Dna Analysis In The Government Sector Market Report

Published Date: 31 January 2026 | Report Code: dna-analysis-in-the-government-sector

Dna Analysis In The Government Sector Market Size, Share, Industry Trends and Forecast to 2033

This report provides a robust analysis of the DNA analysis market within the government sector from 2023-2033. It includes insights on market size, growth drivers, trends, and forecasts that will shape the industry's landscape over the next decade.

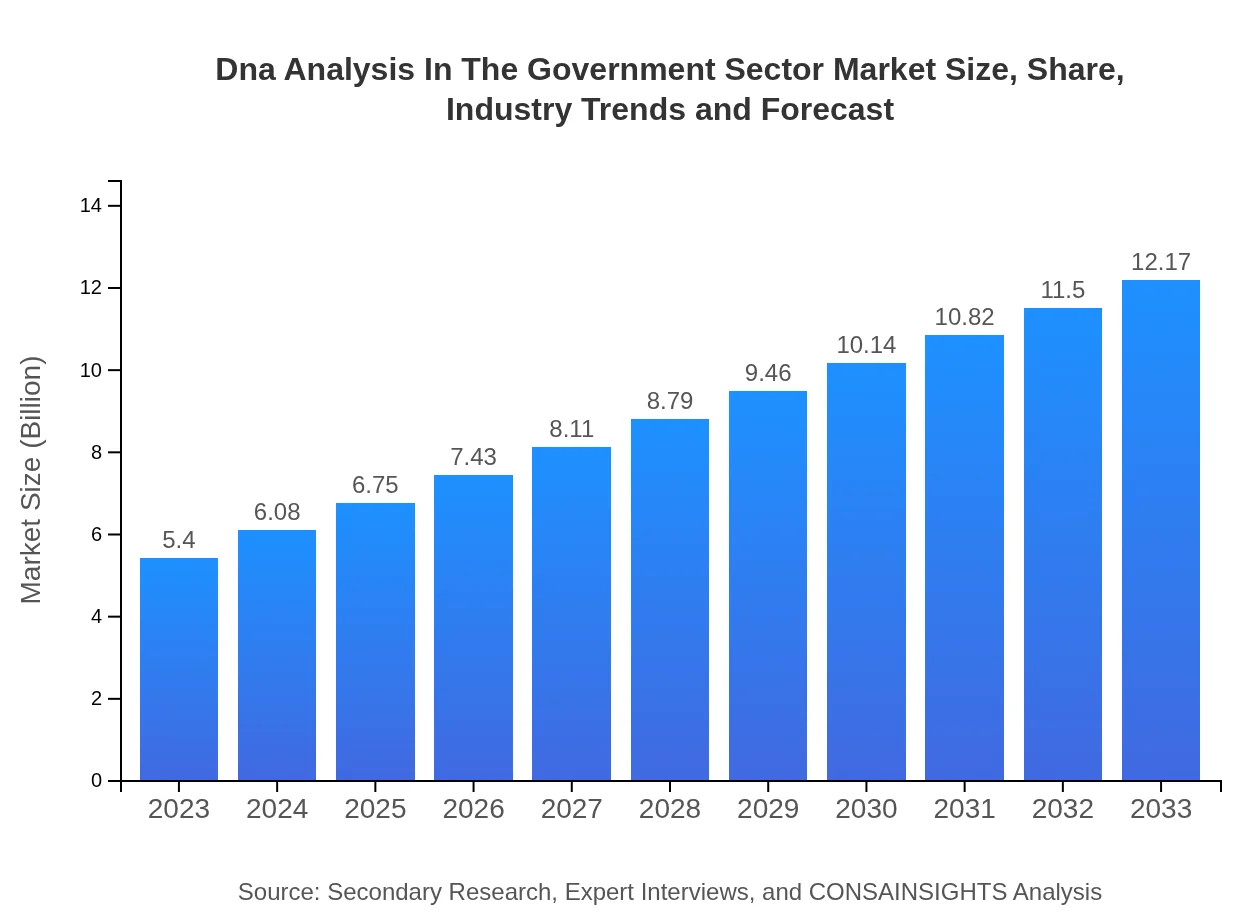

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $12.17 Billion |

| Top Companies | Thermo Fisher Scientific, Illumina, Inc., Agilent Technologies, Roche Diagnostics |

| Last Modified Date | 31 January 2026 |

Dna Analysis In The Government Sector Market Overview

Customize Dna Analysis In The Government Sector Market Report market research report

- ✔ Get in-depth analysis of Dna Analysis In The Government Sector market size, growth, and forecasts.

