Dispensing Systems Market Report

Published Date: 22 January 2026 | Report Code: dispensing-systems

Dispensing Systems Market Size, Share, Industry Trends and Forecast to 2033

This report delivers a comprehensive analysis of the Dispensing Systems market, covering insights on market trends, regional performance, competitive landscape, and future forecasts for the years 2023 to 2033.

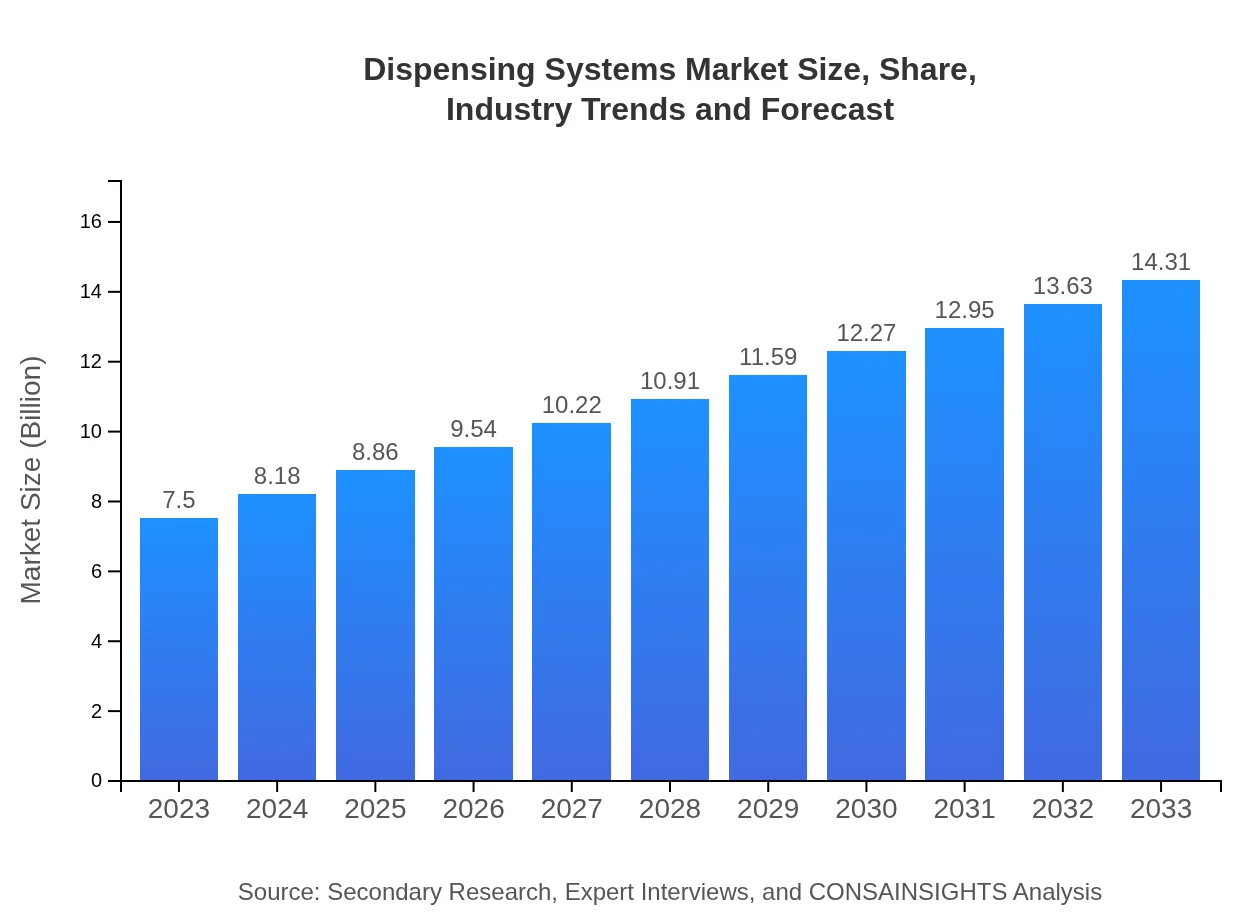

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $14.31 Billion |

| Top Companies | Graco Inc., Nordson Corporation, Herma GmbH, Dynatect Manufacturing Inc. |

| Last Modified Date | 22 January 2026 |

Dispensing Systems Market Overview

Customize Dispensing Systems Market Report market research report

- ✔ Get in-depth analysis of Dispensing Systems market size, growth, and forecasts.

