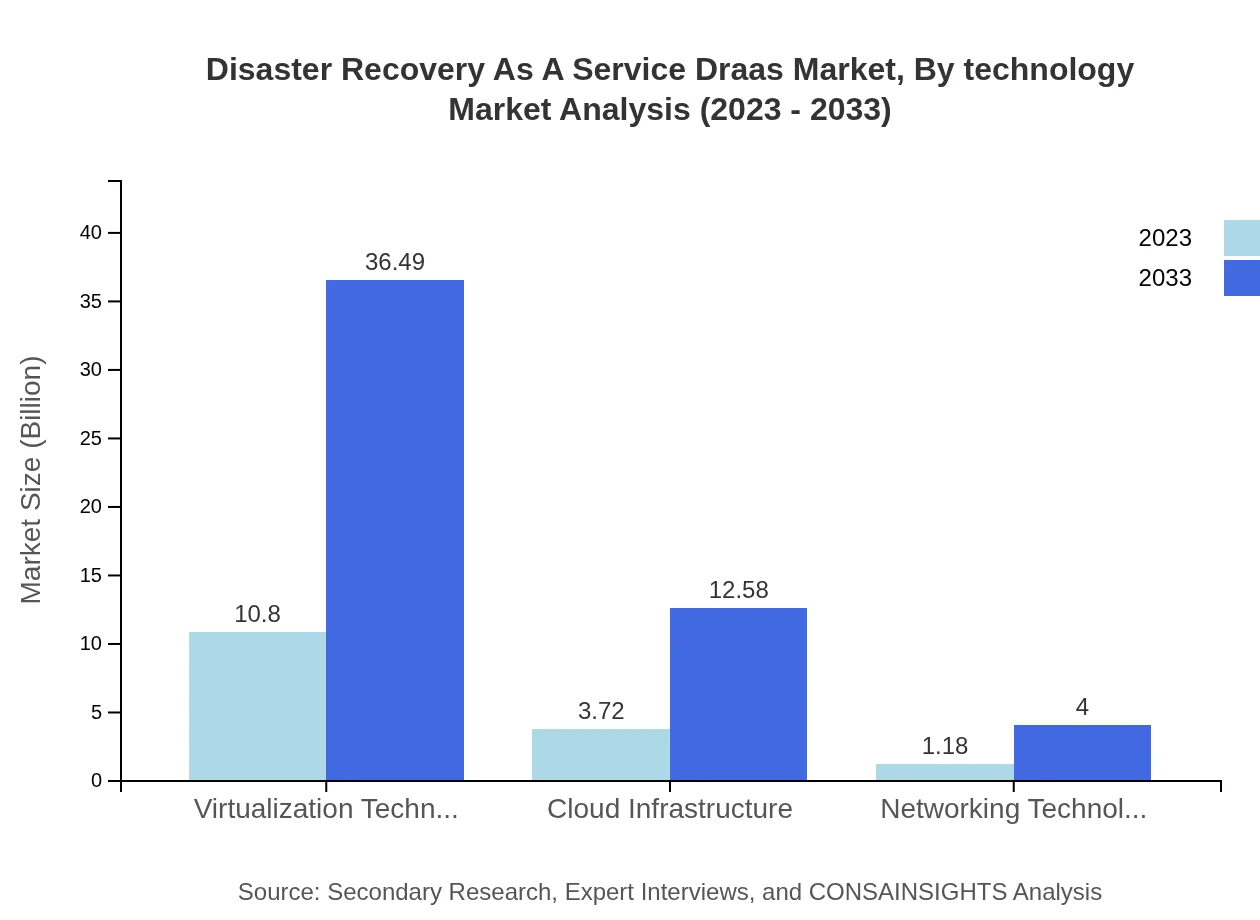

Disaster Recovery As A Service Draas Market Analysis By Technology

Among technology segments, Virtualization Technologies dominate with a share of 68.77% in 2023, increasing to the same share in 2033 due to the technology's scalability and cost-effectiveness. Cloud Infrastructure is also critical, growing to an estimated 23.7% market share, supporting the trend towards integrated cloud-based solutions for disaster recovery.

