Distributed Generation And Energy Storage In Telecom Networks Market Report

Published Date: 31 January 2026 | Report Code: distributed-generation-and-energy-storage-in-telecom-networks

Distributed Generation And Energy Storage In Telecom Networks Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Distributed Generation and Energy Storage in Telecom Networks market from 2023 to 2033, offering insights into market trends, segmentation, regional performance, and leading industry players.

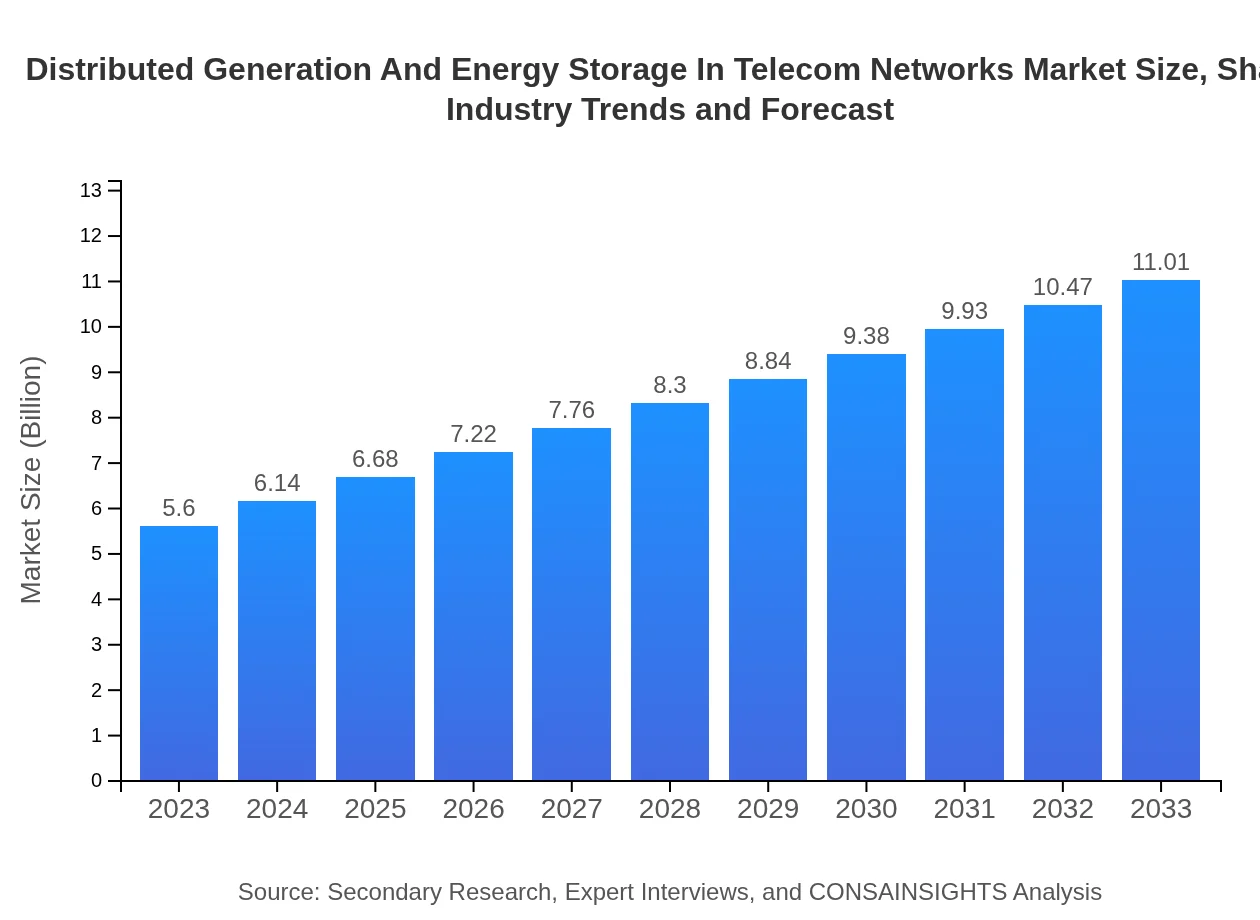

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Siemens AG, General Electric, Schneider Electric, Tesla, Inc., ABB Group |

| Last Modified Date | 31 January 2026 |

Distributed Generation And Energy Storage In Telecom Networks Market Overview

Customize Distributed Generation And Energy Storage In Telecom Networks Market Report market research report

- ✔ Get in-depth analysis of Distributed Generation And Energy Storage In Telecom Networks market size, growth, and forecasts.

