Display Material Market Report

Published Date: 31 January 2026 | Report Code: display-material

Display Material Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Display Material market, providing valuable insights, market forecasts from 2023 to 2033, and comprehensive data on market trends, regional analyses, product performances, and key industry players.

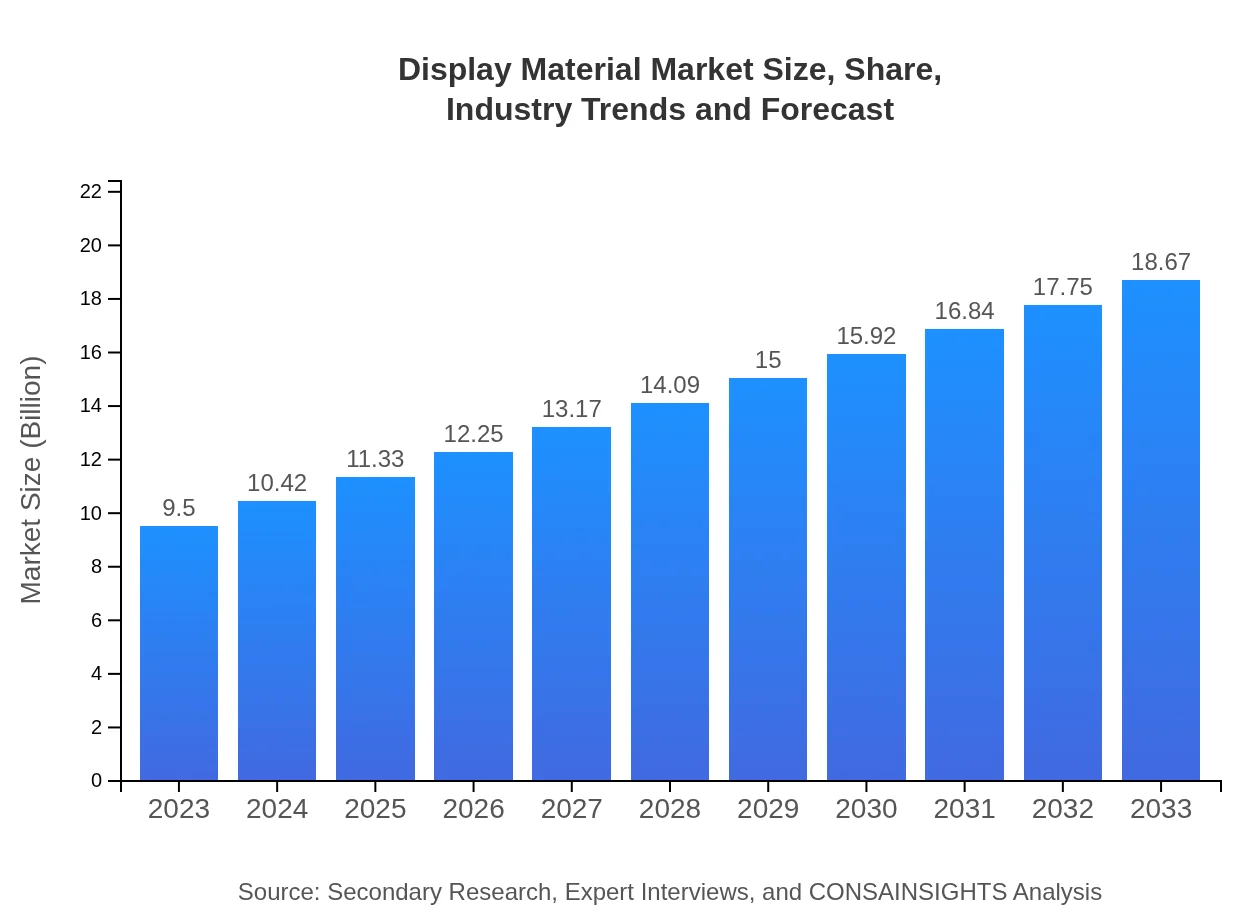

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $18.67 Billion |

| Top Companies | Samsung Display Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., Sharp Corporation |

| Last Modified Date | 31 January 2026 |

Display Material Market Overview

Customize Display Material Market Report market research report

- ✔ Get in-depth analysis of Display Material market size, growth, and forecasts.