- ✔ Understand Dispensing Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dispensing Systems

What is the Market Size & CAGR of Dispensing Systems market in 2023 and 2033?

Dispensing Systems Industry Analysis

Dispensing Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dispensing Systems Market Analysis Report by Region

Europe Dispensing Systems Market Report:

Europe is expected to experience a steady rise in the dispensing systems market, growing from $1.93 billion in 2023 to $3.68 billion by 2033. Stringent regulations in healthcare and safety standards support the demand for quality dispensing devices.Asia Pacific Dispensing Systems Market Report:

The Asia-Pacific region is poised for remarkable growth, expanding from $1.60 billion in 2023 to $3.05 billion by 2033. The growing population and rapid industrialization are key drivers, with countries like China and India leading in adoption of advanced dispensing technologies.North America Dispensing Systems Market Report:

North America currently leads the global market with a size of $2.58 billion in 2023, projected to reach $4.92 billion by 2033. Strong demand in healthcare and food sectors, alongside sustained technological advancements, drives this growth.South America Dispensing Systems Market Report:

In South America, the Dispensing Systems market is anticipated to grow from $0.44 billion in 2023 to $0.85 billion by 2033. Factors such as urbanization, increased healthcare spending, and infrastructure development are fostering growth in this region.Middle East & Africa Dispensing Systems Market Report:

The Middle East and Africa market will increase from $0.95 billion in 2023 to $1.81 billion by 2033, driven by the expansion of industries and investments in automation.Tell us your focus area and get a customized research report.

