Draas Market Report

Published Date: 31 January 2026 | Report Code: draas

Draas Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Disaster Recovery as a Service (DRaaS) market, focusing on trends, forecasts, regional insights, and competitive landscape from 2023 to 2033. It contains valuable data regarding market size, growth rates, and key players shaping the industry.

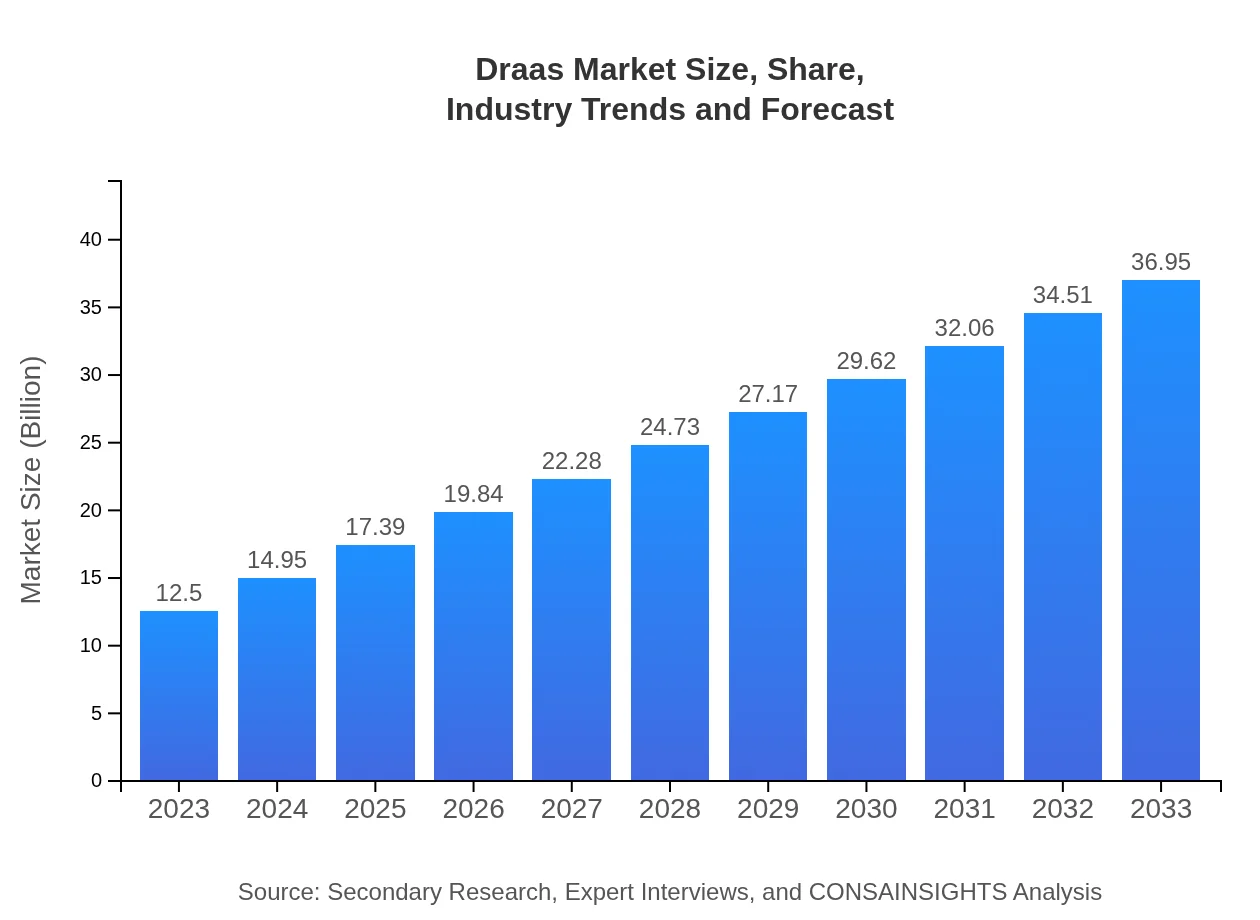

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 11% |

| 2033 Market Size | $36.95 Billion |

| Top Companies | IBM, Microsoft, Veeam Software, Zerto, Acronis |

| Last Modified Date | 31 January 2026 |

Draas Market Overview

Customize Draas Market Report market research report

- ✔ Get in-depth analysis of Draas market size, growth, and forecasts.

