Document Capture Software Market Report

Published Date: 31 January 2026 | Report Code: document-capture-software

Document Capture Software Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Document Capture Software industry from 2023 to 2033, focusing on market size, growth trends, segmentation, technology advancements, and regional insights relevant to stakeholders and decision-makers.

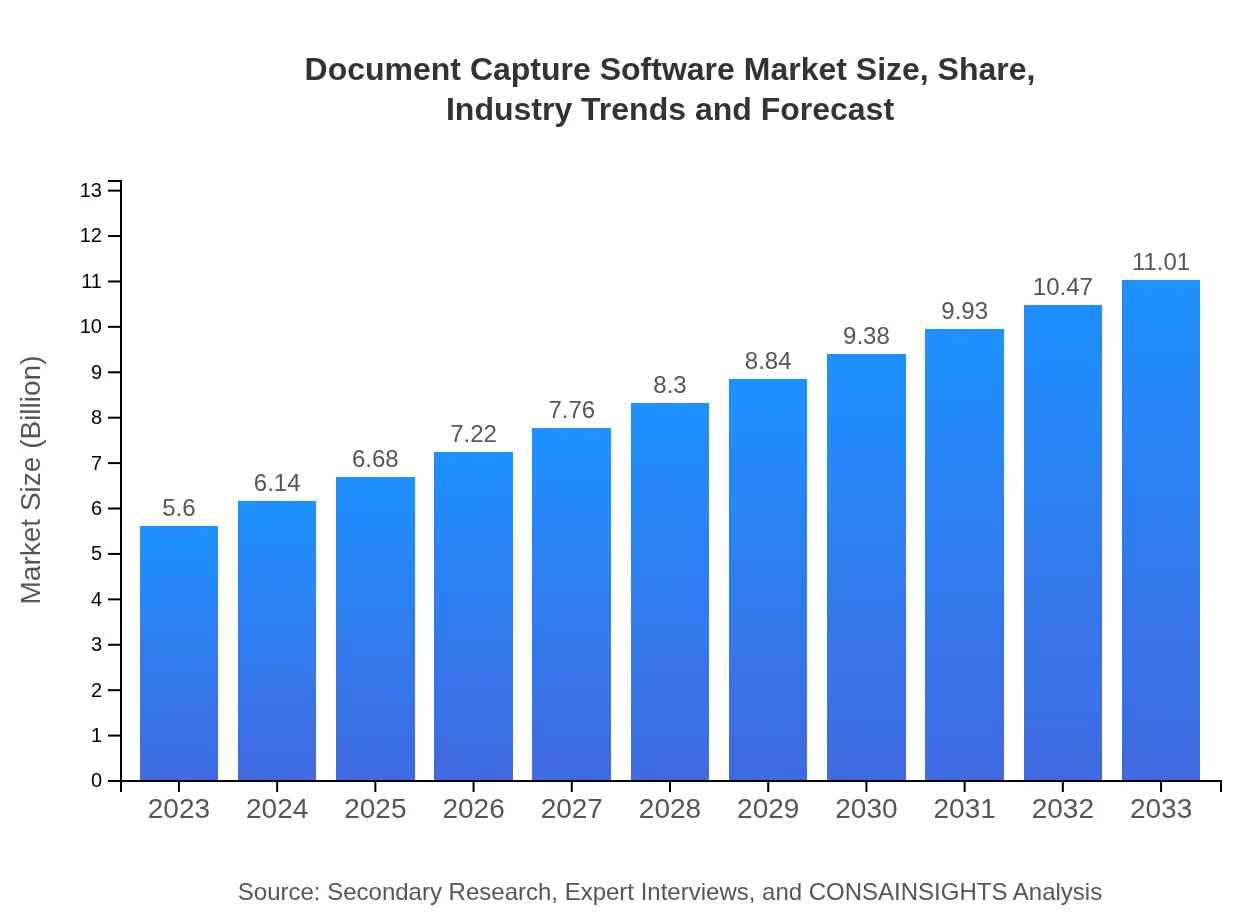

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Kofax, ABBYY, Nuance Communications, OpenText, DocuWare |

| Last Modified Date | 31 January 2026 |

Document Capture Software Market Overview

Customize Document Capture Software Market Report market research report

- ✔ Get in-depth analysis of Document Capture Software market size, growth, and forecasts.

