Disposable Medical Device Sensors Market Report

Published Date: 31 January 2026 | Report Code: disposable-medical-device-sensors

Disposable Medical Device Sensors Market Size, Share, Industry Trends and Forecast to 2033

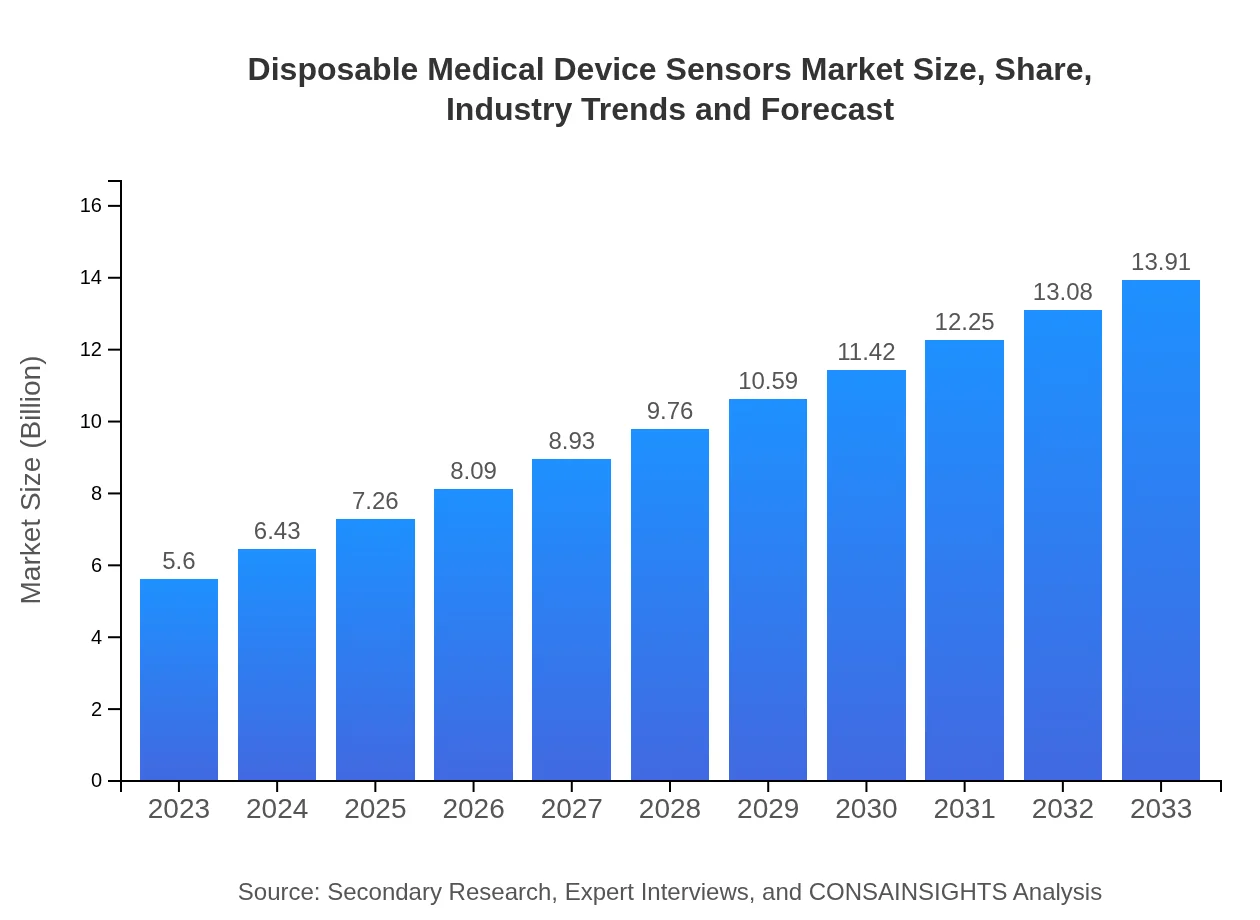

This report provides a comprehensive analysis of the Disposable Medical Device Sensors market, detailing current trends, market size, and future forecasts from 2023 to 2033. Insights into industry dynamics, regional performance, and key players are also included.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Medtronic , Philips Healthcare, Siemens Healthineers, Johnson & Johnson, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Disposable Medical Device Sensors Market Overview

Customize Disposable Medical Device Sensors Market Report market research report

- ✔ Get in-depth analysis of Disposable Medical Device Sensors market size, growth, and forecasts.