- ✔ Understand Display Material's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Display Material

What is the Market Size & CAGR of Display Material market in 2023?

Display Material Industry Analysis

Display Material Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Display Material Market Analysis Report by Region

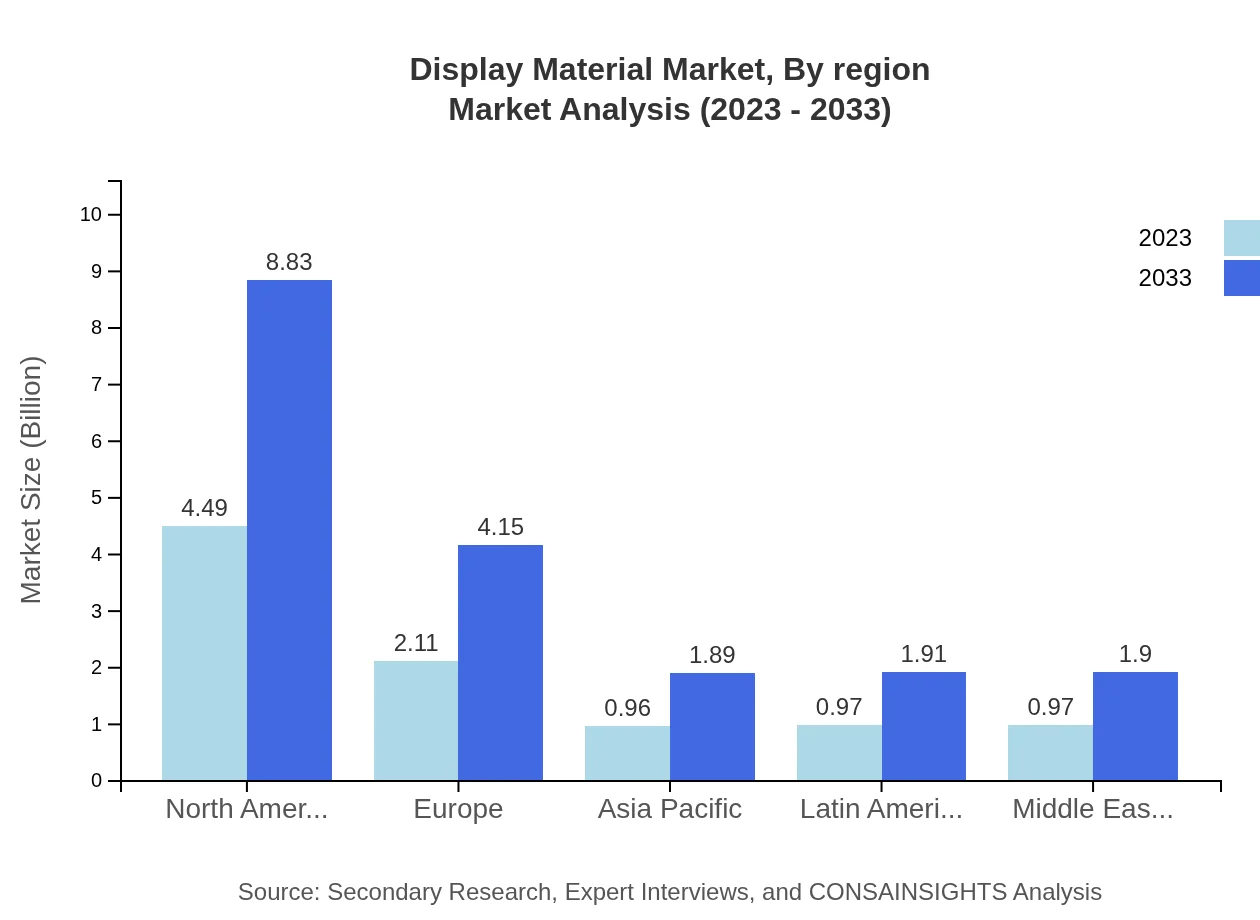

Europe Display Material Market Report:

