Display Panel Market Report

Published Date: 31 January 2026 | Report Code: display-panel

Display Panel Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Display Panel market from 2023 to 2033, featuring insights on market size, growth forecasts, industry challenges, and regional dynamics, aimed at guiding stakeholders in strategic decision-making.

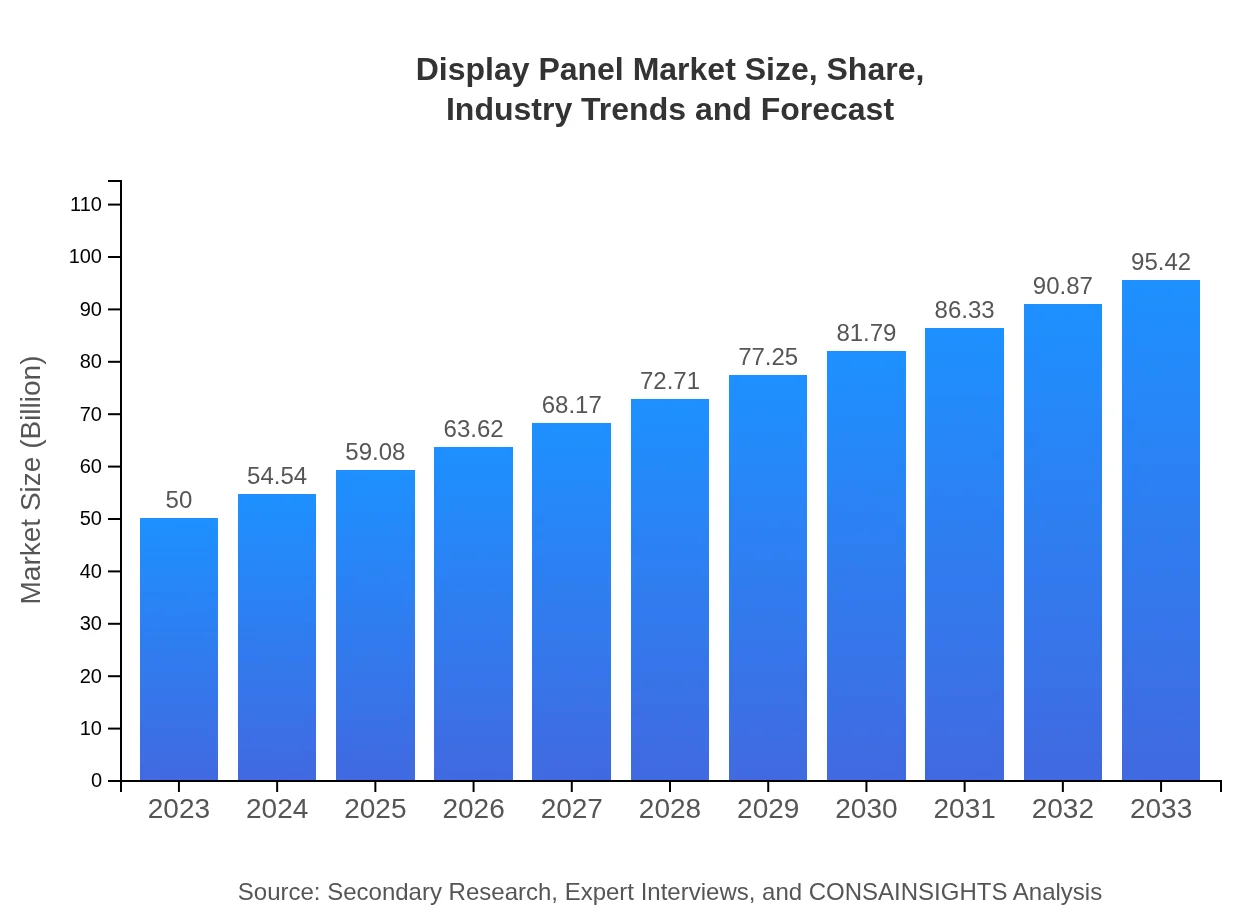

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $95.42 Billion |

| Top Companies | Samsung Electronics, LG Display, Sharp Corporation, BOE Technology Group |

| Last Modified Date | 31 January 2026 |

Display Panel Market Overview

Customize Display Panel Market Report market research report

- ✔ Get in-depth analysis of Display Panel market size, growth, and forecasts.

