Dna Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: dna-diagnostics

Dna Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an in-depth analysis of the DNA diagnostics sector, including market trends, size forecasts from 2023 to 2033, and regional insights. It aims to equip stakeholders with valuable information to navigate the evolving landscape of DNA diagnostics.

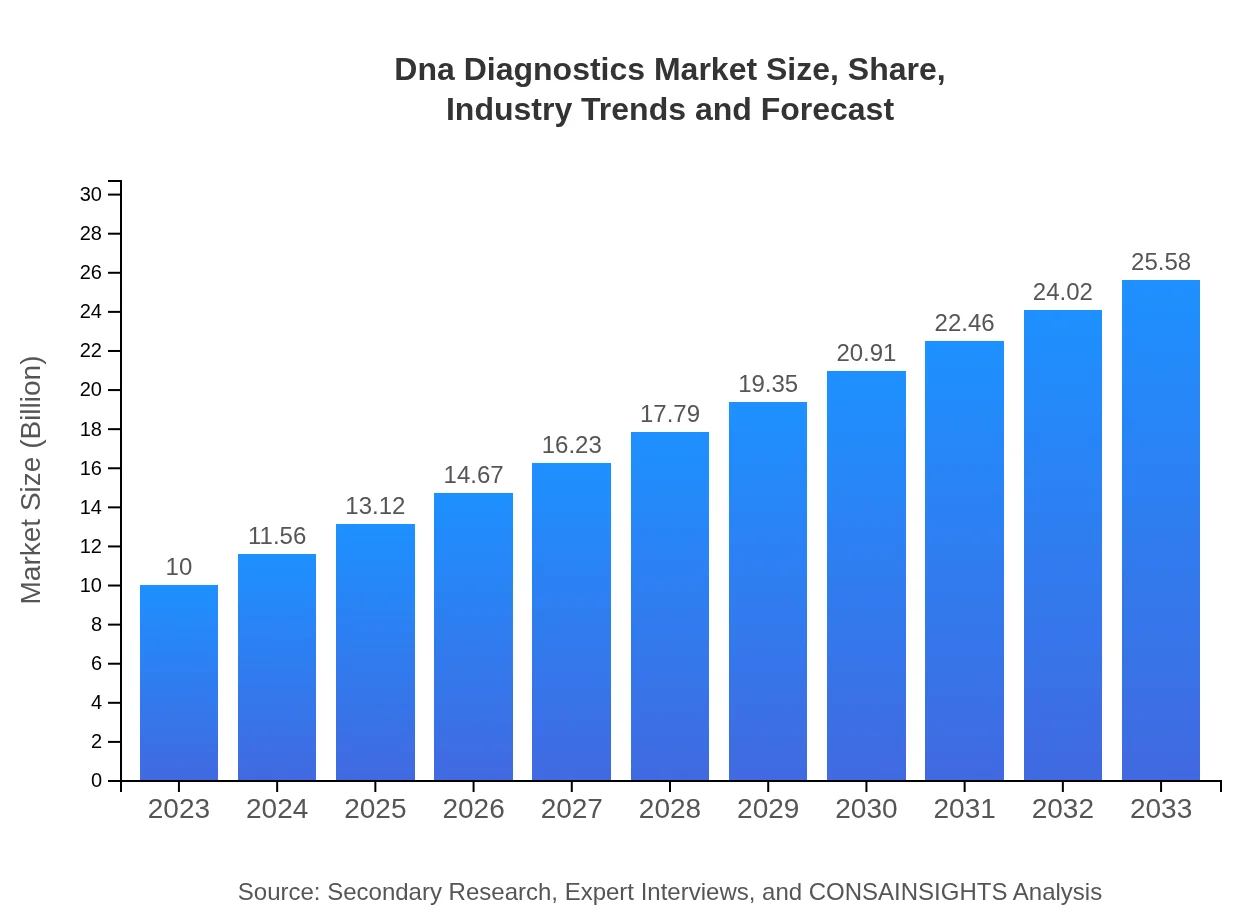

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $25.58 Billion |

| Top Companies | Illumina, Inc., Thermo Fisher Scientific Inc., Roche Diagnostics, QIAGEN N.V., Abbott Laboratories |

| Last Modified Date | 31 January 2026 |

Dna Diagnostics Market Overview

Customize Dna Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Dna Diagnostics market size, growth, and forecasts.

