Distributed Antenna System Market Report

Published Date: 31 January 2026 | Report Code: distributed-antenna-system

Distributed Antenna System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Distributed Antenna System (DAS) market from 2023 to 2033, including market size, growth trends, segmentation, regional insights, and technology advancements impacting the industry.

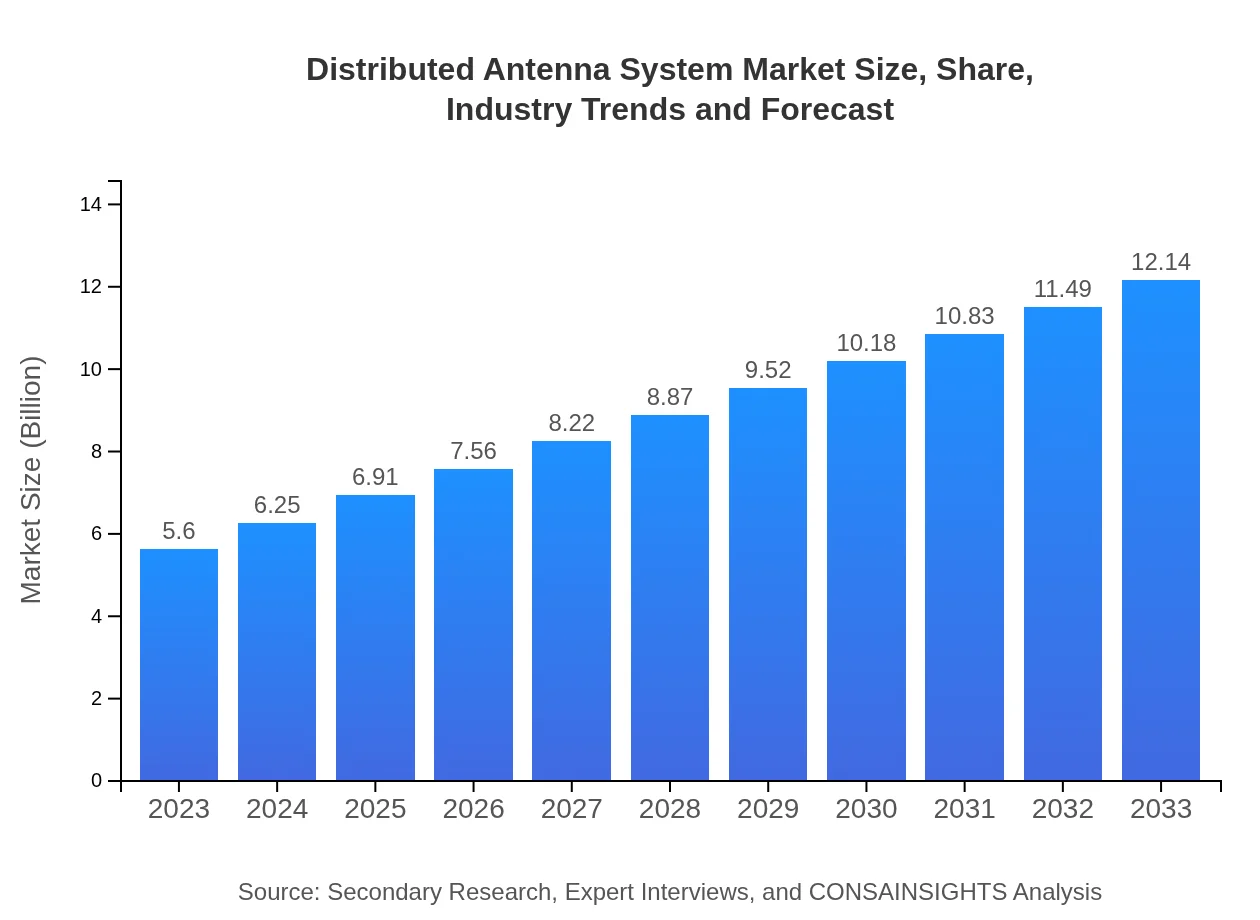

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | Corning Incorporated, CommScope, Dali Wireless, SOLiD, American Tower |

| Last Modified Date | 31 January 2026 |

Distributed Antenna System Market Overview

Customize Distributed Antenna System Market Report market research report

- ✔ Get in-depth analysis of Distributed Antenna System market size, growth, and forecasts.

