Downstream Processing Market Report

Published Date: 31 January 2026 | Report Code: downstream-processing

Downstream Processing Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Downstream Processing market, covering comprehensive insights including market size, growth forecasts till 2033, segmentation, and regional analysis, along with identified trends and leading companies in the industry.

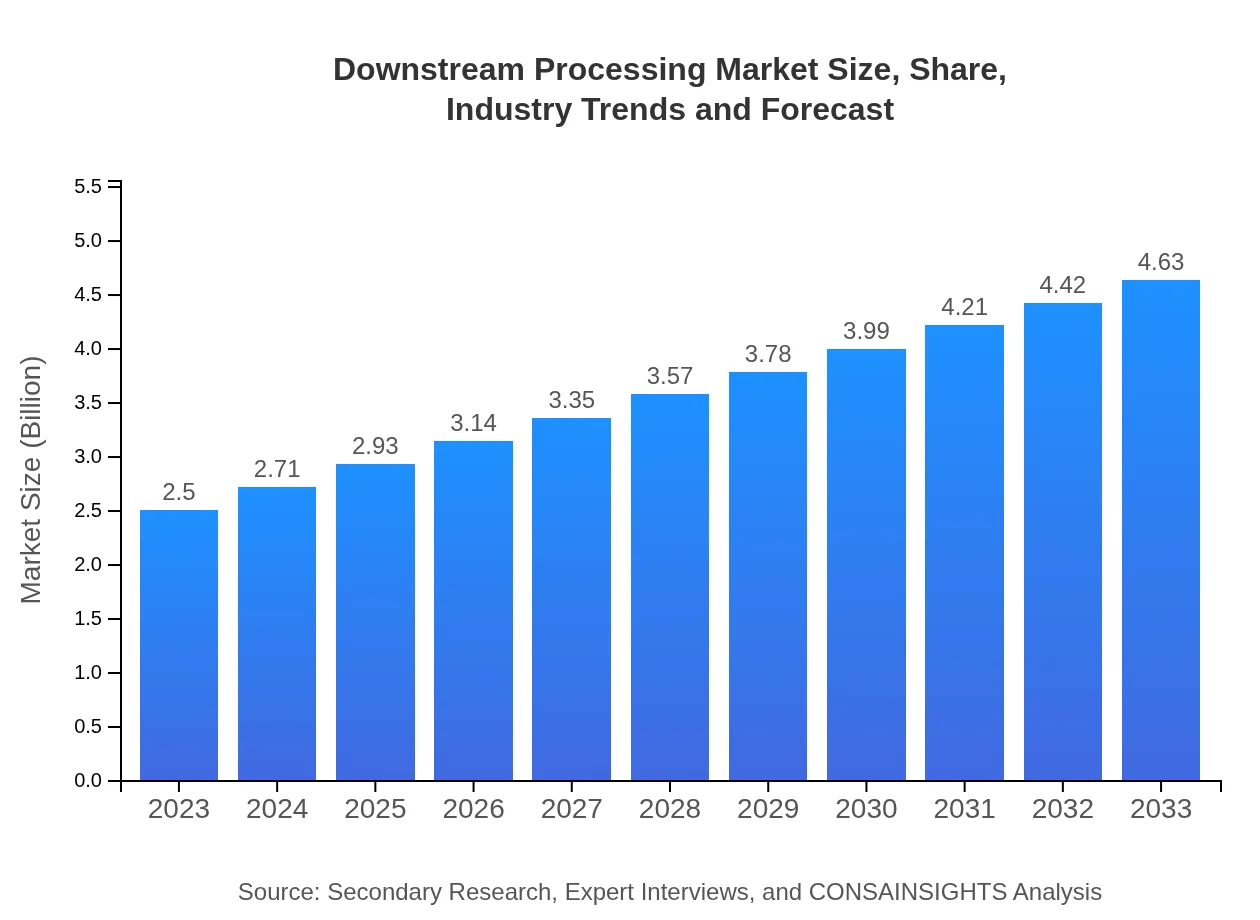

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $4.63 Billion |

| Top Companies | Thermo Fisher Scientific, Sartorius AG, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Downstream Processing Market Overview

Customize Downstream Processing Market Report market research report

- ✔ Get in-depth analysis of Downstream Processing market size, growth, and forecasts.

