Discrete Manufacturing And Plm Market Report

Published Date: 31 January 2026 | Report Code: discrete-manufacturing-and-plm

Discrete Manufacturing And Plm Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Discrete Manufacturing and Product Lifecycle Management (PLM) market, including trends, technology advancements, and detailed regional insights, along with market size and growth forecasts from 2023 to 2033.

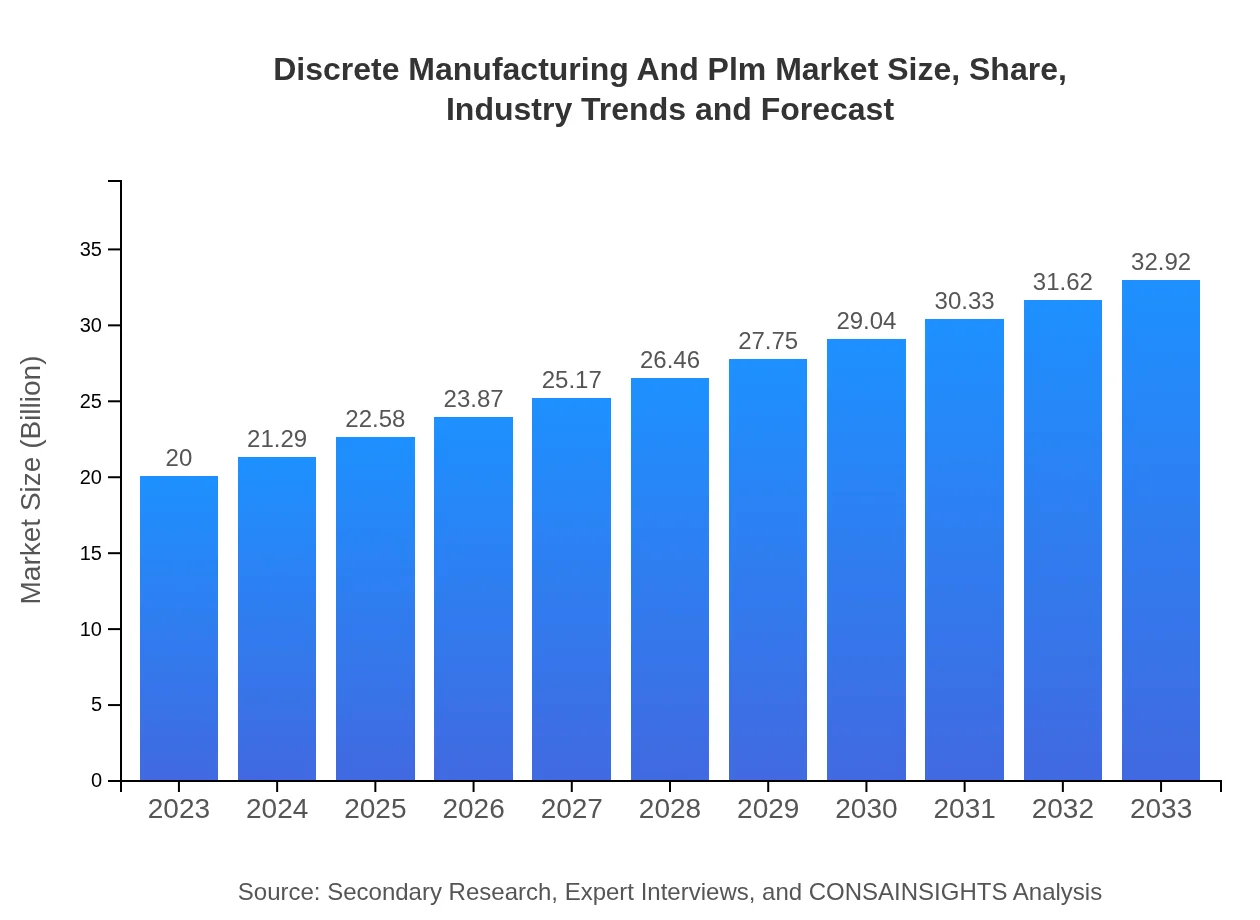

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | PTC Inc., Siemens AG, Dassault Systèmes, SAP SE, Oracle Corporation |

| Last Modified Date | 31 January 2026 |

Discrete Manufacturing And PLM Market Overview

Customize Discrete Manufacturing And Plm Market Report market research report

- ✔ Get in-depth analysis of Discrete Manufacturing And Plm market size, growth, and forecasts.