- ✔ Understand Distributed Antenna System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Distributed Antenna System

What is the Market Size & CAGR of Distributed Antenna System market in 2023?

Distributed Antenna System Industry Analysis

Distributed Antenna System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Distributed Antenna System Market Analysis Report by Region

Europe Distributed Antenna System Market Report:

In Europe, the market size is forecasted at USD 1.65 billion for 2023, projected to rise to USD 3.57 billion by 2033, driven by increasing demand for enhanced network solutions in densely populated areas and commercial spaces.Asia Pacific Distributed Antenna System Market Report:

The Asia Pacific region, with an estimated market size of USD 1.19 billion in 2023, is projected to reach USD 2.57 billion by 2033. The growth is driven by increasing mobile adoption, infrastructure upgrades, and government investments in smart city initiatives.North America Distributed Antenna System Market Report:

North America is leading the market with a valuation of USD 1.85 billion in 2023, expected to grow to USD 4.00 billion by 2033. The rapid deployment of 5G technology and the need for improved network reliability in both urban and rural settings present strong growth opportunities.South America Distributed Antenna System Market Report:

The South American market is relatively smaller, forecasted at USD 0.16 billion in 2023, growing to USD 0.34 billion by 2033. The demand for enhanced connectivity in urban regions and growing investments in telecommunications are key growth drivers.Middle East & Africa Distributed Antenna System Market Report:

The Middle East and Africa market, with a size of USD 0.77 billion in 2023, is expected to expand to USD 1.66 billion by 2033, mainly due to infrastructure development projects and increasing mobile usage across the region.Tell us your focus area and get a customized research report.