Europe's market is projected to grow from $2.78 billion in 2023 to $5.47 billion by 2033. The region is supported by stringent energy efficiency regulations driving demand for advanced display materials, particularly in automotive and industrial applications.Asia Pacific Display Material Market Report:

The Asia-Pacific region is expected to show remarkable growth from $1.74 billion in 2023 to $3.42 billion by 2033. This growth is primarily driven by the rising demand for consumer electronics, particularly smartphones and televisions, and the presence of major manufacturers in countries like China, Japan, and South Korea, which are pivotal in technology innovation.North America Display Material Market Report:

North America is anticipated to lead the market, growing from $3.66 billion in 2023 to $7.20 billion in 2033. This region benefits from the high penetration of advanced display technologies and consumer electronics, stable economic conditions, and strong R&D investments in new materials and applications.South America Display Material Market Report:

In South America, the market shows a modest growth, projected to increase from $0.42 billion in 2023 to $0.83 billion in 2033. Key factors include rising disposable incomes and increasing adoption of display technologies in communications and advertising sectors, though growth will be slower compared to other regions.Middle East & Africa Display Material Market Report:

The Middle East and Africa region will witness growth from $0.89 billion in 2023 to $1.75 billion by 2033. This growth is supported by infrastructural developments and the increasing adoption of digital displays for communication and advertising purposes.Tell us your focus area and get a customized research report.