- ✔ Understand Dna Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dna Diagnostics

What is the Market Size & CAGR of Dna Diagnostics market in 2023?

Dna Diagnostics Industry Analysis

Dna Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dna Diagnostics Market Analysis Report by Region

Europe Dna Diagnostics Market Report:

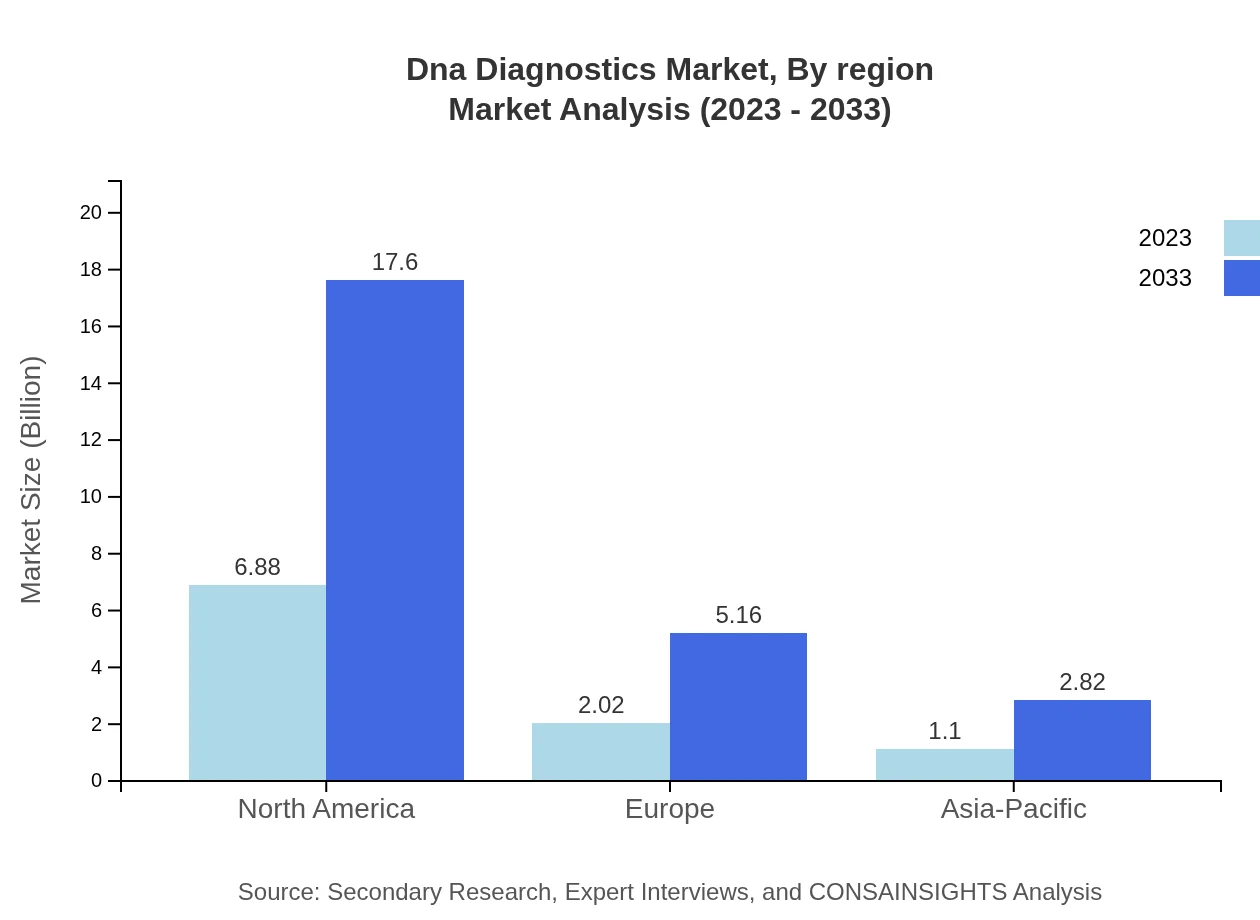

Europe's market size is anticipated to grow from $2.42 billion in 2023 to $6.18 billion by 2033. The region is witnessing extensive adoption of next-generation sequencing and robust regulatory frameworks that encourage innovation in genetic testing.Asia Pacific Dna Diagnostics Market Report:

In Asia-Pacific, the market is expected to grow from $2.15 billion in 2023 to $5.49 billion by 2033, driven by increasing investments in healthcare infrastructure and rising disposable incomes. Countries like China and India are leading this growth due to their vast populations and growing awareness of genetic testing.North America Dna Diagnostics Market Report:

North America remains a key player in the DNA diagnostics market, with projected growth from $3.47 billion in 2023 to $8.88 billion by 2033. High healthcare spending, advanced healthcare infrastructure, and extensive R&D investments in genetic testing technologies drive this region's dominance.South America Dna Diagnostics Market Report:

The South American market is projected to expand from $0.71 billion in 2023 to $1.81 billion by 2033. The growth is fueled by improvements in healthcare access and the rising focus on personalized healthcare solutions as governments invest more in health-related initiatives.Middle East & Africa Dna Diagnostics Market Report:

In the Middle East and Africa, the market is expected to grow from $1.26 billion in 2023 to $3.21 billion by 2033. This growth is attributed to increasing awareness regarding genetic disorders and the expansion of healthcare services in this region.Tell us your focus area and get a customized research report.

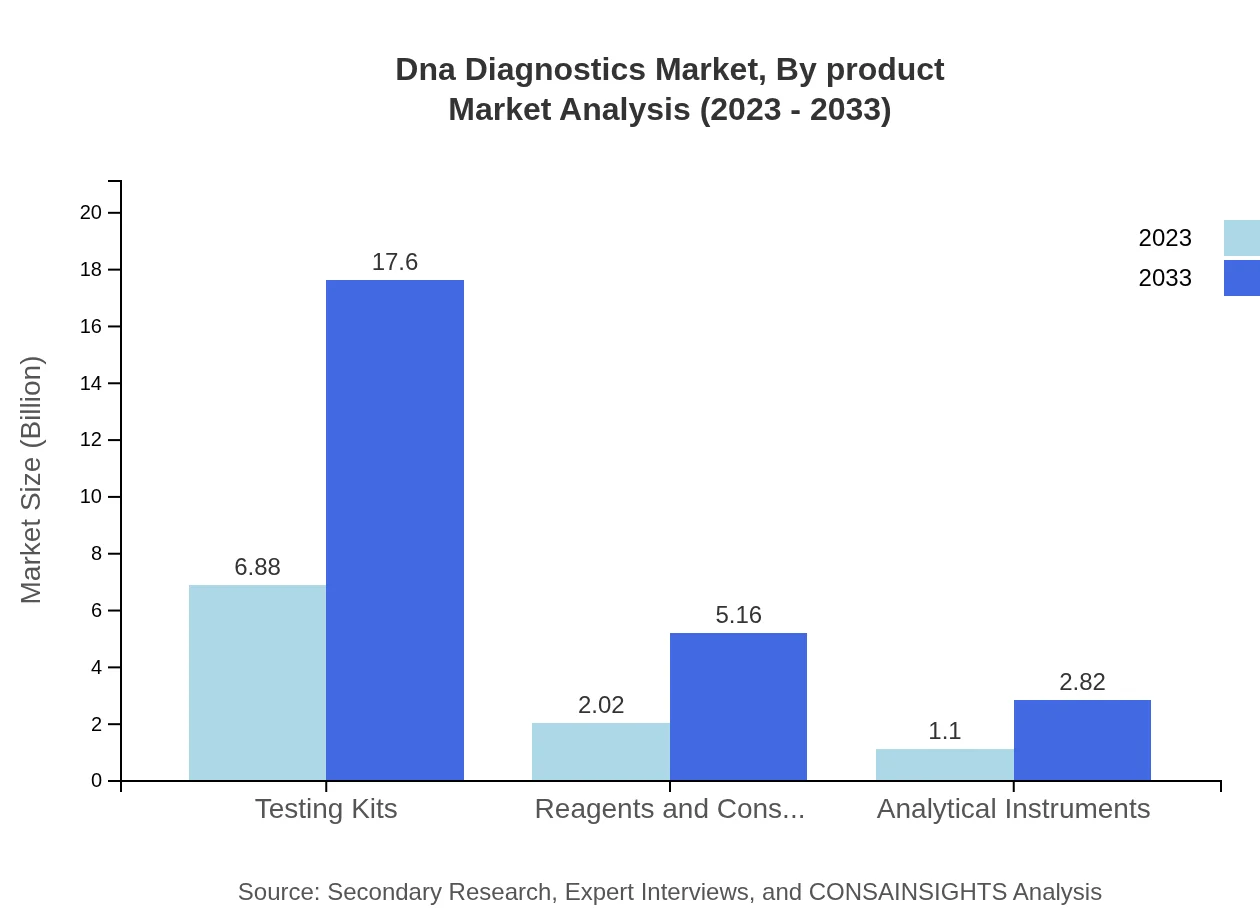

Dna Diagnostics Market Analysis By Product

The DNA diagnostics market by product includes testing kits, reagents and consumables, and analytical instruments. Testing kits are projected to dominate the market, growing from $6.88 billion in 2023 to $17.60 billion by 2033, making up 68.79% share in both years due to their essential role in clinical diagnostics and research laboratories.