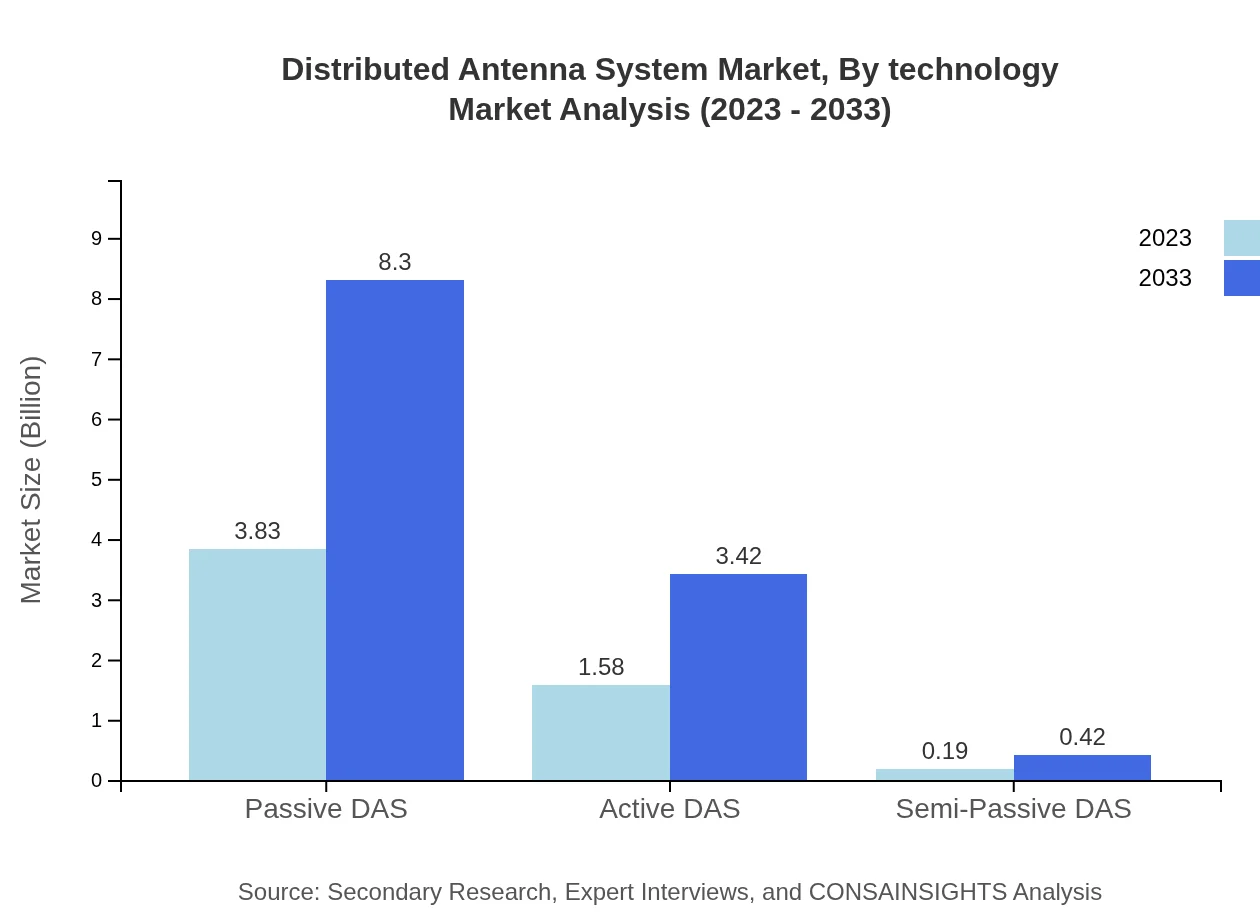

Distributed Antenna System Market Analysis By Technology

The market by technology is significant, with Passive DAS contributing majorly with a market size of USD 3.83 billion projected to USD 8.30 billion by 2033, holding 68.38% share. Active DAS, on the other hand, has shown growth from USD 1.58 billion to 3.42 billion, gaining 28.19% share, indicating a trend towards more flexible and efficient network solutions.