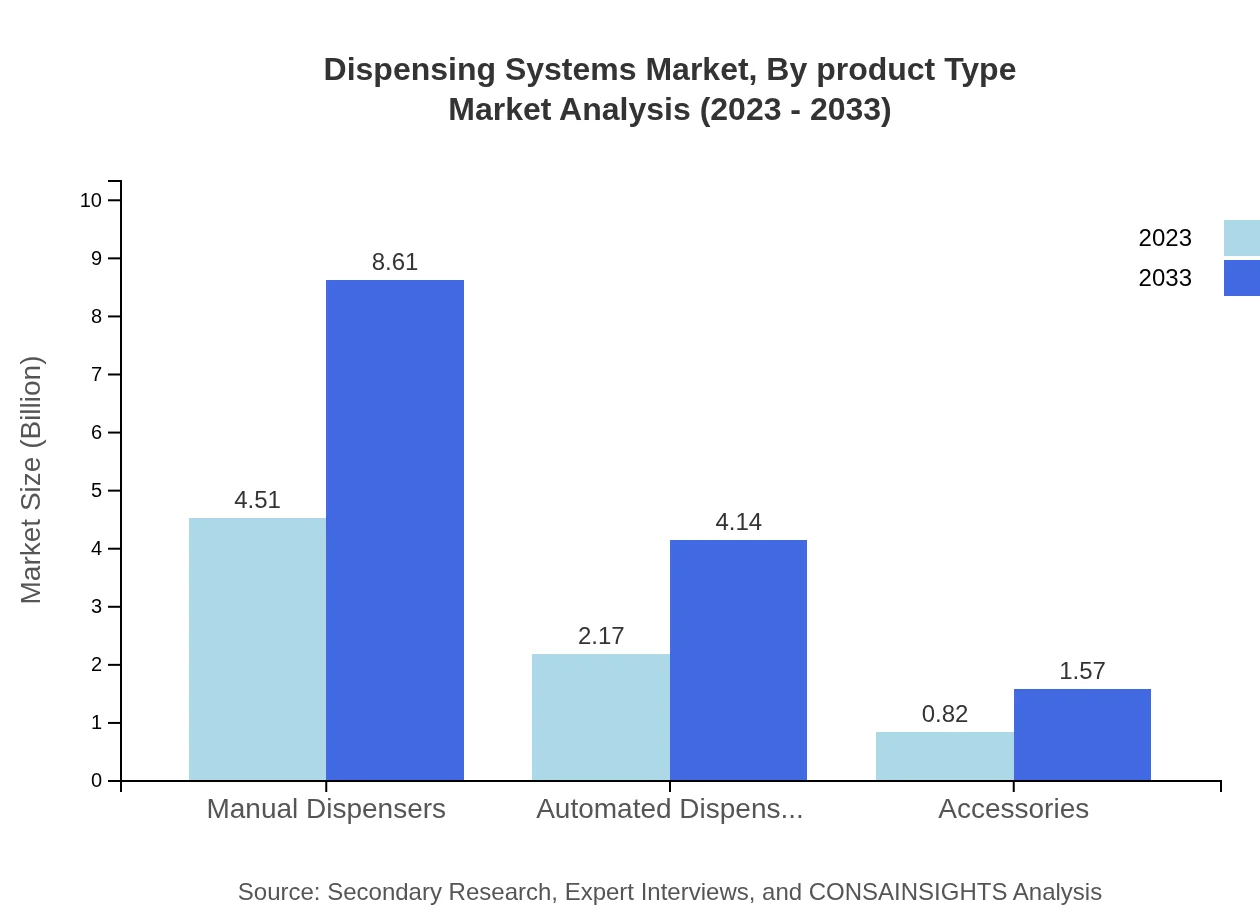

Dispensing Systems Market Analysis By Product Type

In 2023, Manual Dispensers dominate the market with a size of $4.51 billion, reflecting 60.14% market share, followed by Automated Dispensers at $2.17 billion with 28.90%. Accessories account for $0.82 billion. The trend towards automation is expected to boost the Automated Dispenser segment significantly, indicating a shift in user preferences towards efficiency and technology.

