Distribution Transformer Market Report

Published Date: 22 January 2026 | Report Code: distribution-transformer

Distribution Transformer Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Distribution Transformer market, focusing on current trends, market size, and growth forecasts from 2023 to 2033. Key insights into industry analysis, regional dynamics, and technology advancements are also covered.

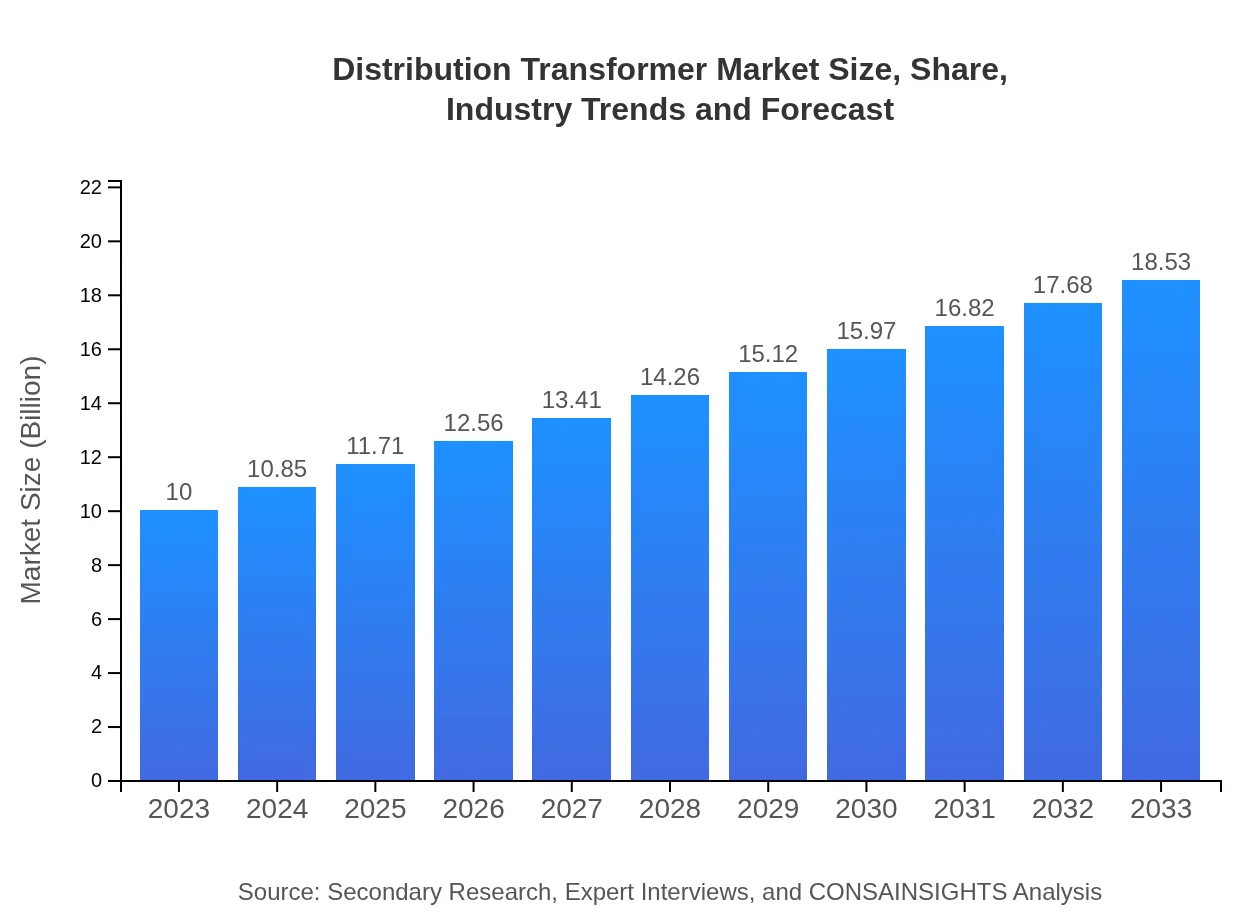

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $18.53 Billion |

| Top Companies | Siemens AG, Schneider Electric, General Electric, Eaton Corporation, ABB Ltd. |

| Last Modified Date | 22 January 2026 |

Distribution Transformer Market Overview

Customize Distribution Transformer Market Report market research report

- ✔ Get in-depth analysis of Distribution Transformer market size, growth, and forecasts.