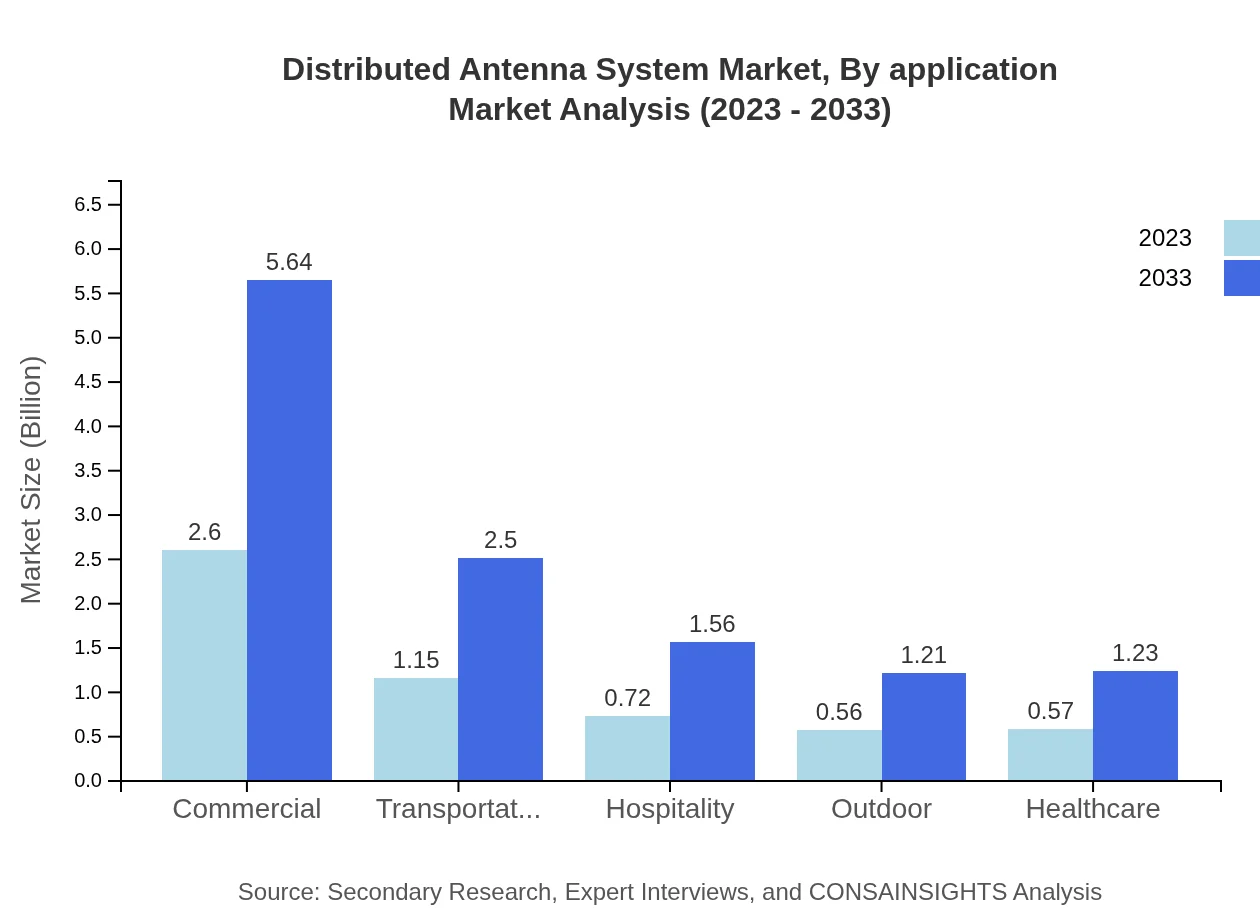

Distributed Antenna System Market Analysis By Application

Key applications include IT and Telecom which constitutes a large portion of the market with a size of USD 2.60 billion in 2023 and expected to reach USD 5.64 billion by 2033. Other significant segments include transportation, healthcare, hospitality, and education, reflecting varied adoption across sectors.

