Dithiocarbamates Fungicide Market Report

Published Date: 02 February 2026 | Report Code: dithiocarbamates-fungicide

Dithiocarbamates Fungicide Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dithiocarbamates Fungicide market, focusing on key trends, segmentation, regional insights, and forecasts for the period 2023 - 2033.

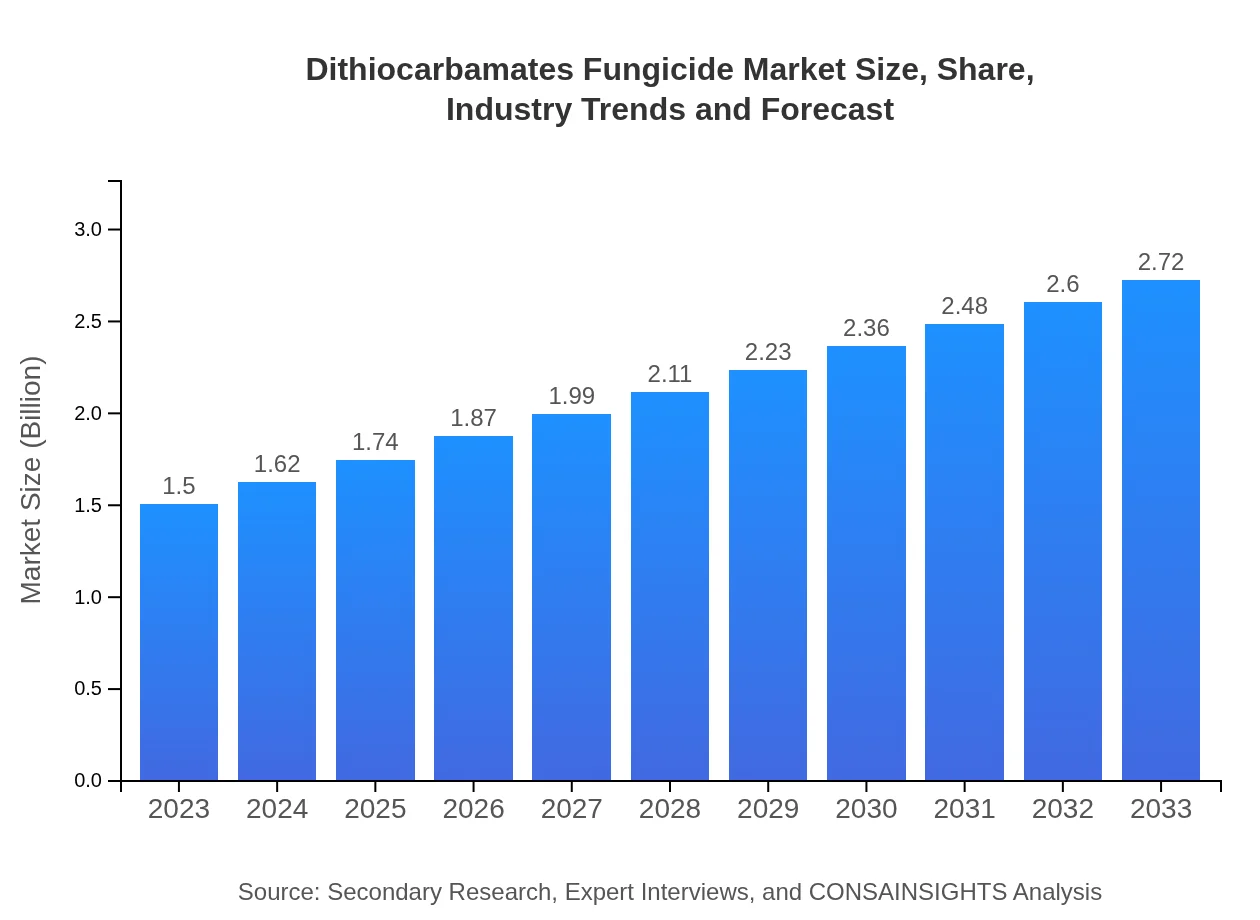

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $2.72 Billion |

| Top Companies | BASF, Syngenta, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Dithiocarbamates Fungicide Market Overview

Customize Dithiocarbamates Fungicide Market Report market research report

- ✔ Get in-depth analysis of Dithiocarbamates Fungicide market size, growth, and forecasts.

