Document Scanner Market Report

Published Date: 31 January 2026 | Report Code: document-scanner

Document Scanner Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Document Scanner market, covering market trends, segmentation, technology advancements, and regional insights. The forecast period spans from 2023 to 2033, offering valuable predictions for industry stakeholders.

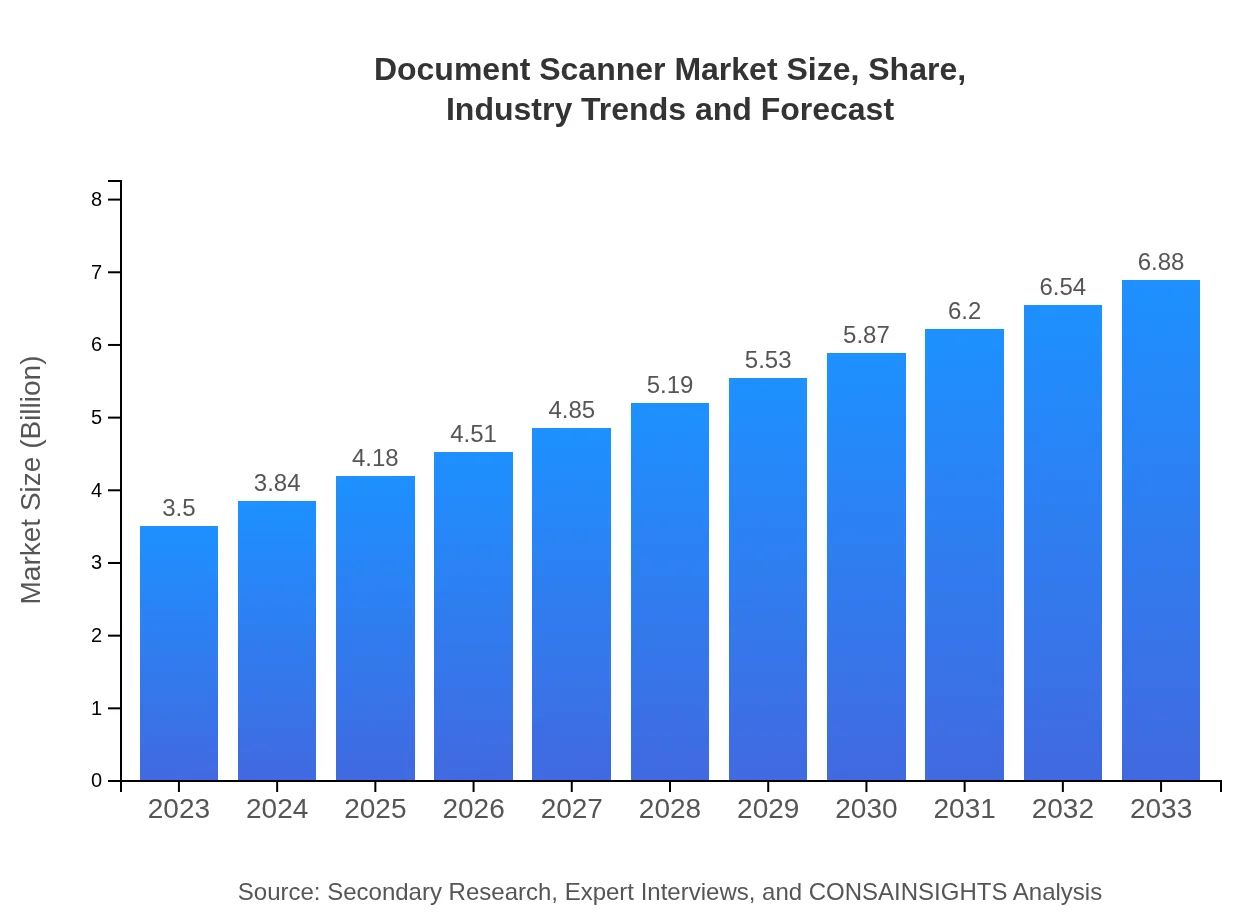

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Fujitsu, Canon, Brother, Epson, Xerox |

| Last Modified Date | 31 January 2026 |

Document Scanner Market Overview

Customize Document Scanner Market Report market research report

- ✔ Get in-depth analysis of Document Scanner market size, growth, and forecasts.