- ✔ Understand Discrete Manufacturing And Plm's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Discrete Manufacturing And Plm

What is the Market Size & CAGR of Discrete Manufacturing And PLM market in 2023?

Discrete Manufacturing And PLM Industry Analysis

Discrete Manufacturing And PLM Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Discrete Manufacturing And PLM Market Analysis Report by Region

Europe Discrete Manufacturing And Plm Market Report:

The European market, valued at $5.01 billion in 2023, is projected to reach $8.25 billion by 2033. The region is witnessing advancements in digital manufacturing and sustainability measures, pushing the envelope for innovative PLM practices across industries.Asia Pacific Discrete Manufacturing And Plm Market Report:

In 2023, the Asia Pacific market is valued at $3.91 billion and is expected to reach $6.43 billion by 2033. The rapid industrialization, coupled with the adoption of advanced PLM solutions, drives this growth. China and India are significant contributors, emphasizing innovation and manufacturing capabilities.North America Discrete Manufacturing And Plm Market Report:

North America holds a key position with a market size of $6.72 billion in 2023, growing to $11.06 billion by 2033. The focus on smart manufacturing paired with high investments in R&D activities indicates a robust growth potential, particularly in the automotive and aerospace sectors.South America Discrete Manufacturing And Plm Market Report:

The South American market is projected to grow from $1.91 billion in 2023 to $3.15 billion by 2033. This region is increasingly looking towards modernization and enhancing manufacturing efficiency, presenting opportunities for PLM solutions to streamline processes.Middle East & Africa Discrete Manufacturing And Plm Market Report:

In 2023, the Middle East and Africa market stands at $2.44 billion and is anticipated to grow to $4.02 billion by 2033. The market growth can be attributed to emerging industries in manufacturing and the increasing demand for modern PLM systems to enhance operational efficiencies.Tell us your focus area and get a customized research report.