- ✔ Understand Dna Analysis In The Government Sector's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dna Analysis In The Government Sector

What is the Market Size & CAGR of Dna Analysis In The Government Sector market in 2023?

Dna Analysis In The Government Sector Industry Analysis

Dna Analysis In The Government Sector Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dna Analysis In The Government Sector Market Analysis Report by Region

Europe Dna Analysis In The Government Sector Market Report:

The European market is anticipated to grow from $1.72 billion in 2023 to $3.88 billion by 2033. Government regulations favoring DNA data gathering and the use of DNA evidence in courts are vital growth factors. Additionally, innovations in bioinformatics and genetics research are expected to thrive within governmental agencies.Asia Pacific Dna Analysis In The Government Sector Market Report:

The Asia-Pacific market for DNA analysis in the government sector is evolving, projected to grow from $0.85 billion in 2023 to $1.92 billion by 2033. Increasing government expenditure on health care systems and law enforcement technologies will drive the growth in this region. Enhanced research and development in genomics and public health initiatives further contribute to market expansion.North America Dna Analysis In The Government Sector Market Report:

North America is the largest market, forecasted to rise from $2.03 billion in 2023 to $4.58 billion by 2033. The prevalence of state-of-the-art forensic labs, significant public sector investments, and rising crime rates necessitating DNA analysis contribute to this impressive growth rate.South America Dna Analysis In The Government Sector Market Report:

In South America, the market is expected to increase from $0.48 billion in 2023 to $1.09 billion by 2033. This growth can be attributed to the growing importance of forensic labs in criminal cases and public health programs aimed at combating diseases, paving the way for advanced DNA analysis applications.Middle East & Africa Dna Analysis In The Government Sector Market Report:

In the Middle East and Africa, the market for DNA analysis will increase from $0.31 billion in 2023 to $0.70 billion by 2033. The awareness of public health DNA genomics and initiatives for enhanced border security in certain nations are propelling this market's growth.Tell us your focus area and get a customized research report.