- ✔ Understand Document Scanner's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Document Scanner

What is the Market Size & CAGR of Document Scanner market in 2023?

Document Scanner Industry Analysis

Document Scanner Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Document Scanner Market Analysis Report by Region

Europe Document Scanner Market Report:

The European market for Document Scanners is forecasted to grow from $1.25 billion in 2023 to $2.45 billion by 2033, influenced by stringent regulations on document management and a growing need for security in business processing. Countries like Germany, France, and the UK lead in technology adoption.Asia Pacific Document Scanner Market Report:

In the Asia Pacific region, the Document Scanner market is projected to grow from $0.66 billion in 2023 to $1.29 billion by 2033, benefiting from increasing digitalization efforts among businesses and governmental bodies. Countries like China and India are driving the demand through significant investments in technology infrastructure.North America Document Scanner Market Report:

In North America, the Document Scanner market is expected to expand from $1.18 billion in 2023 to $2.33 billion by 2033, largely driven by corporate adoption of advanced scanning technologies to facilitate efficient workflows and remote document management solutions. The United States remains a significant market due to its robust economy and focus on innovation.South America Document Scanner Market Report:

The South America market for Document Scanners is expected to increase from $0.11 billion in 2023 to $0.22 billion by 2033, fueled by rising adoption of office automation tools. Brazil and Argentina are the key contributors to this growth as they embrace digital solutions in various sectors.Middle East & Africa Document Scanner Market Report:

In the Middle East and Africa, the Document Scanner market is set to increase from $0.30 billion in 2023 to $0.59 billion by 2033. The region's expanding retail and banking sectors are key drivers in this growth, with a rising demand for document digitization to enhance efficiency and customer experience.Tell us your focus area and get a customized research report.

