Disclosure Management Market Report

Published Date: 31 January 2026 | Report Code: disclosure-management

Disclosure Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Disclosure Management market, including insights on market size, growth forecasts for 2023-2033, industry trends, regional analyses, and key players shaping the landscape.

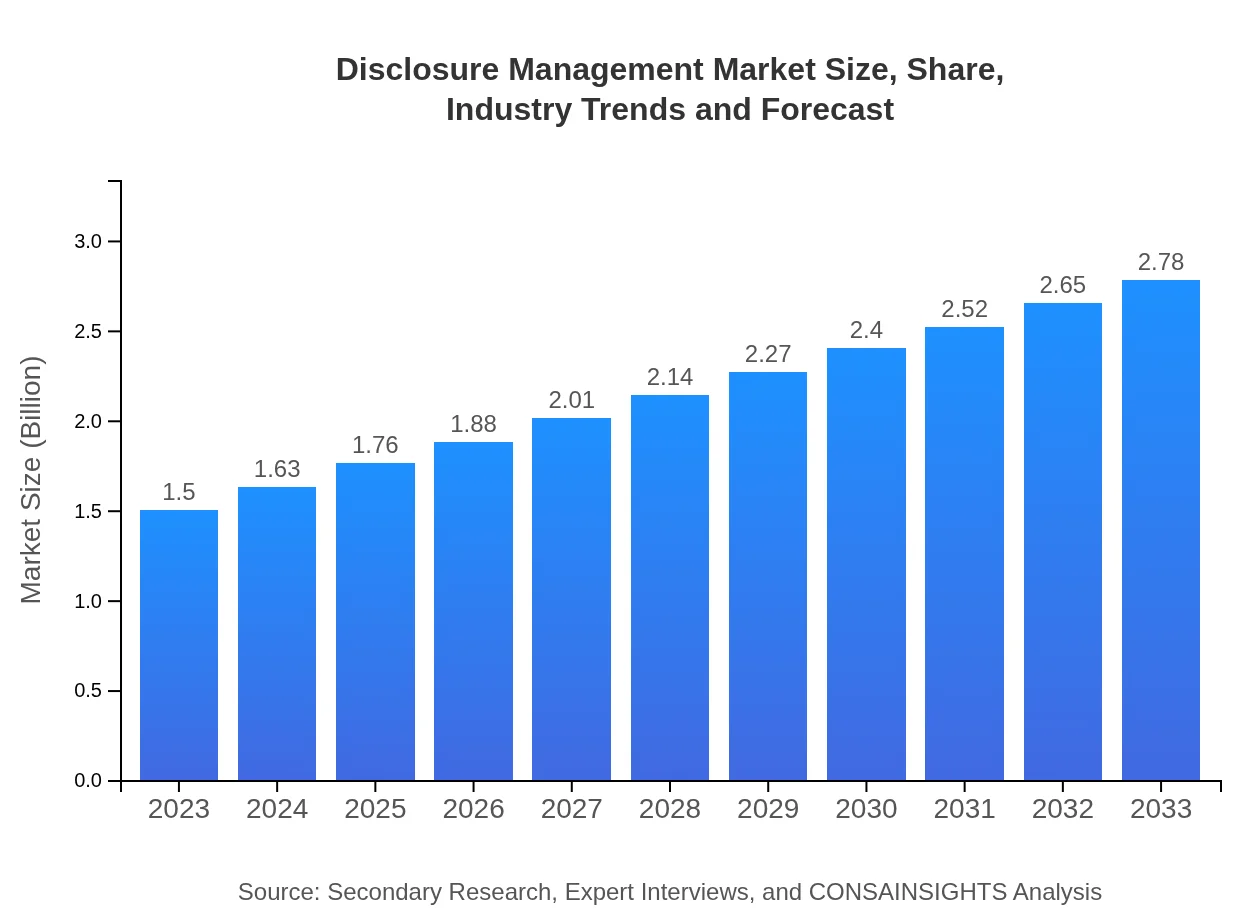

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Workiva , Oracle Corporation, SAP SE, Deloitte, NetSuite |

| Last Modified Date | 31 January 2026 |

Disclosure Management Market Overview

Customize Disclosure Management Market Report market research report

- ✔ Get in-depth analysis of Disclosure Management market size, growth, and forecasts.