- ✔ Understand Distribution Transformer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Distribution Transformer

What is the Market Size & CAGR of Distribution Transformer market in 2023?

Distribution Transformer Industry Analysis

Distribution Transformer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Distribution Transformer Market Analysis Report by Region

Europe Distribution Transformer Market Report:

Europe's market is anticipated to expand from $3.11 billion to $5.76 billion over the same period. Environmental regulations and a commitment to reducing carbon emissions drive investments in more efficient transformer technologies.Asia Pacific Distribution Transformer Market Report:

The Asia Pacific region is witnessing significant growth in the Distribution Transformer market, with a projected size increase from $1.90 billion in 2023 to $3.52 billion by 2033. Key drivers include rapid urbanization, industrialization, and government initiatives promoting renewable energy integration.North America Distribution Transformer Market Report:

North America’s Distribution Transformer market is expected to grow from $3.48 billion in 2023 to $6.46 billion by 2033, supported by technological advancements and regulatory frameworks focusing on renewable energy. The U.S. leads in innovations and is transitioning towards smart technologies.South America Distribution Transformer Market Report:

In South America, the market size will advance from $0.24 billion in 2023 to $0.45 billion by 2033, driven by increasing power demand and infrastructure upgrades. Investments in green projects are likely to foster growth in this region.Middle East & Africa Distribution Transformer Market Report:

The Middle East and Africa market will observe an increase from $1.26 billion in 2023 to $2.34 billion by 2033, propelled by energy demand, population growth, and investments in infrastructure. The shift towards sustainable energy practices is also enhancing market potential.Tell us your focus area and get a customized research report.