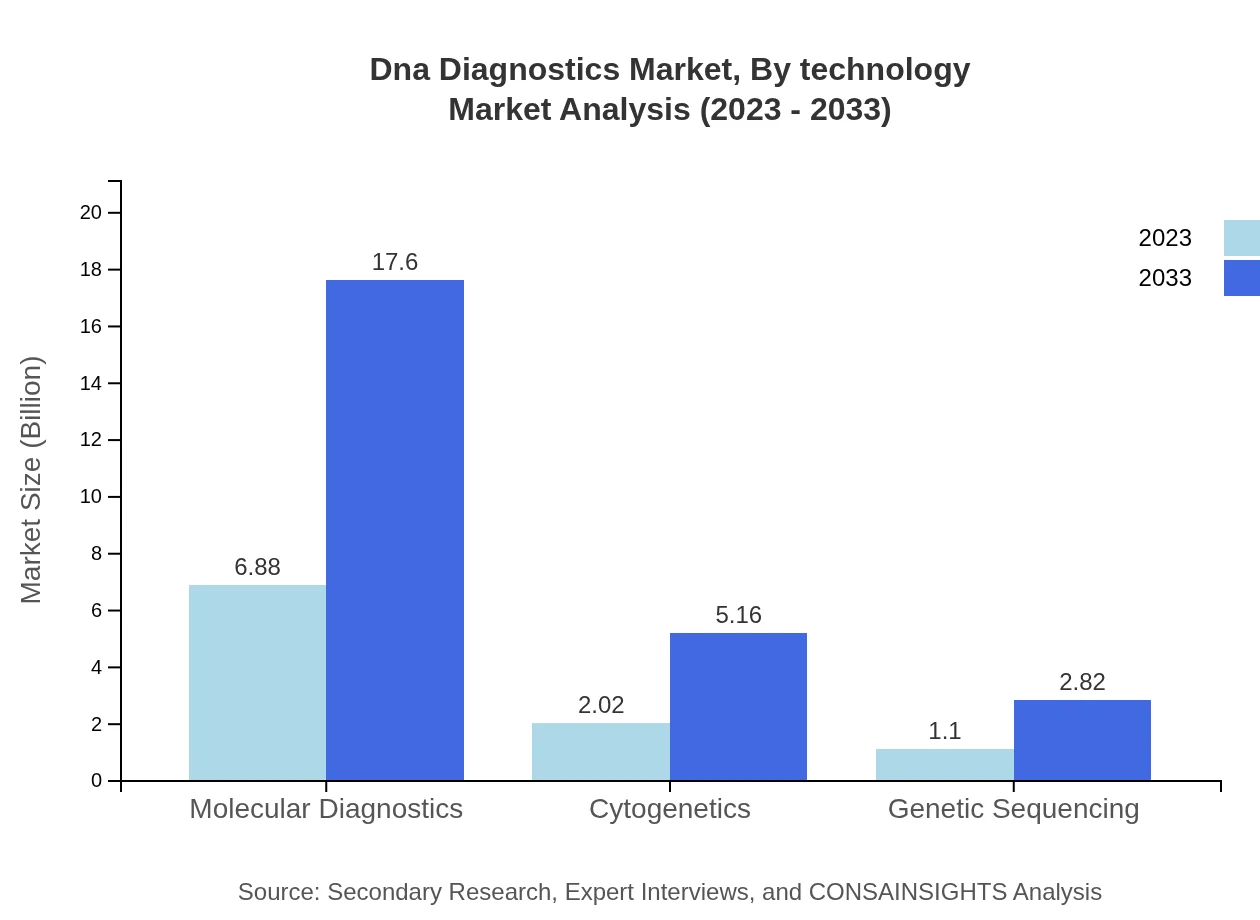

Dna Diagnostics Market Analysis By Technology

In terms of technology, the market includes methods like PCR, NGS, and microarrays. PCR remains the frontrunner, while NGS is rapidly gaining popularity. The market for PCR technologies is forecast to significantly grow, particularly in oncological diagnostics and genetic testing applications.