- ✔ Understand Disclosure Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Disclosure Management

What is the Market Size & CAGR of Disclosure Management market in 2023?

Disclosure Management Industry Analysis

Disclosure Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Disclosure Management Market Analysis Report by Region

Europe Disclosure Management Market Report:

The European market will expand from $0.47 billion in 2023 to $0.87 billion in 2033, as companies comply with the EU's increasingly stringent disclosure requirements, including GDPR and other financial regulations.Asia Pacific Disclosure Management Market Report:

In the Asia Pacific region, the market is poised to grow from $0.24 billion in 2023 to $0.45 billion by 2033, driven by increasing investments in technology and a rising number of regulatory frameworks that necessitate robust disclosure practices.North America Disclosure Management Market Report:

North America represents the largest market, growing from $0.57 billion in 2023 to $1.05 billion by 2033, fueled by the region's stringent regulatory environment and the high adoption rate of advanced disclosure management solutions.South America Disclosure Management Market Report:

The South American Disclosure Management market is expected to grow from $0.08 billion in 2023 to $0.15 billion by 2033, with key growth strategies including enhancing transparency and adherence to international reporting standards.Middle East & Africa Disclosure Management Market Report:

The Middle East and Africa market is set to rise from $0.14 billion in 2023 to $0.26 billion by 2033, influenced by the growing need for financial transparency and governance in rapidly developing economies.Tell us your focus area and get a customized research report.