Distribution Transformer Market Analysis By Product Type

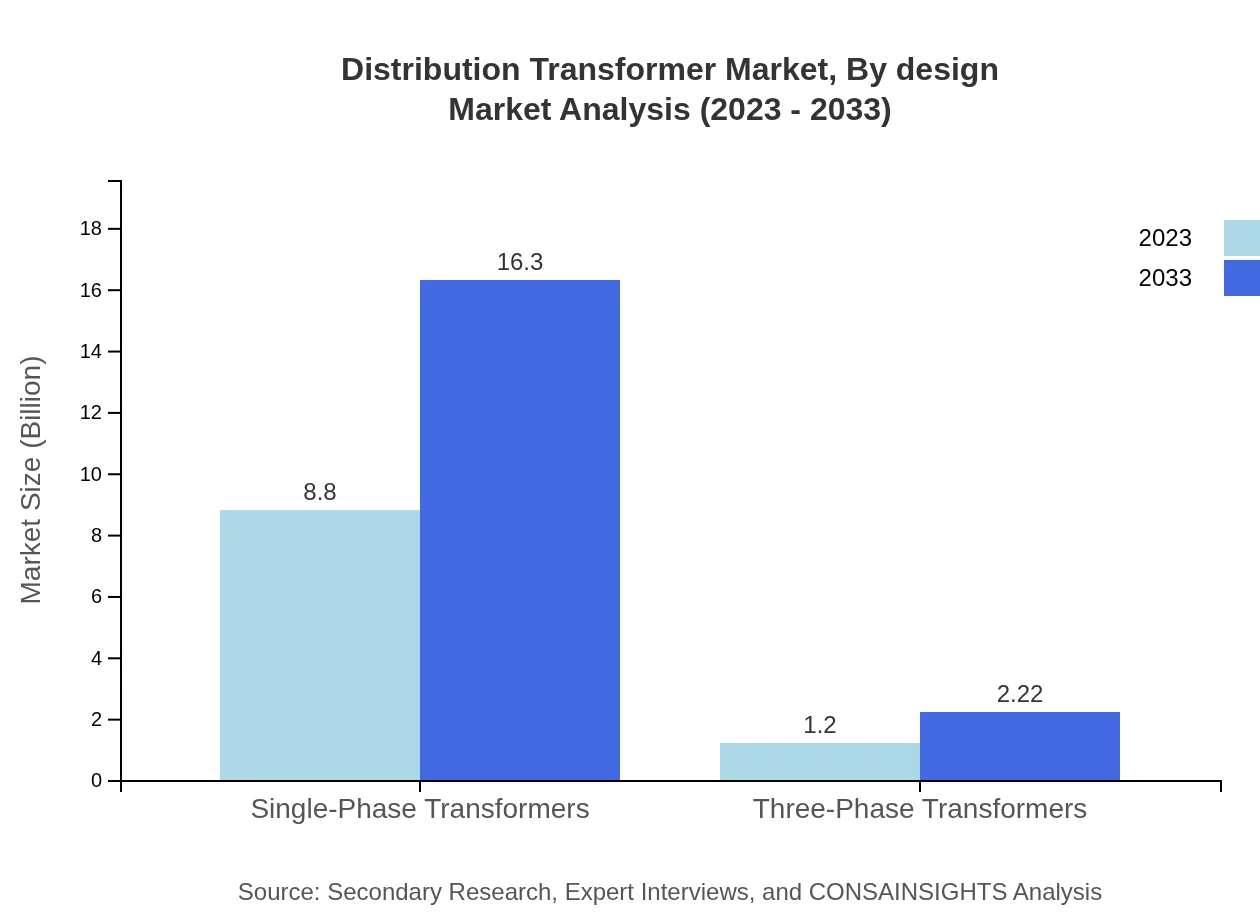

The segment analysis indicates that single-phase transformers, which accounted for approximately $8.80 billion in 2023, are expected to grow to $16.30 billion by 2033, maintaining a market share of 88%. In contrast, three-phase transformers, while currently smaller at $1.20 billion, are projected to increase to $2.22 billion, holding a 12% share. This growth in three-phase transformers highlights their importance in supporting industrial and commercial requirements.