- ✔ Understand Downstream Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Downstream Processing

What is the Market Size & CAGR of Downstream Processing market in 2023?

Downstream Processing Industry Analysis

Downstream Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Downstream Processing Market Analysis Report by Region

Europe Downstream Processing Market Report:

In Europe, the market is expected to grow from $0.74 billion in 2023 to $1.38 billion by 2033. The region is seeing a rise in opportunistic biopharmaceutical production, along with stringent regulatory frameworks that necessitate efficient downstream processing methodologies.Asia Pacific Downstream Processing Market Report:

In the Asia Pacific region, the Downstream Processing market is estimated to grow from $0.49 billion in 2023 to $0.91 billion by 2033. This growth is driven by expanding biopharmaceutical manufacturing capabilities in countries like China and India, coupled with increasing investments in healthcare infrastructure and technology.North America Downstream Processing Market Report:

North America remains a leading market for Downstream Processing, expanding from $0.89 billion in 2023 to approximately $1.64 billion by 2033. Strong pharmaceutical manufacturing bases, advanced technologies, and significant R&D investments contribute to robust market growth.South America Downstream Processing Market Report:

South America's Downstream Processing market is projected to rise from $0.17 billion in 2023 to $0.31 billion by 2033, influenced by growing health concerns, increased healthcare spending, and rising demand for biologics and biopharmaceuticals in the region.Middle East & Africa Downstream Processing Market Report:

The Middle East and Africa market for Downstream Processing is projected to grow from $0.21 billion in 2023 to $0.40 billion by 2033, as governments focus on enhancing healthcare services and biopharmaceutical manufacturing capabilities.Tell us your focus area and get a customized research report.