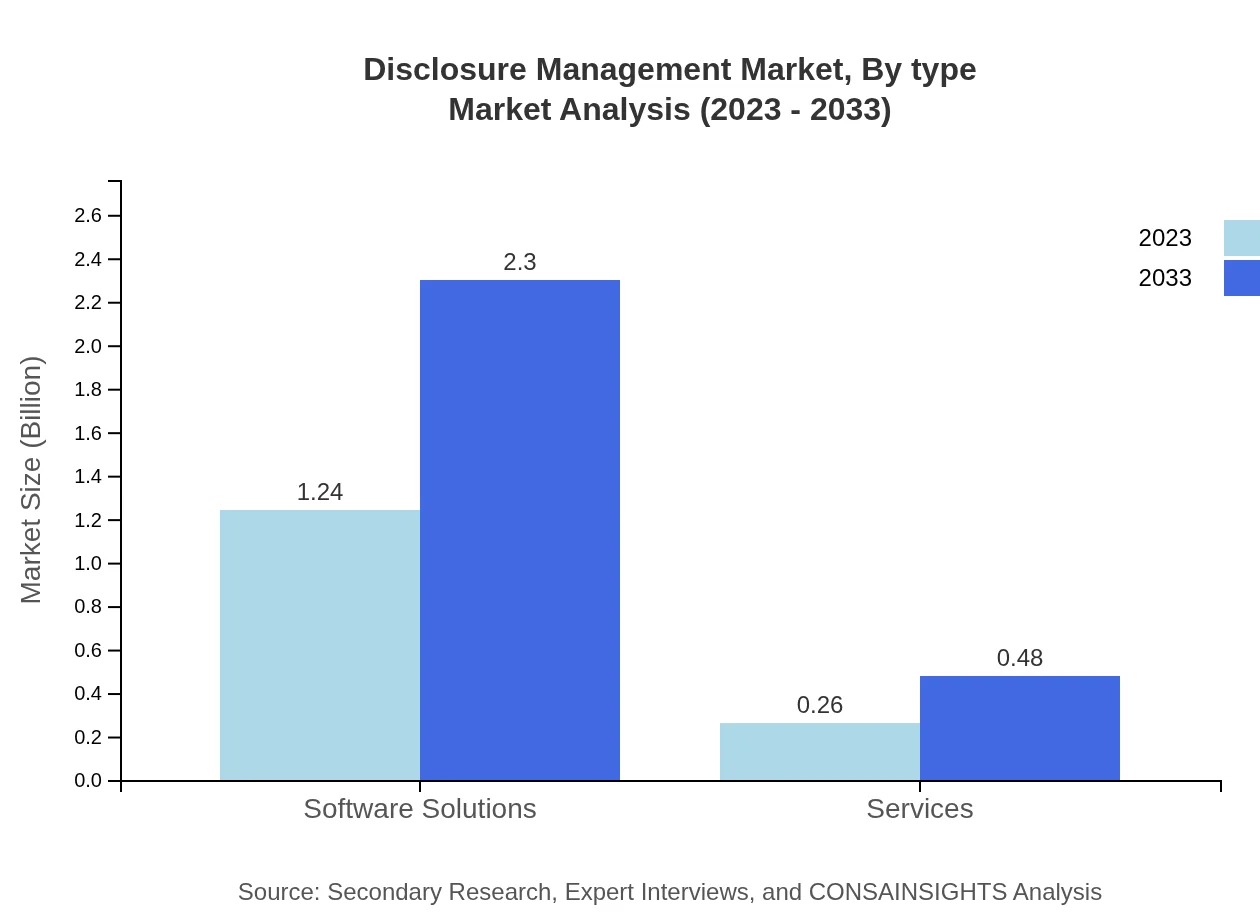

Disclosure Management Market Analysis By Type

The Disclosure Management market is largely dominated by Software Solutions, which are expected to reach $1.24 billion in 2023 and grow to $2.30 billion by 2033, capturing 82.76% market share. Services, while smaller, are projected to grow from $0.26 billion to $0.48 billion, holding 17.24% market share. Cloud-based deployment is preferred, driving efficiencies and scalability across sectors.