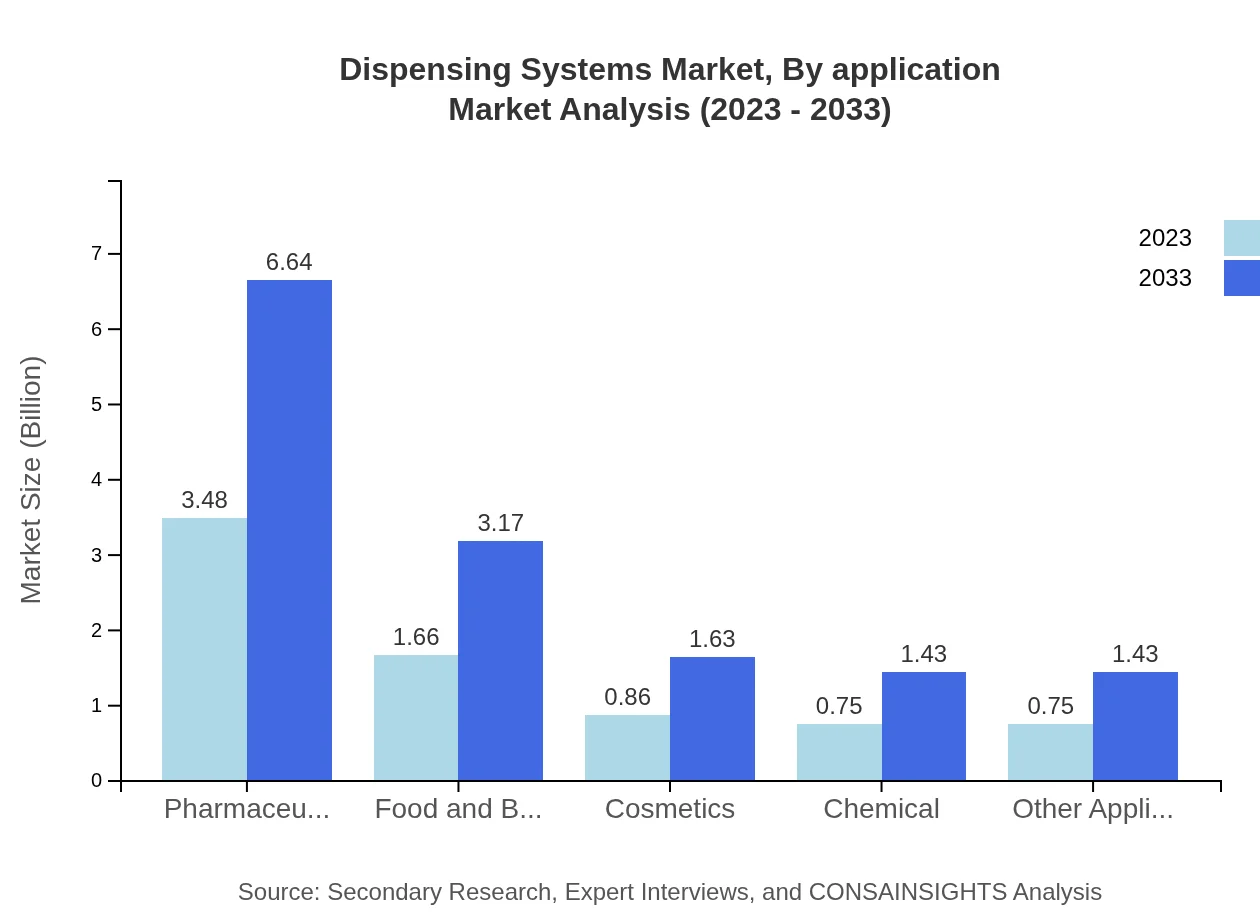

Dispensing Systems Market Analysis By Application

The Healthcare segment, valued at $3.48 billion in 2023, holds 46.37% of the market share, anticipated to rise to $6.64 billion in 2033. The Pharmaceuticals market mirrors this growth. Other vital applications include Food and Beverage, contributing $1.66 billion, and Retail at $0.86 billion, highlighting the broad relevance of dispensing technologies across industries.