- ✔ Understand Display Panel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Display Panel

What is the Market Size & CAGR of Display Panel market in 2023 and 2033?

Display Panel Industry Analysis

Display Panel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Display Panel Market Analysis Report by Region

Europe Display Panel Market Report:

Europe's Display Panel market is valued at $12.61 billion in 2023 and is forecasted to reach $24.06 billion by 2033. Strong regulations on energy efficiency and a focus on sustainable solutions boost regional demand.Asia Pacific Display Panel Market Report:

The Asia Pacific region holds a significant share of the Display Panel market, valued at approximately $10.90 billion in 2023 and expected to reach $20.81 billion by 2033. The rapid industrialization and technological advancements in countries like China and Japan are key growth drivers.North America Display Panel Market Report:

North America stands out with the highest market size, estimated at $18.09 billion in 2023 and projected to grow to $34.53 billion by 2033. Investment in innovative technologies and high demand for advanced display solutions in consumer and commercial sectors support this growth.South America Display Panel Market Report:

In South America, the Display Panel market is emerging with a size of $4.79 billion in 2023, predicted to grow to $9.14 billion by 2033. The expansion of retail and mobile sectors contributes to increased demand for display technology.Middle East & Africa Display Panel Market Report:

The Middle East and Africa market is smaller, valued at $3.60 billion in 2023, with a growth prediction to $6.87 billion by 2033. The region's advancement in infrastructure and increased consumer spending are vital for growth.Tell us your focus area and get a customized research report.