- ✔ Understand Disposable Medical Device Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Disposable Medical Device Sensors

What is the Market Size & CAGR of Disposable Medical Device Sensors market in 2023?

Disposable Medical Device Sensors Industry Analysis

Disposable Medical Device Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Disposable Medical Device Sensors Market Analysis Report by Region

Europe Disposable Medical Device Sensors Market Report:

The European market is expected to grow from $1.91 billion in 2023 to $4.74 billion by 2033. The market is supported by stringent regulations regarding healthcare quality and safety standards, which lead to higher demand for disposable sensors in hospitals and clinics.Asia Pacific Disposable Medical Device Sensors Market Report:

In the Asia Pacific region, the Disposable Medical Device Sensors market is expected to grow from $1.05 billion in 2023 to $2.61 billion by 2033. Increased healthcare spending and rising patient awareness are significant drivers of growth in countries like China and India. Moreover, the adoption of new technologies in healthcare settings supports market expansion.North America Disposable Medical Device Sensors Market Report:

North America is projected to grow from $1.81 billion in 2023 to $4.51 billion by 2033. The region is seen as the leader in disposable medical device sensors due to high healthcare spending, advanced technology adoption, and a growing emphasis on preventive healthcare practices driven by an aging population.South America Disposable Medical Device Sensors Market Report:

In South America, the market is anticipated to grow from $0.55 billion in 2023 to $1.36 billion in 2033. Economic improvements and investments in healthcare infrastructure are pushing the demand for advanced medical devices including disposable sensors, supported by government health initiatives aiming to expand access to healthcare.Middle East & Africa Disposable Medical Device Sensors Market Report:

The Middle East and Africa market will grow from $0.28 billion in 2023 to $0.70 billion by 2033. The increase in disposable income and the presence of several government healthcare initiatives to improve healthcare infrastructure is aiding in the gradual growth of the market in this region.Tell us your focus area and get a customized research report.