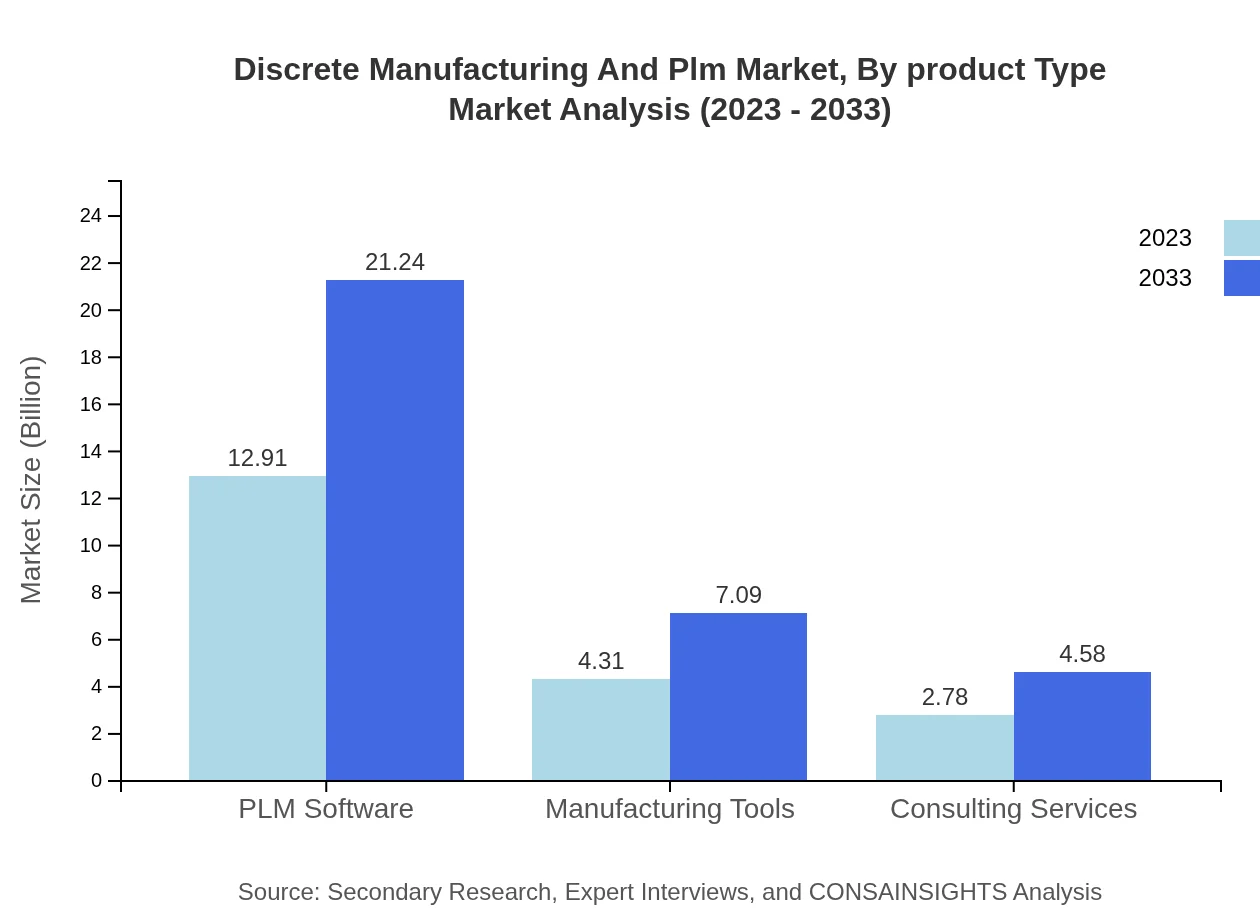

Discrete Manufacturing And Plm Market Analysis By Product Type

The PLM software segment dominates the market, accounting for a size of $12.91 billion in 2023 and expected to expand to $21.24 billion by 2033. Manufacturing tools follow closely, with a size of $4.31 billion in 2023, growing to $7.09 billion. Consulting services also contribute significantly, rising from $2.78 billion in 2023 to $4.58 billion by 2033.