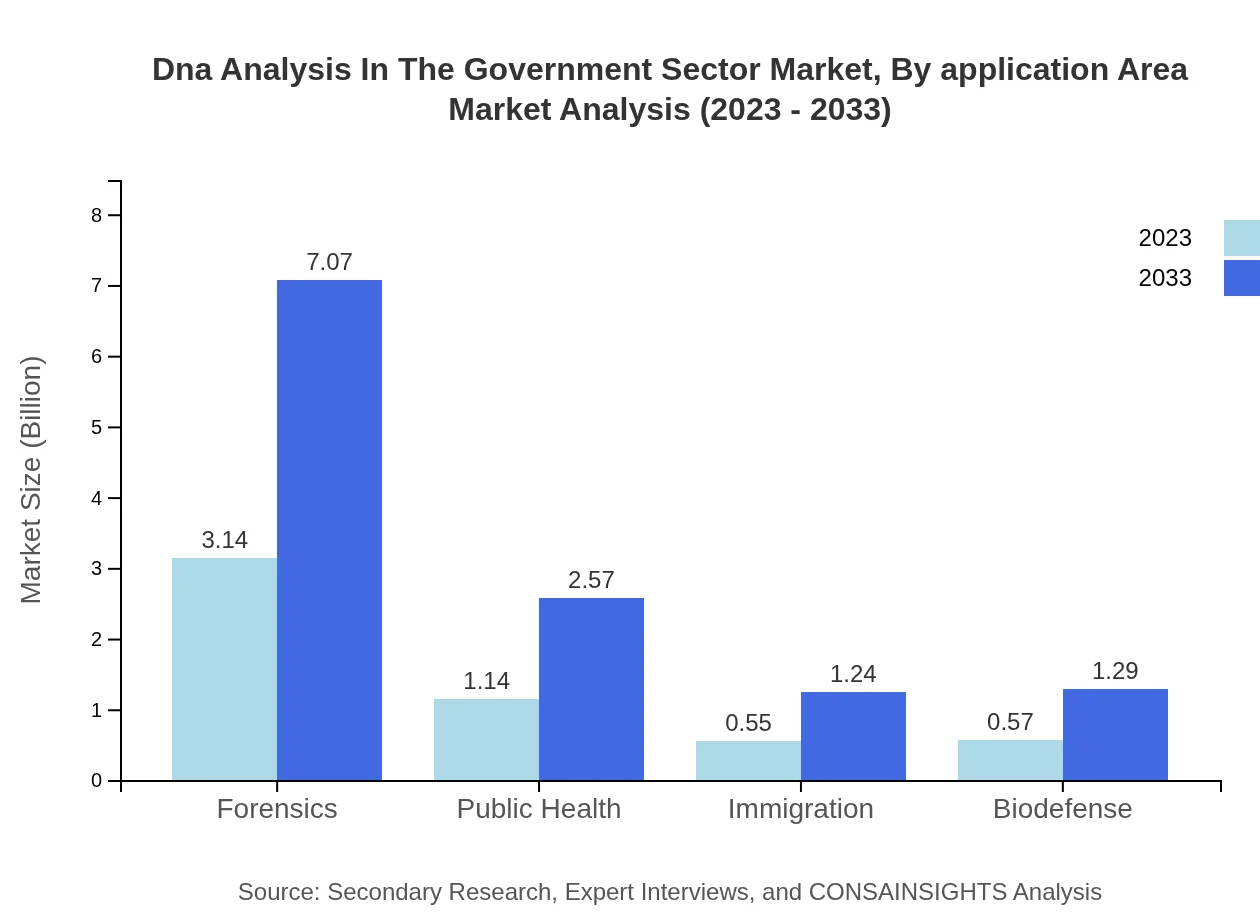

Dna Analysis In The Government Sector Market Analysis By Application Area

The application areas of DNA analysis include: Forensics, holding a market size of $3.14 billion in 2023 with a future projection of $7.07 billion in 2033; Public Health, currently at $1.14 billion projected to grow to $2.57 billion; Immigration, accounting for $0.55 billion and expected to reach $1.24 billion; Biodefense from $0.57 billion to $1.29 billion; and Legislation and Policies worth $4.69 billion, growing to $10.58 billion. Each of these applications plays a crucial role in government functions, ensuring law enforcement and public safety.