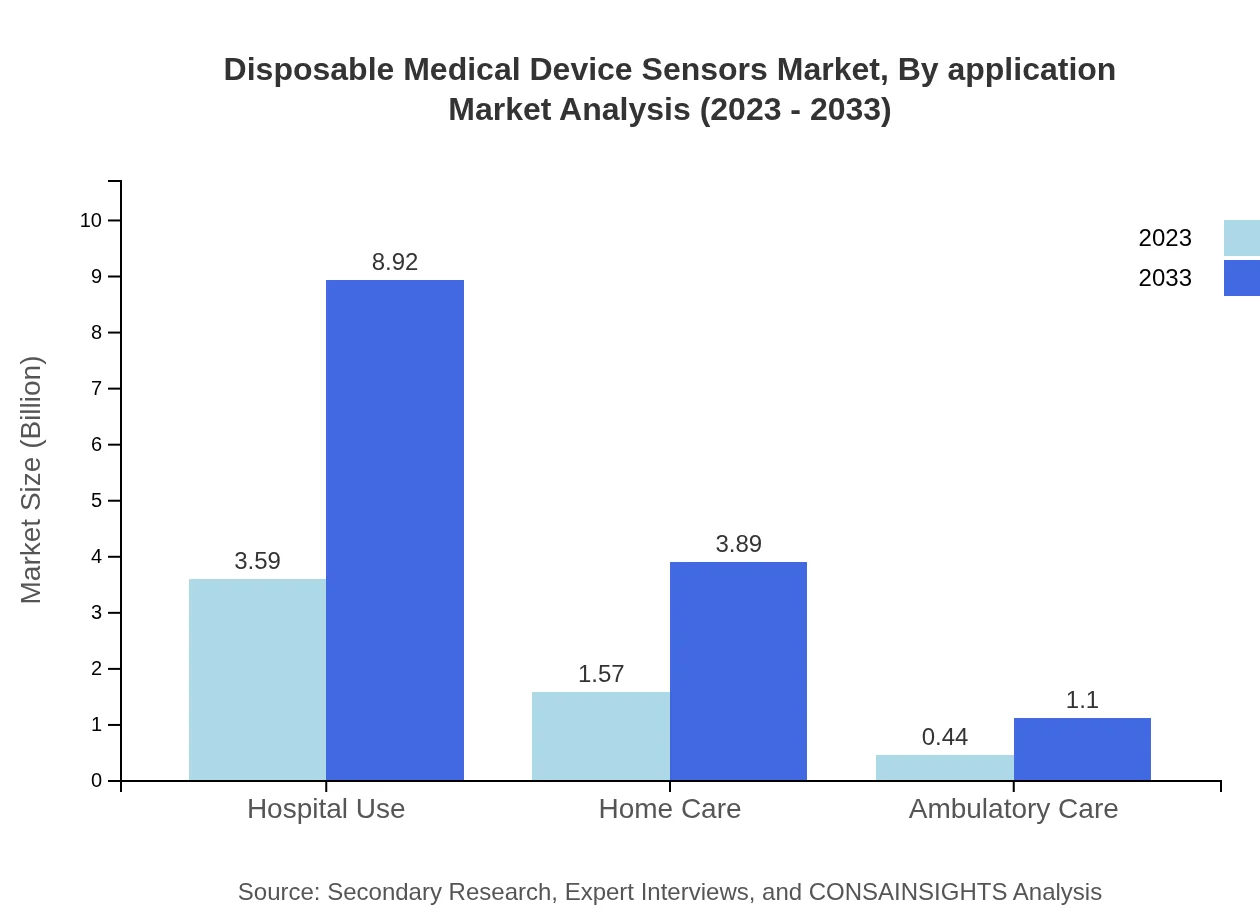

Disposable Medical Device Sensors Market Analysis By Application

The analysis of this segment demonstrates that hospitals lead the market, holding a significant share of 47.02% in 2023. The market value for hospitals is expected to rise from $2.63 billion in 2023 to $6.54 billion by 2033. Clinics follow, expected to grow from $1.25 billion to $3.11 billion, maintaining a 22.37% share. Home healthcare and diagnostic laboratories represent essential growth areas as the demand for convenience and accessibility increases, each projected to account for around 10% of the market share by 2033.