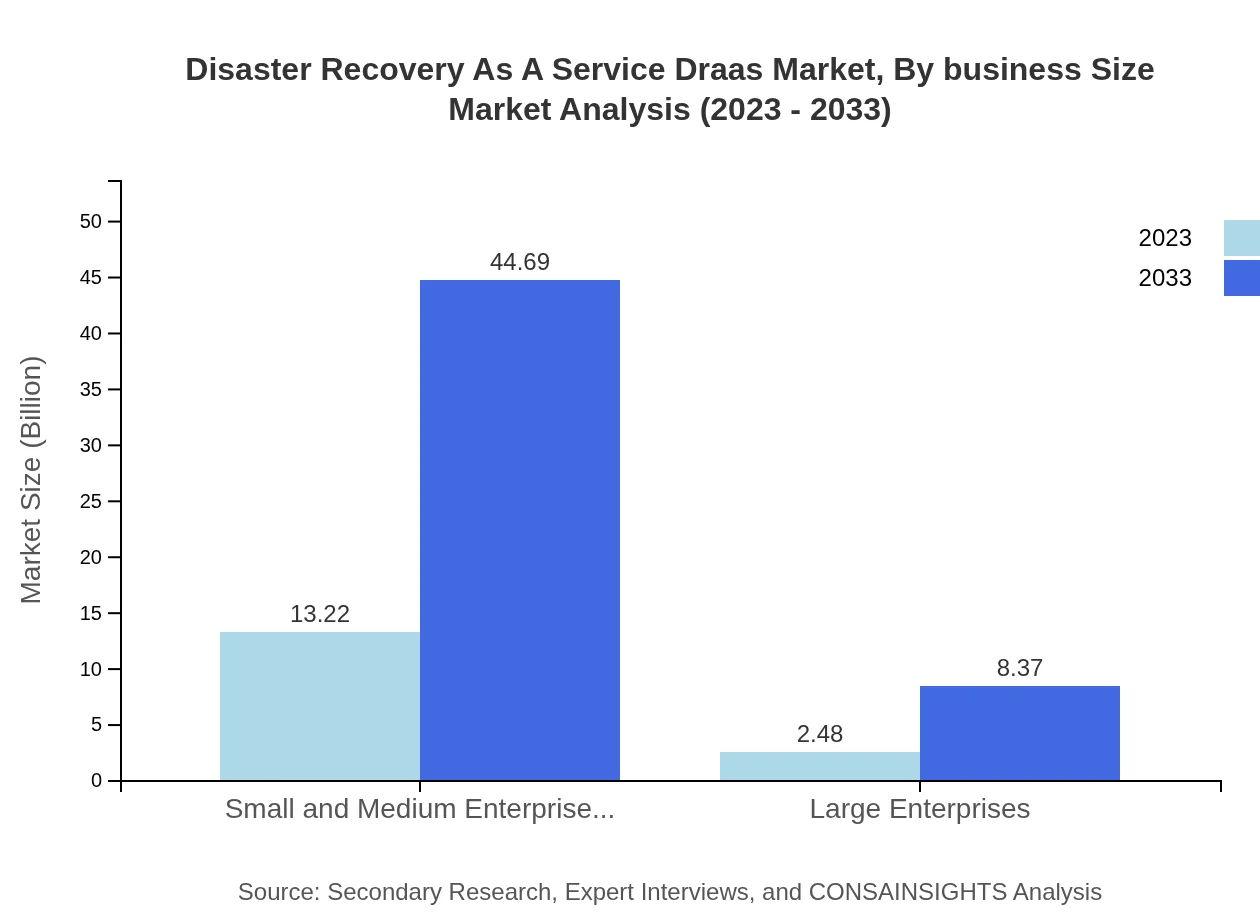

Disaster Recovery As A Service Draas Market Analysis By Business Size

SMEs capture a significant market share of 84.23% in the DRaaS segment, projecting a rise from $13.22 billion in 2023 to $44.69 billion by 2033. Large Enterprises account for 15.77%, highlighting the differences in adoption strategies due to varying resource allocations and recovery needs.