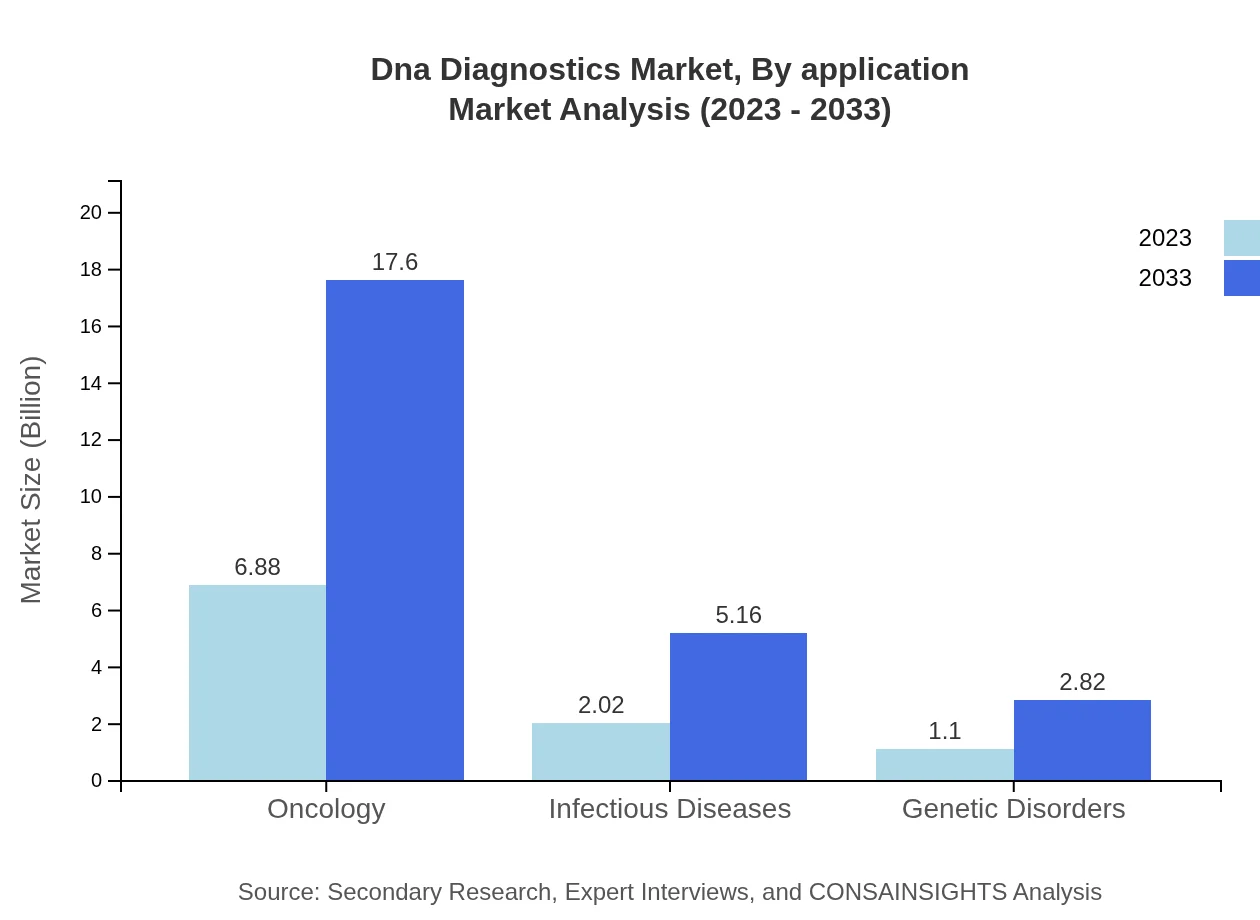

Dna Diagnostics Market Analysis By Application

Key applications such as oncology, infectious diseases, and genetic disorders drive the market. Oncology has a substantial share, growing from $6.88 billion in 2023 to $17.60 billion by 2033, representing 68.79% of the total market, reflecting the critical role of genetic testing in cancer diagnosis and treatment.