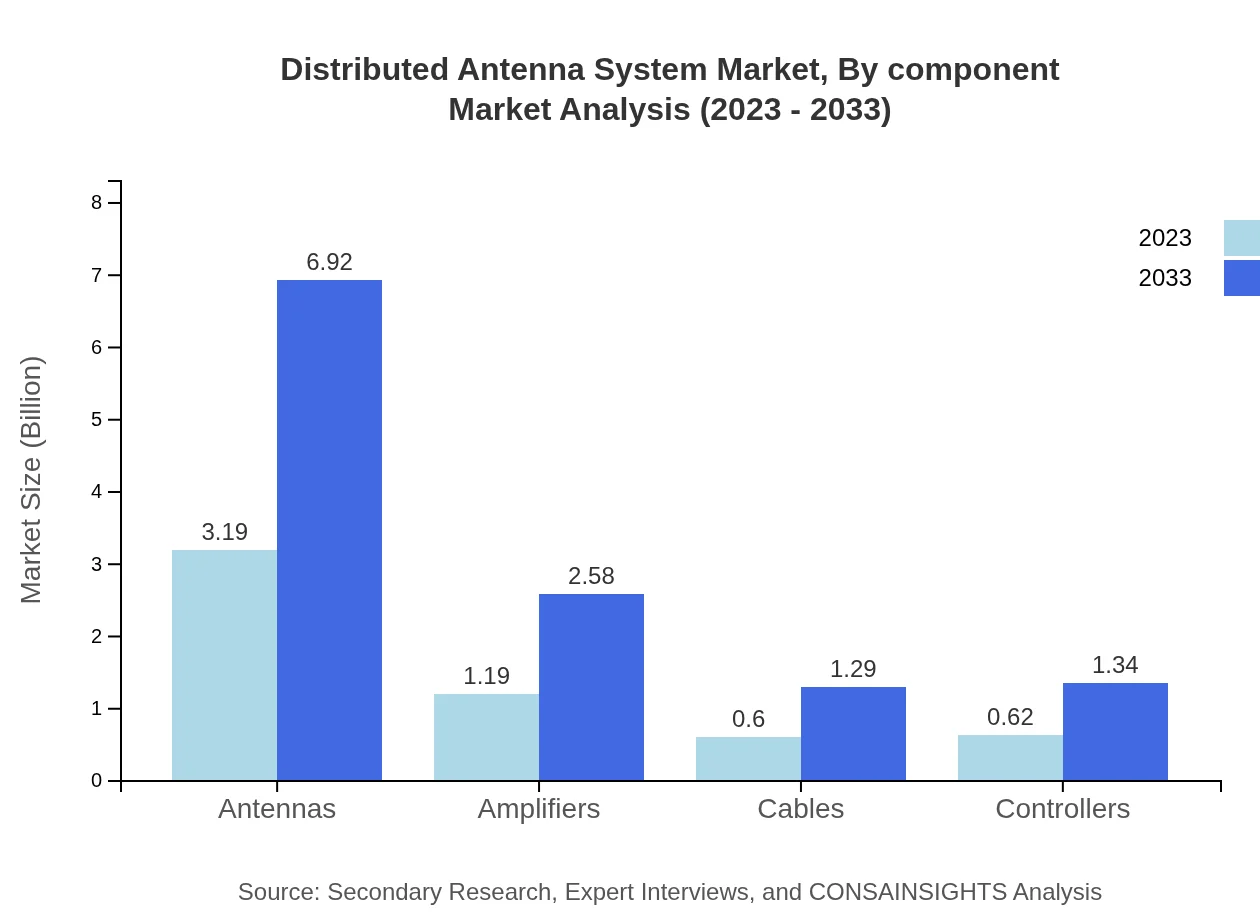

Distributed Antenna System Market Analysis By Component

Components like antennas, amplifiers, cables, and controllers are vital in driving system efficiency. Antennas dominate the market with a share of 57.04% in size estimates of USD 3.19 billion for 2023, expected to grow to USD 6.92 billion. Amplifiers and cables also show robust growth trajectories, highlighting the need for reliable infrastructure.