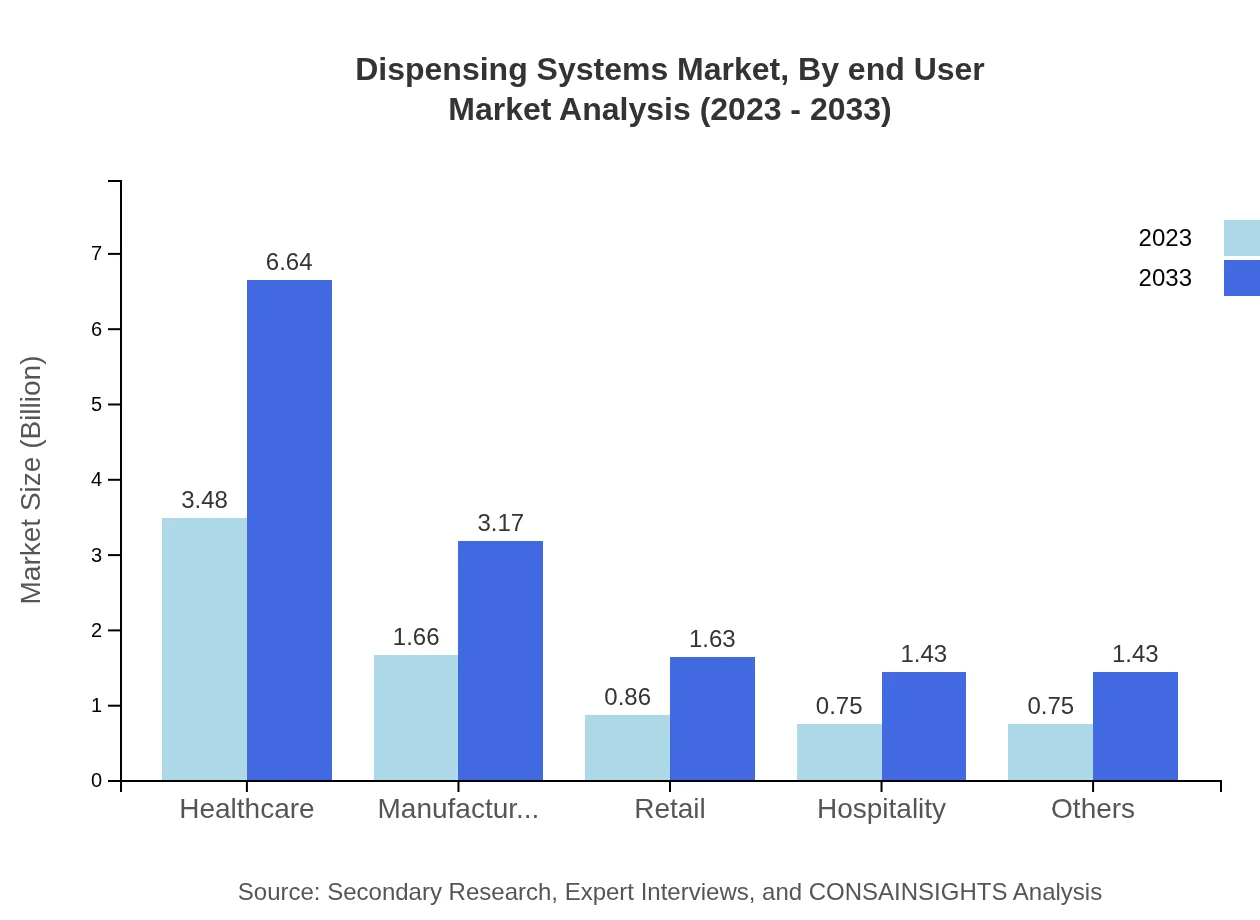

Dispensing Systems Market Analysis By End User

End-user industries such as healthcare and manufacturing represent significant portions of the market, along with growing interest in sectors such as food and pharmaceuticals. For instance, the healthcare segment has seen consistent demand due to increasing patient care standards and technological advancements.