- ✔ Understand Distributed Generation And Energy Storage In Telecom Networks's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Distributed Generation And Energy Storage In Telecom Networks

What is the Market Size & CAGR of Distributed Generation And Energy Storage In Telecom Networks market in {Year}?

Distributed Generation And Energy Storage In Telecom Networks Industry Analysis

Distributed Generation And Energy Storage In Telecom Networks Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Distributed Generation And Energy Storage In Telecom Networks Market Analysis Report by Region

Europe Distributed Generation And Energy Storage In Telecom Networks Market Report:

Europe's market, initially valued at $1.61 billion in 2023, is anticipated to reach $3.16 billion by 2033. Initiatives toward sustainability and the European Union’s emphasis on green technologies are propelling market advancements.Asia Pacific Distributed Generation And Energy Storage In Telecom Networks Market Report:

In Asia Pacific, the market is projected to grow from $1.11 billion in 2023 to $2.18 billion by 2033. The rapid expansion of telecommunications infrastructure and increasing investments in renewable energy sources are key factors driving growth in this region.North America Distributed Generation And Energy Storage In Telecom Networks Market Report:

North America stands out as a significant market, growing from $2.04 billion in 2023 to $4.00 billion in 2033. The region is capitalizing on advanced technologies and regulatory support to adopt distributed generation strategies in telecom networks.South America Distributed Generation And Energy Storage In Telecom Networks Market Report:

South America, with a market size of $0.39 billion in 2023, is expected to reach $0.76 billion by 2033. The region is focusing on integrating energy storage solutions to enhance telecom services and reduce reliance on traditional grid systems.Middle East & Africa Distributed Generation And Energy Storage In Telecom Networks Market Report:

In the Middle East and Africa, the market is expected to grow from $0.46 billion in 2023 to $0.91 billion in 2033, driven by increasing demand for reliable telecommunications services amidst challenging energy supplies.Tell us your focus area and get a customized research report.