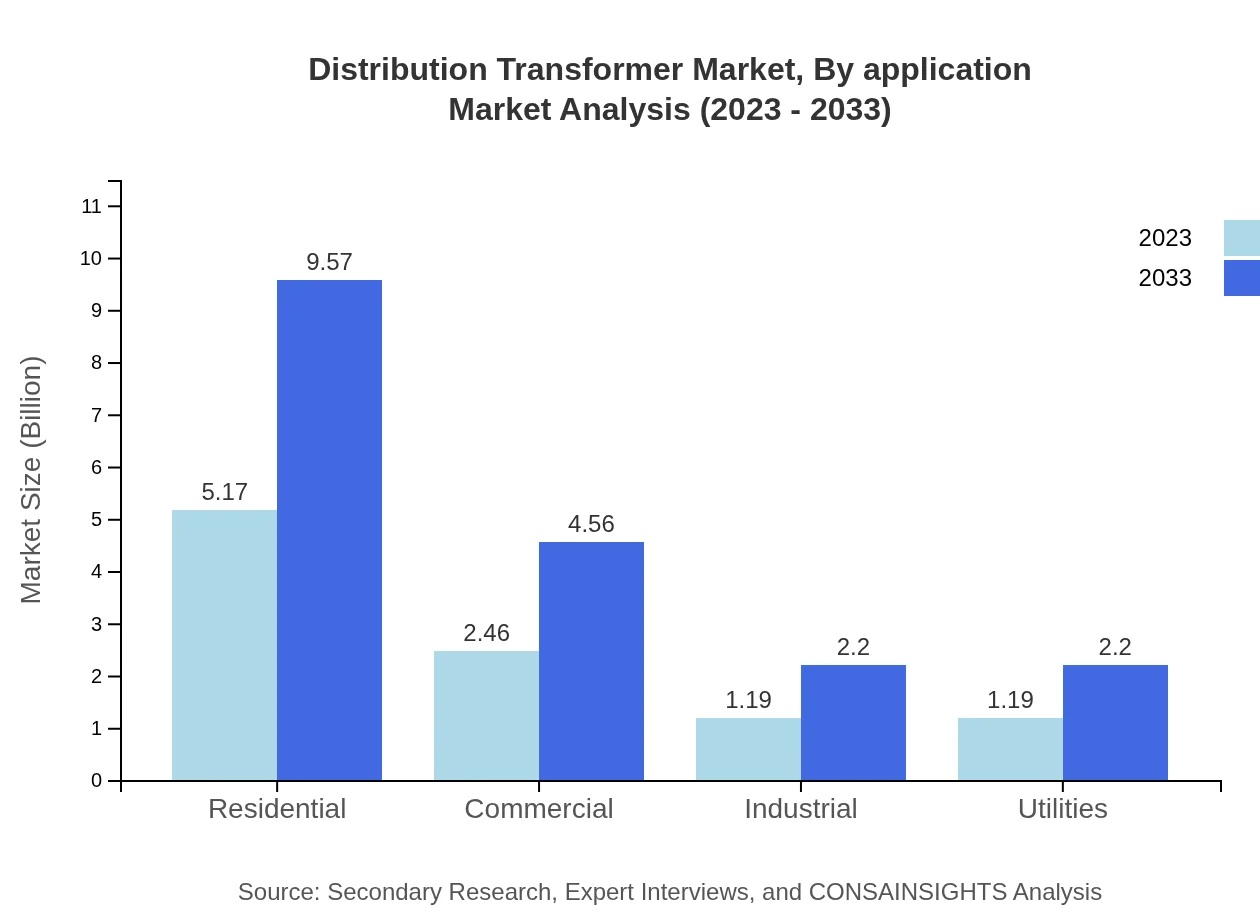

Distribution Transformer Market Analysis By Application

In terms of application, the residential sector is the largest, expected to grow from $5.17 billion in 2023 to $9.57 billion in 2033, accounting for 51.67% of the market. The commercial sector is also significant, increasing from $2.46 billion to $4.56 billion, representing 24.59%. The industrial and utility sectors share similar significance, each expanding from $1.19 billion to $2.20 billion, indicating potential in industrial applications.