- ✔ Understand Draas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Draas

What is the Market Size & CAGR of the Draas market in 2023?

Draas Industry Analysis

Draas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Draas Market Analysis Report by Region

Europe Draas Market Report:

The European DRaaS market is anticipated to grow from $3.82 billion in 2023 to $11.29 billion by 2033, driven by stringent data protection regulations such as GDPR. The need for cost-effective solutions among enterprises to safeguard data is key to this trend.Asia Pacific Draas Market Report:

The DRaaS market in the Asia Pacific is forecasted to grow from $2.46 billion in 2023 to $7.28 billion by 2033. The rising adoption of cloud solutions and increasing data compliance regulations across countries like India and China are driving this growth. Moreover, a surge in digital transformation initiatives among SMEs is anticipated to fuel further demand.North America Draas Market Report:

North America remains the largest DRaaS market, with a size projected to expand from $4.28 billion in 2023 to $12.64 billion by 2033. The region hosts several key players and demonstrates a strong inclination towards adopting advanced IT solutions and disaster recovery services amid rising cyber threats.South America Draas Market Report:

In South America, the market is expected to increase from $0.44 billion in 2023 to $1.30 billion by 2033. Factors such as rising internet penetration, growing awareness about data protection, and the move towards digital services are contributing to market growth.Middle East & Africa Draas Market Report:

The market in the Middle East and Africa is projected to progress from $1.50 billion in 2023 to $4.43 billion by 2033. Growing investments in IT infrastructure and an increasing focus on business continuity plans are some of the major factors enhancing market growth in this region.Tell us your focus area and get a customized research report.