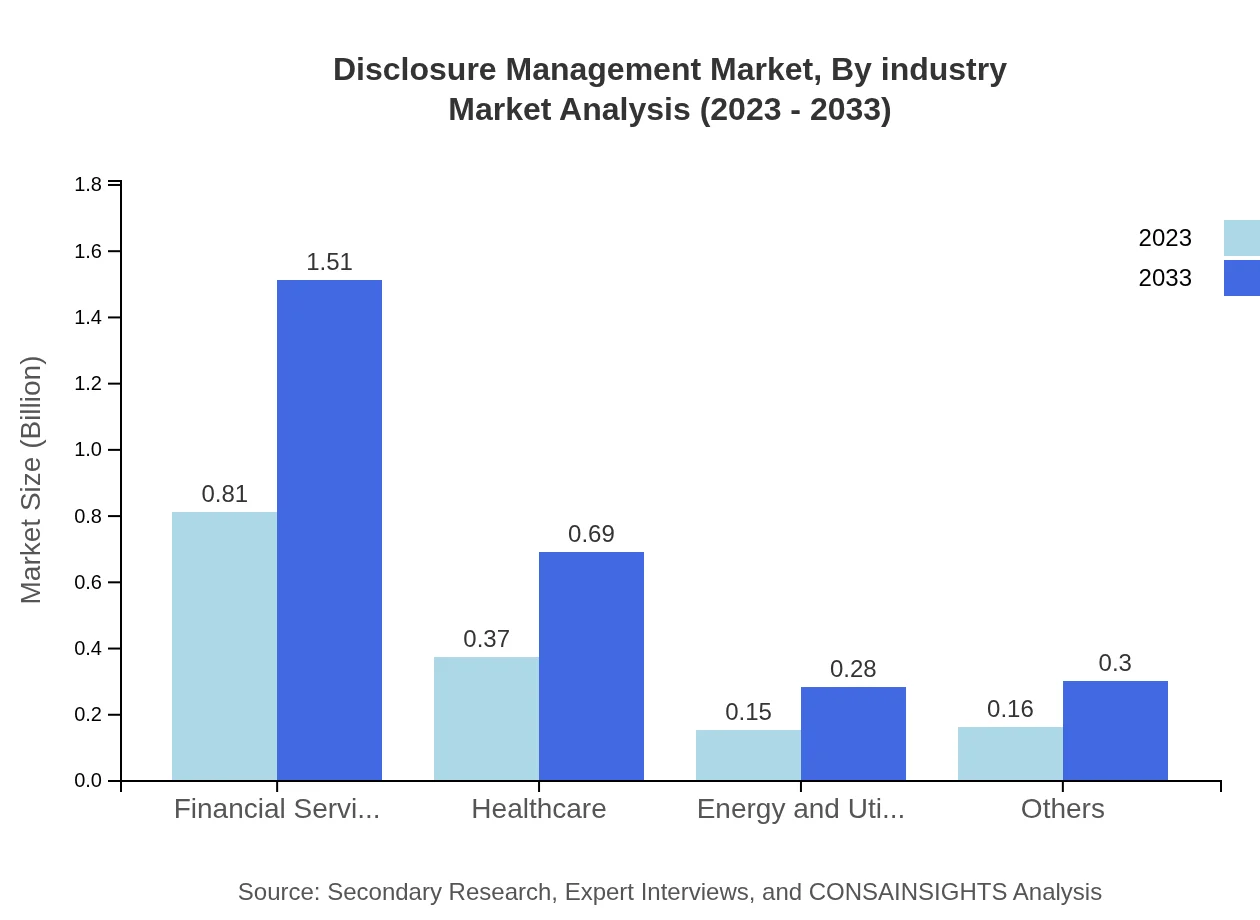

Disclosure Management Market Analysis By Industry

In the industry segment, Financial Services lead with a market size of $0.81 billion in 2023, expected to grow to $1.51 billion by 2033 (54.27% share). Healthcare follows with growth from $0.37 billion to $0.69 billion (24.7% share), while Regulatory Compliance also sees substantial growth from $0.40 billion to $0.75 billion (26.99% share), making compliance a critical element of disclosure management.