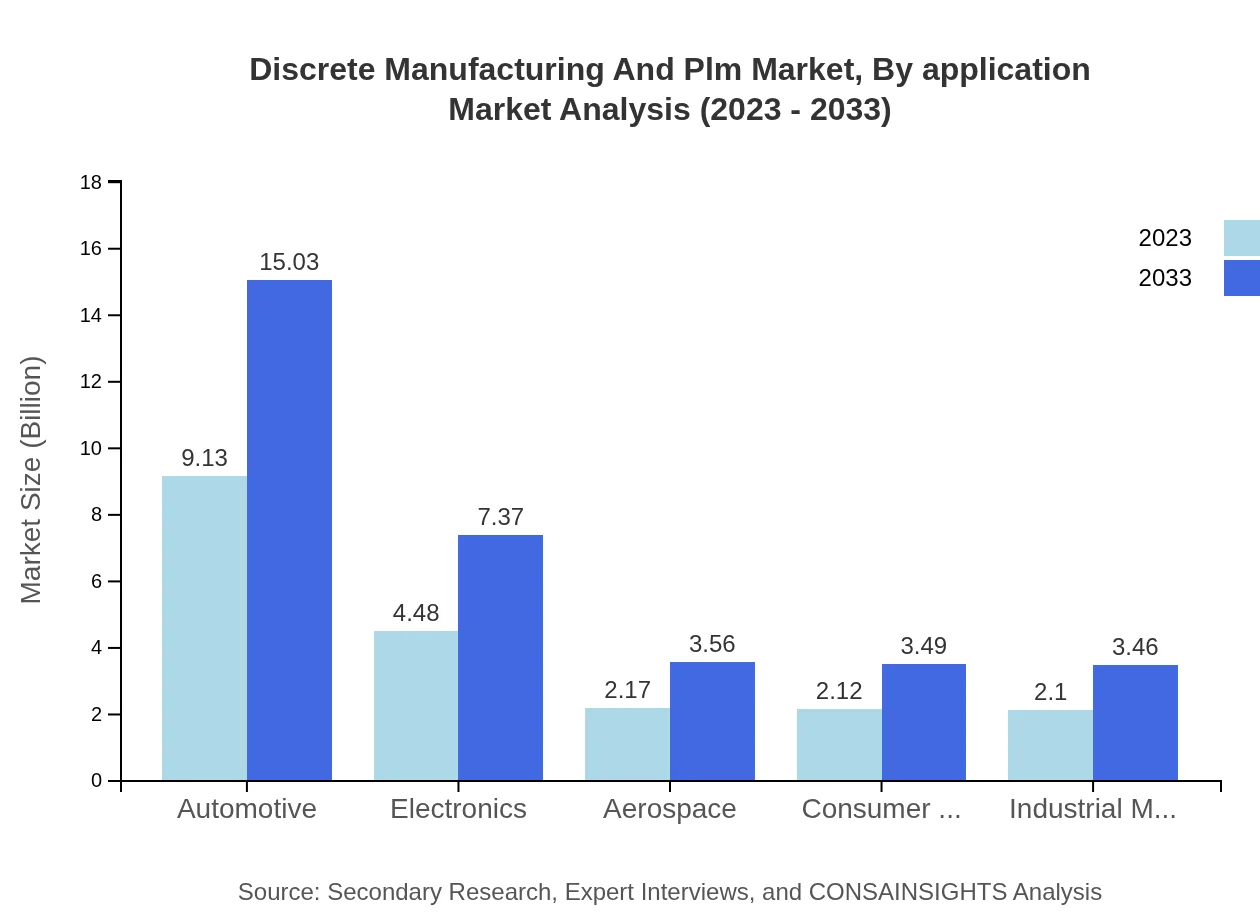

Discrete Manufacturing And Plm Market Analysis By Application

The automotive segment leads the market, valued at $9.13 billion in 2023 and expected to grow to $15.03 billion by 2033, maintaining a significant market share. Electronics and aerospace segments follow, standing at $4.48 billion and $2.17 billion in 2023, respectively, each witnessing substantial growth driven by technological advancements.