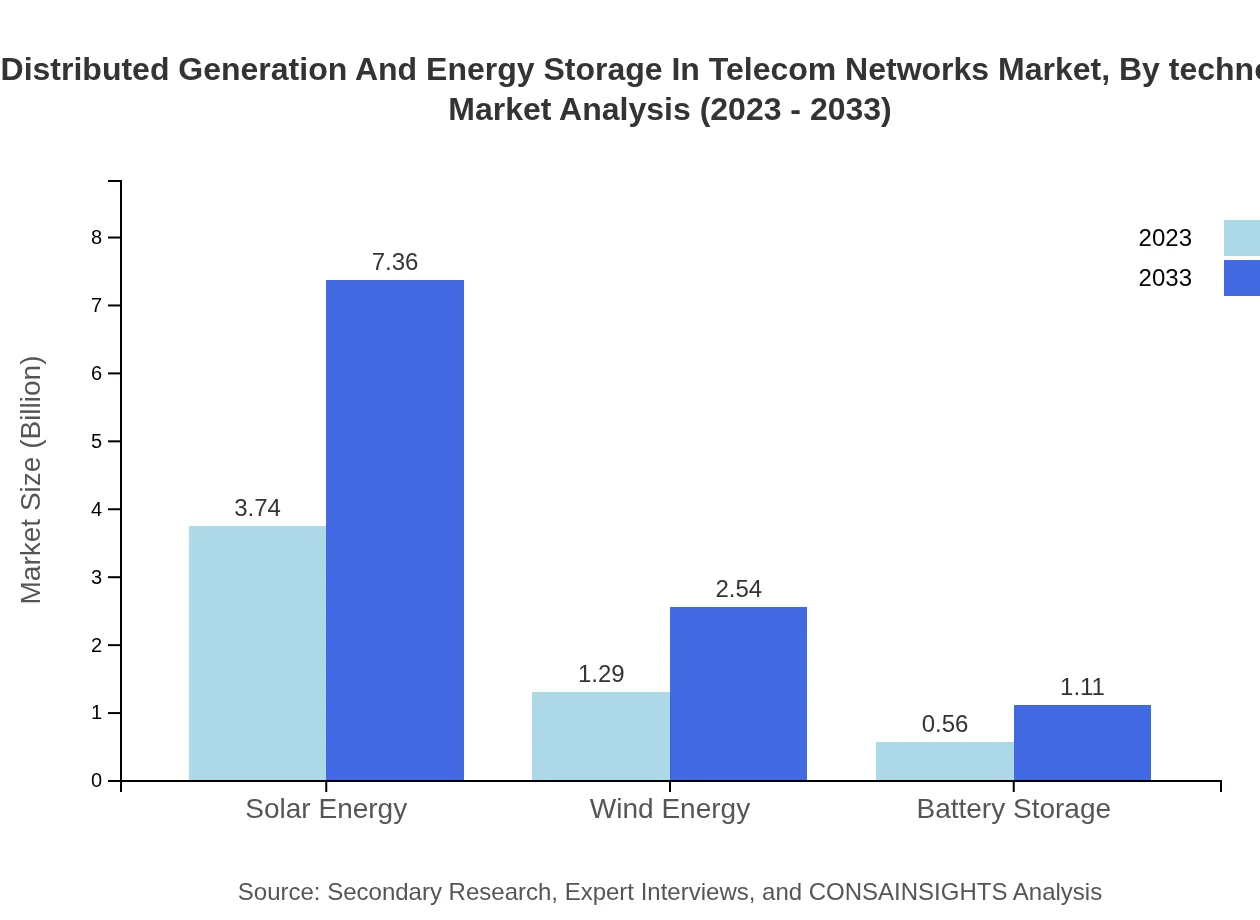

Distributed Generation And Energy Storage In Telecom Networks Market Analysis By Technology

The segment includes significant technologies such as solar energy, wind energy, and battery storage. Solar energy holds the largest market share, constituting 66.83% in 2023 and maintaining that share through 2033. Wind energy and battery storage are also noteworthy contributors, reflecting increasing investments in diversified renewable energy sources.