- ✔ Understand Dithiocarbamates Fungicide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dithiocarbamates Fungicide

What is the Market Size & CAGR of Dithiocarbamates Fungicide market in 2023?

Dithiocarbamates Fungicide Industry Analysis

Dithiocarbamates Fungicide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dithiocarbamates Fungicide Market Analysis Report by Region

Europe Dithiocarbamates Fungicide Market Report:

The European market is anticipated to grow from $0.51 billion in 2023 to $0.92 billion in 2033. Regulatory support for sustainable agriculture in the EU boosts the demand for eco-friendly fungicides, aligning with the market's growth.Asia Pacific Dithiocarbamates Fungicide Market Report:

In the Asia Pacific region, the Dithiocarbamates Fungicide market is estimated at $0.26 billion in 2023 and expected to grow to $0.48 billion by 2033. The rapid expansion of agriculture in countries like India and China significantly drives demand, combined with the increasing adoption of modern farming techniques.North America Dithiocarbamates Fungicide Market Report:

North America, a key market for Dithiocarbamates Fungicide, will see growth from $0.51 billion in 2023 to $0.93 billion in 2033. The rise in cereal production and increased compliance with sustainable farming practices are major growth drivers.South America Dithiocarbamates Fungicide Market Report:

South America shows a moderate growth trajectory in the Dithiocarbamates Fungicide market, with a size projected to increase from $0.04 billion in 2023 to $0.07 billion in 2033. The region's focus on fruit and vegetable exports enhances the demand for effective fungicide solutions.Middle East & Africa Dithiocarbamates Fungicide Market Report:

The Middle East and Africa region is projected to increase from $0.18 billion in 2023 to $0.33 billion by 2033, supported by rising agricultural productivity needs and the economic development of agricultural sectors.Tell us your focus area and get a customized research report.