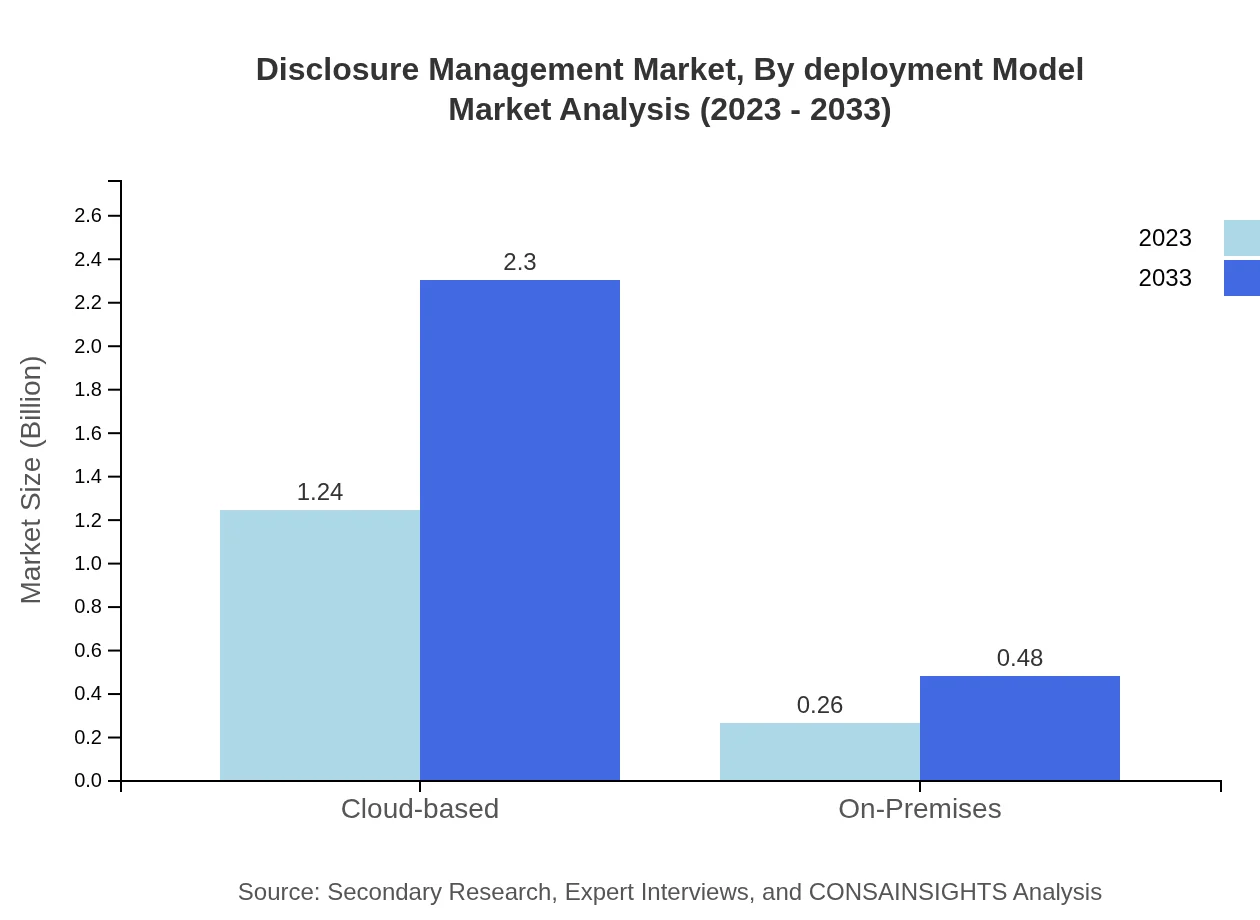

Disclosure Management Market Analysis By Deployment Model

Adoption of Cloud-based solutions dominates the market with a size of $1.24 billion in 2023, escalating to $2.30 billion by 2033 (82.76% share). On-premises solutions are expected to increase from $0.26 billion to $0.48 billion (17.24% share), showcasing a shift towards more flexible and accessible deployment options.