- ✔ Understand Document Capture Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Document Capture Software

What is the Market Size & CAGR of Document Capture Software market in 2023 and 2033?

Document Capture Software Industry Analysis

Document Capture Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Document Capture Software Market Analysis Report by Region

Europe Document Capture Software Market Report:

In Europe, the market is estimated to expand from USD 1.84 billion in 2023 to USD 3.61 billion by 2033, with stringent regulatory standards driving the demand for sophisticated document capture solutions across various industries.Asia Pacific Document Capture Software Market Report:

In the Asia Pacific region, the Document Capture Software market size is projected to grow from USD 1.03 billion in 2023 to USD 2.03 billion by 2033, driven by rapid digital adoption in countries like China and India, alongside increasing investments in automation technologies.North America Document Capture Software Market Report:

North America remains a leading market for Document Capture Software, with an expected growth from USD 1.90 billion in 2023 to USD 3.74 billion by 2033. The region benefits from a well-established IT ecosystem and increasing compliance requirements.South America Document Capture Software Market Report:

The South American market is anticipated to grow from USD 0.17 billion in 2023 to USD 0.33 billion by 2033, propelled by improvements in IT infrastructure and growing awareness of document management software benefits.Middle East & Africa Document Capture Software Market Report:

The Middle East and Africa market is expected to grow from USD 0.66 billion in 2023 to USD 1.30 billion by 2033, supported by increasing investments in smart technology and the push for digital transformation in various sectors.Tell us your focus area and get a customized research report.