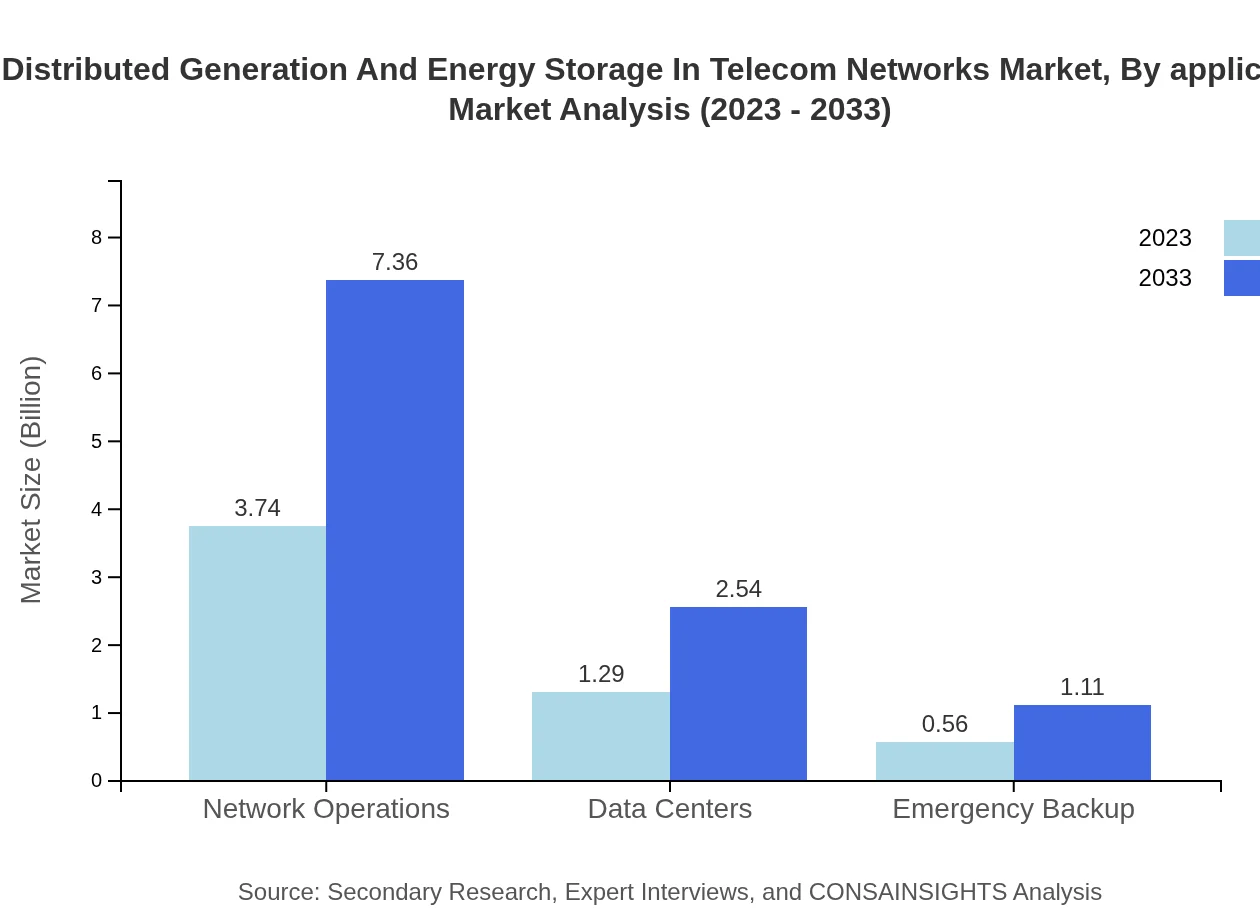

Distributed Generation And Energy Storage In Telecom Networks Market Analysis By Application

Key application areas encompass network operations, data centers, and emergency backup systems. Network operations are crucial for daily telecommunications, accounting for a significant percentage of overall energy usage. Data centers demonstrate a growing need for energy resilience, while emergency backup solutions play a vital role in ensuring uninterrupted service delivery.