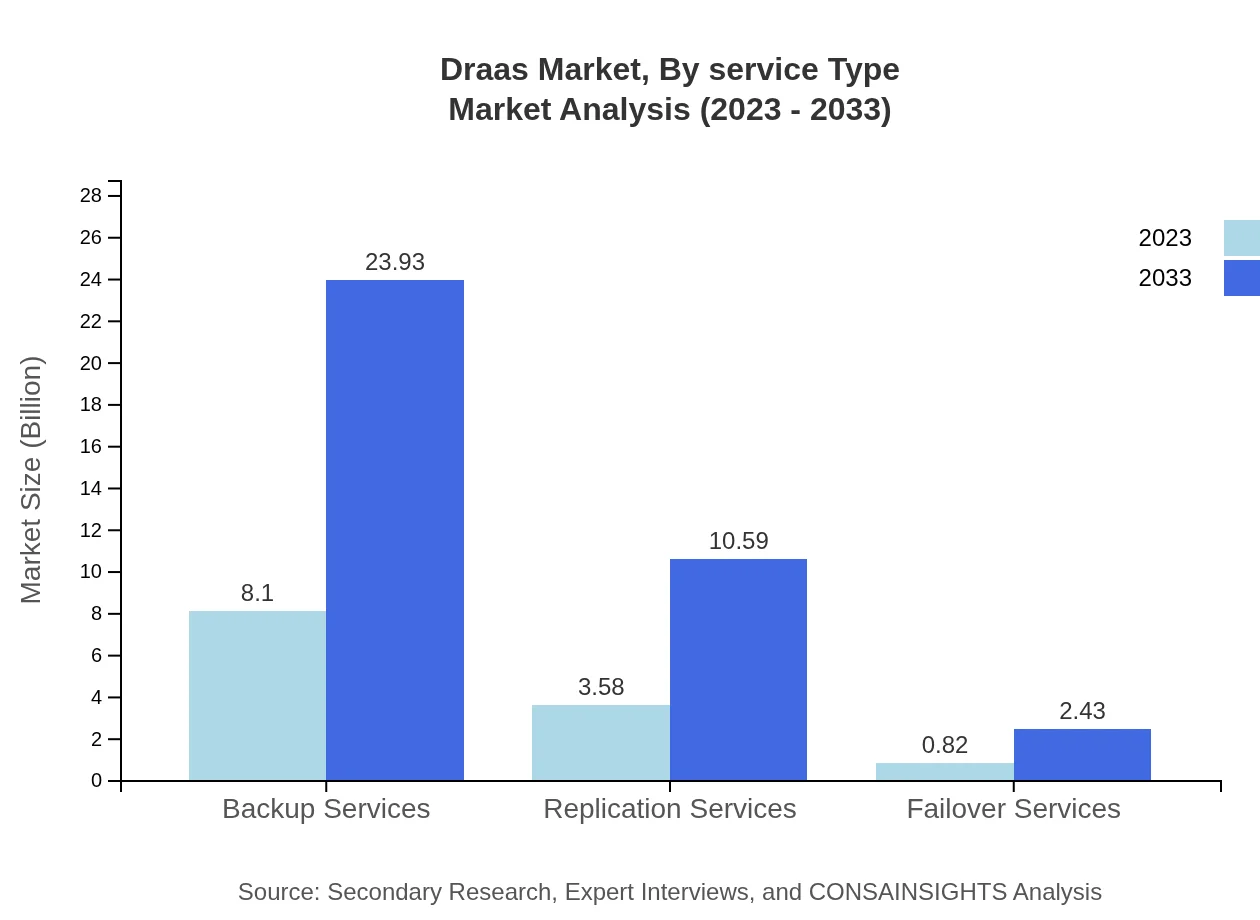

Draas Market Analysis By Service Type

In the service type segmentation, backup services dominate the DRaaS market, reflecting a significant emphasis on data protection strategies. By 2033, the backup services segment is expected to account for a dominant share of the market, with the estimated size rising from $8.10 billion in 2023 to $23.93 billion. Replication services are also key contributors, growing in relevance as data increasingly migrates to the cloud, projected to rise from $3.58 billion to $10.59 billion over the same period. Failover services, while smaller, are critical for immediate data access during outages.