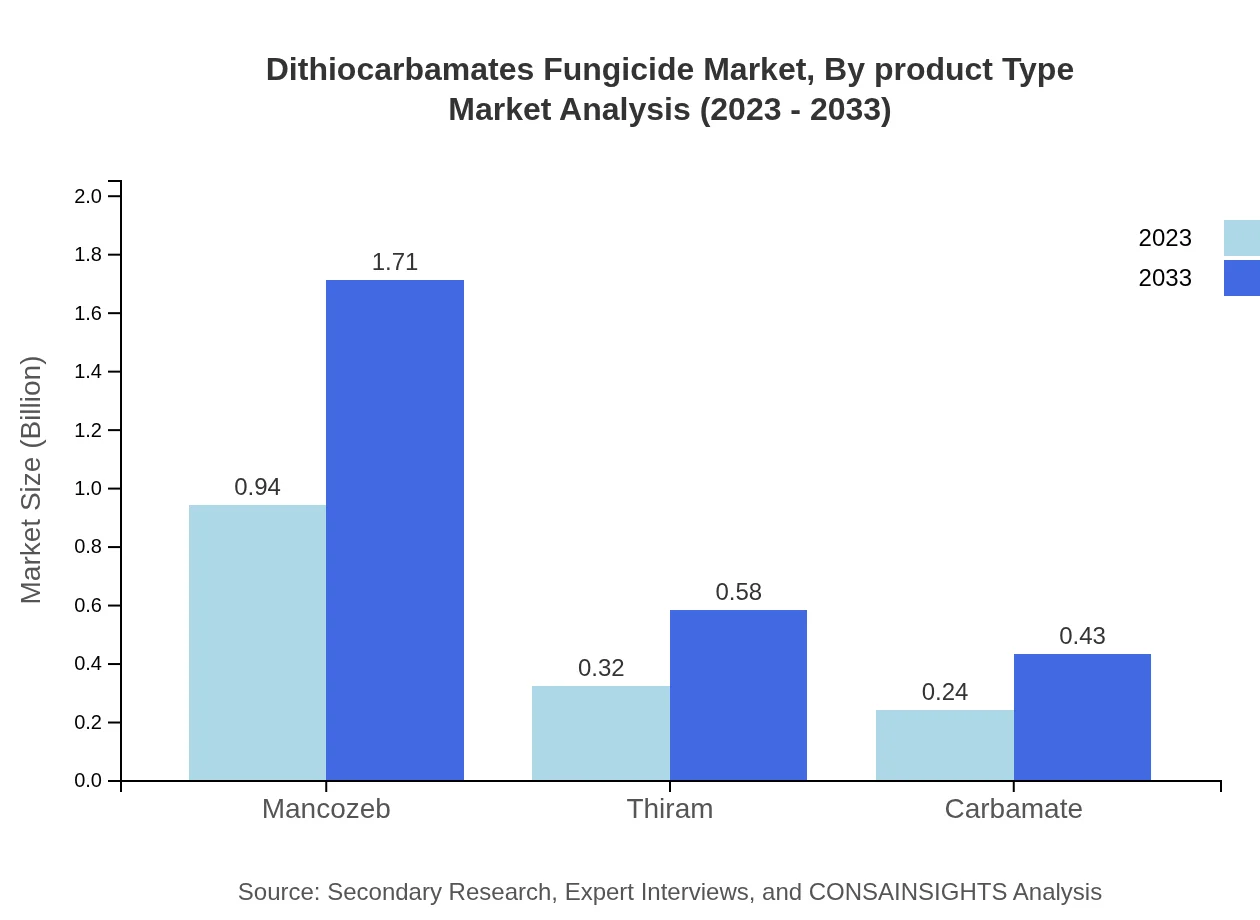

Dithiocarbamates Fungicide Market Analysis By Product Type

The by-product type segment is critical for understanding market dynamics. Mancozeb dominates the market with sales of $0.94 billion in 2023 and is expected to rise to $1.71 billion by 2033. Thiram and Carbamate also represent significant shares, projected to grow at similar rates.