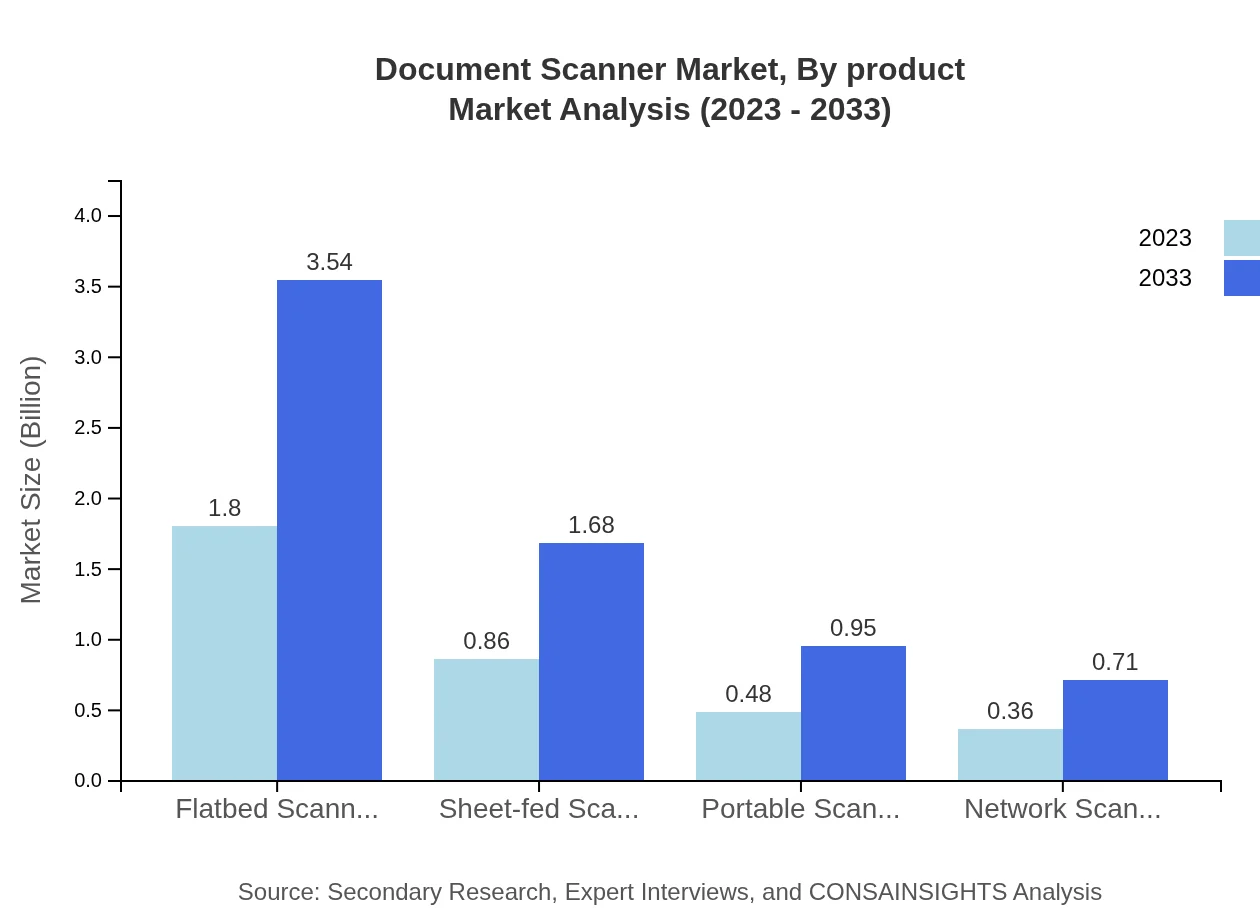

Document Scanner Market Analysis By Product

The Document Scanner market consists of various products such as Flatbed Scanners, Sheet-fed Scanners, Portable Scanners, and Network Scanners. Each product serves unique purposes, with Flatbed Scanners capturing high-resolution images, and Sheet-fed Scanners enabling fast scanning of multiple documents. Portable Scanners are gaining traction for on-the-go professionals, and Network Scanners promote collaborative environments.