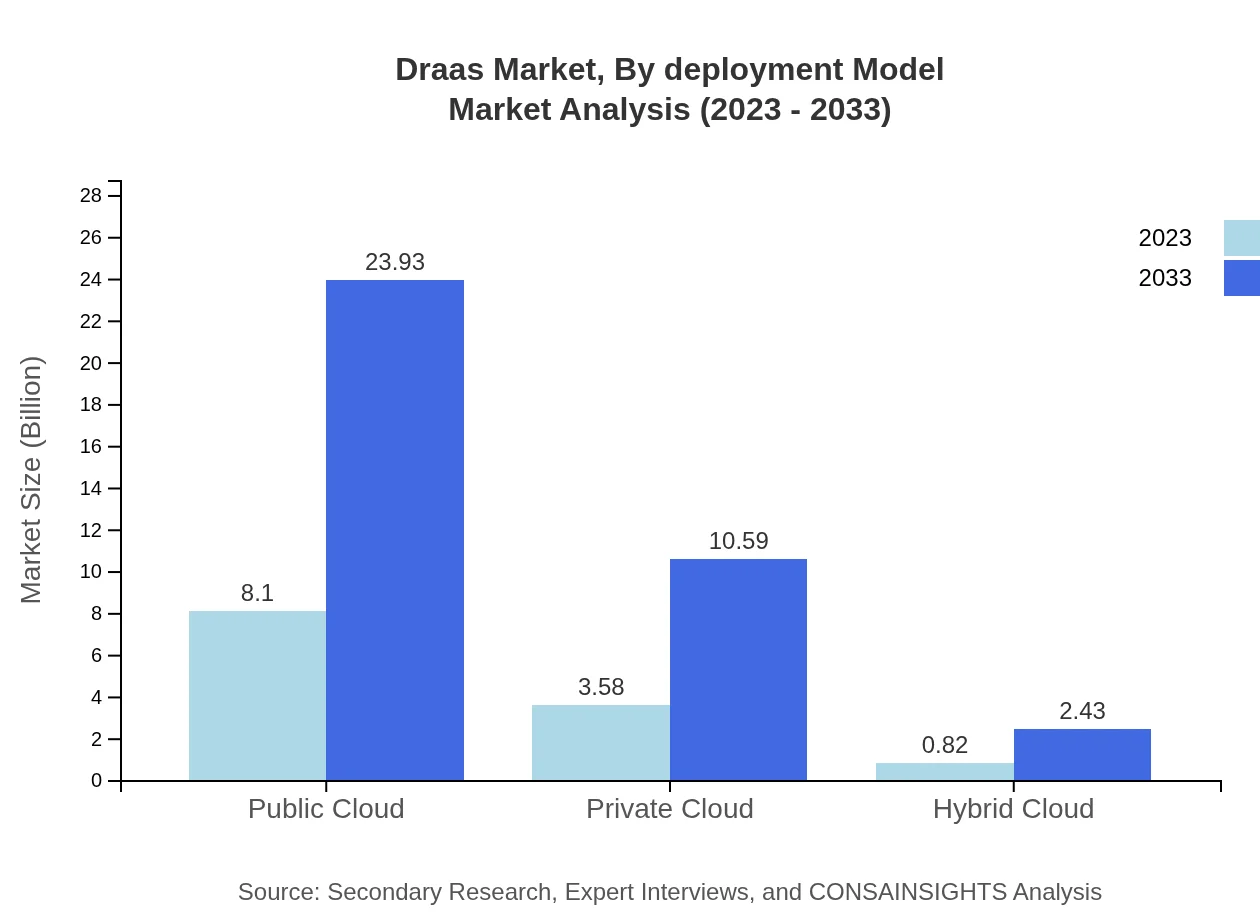

Draas Market Analysis By Deployment Model

The deployment model segmentation highlights the predominance of public cloud solutions in the DRaaS market, expected to reach $23.93 billion by 2033 from $8.10 billion in 2023. Hybrid cloud models are gaining traction as organizations seek flexible and optimized infrastructure solutions, while private cloud deployments are also notable for businesses managing sensitive data, growing from $3.58 billion to $10.59 billion over the forecast period.