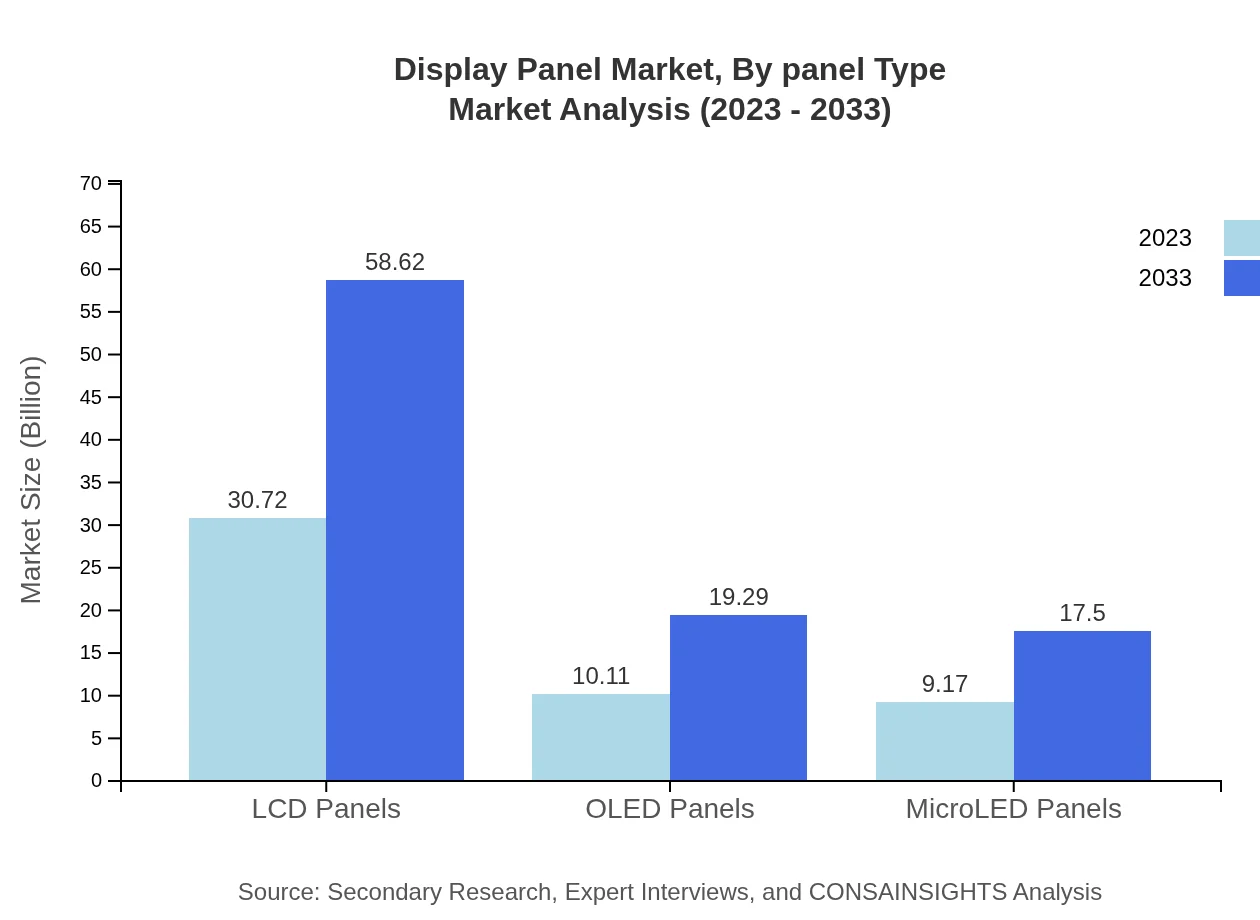

Display Panel Market Analysis By Panel Type

The Display Panel market is primarily categorized by panel type: LCD, OLED, and MicroLED. As of 2023, LCD panels dominate the market with a size of $30.72 billion, expected to rise to $58.62 billion by 2033. OLED panels, currently valued at $10.11 billion, will grow to $19.29 billion, reflecting increased adoption in premium devices. MicroLED panels, at $9.17 billion in 2023, are forecasted to hit $17.50 billion, driven by advanced applications.