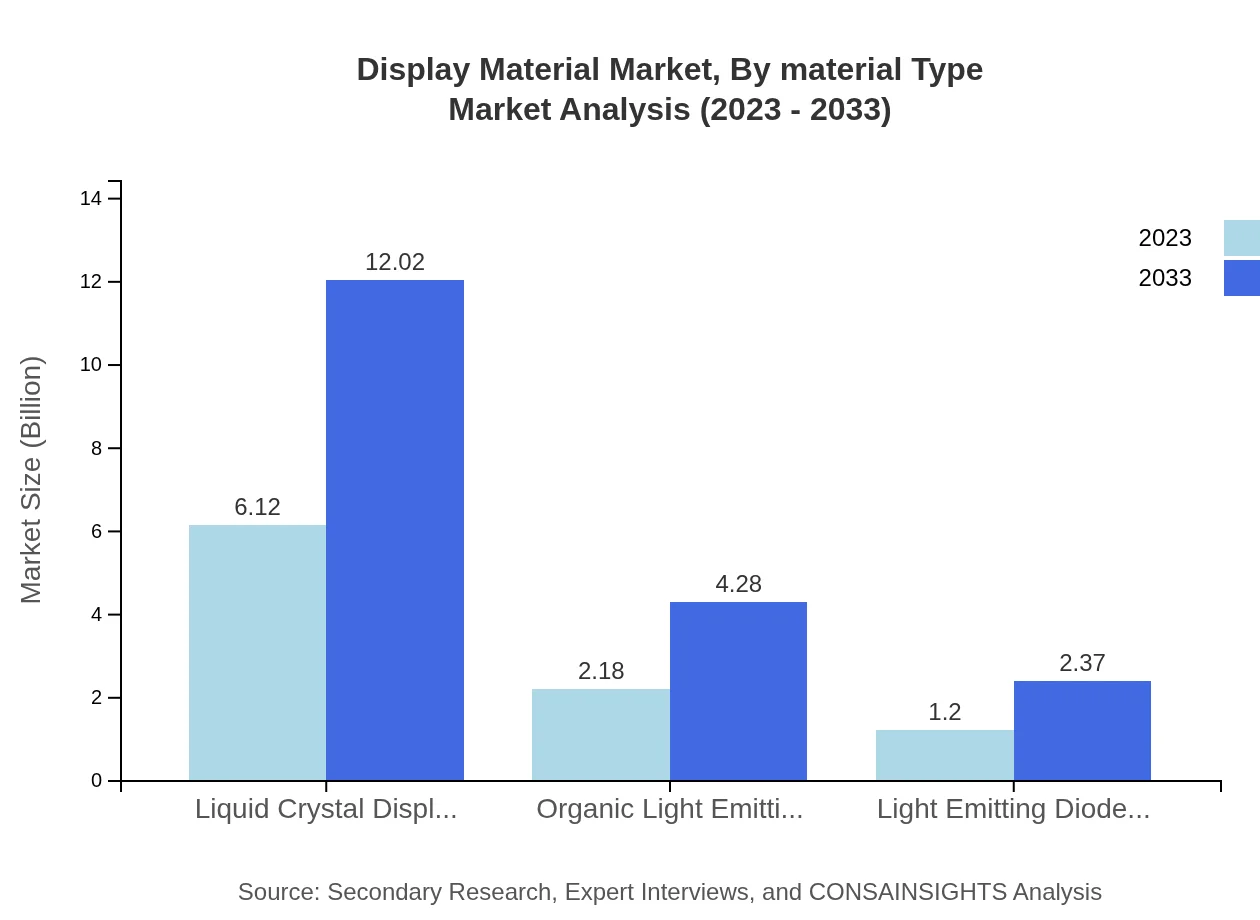

Display Material Market Analysis By Material Type

The Display Material market by material type encompasses segments such as LCD, OLED, LED, and E-Ink Technology. LCD technology holds a dominant market share due to its widespread use in televisions and computer monitors, while OLED is gaining traction for its superior display quality. LED technology is crucial for backlighting, enhancing energy efficiency, while E-Ink Technology is favored for its low energy consumption in e-readers, driving consistent demand in the publishing sector.