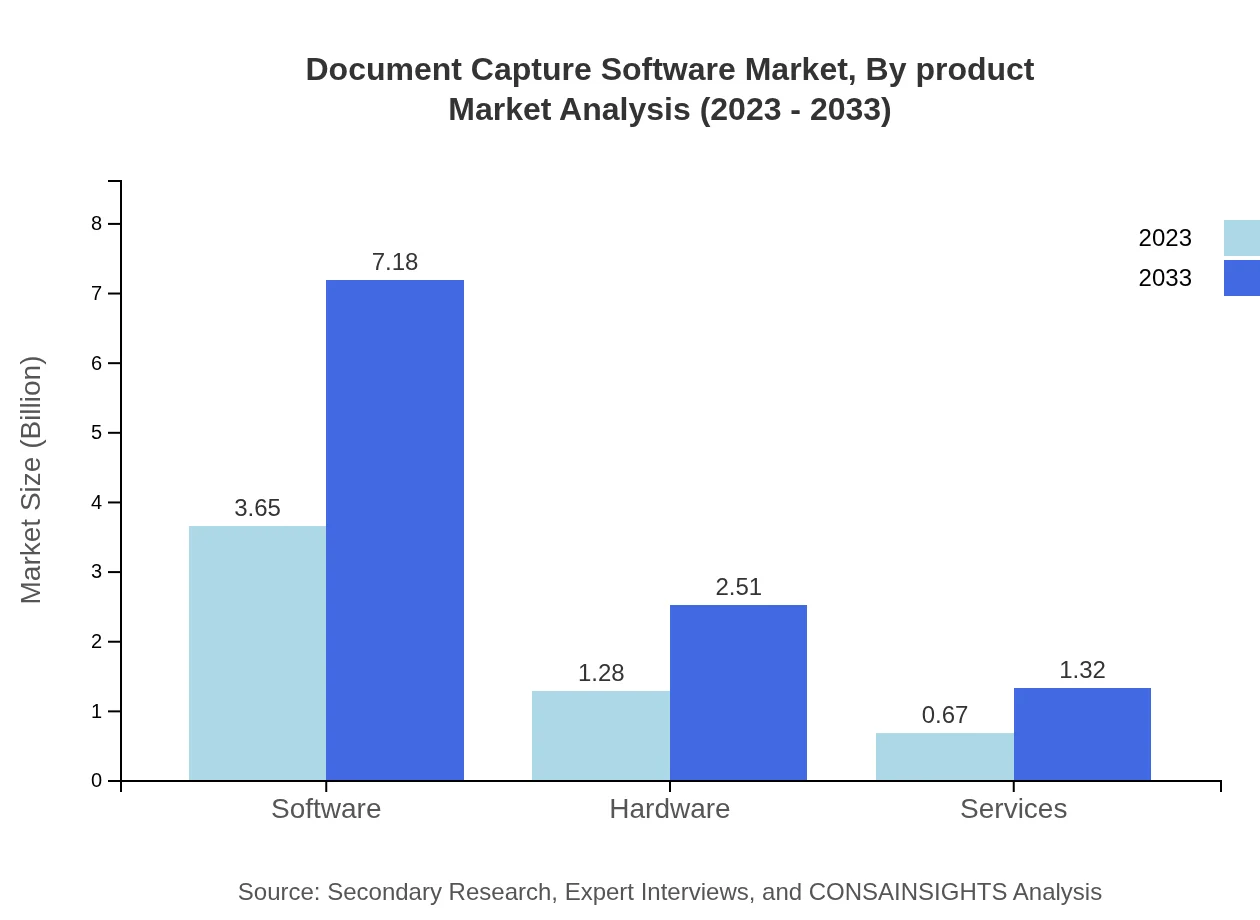

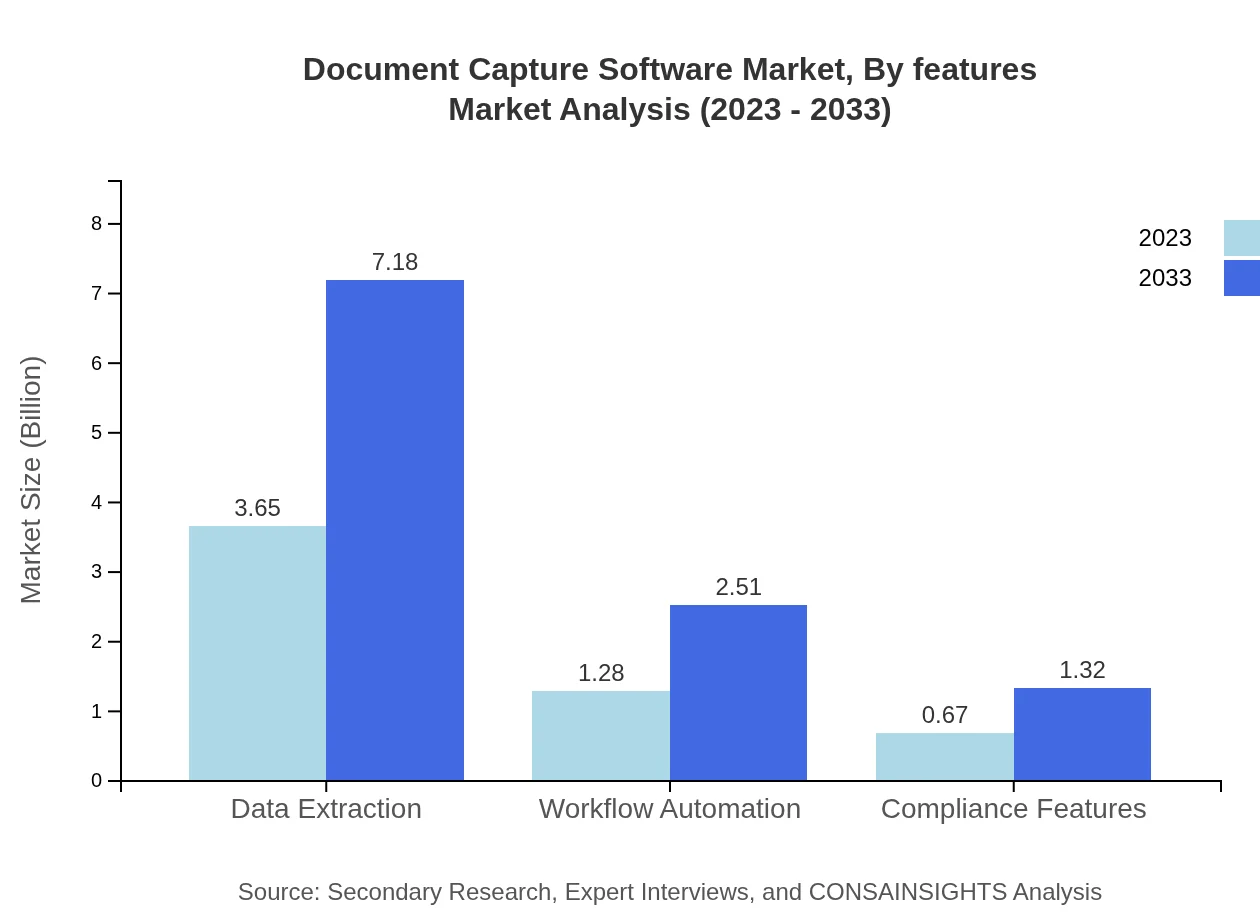

Document Capture Software Market Analysis By Product

The Document Capture Software market is primarily divided into three segments: software, hardware, and services. As of 2023, software holds the largest market share with approximately USD 3.65 billion, reflecting a growing trend in dependency on software solutions for document capture and management. This segment is expected to reach USD 7.18 billion by 2033. Hardware solutions contribute around USD 1.28 billion in 2023, growing to USD 2.51 billion by 2033. Services account for USD 0.67 billion in 2023, projected to reach USD 1.32 billion by 2033, highlighting the growing importance of support and consulting services in the market.