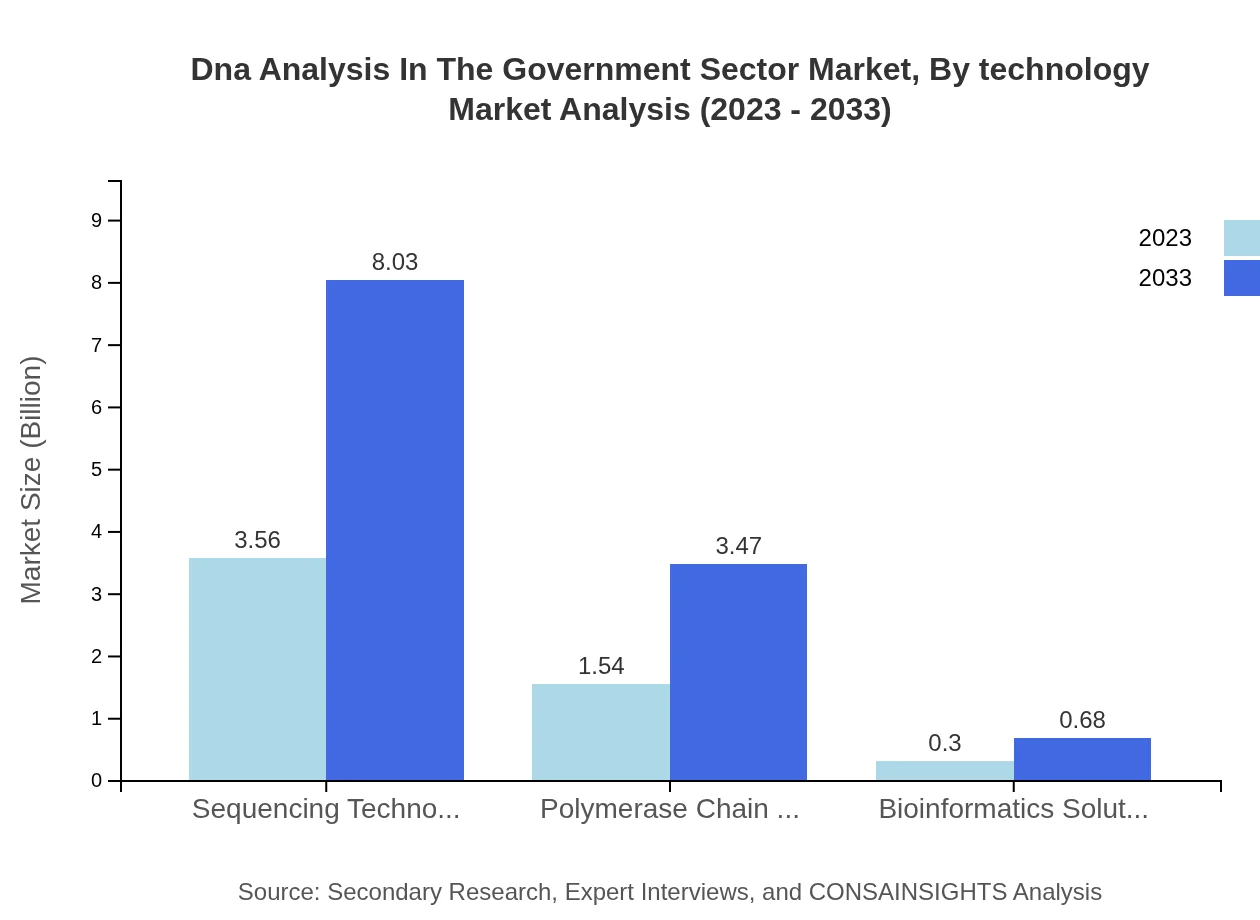

Dna Analysis In The Government Sector Market Analysis By Technology

Technological advancements in DNA analysis are primarily driven by Sequencing Technologies, which represent a market size of $3.56 billion in 2023 and are projected to reach $8.03 billion in 2033. Polymerase Chain Reaction (PCR) technologies will increase from $1.54 billion to $3.47 billion, while Bioinformatics Solutions are forecasted to grow from $0.30 billion to $0.68 billion through analysis improvements and data management solutions.