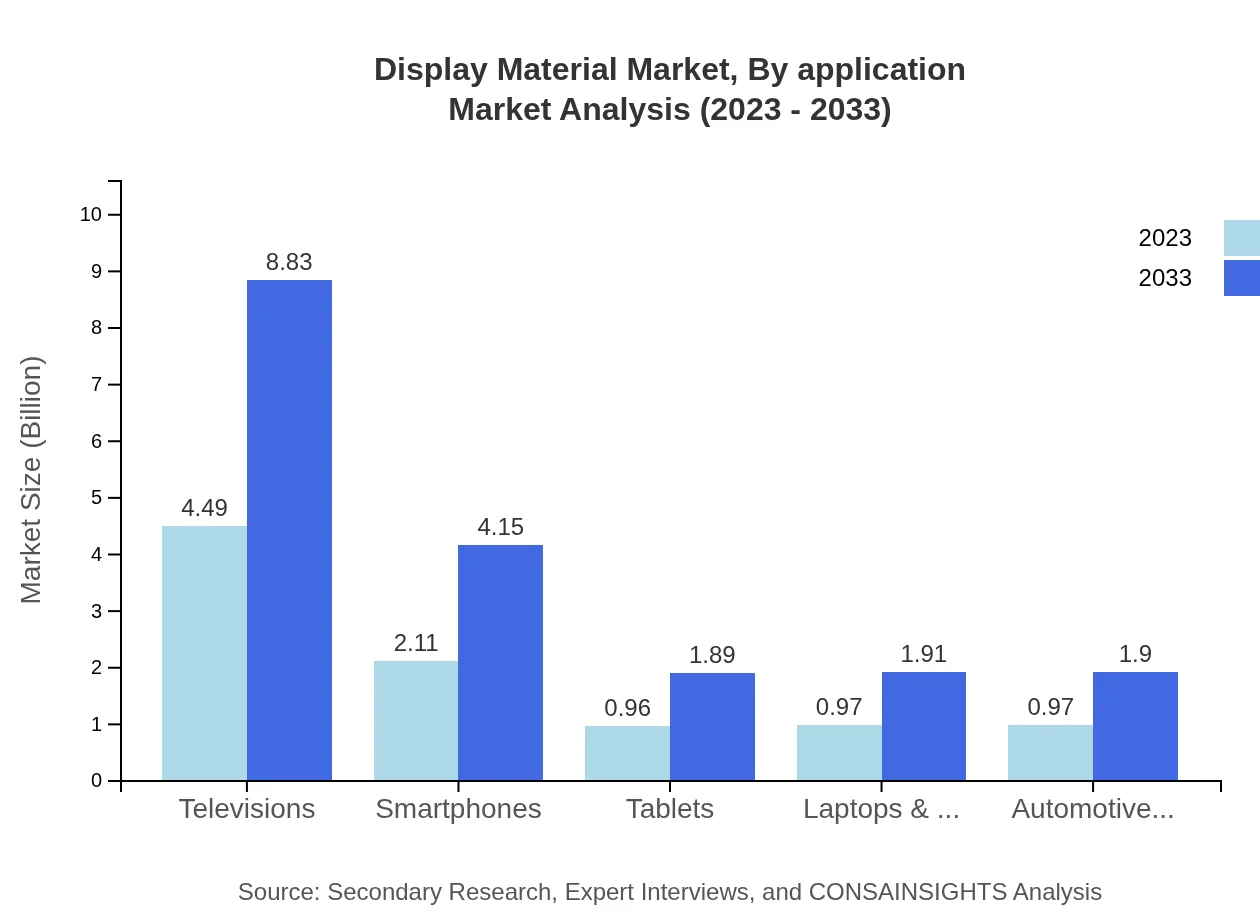

Display Material Market Analysis By Application

The applications of Display Materials span Consumer Electronics, Industrial, Automotive, Healthcare, and Education. Consumer Electronics remain the largest segment, capturing around 47.27% of the market share due to the high demand for televisions and smartphones. Industrial applications are on the rise as factories adopt advanced display solutions for operational efficiency, while the automotive sector is experiencing growth driven by in-car displays and infotainment systems.