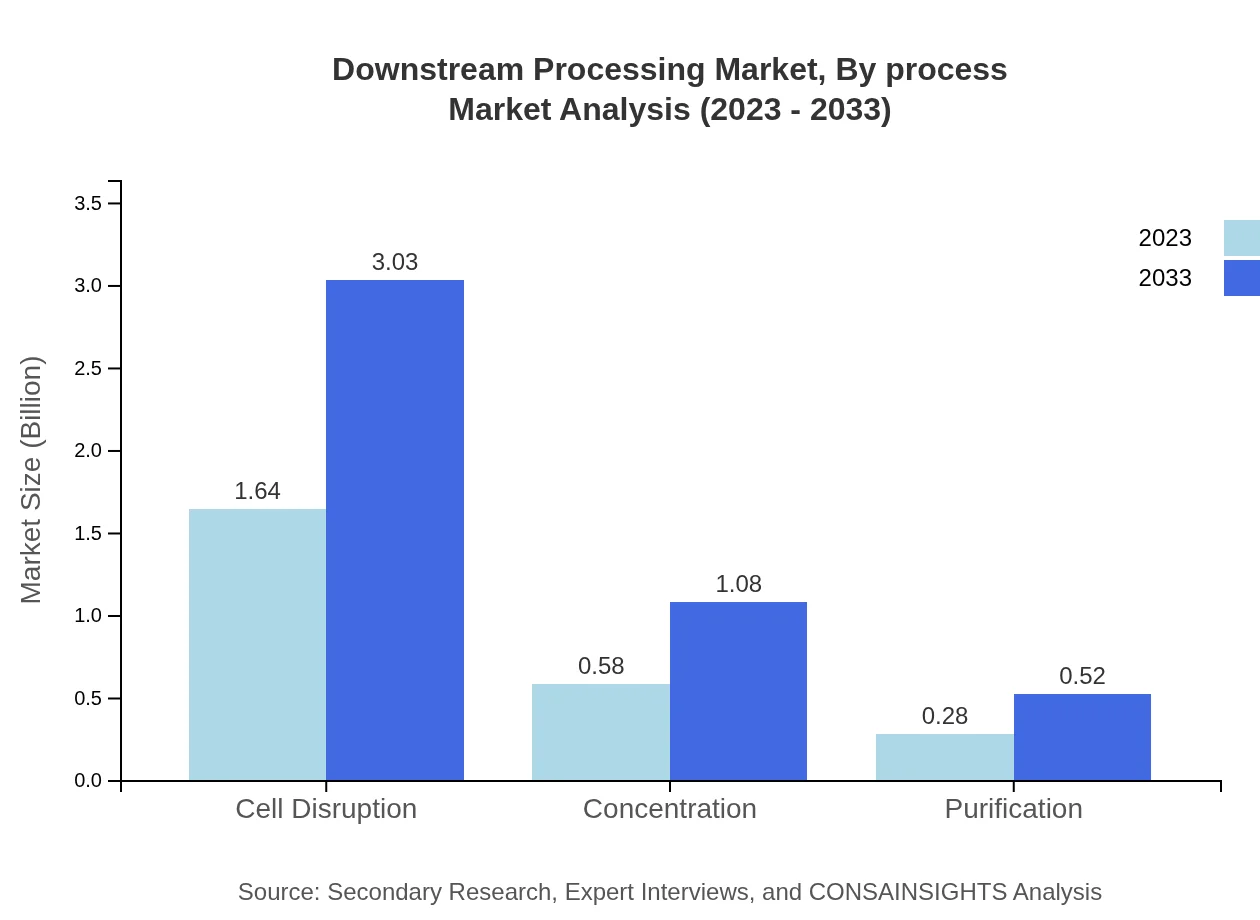

Downstream Processing Market Analysis By Process

The main processes in Downstream Processing include Filtration, Chromatography, Centrifugation, and Precipitation. For instance, Filtration accounts for a market size of $1.64 billion in 2023 with a significant share of 65.5%, indicating its dominance in separating biological products from impurities.