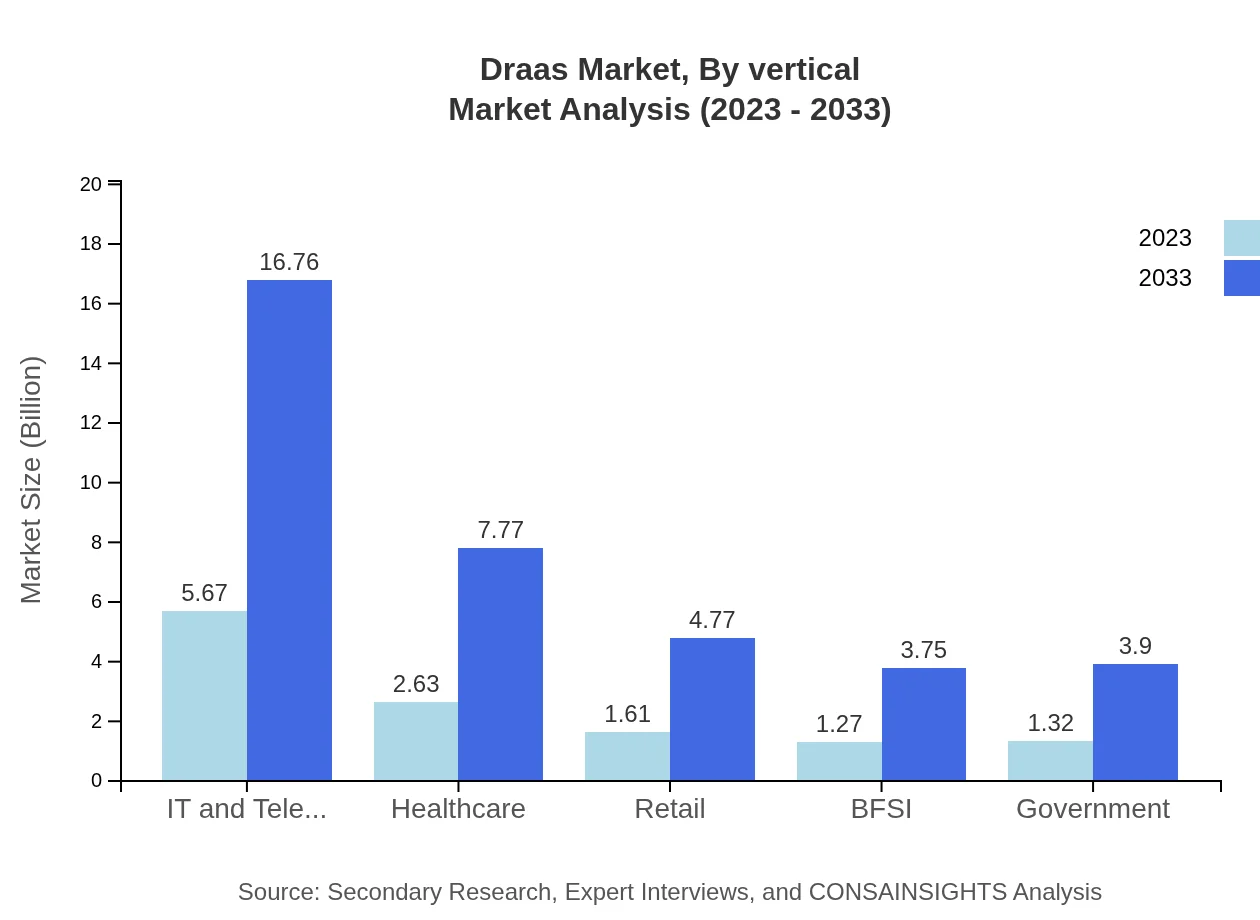

Draas Market Analysis By Vertical

Sector-wise, the IT and telecom industry constitutes the largest share in the DRaaS market, accounting for $5.67 billion in 2023 and projected to grow to $16.76 billion by 2033. In addition, the healthcare sector is increasingly adopting DRaaS for compliance and data security, expected to grow from $2.63 billion to $7.77 billion. Other verticals, such as BFSI and retail, are also significant, focusing on data integrity and operational continuity.