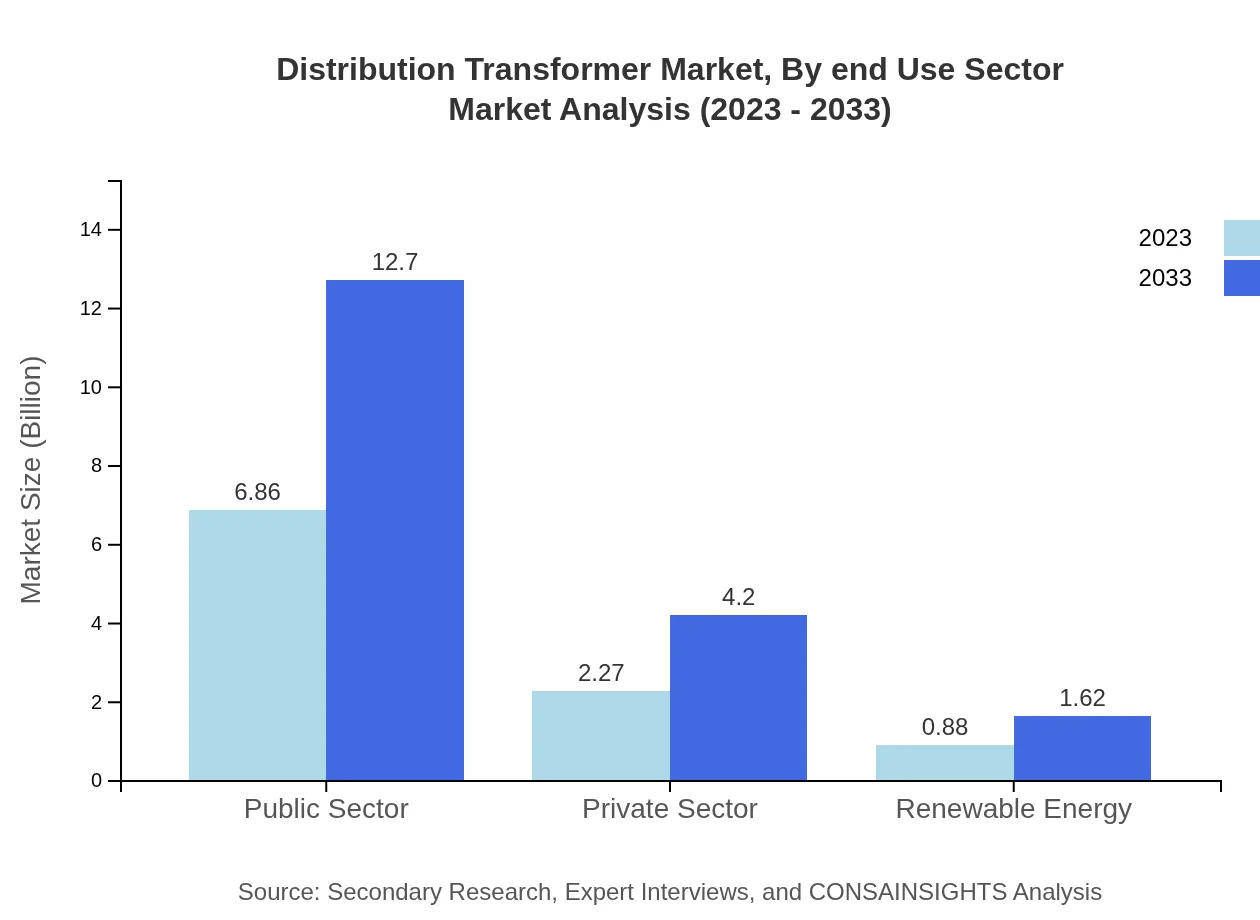

Distribution Transformer Market Analysis By End Use Sector

The Distribution Transformer market is further segmented into public and private sectors. The public sector dominates, with a market size anticipated to rise from $6.86 billion to $12.70 billion by 2033, while the private sector is expected to grow from $2.27 billion to $4.20 billion. This emphasis on public sector investment reflects the global trend towards improved power infrastructure.