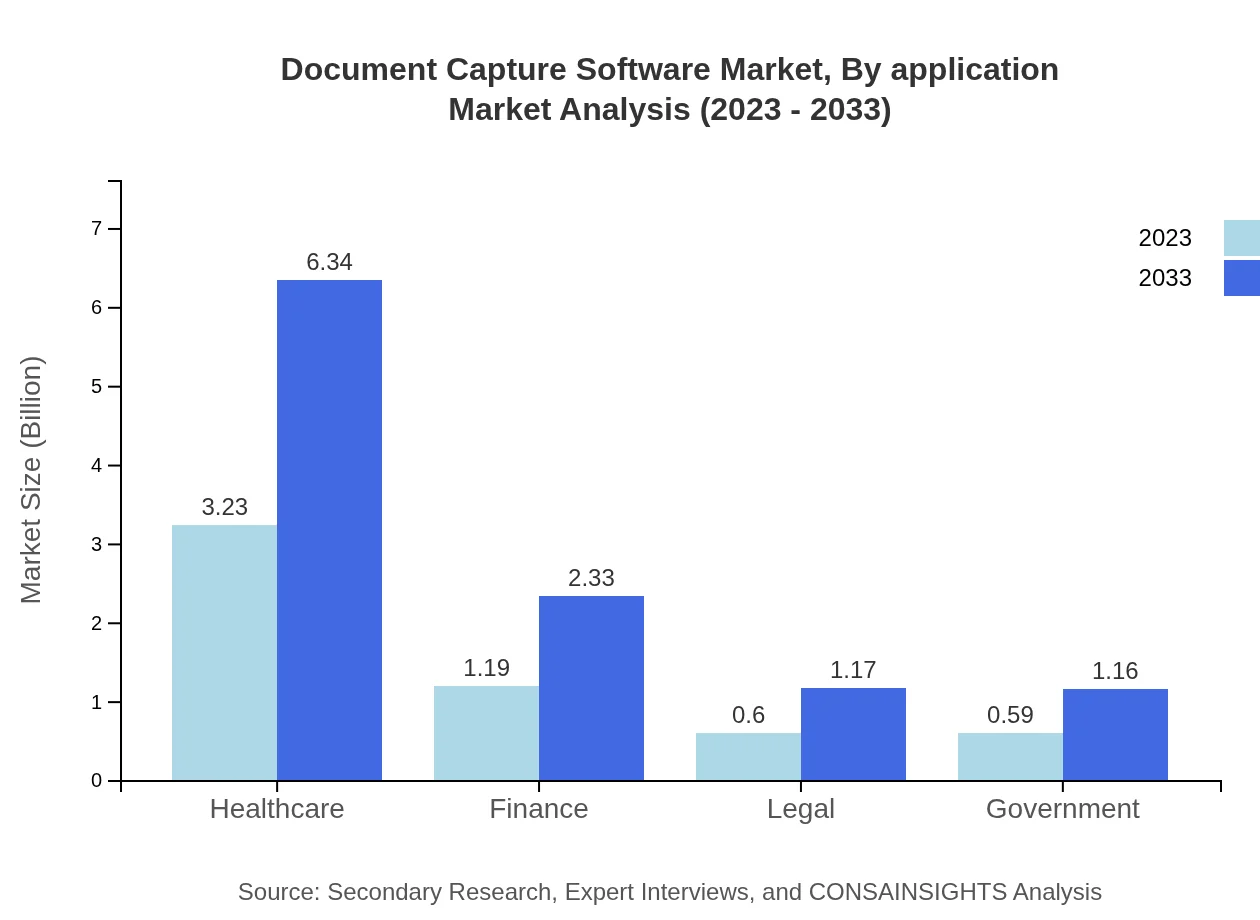

Document Capture Software Market Analysis By Application

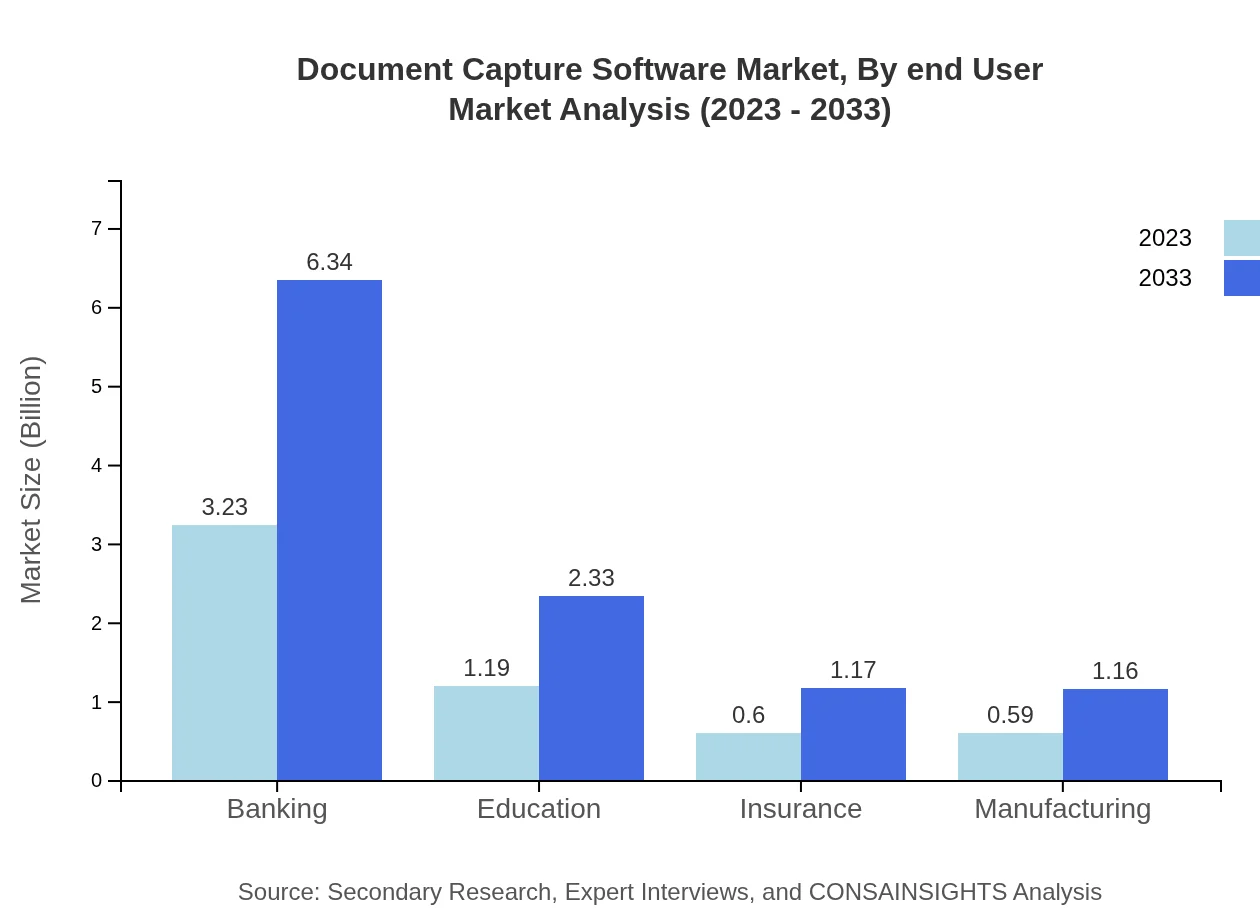

The application segment showcases diverse end-user industries. Banking is a significant contributor, sharing a market size of USD 3.23 billion in 2023, projected to reach USD 6.34 billion by 2033. The education sector follows with an expected growth from USD 1.19 billion in 2023 to USD 2.33 billion by 2033. Other notable sectors include healthcare, finance, insurance, and government, all demonstrating strong reliance on Document Capture Software to enhance efficiencies and compliance.