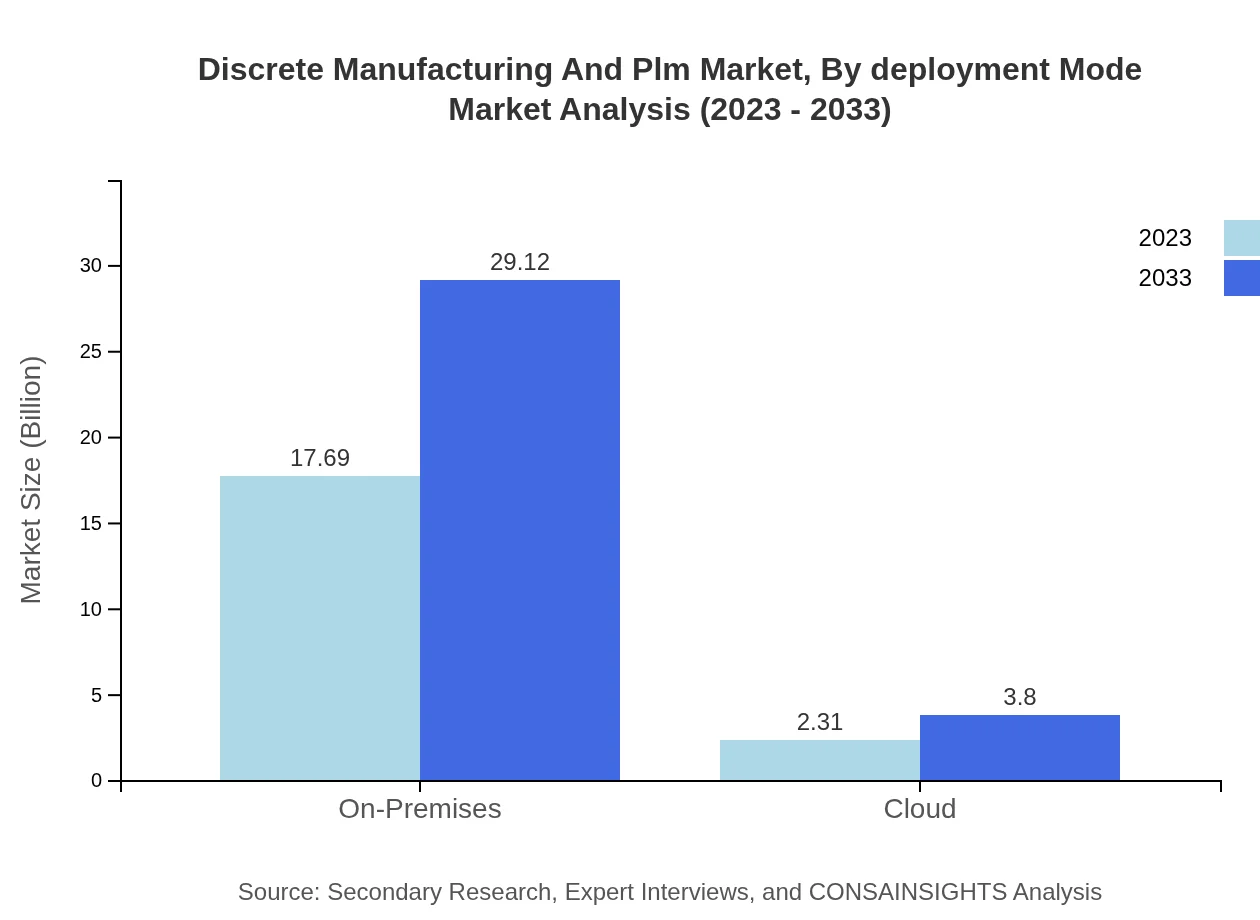

Discrete Manufacturing And Plm Market Analysis By Deployment Mode

The on-premises deployment mode leads with a market size of $17.69 billion in 2023 and projected to rise to $29.12 billion by 2033. Meanwhile, cloud solutions, though smaller in size at $2.31 billion in 2023, show promise with a growth trajectory toward $3.80 billion over the same period, reflecting a shift to more flexible deployment strategies.