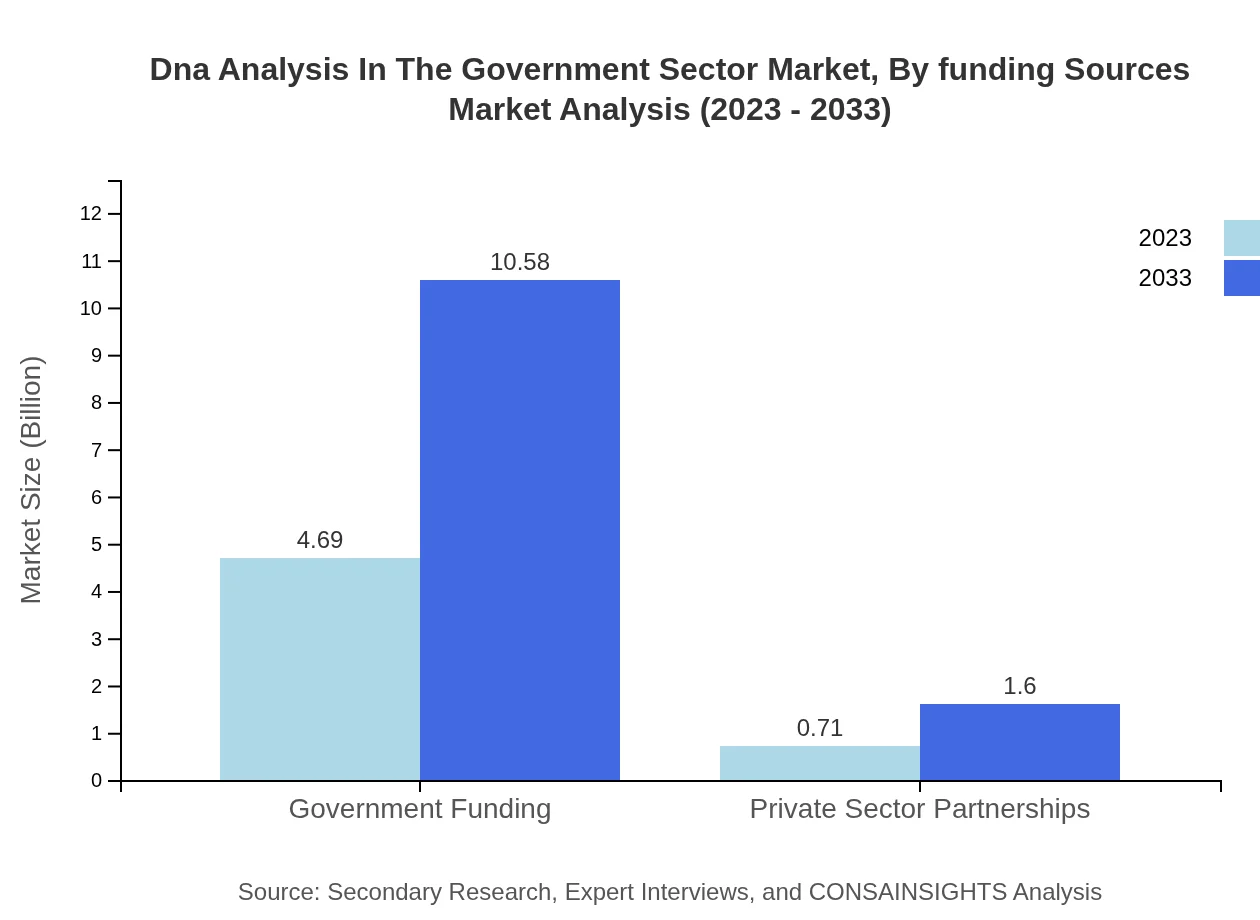

Dna Analysis In The Government Sector Market Analysis By Funding Sources

The governmental funding segment in DNA analysis is substantial, measuring $4.69 billion currently, with an expectation to double to $10.58 billion by 2033. This reinforces the importance of governmental budget allocations aimed at forensic technologies and health improvements. Private sector partnerships, though smaller, are emerging, expected to increase from $0.71 billion to $1.60 billion over the same timeline.