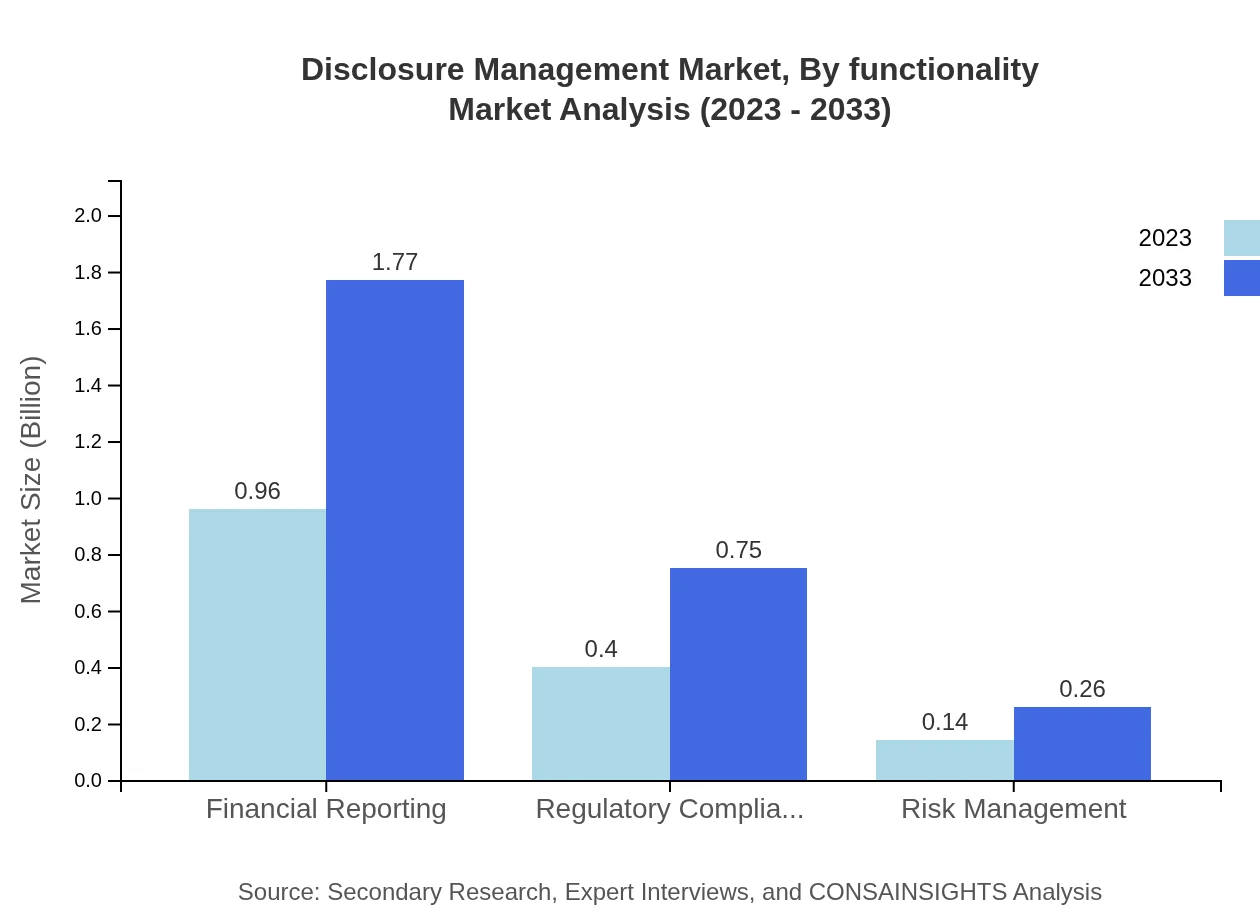

Disclosure Management Market Analysis By Functionality

The market is segmented based on functionalities such as Financial Reporting, Risk Management, and Regulatory Compliance. Financial Reporting is substantial, projected to grow from $0.96 billion to $1.77 billion by 2033 (63.71% share), while Risk Management is expected to grow modestly from $0.14 billion to $0.26 billion (9.3% share), emphasizing the need for comprehensive management of financial disclosures.

Disclosure Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Disclosure Management Industry

Workiva :

Workiva is a leading provider of cloud-based software for performance management and reporting solutions, known for enhancing transparency and compliance for organizations.Oracle Corporation:

Oracle offers a comprehensive portfolio of software solutions including advanced disclosure management systems that support organizations in automating their reporting processes.SAP SE:

SAP provides specialized solutions for financial reporting and compliance, focusing on integration with other enterprise applications to enhance efficiency and accuracy.Deloitte:

Deloitte provides consulting services alongside tailored software solutions that help businesses manage compliance and improve their disclosure processes.NetSuite:

NetSuite, an Oracle company, offers integrated cloud-business software that simplifies financial management and compliance for businesses of all sizes.We're grateful to work with incredible clients.

FAQs

What is the market size of disclosure Management?

The disclosure management market is projected to reach $1.5 billion by 2033, growing at a CAGR of 6.2% from its current valuation. This growth reflects increasing demands for compliance and transparency across various industries.

What are the key market players or companies in this disclosure Management industry?

Key players in the disclosure management industry include large tech companies specializing in software solutions, compliance management systems, and consulting firms that provide regulatory advice. These companies are competing to enhance their offerings and expand market share.

What are the primary factors driving the growth in the disclosure Management industry?

The growth in disclosure management is driven by heightened regulatory frameworks, rising complexities in financial reporting, and increased demand for transparency from stakeholders. Companies are also adopting technology solutions to streamline compliance and reporting processes.

Which region is the fastest Growing in the disclosure Management?

North America is the fastest-growing region in the disclosure management market, expected to grow from $0.57 billion in 2023 to $1.05 billion by 2033. This growth is fueled by technological advancements and stringent legislative requirements in financial reporting.

Does ConsaInsights provide customized market report data for the disclosure Management industry?

Yes, ConsaInsights offers customized market reports tailored to clients' specific needs within the disclosure management industry. Clients can access detailed analyses and data relevant to their unique organizational requirements.

What deliverables can I expect from this disclosure Management market research project?

Deliverables from this market research include comprehensive reports, market forecasts, competitive analysis, regional insights, and segment breakdowns, enabling businesses to strategize effectively in the disclosure management landscape.

What are the market trends of disclosure Management?

Current trends in the disclosure management market include a shift toward cloud-based solutions, increasing automation in compliance processes, and the integration of AI and machine learning to enhance reporting accuracy and efficiency.