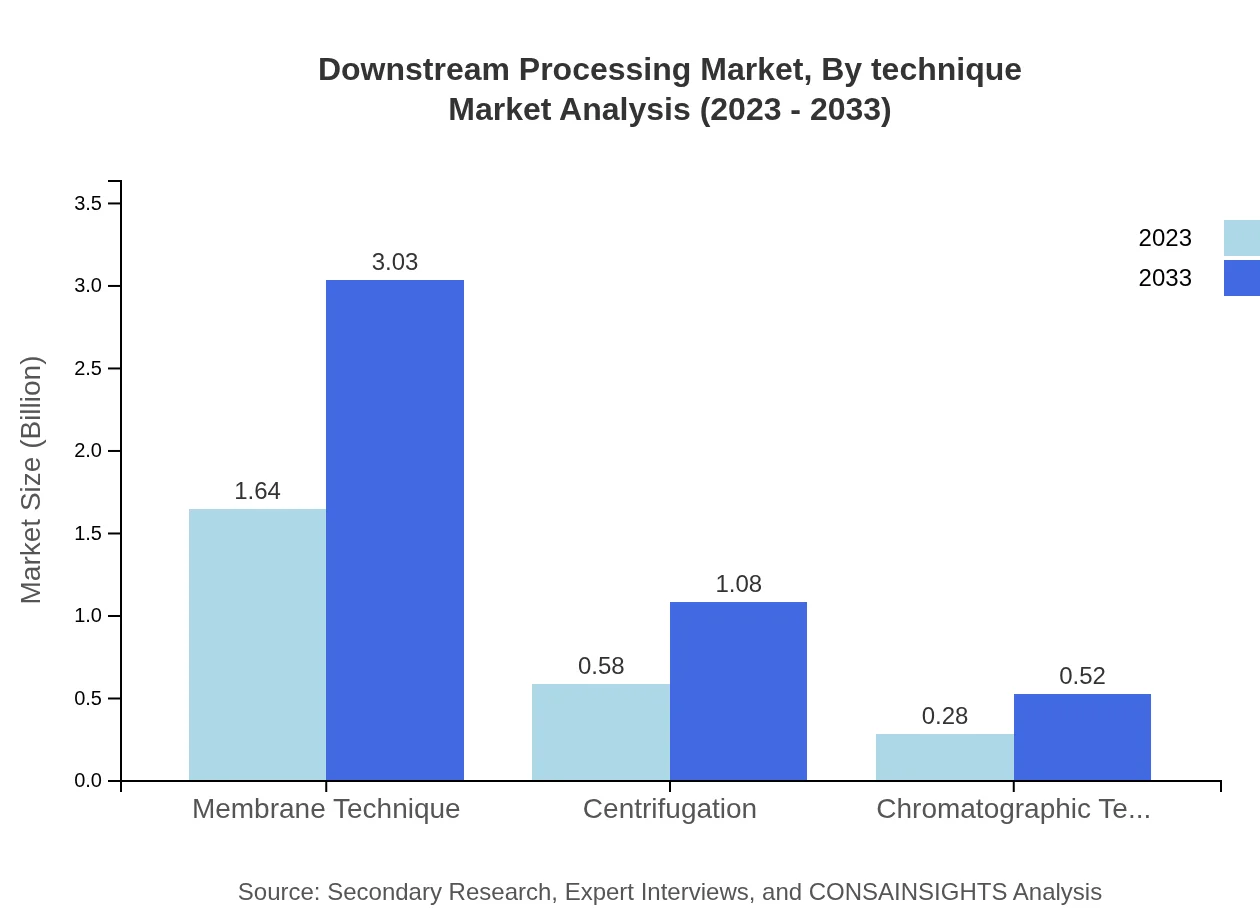

Downstream Processing Market Analysis By Technique

Techniques such as Membrane Filtration and Chromatographic Techniques are crucial in the purification process. Membrane Techniques lead the segment with a market value of $1.64 billion (65.5% share) projected to grow significantly by 2033.