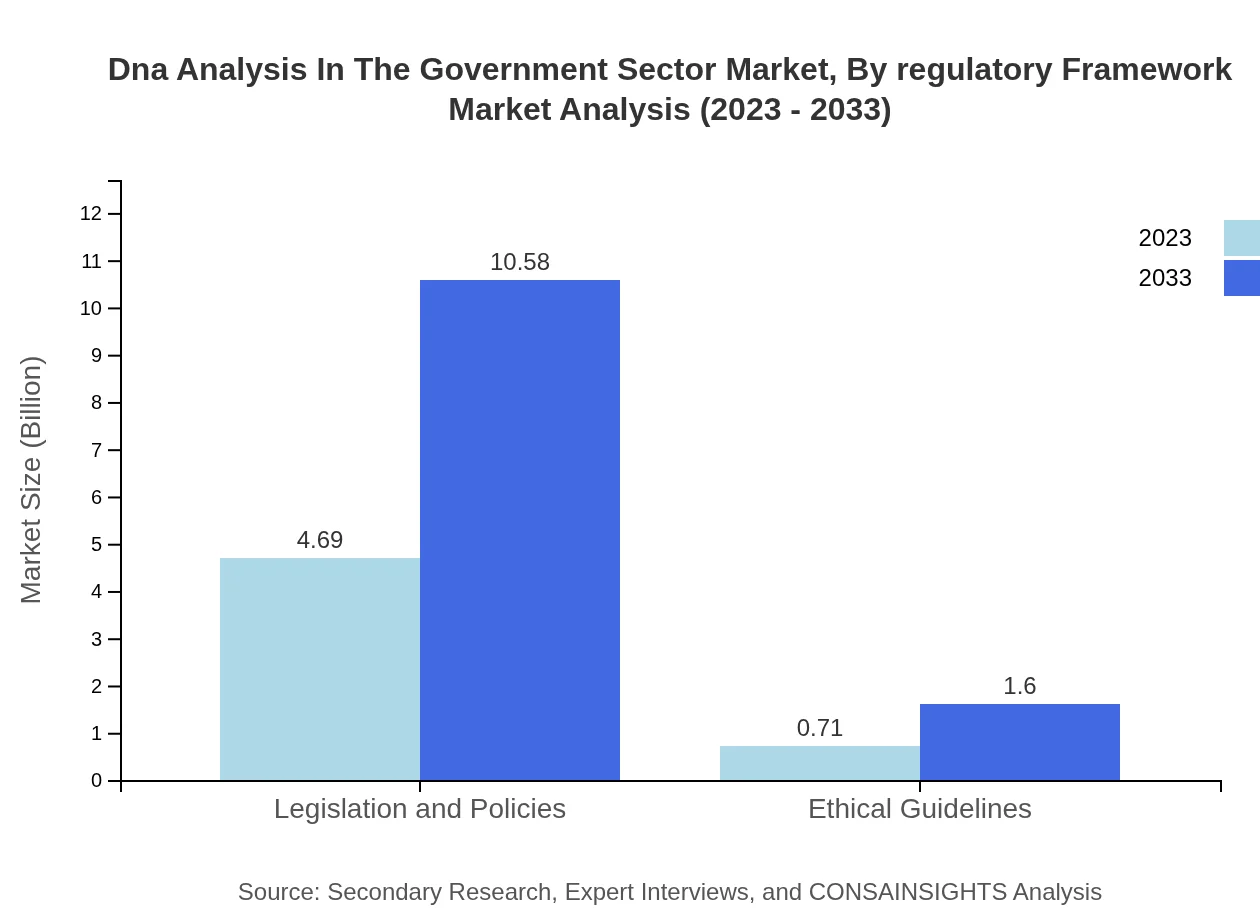

Dna Analysis In The Government Sector Market Analysis By Regulatory Framework

The regulatory framework for DNA analysis is critical in ensuring ethical guidelines, which currently holds a market size of $0.71 billion and is expected to grow to $1.60 billion by 2033. Balancing rigorous analysis with privacy considerations will shape the future landscape of this market, as both governments and institutions navigate sensitive data governance.

Dna Analysis In The Government Sector Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dna Analysis In The Government Sector Industry

Thermo Fisher Scientific:

A leading company in the biotechnological field, Thermo Fisher offers innovative solutions for DNA analysis, focusing on high-throughput sequencing and forensic applications, contributing significantly to enhancing governmental forensic capacities.Illumina, Inc.:

Illumina is renowned for its advanced sequencing technology and bioinformatics solutions. They provide essential tools that support government programs in public health, forensic science, and genetic research, bolstering data analysis efforts.Agilent Technologies:

Agilent provides genomic solutions that help facilitate DNA analysis in various government applications, including environmental monitoring and public health initiatives, ensuring regulatory compliance and health safety.Roche Diagnostics:

Roche is recognized for its contributions to diagnostics and life science research, playing a pivotal role in government sectors for precise DNA testing in healthcare and forensic studies.We're grateful to work with incredible clients.

FAQs

What is the market size of dna Analysis In The Government Sector?

The global DNA analysis market in the government sector is estimated to be approximately $5.4 billion in 2023, with a robust compound annual growth rate (CAGR) of 8.2% projected through 2033.

What are the key market players or companies in this dna Analysis In The Government Sector industry?

Key players in the DNA analysis market include companies specializing in forensic technologies, genomics, and bioinformatics solutions, focusing on government contracts for law enforcement, public health, and defense applications.

What are the primary factors driving the growth in the dna Analysis In The Government Sector industry?

Growth factors include increasing government funding for forensic technologies, rising demand for bioinformatics in public health, and enhanced regulations requiring DNA testing in immigration and biodefense sectors.

Which region is the fastest Growing in the dna Analysis In The Government Sector?

North America is the fastest-growing region, with market size expected to rise from $2.03 billion in 2023 to $4.58 billion by 2033, driven by high investments in government funding and advanced forensic technologies.

Does ConsaInsights provide customized market report data for the dna Analysis In The Government Sector industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and sectors within the DNA analysis in government, ensuring clients receive relevant insights for strategic decision-making.

What deliverables can I expect from this dna Analysis In The Government Sector market research project?

Expect comprehensive deliverables including detailed market analysis, segment-by-segment data, regional insights, competitive landscape overviews, and strategic recommendations to guide investment and operational strategies.

What are the market trends of dna Analysis In The Government Sector?

Trends include the proliferation of sequencing technologies and PCR advancements, with the sequencing technology segment projected to grow from $3.56 billion in 2023 to $8.03 billion by 2033, highlighting a significant shift towards precision in government-funded DNA applications.