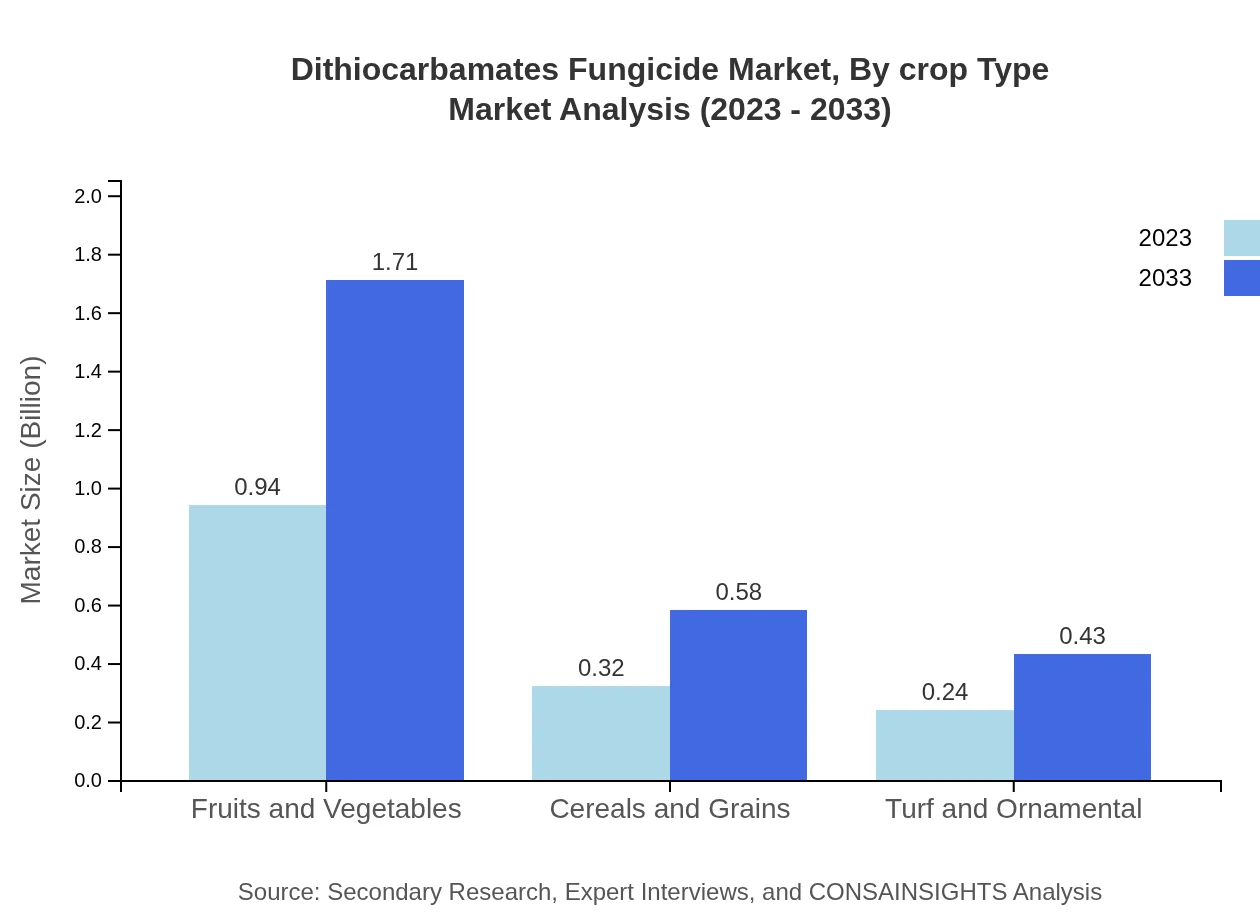

Dithiocarbamates Fungicide Market Analysis By Crop Type

The crop type analysis reveals that the agricultural segment leads the market, encompassing various sub-segments such as fruits, vegetables, and cereals. The market size for Fruits and Vegetables is expected to grow from $0.94 billion in 2023 to $1.71 billion by 2033.