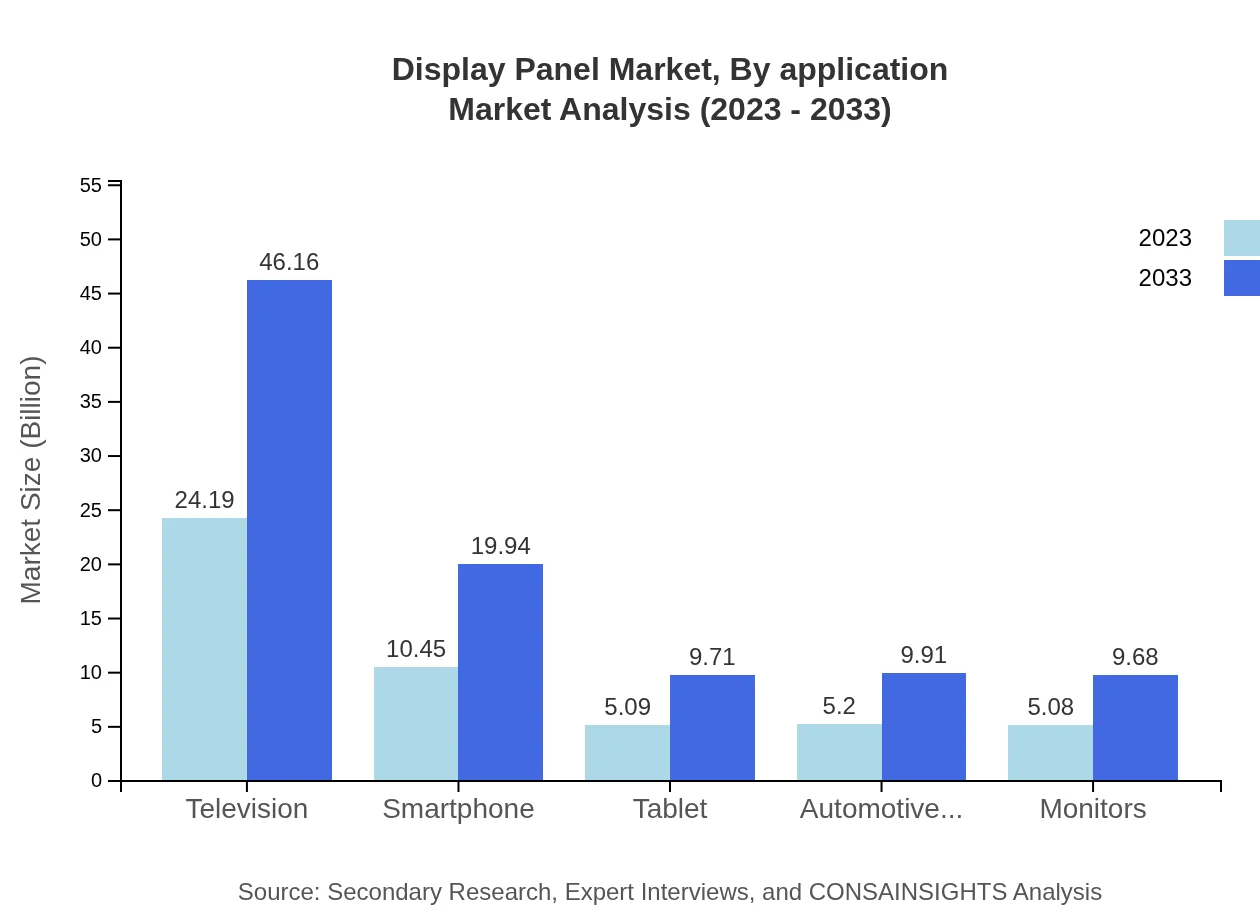

Display Panel Market Analysis By Application

The market segments by application mainly include consumer electronics, automotive displays, healthcare, education, and gaming. Consumer electronics, with an estimated market size of $24.19 billion in 2023, is expected to reach $46.16 billion by 2033. Automotive displays and healthcare applications are also anticipated to grow significantly, driven by technological advancements and rising demand for innovative solutions.