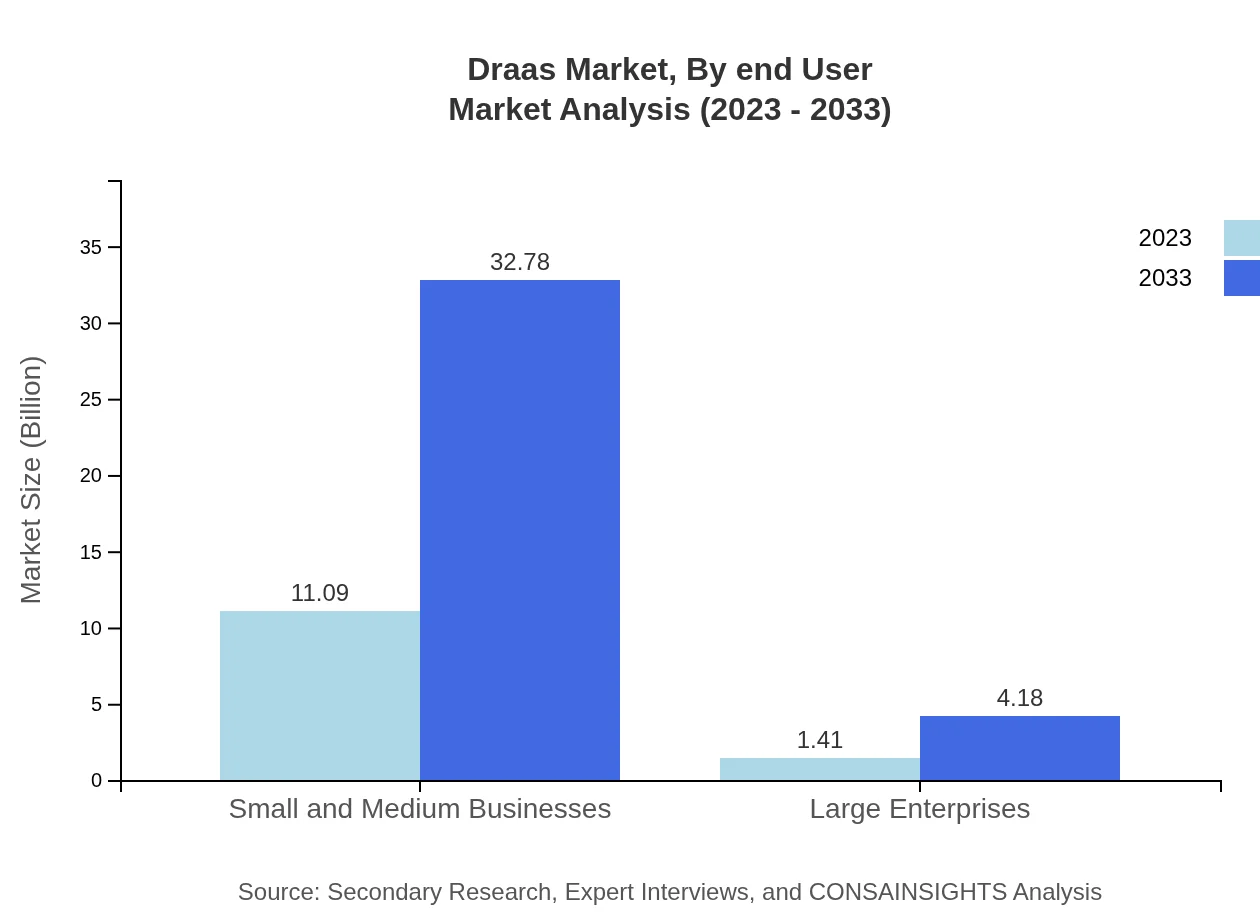

Draas Market Analysis By End User

End-user analysis indicates a broader adoption across SMEs, anticipated to grow from $11.09 billion to $32.78 billion by 2033. Large enterprises, while representing a smaller segment, are increasingly investing in DRaaS to bolster their resilience strategies, growing from $1.41 billion to $4.18 billion by 2033. The need for comprehensive disaster recovery plans among businesses of all sizes drives market demand.