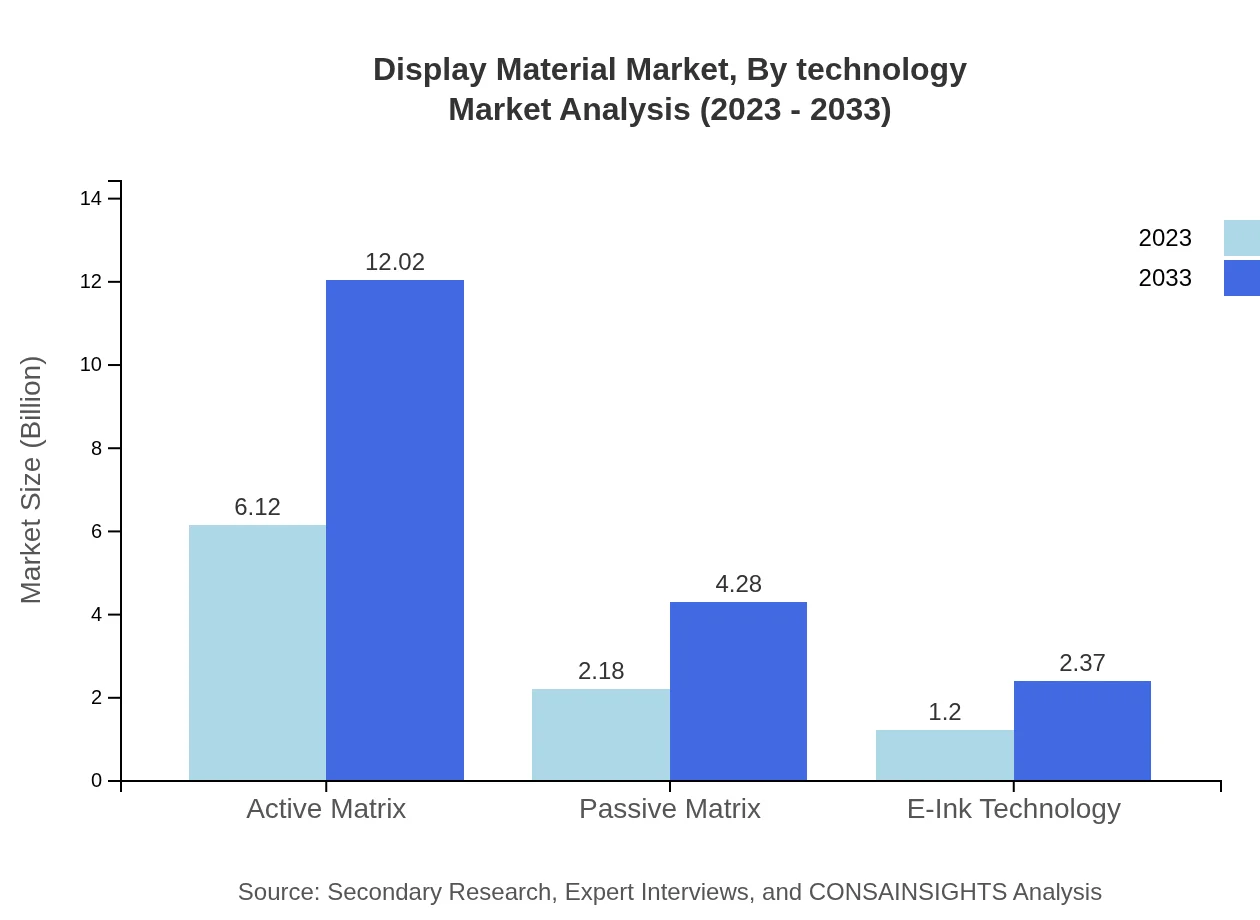

Display Material Market Analysis By Technology

By technology, the Display Material market is segmented into Active and Passive Matrix. Active Matrix technology dominates due to its efficiency and capability to drive high-resolution displays, particularly in smartphones and tablets. Passive Matrix is being gradually phased out but still holds relevance in specific applications where cost efficiency is prioritized.