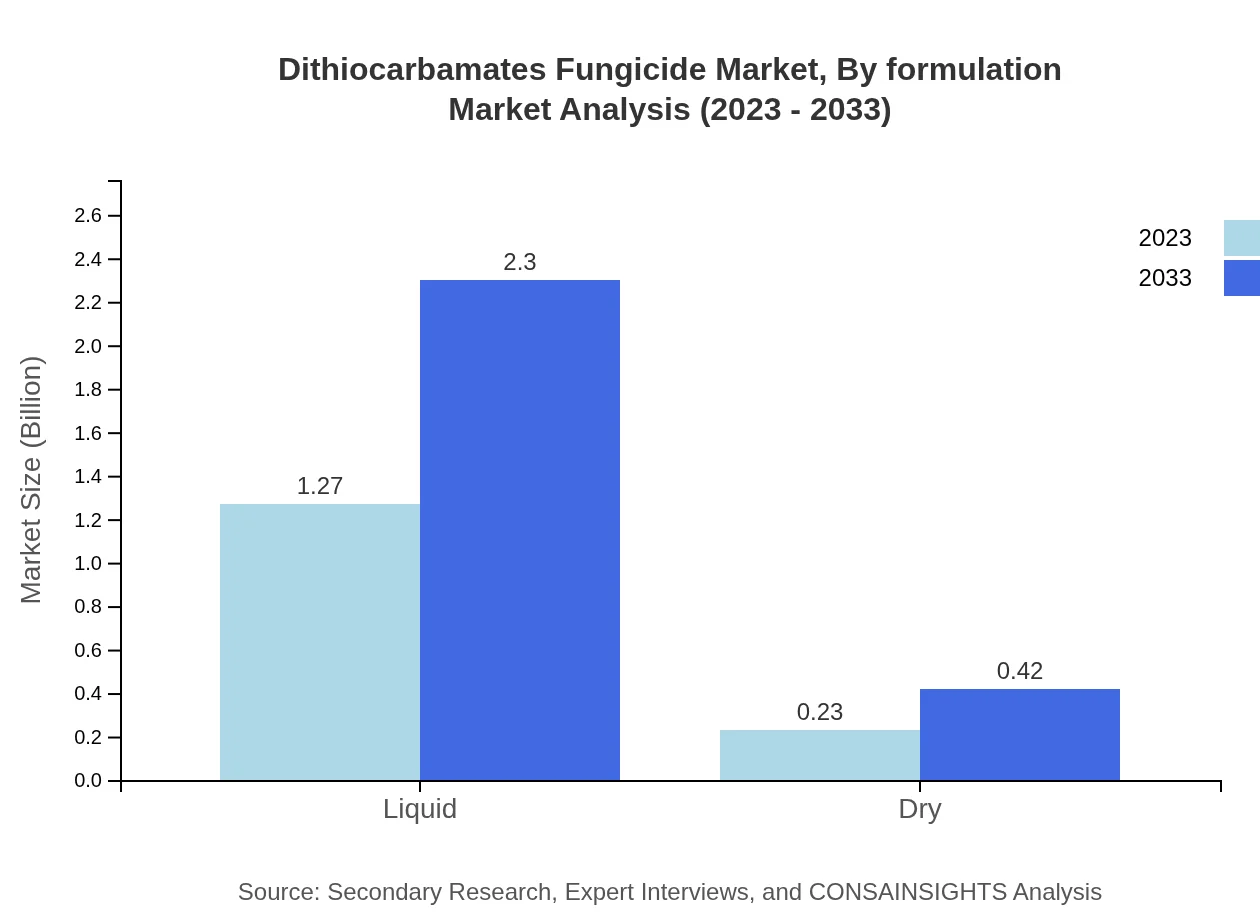

Dithiocarbamates Fungicide Market Analysis By Formulation

Liquid formulations dominate the Dithiocarbamates Fungicide market, holding a substantial size of $1.27 billion in 2023, expected to grow to $2.30 billion by 2033. This preference is driven by ease of application and effectiveness.