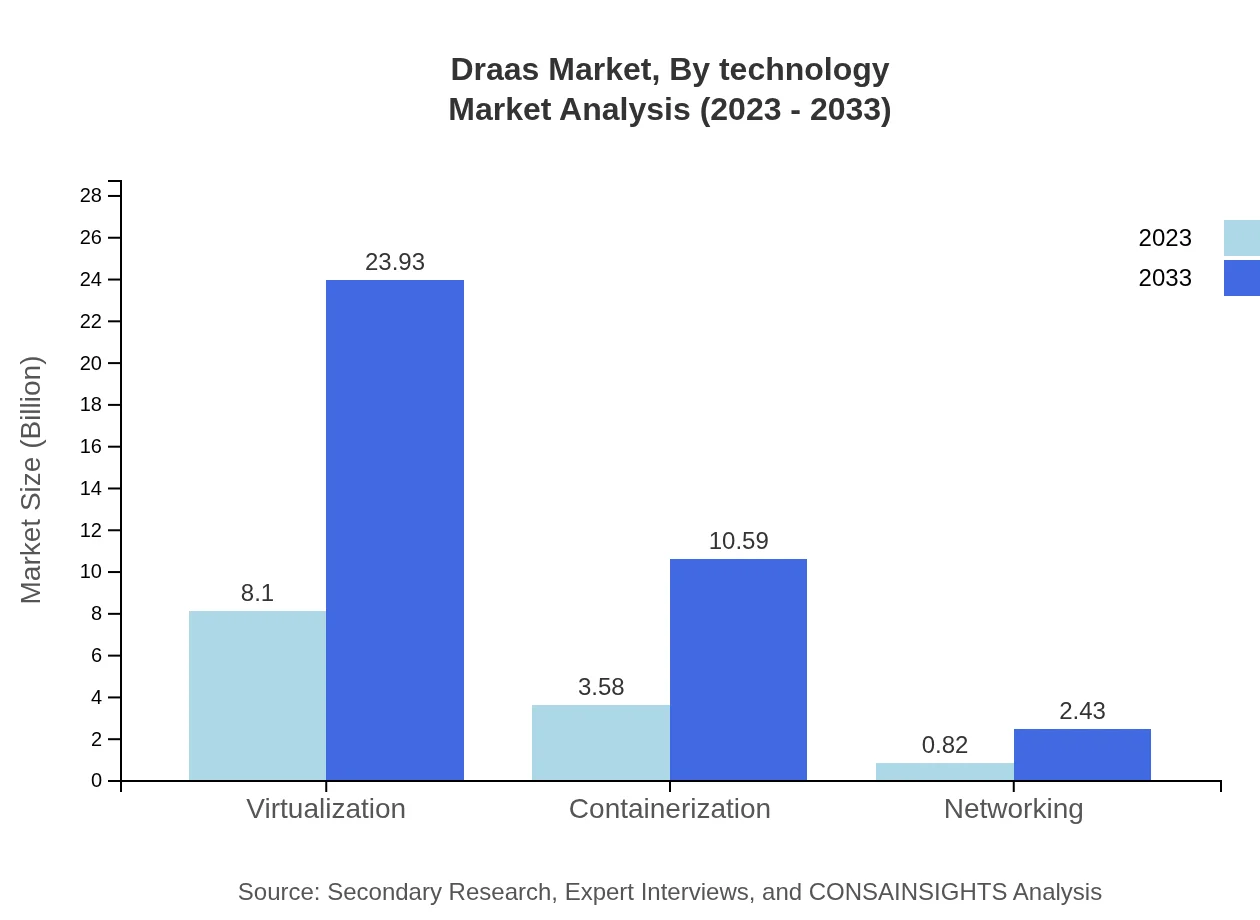

Draas Market Analysis By Technology

Technological advancements underpin the DRaaS market's growth, with virtualization leading the charge. This segment is projected to grow from $8.10 billion in 2023 to $23.93 billion by 2033. Containerization is also gaining popularity for its efficiency and scalability, expected to shift from $3.58 billion to $10.59 billion. Innovations in data management and cloud technologies will continue to shape the market's future landscape.

Draas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Draas Industry

IBM:

IBM provides robust DRaaS solutions tailored for enterprises, emphasizing cloud integration and data security with strong market presence across multiple sectors.Microsoft:

Microsoft offers Azure Site Recovery, a leading DRaaS offering that helps customers maintain business continuity with its highly integrated cloud services.Veeam Software:

Veeam Software specializes in backup solutions and DRaaS, providing scalable services suitable for small businesses and large enterprises alike.Zerto:

Zerto focuses on business continuity through its DRaaS solutions, leveraging its patented continuous data protection technology to offer real-time recovery.Acronis:

Acronis provides comprehensive cyber protection along with DRaaS, ensuring data integrity and availability for a wide range of customers.We're grateful to work with incredible clients.

FAQs

What is the market size of DRaaS?

The Disaster Recovery as a Service (DRaaS) market is valued at approximately $12.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 11% leading up to 2033. This growth indicates a robust demand for secure and reliable data recovery solutions.

What are the key market players or companies in the DRaaS industry?

Key market players in the DRaaS industry include major technology firms like Microsoft, IBM, and VMware. Their innovations and comprehensive service offerings drive competition, ensuring advancements in security, efficiency, and user experience in the disaster recovery domain.

What are the primary factors driving the growth in the DRaaS industry?

The DRaaS industry is primarily driven by increasing data volumes, regulatory compliance requirements, and the growing need for business continuity solutions. The rise in cyber threats and natural disasters further accentuates the demand for robust disaster recovery solutions across sectors.

Which region is the fastest Growing in the DRaaS?

The fastest-growing region in the DRaaS market is Europe, with the market size projected to grow from $3.82 billion in 2023 to $11.29 billion by 2033. This growth is fueled by increased cloud adoption and stringent data regulatory frameworks.

Does ConsaInsights provide customized market report data for the DRaaS industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the DRaaS industry. Clients can request personalized analyses that focus on niche segments, geographic regions, or competitive landscape to inform their strategic decision-making.

What deliverables can I expect from this DRaaS market research project?

Deliverables from the DRaaS market research project include comprehensive market analysis reports, trend assessments, competitive landscape evaluations, and forecasts. Additionally, visual data presentations and strategic recommendations will aid in your understanding and decision-making.

What are the market trends of DRaaS?

Significant trends in the DRaaS market include the shift toward cloud-based solutions, increased integration with AI and machine learning, and a focus on security enhancements. The adoption of hybrid and multi-cloud strategies also plays a crucial role in shaping the future of this industry.