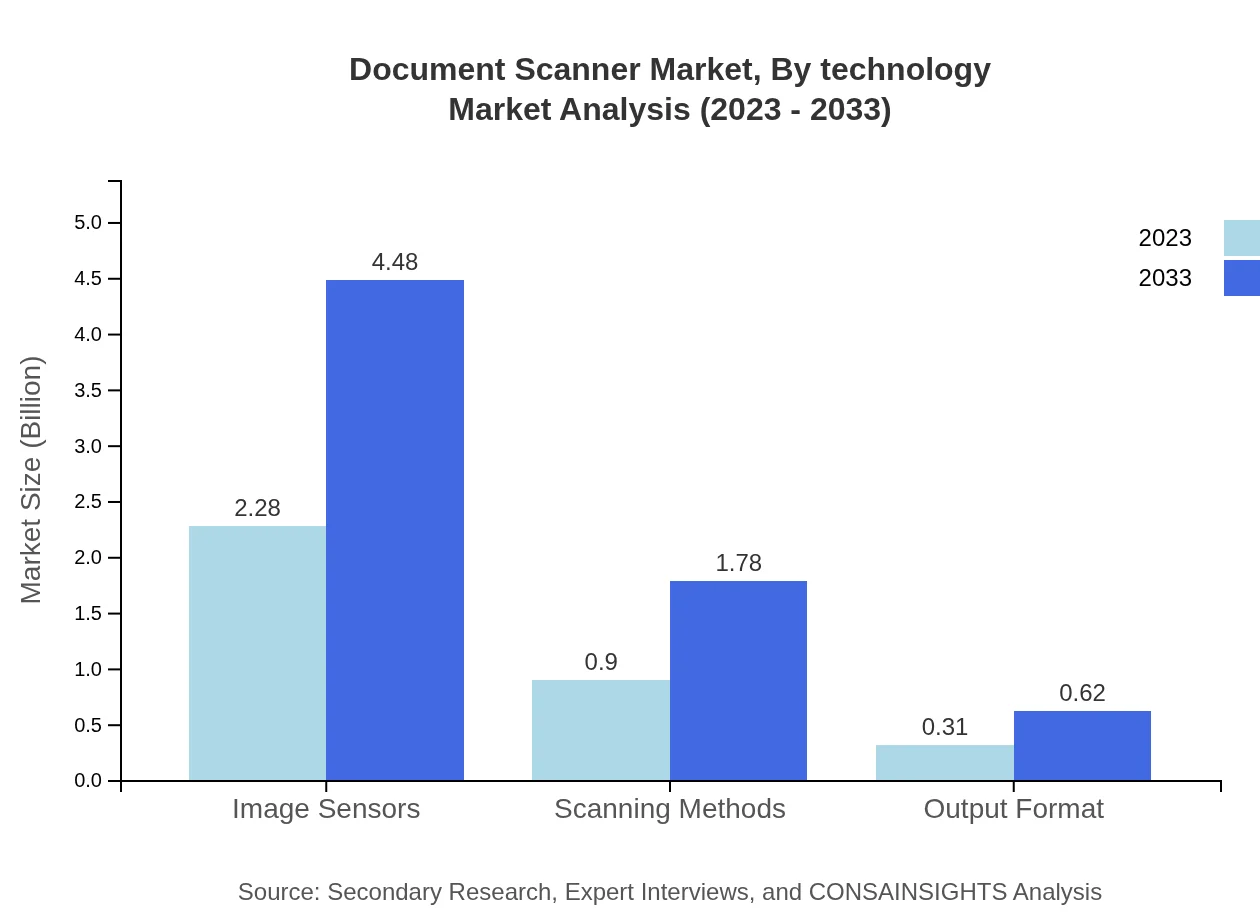

Document Scanner Market Analysis By Technology

Technological innovations like high-resolution sensors, duplex scanning, and wireless connectivity are transforming the Document Scanner landscape. Emerging technologies such as AI-based document management and cloud integration enhance scanner capabilities, further driving their adoption across sectors.