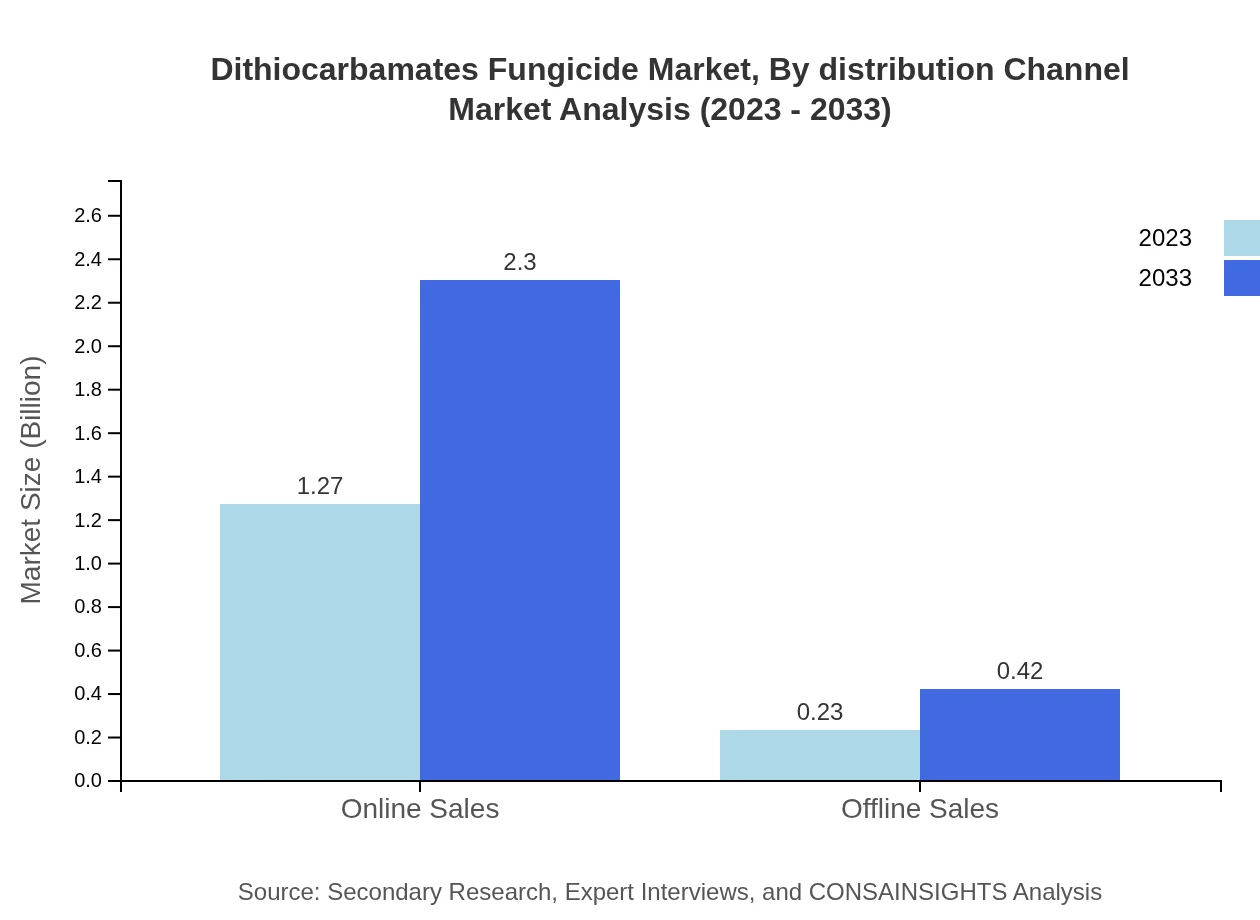

Dithiocarbamates Fungicide Market Analysis By Distribution Channel

The distribution channel landscape is comprised of online and offline sales channels. Online sales dominate with a market size of $1.27 billion in 2023, projected to maintain an 84.54% market share through 2033.