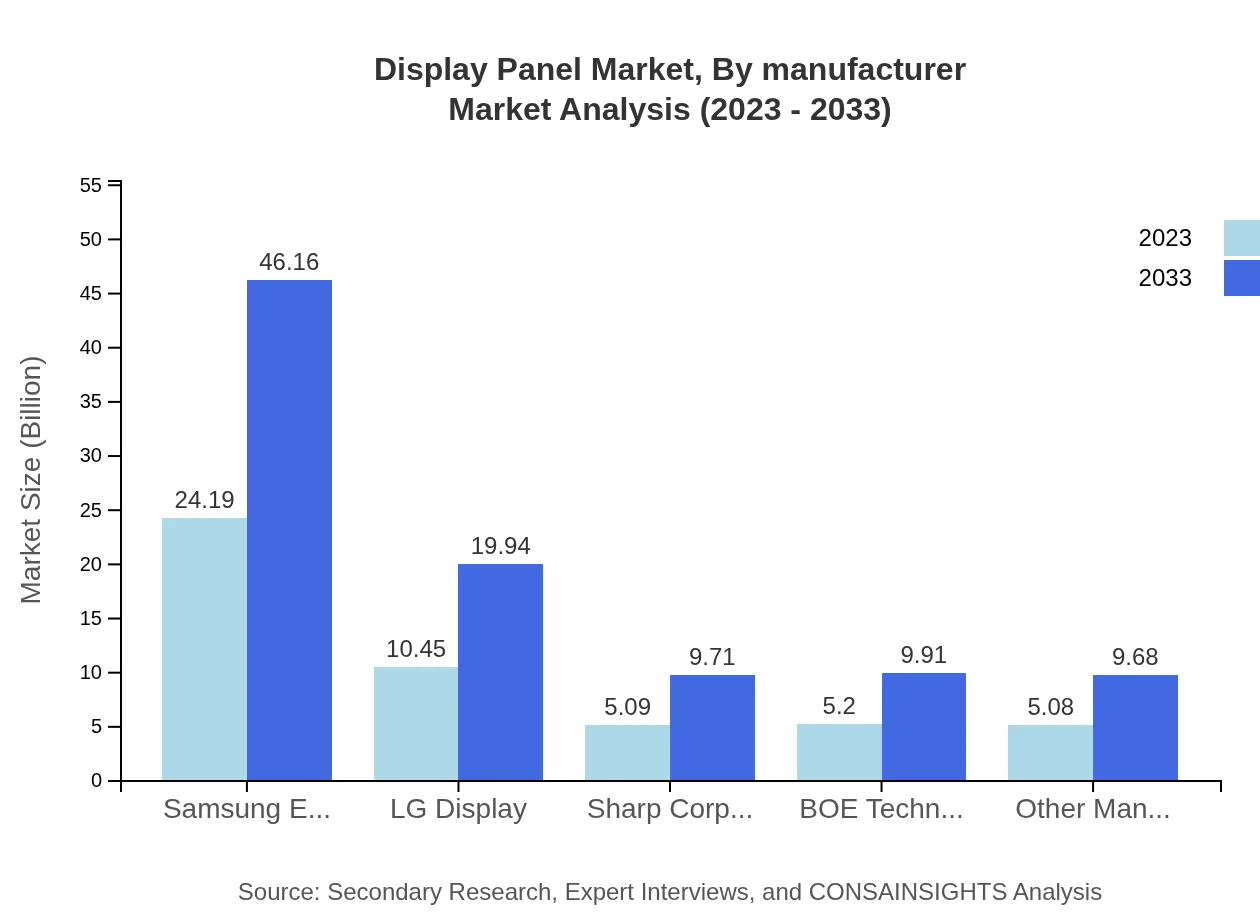

Display Panel Market Analysis By Manufacturer

In analyzing the market by manufacturer, key players include Samsung Electronics, LG Display, Sharp Corporation, and BOE Technology Group. Samsung Electronics leads with a market size of $24.19 billion in 2023, maintaining a 48.38% market share. Similarly, LG Display captures significant segments, reflecting strong brand presence and technological innovation.