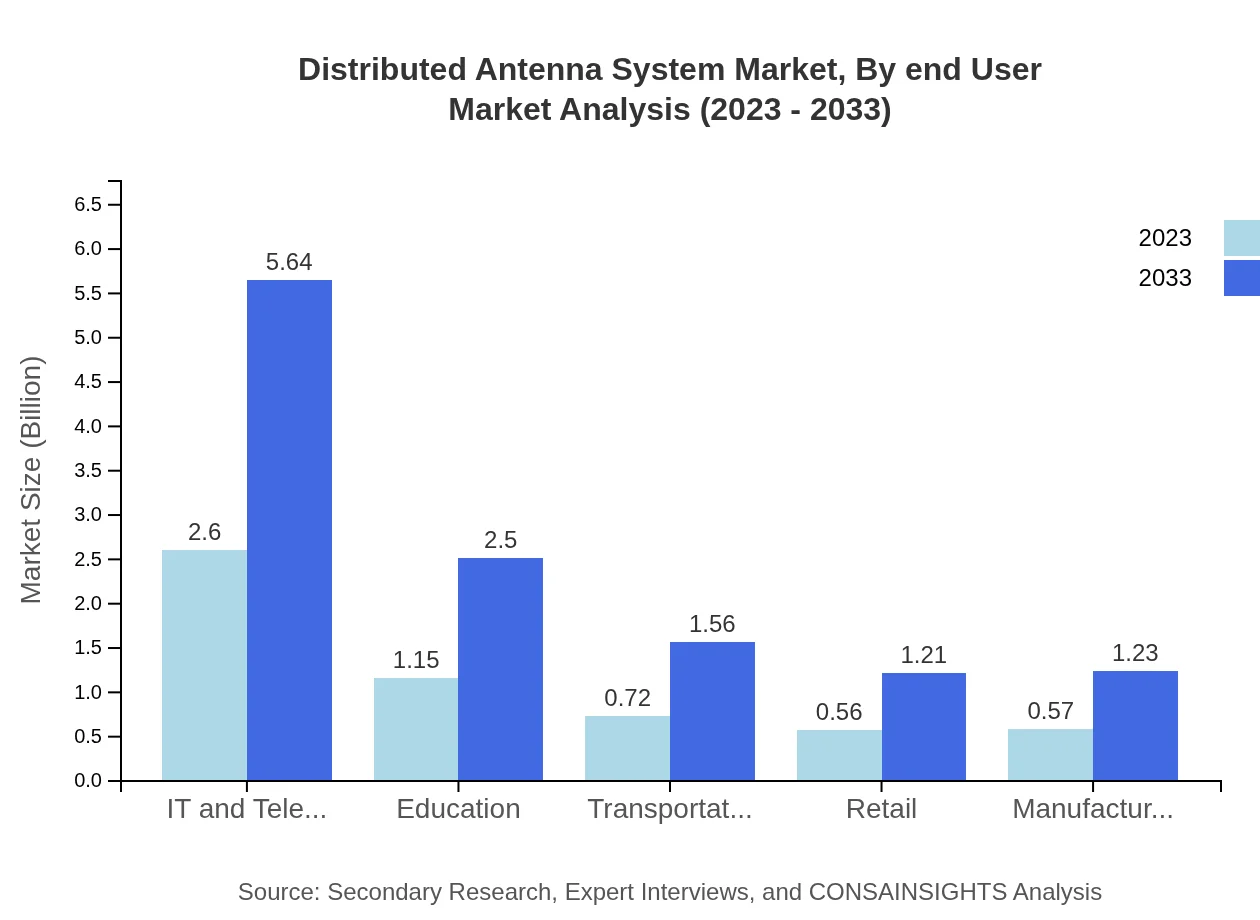

Distributed Antenna System Market Analysis By End User

Major end-users include commercial sectors and public safety services, indicating a shift towards improving user connectivity in critical applications. The commercial sector is projected to grow from USD 2.60 billion to USD 5.64 billion, maintaining a significant share throughout the forecast period.

Distributed Antenna System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Distributed Antenna System Industry

Corning Incorporated:

Corning leads the DAS market through its innovative solutions aimed at enhancing connectivity in high-density environments.CommScope:

CommScope specializes in network infrastructure products, including DAS systems, focusing on both commercial and public safety applications.Dali Wireless:

Dali Wireless provides advanced wireless systems designed to improve cellular and public safety coverage in a variety of applications.SOLiD:

SOLiD offers robust solutions in the DAS sector, with an emphasis on operational efficiency and responsiveness to customer needs.American Tower:

As a leading tower company, American Tower also develops DAS systems, catering to the rising demand for connectivity solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of Distributed Antenna System?

The Distributed Antenna System market is projected to grow from $5.6 billion in 2023 to substantial heights by 2033, with a CAGR of 7.8%. The growth indicates increasing demand for enhanced mobile connectivity and network reliability.

What are the key market players or companies in the Distributed Antenna System industry?

Key players in the Distributed Antenna System market include established telecom infrastructure companies, technology innovators, and service providers strategically positioned to capture market shares concentrated on enhancing connectivity solutions.

What are the primary factors driving the growth in the Distributed Antenna System industry?

The growth in the Distributed Antenna System market is driven by increasing mobile data traffic, the proliferation of smart devices, and the implementation of 5G technology, alongside heightened demand for reliable indoor connectivity across various sectors.

Which region is the fastest Growing in the Distributed Antenna System?

The North America region stands out as the fastest-growing market for Distributed Antenna Systems, expanding from $1.85 billion in 2023 to an estimated $4 billion by 2033, fueled by technological advancements and investment in telecommunications infrastructure.

Does ConsaInsights provide customized market report data for the Distributed Antenna System industry?

Yes, ConsaInsights offers customized market report data for the Distributed Antenna System sector, tailored to client requirements and insights, encompassing various parameters involving market trends, competitive landscape, and regional analyses.

What deliverables can I expect from this Distributed Antenna System market research project?

Deliverables from the Distributed Antenna System market research project include comprehensive market analysis reports, detailed insights on market trends, competitive strategies, regional forecasts, and in-depth segmentation data across key industry lines.

What are the market trends of Distributed Antenna System?

Current trends in the Distributed Antenna System market include a shift towards hybrid technologies, increased investment in wireless infrastructure, integration of advanced communication technologies, and a growing focus on enhancing user experience across various sectors.

What are the segments of the Distributed Antenna System market?

Segments in the Distributed Antenna System market include IT and Telecom, Education, Transportation, Retail, Manufacturing, with anticipated growth in each segment focusing on scalable solutions and enhancing connectivity infrastructure in 2023-2033.