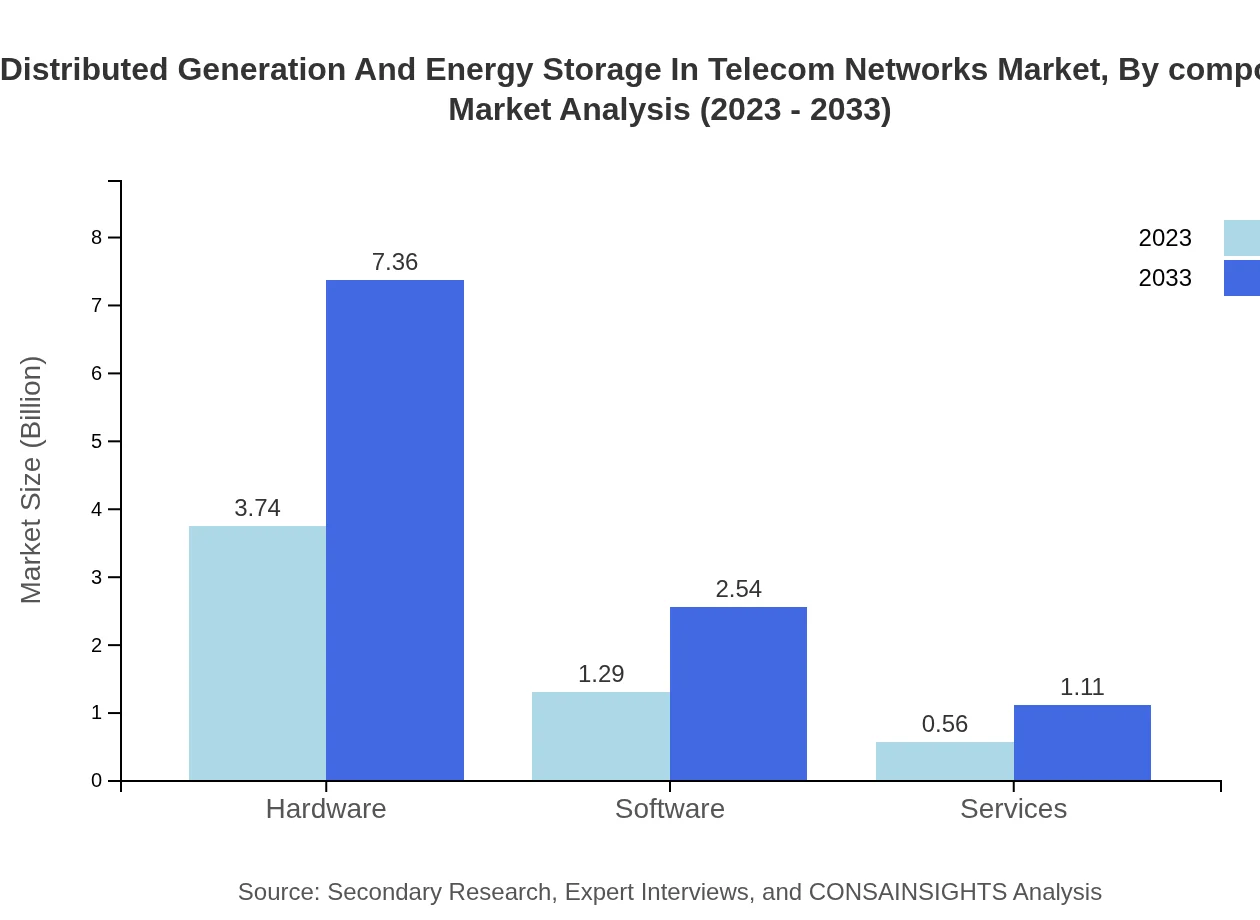

Distributed Generation And Energy Storage In Telecom Networks Market Analysis By Component

Components disaggregated into hardware, software, and services reflect a balanced approach to operational efficiency. Hardware solutions necessitate robust infrastructure, software aids in optimizing the energy management process, and services ensure ongoing maintenance and support, boosting reliability and performance.