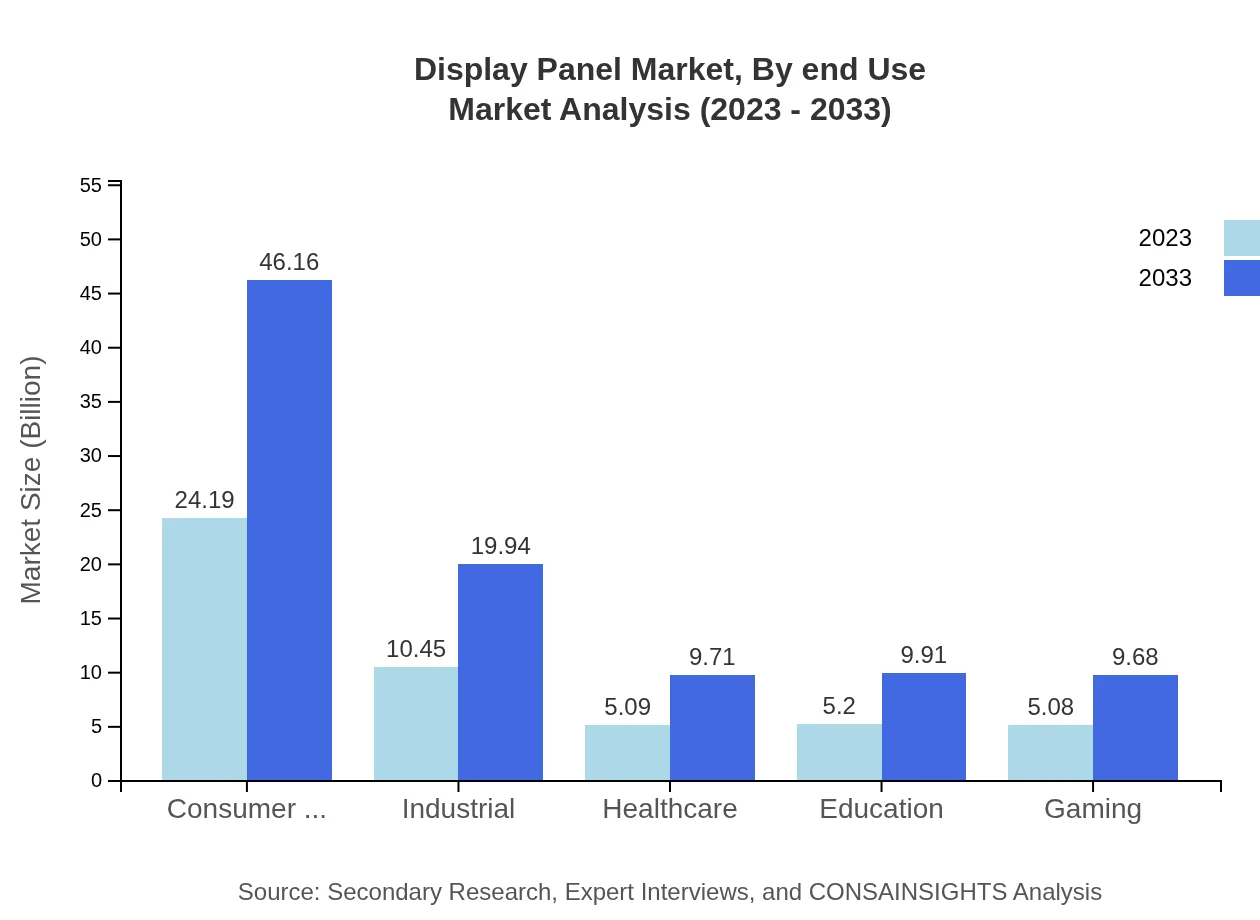

Display Panel Market Analysis By End Use

End-use segments comprise consumer electronics, industrial applications, healthcare, and education. Consumer electronics continue to dominate with a projected market size growth from $24.19 billion in 2023 to $46.16 billion by 2033. Healthcare applications are also on the rise, focusing on advanced imaging techniques and patient monitoring solutions.

Display Panel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Display Panel Industry

Samsung Electronics:

A leading global conglomerate specializing in electronics, highly renowned for its role in the development and manufacturing of advanced display technologies, notably in OLED and QLED panels.LG Display:

A major player in the manufacture of LCD and OLED panels, well-regarded for innovation and technological advancement in display quality and efficiency.Sharp Corporation:

Known for high-quality LCD technologies, Sharp Corporation excels in the production of displays for consumer electronics and industrial applications.BOE Technology Group:

A Chinese multinational manufacturer dedicated to display technologies, recognized for its advancements in LCD, OLED, and flexible display panels.We're grateful to work with incredible clients.

FAQs

What is the market size of display Panel?

The global display panel market size is projected to reach $50 billion by 2033, with a CAGR of 6.5% from 2023. The growth reflects increased demand in various sectors such as consumer electronics, healthcare, and education.

What are the key market players or companies in this display Panel industry?

Key players in the display panel industry include renowned companies like Samsung Electronics, LG Display, Sharp Corporation, and BOE Technology Group. These companies dominate the market by offering innovative and high-quality display technologies across various applications.

What are the primary factors driving the growth in the display Panel industry?

Growth in the display panel industry is driven by rising consumer demand for high-definition displays, advancements in display technologies (such as OLED and MicroLED), and the proliferation of smart devices across various sectors, particularly consumer electronics and automotive.

Which region is the fastest Growing in the display Panel?

Asia Pacific is the fastest-growing region in the display panel market, projected to grow from $10.90 billion in 2023 to $20.81 billion by 2033. This growth is attributed to increased manufacturing facilities and demand from the electronics sector.

Does ConsaInsights provide customized market report data for the display Panel industry?

Yes, ConsaInsights offers customized market report data for the display panel industry. Clients can request tailor-made reports that suit their specific business needs by focusing on niche markets or regional data insights.

What deliverables can I expect from this display Panel market research project?

Deliverables from the display panel market research project include comprehensive market analysis, segmented data, regional insights, competitive landscape assessments, and actionable business strategies to facilitate informed decision-making.

What are the market trends of display Panel?

Current market trends in the display panel industry include the shift towards larger, high-resolution displays, increased adoption of OLED technology, and growing interest in sustainable production methods. These trends reflect consumer preferences for improved visual experiences.