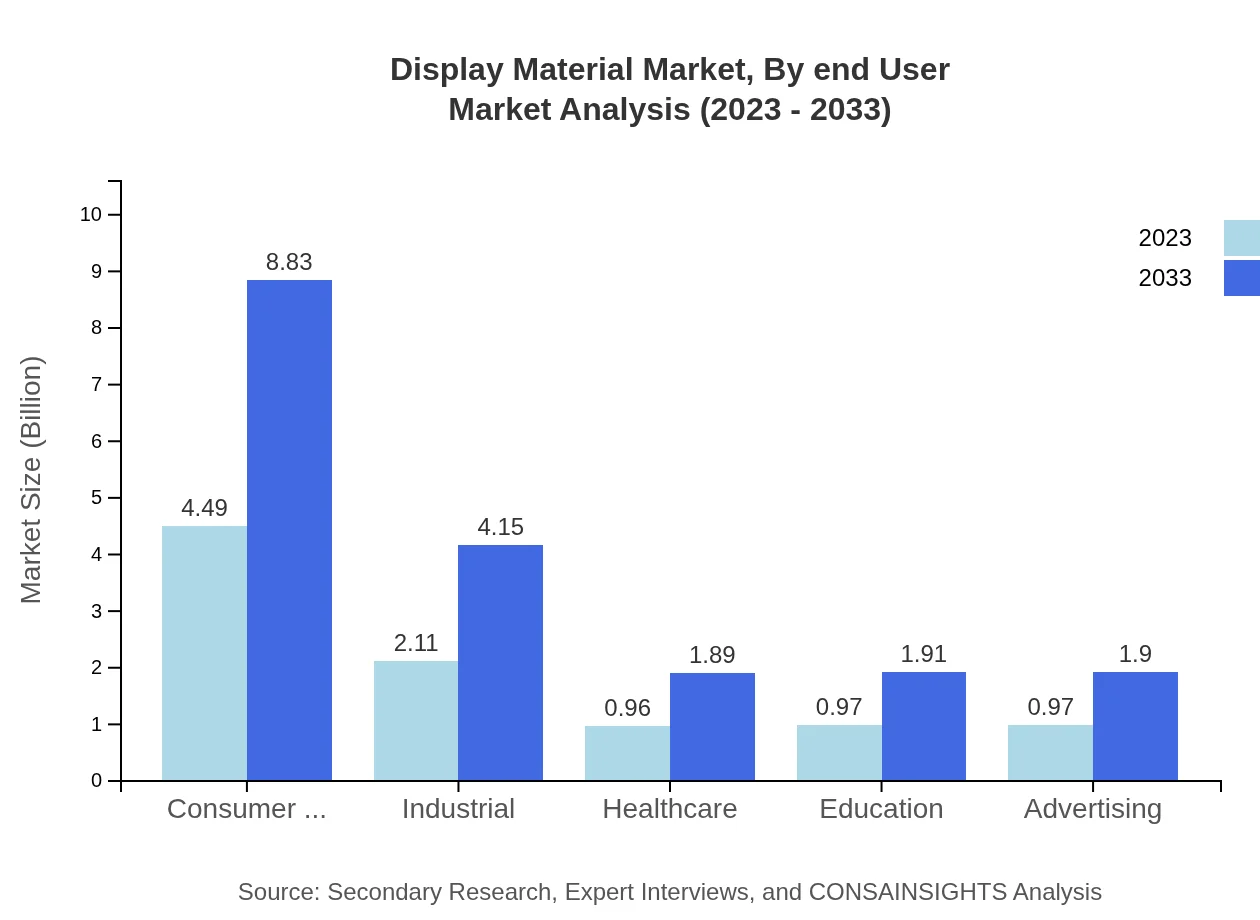

Display Material Market Analysis By End User

The Display Material market by end-user includes Consumer Electronics, Automotive, Healthcare, Education, and Advertising sectors. Consumer Electronics continues to lead, followed by automotive enhancements in display technologies. Education is increasingly adopting digital displays for interactive learning environments, and the advertising sector utilizes advanced displays to capture audience attention effectively.

Display Material Market Analysis By Region

The regional markets display diverse growth trends with North America and Europe spearheading technological advancements, while Asia-Pacific showcases substantial growth due to rapid consumer electronics adoption. South America and the Middle East & Africa are emerging markets where increased infrastructure investment is gradually scaling up demand for innovative display solutions.

Display Material Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Display Material Industry

Samsung Display Co., Ltd.:

A leader in display technologies, Samsung Display produces advanced OLED and LCD panels, driving innovation in the consumer electronics and mobile sectors.LG Display Co., Ltd.:

Renowned for its cutting-edge OLED technology, LG Display is a prominent player in the flat-panel display market, providing high-quality screens for TVs and mobile devices.BOE Technology Group Co., Ltd.:

A leading provider of display solutions, BOE Technology focuses on LCD and OLED products, catering to global demand across consumer and industrial applications.Sharp Corporation:

Sharp Corporation specializes in display technologies including LCDs and innovative display solutions for a range of industries including automotive and healthcare.We're grateful to work with incredible clients.

FAQs

What is the market size of display Material?

The global display material market is valued at approximately $9.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching substantial growth by 2033.

What are the key market players or companies in this display Material industry?

Key players in the display-material industry include major corporations like Samsung, LG Display, and Sharp, alongside technology providers such as Corning and 3M, which contribute significantly to market advancements.

What are the primary factors driving the growth in the display Material industry?

Key growth drivers for the display-material industry include increasing consumer demand for advanced display technologies, significant investments in research and development, and the rising penetration of display technologies in consumer electronics.

Which region is the fastest Growing in the display Material market?

The fastest-growing region in the display-material market is North America, expected to grow from $3.66 billion in 2023 to $7.20 billion by 2033, driven by robust consumer electronics demand and technological innovations.

Does ConsaInsights provide customized market report data for the display Material industry?

Yes, ConsaInsights specializes in providing customized market report data for the display-material industry, tailoring insights and analytics to meet specific client needs and market objectives.

What deliverables can I expect from this display Material market research project?

Clients can expect comprehensive deliverables including detailed market analysis, growth forecasts, regional insights, competitive landscape assessments, and tailored recommendations based on the latest market trends.

What are the market trends of display Material?

Key trends in the display-material market include the shift towards OLED and AMOLED technologies, advancements in flexible displays, and increased applications in automotive and industrial sectors for enhanced user interfaces.