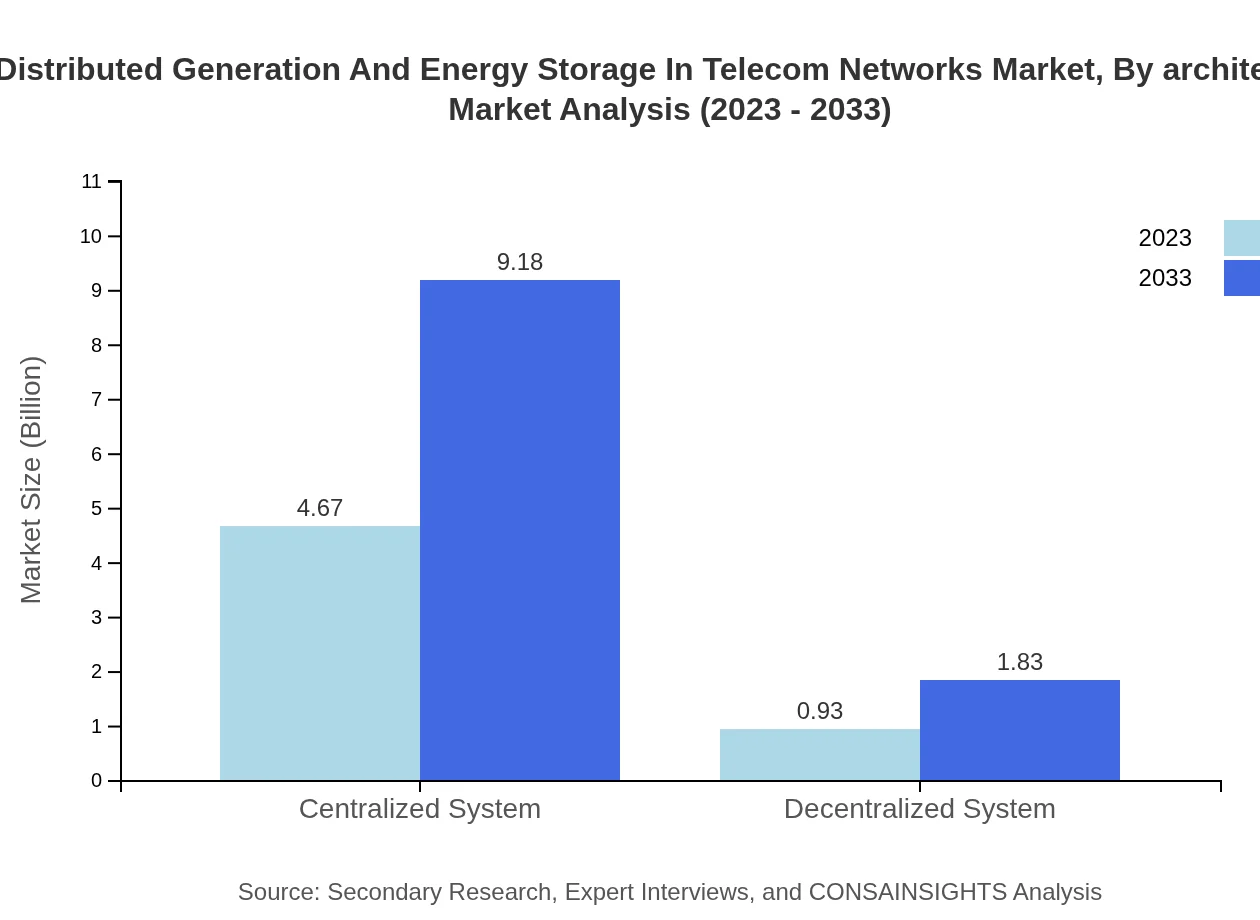

Distributed Generation And Energy Storage In Telecom Networks Market Analysis By Architecture

Architectural choices between centralized and decentralized systems highlight the flexibility required in telecom operations. Centralized systems dominate the market at 83.4% share, facilitating bulk energy generation, while decentralized systems are gaining traction for their resilience and adaptability in varying operational environments.

Distributed Generation And Energy Storage In Telecom Networks Market Analysis By Usage Scenario