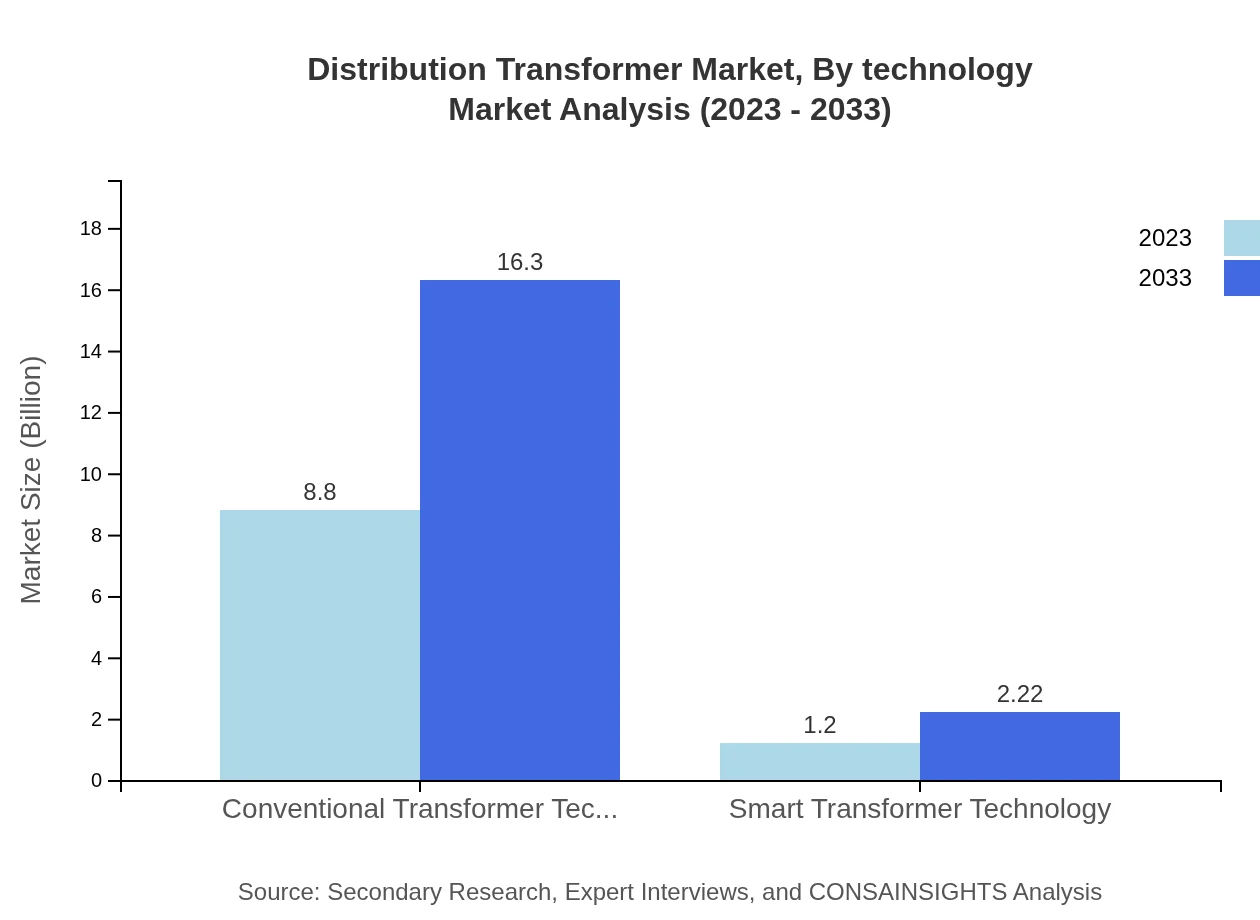

Distribution Transformer Market Analysis By Technology

Technological advancements are critical in the distribution transformer sector. Conventional technologies, which currently dominate with a size of $8.80 billion, will expand similarly to smart technologies, growing from $1.20 billion to $2.22 billion. The ongoing transition to smart transformers highlights the industry's move towards enhanced efficiency and monitoring capabilities.