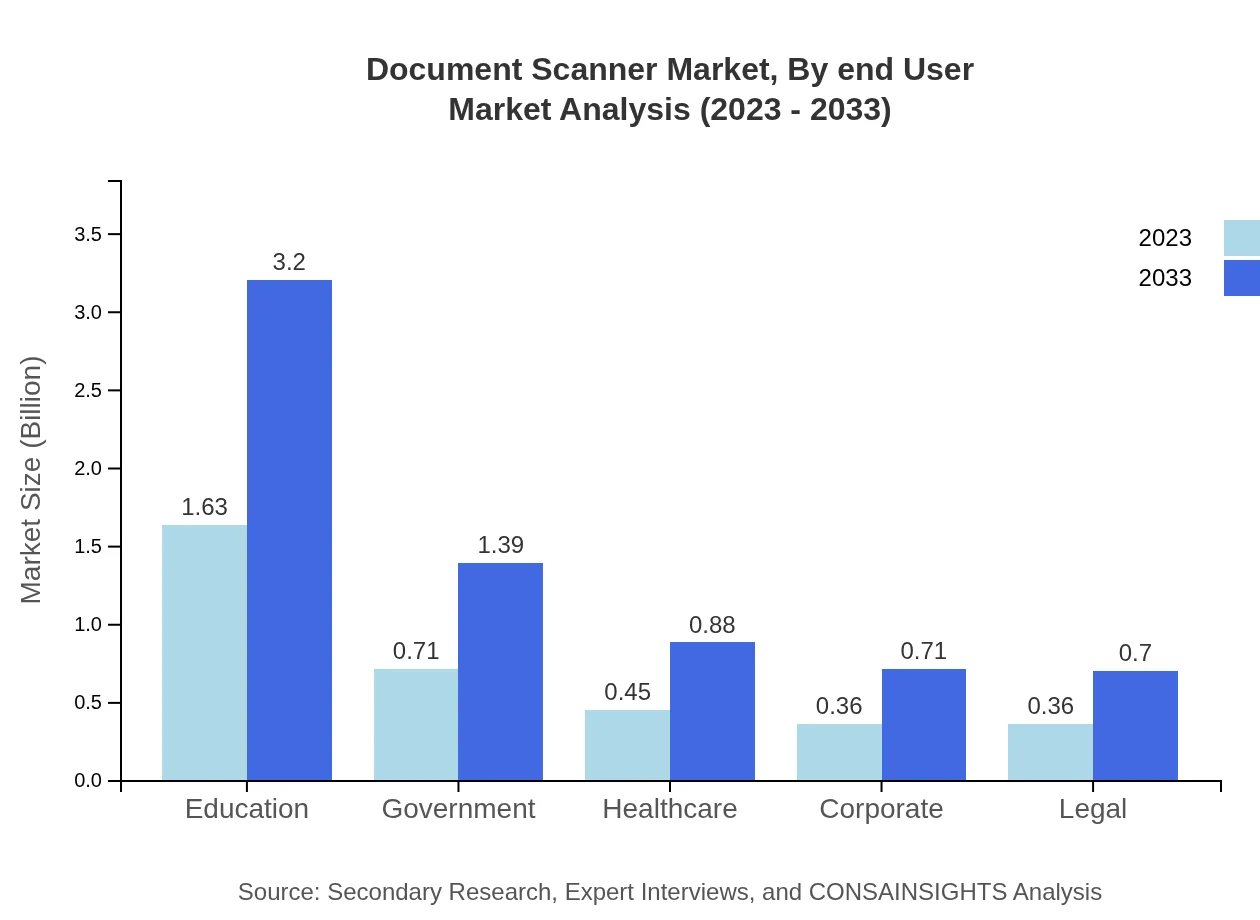

Document Scanner Market Analysis By End User

The market serves a diverse range of end-users, including Education, Government, Healthcare, Corporate, and Legal sectors. Education leads at 46.46% market share due to large-scale digitization of educational materials. Government agencies and Corporations also represent a significant share as they seek efficient document management solutions.