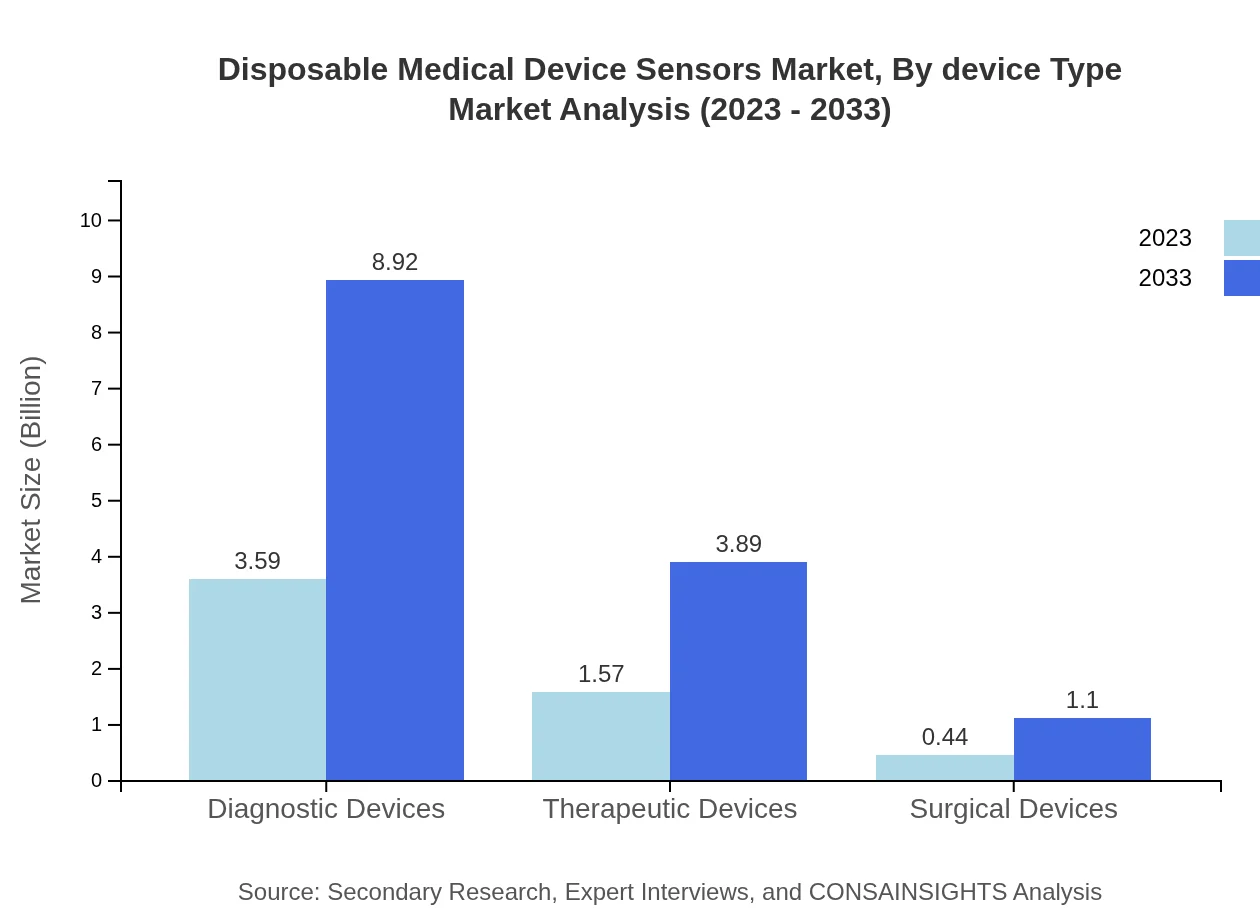

Disposable Medical Device Sensors Market Analysis By Device Type

The market, by device type, highlights microelectronic sensors as the most substantial segment. This category is expected to grow from $3.59 billion (64.09% market share) in 2023 to $8.92 billion by 2033. Optical sensors follow, starting at $1.57 billion (27.98% share) in 2023 and expanding to $3.89 billion. New developments in biosensors, although a smaller market currently at $0.44 billion (7.93% share) in 2023, are also anticipated to grow to $1.10 billion, driven by innovations in personalized medicine.

Disposable Medical Device Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Disposable Medical Device Sensors Industry

Medtronic :

A pioneer in medical technology, Medtronic offers a variety of disposable sensors for both diagnostics and monitoring applications, significantly improving patient safety and outcomes.Philips Healthcare:

Philips specializes in ICU and monitoring devices, incorporating innovative disposable sensors to enhance patient monitoring experiences across various healthcare settings.Siemens Healthineers:

Siemens provides advanced sensing technologies and solutions that enable efficient monitoring and diagnostics across healthcare facilities worldwide, focusing on integration and innovation.Johnson & Johnson:

Known for its consumer health products, J&J also explores disposable sensor technology improving medical device safety and functionality in acute care settings.GE Healthcare:

With a wide range of health technologies, GE Healthcare develops effective disposable sensors that play a crucial role in their imaging and monitoring devices enhancing patient safety.We're grateful to work with incredible clients.

FAQs

What is the market size of disposable Medical Device Sensors?

The global Disposable Medical Device Sensors market is projected to grow from $5.6 billion in 2023 to a size of approximately $13.38 billion by 2033, with a robust CAGR of 9.2%. This significant growth reflects increasing healthcare demands.

What are the key market players or companies in the disposable Medical Device Sensors industry?

Key players in the Disposable Medical Device Sensors market include major companies such as Medtronic, GE Healthcare, Philips, and Siemens. These companies lead through innovation and advanced technology in sensor integration within medical devices.

What are the primary factors driving the growth in the disposable Medical Device Sensors industry?

Growth drivers for the Disposable Medical Device Sensors industry include technological advancements, rising healthcare awareness, increased demand for home healthcare devices, and growing incidences of chronic diseases requiring continuous monitoring through sensors.

Which region is the fastest Growing in the disposable Medical Device Sensors?

The fastest-growing region for Disposable Medical Device Sensors is Europe, with the market expanding from $1.91 billion in 2023 to $4.74 billion by 2033. The rise is attributed to technological advancements and an aging population requiring health monitoring.

Does ConsaInsights provide customized market report data for the disposable Medical Device Sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Disposable Medical Device Sensors industry. Clients can receive detailed insights covering various segments, trends, and forecasts to help with strategic decisions.

What deliverables can I expect from this disposable Medical Device Sensors market research project?

From the Disposable Medical Device Sensors market research project, expect comprehensive reports including market size analysis, growth forecasts, segmentation data, competitive landscape evaluations, and strategic recommendations for market entry or expansion.

What are the market trends of disposable Medical Device Sensors?

Key trends in the Disposable Medical Device Sensors market include increased adoption of telemedicine, integration of IoT technology in healthcare, the rise of home monitoring solutions, and a focus on sustainability in device manufacturing.