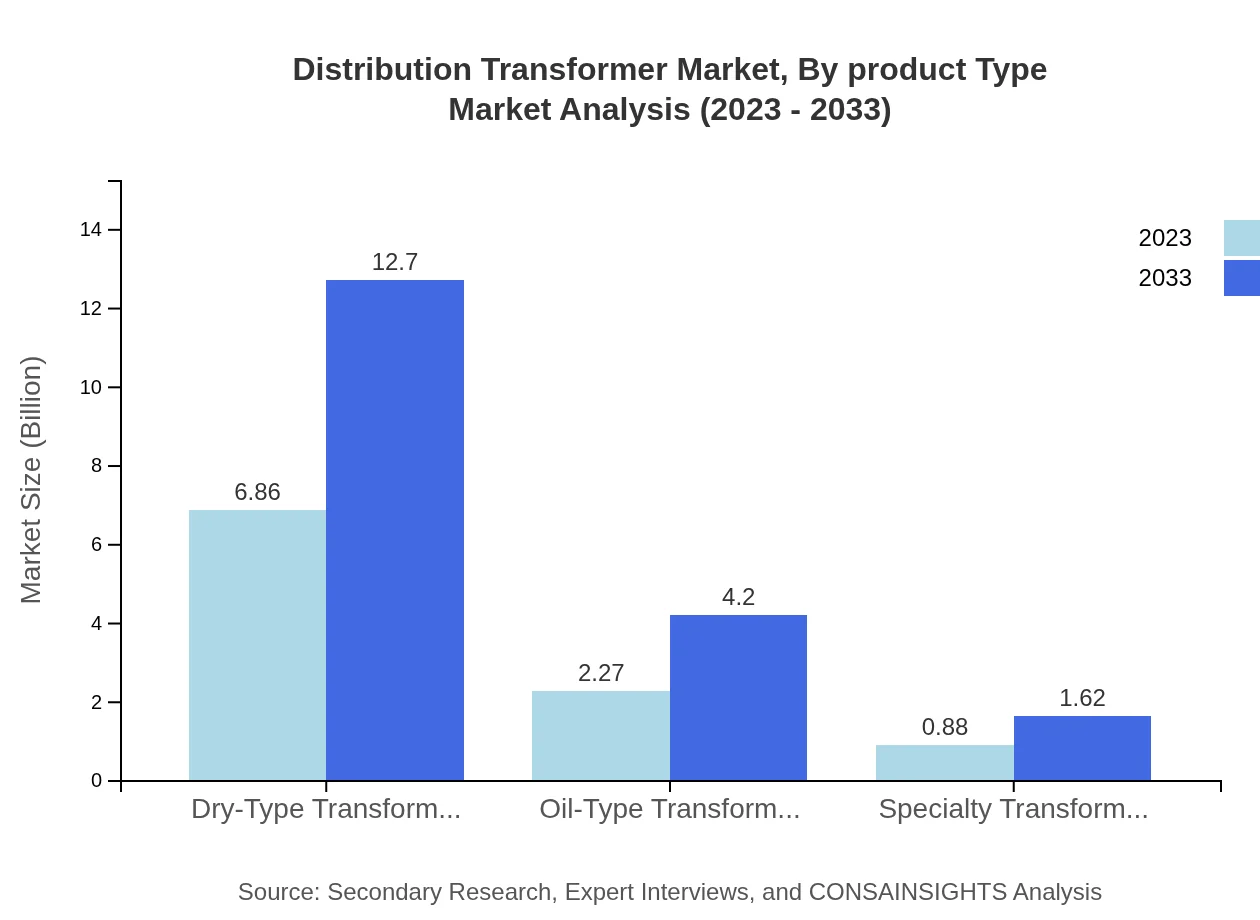

Distribution Transformer Market Analysis By Design

In terms of design, the market showcases growth for both dry-type and oil-type transformers. The dry-type transformers, leading the market with an expected size of $6.86 billion in 2023, will grow to $12.70 billion, emphasizing their suitability in environmentally constrained areas. Oil-type transformers will also experience growth from $2.27 billion to $4.20 billion, signifying ongoing demand in various applications.

Distribution Transformer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Distribution Transformer Industry

Siemens AG:

Siemens AG is a global leader in the industrial and energy sectors, providing innovative transformer solutions emphasizing efficiency and sustainability.Schneider Electric:

Schneider Electric specializes in energy management and offers cutting-edge distribution transformer technologies focused on smart grid applications to enhance overall power efficiency.General Electric:

General Electric is prominent in power generation and distribution, developing high-performance distribution transformers that contribute to global energy solutions.Eaton Corporation:

Eaton Corporation is known for its diverse portfolio in electrical systems, providing innovative distribution transformers and focusing on sustainability.ABB Ltd.:

ABB Ltd. integrates electrification and automation services, delivering efficient distribution transformers that enhance operational reliability and energy efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of distribution Transformer?

The distribution transformer market is anticipated to reach a size of $10 billion by 2033, growing at a CAGR of 6.2%. This growth reflects increasing energy demands and infrastructure developments globally.

What are the key market players or companies in this distribution Transformer industry?

Key market players in the distribution transformer industry include leading manufacturers and suppliers renowned for their innovative technologies and market presence, playing crucial roles in shaping market trends and competition.

What are the primary factors driving the growth in the distribution transformer industry?

Primary factors contributing to growth in the distribution transformer industry include increasing demand for energy, rising investments in renewable energy, and advancements in smart grid technologies that enhance efficiency and reliability.

Which region is the fastest Growing in the distribution transformer?

The fastest-growing region in the distribution transformer market is North America, projected to grow from $3.48 billion in 2023 to $6.46 billion by 2033, driven by infrastructure investments and energy sustainability initiatives.

Does ConsaInsights provide customized market report data for the distribution transformer industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of clients in the distribution transformer industry, providing insights based on specific regional and segment requirements.

What deliverables can I expect from this distribution transformer market research project?

Deliverables from the distribution transformer market research project include comprehensive reports, detailed market analyses, segment data, and insights on trends, helping stakeholders make informed decisions.

What are the market trends of distribution transformer?

Current market trends in the distribution transformer industry include a shift towards smart transformer technologies, increasing adoption of dry-type transformers, and rising focus on sustainability with improved efficiency and reduced losses.