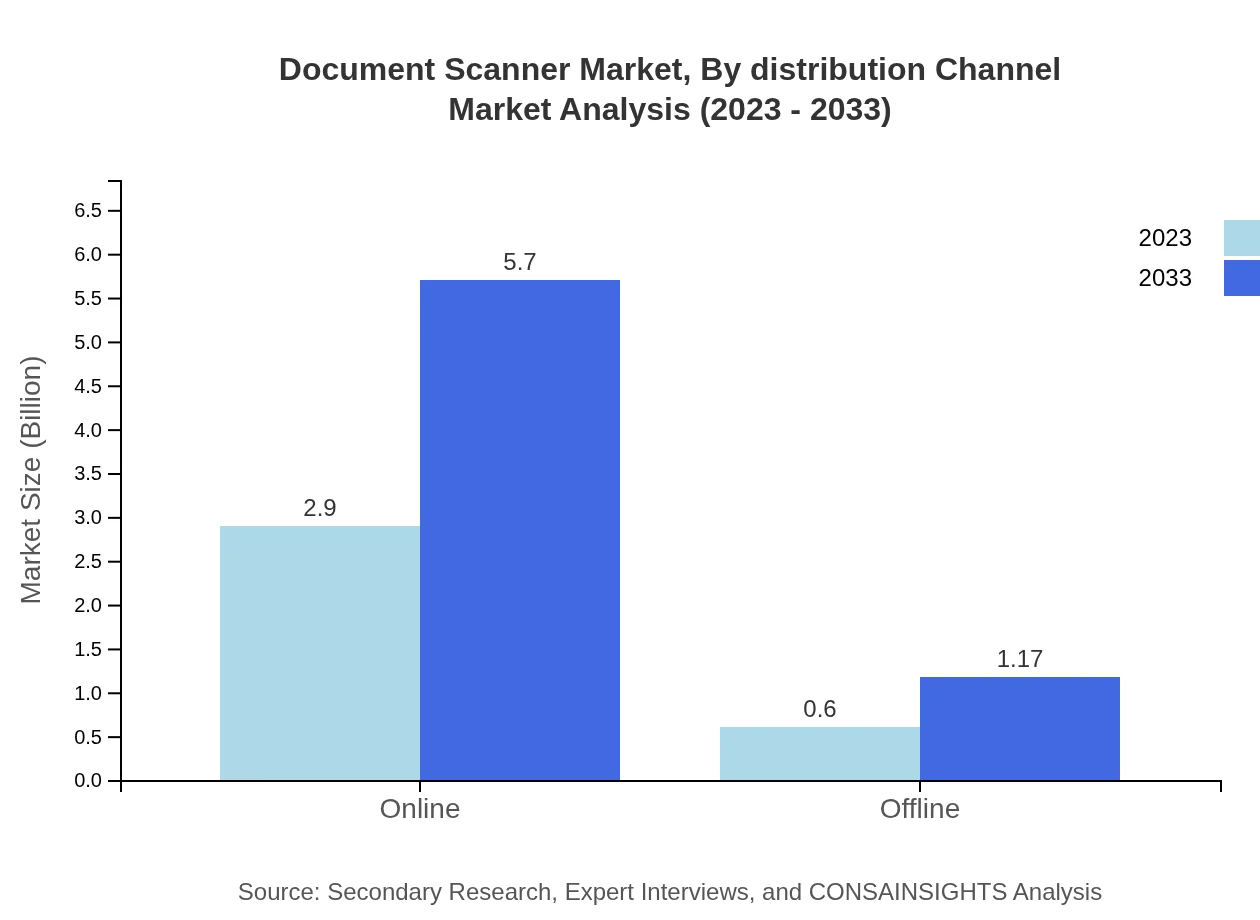

Document Scanner Market Analysis By Distribution Channel

Distribution channels for Document Scanners include Online and Offline sales. With the increasing trend toward e-commerce, the Online channel commands a significant 82.92% share of the market. Offline sales through retail stores and specialized distributors also play a key role but are gradually declining.