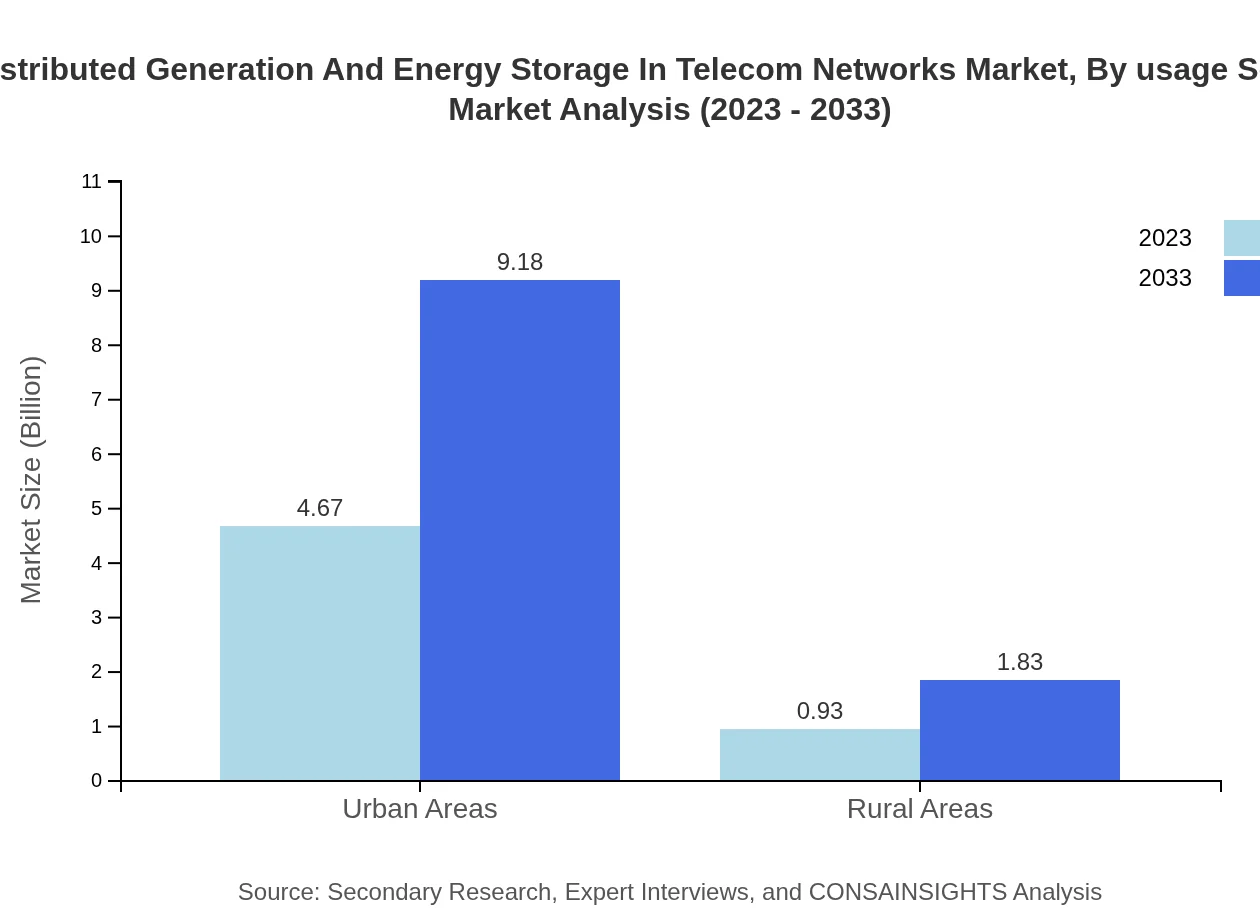

Usage scenarios between urban and rural areas depict diverse energy needs. Urban areas require significant deployments of distributed generation solutions due to higher energy demands, whereas rural areas are increasingly adopting scalable renewable energy systems, underscoring the need for local energy independence.

Distributed Generation And Energy Storage In Telecom Networks Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Distributed Generation And Energy Storage In Telecom Networks Industry

Siemens AG:

Siemens AG is at the forefront of integrating energy-efficient solutions within telecom networks, focusing on sustainable energy generation technologies.General Electric:

General Electric offers innovative energy storage systems that enhance telecom infrastructure resilience, fostering decentralized energy solutions.Schneider Electric:

Schneider Electric leads the market with its smart grid technologies and energy management software tailored for telecom applications.Tesla, Inc.:

Tesla is revolutionizing energy storage solutions with its advanced battery technologies, significantly impacting telecom energy independence.ABB Group:

ABB Group is recognized for its pioneering solutions in energy automation, facilitating the integration of renewable energy into telecom networks.We're grateful to work with incredible clients.

FAQs

What is the market size of Distributed Generation and Energy Storage in Telecom Networks?

The Distributed Generation and Energy Storage in Telecom Networks market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.8% through to 2033.

What are the key market players or companies in this industry?

Key players in the Distributed Generation and Energy Storage in Telecom Networks industry include major technology firms and telecom service providers, who are enhancing their capabilities and investing in innovative solutions for energy efficiency.

What are the primary factors driving the growth in the Distributed Generation and Energy Storage industry?

Growth in this sector is driven by increasing energy demands, technological advancements in energy storage solutions, regulatory incentives for renewable energy adoption, and the need for enhanced telecommunications infrastructure.

Which region is the fastest Growing in this industry?

The Asia Pacific region is the fastest-growing area for Distributed Generation and Energy Storage in Telecom Networks, expected to grow from $1.11 billion in 2023 to $2.18 billion by 2033.

Does ConsaInsights provide customized market report data for this industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients interested in the Distributed Generation and Energy Storage in Telecom Networks industry.

What deliverables can I expect from this market research project?

Deliverables from the market research project will include comprehensive reports, market forecasts, analysis of trends, and insights on competitive landscape and technology advancements in the Distributed Generation and Energy Storage sector.

What are the market trends of Distributed Generation and Energy Storage?

Market trends include a shift towards decentralized energy models, increased integration of renewable energy sources, advancements in battery storage technologies, and a growing emphasis on energy efficiency across telecom networks.