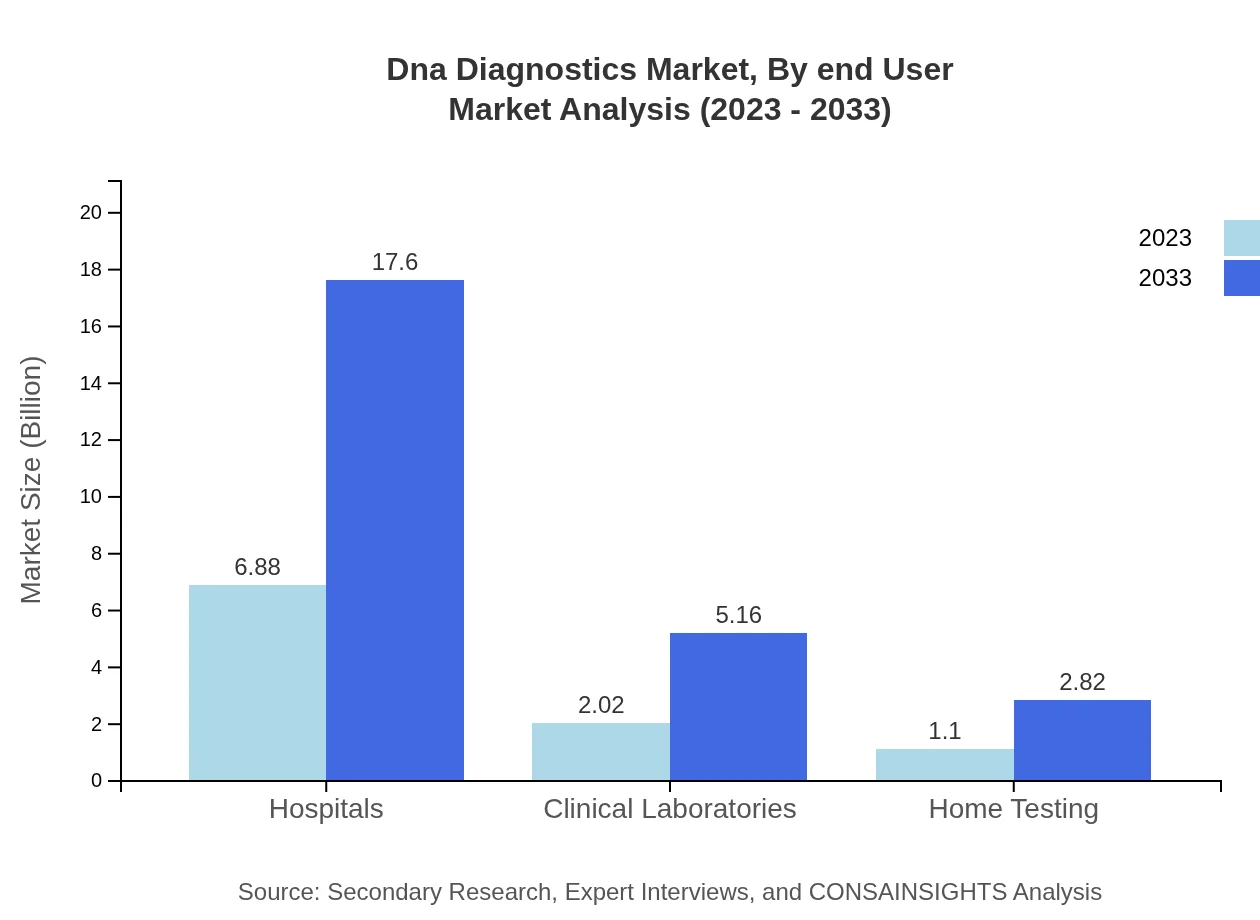

Dna Diagnostics Market Analysis By End User

Significant end-users in the DNA diagnostics market include hospitals, clinical laboratories, and home testing. Hospitals hold the majority share, with expectations of growth from $6.88 billion in 2023 to $17.60 billion by 2033, indicating their reliance on advanced diagnostic tools for patient care.

Dna Diagnostics Market Analysis By Region

The regional market analysis shows North America leading with a size of $3.47 billion in 2023, followed by Europe ($2.42 billion) and Asia-Pacific ($2.15 billion). Each region's unique healthcare challenges and advancements contribute to their growth trajectories in the market.

Dna Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dna Diagnostics Industry

Illumina, Inc.:

Illumina is a global leader in DNA sequencing technologies and is committed to advancing genomics, improving health outcomes through innovative solutions.Thermo Fisher Scientific Inc.:

Thermo Fisher is a prominent player known for its wide range of life sciences solutions, including genetic testing and molecular biology products, enhancing research and clinical workflows.Roche Diagnostics:

Roche Diagnostics develops diagnostic tools and tests aimed at improving disease management, including advanced applications in genetic testing and oncology.QIAGEN N.V.:

QIAGEN specializes in sample and assay technologies, particularly in molecular diagnostics, offering a variety of testing solutions for clinical applications.Abbott Laboratories:

Abbott is a diversified healthcare company that provides comprehensive diagnostic products, including innovative genetic testing technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of DNA diagnostics?