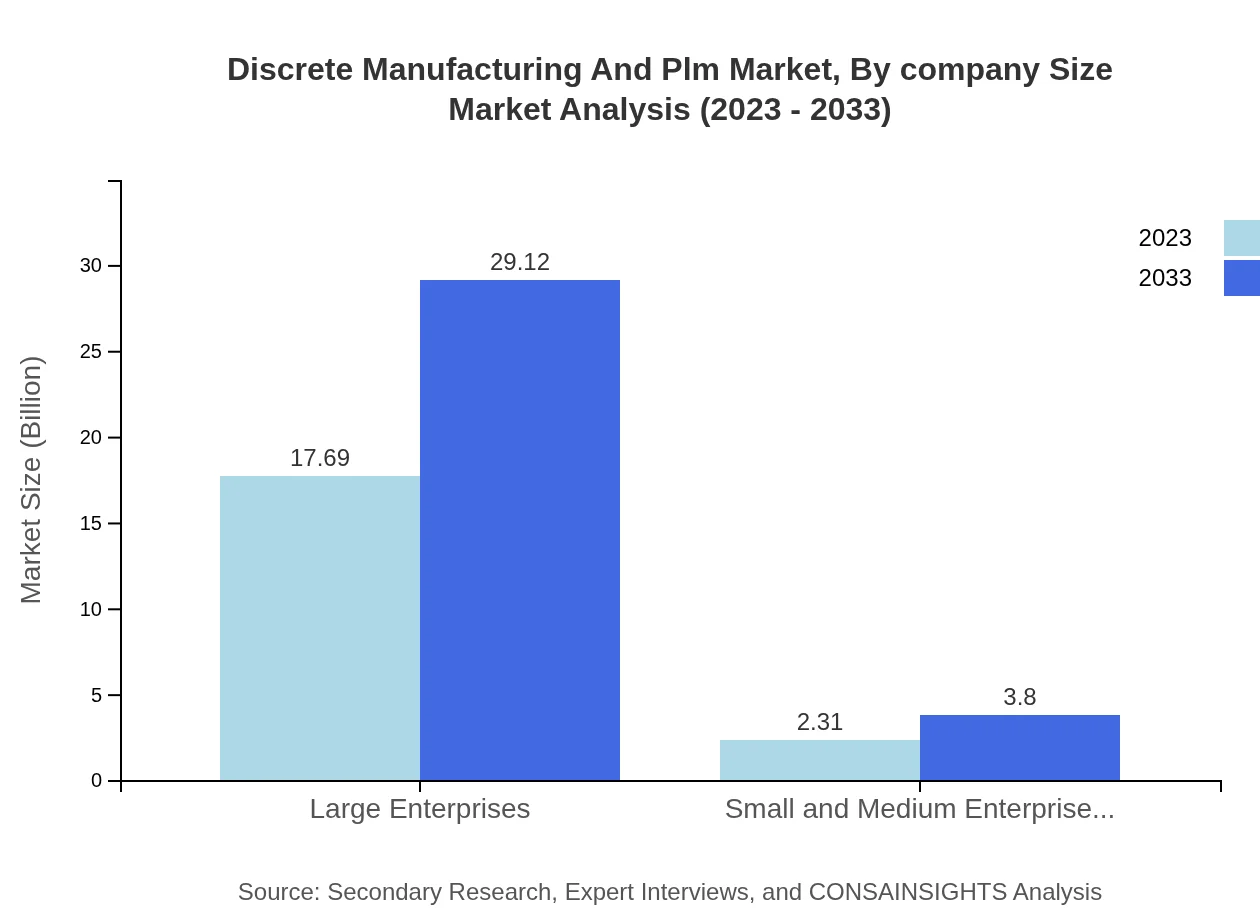

Discrete Manufacturing And Plm Market Analysis By Company Size

Large enterprises dominate the market with a size of $17.69 billion in 2023, growing to $29.12 billion by 2033. Small and Medium Enterprises (SMEs) represent a smaller segment at $2.31 billion in 2023, with expectations for growth to $3.80 billion by 2033 as more SMEs adopt PLM solutions to enhance competitiveness.

Discrete Manufacturing And PLM Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Discrete Manufacturing And PLM Industry

PTC Inc.:

PTC is a global leader in PLM and CAD software, known for its Windchill suite, which enhances product development and collaboration across various manufacturing sectors.Siemens AG:

Siemens specializes in automation and digitalization, particularly in manufacturing. Its Teamcenter PLM software is utilized widely to manage product data and lifecycle management effectively.Dassault Systèmes:

Dassault Systèmes is renowned for its 3D design and simulation software, notably the SOLIDWORKS and ENOVIA platforms, facilitating innovation in manufacturing through effective PLM solutions.SAP SE:

SAP specializes in enterprise software, with its PLM solutions integrated into ERP systems for real-time data insights and streamlined manufacturing processes.Oracle Corporation:

Oracle provides a range of applications, including Oracle Agile PLM, which enhances product strategy, compliance, and data management across the manufacturing domain.We're grateful to work with incredible clients.

FAQs

What is the market size of discrete Manufacturing And Plm?

The global discrete manufacturing and PLM market is projected to reach approximately $20 billion by 2033, growing at a CAGR of 5%. This growth can be attributed to increasing demand for efficient manufacturing processes.

What are the key market players or companies in this discrete Manufacturing And Plm industry?

Key players in the discrete manufacturing and PLM industry include major software and technology companies that specialize in product lifecycle management and manufacturing tools, contributing significantly to market innovation.

What are the primary factors driving the growth in the discrete Manufacturing And Plm industry?

Growth drivers include rising automation in manufacturing, increasing complexity of product designs, and the need for seamless integration of PLM solutions to enhance product development and lifecycle management.

Which region is the fastest Growing in the discrete Manufacturing And Plm?

The Asia Pacific region is anticipated to be the fastest-growing, with market size increasing from $3.91 billion in 2023 to $6.43 billion by 2033, reflecting a surge in manufacturing activities.

Does ConsaInsights provide customized market report data for the discrete Manufacturing And Plm industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the discrete manufacturing and PLM sector, allowing businesses to gain insights relevant to their operational requirements.

What deliverables can I expect from this discrete Manufacturing And Plm market research project?

Deliverables from this project include detailed market analyses, trend reports, regional performance assessments, and segmentation data, providing a comprehensive view of the discrete manufacturing and PLM landscape.

What are the market trends of discrete Manufacturing And Plm?

Current trends include increasing adoption of cloud-based PLM solutions, growing emphasis on sustainability in manufacturing, and the integration of advanced technologies like AI and IoT to optimize product lifecycle management.