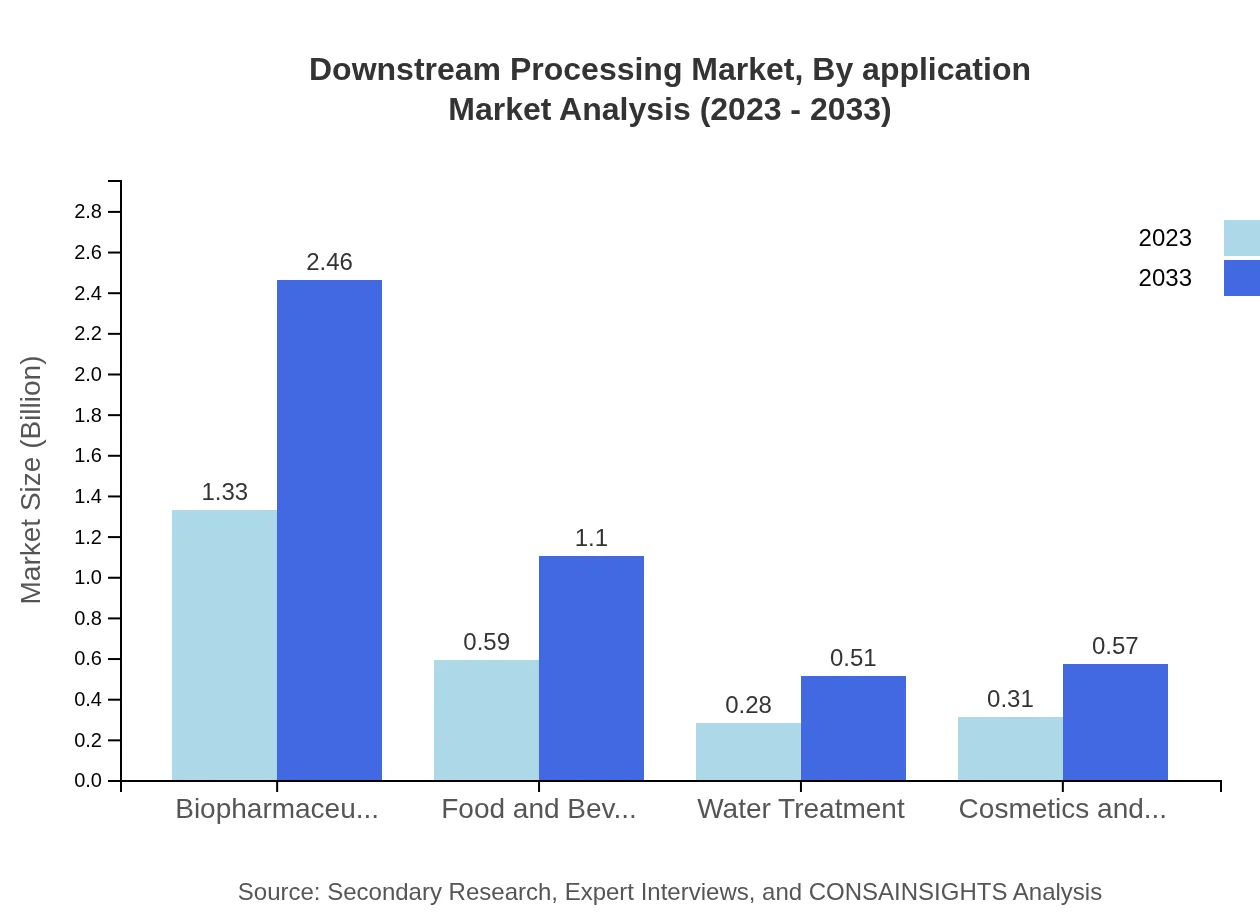

Downstream Processing Market Analysis By Application

Applications in biopharmaceuticals lead the market, holding a share of 53.05% in 2023 with projected growth to $2.46 billion by 2033. Other notable applications include Food and Beverages and Water Treatment, showing promising growth due to rising global health standards.