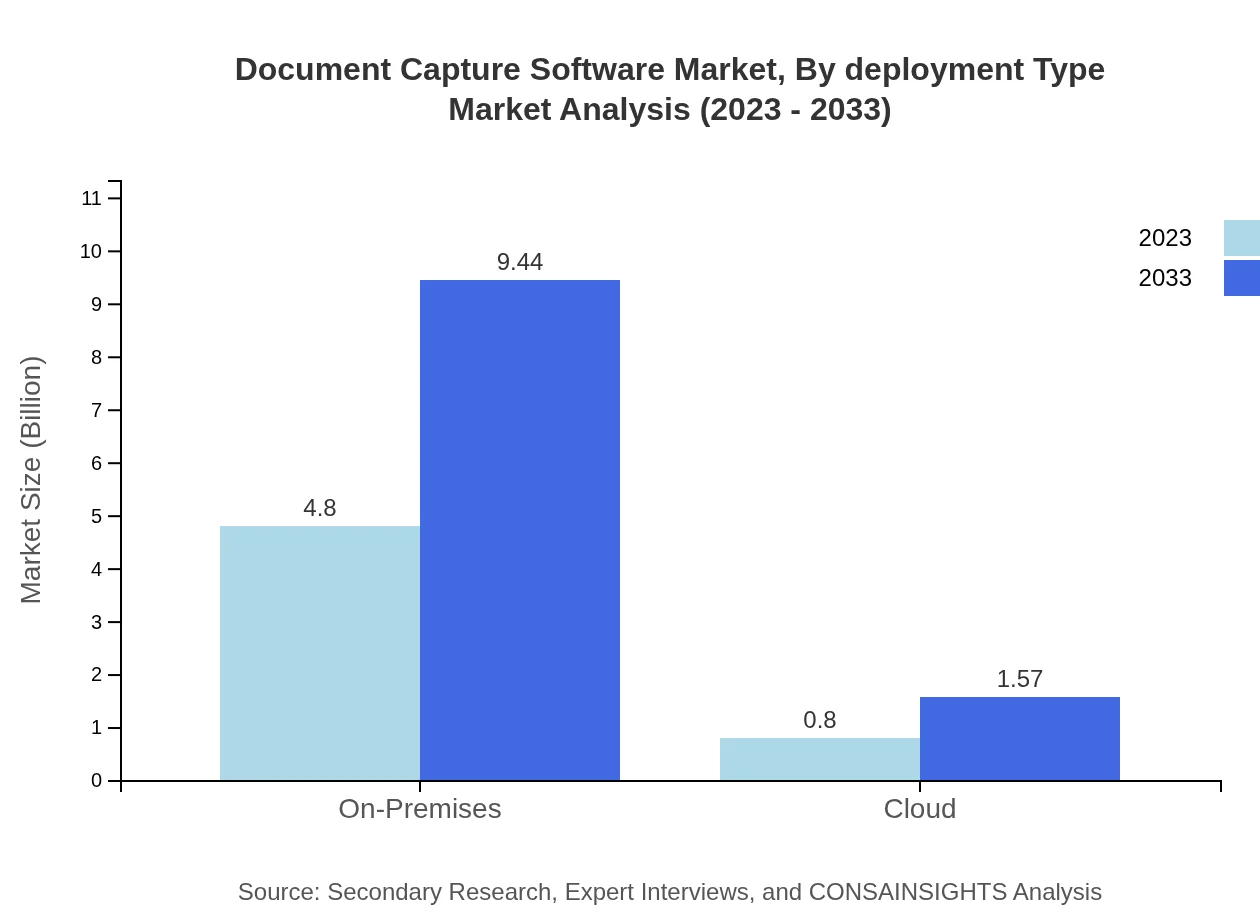

Document Capture Software Market Analysis By Deployment Type

The deployment type analysis reveals a strong preference for on-premises solutions, currently valued at USD 4.80 billion and forecasted to grow to USD 9.44 billion by 2033. This preference is driven by organizations due to data security concerns. On the other hand, cloud offerings, valued at USD 0.80 billion in 2023, are anticipated to grow significantly, reaching USD 1.57 billion by 2033, as more businesses transition to hybrid environments for flexibility and scalability.

Document Capture Software Market Analysis By End User

End-user analysis highlights critical sectors such as banking and healthcare, which constitute a significant portion of the market. Banking alone commands about 57.6% share in 2023, reflecting its reliance on efficient document processing. Healthcare accounts for 57.6% in the same year, evidencing the sector's pressing need for robust data handling solutions. Other sectors like legal and government show continued investment in document capture technologies to improve service delivery.

Document Capture Software Market Analysis By Features

Key features of Document Capture Software include data extraction, workflow automation, and compliance capabilities. Data extraction dominates with a significant market share of 65.21% in 2023, reflecting its essential role in capturing and processing information. Workflow automation serves as the next critical feature, with a share of 22.81%, allowing businesses to streamline operations effectively. Compliance features attract 11.98% of the market, particularly among industries facing rigorous regulatory demands. These feature segments are pivotal to understanding the comprehensive needs of users across different sectors.

Document Capture Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Document Capture Software Industry

Kofax:

Kofax is renowned for its innovative automation software solutions, providing advanced document capture capabilities that enhance workflow efficiency and productivity for enterprises globally.ABBYY:

ABBYY specializes in smart data capture and document processing solutions, leveraging AI technologies to empower organizations in extracting valuable insights from unstructured data.Nuance Communications:

Nuance offers a broad range of document management and capture solutions, focusing on intelligent automation and security features to meet diverse business needs.OpenText:

OpenText delivers enterprise information management solutions, including document capture technologies that support digital transformation and improve compliance across various industries.DocuWare:

DocuWare provides cloud-based document management and capture solutions, prioritizing ease of use and integration capabilities for businesses looking to streamline their operations.We're grateful to work with incredible clients.

FAQs

What is the market size of document capture software?

The document capture software market is valued at approximately $5.6 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 6.8% through 2033, reflecting significant growth and expansion opportunities in this segment.

What are the key market players or companies in this document capture software industry?

Key players in the document capture software industry include major enterprises that provide comprehensive solutions to enhance data management and processing. These players are pivotal in driving innovation and competition within the market.

What are the primary factors driving the growth in the document capture software industry?

The growth in the document capture software industry is driven by increasing automation demands, the need for efficient data management solutions, and technological advancements that simplify document processing across various sectors.

Which region is the fastest Growing in the document capture software?

The document capture software market shows rapid growth in regions like Europe, projected to expand from $1.84 billion in 2023 to $3.61 billion by 2033, followed by Asia Pacific, which is expected to grow from $1.03 billion to $2.03 billion.

Does ConsaInsights provide customized market report data for the document capture software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the document capture software industry, enabling businesses to gain insights relevant to their strategic objectives and market conditions.

What deliverables can I expect from this document capture software market research project?

Expect comprehensive deliverables such as detailed market analysis, segmentation data, competitive landscape insights, and growth forecasts to assist in strategic decision-making within the document capture software industry.

What are the market trends of document capture software?

Current trends in the document capture software market include increased adoption of cloud solutions, the integration of artificial intelligence for enhanced data extraction, and growing emphasis on compliance and security features within software offerings.