Document Scanner Market Analysis By Price Range

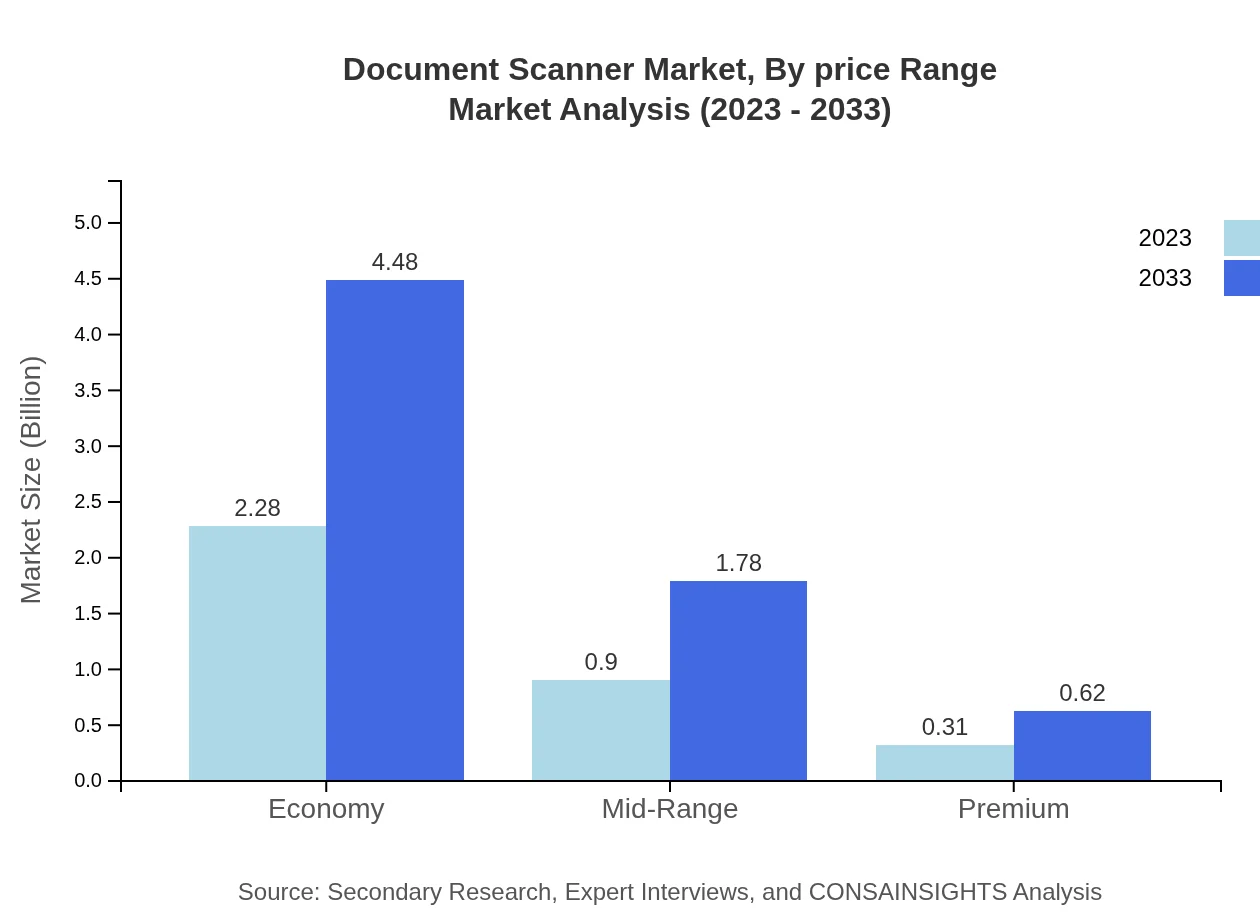

The Document Scanner market segments include Premium, Mid-Range, and Economy scanners. The Economy segment holds the largest portion at 65.19% of the overall market, appealing to budget-conscious consumers, while Premium segments attract businesses needing high-quality solutions.

Document Scanner Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Document Scanner Industry

Fujitsu:

Fujitsu is a leading provider of document imaging solutions, known for their high-quality scanning devices, including the ScanSnap series, which is widely used for personal and business needs.Canon:

Canon offers a comprehensive range of document scanners that cater to diverse applications, with innovative features like dual-sided scanning and advanced software integration for enhanced productivity.Brother:

Brother specializes in multifunctional devices, including high-performance document scanners, known for their reliability and user-friendly interface tailored for office environments.Epson:

Epson is recognized for its high-end document scanners, particularly in the corporate sector, integrating advanced imaging technology and quick-processing features for efficient document handling.Xerox:

Xerox is known for its innovative document management solutions, including document scanners that enable seamless workflow integration and enhanced document security features.We're grateful to work with incredible clients.

FAQs

What is the market size of document Scanner?

The document scanner market is valued at approximately $3.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%. By 2033, this market is expected to grow significantly, reflecting increasing adoption across various sectors.

What are the key market players or companies in the document Scanner industry?

Key players in the document scanner market include Canon, Epson, Fujitsu, HP, and Panasonic. These companies are integral to the industry, driving innovation and contributing to exports, enhancing the market landscape as competition intensifies.

What are the primary factors driving the growth in the document scanner industry?

The document scanner industry's growth is primarily driven by the digitization of documents, increased demand for office automation, and advancements in scanning technology. Moreover, the rising need for remote working solutions continues to influence market dynamics significantly.

Which region is the fastest Growing in the document scanner?

The Europe region is the fastest-growing market for document scanners, with an increase from $1.25 billion in 2023 to $2.45 billion by 2033. Asia Pacific also shows notable growth, from $0.66 billion to $1.29 billion in the same period.

Does ConsaInsights provide customized market report data for the document scanner industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs within the document scanner industry. This customization allows businesses to gain targeted insights, helping them make informed decisions in a competitive landscape.

What deliverables can I expect from this document scanner market research project?

From this document scanner market research project, you can expect comprehensive deliverables, including market analysis reports, segmentation data, regional insights, and trends forecasts that support strategic planning and decision-making processes.

What are the market trends of document scanner?

Current trends in the document scanner market include the rise in portable scanner adoption, demand for high-speed scanning, and a focus on cloud integration. Additionally, sustainability is becoming more crucial as companies aim to minimize their carbon footprints.