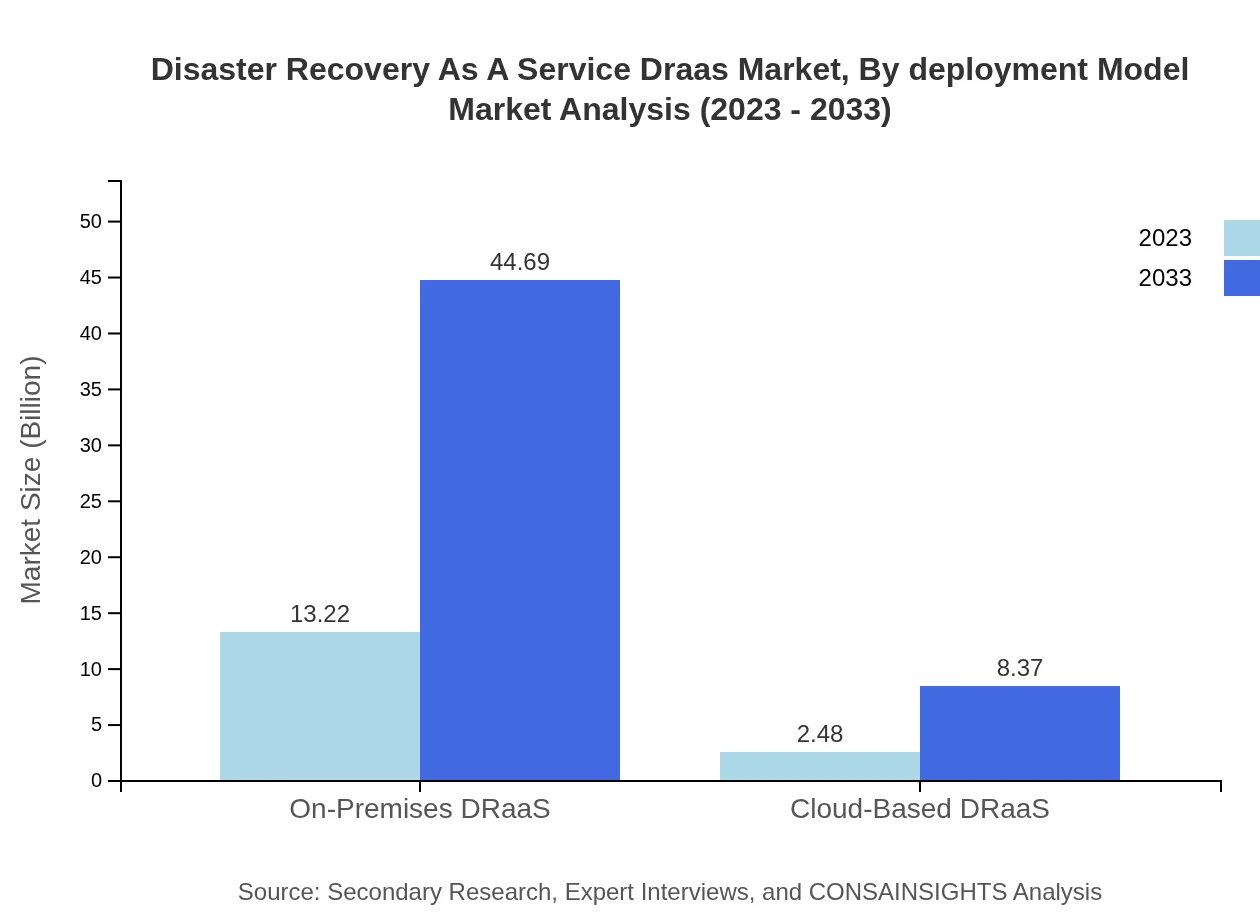

Disaster Recovery As A Service Draas Market Analysis By Deployment Model

The deployment model of On-Premises DRaaS predicted a stronghold at 84.23% market share, while Cloud-Based DRaaS is projected to hold 15.77%. The dominance of on-premises solutions reflects traditional recovery preferences, though market shifts are favoring cloud integrations.

Disaster Recovery As A Service Draas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Disaster Recovery As A Service Draas Industry

IBM:

IBM provides a comprehensive suite of DRaaS offerings, leveraging its extensive cloud infrastructure and advanced technologies to ensure high standards of disaster recovery across multiple industries.Microsoft:

Microsoft's Azure Disaster Recovery solutions offer scalable and flexible options for businesses, combining cloud integration with on-premises capabilities, ensuring a robust disaster recovery framework.VMware:

VMware focuses on virtualization technologies for effective DRaaS solutions, supporting organizations in managing and recovering their data with seamless cloud integration.Acronis:

Acronis specializes in backup solutions and DRaaS, providing businesses with innovative technologies to protect their data and ensure continuity during disasters.Zerto:

Zerto delivers cloud data management and protection solutions, facilitating enterprise-level disaster recovery through continuous data protection and real-time replication.We're grateful to work with incredible clients.

FAQs

What is the market size of Disaster Recovery as a Service (DRaaS)?

The global DRaaS market size is $15.7 billion in 2023, with a projected growth rate (CAGR) of 12.4% until 2033, indicating robust demand for disaster recovery solutions across various industries.

What are the key market players or companies in the DRaaS industry?

Key players in the DRaaS market include industry leaders like VMware, IBM, and Microsoft, who provide comprehensive disaster recovery solutions and services that cater to diverse business needs and enhance operational resilience.

What are the primary factors driving the growth in the DRaaS industry?

The growth of DRaaS is driven by increasing cyber threats, regulatory compliance demands, and the need for business continuity. Additionally, the rising adoption of cloud computing and virtualization technologies enhances accessibility and data protection.

Which region is the fastest Growing in the DRaaS market?

The North American region is expected to grow rapidly, with a market size projected to reach $18.44 billion by 2033, driven by high adoption rates of advanced technological solutions and increasing requirements for reliable disaster recovery.

Does ConsaInsights provide customized market report data for the DRaaS industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the DRaaS industry, ensuring clients receive tailored insights and analytics that align with their strategic objectives.

What deliverables can I expect from the DRaaS market research project?

From the DRaaS market research project, clients can expect comprehensive reports including market forecasts, industry analysis, competitive landscape assessments, and strategic recommendations tailored to enhance business decision-making.

What are the market trends of DRaaS?

Emerging trends in the DRaaS market include greater emphasis on automation, integration of artificial intelligence, and the shift towards hybrid and multi-cloud solutions, reflecting the evolving needs of businesses in ensuring data resilience.