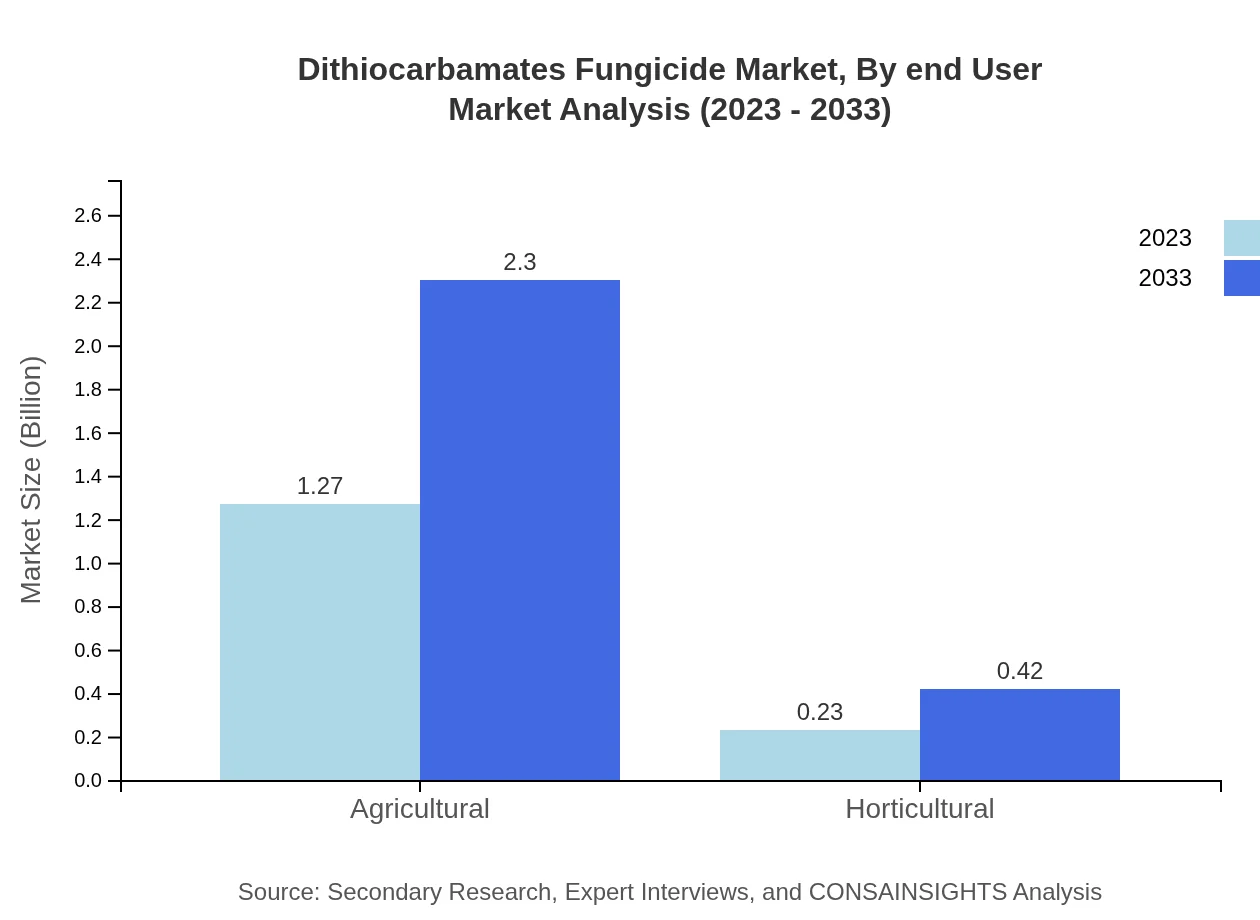

Dithiocarbamates Fungicide Market Analysis By End User

End-users range from commercial growers to home gardeners. The agricultural sector comprises the majority, with a growing interest in residential usage driven by trends in home gardening.

Dithiocarbamates Fungicide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dithiocarbamates Fungicide Industry

BASF:

BASF is a leading player in the agrochemical sector, focusing on innovative fungicide formulations that enhance crop protection effectively and sustainably.Syngenta:

Syngenta specializes in crop protection and seeds, offering a wide range of dithiocarbamate fungicides and playing a crucial role in the global agricultural landscape.FMC Corporation:

FMC Corporation is known for its advanced crop protection solutions, including effective dithiocarbamate fungicides that help farmers manage plant diseases efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of dithiocarbamates Fungicide?

The global dithiocarbamates fungicide market is currently valued at approximately $1.5 billion and is projected to grow at a CAGR of 6.0%, reaching an estimated value of over $2.6 billion by 2033.

What are the key market players or companies in the dithiocarbamates Fungicide industry?

Key players in the dithiocarbamates fungicide market include major agricultural companies and chemical manufacturers. Their innovations and product expansions significantly influence market growth, especially in the fungicide segment.

What are the primary factors driving the growth in the dithiocarbamates Fungicide industry?

Factors such as increased agricultural production, rising pest resistance, and the need for efficient crop protection solutions are driving the growth of the dithiocarbamates fungicide market. Environmental concerns also push for sustainable farming practices.

Which region is the fastest Growing in the dithiocarbamates Fungicide?

The Asia-Pacific region is the fastest-growing market for dithiocarbamates fungicides, with market size projected to increase from $0.26 billion in 2023 to approximately $0.48 billion by 2033, reflecting the expansion of agricultural practices.

Does ConsaInsights provide customized market report data for the dithiocarbamates Fungicide industry?

Yes, ConsaInsights offers customized market report data for the dithiocarbamates fungicide industry, catering to specific client needs, including segmentation analysis and tailored insights for strategic decision-making.

What deliverables can I expect from this dithiocarbamates Fungicide market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, growth forecasts, competitor analysis, and insights into regional and segment trends tailored to the dithiocarbamates fungicide industry.

What are the market trends of dithiocarbamates Fungicide?

Current market trends include increased adoption of sustainable farming techniques, innovations in fungicide formulations, and growth in online sales platforms, impacting the distribution and purchase behaviors in the dithiocarbamates fungicide market.