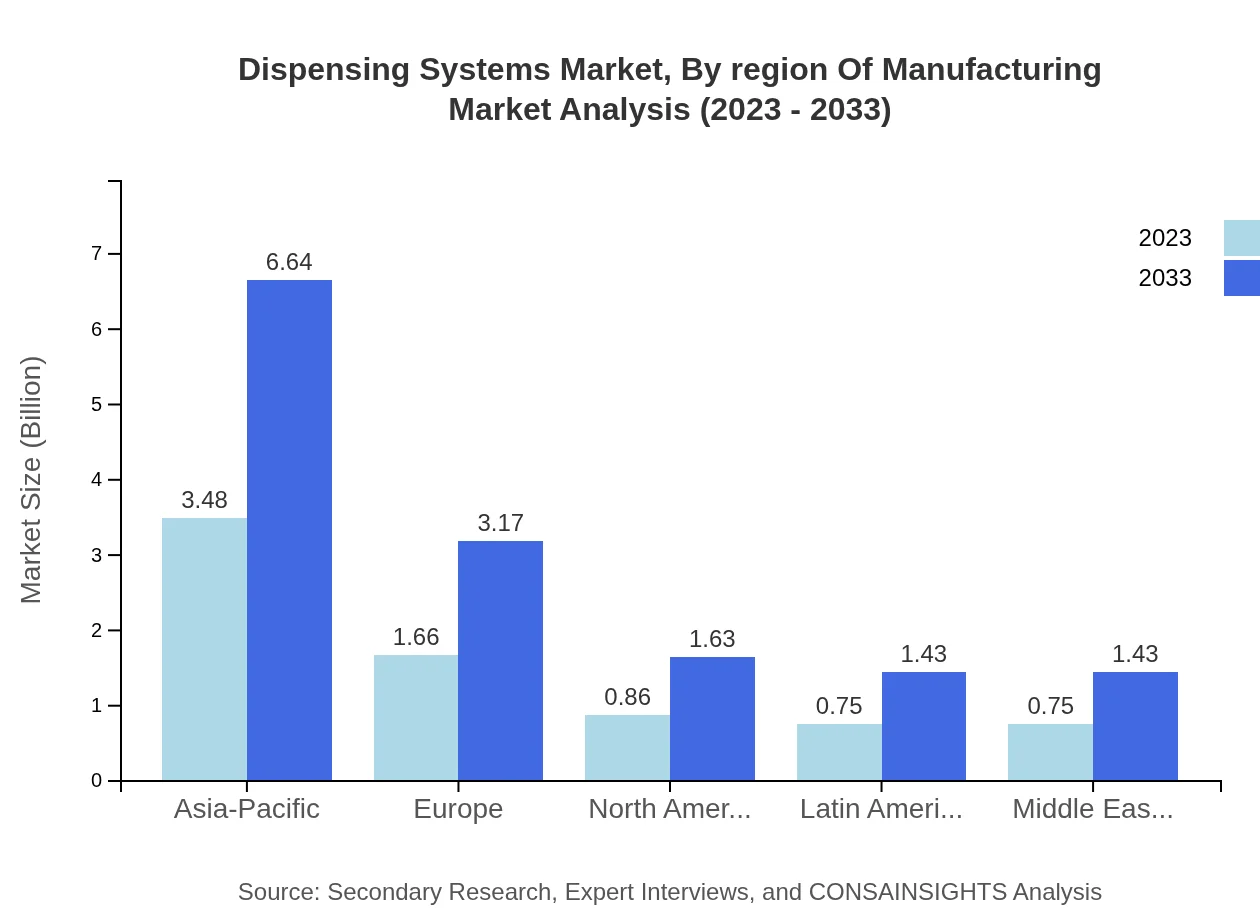

Dispensing Systems Market Analysis By Region Of Manufacturing

Manufacturing hubs in North America and Europe are pivotal for the Dispensing Systems market, offering advanced production capabilities. Emerging markets in Asia-Pacific show tremendous growth potential due to lower labor costs and increasing investment in technology.

Dispensing Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dispensing Systems Industry

Graco Inc.:

Graco Inc. is a leader in fluid handling systems and products, known for providing reliable dispensing solutions that cater to the industrial and commercial sectors.Nordson Corporation:

Nordson Corporation specializes in dispensing systems and technology, offering innovative solutions for manufacturing processes across diverse industries.Herma GmbH:

Herma GmbH is recognized for its precision dispensing technology, particularly in labels and packaging, enhancing efficiency and accuracy in the delivery process.Dynatect Manufacturing Inc.:

Dynatect focuses on manufacturing automatic dispensers that ensure protection and safe handling of various products in industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of dispensing systems?

As of 2023, the global dispensing systems market is valued at approximately $7.5 billion, forecasted to grow at a compound annual growth rate (CAGR) of 6.5% through to 2033.

What are the key market players or companies in the dispensing systems industry?

The dispensing systems market features prominent companies such as XYZ Corp, ABC Industries, and DEF Technologies, which lead in innovation and market share, providing a range of solutions across various sectors.

What are the primary factors driving the growth in the dispensing systems industry?

Key growth factors include advancements in technology, increasing demand for automation in various sectors, and rising consumer expectations for efficient, user-friendly dispensing solutions.

Which region is the fastest Growing in the dispensing systems?

The Asia-Pacific region is the fastest-growing in the dispensing systems market, anticipating a rise from $1.60 billion in 2023 to $3.05 billion by 2033, reflecting significant market expansion.

Does ConsaInsights provide customized market report data for the dispensing systems industry?

Yes, ConsaInsights offers tailored market report data for the dispensing systems industry, allowing businesses to receive insights specific to their needs and market conditions.

What deliverables can I expect from this dispensing systems market research project?

Expect comprehensive insights including market analysis, segmentation data, regional trends, competitive landscape, and forecasts, ensuring well-informed strategic decision-making.

What are the market trends of dispensing systems?

Current trends in the dispensing systems market include an increase in automated solutions, integration of IoT technologies, and a growing focus on sustainability within the industry.