The DNA diagnostics market is currently valued at $10 billion in 2023 and is projected to grow at a CAGR of 9.5% till 2033, indicating robust expansion due to increasing genetic testing demand.

What are the key market players or companies in this DNA diagnostics industry?

Key players in the DNA diagnostics market include Roche, Illumina, Thermo Fisher Scientific, Qiagen, and Agilent Technologies, which are noted for their innovative products and significant market share.

What are the primary factors driving the growth in the DNA diagnostics industry?

Growth drivers for the DNA diagnostics market include rising incidences of genetic disorders, advancements in genomic technologies, increasing public awareness, and higher investments in R&D from public and private sectors.

Which region is the fastest Growing in the DNA diagnostics?

The fastest-growing region in the DNA diagnostics market is Europe, projected to expand from $2.42 billion in 2023 to $6.18 billion by 2033, driven by increasing healthcare investments and innovation in genetic testing.

Does ConsaInsights provide customized market report data for the DNA diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the DNA diagnostics industry, ensuring relevant insights aligned with unique business objectives.

What deliverables can I expect from this DNA diagnostics market research project?

Deliverables from the DNA diagnostics market research project include detailed market analysis, competitive landscape, regional breakdowns, segment data, trend analysis, and actionable insights for decision-making.

What are the market trends of DNA diagnostics?

Current trends in the DNA diagnostics market include a rise in personalized medicine, increasing use of liquid biopsies, growth of home testing services, and advancements in next-generation sequencing technologies.