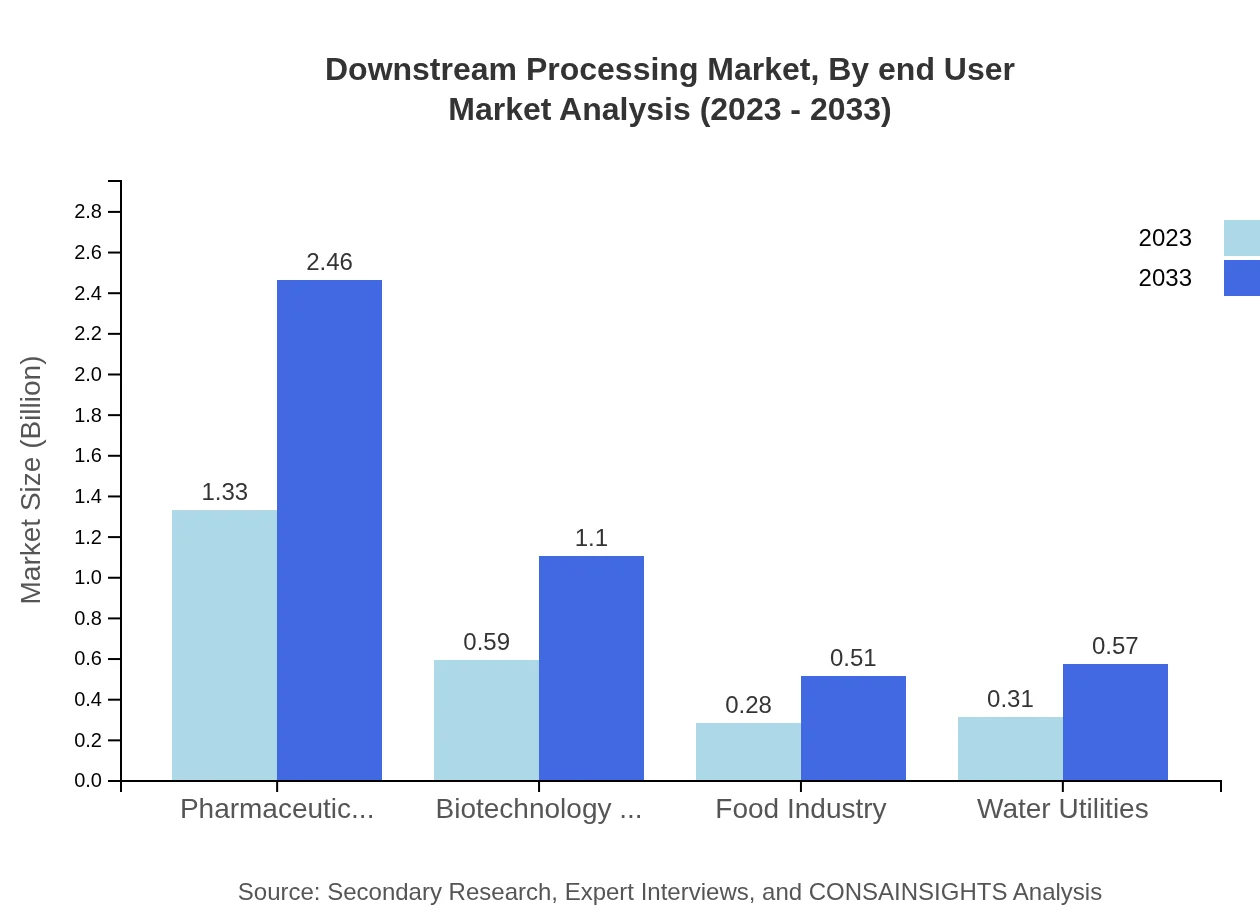

Downstream Processing Market Analysis By End User

End-user industries range from pharmaceutical manufacturers to biotechnology companies, with the pharmaceutical industry dominating with a market share of 53.05%. This trend reflects the demand for high-quality biologics and accelerated productions.

Downstream Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Downstream Processing Industry

Thermo Fisher Scientific:

A prominent player in the life sciences sector, specialized in performing advanced biopharmaceutical production technologies and serving various downstream processes.Sartorius AG:

Recognized for its cutting-edge bioprocess solutions, Sartorius AG significantly contributes to the downstream processing market through innovative technologies design.GE Healthcare:

A leading market provider offering a comprehensive range of downstream processing technologies, GE Healthcare plays a crucial role in the biotech manufacturing segment.We're grateful to work with incredible clients.

FAQs

What is the market size of downstream processing?

The downstream processing market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 6.2% through 2033, indicating significant growth potential across the sector.

What are the key market players or companies in the downstream processing industry?

Key players in downstream processing include leading pharmaceutical manufacturers and biotechnology companies, leveraging advanced bioprocessing technologies for effective product development and market strategy.

What are the primary factors driving the growth in the downstream processing industry?

The growth is driven by advancements in biotechnology, increased pharmaceutical production, and demand for efficient bioprocessing technologies, supporting enhanced product yields and quality.

Which region is the fastest Growing in the downstream processing market?

The fastest-growing regions include North America, expected to reach $1.64 billion by 2033, and Europe, projected to grow to $1.38 billion, reflecting increased R&D investments.

Does ConsaInsights provide customized market report data for the downstream processing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the downstream processing industry, ensuring insights are aligned with your business objectives.

What deliverables can I expect from this downstream processing market research project?

Deliverables typically include comprehensive market analysis reports, trend forecasts, competitive landscape assessments, and recommendations tailored to the downstream processing sector.

What are the market trends of downstream processing?

Market trends show a focus on innovative bioprocessing methods like cell disruption and purification, with increasing shares in filtration, indicating a shift towards efficiency and product quality.